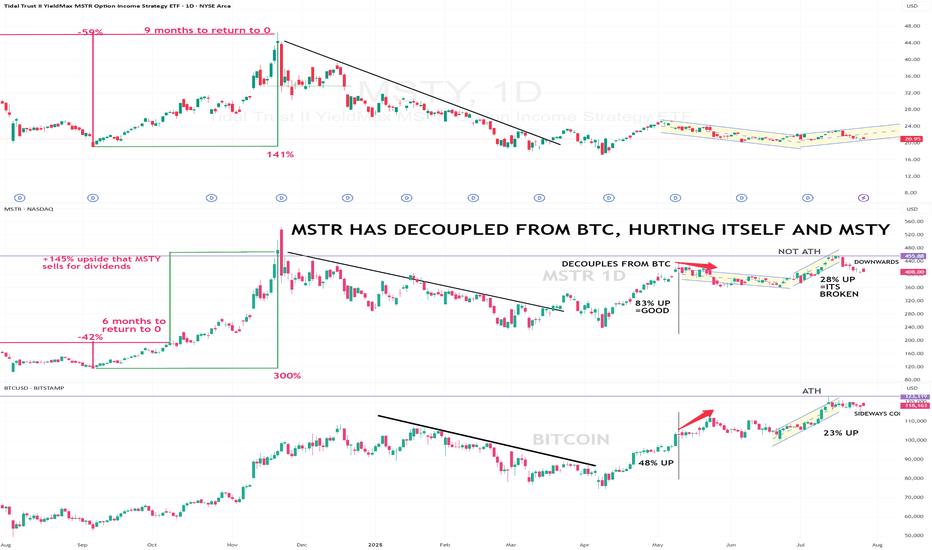

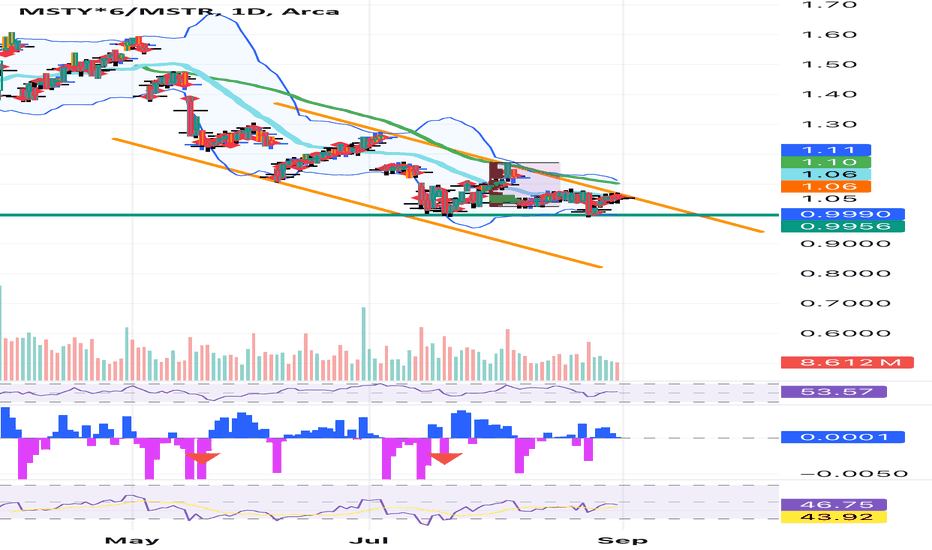

MSTR decouples from BTC, hurting MSTYI use this chart to track BTC, and MSTR so I can safely hold MSTY shares at a price that "should" be safe as long as BTC follows Global Liquidity with a 70-90 day offset (which it IS doing) and MSTR follows BTC price action with a 2x or so, multiplier, (which it WAS, until it decoupled recently). This makes holding MSTY for any share price at $23 or higher, dicey, when MSTR should be in the $500-600 range at the recent BTC ATH and MSTY share price should be in the $30 range, at least. Add to this: BTC is not enjoying the monster 400% runups it had 2021 and previous.

