GLD trade ideas

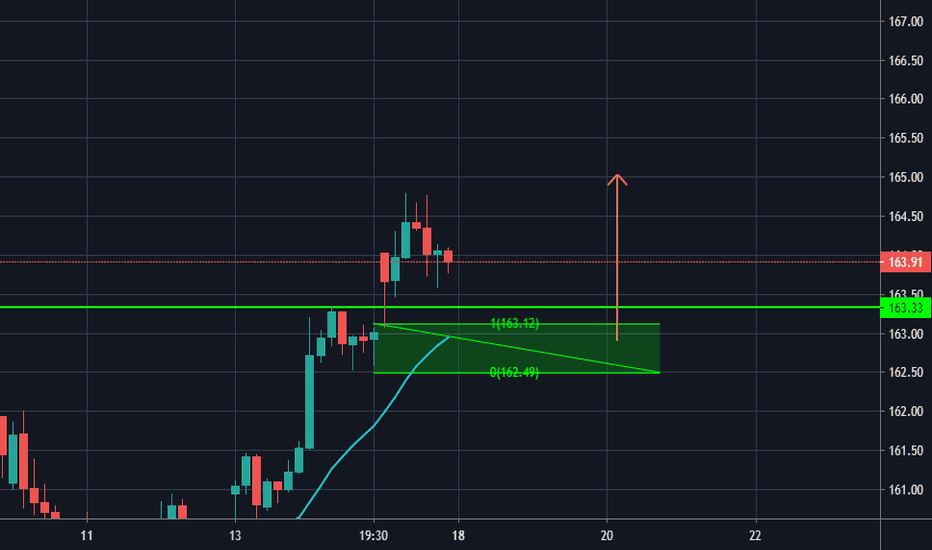

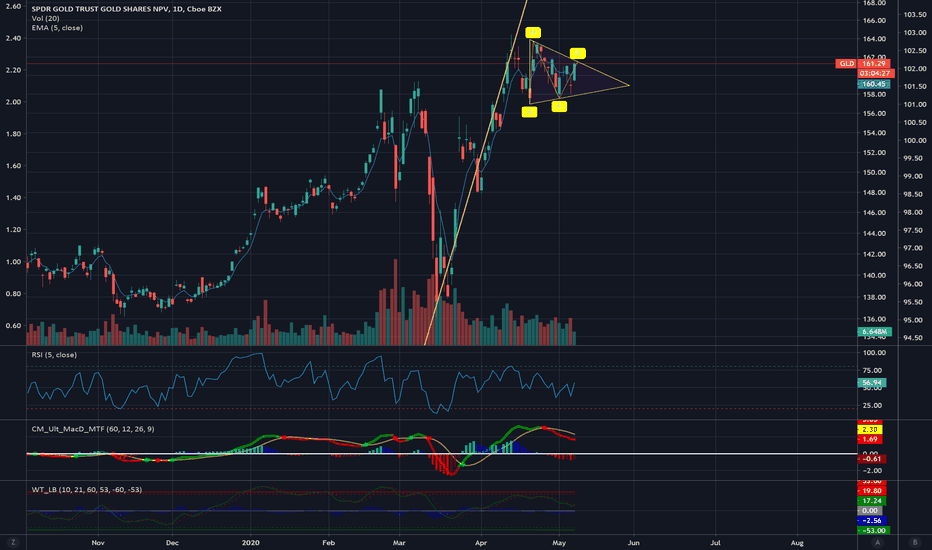

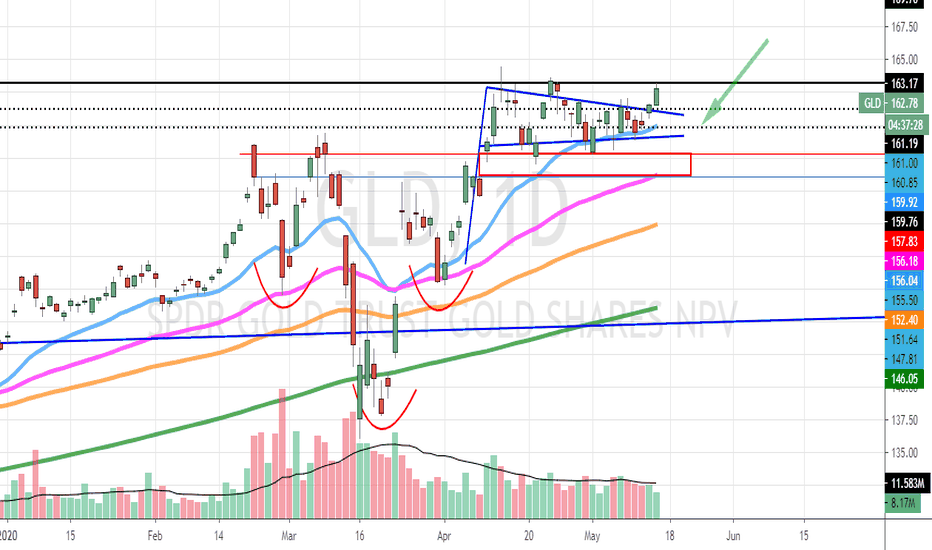

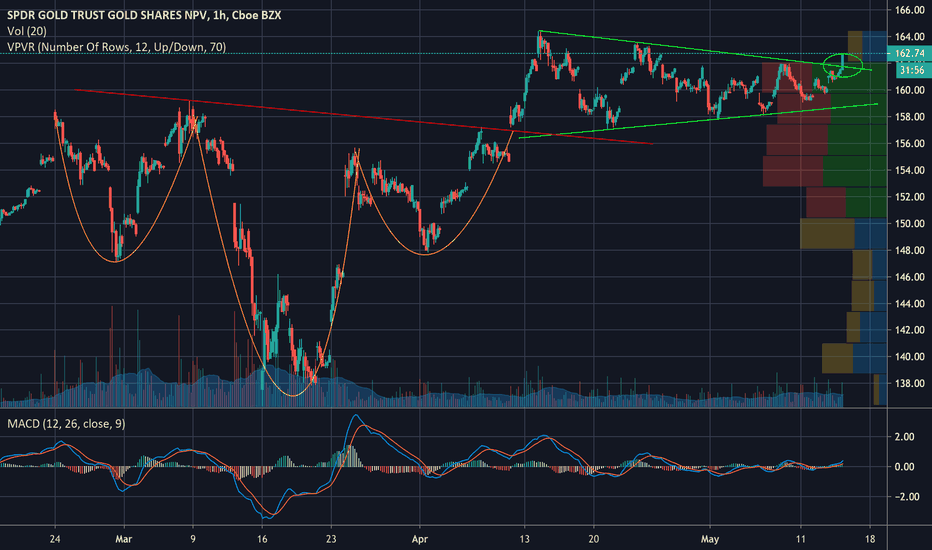

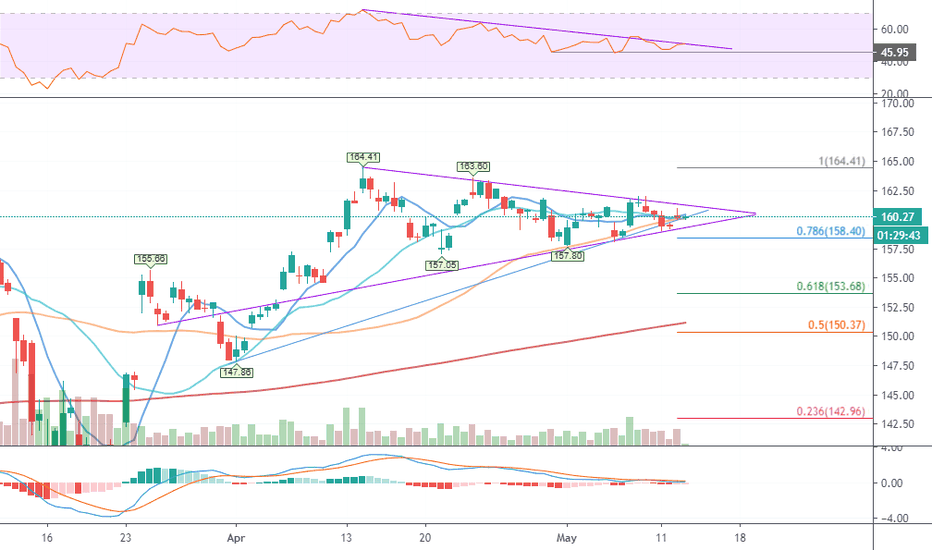

GLD short updateFor those profited from the short positions since yesterday, monitor the