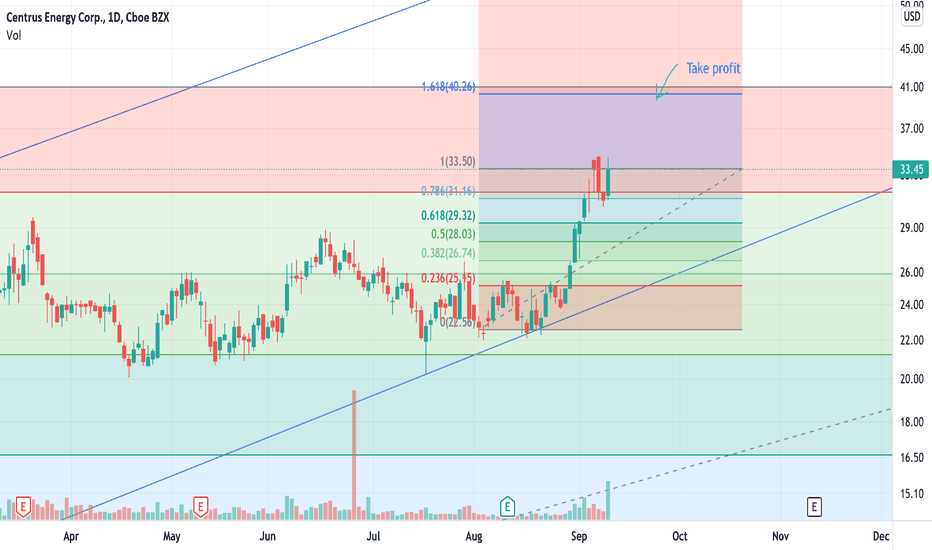

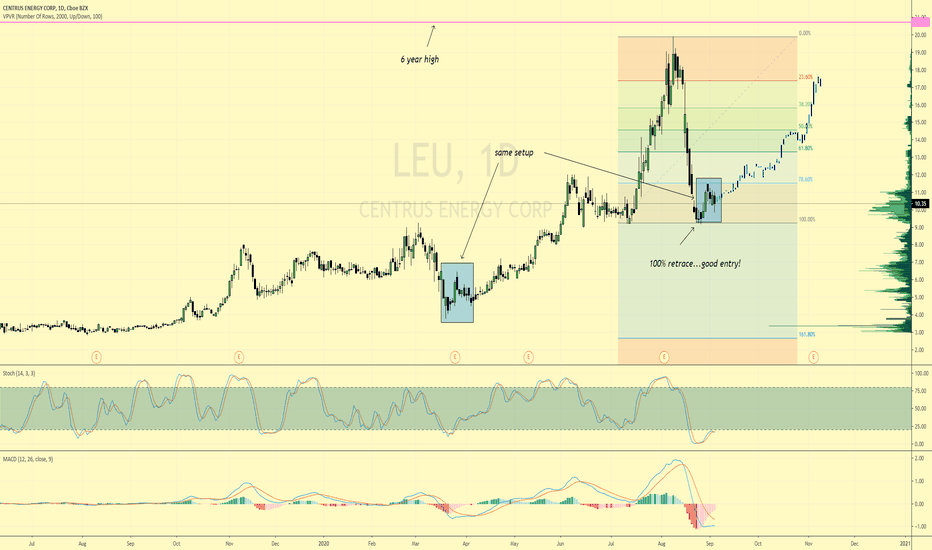

$LEU Long planAfter almost a year long of consolidation and flagging, Centrus Energy Corp moved impulsively on August 30th and begun flagging again for a larger move up. Backed by Uranium spot prices increasing due to physical accumulation, LEU held strong in range despite the market downturn as of late. Last Thursday and Friday LEU showed relative strength moving to highs not seen since 2014. The 35 to 39 price range provided good support from an area last visited in May 2014. The next area of resistance/support should a wide area between 53 and 64.

The trade plan here to go long, would be to wait if there is a retest of the breakout at 39.90 or if there is a retest of the previous weekly high. Notice how the bullish candle from Sept 13th is showing strong VWAP support as the launch pad for last Friday's move.