MSTY trade ideas

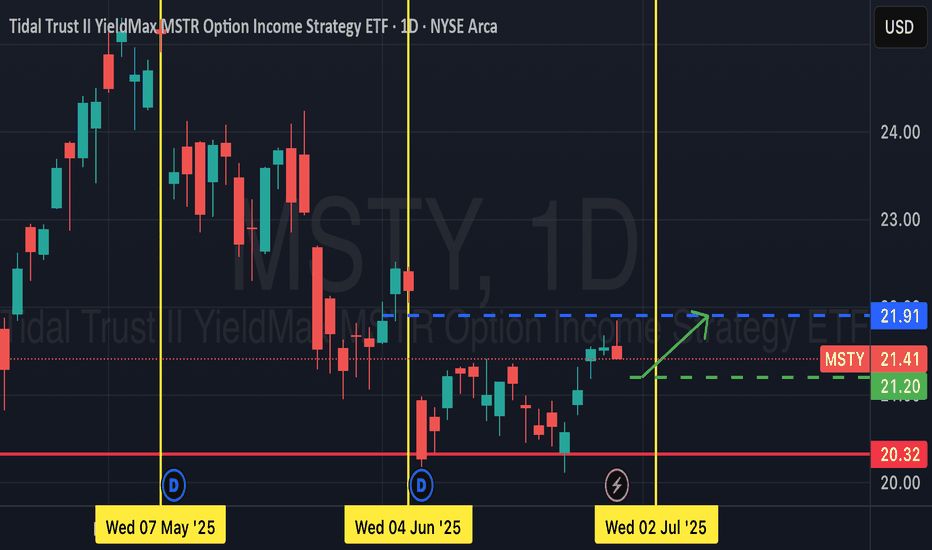

Msty pull back/ dipMsty has a monthly dividend noted by the yellow vertical line. The ex dividend date typically drops, so buying at a favorable price before that ex date is crucial. The chart shows a double bottom followed by a strong bullish movement. This coming week will give a small pullback for a great buying opportunity prior to the dividend announcement ex date.

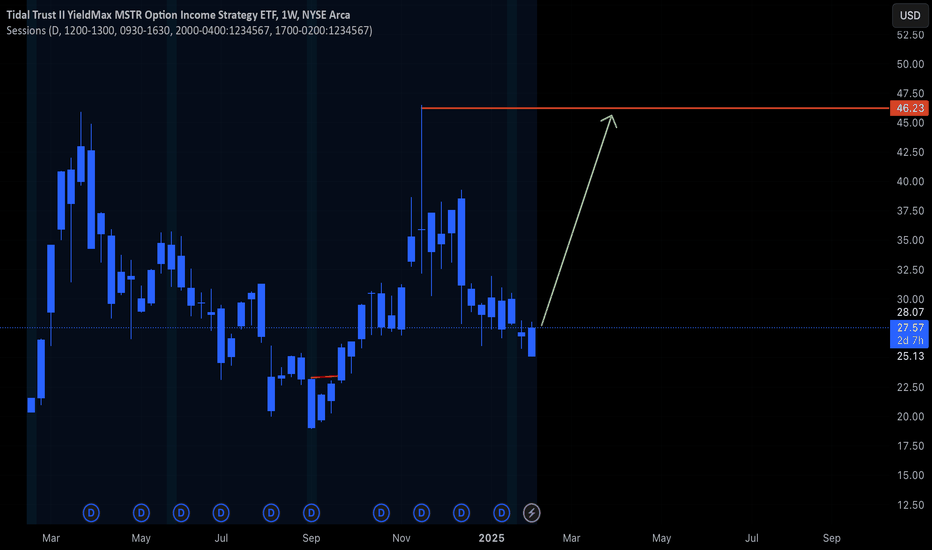

MSTY trading ideaThis upcoming week is pretty important for Bitcoin: when the tariffs are over, there is a fundamental opportunity for investors, not also that, but the technical chart may be has some justification too. In particular, MSTY is a ticker who has an incredible dividend yield of 154 % so it really helps to maintain the position even when it dips.

My short term target is 21.65 🚀🟢

What do you Think?💥

Stay safe 💜

Sebastian.