Using Excel to Backtest your Strategy Hello everyone!

This is a tutorial video on how to use Excel to backtest your strategies using technical indicators on Tradingview.

This provides the foundations for you to get creative and have the essential tools and knowledge required to begin back-testing your strategies using Excel.

There is much more than can be done using Excel for back-testing, so if you are interested in seeing more in-depth functionality for more advanced back-testing methods, let me know below!

The essential functions in this video are the conditional functions of Excel. These are the "If" "Then" statements.

The code used to identify conditions are:

Single condition:

=if(condition1,"Result1","Result2")

More than One Condition:

=if(and(condition1, condition2, condition3, etc.),"Result 1", "Result 2")

If you do not have Excel, you can use OpenOffice which is opensource and free to use!

As always, let me know your questions and comments below!

Safe trades everyone!

IWM trade ideas

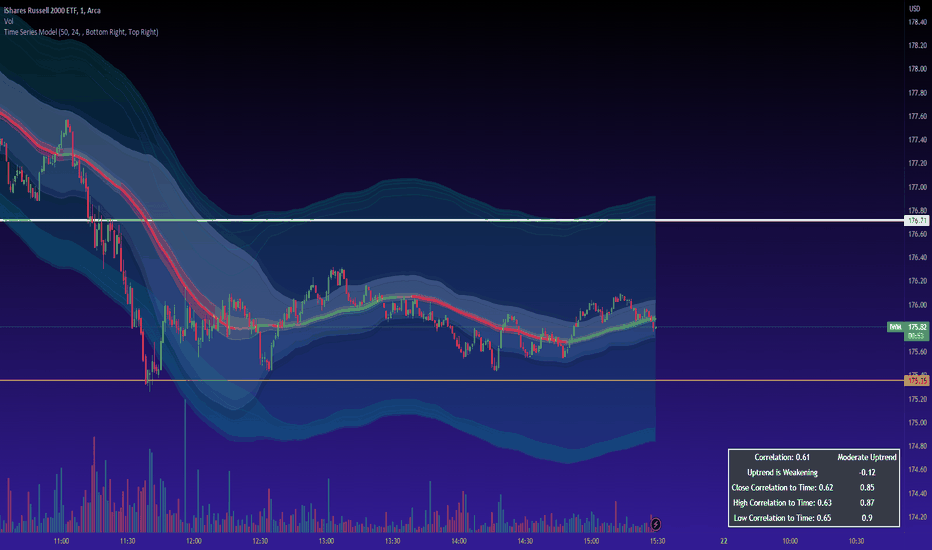

Time series model indicatorHello all!

Releasing the time series model indicator later today.

Here is a brief instructional video and informational video about its use.

Leave any questions below or on the indicator's page once posted. I will link the link below once it has been posted.

Thanks for watching!

