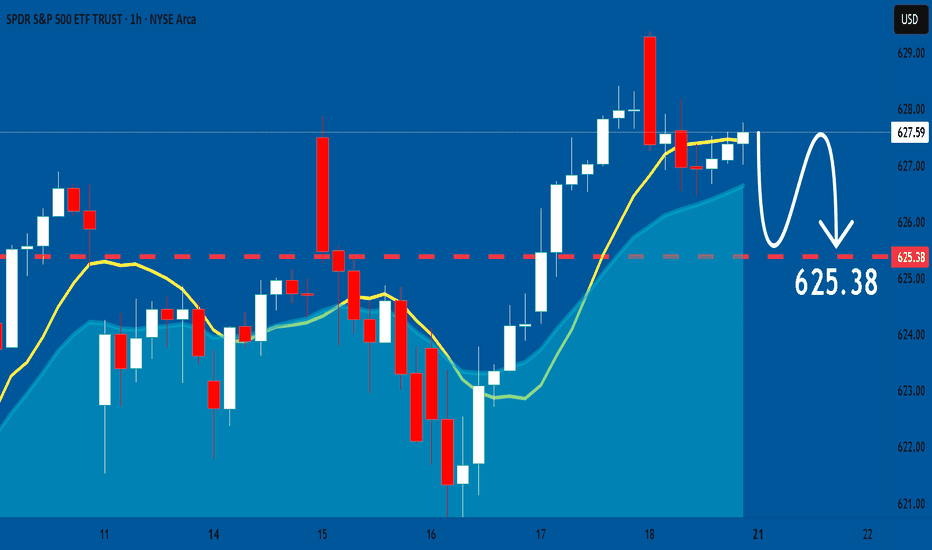

SPY What Next? SELL!

My dear friends,

Please, find my technical outlook for SPY below:

