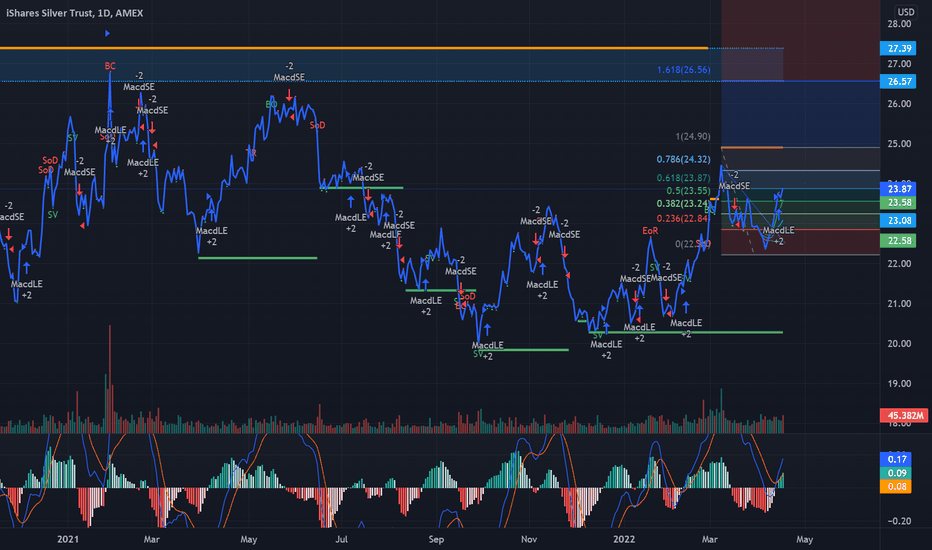

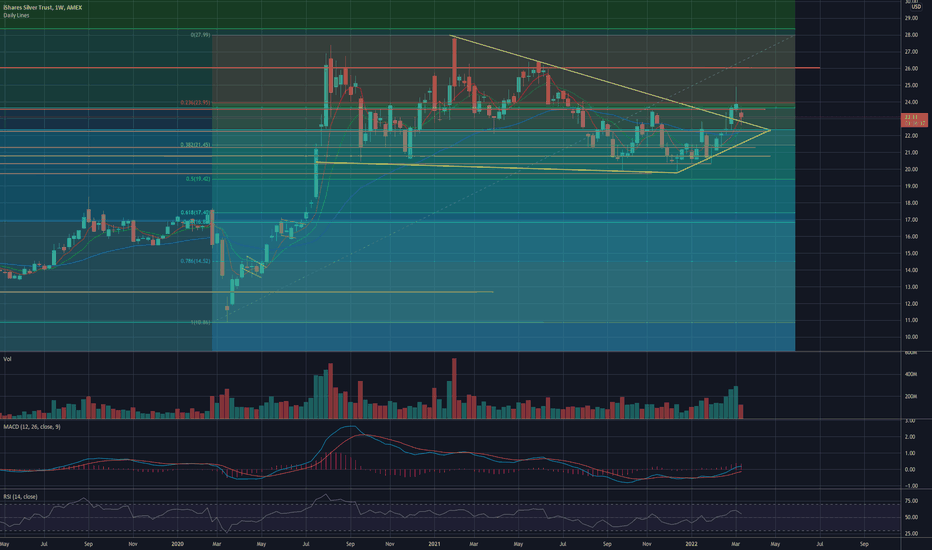

LONG SLV more upside potential than GLDGLD and SLV tend to do well during these chaotic times, with inflation sky-high, Russian attacks, and crypto still at an early stage. At the moment, I believe investing in GLD and SLV is a hedge against risk and has potential upside growth until inflation drops.

