Russell 2000 Order Flow: Bullish Pattern ActivatedHey traders,

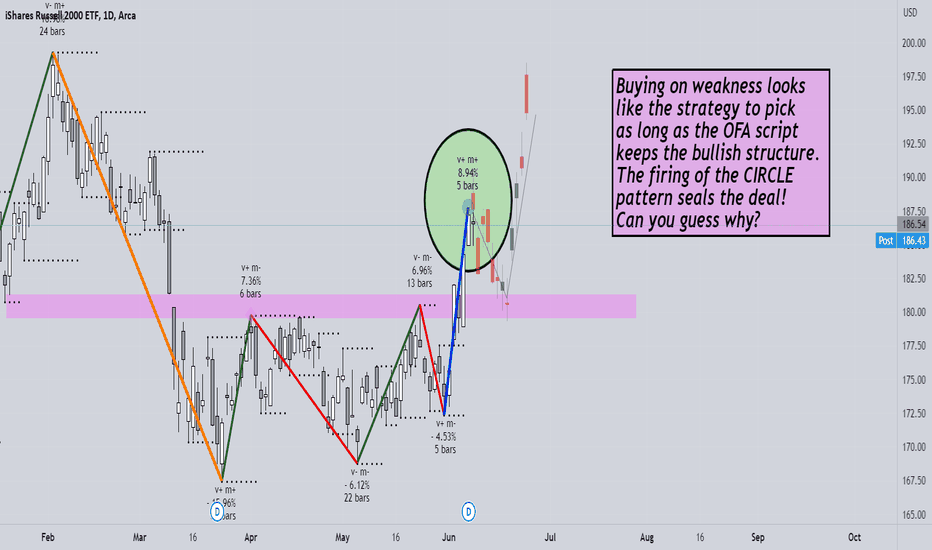

In today’s analysis, it’s hard to ignore IWM following the 🚀explosive🚀 8%+ move up.

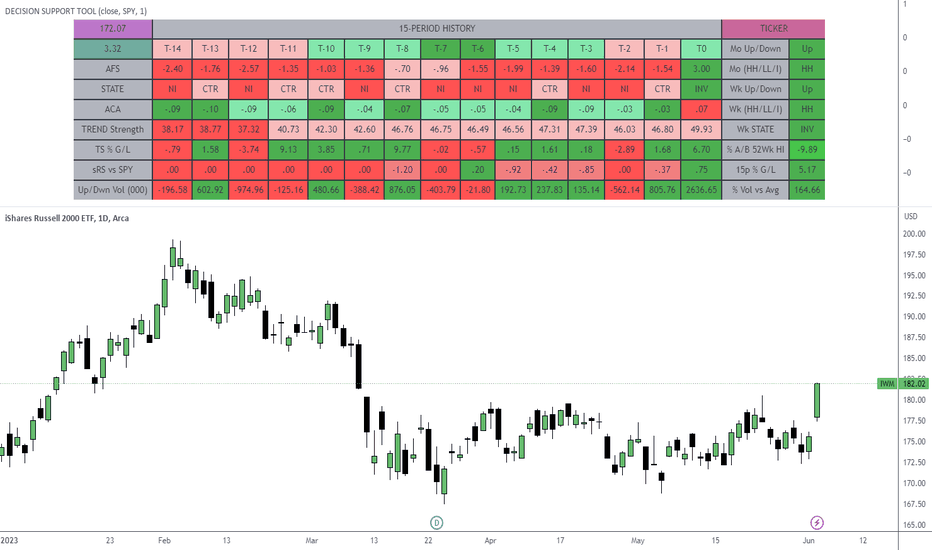

Let’s unpack the action as of late via the OFA script :

To do so, I am NOT going to apply any subjective type of analysis such as crawing trendlines, counting waves based on what way the wind blows, or any other form of guessing…

Instead, we let the formation of fractal structures (an objective measure of moves) create the pathway from which we can all make decisions.

Fortunately, there is no need to engage in laborious manual work. Why? The OFA script has all of us covered. So, with that in mind, what can we observe in the IWM market?