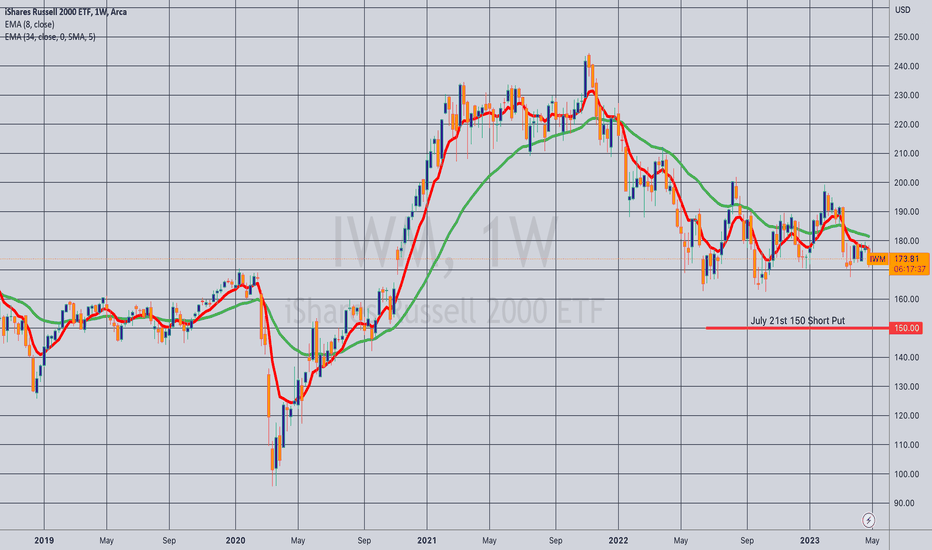

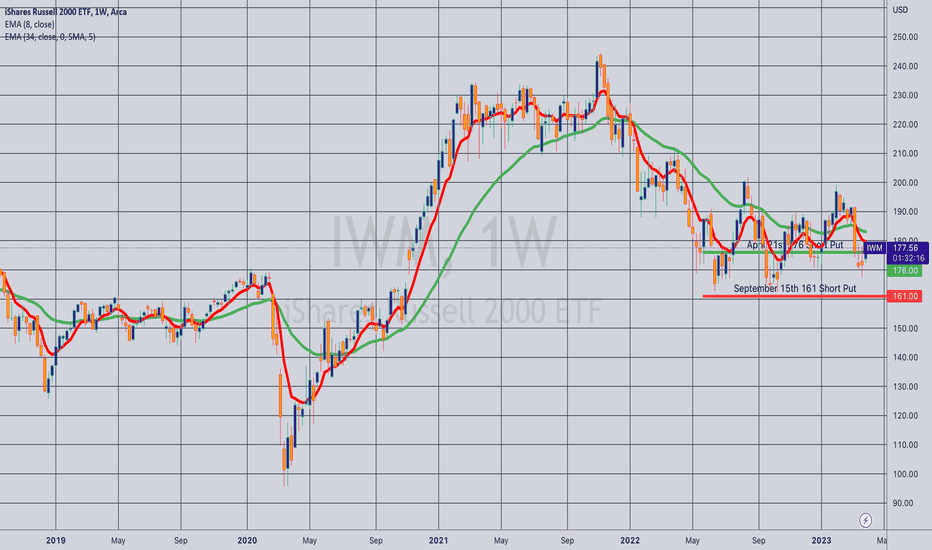

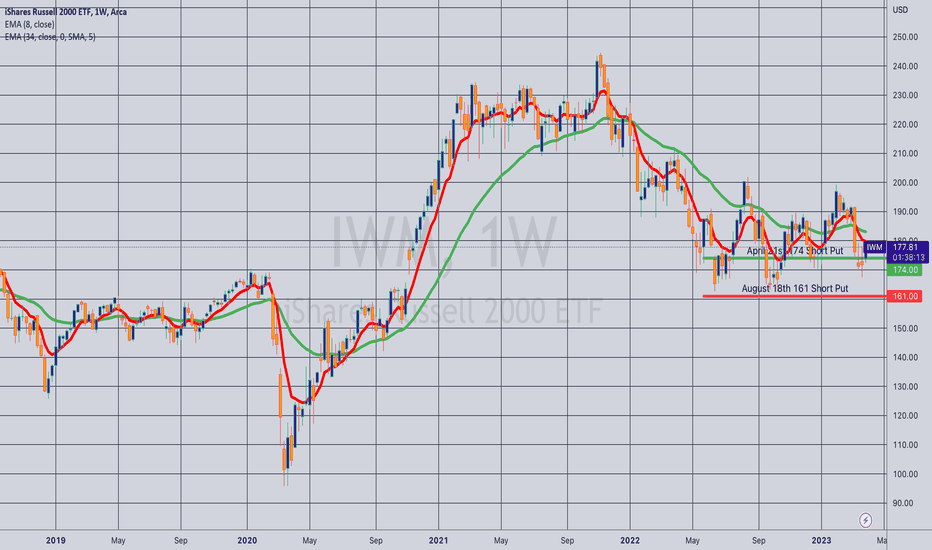

Opening (IRA): IWM July 21st 150 Short Put... for a 1.48 credit.

Comments: Targeting the <16 delta strike in the shortest duration paying around 1% of the strike price in credit to emulate dollar cost averaging into the broad market. IVR/IV isn't fabulous here at 1/22.7%, but will look to add in shorter duration and/or at better strikes in higher IV should we get it at some point.

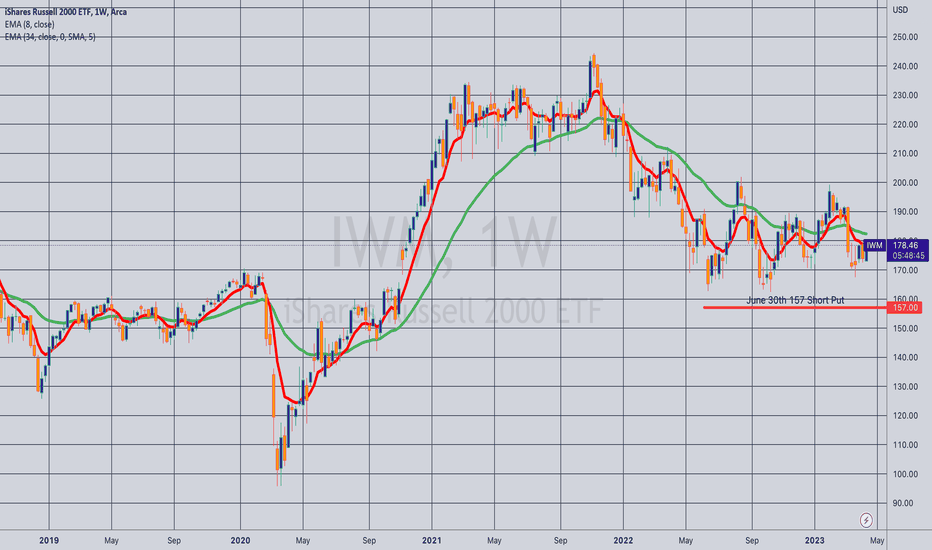

Opening (IRA): IWM June 30th 157 Short Put... for a 1.61 credit.

Comments: Targeting the shortest duration <16 delta strike paying around 1% of the strike price in credit to emulate dollar cost averaging into small caps.

This, admittedly, isn't an ideal premium-selling environment here, with 30-day at the very low end of the 52-week range, but will look to add at intervals and in shorter duration if that starts to pay again.