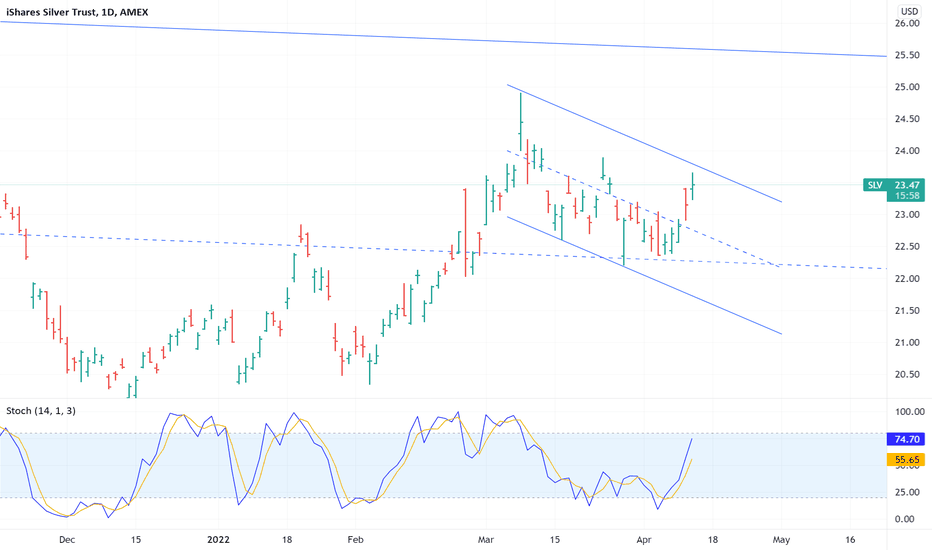

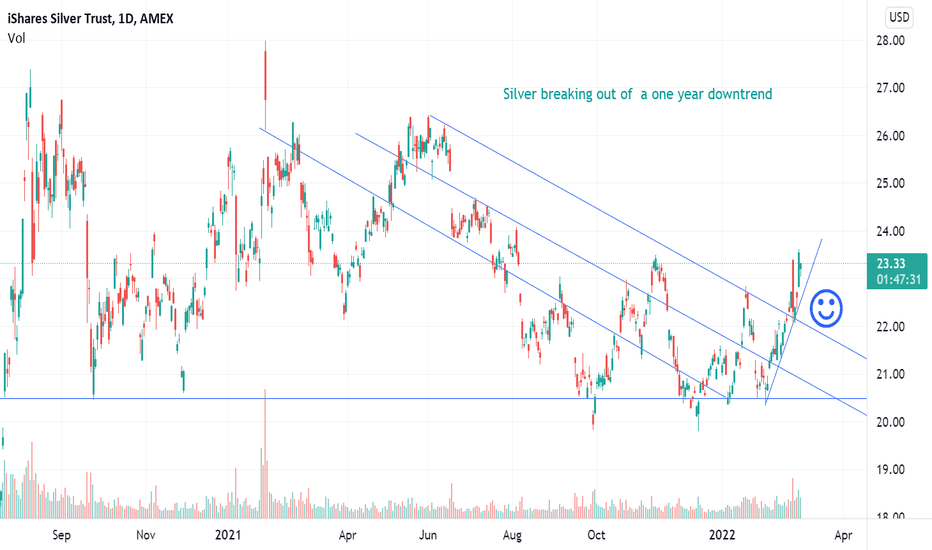

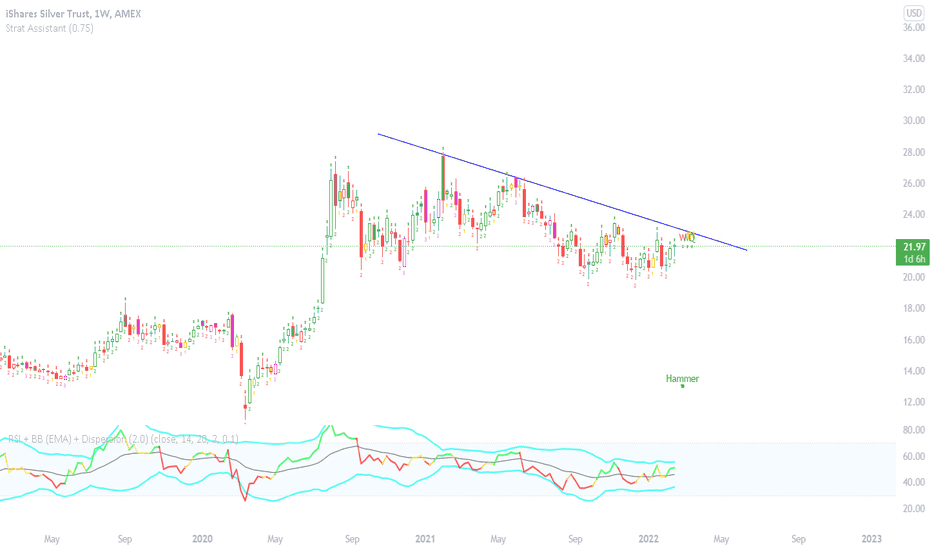

Since the Easter holiday, SLV has broken the downtrend line and found a bottom around $22.37. It's shooting for the March high (where the resistance is around 24.50)