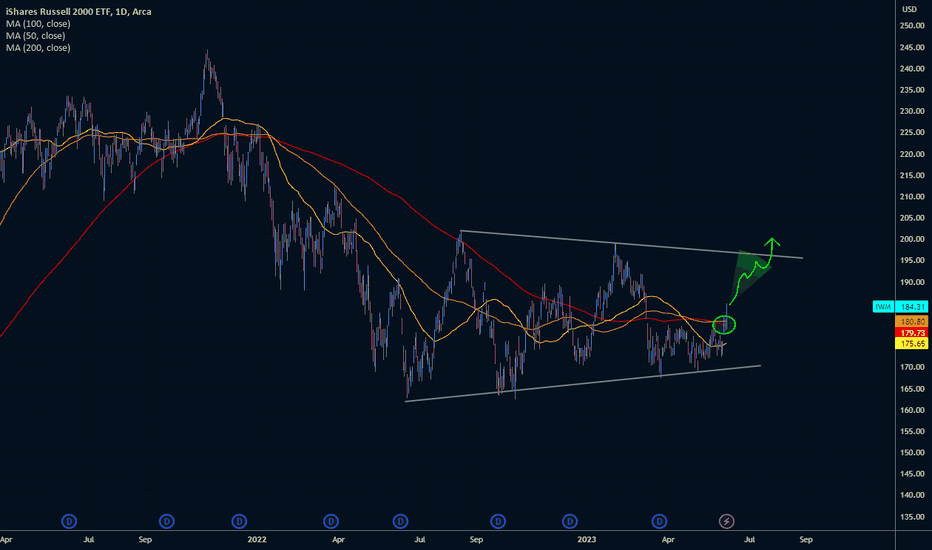

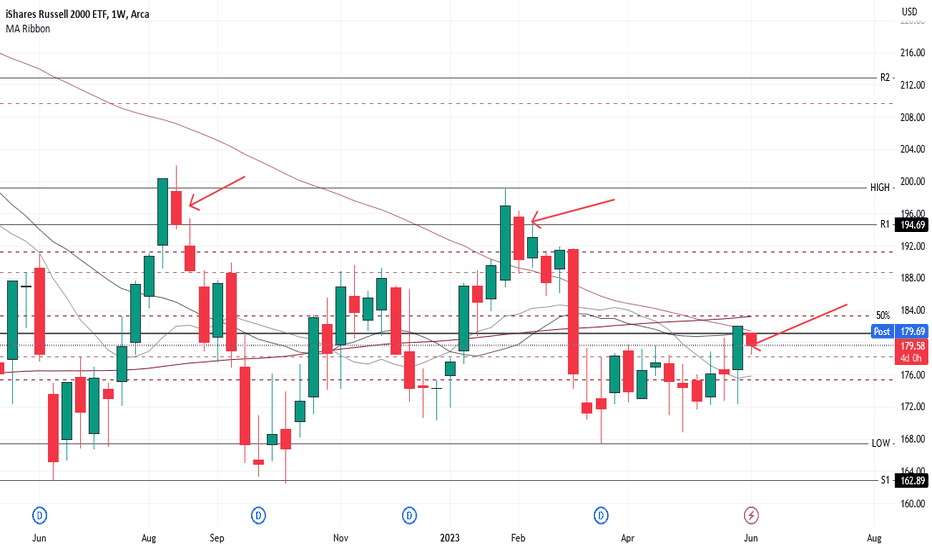

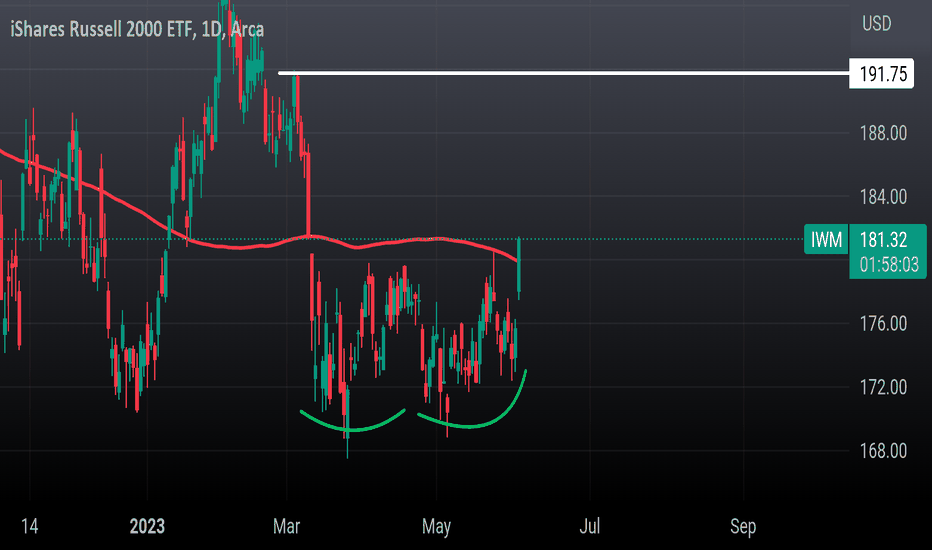

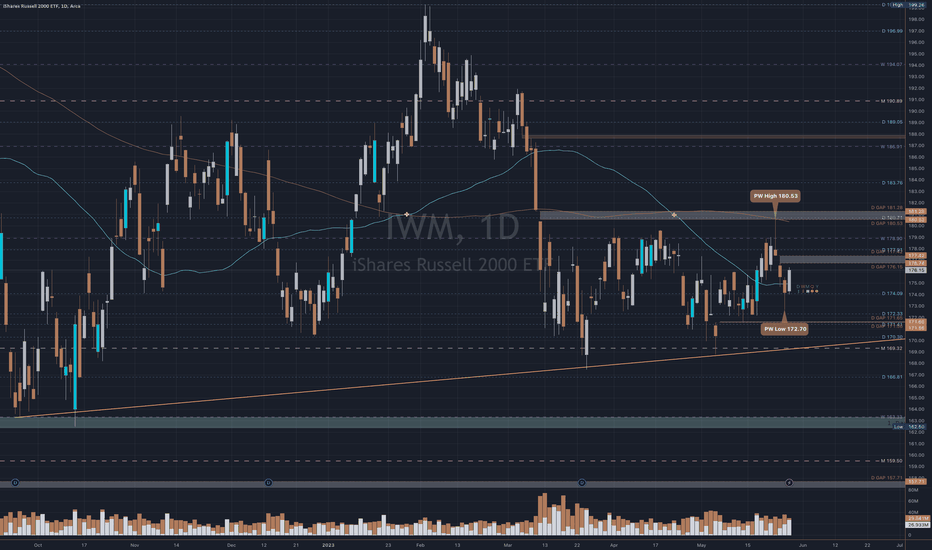

What recurring pattern do you notice? Clue - Pay attention to the visual CIRCLE feature in the last leg.

These patterns entail, “dynamic fractal-based order flow cycles where a decreasing involvement in one direction (depicted by cycle/wave/line counts) is followed by a predictable move in the opposite direction with greater commitment seeking out the next equilibrium area, in most instances, with potential profits as a by-product thereafter…”

If you are into disseminating order flow, nothing I’ve seen beats the objectivity in analysis one can carry out via the formation of structures derived off fractal structures.

So, how are you going to profit from the latest pattern printed? I know how I will...

Remember the two key main features of the OFA script:

Magnitude: A major clue that will help determine the health of a trend is the type of progress by the dominant side in control of the trend. We need to ask the following question: Are the new legs in the active buy-sell side campaign as identified by the script increasing or decreasing in magnitude?

Velocity: When it comes to the distance the price moves, the magnitude is only ½ the equation. The other ½ has to do with the velocity of the move or the speed. Was the new leg created after a fast and impulsive move? Or did price make a new low or high with the movement being sluggish, compressive and taking too long to form? A good rule of thumb is to count the number of candles it took to achieve a new leg.

