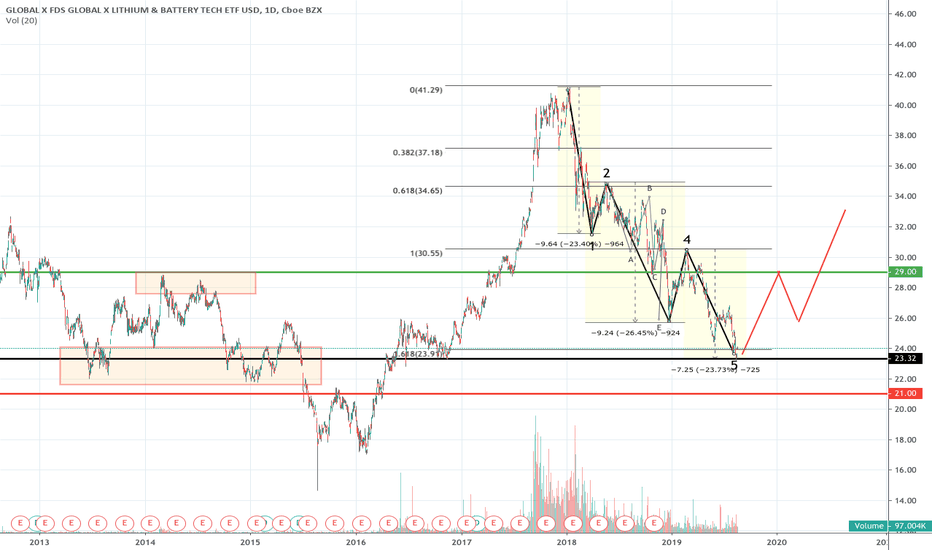

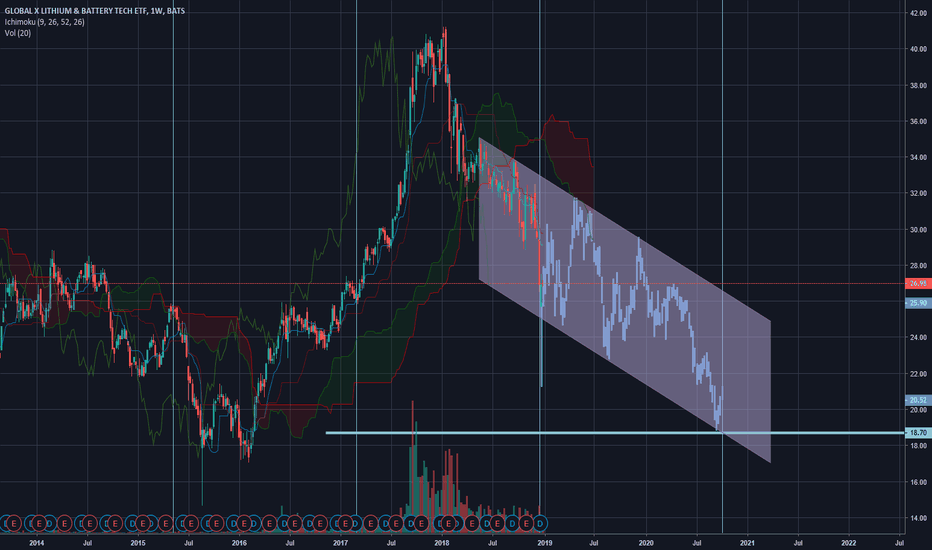

Lithium ETF clean EW and supportThis ETF has completed a nice 5W down, very precise 5=1, The W3 is a bit short, although there's reasonable subwave in there. Add to that the support from 2013-2015 and more recently in late 2016, which is where we are now, and if W2 is .618 and W4 is 1.0 we have a fairly neat 1.618 to finally reverse at here. Climbing back to 29 allows me to place a wide stop of 21 under 2013 and 2015 lows and still get a 2.5:1 trade, shown by the green and red lines. The volume bars look quite encouraging close up, as well, it tails off into the decline.