LEU trade ideas

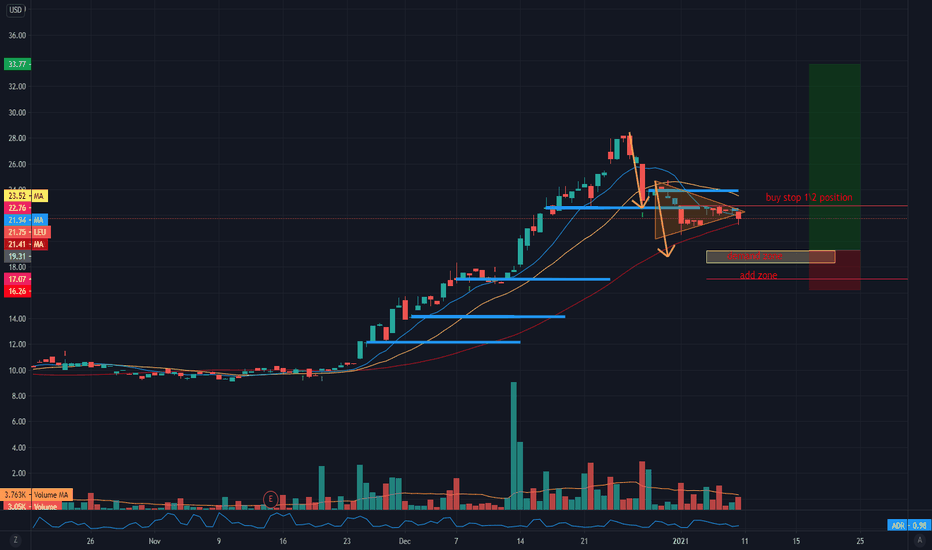

LEU WILL POWER THE FUTUREWith a major infrastructure plan in the works, EV burning up the roads, and hoping for a green future, Leu is waving its flag and trying to get our attention.

Earning report on 8/17

Bill could pass any day, earnings report likely positive - If they happen close together this will be a one-two punch on the accelerator.

Price to drop on 8/11 with 8:30 AM inflation numbers - good time to load up and strap in before lift off!

the above is personal opinion and should not be construed as stock advice or direction.

Good luck!

