SLV trade ideas

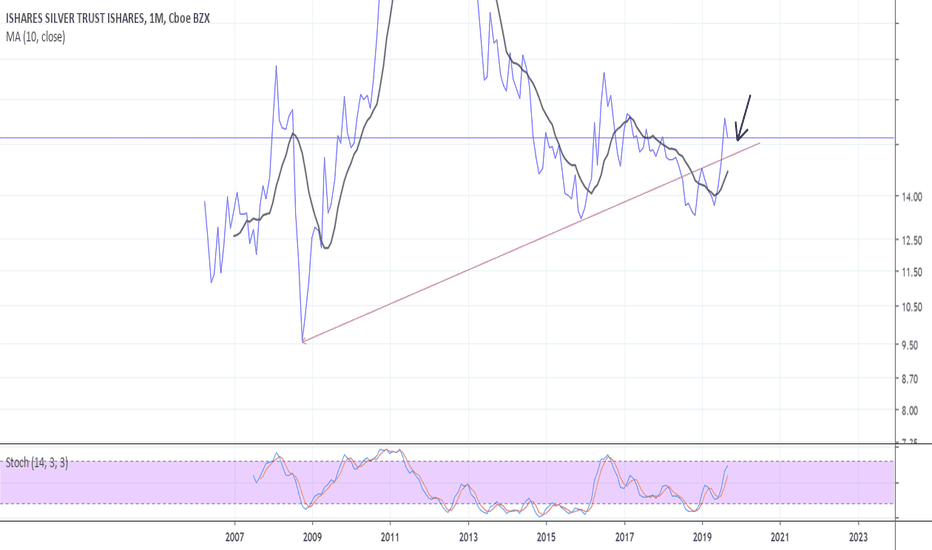

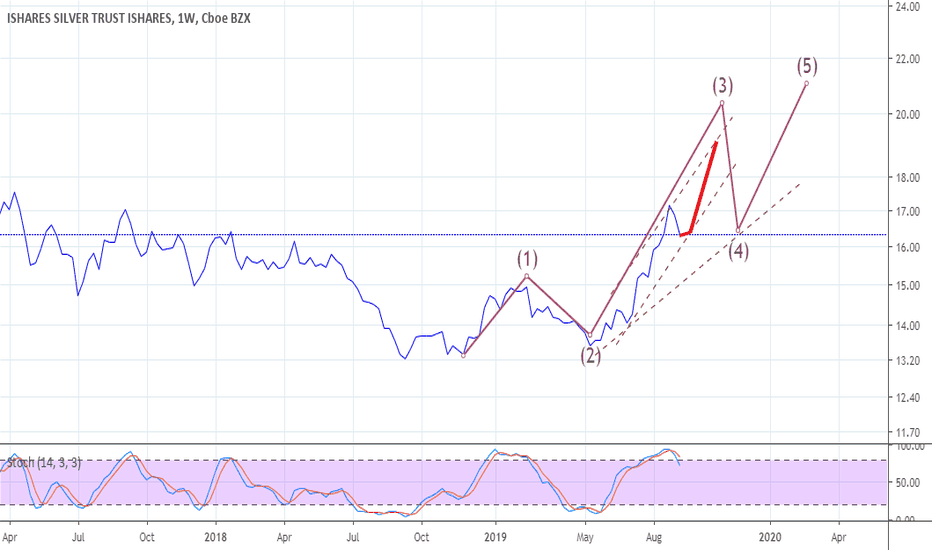

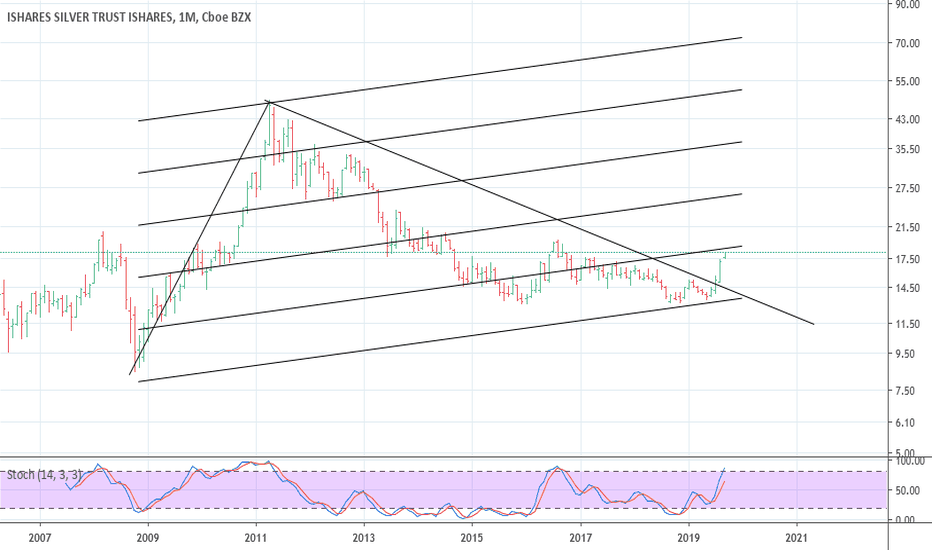

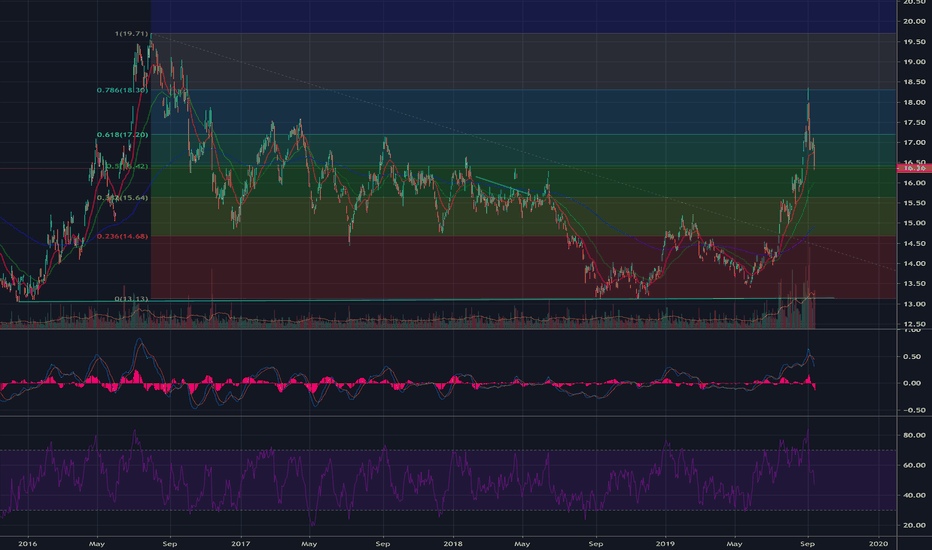

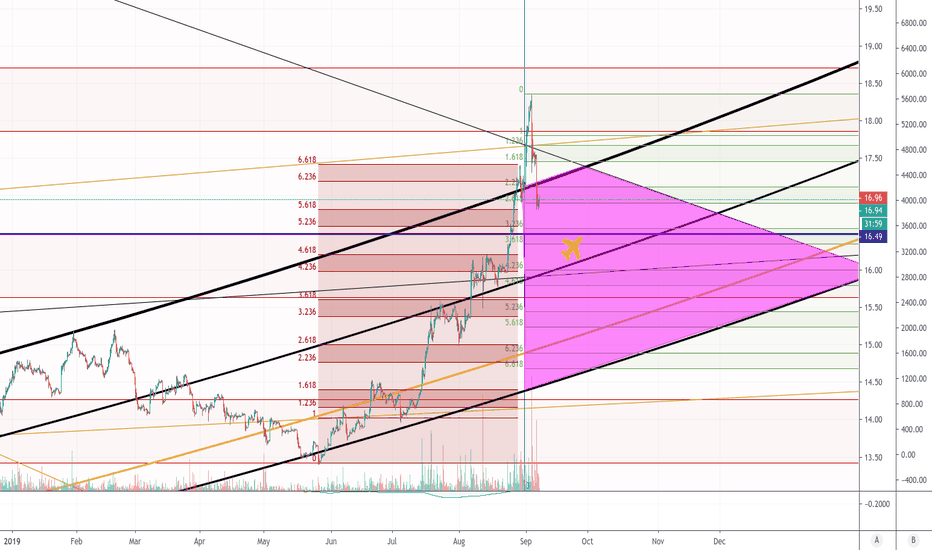

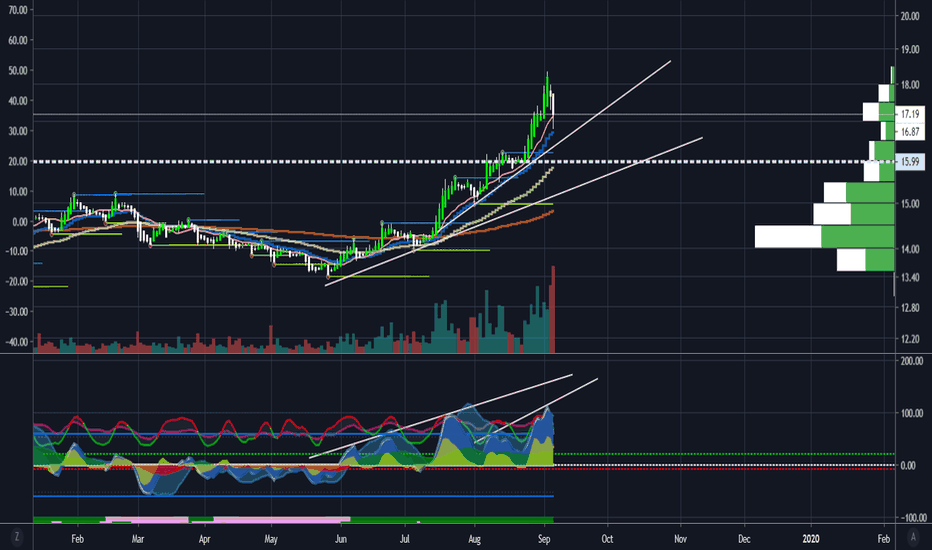

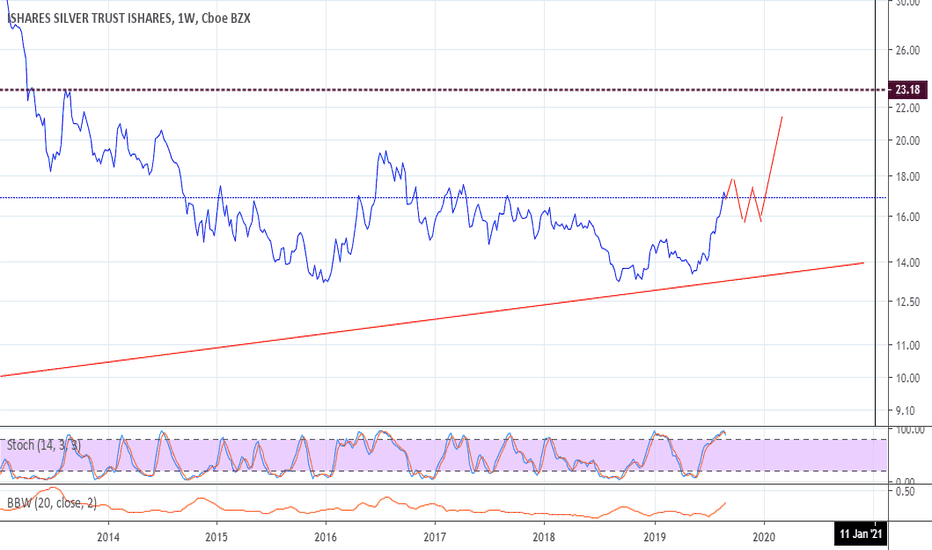

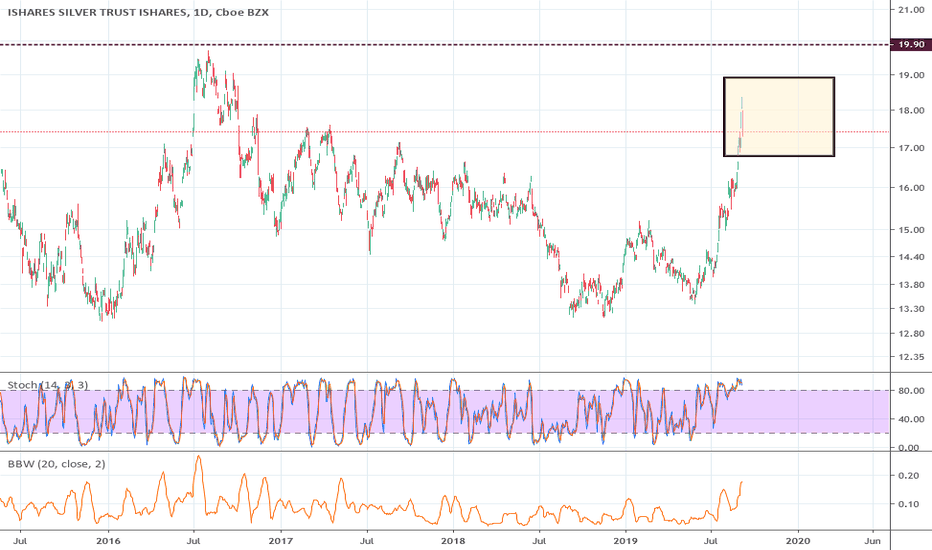

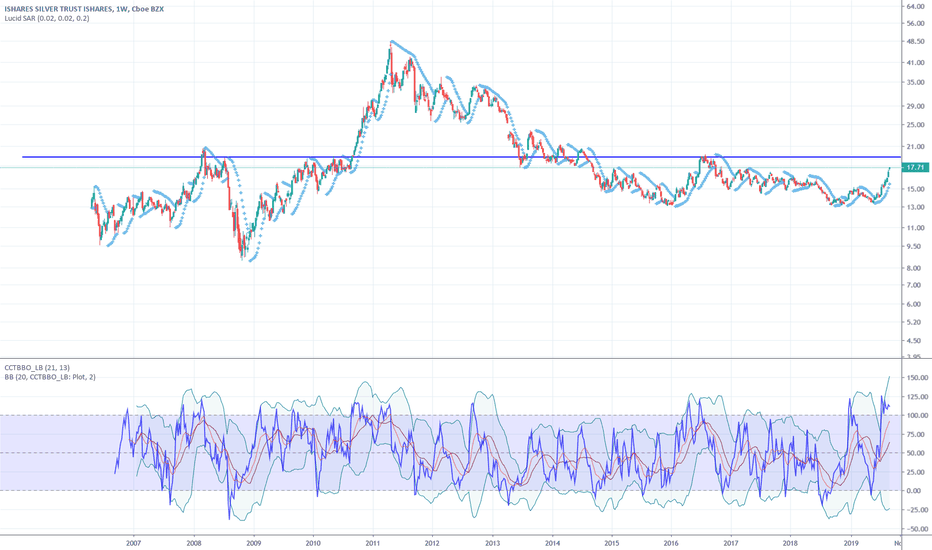

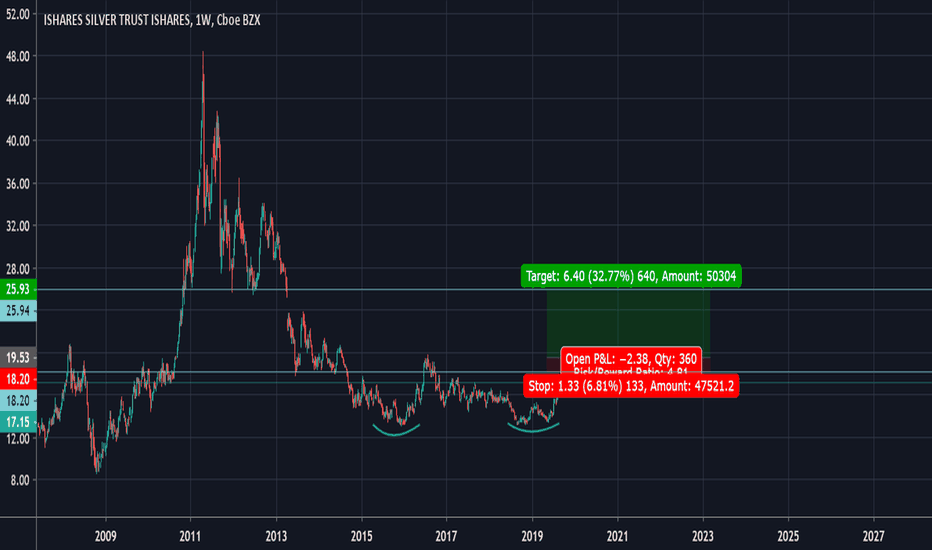