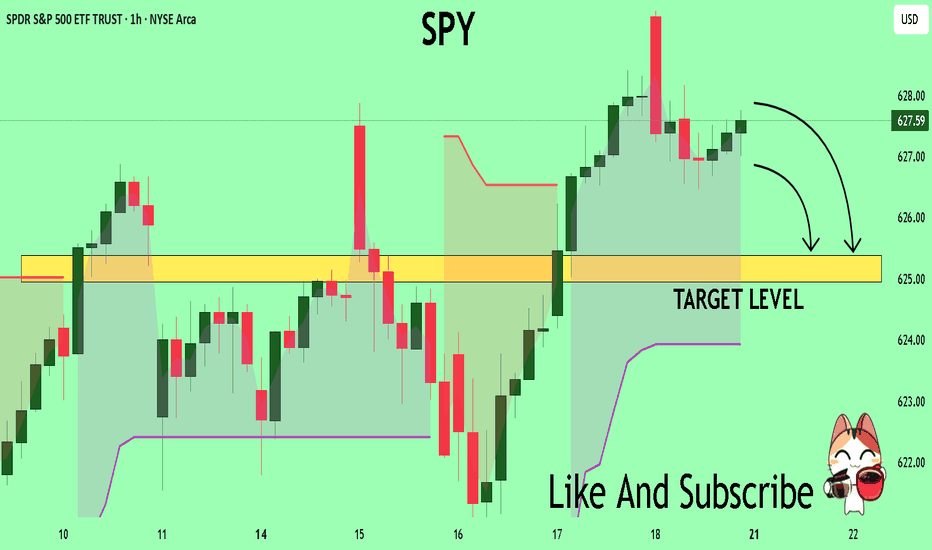

The instrument tests an important psychological level 627.59

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 625.38

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

SPY trade ideas

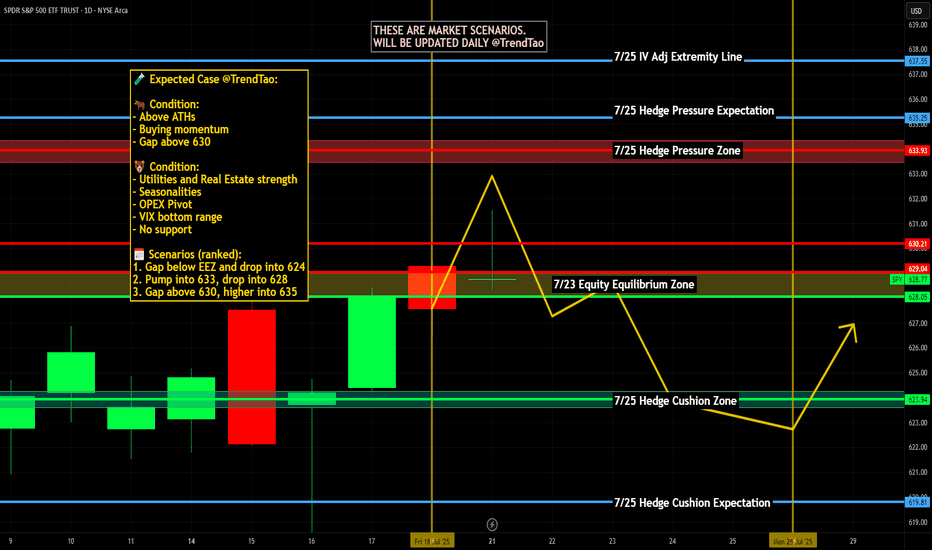

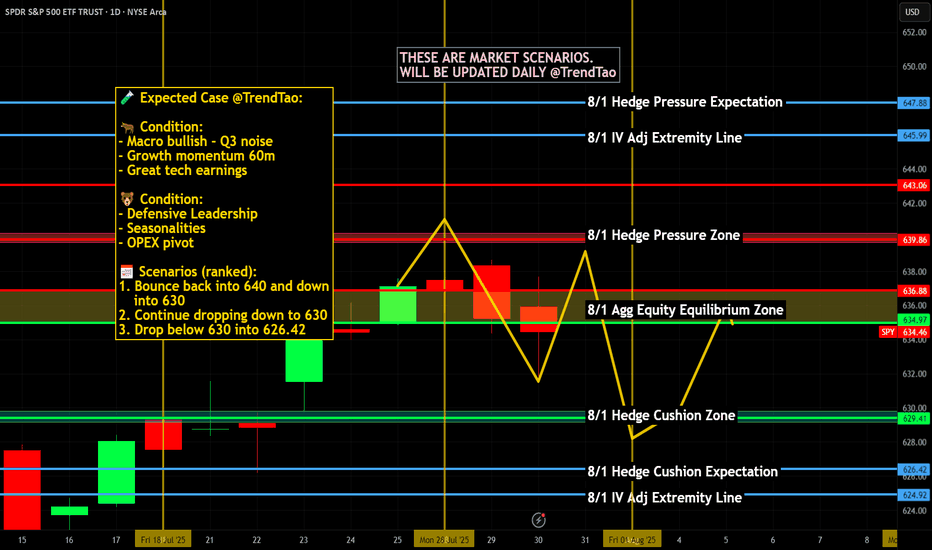

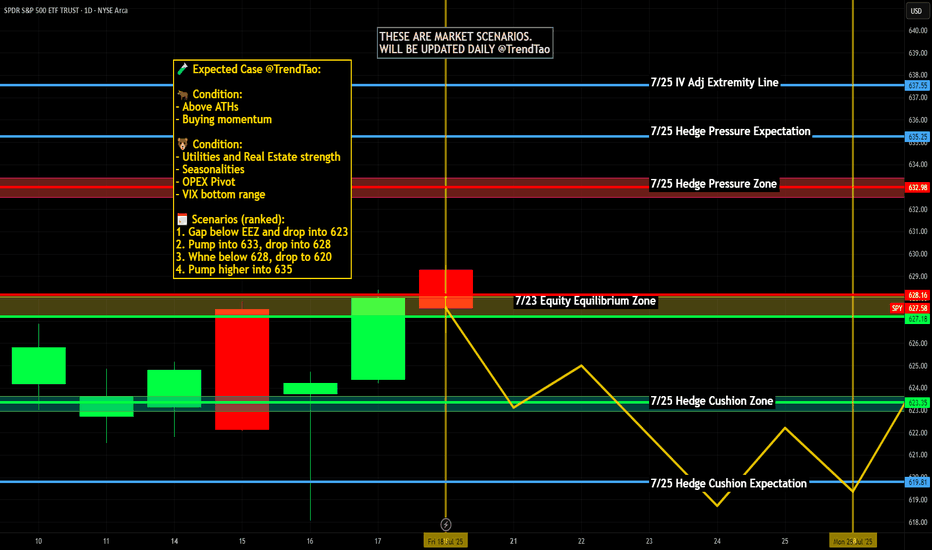

Nightly $SPY / $SPX Scenarios for July 22, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 22, 2025 🔮

🌍 Market-Moving News 🌍

🚀 Tech & EV Stocks in Focus Ahead of Earnings

Futures were quiet ahead of Tuesday’s open, but key movers included Astera Labs (+19%), Alphabet (+2.7%), Netflix +2%, and Robinhood –4.9% after being passed over for the S&P 500. Investors are positioning ahead of major tech and EV earnings this week — including Tesla, Alphabet, Lockheed Martin, Coca‑Cola, and Honeywell

📣 Powell Speech Eyed for Rate Clues

Fed Chair Jerome Powell is set to speak at 8:30 AM ET today at the Integrated Review of the Capital Framework for Large Banks Conference in D.C. Markets will be watching for any indications on future interest rate direction

🌏 Japan’s Political Shift Has Little Market Impact

Japan’s ruling coalition lost its upper-house majority over the weekend, but markets remained stable as it was largely expected. The yen held steady, and Asian equities stayed calm amid the holiday—focus remains on upcoming corporate earnings

📊 Key Data Releases & Events 📊

📅 Tuesday, July 22:

8:30 AM ET – Powell Speech: Key address at the bank regulation conference. Tone and forward guidance may sway bond and equity markets.

After Market Close – Alphabet & Tesla Earnings: Heavyweights due today—market attention will track revenue guidance, especially on advertising, EV demand, and AI.

⚠️ Disclaimer:

For educational and informational purposes only. Not financial advice—consult a licensed advisor before making investment decisions.