DISCLAIMER: This post contains commentary published solely for educational and informational purposes. This post's content (and any content available through links in this post) and its views do not constitute financial advice or an investment or trading recommendation, and they do not account for readers' personal financial circumstances, or their investing or trading objectives, time frame, and risk tolerance. Readers should perform their own due diligence, and consult a qualified financial adviser or other investment / financial professional before entering any trade, investment or other transaction.

IWM trade ideas

IWM - Perking up?Small caps have moved up to resistance. With Friday's move and todays move my guess is that the next move will be a consolidation of the almost 7% move in the last week. Volume has picked up but I wouldn't be surprised if there is just as much selling as buying into this lift. Economic factors do not have me pounding my fist to buy the most vulnerable companies out there. Typically small caps lead in a new bull market and not at the end of a cyclical bull inside a secular bear. My guess is to fade this move. I think markets want people to believe that the rally is broadening out and will pull the rug out on everything soon. Call me skeptical but I'm not in IWM until resistance is broken and there is a successful retest of the breakout.

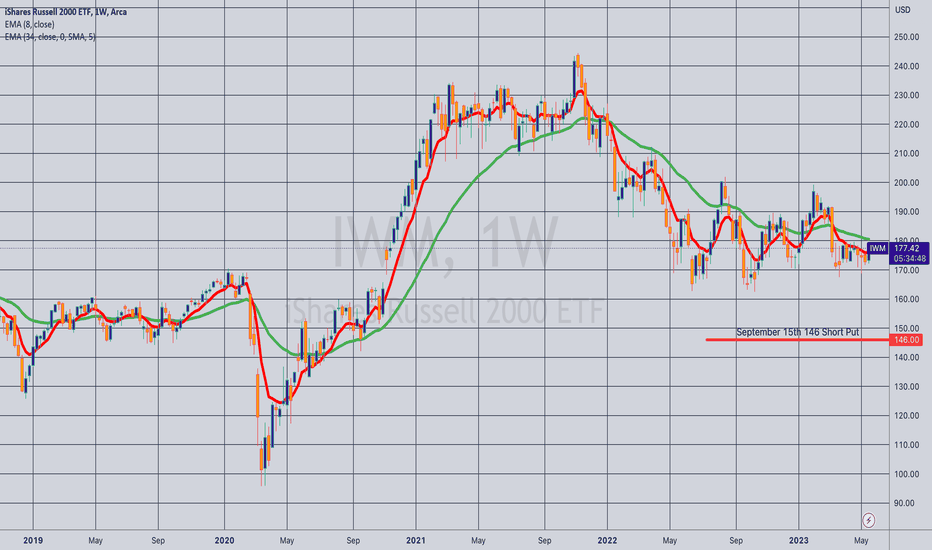

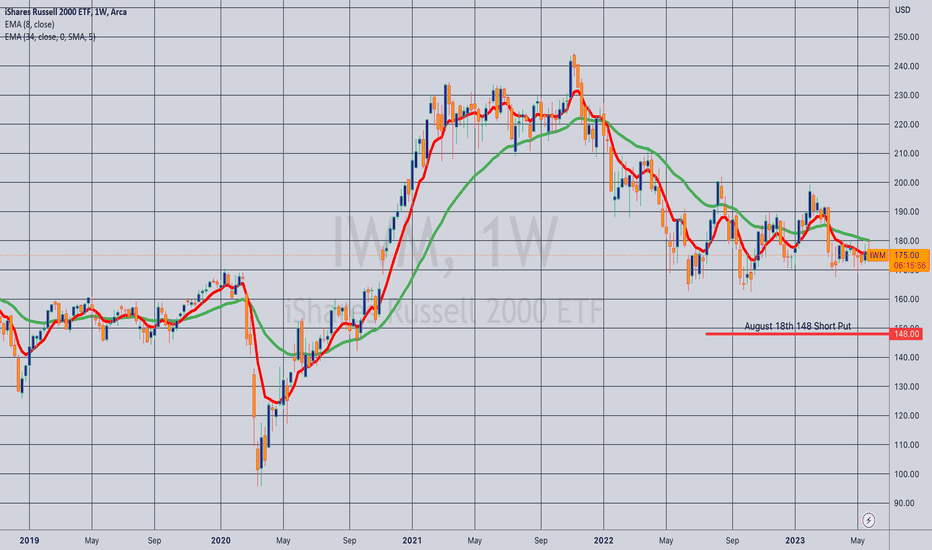

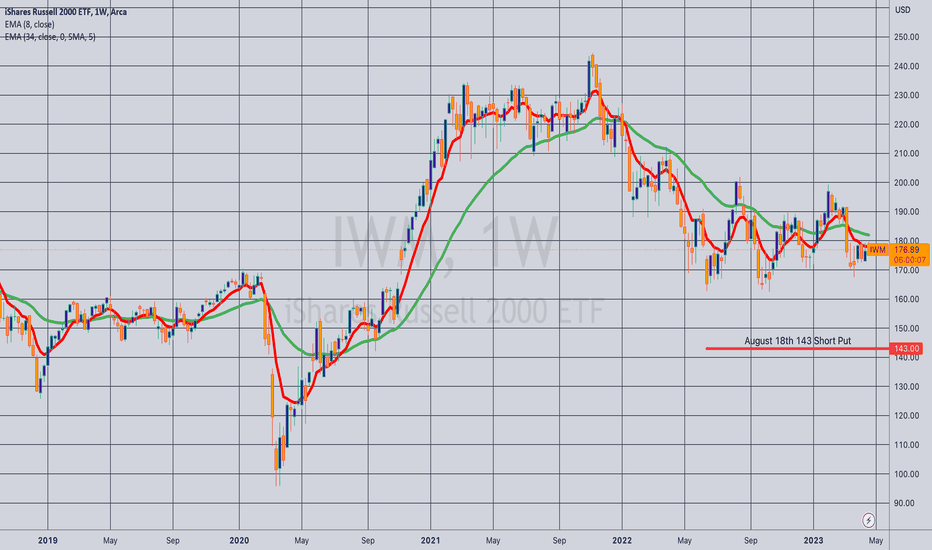

Opening (IRA): IWM September 15th 146 Short Put... for a 1.46 credit.