SLV Will Buy the Dip Mentality Move to PMs?A more bullish view may place us in a minor wave 4 of a larger wave 3 structure with a test of the highs and the potential wave 5 coming in a couple of weeks. Some suggest that in commodities, wave 5 can be the strongest move. My longer term view (other posts) suggests a confirmation of the Major Double Bottom. To complete this formation, SLV must break above 20. As Central Banks continue to lower interest rates to negative levels, the move to precious metals should continue. With the gold/silver ratio so out of whack as it has been, it's possible that silver will eventually test the highs.

SLV 2022 LEAPs are now listed. My patient money goes into LEAPs and physicals to take away my urge to trade my positions. Spreads are not friendly here resulting in stable long term positions.

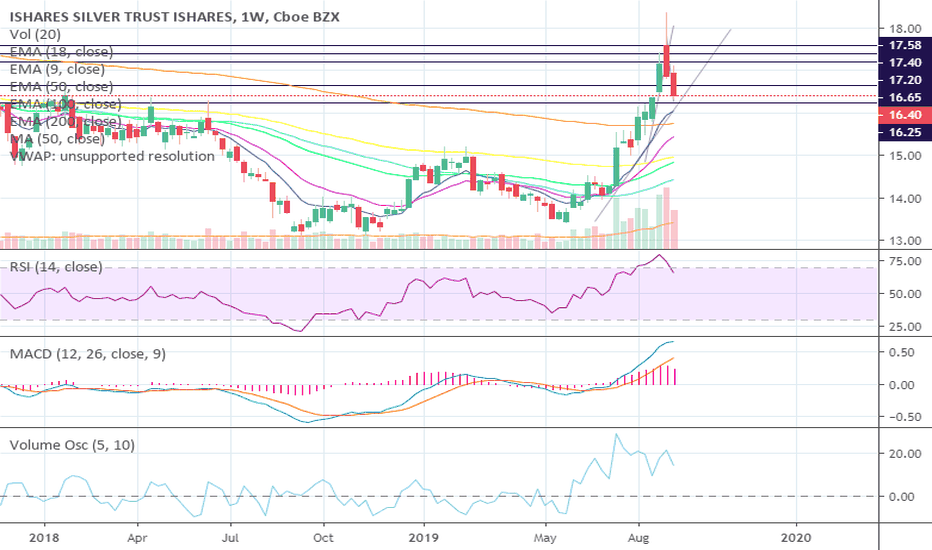

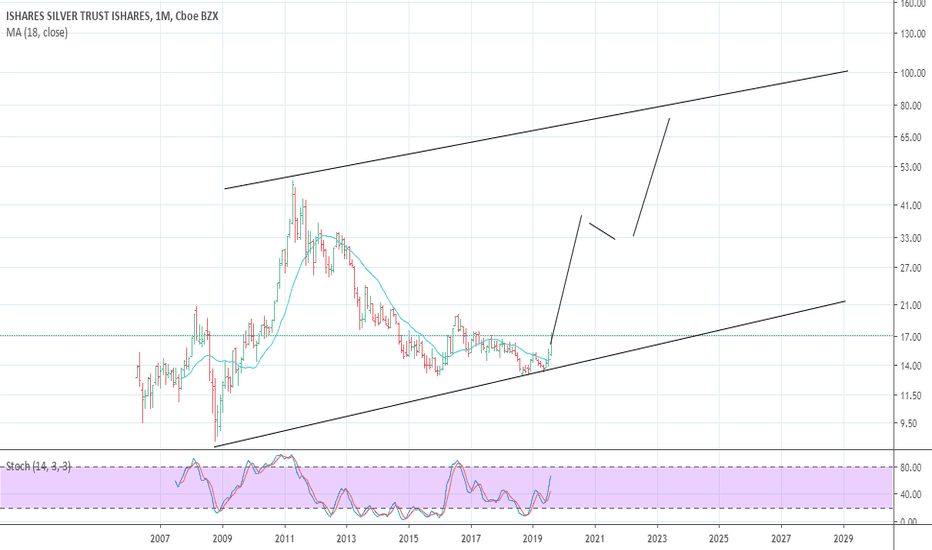

SLV Upward Bias ViewAs SLV appears to be entering into a bull market phase, interesting to see possible channel ranges. In 2021, I could imagine to see $40 as the midpoint. That could be consistent with a gold/silver ratio moving down to 40. Of course, knowing how silver trades, a $2 smackdown could occur in any moment ;-)