📌 #trading #stockmarket #tech #Fed #earnings #AI #infrastructure #volatility

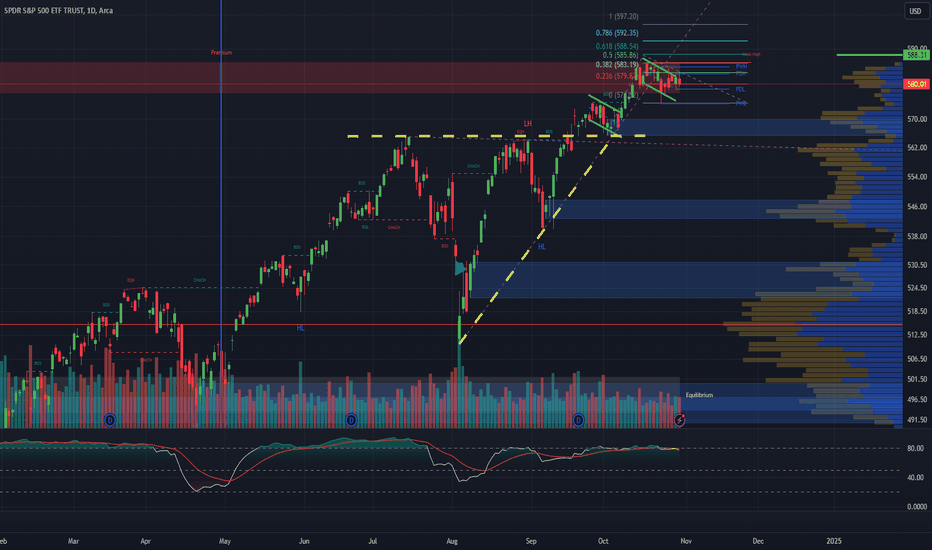

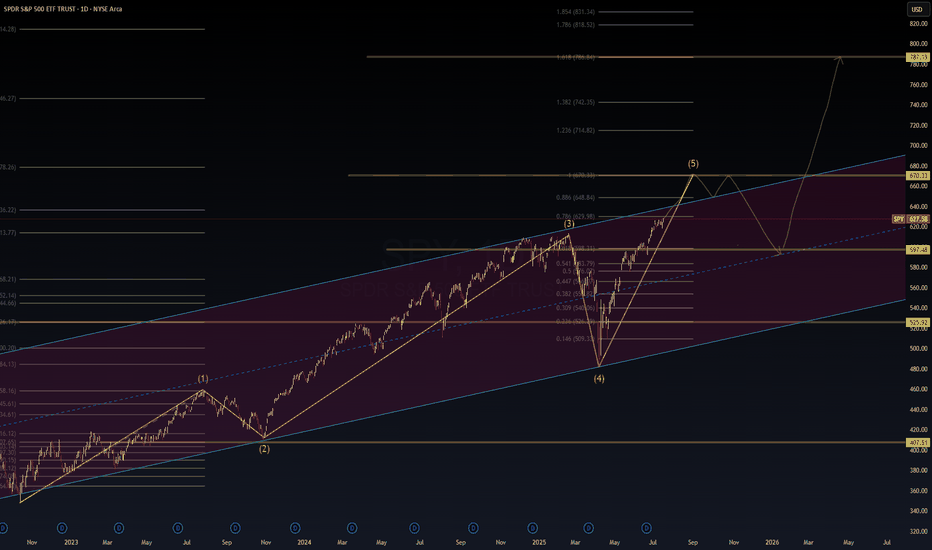

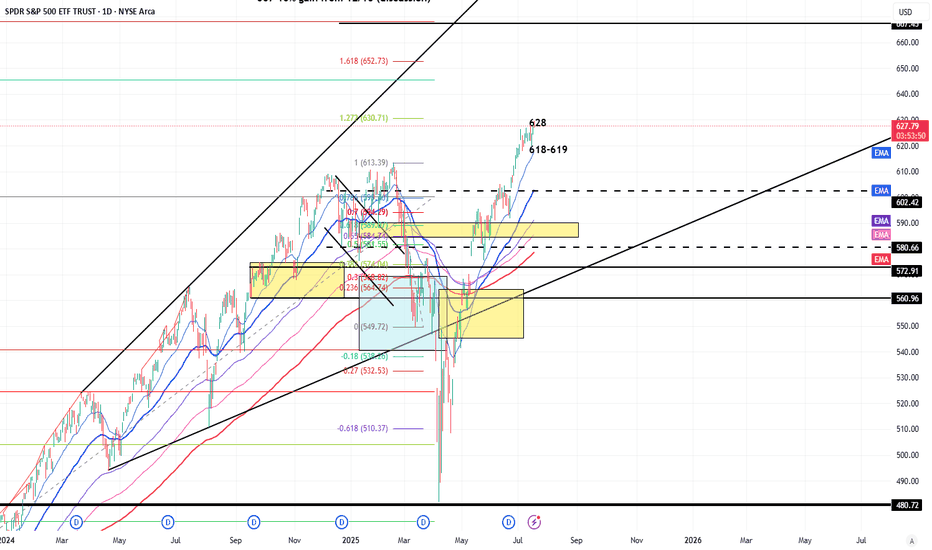

SPY Macro Wave Outlook – Bullish Fifth Wave into AI Supercy📈 SPY Macro Wave Outlook – Bullish Fifth Wave into AI Supercycle?

🧠 WaverVanir DSS | VolanX Protocol | Institutional AI Alignment

The SPY rally appears to be unfolding within a 5-wave macro impulse, currently inside Wave (5) targeting the 670–787 zone, depending on macro alignment and Fed behavior. This structure converges with long-term Fibonacci clusters and macro transition signals.

🔍 Thesis:

Wave (5) in Progress – Next resistance seen at ~670.33, followed by long-term targets near 787.19.

Pullback Scenario – A temporary correction into the 597–600 range is possible before further upside.

Structure Validity – Channel and Fibonacci extensions confirm bullish continuation unless macro conditions deteriorate sharply.