SLV trade ideas

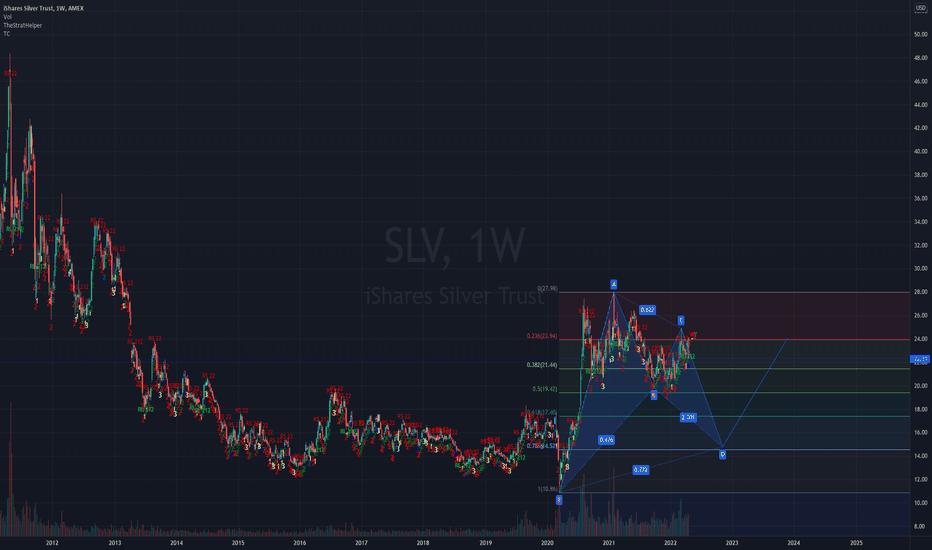

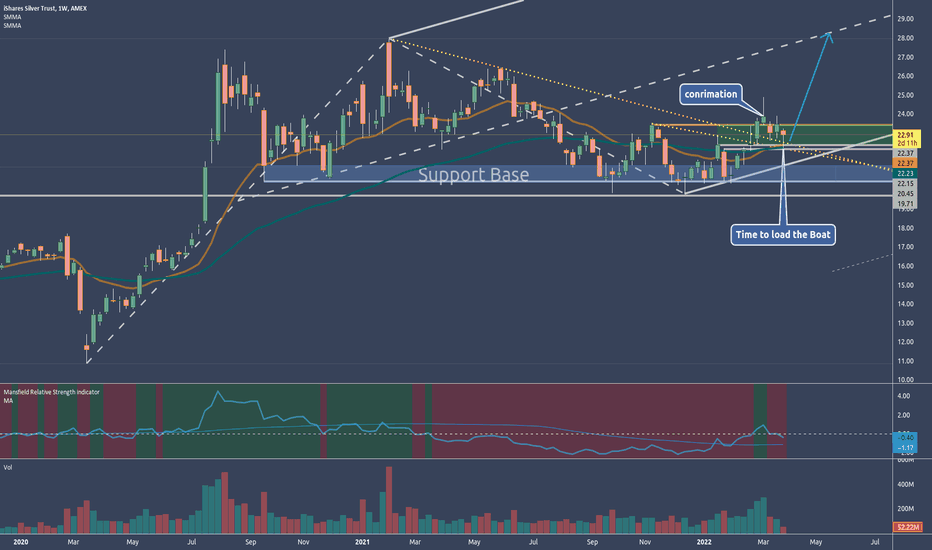

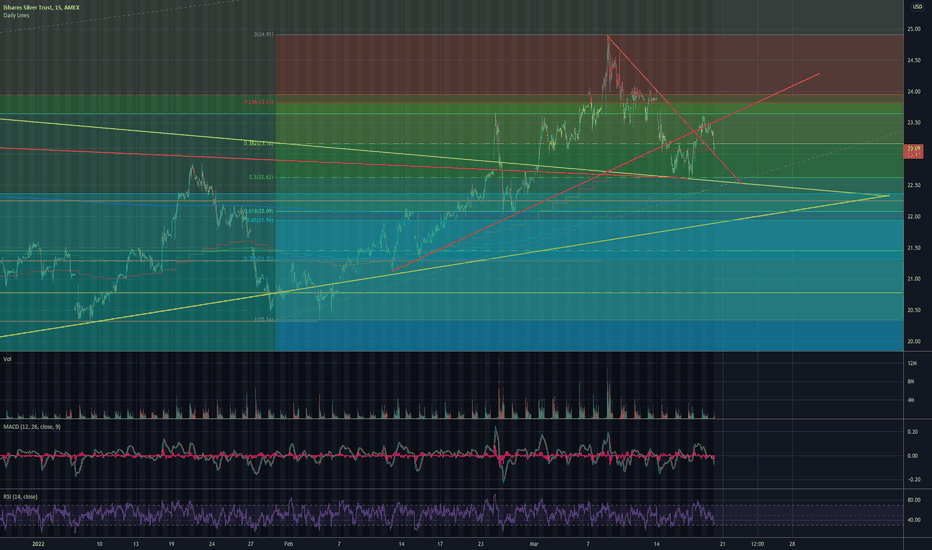