inside upward channel as the price is about to hit the bottom boundary. You can exit some short position depending on your risk setup and/or allow some to possibly drop to the bottom boundary of the outward upward channel.

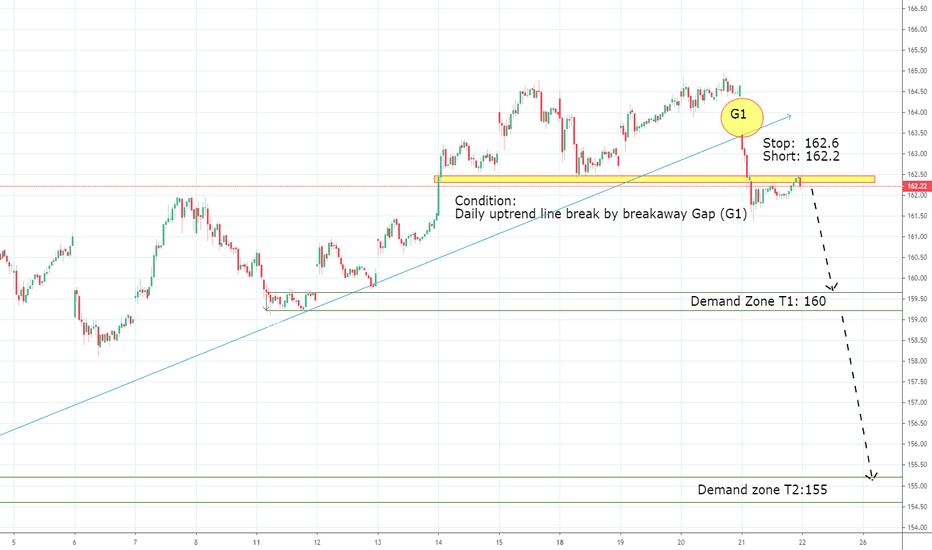

GLD Short, Gap down and trendline break Condition:

Daily uptrend line break by breakaway Gap (G1)

Short: 162.2

Stop: 162.6

Target1: 160

Target2: 155

This is a trading school homework. I need 6 months to practice trading plan.

If you like it, thank you for your support. Please use SIM/Demo account to try it, until my trading plans get high winning rate.