The way to trade something like this is to think either the Oct 16 support of 23.35 will hold or it won't. If it doesn't, then we are straight down to 21.75, ie it's unlikely to bottom in between these prices. So you can either enter here and add at 21.75, not higher (but with the same 21 stop), or even wait for 21.75. Conversely if this is the bottom, we'll know when it breaks 26, allowing you to add (and move the stop up to 23).

One sore point is that the ETF keeping missing on earnings, presumably from its major component NYSE:ALB. Hopefully, this will get better, but the trade should be managed carefully through the next (Q3) earnings date, which for ALB is Nov 6th.

LIT trade ideas

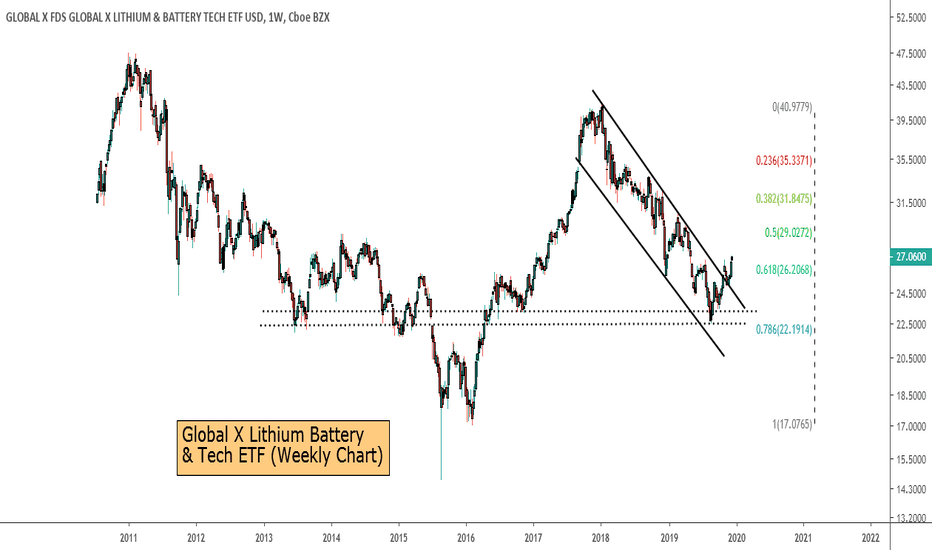

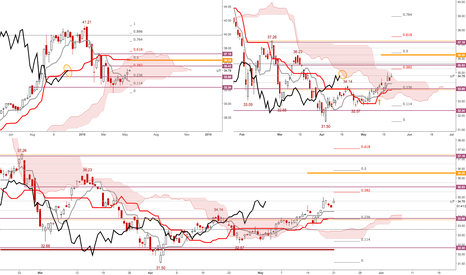

Global X Lithium Battery and Tech ETFGlobal X Lithium Battery and Tech ETF: We provide an update on the ETF which was recommended on 22 October. The price has started to appreciate, having broken out of the bear channel that was in place since January 2018. As per the weekly chart below, the share’s Relative Strength Index is making a 24 month high providing support to the technical bull thesis. Is it too late to purchase this Offshore ETF? No.