🧠 Macro Alignment Required:

Fed Pivot Late 2025 → Probability: 60%

Earnings Growth Led by AI → 11% projected for S&P500 (GS)

Productivity > Consumption → AI-led industries showing 5%+ labor productivity growth (Dallas Fed)

Low Inflation Reacceleration Risk → Core PCE stabilization key

⚠️ Risk Matrix:

Macro Risk Probability Notes

Fed Hawkish Reversal 30% Data-dependent but unlikely unless inflation re-flares

AI Concentration Shock 25% Tech-heavy rally, breadth remains a concern

Valuation Compression 20% Shiller CAPE near 37

Trade War Reignition 15% Tariff risk remains a geopolitical tail

🎯 Target Zones:

Near-term: 670.33 (Wave 5 peak)

Medium-term: 714–787 (Fib clusters)

Correction Zone: 597–600, invalidation below 525

The AI economy is accelerating—productivity is now outpacing consumption in several sectors. This macro regime shift could be the foundation for the next secular bull wave.

🔺 Powered by VolanX Protocol

⚠️ Not financial advice. Educational chart generated by institutional DSS models.

#SPY #VolanX #WaverVanir #ElliottWave #MacroTrading #AIProductivity #Fibonacci #FedPivot #USEquities #TradingSignals #SmartMoneyConcepts #InstitutionalStrategy #AIInvesting #SP500

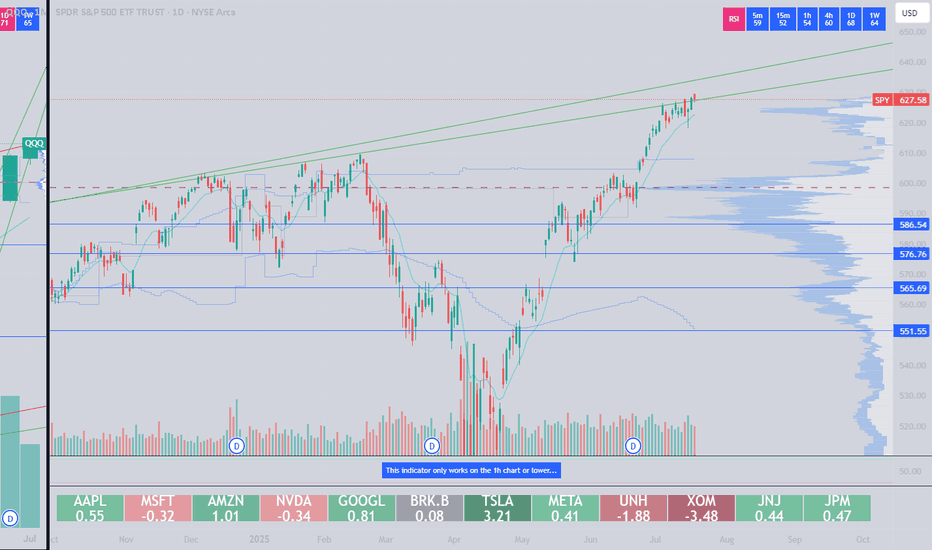

Nightly $SPY / $SPX Scenarios for July 31, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 31, 2025 🔮

🌍 Market-Moving News 🌍

🏦 Fed Holds Rates — Dissent Indicates Division

The Federal Reserve maintained its benchmark rate at 4.25%–4.50%. Notably, two governors—Christopher Waller and Michelle Bowman—dissented in favor of a 25 bp rate cut, underscoring internal divisions amid growing political pressure

📈 Strong Q2 Growth, But No Rate-Cut Signal

U.S. GDP expanded at a 3.0% annualized rate in Q2, rebounding sharply from Q1's contraction. Despite this, Powell emphasized persistent inflation, particularly from tariffs, reinforcing the Fed’s cautious policy stance

🛢️ Oil Climbs as Tariff Tensions Rise

Brent crude rose to ~$73.51 and WTI to ~$70.37 on fears of supply disruptions tied to President Trump’s threats of new tariffs on Russian oil and new tariffs imposed on Brazil and South Korea

📊 Key Data Releases & Events 📊

📅 Thursday, July 31:

8:30 AM ET – Initial Jobless Claims (week ending July 26)

Initial claims rose to 222,000, up from 217,000 previously—an early gauge of labor-market trends

8:30 AM ET – Employment Cost Index (Q2)

Quarterly growth in labor costs edged lower to 0.8%, down from 0.9%—a signal of moderate wage pressures

8:30 AM ET – Personal Income (June)

Data released on household income and spending patterns—crucial for assessing consumer resilience heading into Q3

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #Fed #inflation #jobs #technicalanalysis