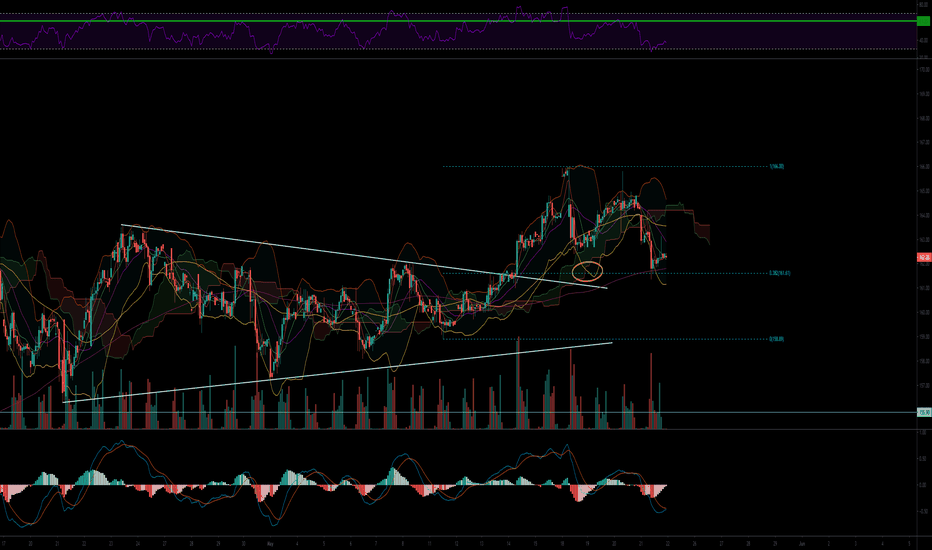

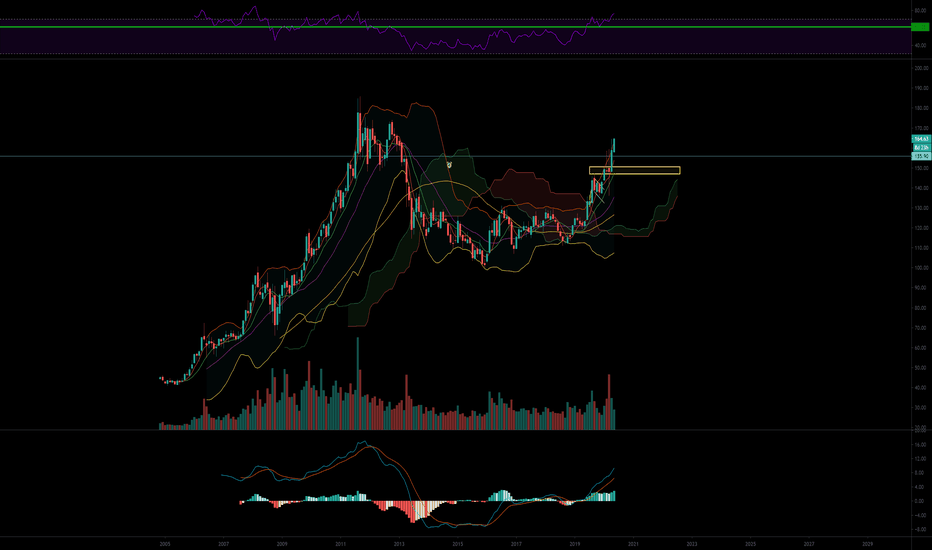

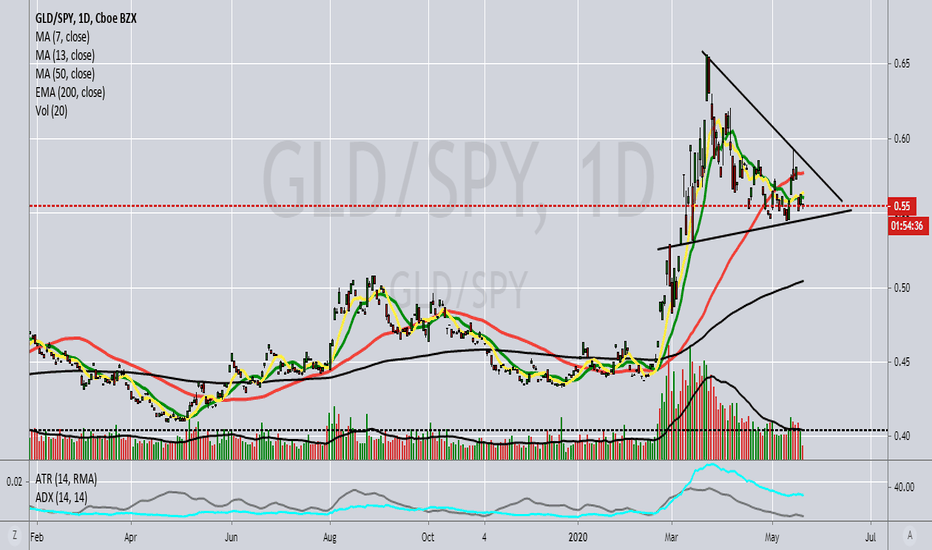

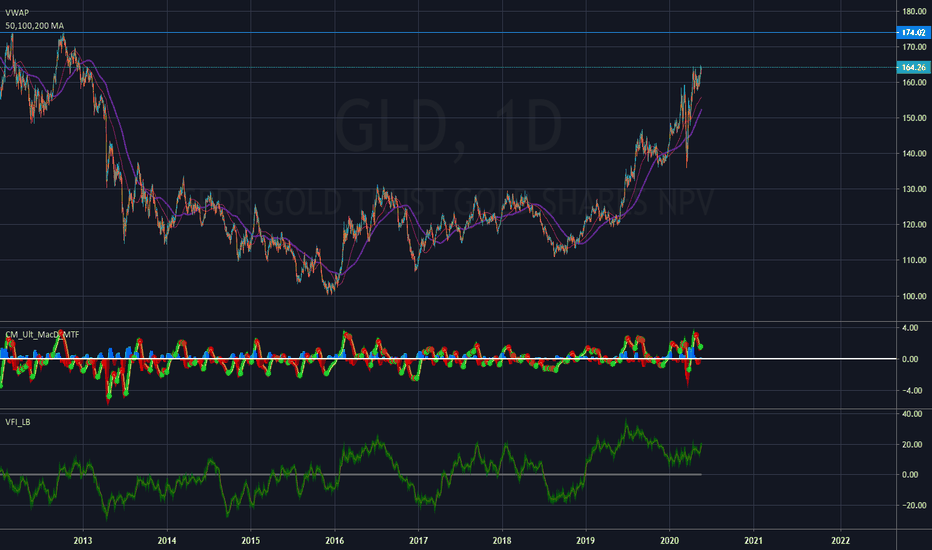

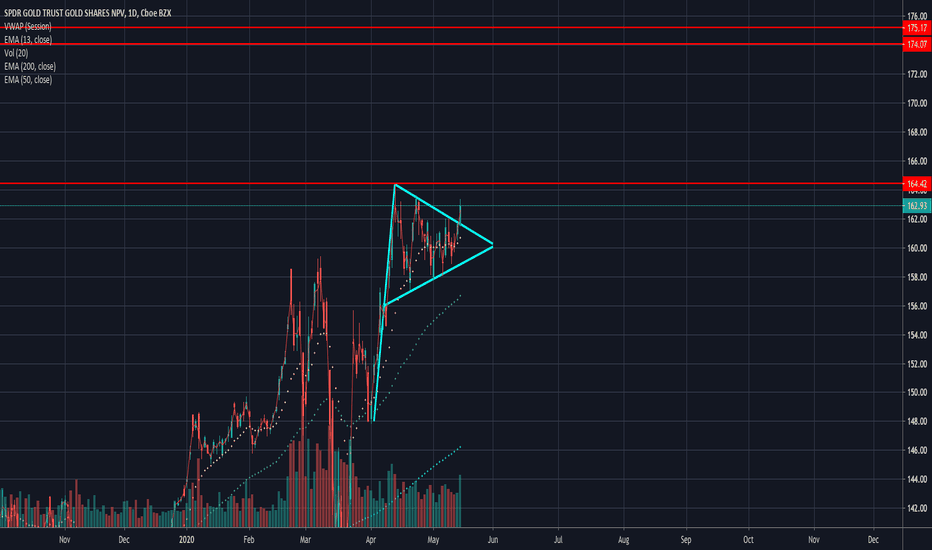

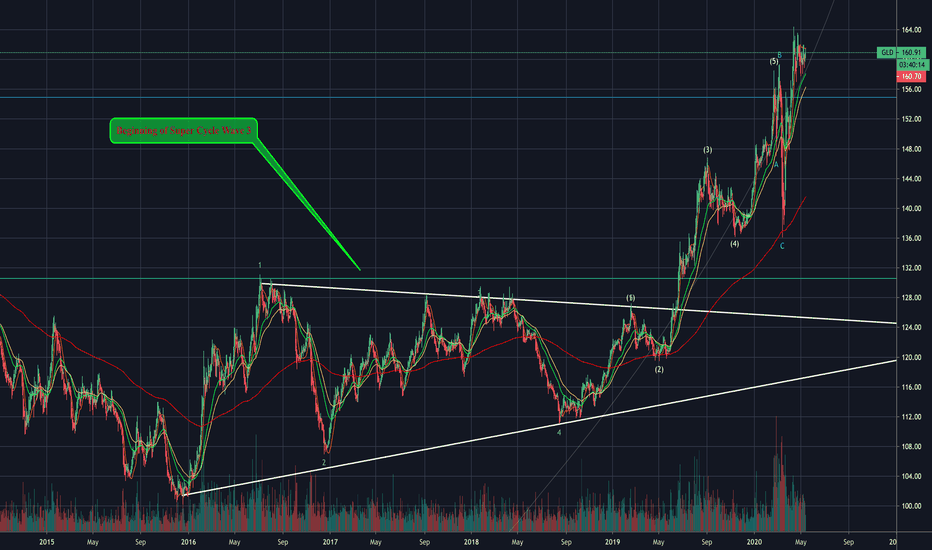

GoldHow far can GLD go? I don't know but note that when monthly RSI pass 70, we would like to see it hold 60 in the next pull back. Also, every time GLD touches 10ma is another potential adding opportunity. As long as these hold, no need to worry about the GLD in IRA account.

That being said, if we see GLD price way way above monthly 10MA. It is worth hedging against long term position, in the meantime, adding short term momentum bets.