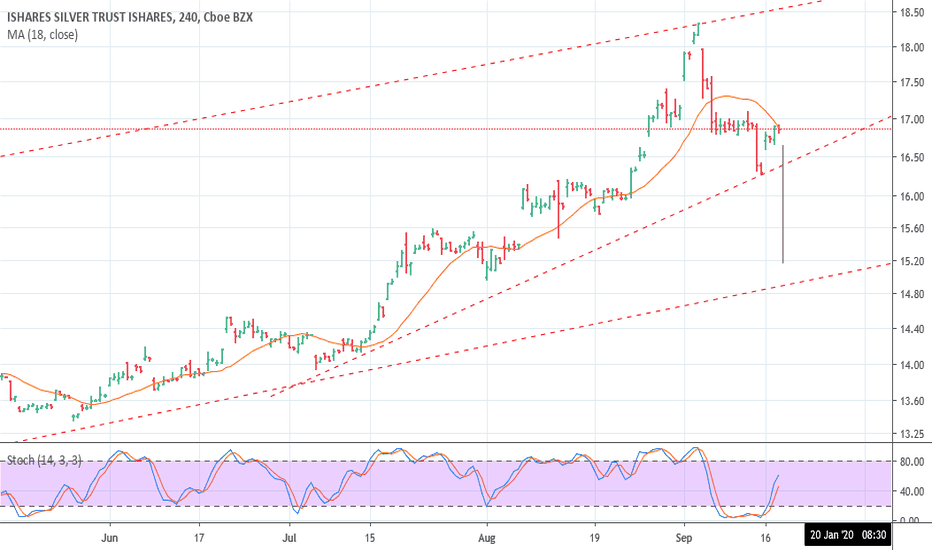

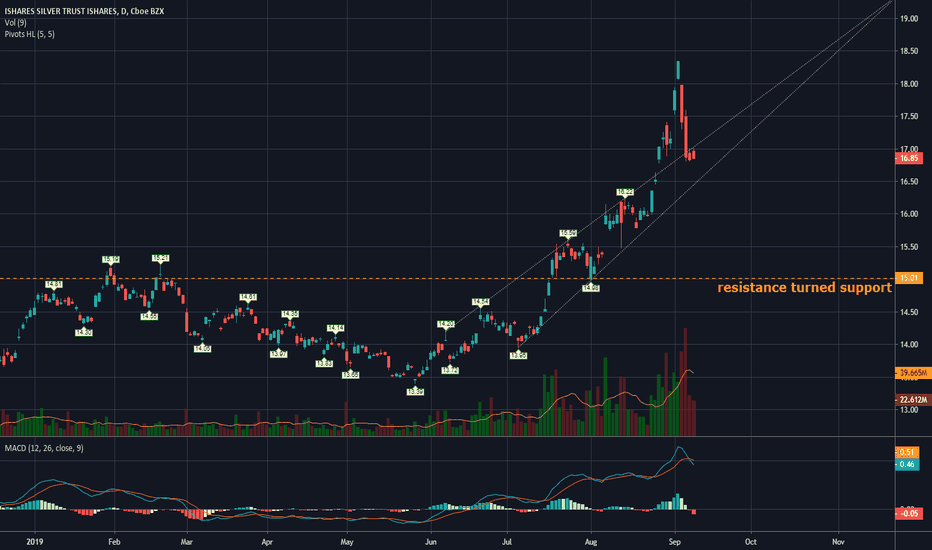

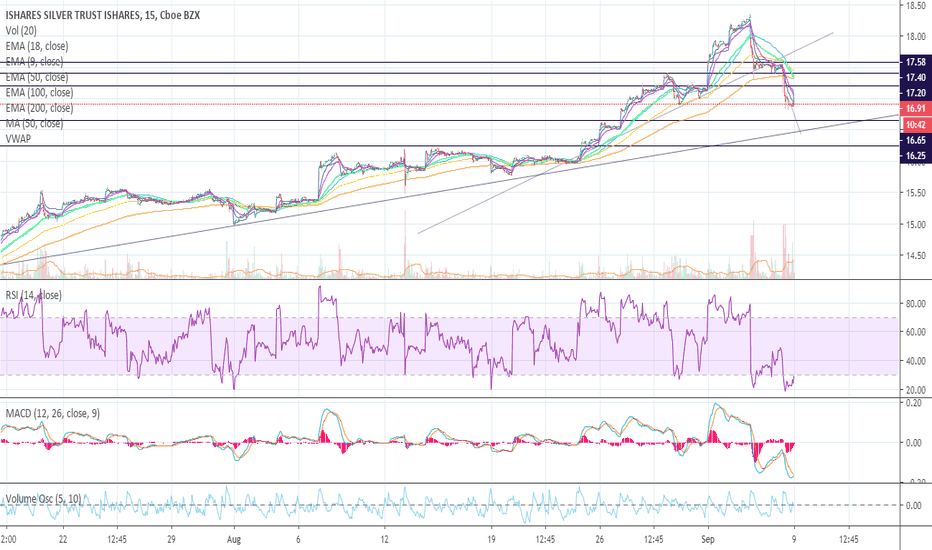

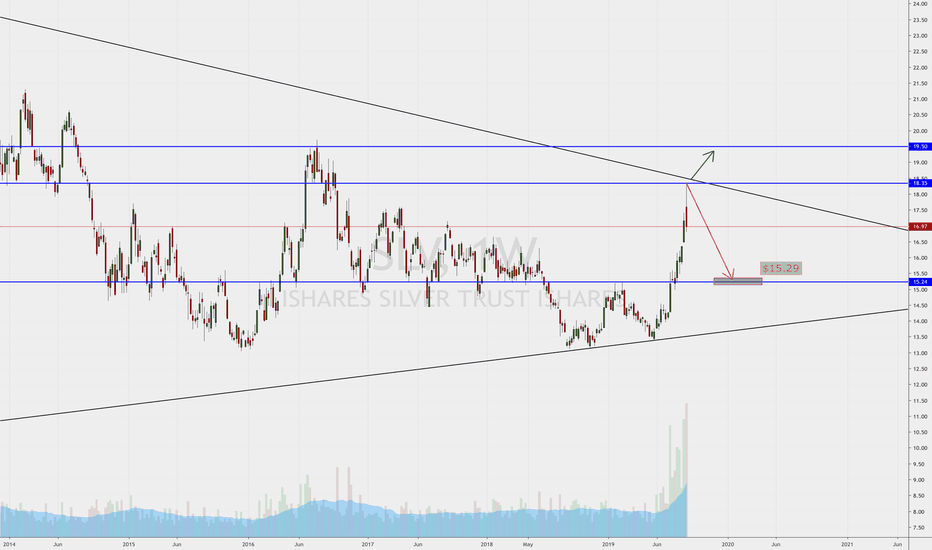

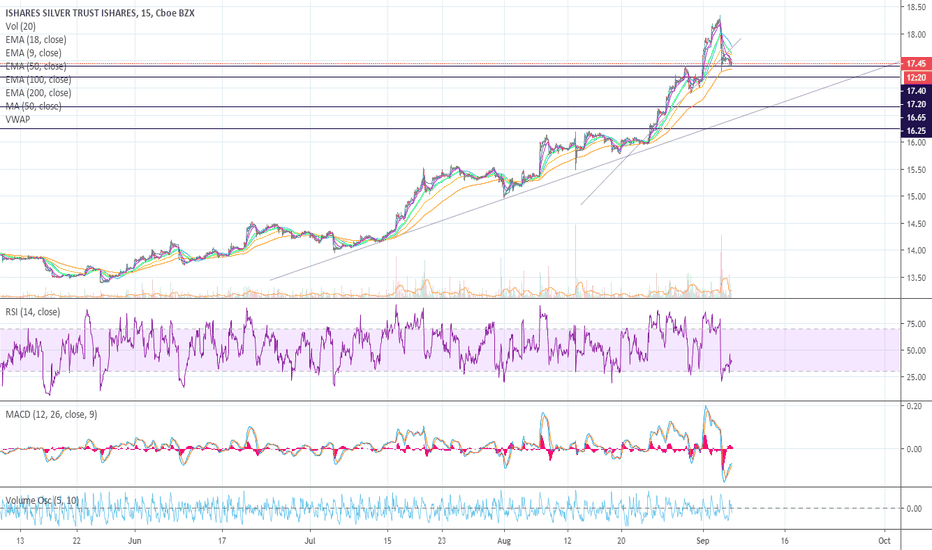

SLV - Oct 18SLV was for quite sometime was following a steady uptrend until broke out. It has now reverted back to exactly where it was 2 weeks ago.

I'm expecting it to trade sideways within the narrow uptrend range, fake a breakout and then fail as the MACD cross under suggests massive downside.