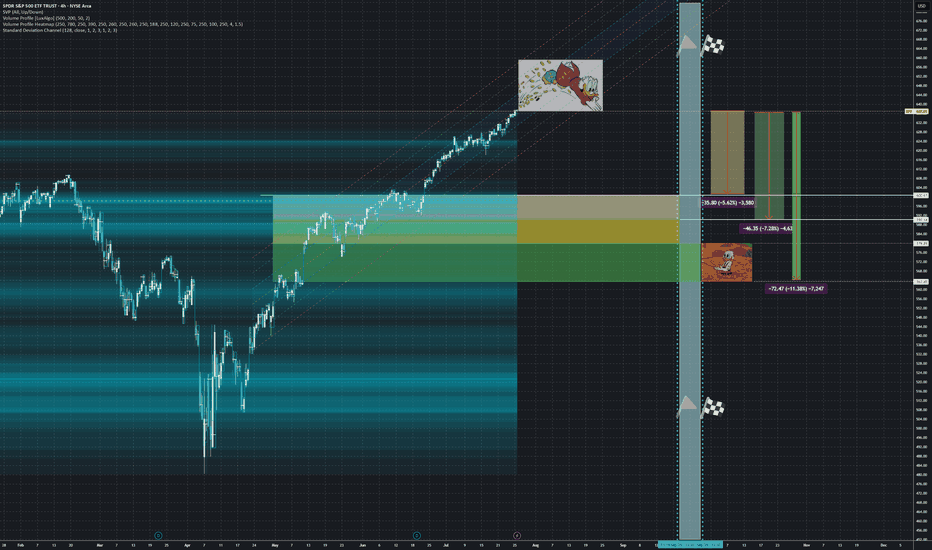

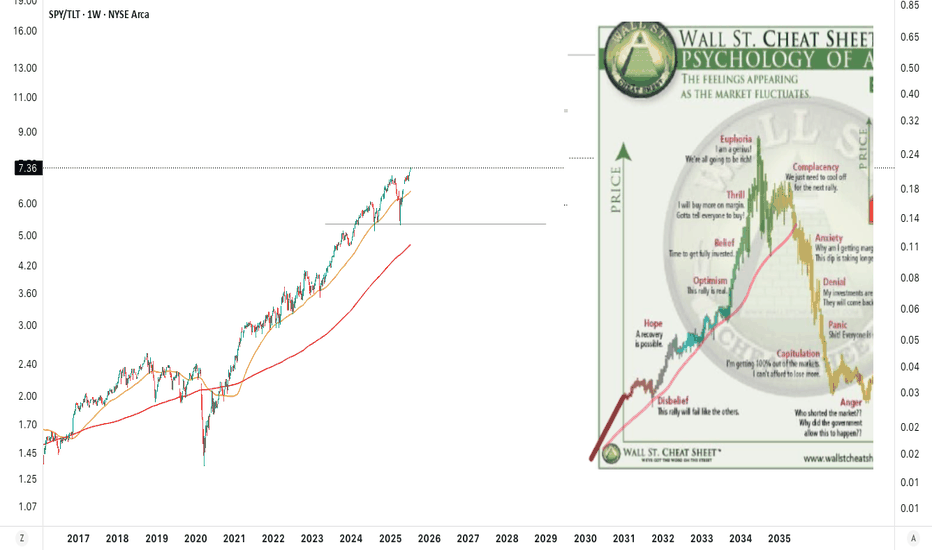

[$SPY] S&P500: The Big mini Short or Why hedging is not a crimeAMEX:SPY CBOE:XSP

No financial advice.

For Entertainment purpose only.

Have you ever considered to protect yourself and wake up from the 'Long-Only-Delirium'?

Now is the time.. do you hear the cracking in the bond-market?

Rate cutting will solve it?

No reason to panic?

Doomsday i*diot?

We will see... 😈 tic tac tic tac

This time THETA is against us, but GAMMA is bleeding.

📊 Strategy Characteristics

+++Note: We set this one as a 'Diagonal Ratio Put Spread'

> Diagonal: Because the options have different expiration dates (Sept 19 + Sept 30)

> Ratio: Because we are buying more puts than selling (4:2 ratio)

> Put Spread: Because both legs are puts with the same strike

"We are all at a wonderful ball where the champagne sparkles in every glass and soft laughter falls upon the summer air. We know, by the rules, that at some moment, the Black Horseman will come shattering through the great terrace doors, wreaking vengeance and scattering the survivors. Those who leave early are saved, but the ball is so splendid no one wants to leave while there is still time, so that everyone keeps asking, ‘What time is it? What time is it?’ But none of the clocks have any hands." ~George Goodman

[$SPY] S&P500: The Big mini Short or Why hedging is not a crimeAMEX:SPY

No financial advice.

For Entertainment purpose only.

Have you ever considered to protect yourself and wake up from the 'Long-Only-Delirium'?

Now is the time.. do you hear the cracking in the bond-market?

Rate cutting will solve it?

No reason to panic?

Doomsday i*diot?

We will see... 😈 tic tac tic tac

This time THETA is against us, but GAMMA is bleeding.

"We are all at a wonderful ball where the champagne sparkles in every glass and soft laughter falls upon the summer air. We know, by the rules, that at some moment, the Black Horseman will come shattering through the great terrace doors, wreaking vengeance and scattering the survivors. Those who leave early are saved, but the ball is so splendid no one wants to leave while there is still time, so that everyone keeps asking, ‘What time is it? What time is it?’ But none of the clocks have any hands." ~George Goodman