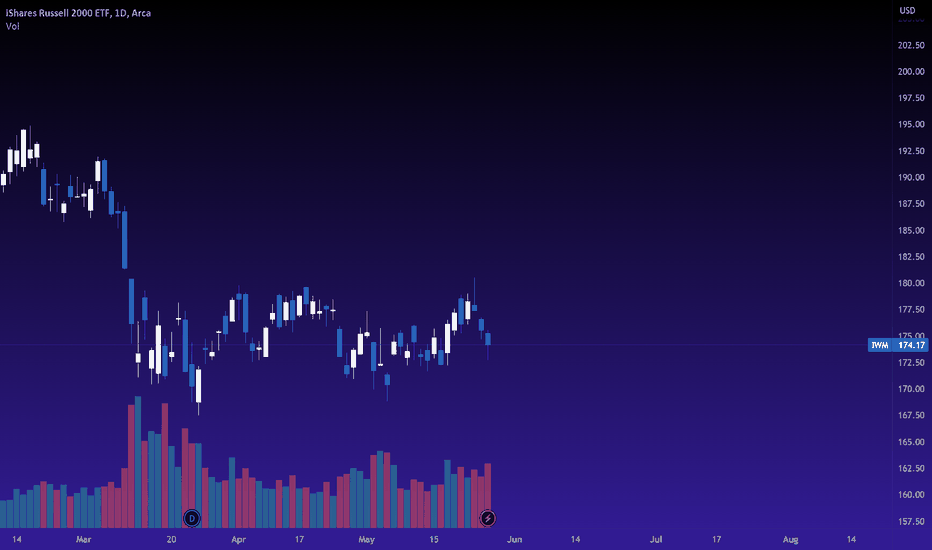

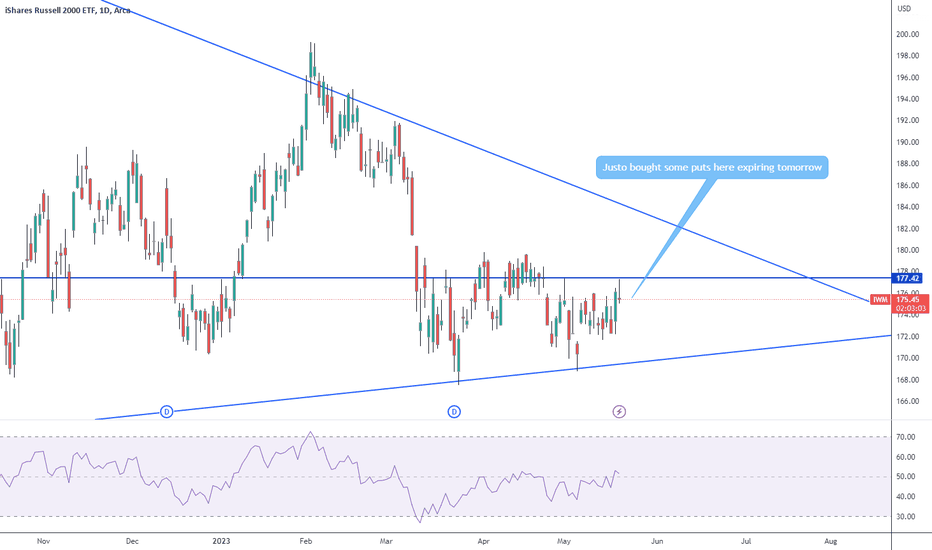

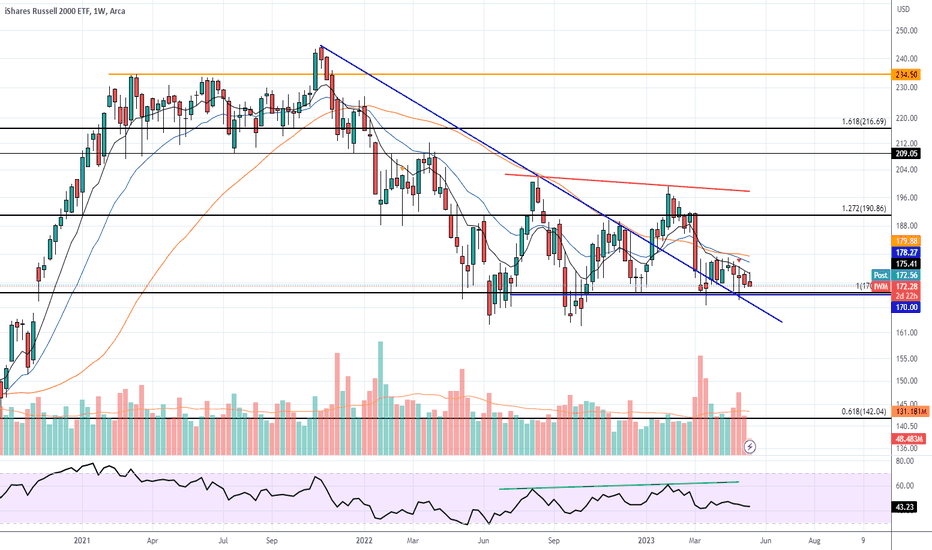

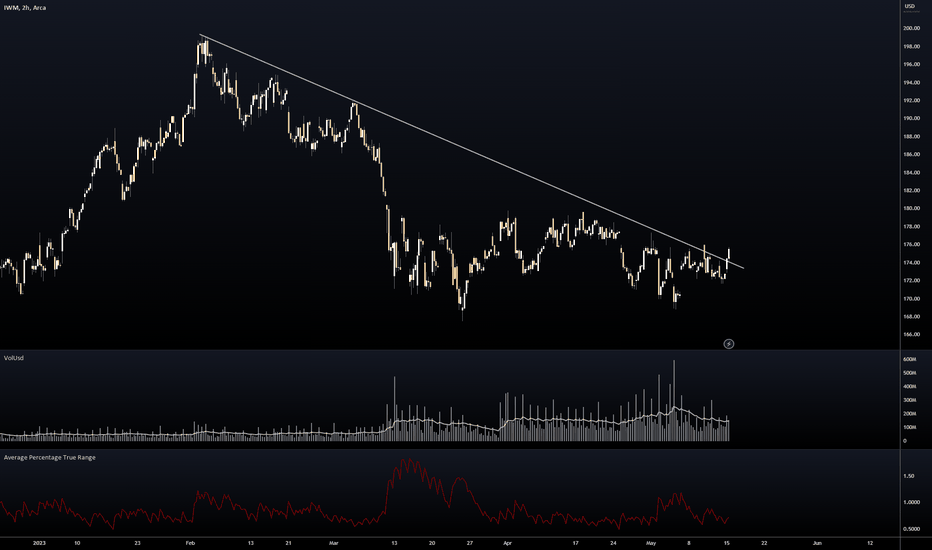

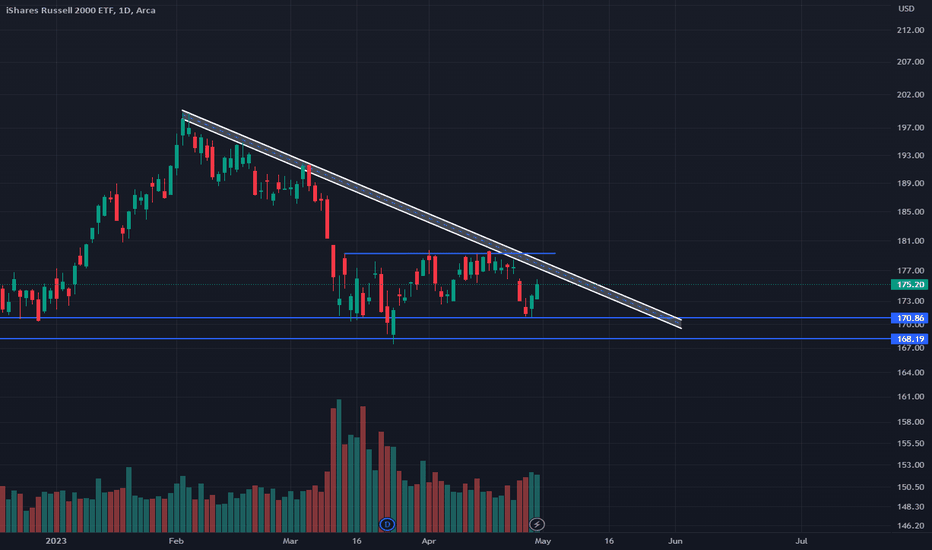

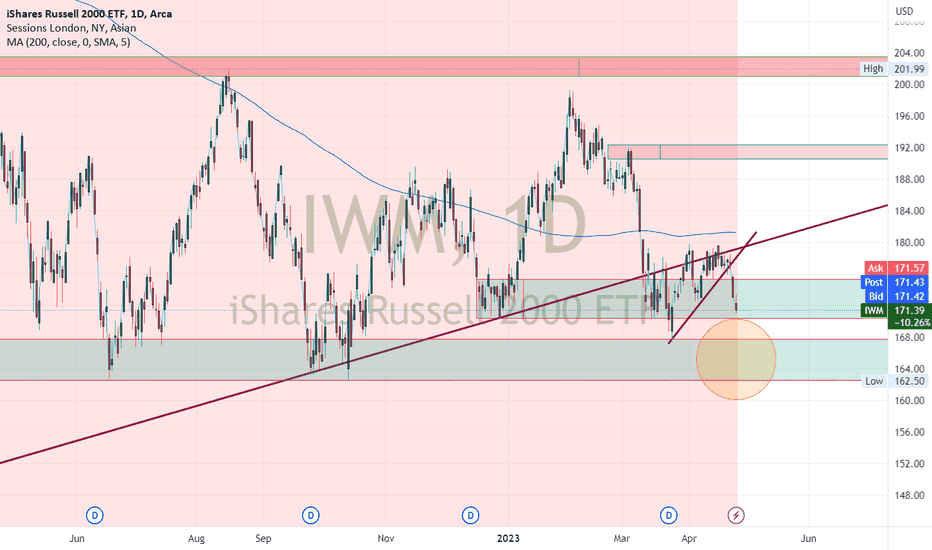

IWMIdk how significant a hidden bearish divergence is, but it's there on the weekly. Whole thing feels heavy. Feels like it'll end up being a false breakout of the blue trendline. I'm short via TZA. Stop is weekly close above 9 ema as it has been a brick wall the past few weeks. Watch out below $170.