Comments: Re-establishing a September rung after scratching out a higher strike trade yesterday, targeting the <16 delta strike paying around 1% of the strike price in credit to emulate dollar cost averaging into the broad market.

The shortest duration trades in which the <16 delta strike is paying around 1% in credit:

IWM: August (at the 154 strike, paying 1.58)

QQQ: August (at the 296 strike, paying 2.99)

SPY: September (at the 367 strike, paying 3.70).

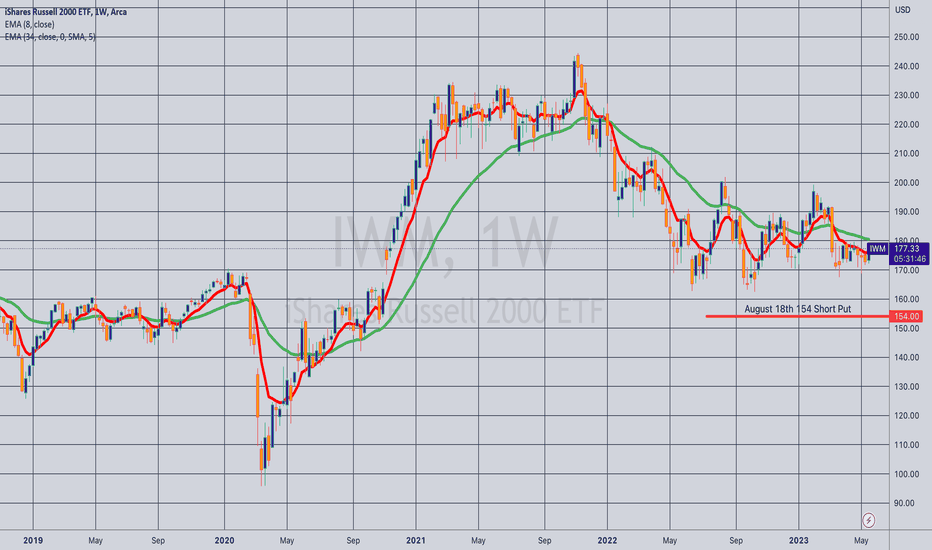

Opening (IRA): IWM August 18th 154 Short Put... for a 1.60 credit.

Comments: Targeting the <16 delta strike in the shortest duration paying around 1% of the strike price in credit to emulate dollar cost averaging into the broad market. Would like higher IV to sell shorter duration in, but you can't have everything.

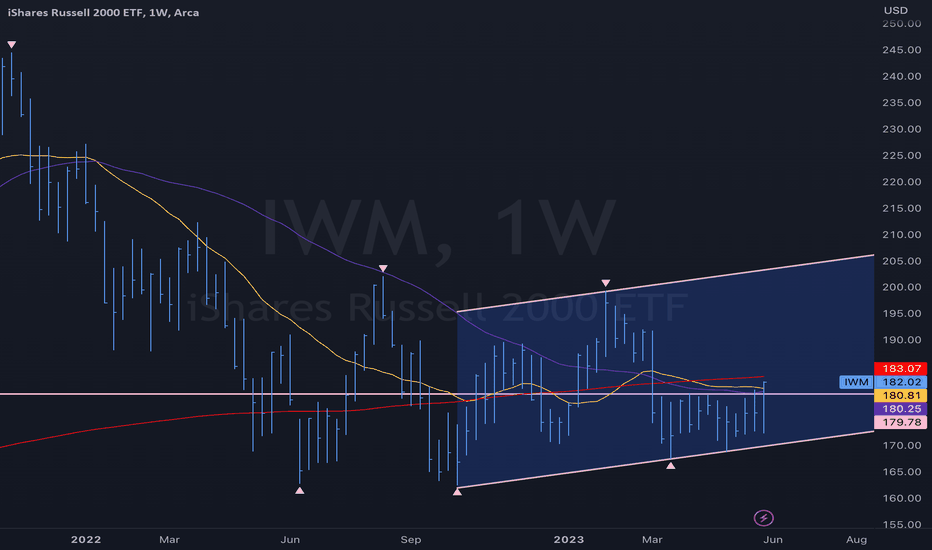

Stock Chart Analysis 101, Recognize the PatternsIf you check my previous post about AMEX:IWM you will see that I signaled the potential for a lower high here. This is no confirmation of that being correct just yet. I just thought the opening of the week was extremely interesting.

Check out the Equity Channel Podcast on Apple, Amazon and Spotify for more information on trading and investing.