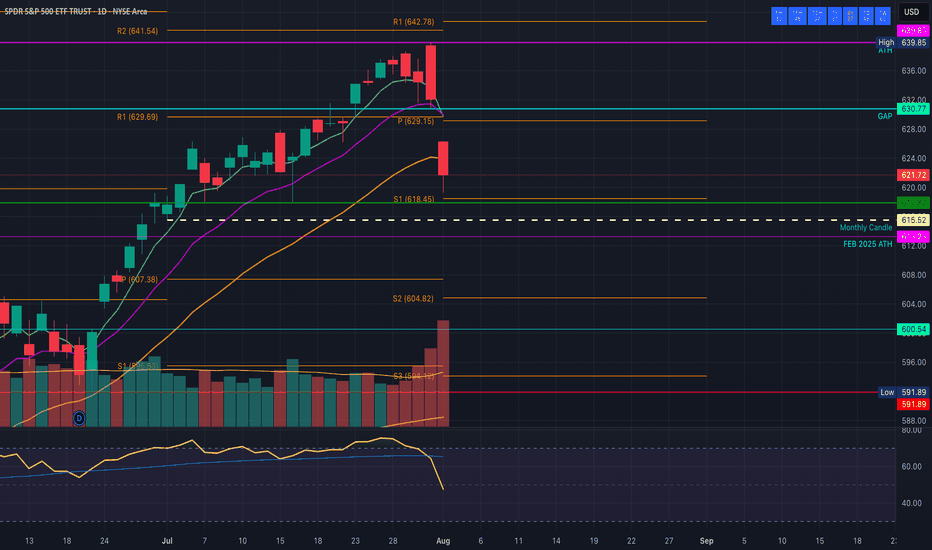

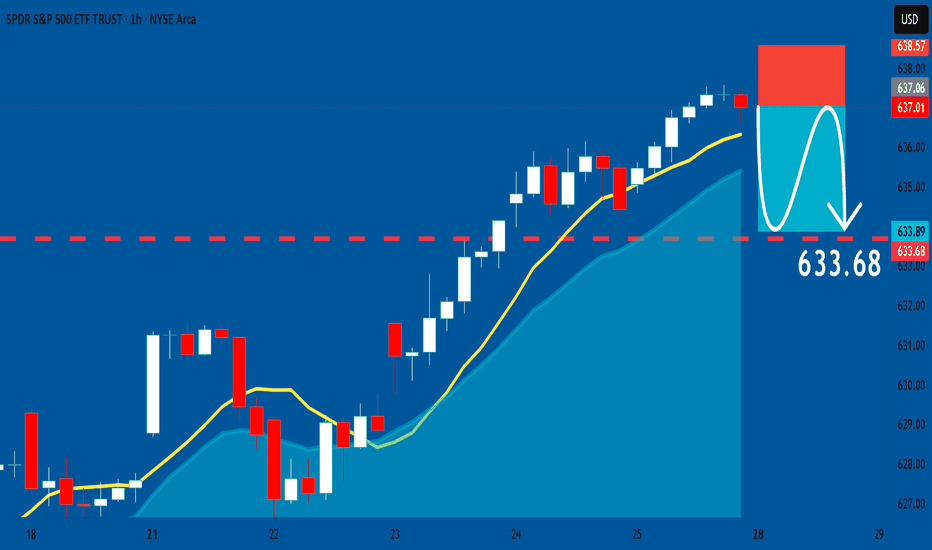

SPY: Bearish Continuation & Short Signal

SPY

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short SPY

Entry Point - 637.01

Stop Loss - 638.57

Take Profit - 633.58

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

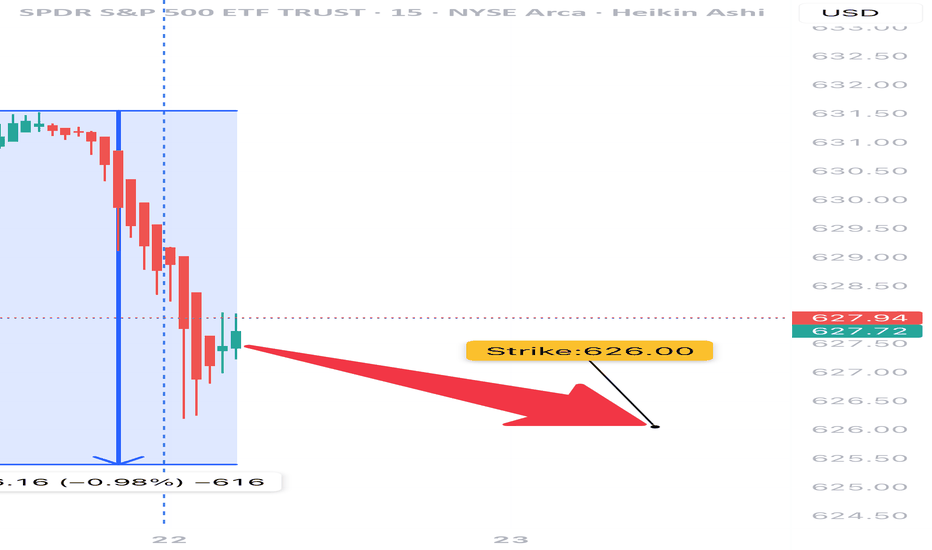

SPY Options Analysis Summary (2025-07-22)

🔻 AMEX:SPY Weak Bearish Put Setup (0DTE) – 07/22/25

All models agree: price is weak, momentum is limp, and VWAP is above.

But conviction? Not unanimous. High-risk, high-reward 0DTE scalpers only.