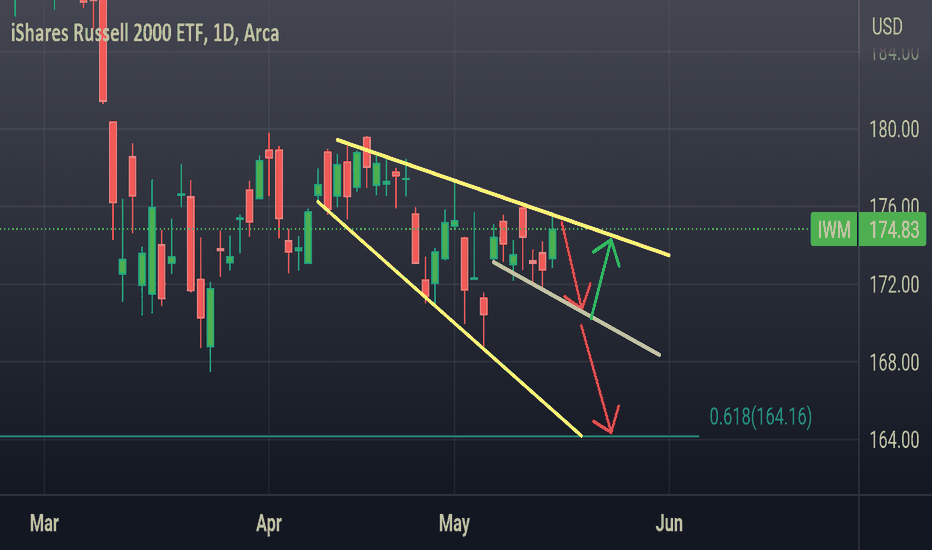

IWM Broadening wedge here, long term bullish, short term bearish..

I think IWM is headed to 165 fibonacci support or Sept lows.

Has a split channel with support on the white trendline, I think It tags it in the next couple of days (170-171).

If it breaks below 170 we're headed to 165..

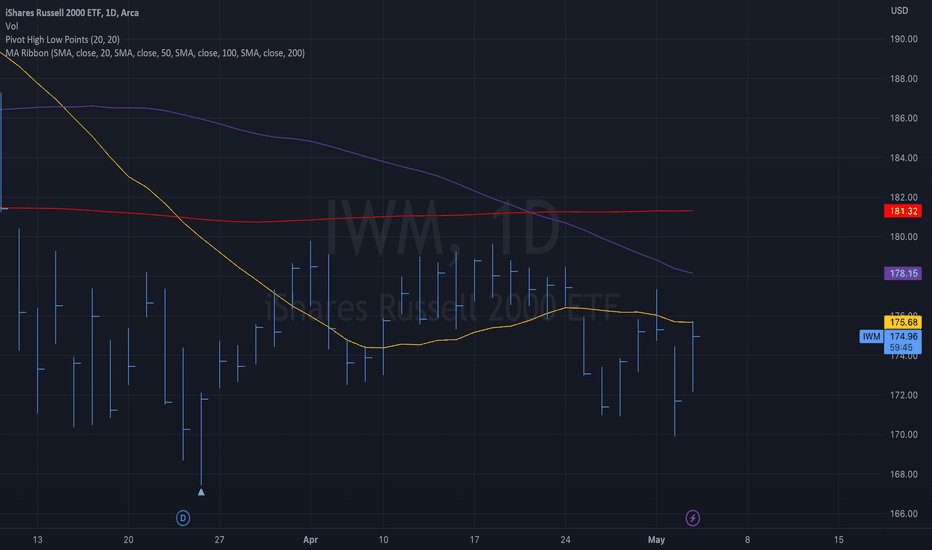

Today IWM closed above its 20sma but got rejected by its 50sma.

Use those MA as your entries.