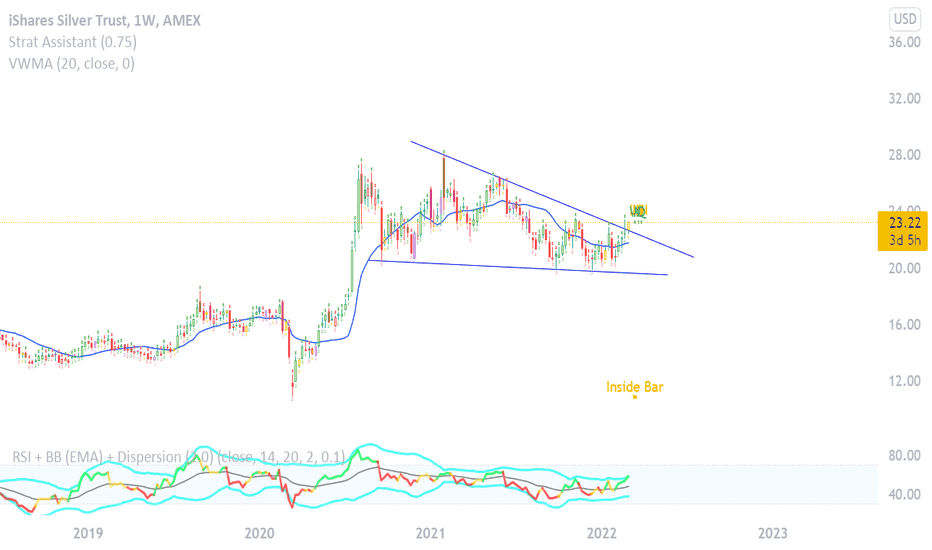

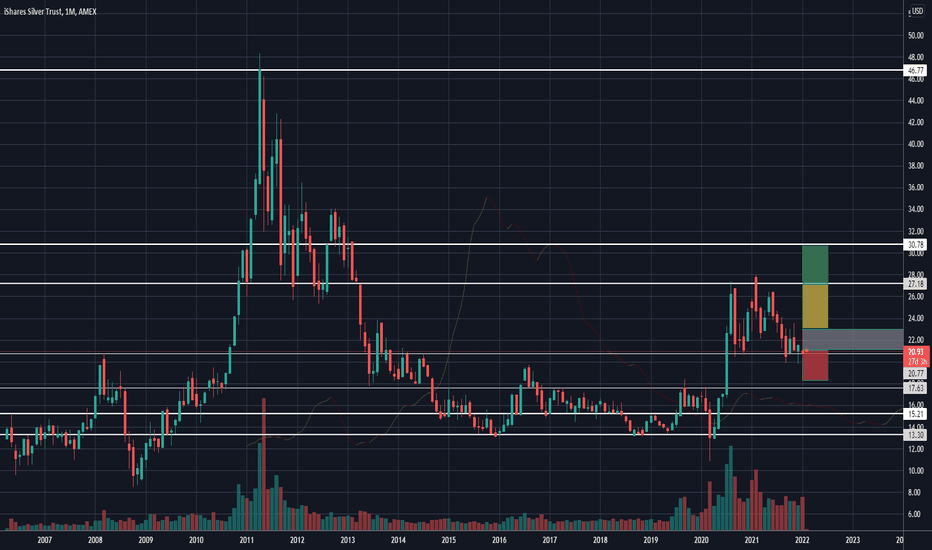

SLV - Time To Load The BoatWhat a superb pattern.

Since 2020 SLV proved to climb higher.

