SLV trade ideas

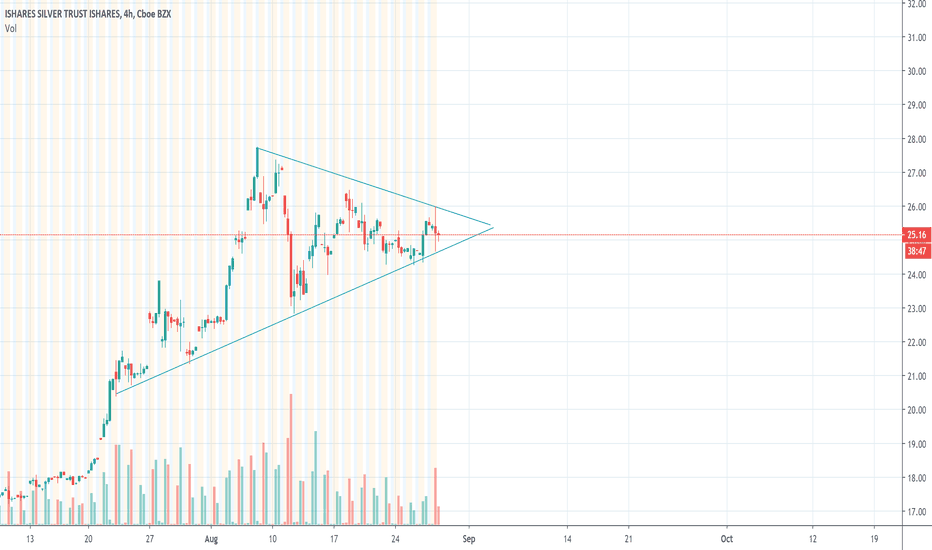

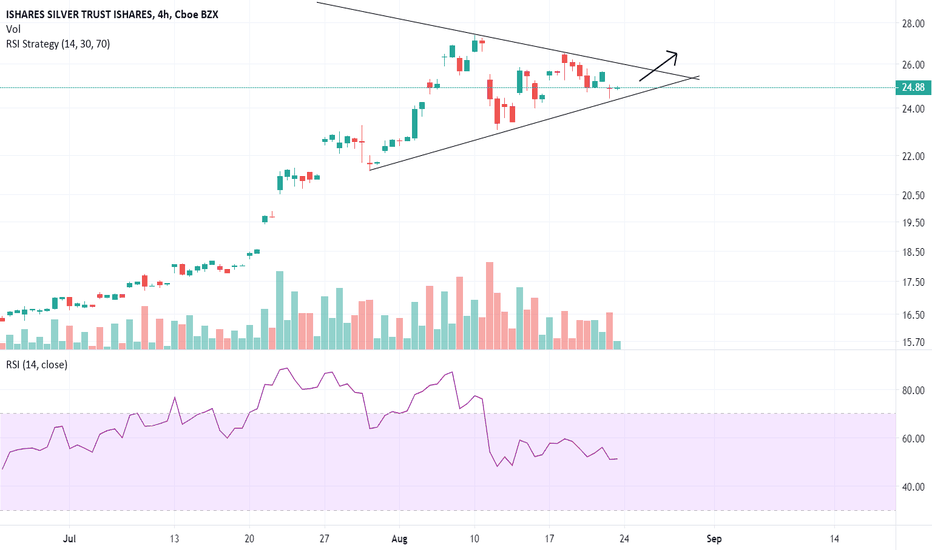

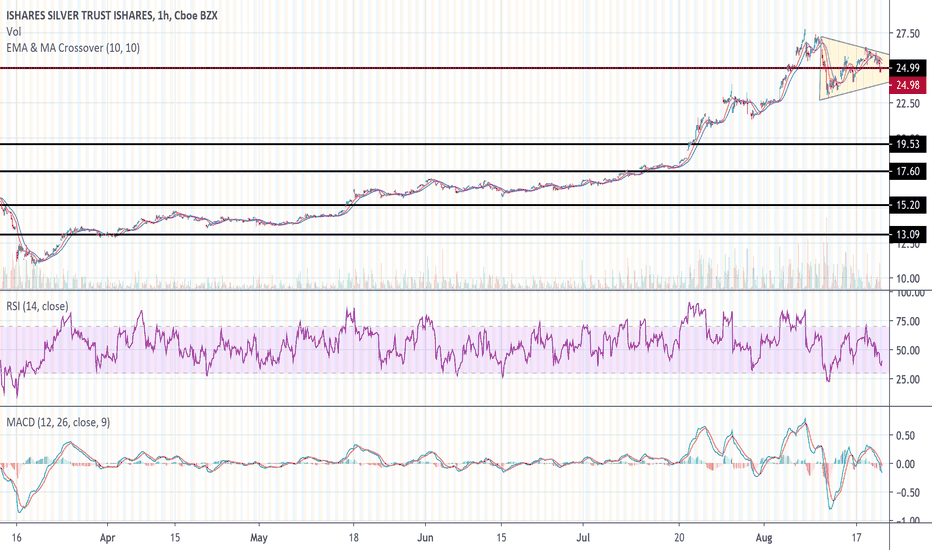

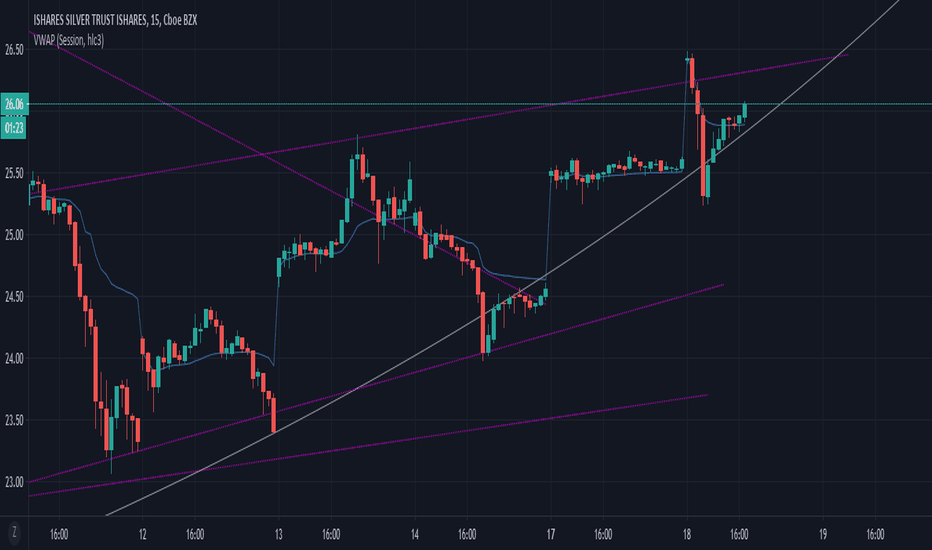

Silver - Next PlayChecking back in with Silver $SLV. If you saw our previous charts on Silver, both Gold and Silver have been on bullish runs this year. SLV seems to be consolidating at the moment and wouldn't be surprised to see a bullish break on this pennant pushing to the $34 levels.

We'll be keeping a close watch on this one. Looking for confirmation before entering. Good zone would be a breakout and $26.50 buy in with a 2% trailing stop loss.

Give us a follow and shoot us a Like for more analysis updates. Cheers!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor. I am an amateur investor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on here, expressed or implied herein, are committed at your own risk, financial or otherwise.cHE