Below 20sma - Short to white trendline

Above 50sma and that's a breakout.. target 177,180

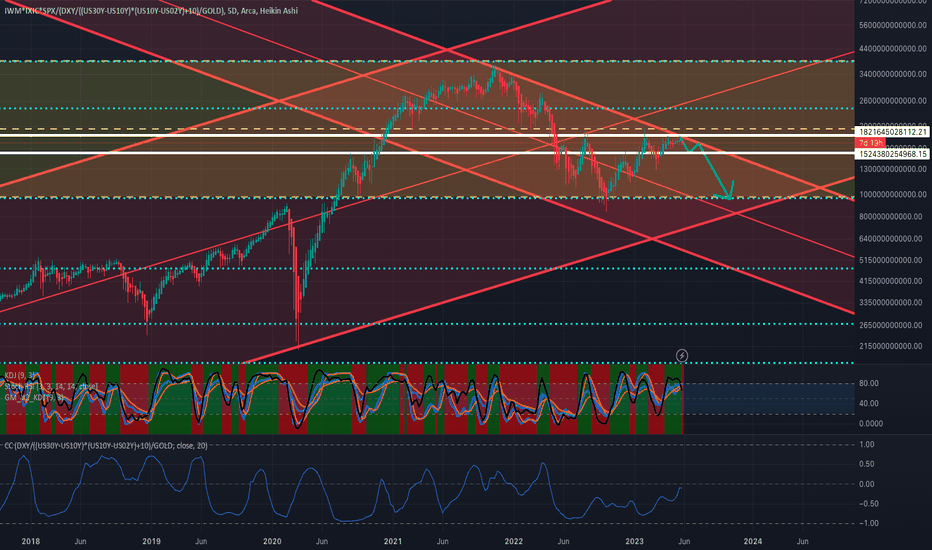

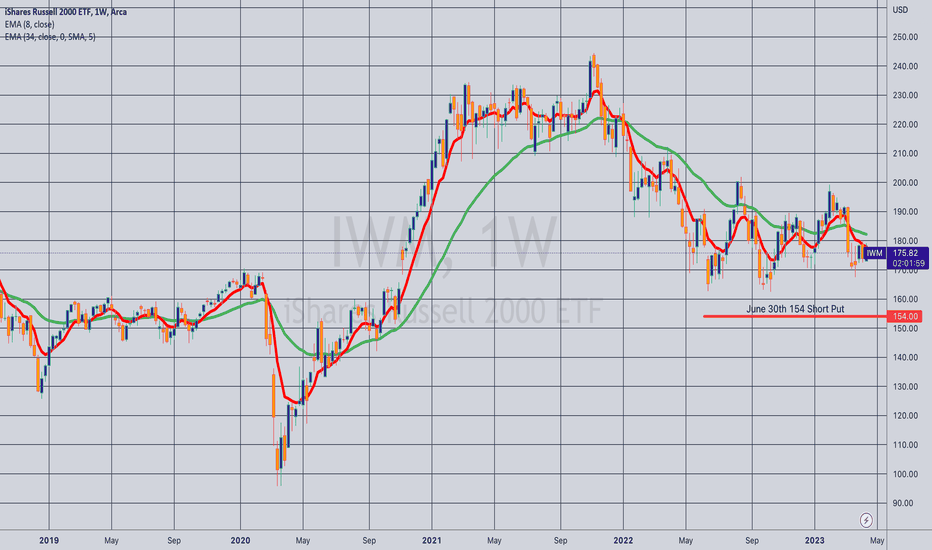

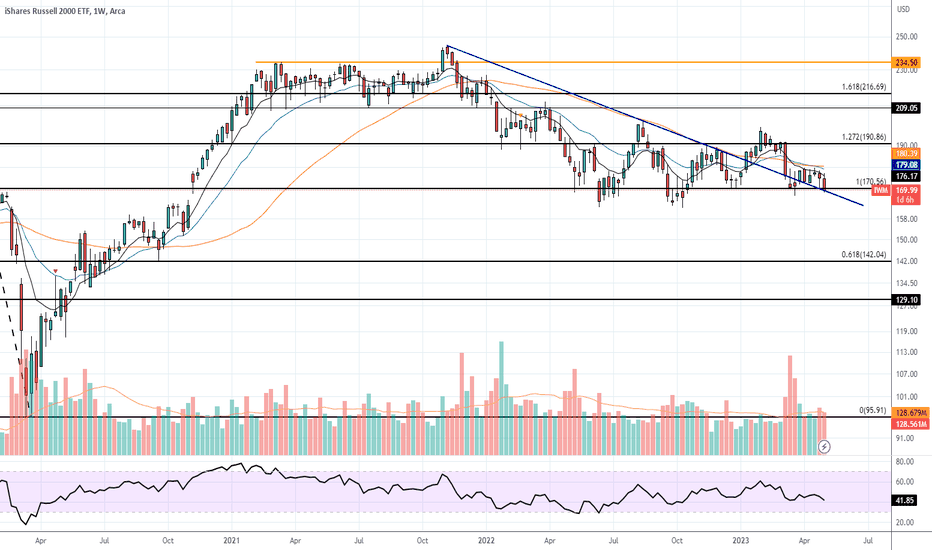

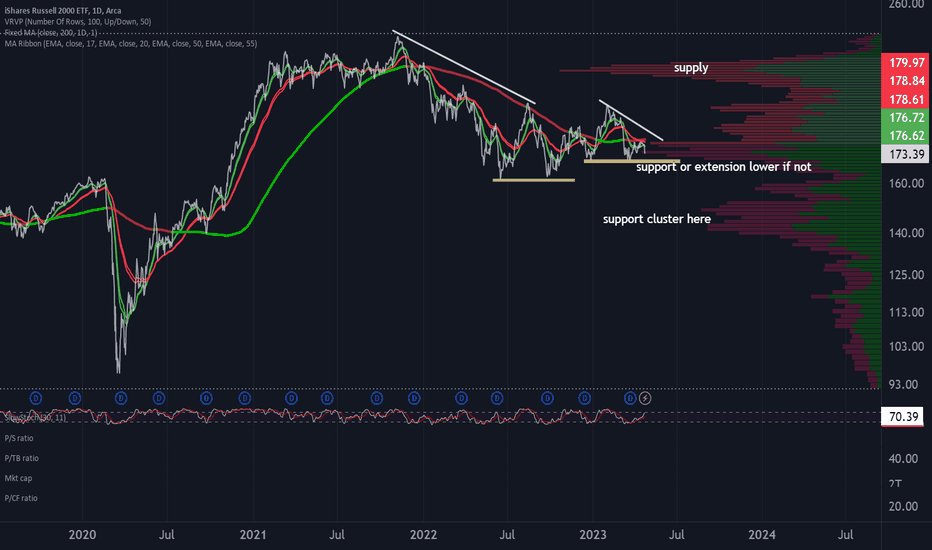

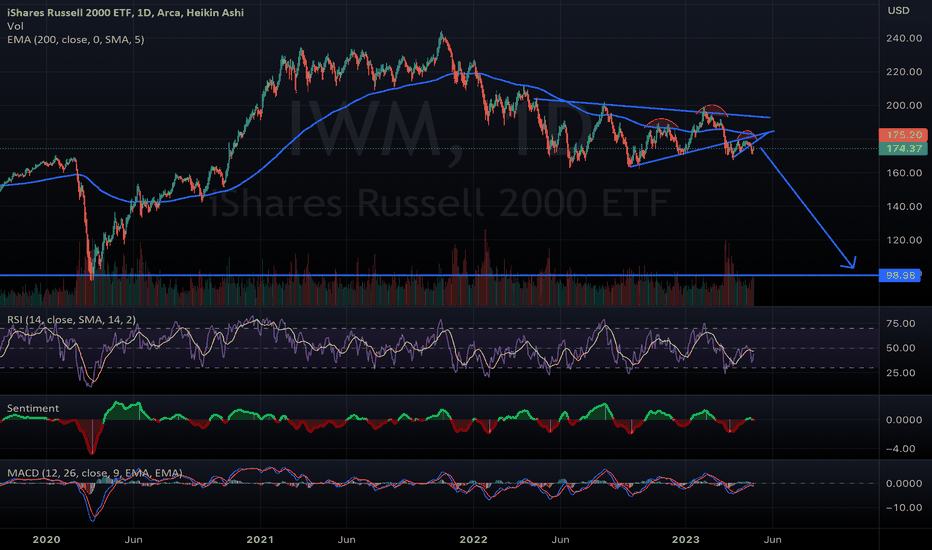

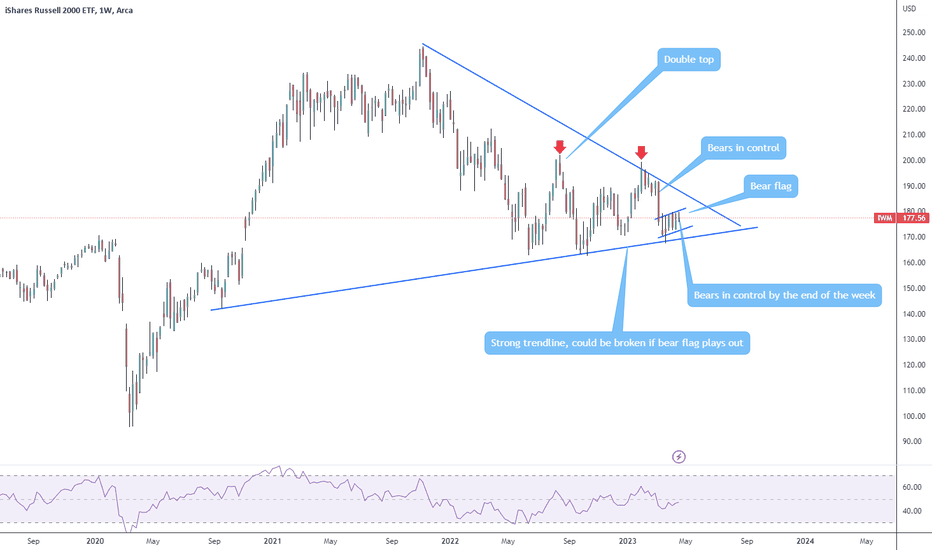

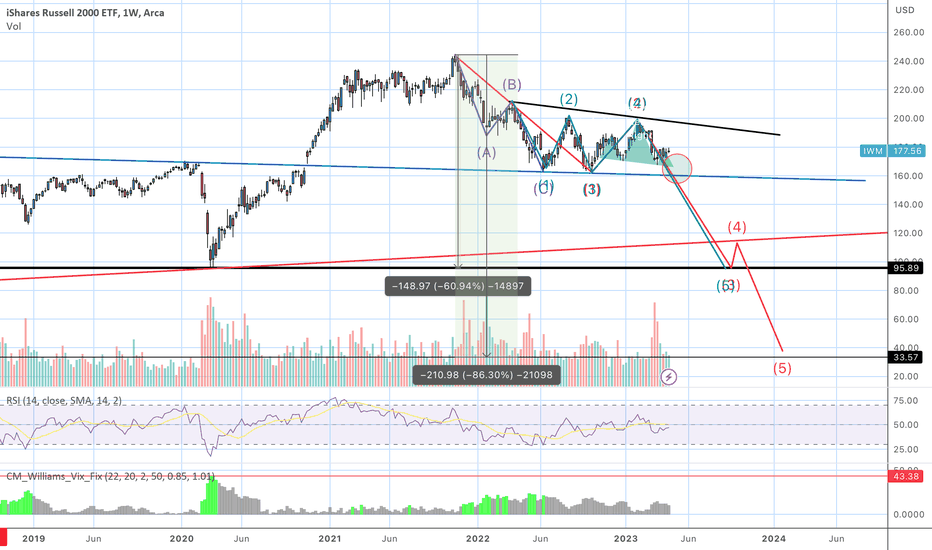

Head and Shoulders Topping Formation on the Russell2000The recent failure of First Republic Bank highlights the problems facing the US banking system. These problems include the continued increase of delinquency rates on Credit cards, Commercial Real Estate & Automobiles, as well as a decrease of commercial bank deposits and M2 money supply (-4.2% YoY). These problems, among others, are causing banking institutions to rein in their lending to build reserves and take on debt from the FED & FHLBs to meet deposit withdrawals. This reduces the profitability of banks and restricts credit into the economy, which reduces economic activity as a whole. The economy had already begun slowing heavily before the credit crunch began in March 2023, but the current business cycle downturn, combined with 3 large regional bank failures and rising continuing jobless claims, portend a severe & lengthy economic contraction. The Conference Board Leading Economic Indicators registered a -7.2% YoY Contraction recently. Since 1968, Any Conference Board LEI contraction of more than -2% YoY has never yielded a false positive in regards to a coming recession.