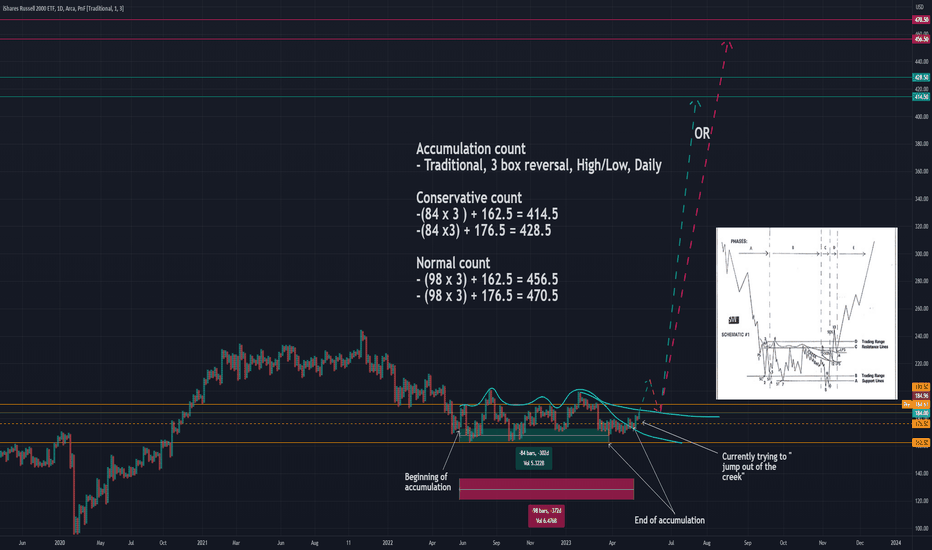

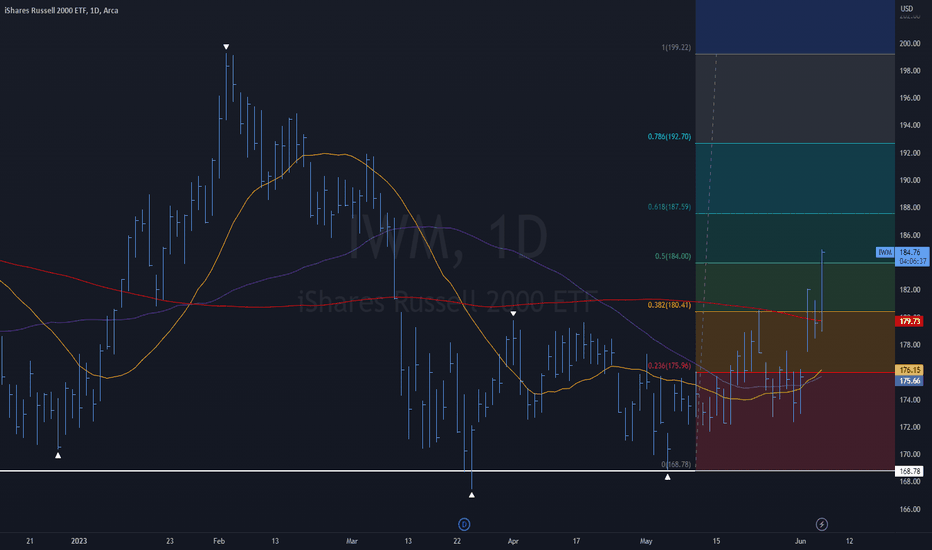

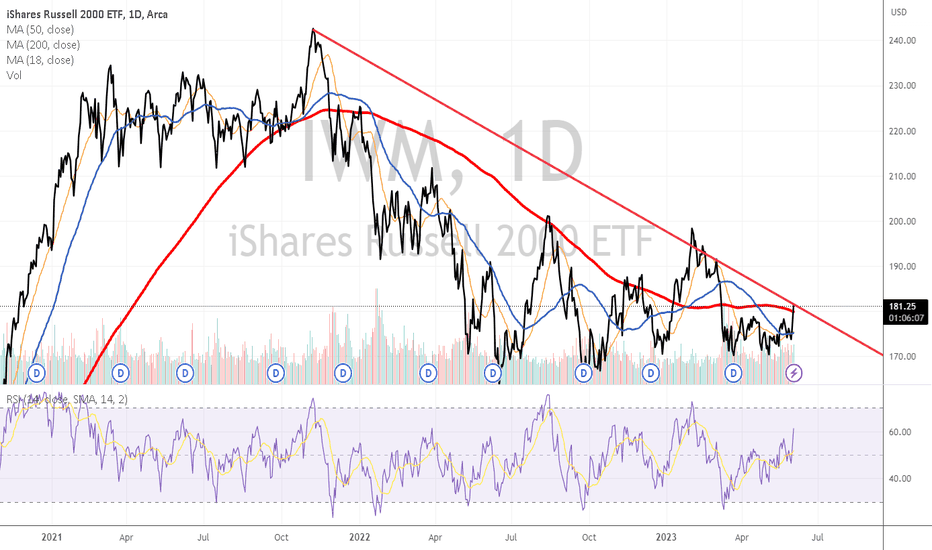

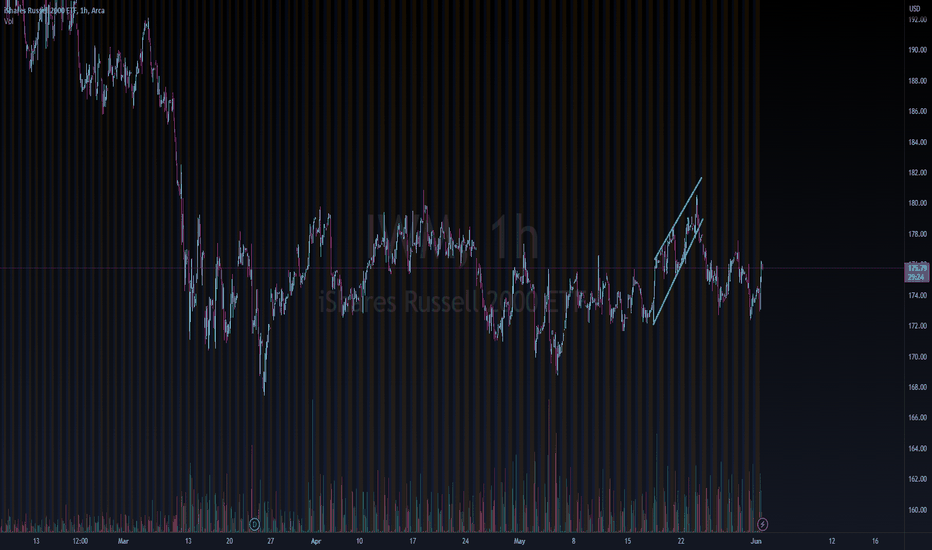

$IWM - Local technical breakout. Is it the right time to long?AMEX:IWM

Daily: Golden cross in process, however not happened yet.