Then from 2021 we see a consolidation until September.

In November the pivot was already signaling a potential rise. And now in March we had the confirmation.

I think, after this pump in the market, it's time to load the Boat. A free fundamental sign we got as a Bonus is the inversion of the "curve".

See you later, have to load up ...

#loadthesilverboat

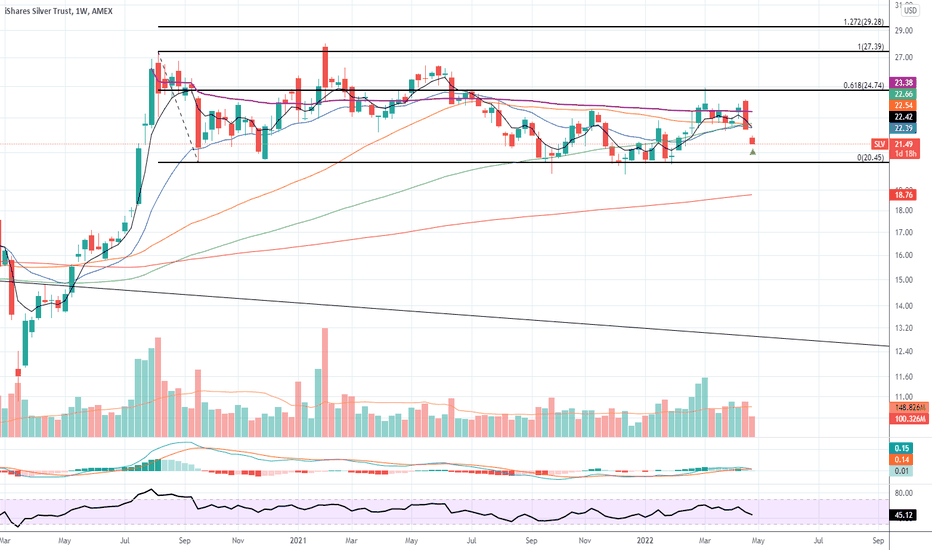

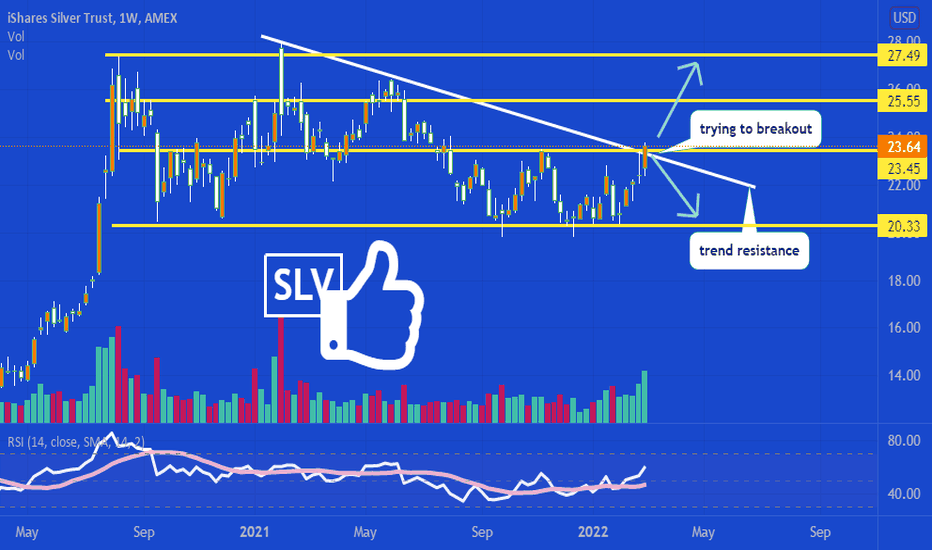

SLV Breakout ConfirmationAs always, the sharp silver breakout was quickly sold. Support appears to have emerged however at the top boundary of the downward channel. While the constraint of the sideway channel shows upside potential only to 27, seeing how Nickel broke the LME exchange shows what can happen. Notice though that the nickel longs were not able to profit as the exchange shut it all down. Just goes to show that even if you are right, you can never win.