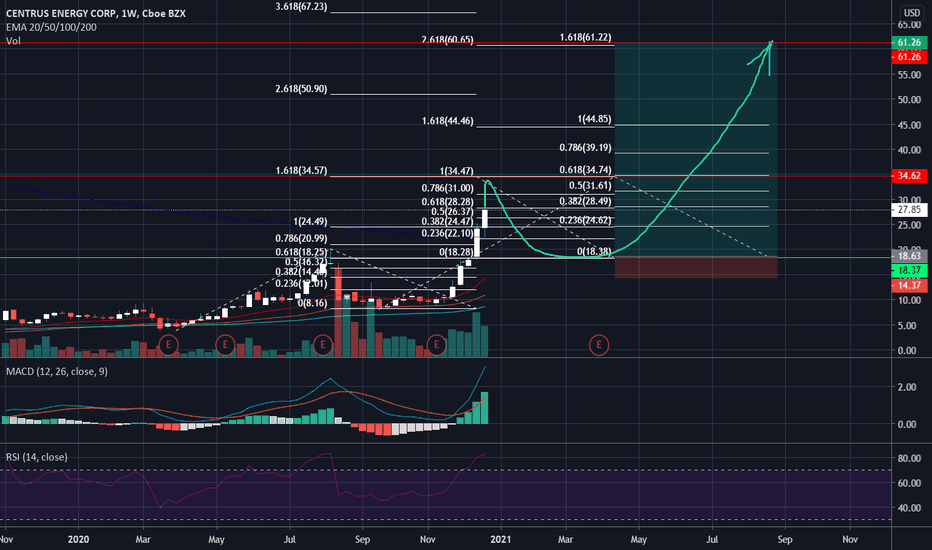

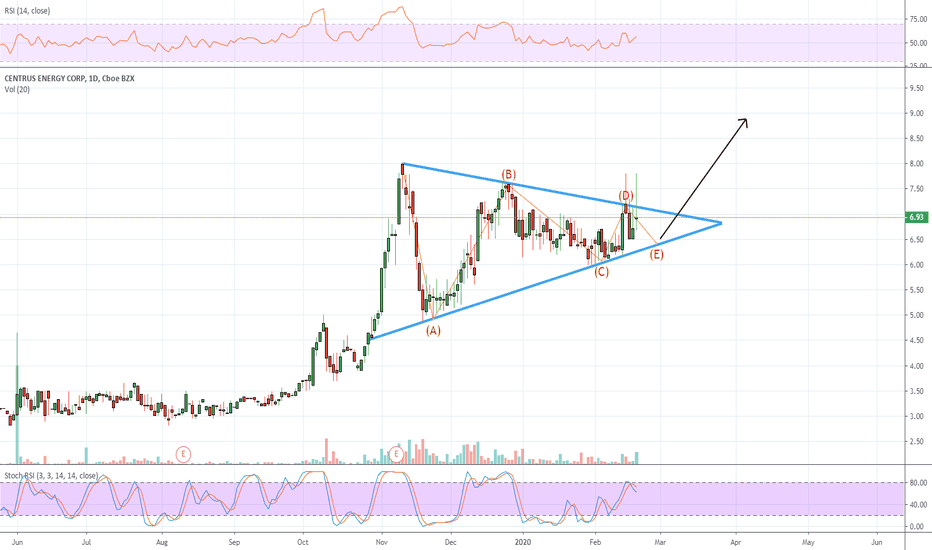

Centrus Energy Corp On breakout Alert Centrus Energy Corp. engages in the supply of nuclear fuel and services for the nuclear power industry. It operates through the low-enriched uranium (LEU) and Contract Services segments. The LEU segment has two components which include the sale of SWU and uranium. The Contract Services segment relates to the contract with UT-Battelle and limited services provided by Centrus to the United States Department of Energy and to contractors at the Piketon facility. The company was founded in October 1992 and is headquartered in Bethesda, MD.

$LEU Trend Retracement To Golden RatioCentrus Energy Corp. engages in the supply of nuclear fuel and services for the nuclear power industry. It operates through the low-enriched uranium (LEU) and Contract Services segments. The LEU segment has two components which include the sale of SWU and uranium. The Contract Services segment relates to the contract with UT-Battelle and limited services provided by Centrus to the United States Department of Energy and to contractors at the Piketon facility. The company was founded in October 1992 and is headquartered in Bethesda, MD.

SHORT INTEREST

45.72K 09/30/19

P/E Current

-0.35

P/E Ratio (with extraordinary items)