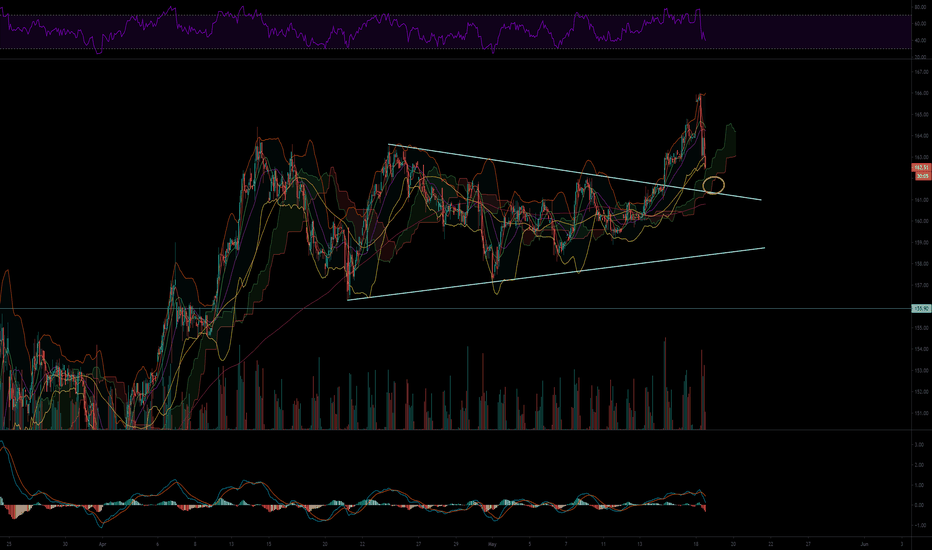

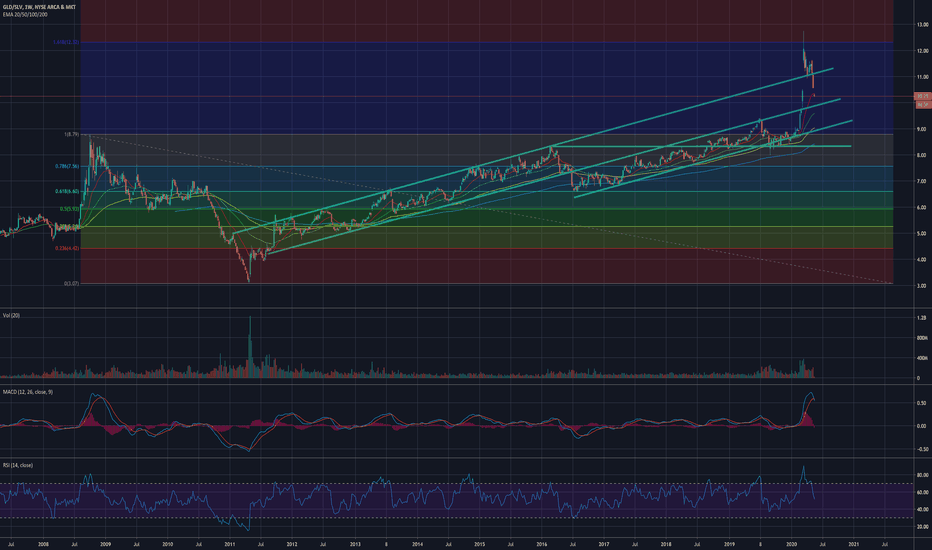

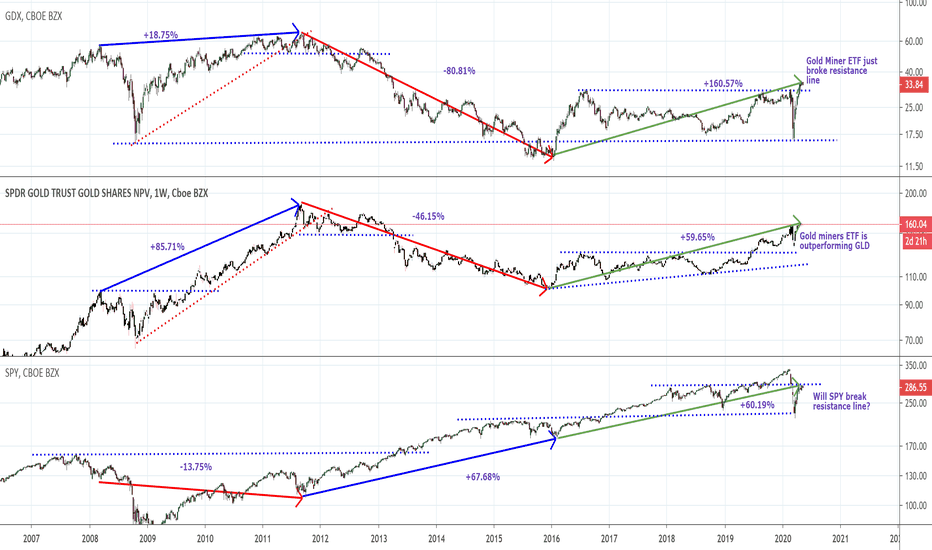

GLD/SLV Ratio - Still normalizing!Expecting we will see 9 or so very soon which is still relatively high for the ratio. Weekly finally rolling over on MACD and RSI comfortably into move down. Looking for $17 SLV while GLD deals with 163-165 or so. GLD working on consolidation base for next move up through 165. SLV still playing corona catch up!