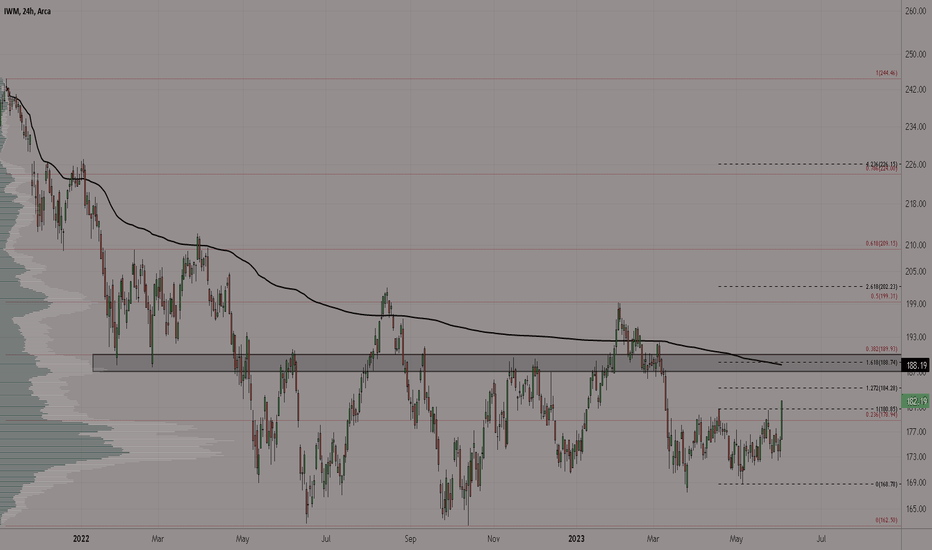

Overall bulls are not in control yet below 189/190+. AVWAP at 188.19

Short-term, bulls legitimately succeeded to trigger a technical breakout at 180.85 with volume!

As long as 180.85 hold, price should head into 184.28, 188.74, 189.93 (breakout > 199.31).

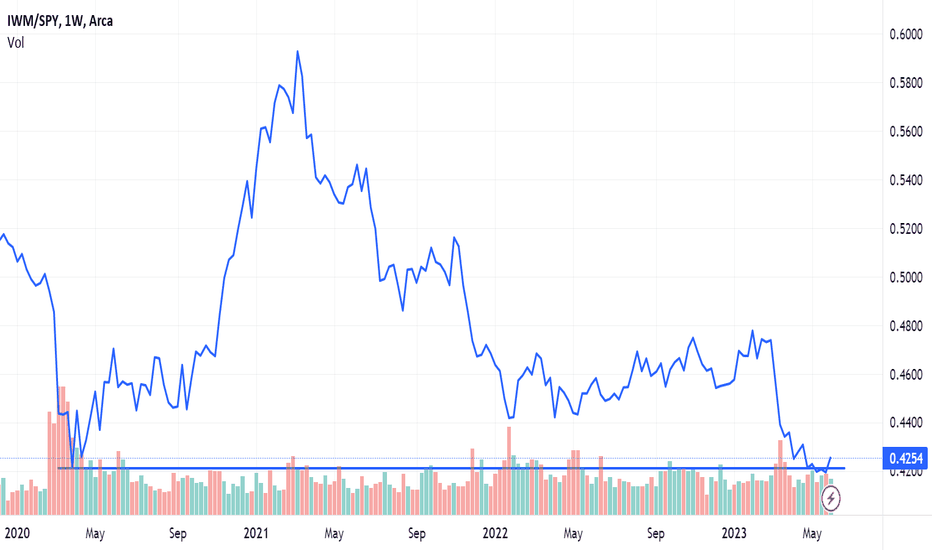

WEEKEND UPDATE JUNE 4 2023 - SMALL CAPS JOIN THE PARTYMacro

2/10 YR CURVE - Inverted = -.81 (More Negative from -.74 last week)

HIGH YIELD SPREADS = 4.65 (Up from 4.58 last week)

US ISM PMI - Contracting Faster = 46.90 down from 47.10%

US ISM SERVICES - Growing Faster = 51.90% up from 51.20%

S&P 500 ( SPY ) - Investable

Nasdaq100 ( QQQ ) - Investable

Russell2000 ( IWM ) - Investable

Gold ( GLD ) - Investable(Pullback)

US 30yr Treasury Bonds ( TLT ) - Not Investable

US Dollar ( UUP ) - Investable

US Real Estate ( IYR ) - Not Investable

European Equities ( VGK ) - Investable(Pullback)

India ( INDA ) - Investable

Broad Asia Equities ( VPL ) - Investable

China A-Shares ( ASHR ) - Not Investable

Emerging Markets ( EEM ) - Investable (Pullback)

Wheat Futures (ZW) - Not Investable

Corn Futures ( ZC ) - Counter Trend Rally

Soybean Futures (ZS) - Not Investable

Silver ( SLV ) - Investable(Pullback)

Natural Gas Futures ( NG ) - Not Investable

Volatility Levels

S&P 500 - 14.60 - Investable Market (Down from 17.95 last week)

Nasdaq100 - 19.29 - Investable Market (Down from 22.21 last week)

Russell2000 - 20.88 - Investable Market (Down from 23.51 last week)

S&P 500 Volatility Structure - Normal Contango Structure

VIX 9-Day - 12.74

VIX Short Term - 14.50

VIX - 14.60

VIX Long Term - 14.79

Now, here is the list of individual ETFs and individual names are showing strength.