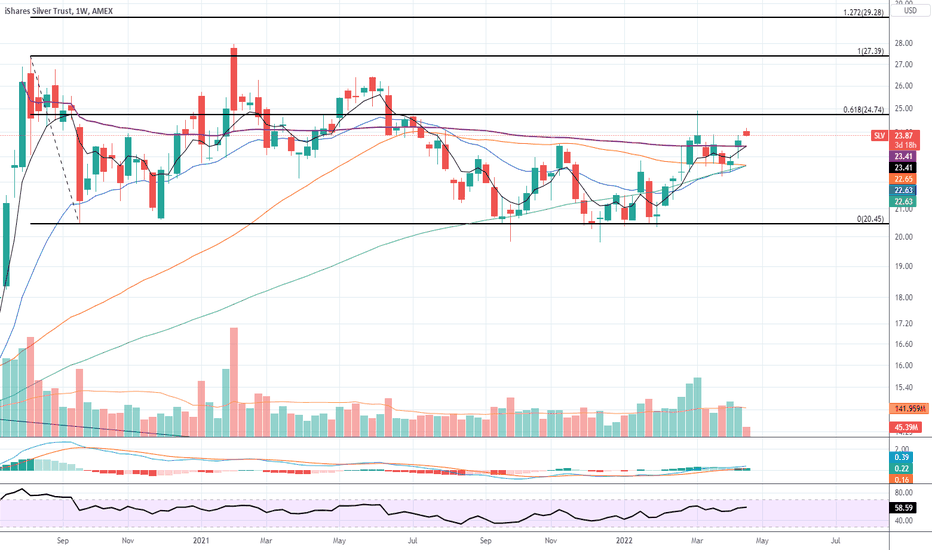

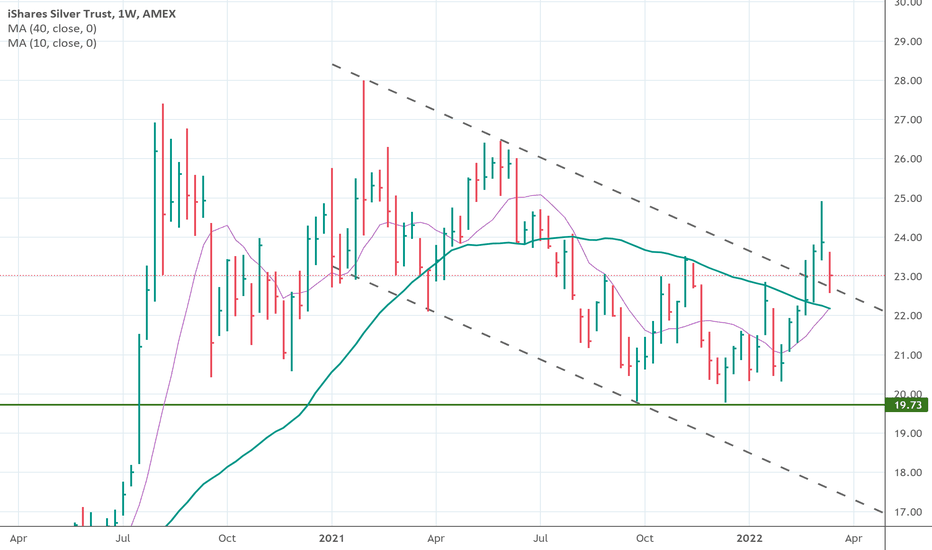

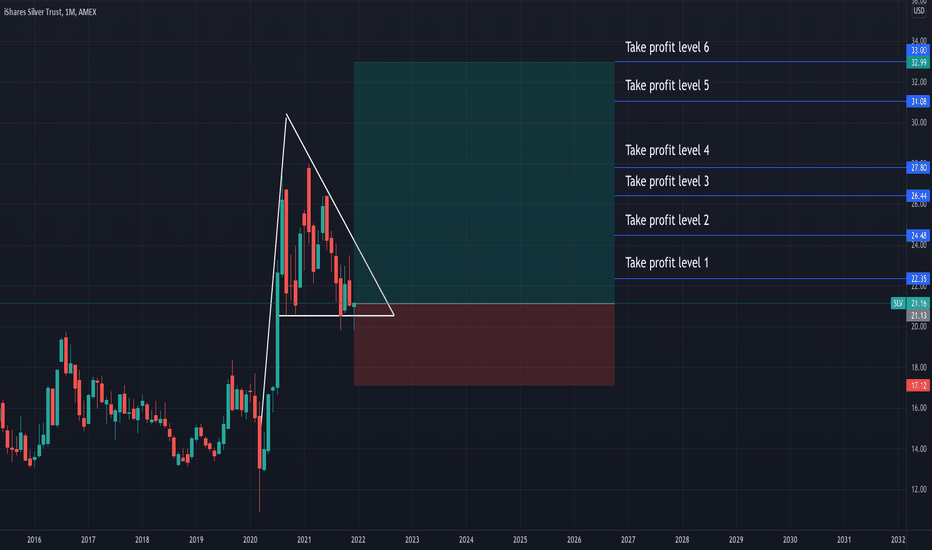

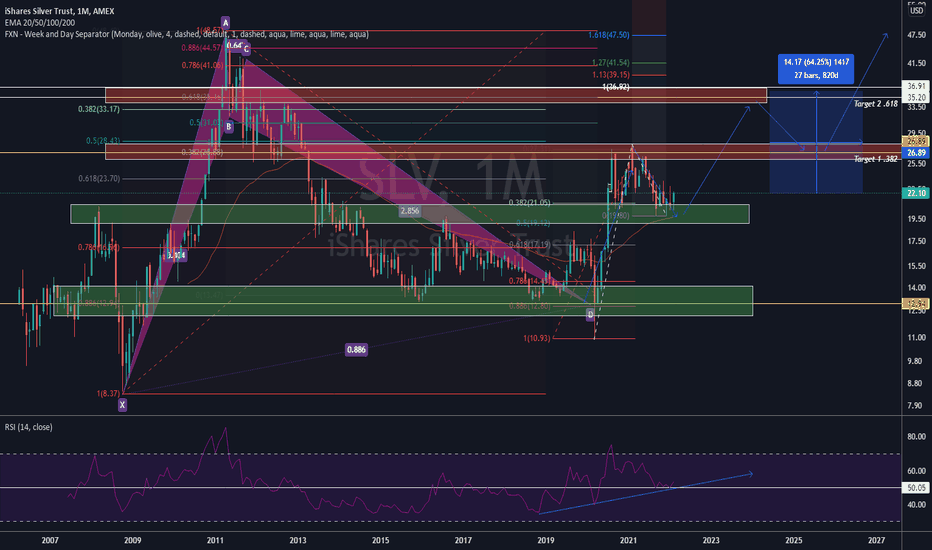

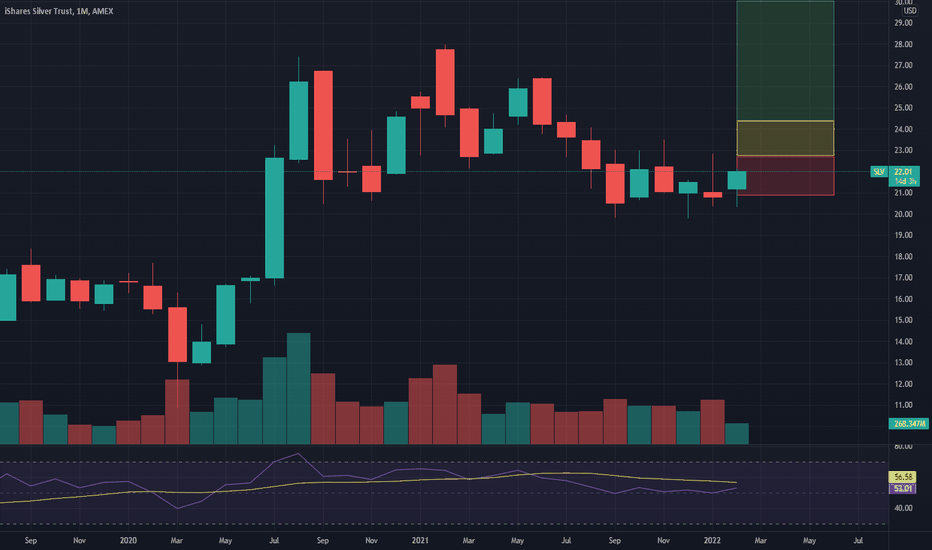

LONG SLV (iShares Silver Trust) - very bullish!AMEX:SLV price action is showing a strong bullish flag on the monthly time-frame. Due to the macroeconomic environment, very high inflation rates, and high gold:silver ratio, I am expecting the SLV price to break the bullish flag on the upwards side. If this happens, we can look at the following levels for taking profit:

Take profit level 1: $22.35

Take profit level 2: $24.48

Take profit level 3: $26.44

Take profit level 4: $27.80

Take profit level 5: $31.08

Take profit level 6: $33.00

Those levels were drawn in accordance to various resistance levels.