⸻

📉 Trade Setup

• 🟥 Direction: PUT

• 🎯 Strike: $626.00

• 💵 Entry: $0.57

• 💰 Target: $1.70 (+200%)

• 🛑 Stop: $0.28 (–50%)

• 📅 Expiry: Today (0DTE)

• ⚖️ Confidence: 65%

• ⏰ Entry Timing: Market Open

⸻

🧠 Multi-AI Consensus

Model Bias Action

Grok/xAI Weak Bearish ⚠️ No Trade

Claude Weak Bearish ⚠️ No Trade

Gemini Bearish ✅ $627 Put

Llama Moderately Bearish ⚠️ Conservative Put

DeepSeek Bearish ✅ $626 Put

🔹 VWAP < Price = Bearish bias

🔹 RSI = Neutral → watch for fakeouts

🔹 VIX favorable (<22)

🔹 Volume = weak = risk of whipsaw

⸻

⚠️ Risk Notes

• Bounce risk off session lows is real

• Lack of momentum may cause theta burn

• Best for scalpers who react fast — not a swing trade

• No conviction = smaller size, tighter leash

⸻

📢 Tagline (for virality):

“ AMEX:SPY is limping, not bleeding. But if it breaks, 200% comes fast. 0DTE scalpers: this is your window.” 💣

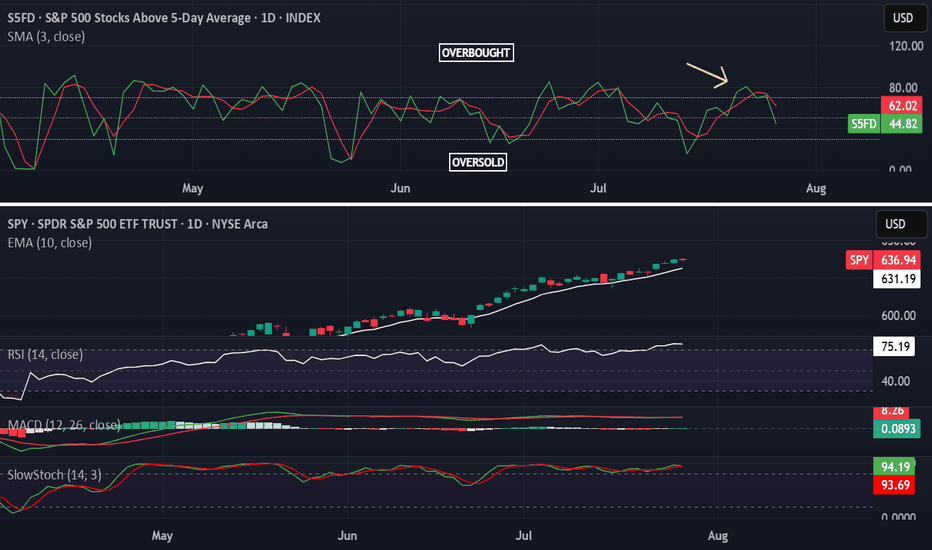

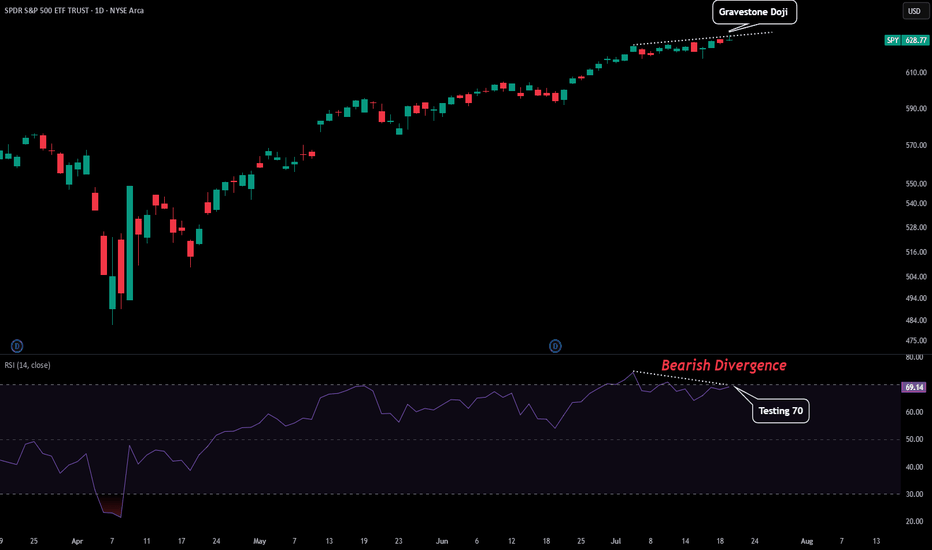

SPY - First Signs of TroubleFrom this entire uptrend we might be seeing the first signs of trouble.

Here are some reasons for this from a technical perspective:

-Daily Printed a Gravestone Doji

-RSI Testing Overbought as Resistance

-Slight Bearish Divergence on Daily RSI

-Momentum Stalling

There could also be some catalyst tomorrow that contribute to this. Powell speaks tomorrow so depending on what he says could either add fuel to a market reversal or negate these bearish signals and send us on another leg. Prepare for volatility.