Strongest of our ETF universe

SVIX

SMH

XLK

QQQ

IGV

IWF

NIB

ARKF

ARKG

XLY

QUAL

EWJ

Strongest of our ETF Leveraged/Inverse Funds

KOLD

TQQQ

SOXL

QLD

SDP

KORU

WANT

SPXL

SPUU

RXD

INDL

Strongest of our Individual Equities

MDB

NVDA

META

AMD

CFLT

MRVL

AVGO

HUBS

EXAS

BLDR

GOOGL

NOW

SNPS

MSFT

CPRT

NET

AMZN

NFLX

ADBE

LRCX

TTD

RCL

SHOP

PACB

AKAM

TTWO

ORCL

KLAC

FSLY

VRSK

PANW

WDAY

ACN

MU

AMAT

CRM

AAPL

VMC

CDNS

SPLK

ASML

UBER

CCL

MLM

SNOW

DVA

CEG

ANET

DRI

IT

FTNT

COF

PTC

FLT

NTAP

STZ

MCK

PWR

MCO

GRMN

IPG

ETN

KEYS

NWS

SPGI

ANSS

STE

CSCO

CTAS

MKC

MPWR

EFX

TER

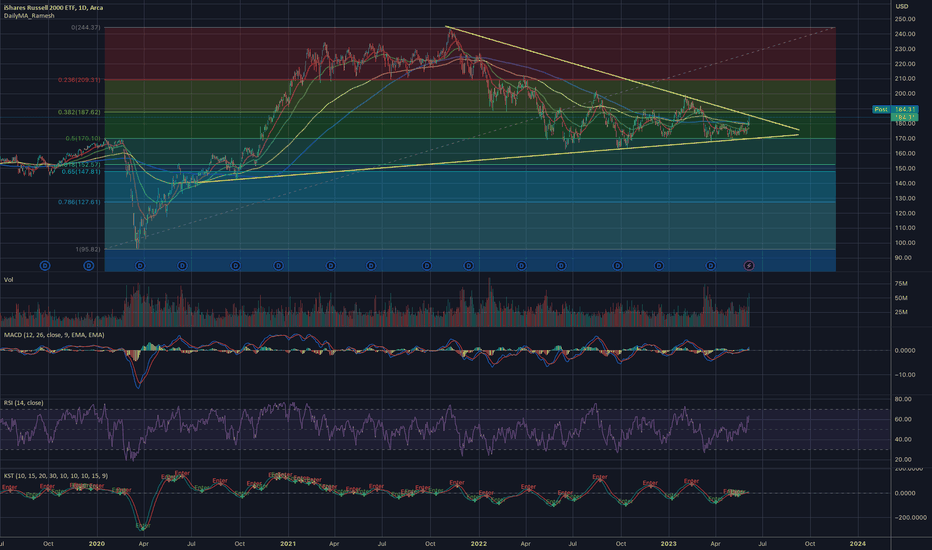

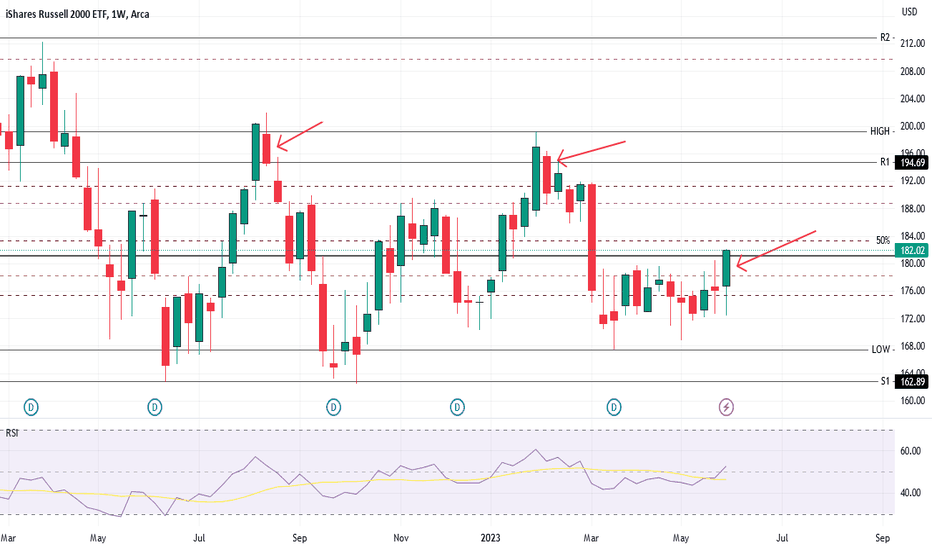

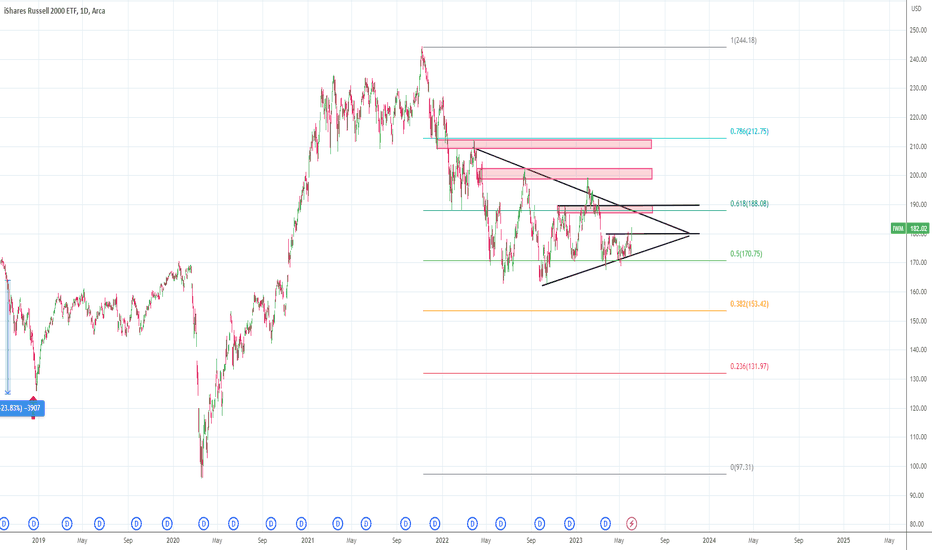

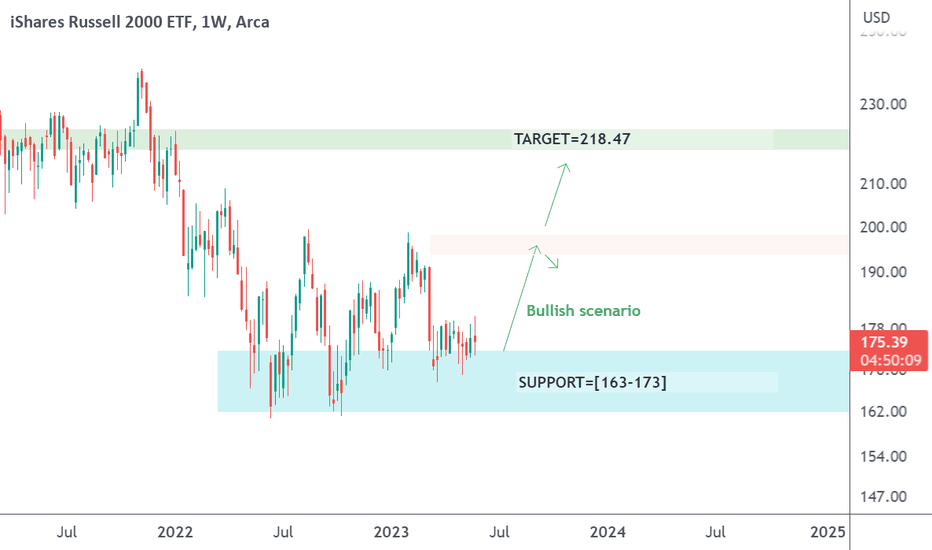

$IWM, #RUTAMEX:IWM , the Russell 2000, experienced a significant move on Friday, June 2nd, accompanied by high trading volume. On the daily chart, it successfully broke out of its structure, indicating the next potential levels at $185-190. If it manages to surpass this range, it could potentially reach $200 and even $220. It is worth noting that there are several bullish setups observed in mid-cap stocks.

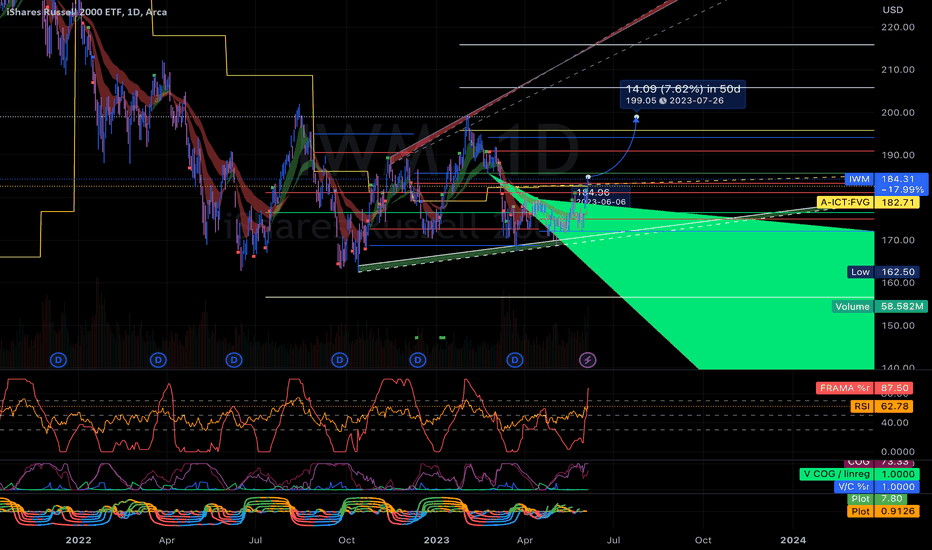

IWMBroke from under its 200sma today for the first time since March.

Currently outside Daily bbands sowe may see a pullback and we retest of 179-178..

Only bearish if we close back below 177.

Next resistance is 183 or weekly 200sma, if it breaks over that then IWM is headed back to 192.

Either wait for the 178 backrest or wait for a close above 183 to go long.

Using Pinescript for BacktestingA bit of a lengthy video on using pinescript to develop your trading strategy.

I just basically go over very basic functionality to get you on track if you have an interest in using pinescript for these functions.