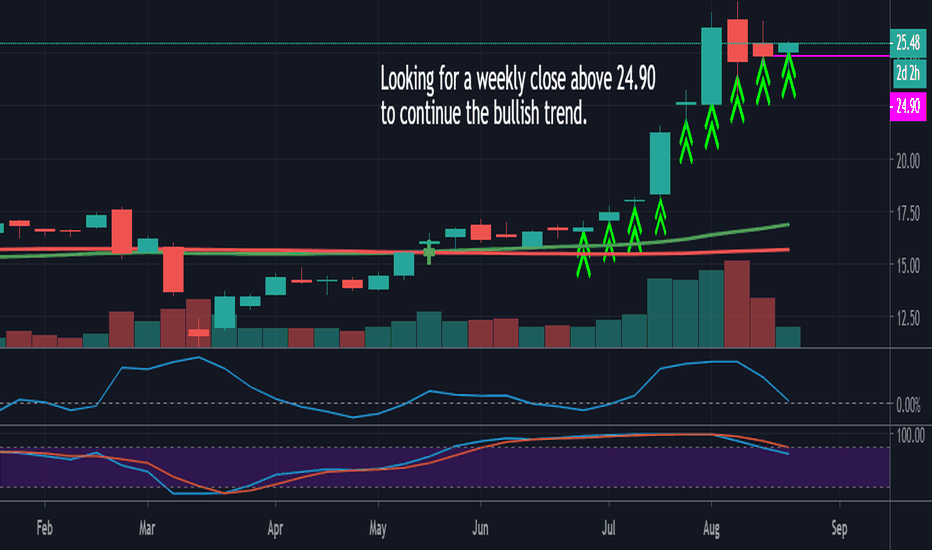

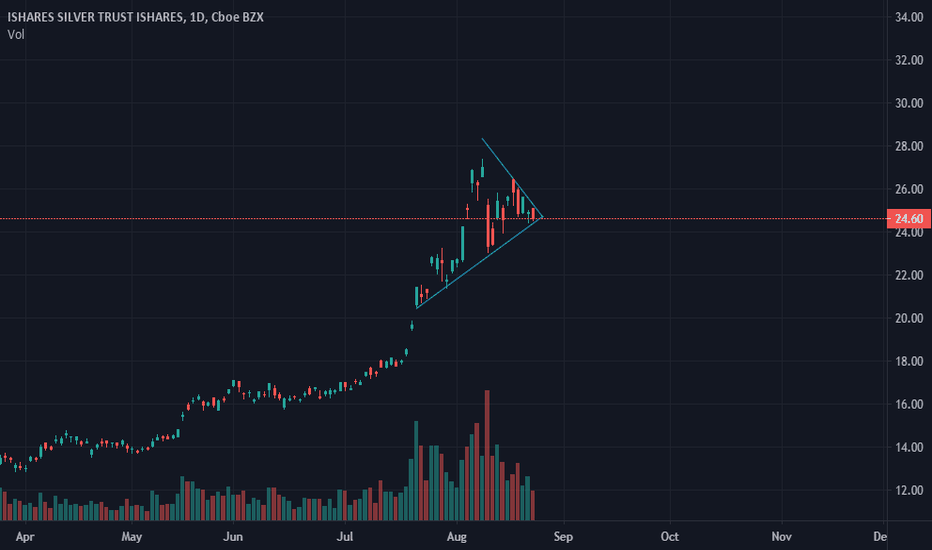

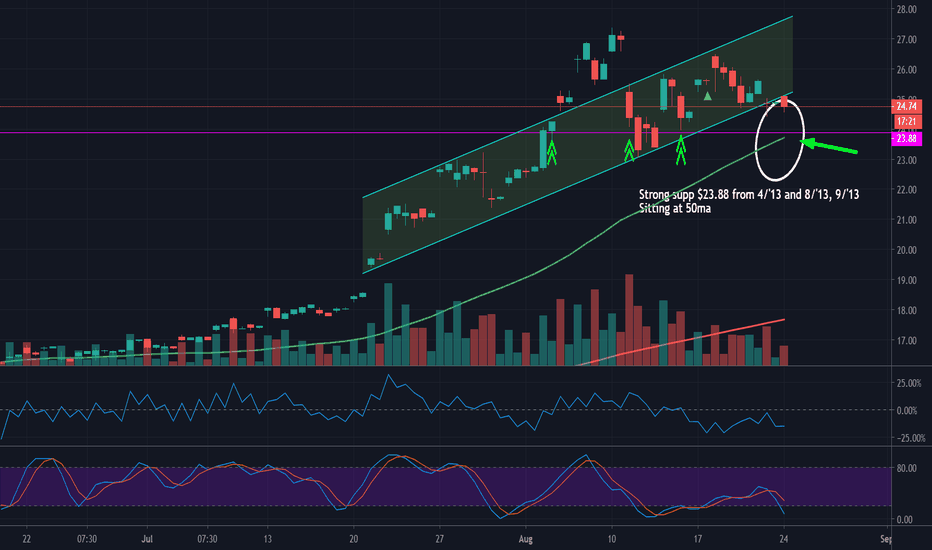

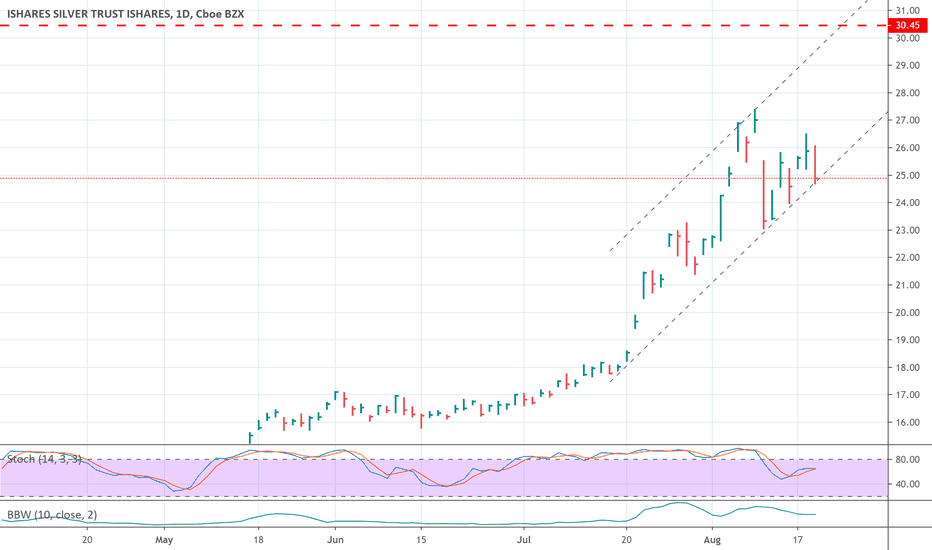

SLV - More upside than downside - Strong supportSilver has been resilient, yet still dropping slightly as the DXY struggles at best to stay afloat trading near .94

Fed continues to print = falling Dxy = rising silver. Still extremely tight phys supply in US will keep silver prices supported and elevated as the price fluctuates due to Dxy

There is strong support for from April 2013 and Aug/Sept 2013 at $23.88, as well as some recent support on the 4 hr at the same level.

4Hr chart shows SLV hitting the 50 SMA right at $23.88(ish), which further affirms strong support at that level.