Good luck,

Your Ganbu

⚠️ Let me know your feedback and comments below!

⚠️ Follow me if you would like to see more analysis like this

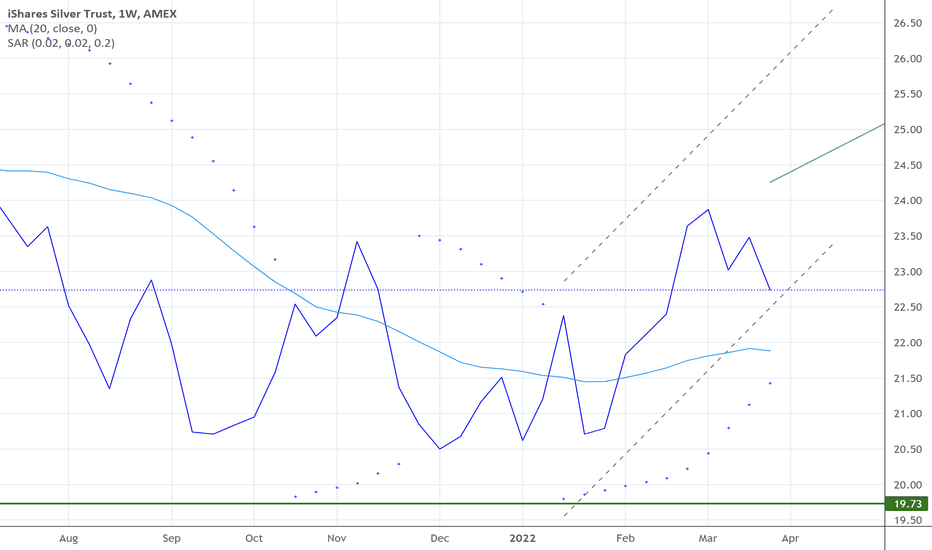

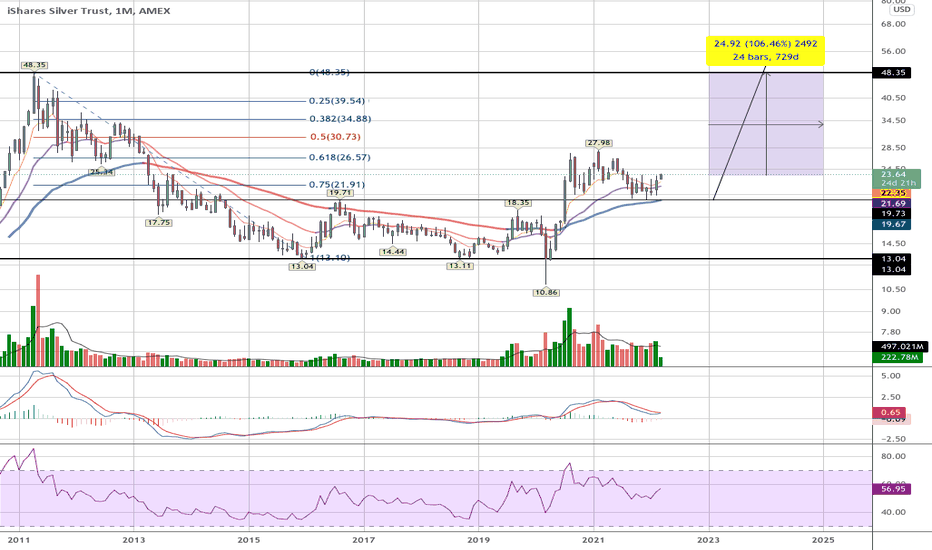

Silver OutlookSilver is looking very good right now. On the monthly time frame rsi looks very good. It is bouncing on 50 and staying above. This shows a lot of strength. Also we are in an are of support from previous resistance. We are also in the zone where most patterns gain support. In this case we have a W pattern that reached its first target. The .382 retracement. We would then expect a pull back into an area of support. (this is happening) Now we are seeing a buyers fighting the sellers once we have a clear indication that the buyers will win we will look to join them. The next target we have would be 36. This is the second target of the .618 retracement. We will likely see resistance in this area as well.

$SLV - SilverSilver has also been consolidating for a long while and the risk return here is beautiful. Silver will only be used more and more over the next decade. I like the alternative uses for silver whereas gold is not as versatile. Silver is much more volatile though.

This is not a recommendation to buy or sell. It is for informational purposes only.