-0.42

Average Recommendation: HOLD

Average Target Price: 44.60

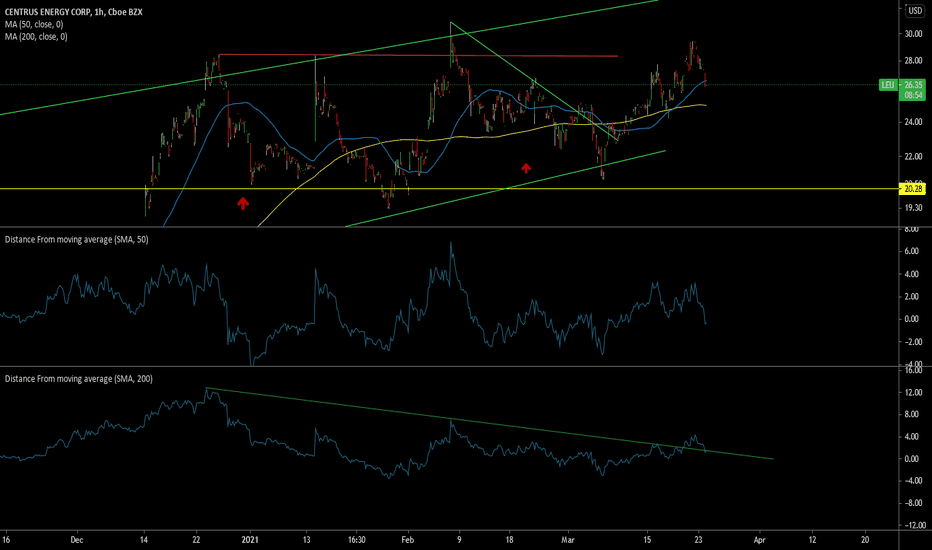

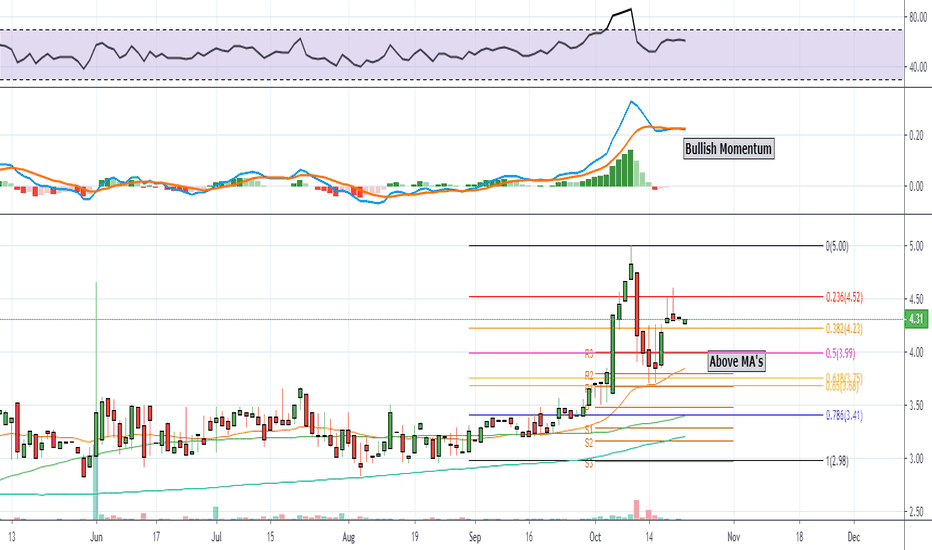

LEU - Bullish Momentum Over MA's Trend Likely To Keep GoingCentrus Energy Corp. engages in the supply of nuclear fuel and services for the nuclear power industry. It operates through the low-enriched uranium (LEU) and Contract Services segments. The LEU segment has two components which include the sale of SWU and uranium. The Contract Services segment relates to the contract with UT-Battelle and limited services provided by Centrus to the United States Department of Energy and to contractors at the Piketon facility. The company was founded in October 1992 and is headquartered in Bethesda, MD.

SHORT INTEREST

52.18K 09/13/19

P/E Current

-0.28

P/E Ratio (with extraordinary items)

-0.34

Average Recommendation: HOLD Average Target Price: 44.60

Simple Trading Techniques – Bullish Strategy

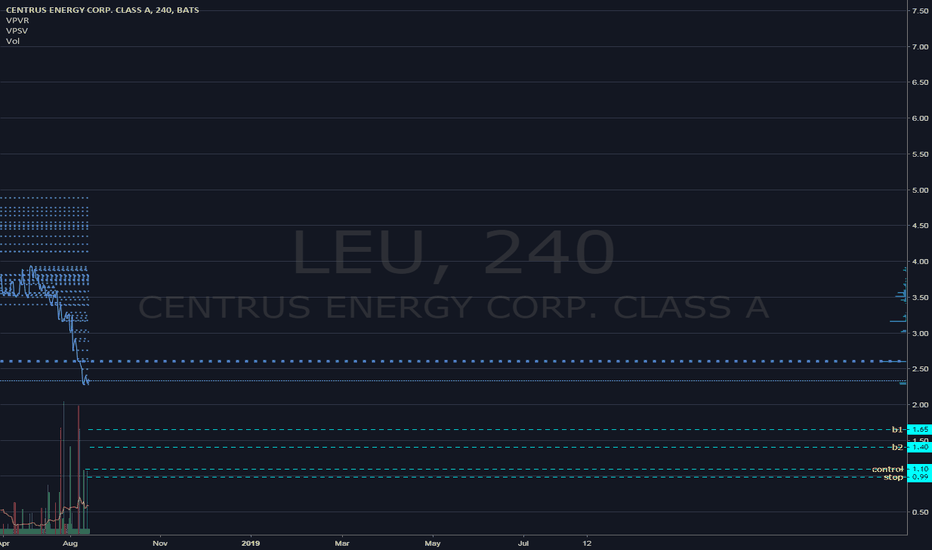

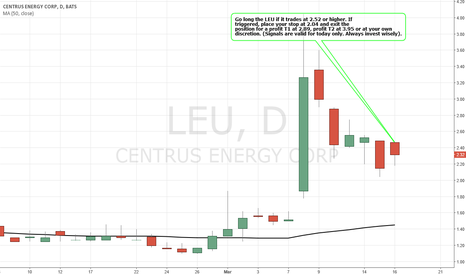

Go long the LEU if it trades at 2.52 or higher. If triggered, place your stop at 2.04 and exit the position for a profit T1 at 2.89, profit T2 at 3.95 or at your own discretion. (Signals are valid for today only. Always invest wisely).

Learn the rules of a strategy at: www.udemy.com