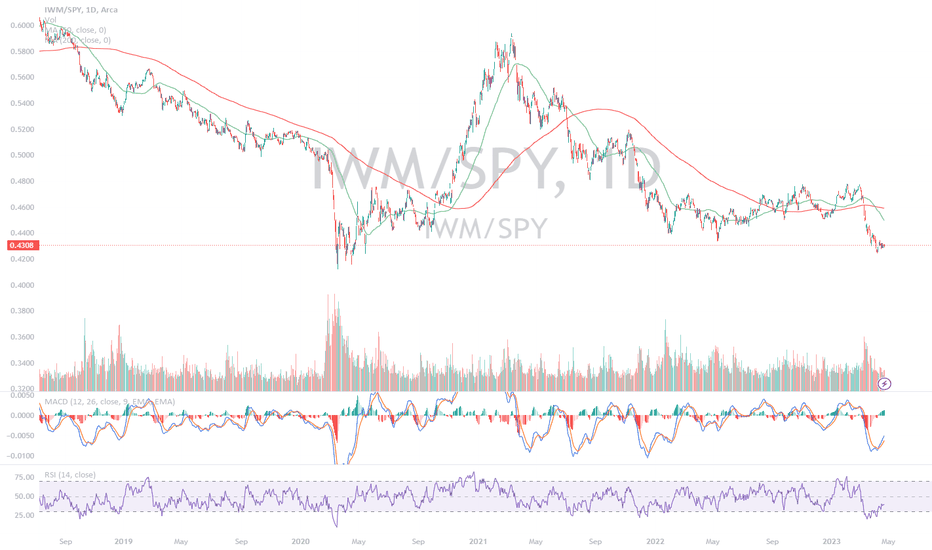

Over 40% of Russell2000 companies are unprofitable and over 24% of S&P500 companies are zombie companies. Markets are still very overvalued within the context of a 5% Fed funds rate, contracting earnings, a credit crunch, and ongoing quantitative tightening by the FED. The markets have been seeing less buying volumes as well as carving out a head and shoulders top on the Russell2000. Other problems facing the banks include the popping auto & commercial real estate debt bubbles, as well as increasing large corporate bankruptcies (The most since 2010 thus far this year). The IPO market is the weakest it has been since 2009 (by total proceeds), which is also hurting Investment banking profits. I see the potential for 5%-10% possible upside and 35%-50% downside for the Russell2000 & S&P500 over the next 9 -18 months.

Thank you for reading,

Alexander C. Lambert

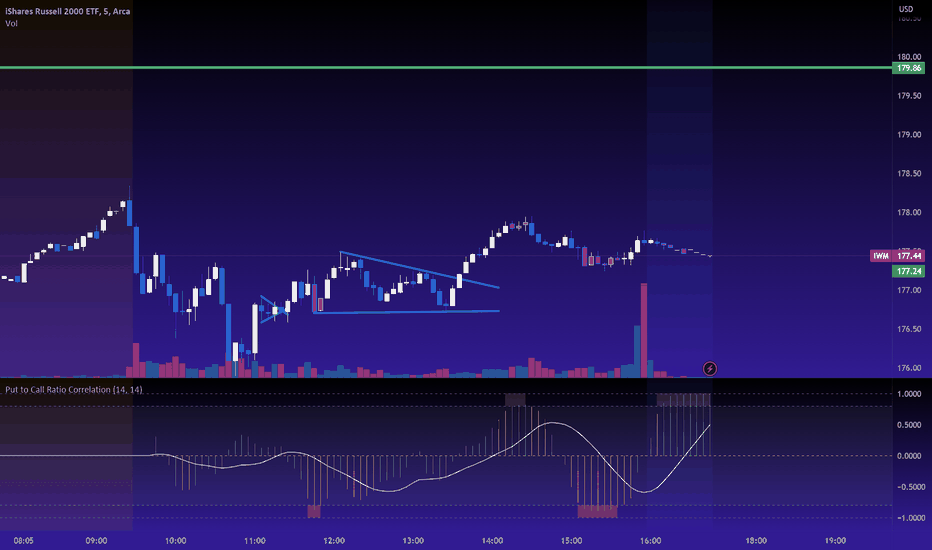

Put to Call Ratio Correlation IndicatorOverview of the put to call ratio correlation indicator I released over the weekend.

It is linked below.

Its best to review the indicator description prior to watching the video to get an idea of how it works.

This video goes over the practical application of the indicator in trading.

Let me know your questions/comments below.

Safe trades everyone!