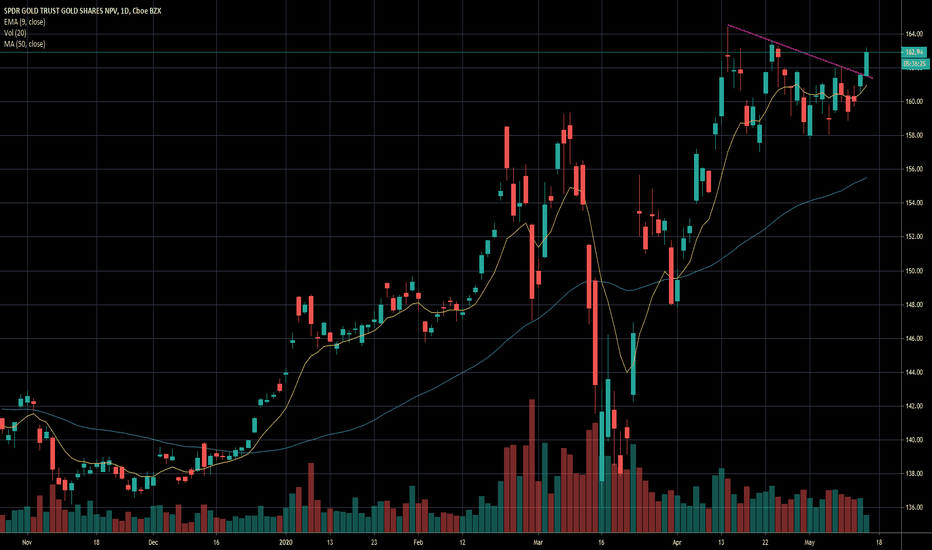

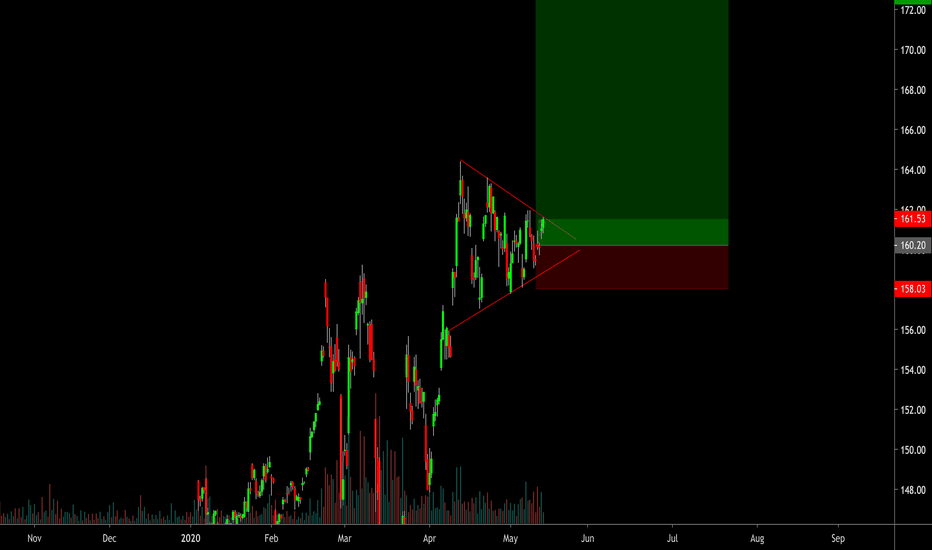

GLD fills an "old" gap around bullish pennant-moves higherI've been learning more about gaps and their importance in price action from Alessio Rastani, Leading Trader. Down gaps especially have the need to eventually go back and fill. During the market crash, Gold displayed massive volatility and formed an inverse head and shoulders pattern through FEB & MAR. A bullish pennant followed in APR & MAY above the inverse h/s. Going back many years it was interesting to find that in FEB of 2013 there was an unfilled "down gap" on the weekly time-frame. About a 1% drop.

Even more intriguing is that the current bullish pennant (broke out and up today) was formed around the 2013 down gap (green arrow points to gap range). Lesson for me is that down gaps matter and often come into play when doing chart detective work to make decisions around putting capital in play while managing risk.

Many thanks to Alessio and the LT team for the ongoing weekly education. Becoming a member was a great decision for my trading endeavors. AMEX:GLD

GLD: Bullish Bias$GLD is attempting a bull flag breakout with volume after confirming an inverted SHS formation - investors continue to hedge in safe haven assets.

We are bullish biased while we wait for opportunities in the equity markets.

Continue to reiterate stock picking of fundamentally strong stocks around a "lockdown" theme (e.g. e-commerce & tech).

EnsoAM