I'll be watching:

- OTM Long 15 Put Oct 18

- ITM Long 17 Put Oct 18

- Short Iron Fly 18/16/14

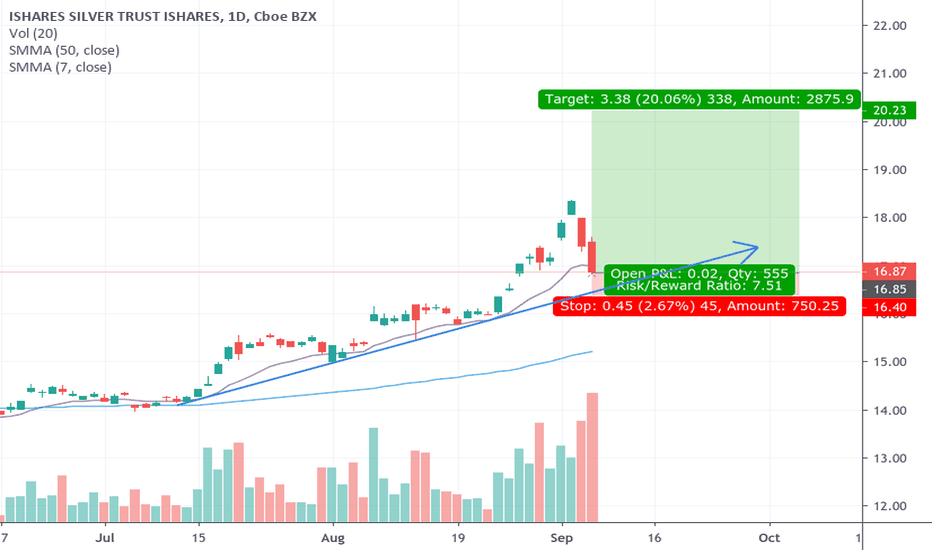

Breakout on SLV to continueNext trading day will tell. Looking for AMEX:SLV to touch on the SMA50 for support. That would be a buy signal for me, then I would monitor for it not to go lower than 5% down from entry and 20% up. 5%_down is an instant sell. Depending on market feel at 20%_up it may warrant carrying a partial set of stock over with an fresh exit bracket.