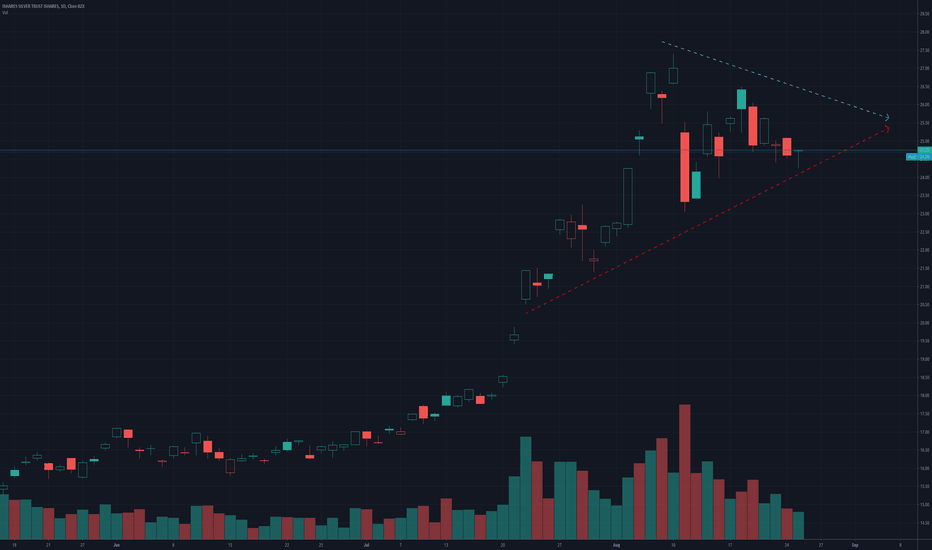

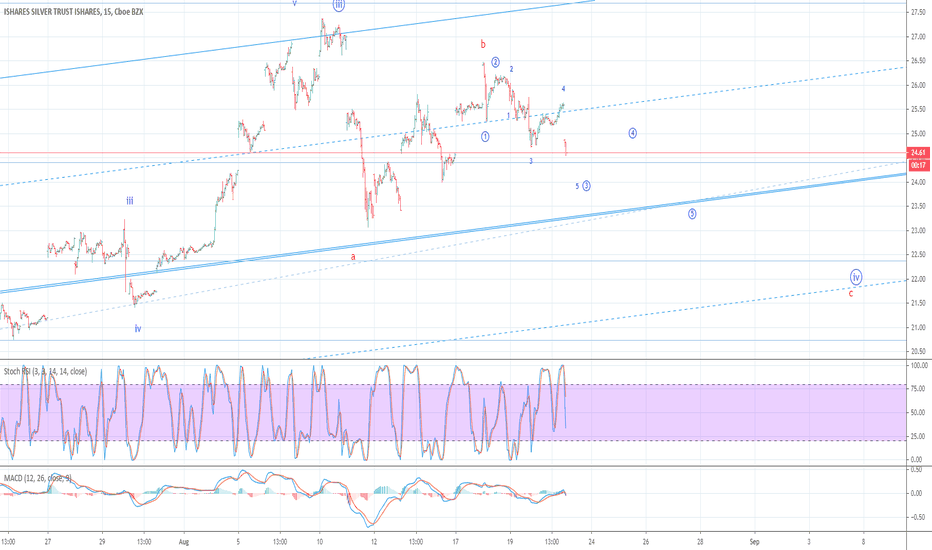

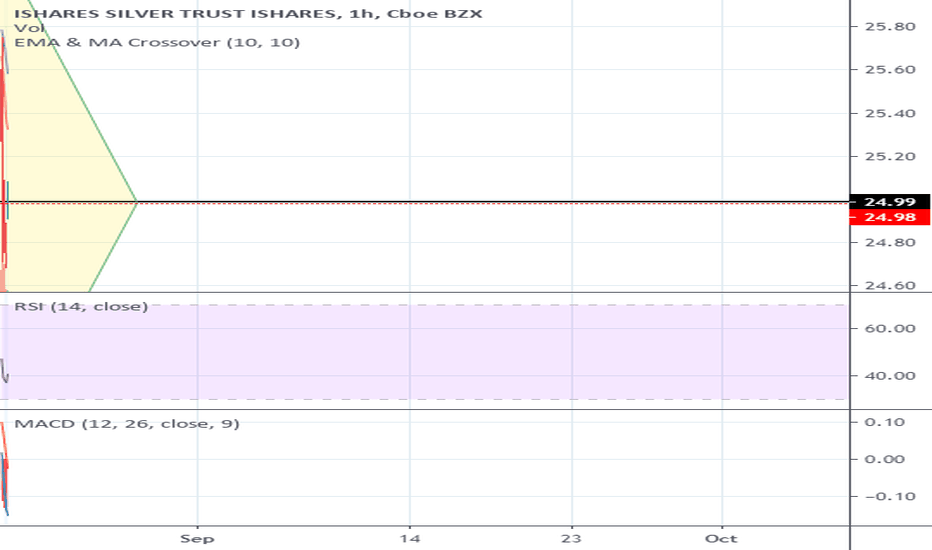

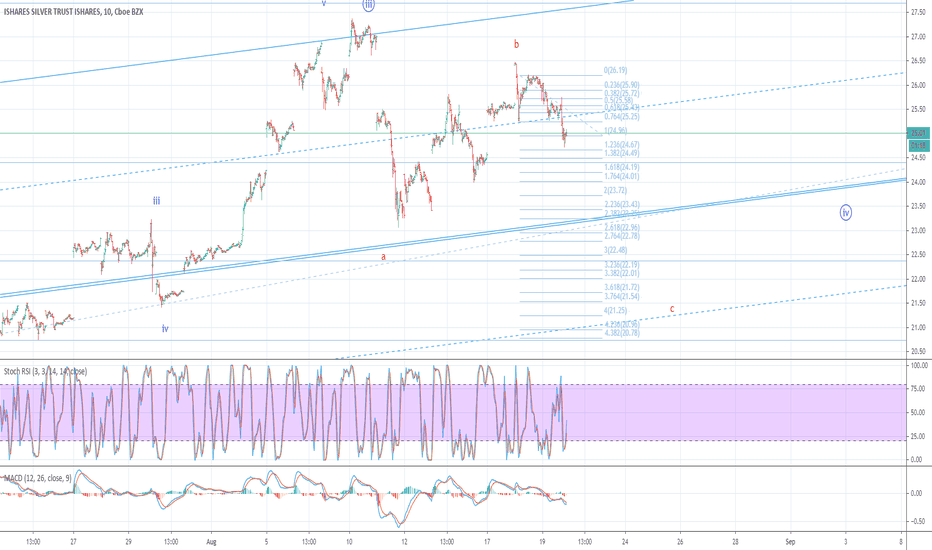

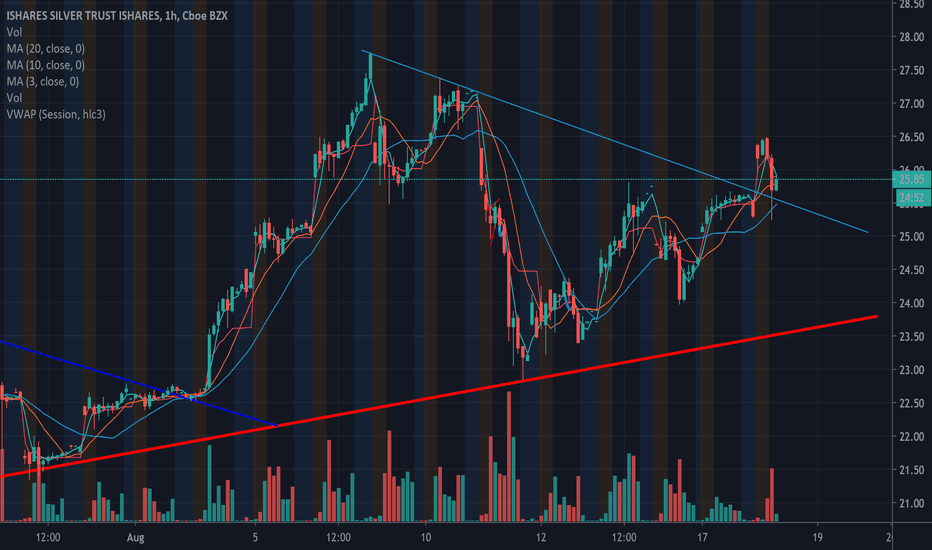

SLV short term trendJust discovered SLV is forming a triangle pattern at this resistance level ($25). Something to look for:

Case 1) A good entry point in the next couple days if the price remains in this area

Case 2) Price would be less volatile approaching the end of next week

If 1 and 2 are true, the price likely goes up and tests the previous high (above $27).

P.S. I still own the positions I opened from March and May earlier this year and remain bullish on it. Will keep update on this prediction.

$SLV breaking out of the triangle in a week This triangle formed perfectly on the resistance level and is about to explode soon. Good loading timing would be tomorrow until early next week and likely to see a significant change in a week or so. Play safe but expect to see a break above the previous high!