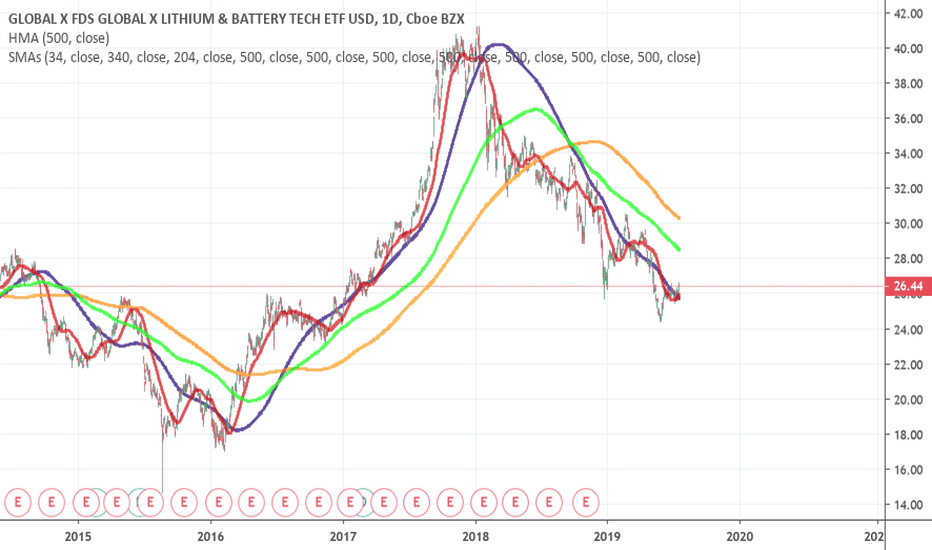

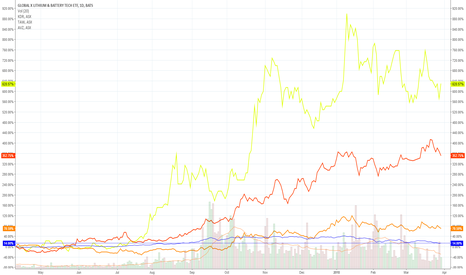

LIT up in 2018 is starting to re-build energy...After a tremendous run in 2017, $LIT was beat up and gave back much of its gains to begin 2018. However it has broken the down trend and has established a strong counter trend. This is a necessary battery for much of our consumer tech and global industrial tech. As always must make new highs to confirm a reversal with multiple indicators supporting, this looks buy-able against the uptrend-line until proven wrong.

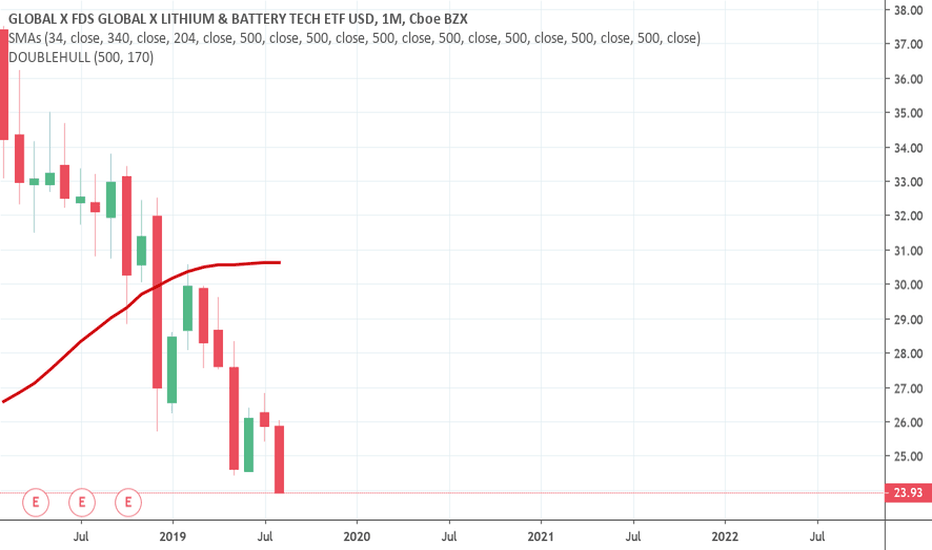

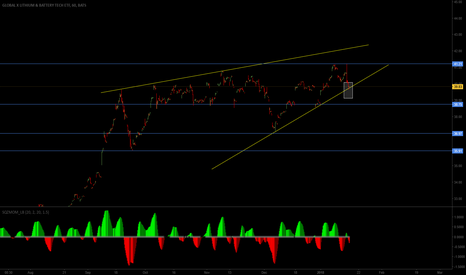

LIT ETF: Further Trending Down Bullish Descending WedgeExpect a further slide down the large bullish wedge into more probabilistic BO zones (as indicated by green projection area within the wedge), then trend reversal that moves within the trident. The current movement is a completion of a bearish ascending wedge, which correlates with a continuation of the downward trend. The VFL shares the current bearish sentiment as does the Wies, with an overall decrease in buying and selling volume - such things also indicate a possibility of a large movement.