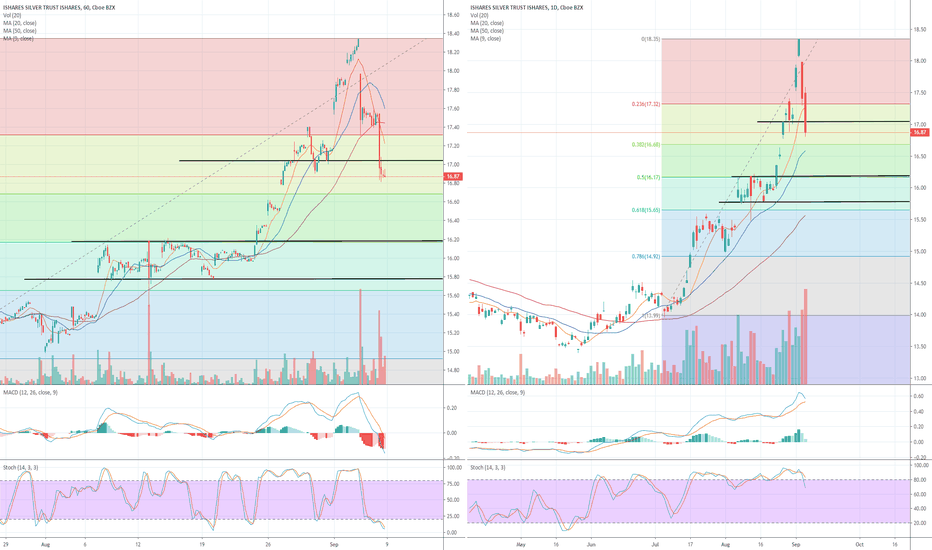

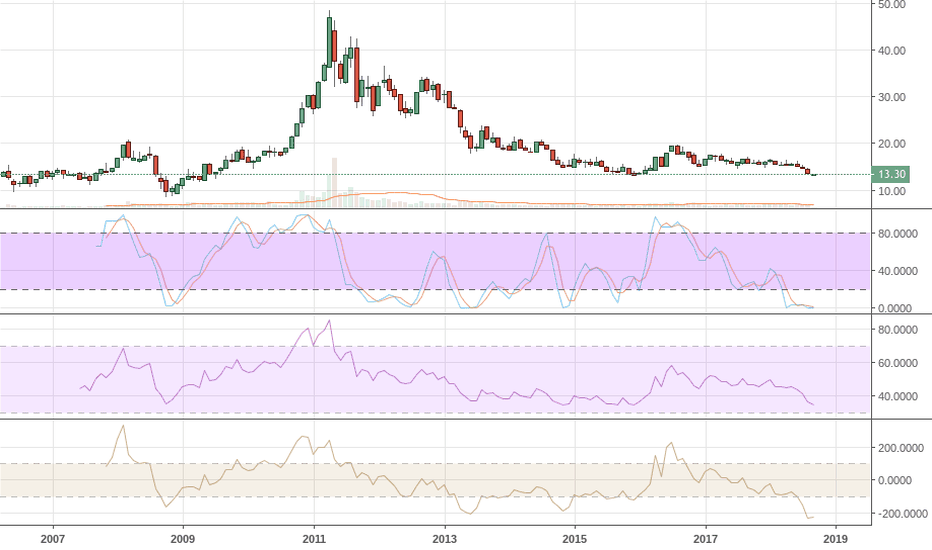

My take on SLV Would love any feedback, I am still learning!

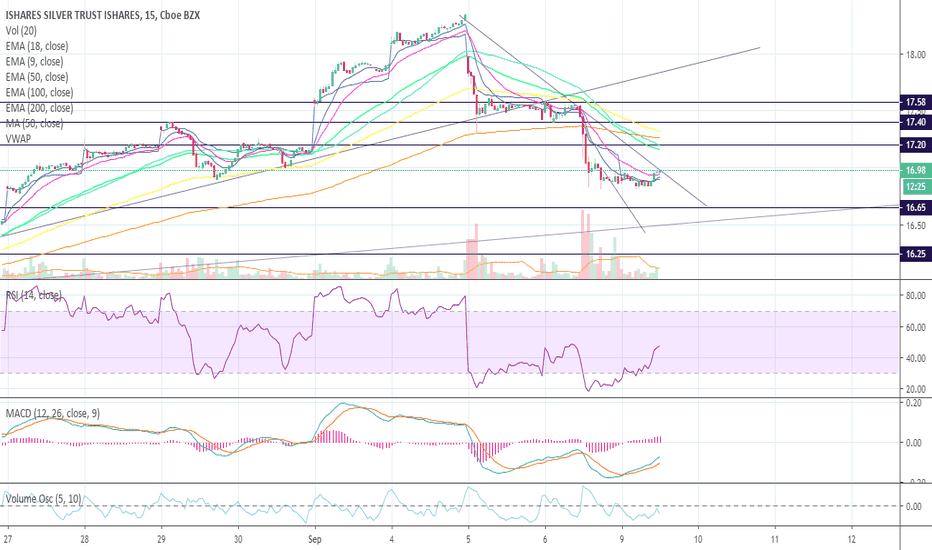

Reasons I am bearish in the short-term:

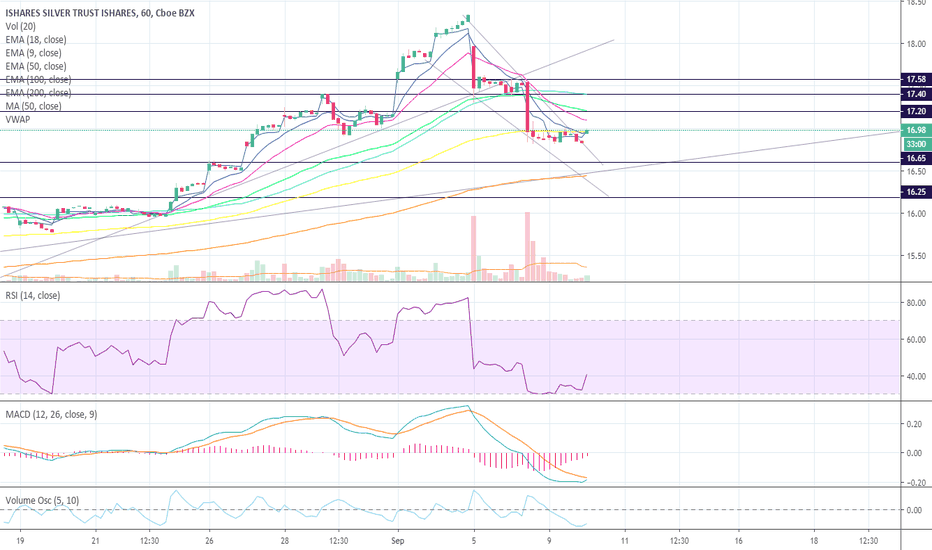

- The meteoric rise of Silver and SLV prices has had no time to develop strong support or resistance

- Bearish Volume is increasing, both in raw vol but also in its reaction to bulls trying to recover

- MACD is not looking healthy for hourly and the daily looks like it is going to converge soon - Bearish signal

- Massive shooting star on the weekly chart

- Hourly Stoch says oversold, but daily says overbought

- Hourly MA(9,20,50) all looking not so great as the short term (MA9) has completely crossed the 20 and 50

- Forex Silver to USD (XAGUSD) is also barely holding support, and looks like it is starting to downtrend

Reasons I am bullish:

- Volatility is insane, so who knows

Just some ideas, please leave a comment and let me know what YOU think! :)

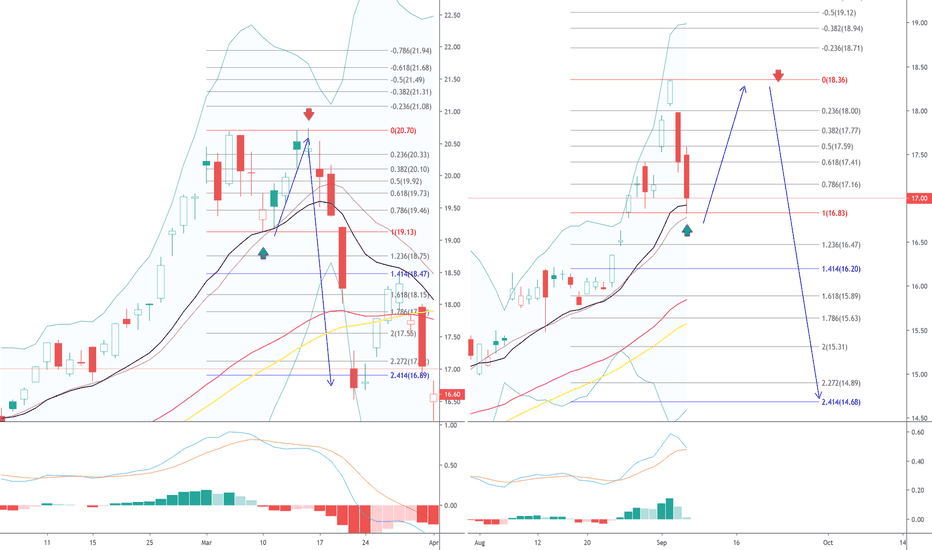

Possible Wave 4 startingCould be that we have just completed a wave 5 finishing off a wave 3. The current downturn may be signalling the beginning of Wave 4.

The last correction, wave 2, lasted approximately 3 months. Sometimes wave 4s can last a long time and display many different formations. The eventual Wave 5 should challenge the last major high, just under $20. I'm projecting that it will overshoot, going to a gap above $25 and then testing the breakout area ($20).

I will be watching price on Monday or Tuesday to rally and test Wednesday's high. Given the current strength in the recent move, I expect price to break through to higher highs. But a failure to make new highs may confirm that Wave 4 is beginning.