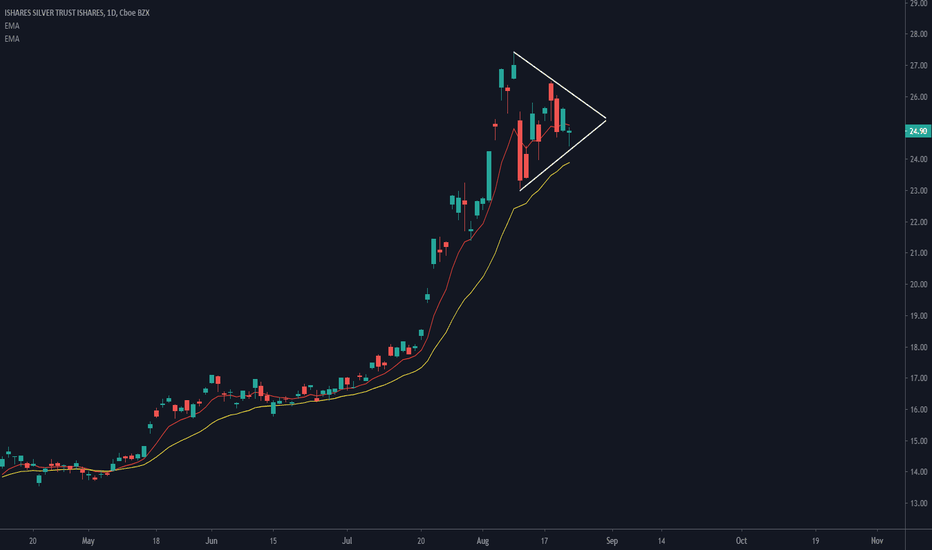

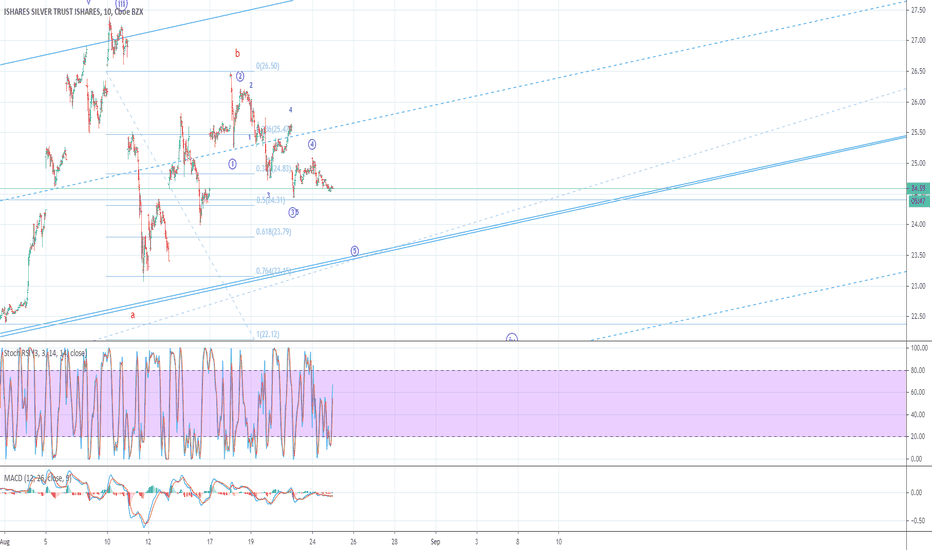

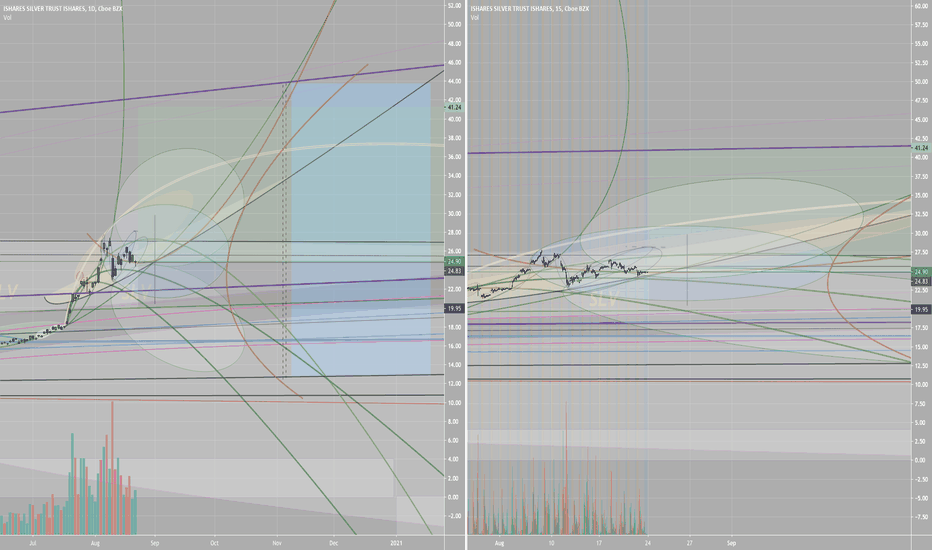

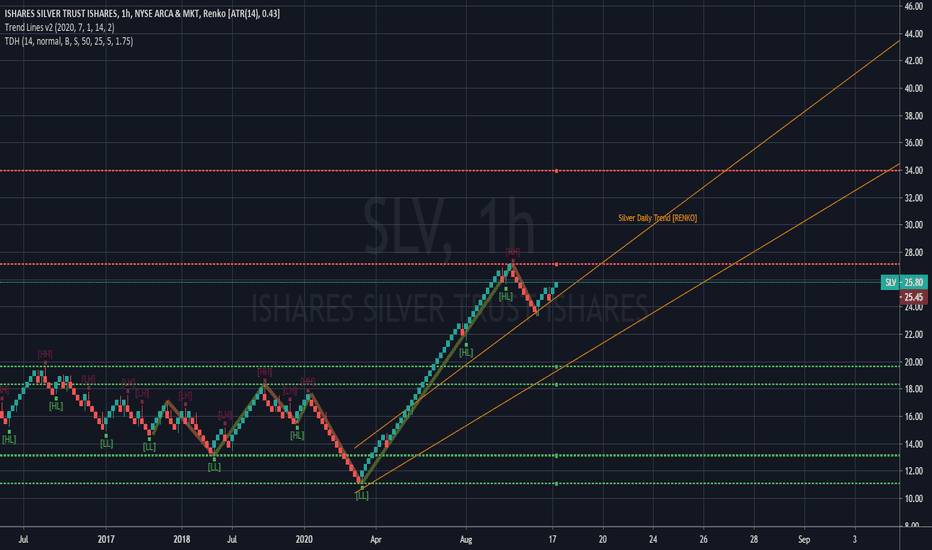

SLV longI had this chart for about 3 days, it's held that silver line well and turning it into support. This is almost mirroring the trend back in 2011. Silver I can see above $30 in a couple weeks. Need to get past that yellow line which is major resistance which it got rejected on prior a while back.