If you are interested in seeing a little more advanced stuff or seeing how to repurpose pre-existing indicators into strategies, leave a comment and this could be a future tutorial!

I have also done a tutorial on using Excel to backtest your Strategy which is available here:

Thanks for watching!

$IWM Outlook 05/30 - 06/02 @capgainsgroupAs the S&P 500 and the NASDAQ rally into the green for the year, the Russell 2000 (aka the small cap index) has lagged behind and is barely green at +1.03% YTD for 2023. One of the reasons why this index hasn’t been doing well can be attributed to the index’s 15.18% allocation in the Finance Sector. Failing regional banks such as Silicon Valley Bank ( NASDAQ:SIVB ) and Signature Bank ( OTC:SBNY ) haven’t helped the index much.

Investors who would like to play the Russell 2000 should pay attention to the 5 major sectors that makes up 73.23% of AMEX:IWM : Health Care (17.62%), Industrials (16.66%), Financials (15.18%), Information Technology (12.74%), and Consumer Discretionary (11.03%).

Technical Analysis:

AMEX:IWM recently formed a Death Cross (50 SMA x 200 SMA) on the daily chart in mid April. Although not very clean, there is a support uptrend line dating back to October 2022. Also, it seems like we have a head and shoulders pattern, using the Daily 170.30 level as the neckline.

Bulls will want price to reclaim the weekly 178.90 level as a support.

I lean bearish on this index. If AMEX:IWM can’t reclaim the two daily gaps above, at 176.74 - 177.42 and 180.53 - 181.28, I expect it to come down and test the yellow uptrend line and potentially break it to the downside in the coming weeks.

Upside Targets: 176.74 → 177.42 → 180.71 → 181.28 → 183.76 Extended: 186.91

Downside Targets: 174.09 → 172.33 → 171.41 → 170.30 → 169.32 Extended: 166.81