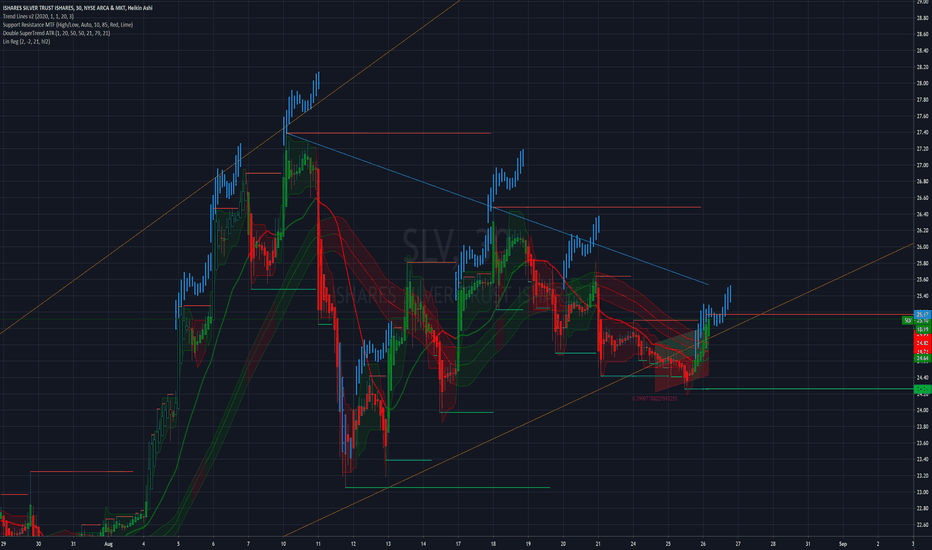

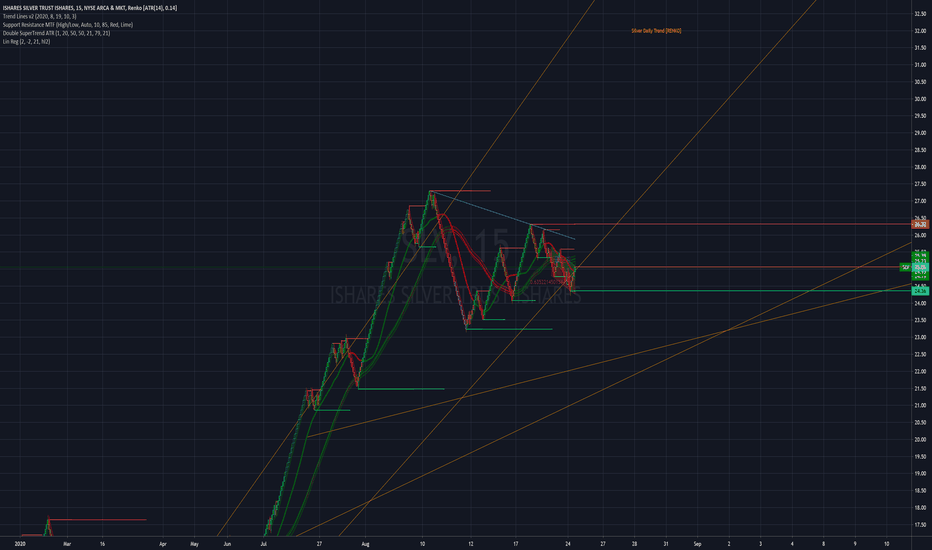

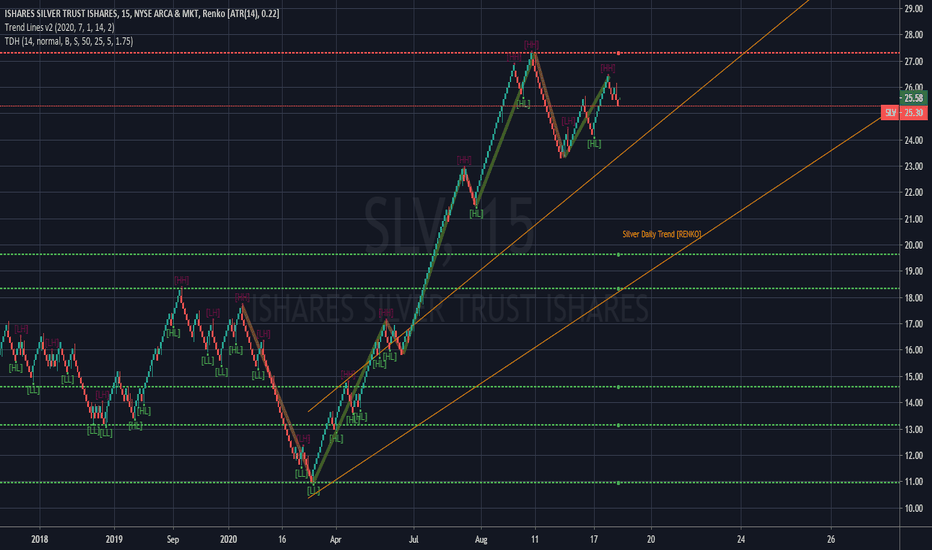

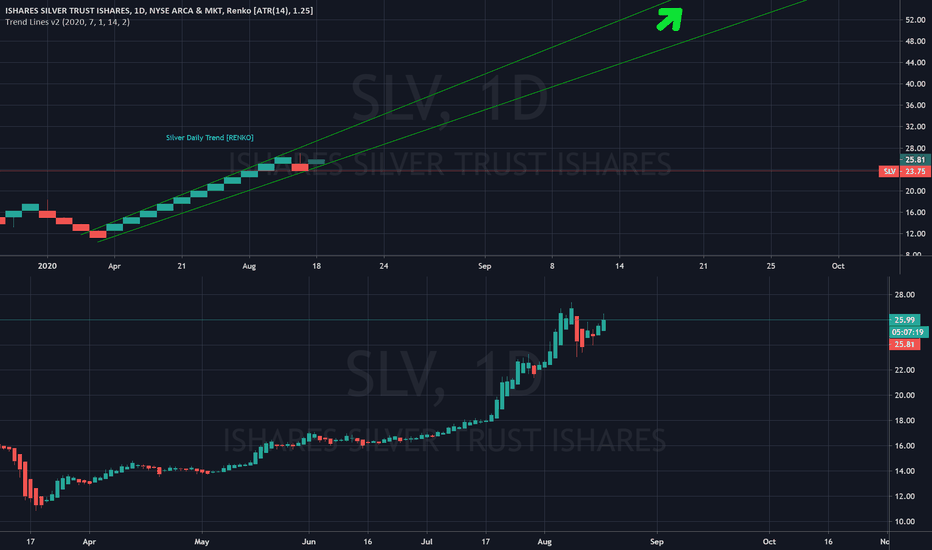

SLV Silver Trends with Gold RatioWhich trend can you follow "Daily"

Price sometimes moves independently from 'time'.

Look at trends and mark those in "Renko" bricks.

Then use your candle charts to trade interday moves knowing the TREND!

Watch the Gold/Silver ratio

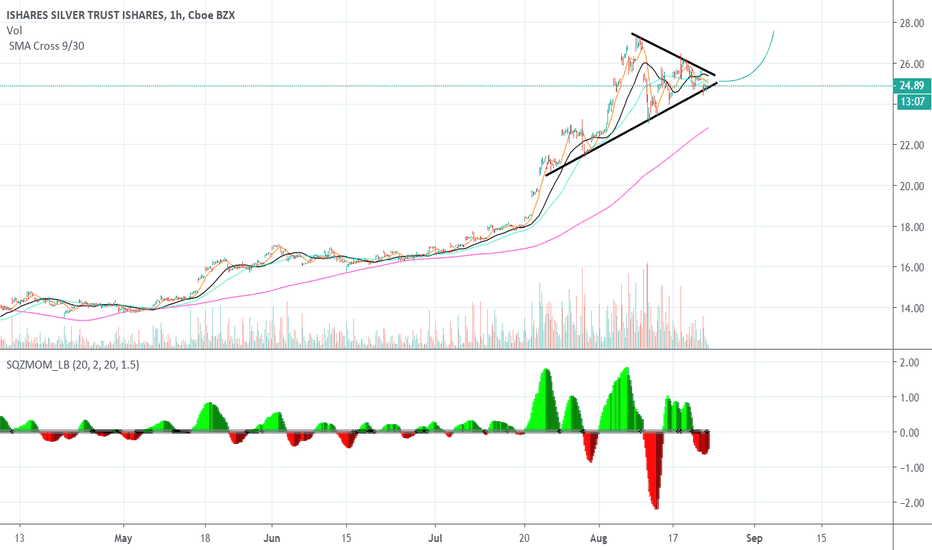

TRADING GUIDE use DAILY trends to plan buy/sell orders...

GOLD-SILVER RATIO TREND GOLD AND SILVER TREND SIGNAL

Gold-Silver Ratio Uptrend Gold and silver in Uptrend Buy Gold (this was the trend...)

Gold-Silver Ratio Uptrend Gold and Silver in Downtrend Sell Silver (this may not happen in 2020?)

Gold-Silver Ratio Downtrend Gold and Silver in Uptrend Buy Silver (we are here ...usually)

Gold-Silver Ratio Downtrend Gold and Silver in Downtrend Sell Gold (add to positions if a short "pullback")