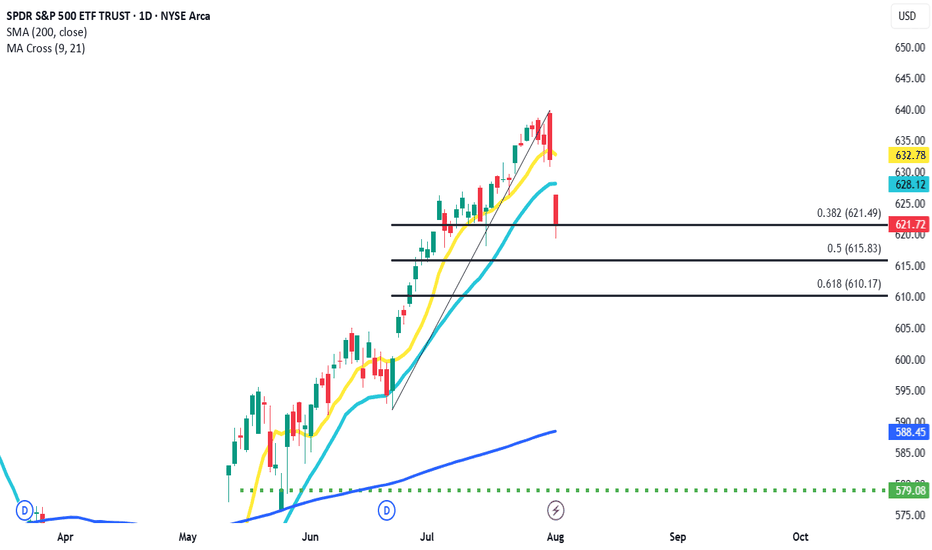

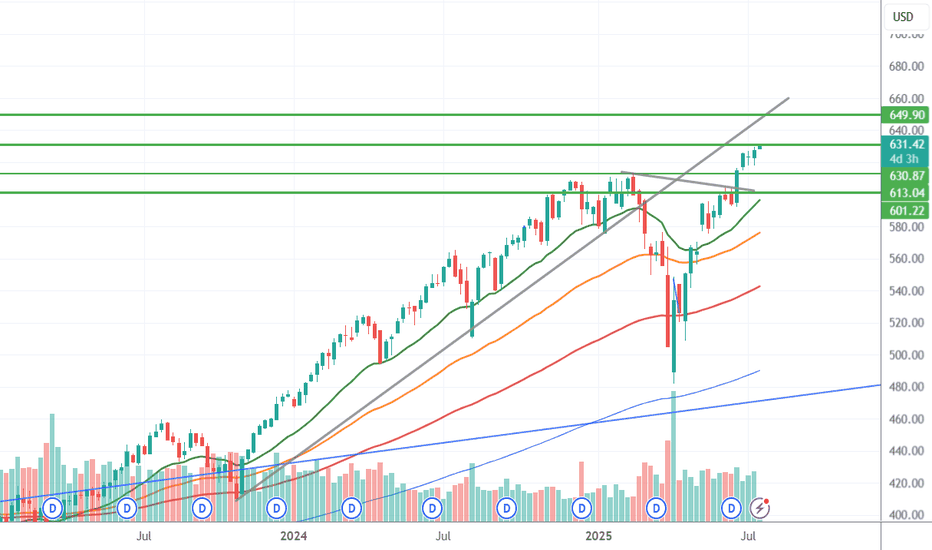

SPY: Climbing the Wall of Worry — But Is a Turn Coming?SPY: Climbing the Wall of Worry — But Is a Turn Coming?

The S&P 500 (SPY) is pushing into a critical zone as we approach July 28th, and I can’t ignore the confluence of signals piling up here.

Technical Setup

We’re testing the top of a rising wedge formation.

Key round number overhead at $640 — a psychological and options magnet.

Price is extended well above moving averages with declining volume, often a warning sign for bulls.

Multiple resistance lines converge in this zone, creating a high-pressure point.

📆 Timing Matters

July 28 = weekly options expiry — with massive open interest clustered around $630–$640.

Seasonally, late July often marks a peak before August chop.

Add in some “tin foil hat” vibes: SPY’s riding momentum while major indices are diverging (looking at you, IWM), and the macro narrative feels shaky at best.

What Would Confirm a Reversal?

Breakdown below $625 with a high-volume red candle.

Bearish engulfing or shooting star candle near resistance.

VIX divergence or big money flowing into puts mid-week.

Key Levels

Resistance: $640 / $649.90

Support: $630 / $622 / $595

Reversal target (if confirmed): $594–$575 area

Final Thoughts

As we all know, markets can stay irrational longer than you can stay solvent. However, when trendlines, round numbers, timing, and seasonality align, I start watching for cracks. This may not be the top — but it might be the spark.

Following closely. Alerts set. Ready for the flush if it comes.

Weekly $SPY / $SPX Scenarios for July 21–25, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for July 21–25, 2025 🔮

🌍 Market-Moving News 🌍

🏦 Fed Chair Powell Speaks — Markets Key Into Tone

Federal Reserve Chair Jay Powell’s Jackson Hole speech is the week’s centerpiece. Markets will be closely listening for clues on inflation strategy, rate-cut timing, and sensitivity to geopolitical inflation drivers like tariffs.

📦 Tariff Deadlines Gain Spotlight

Multiple tariff deadlines are set this week for targeted trade partners including the EU, Mexico, Canada, Japan, South Korea, and Thailand. Any new announcements or extensions could trigger volatility in trade-exposed sectors.

🛢️ Oil Market Mixed Signals

Brent crude prices have stabilized near mid-$70s, but OPEC+ discussions regarding supply extensions and global growth concerns continue to inject uncertainty into energy-linked equities.

📈 Big Tech Earnings Kick Off

The “Magnificent Seven” tech giants begin reporting: Nvidia leads on Tuesday, followed by Microsoft, Amazon, Alphabet, and Meta later in the week. Expect significant sentiment swings based on forward commentary.

📊 Key Data Releases & Events 📊

📅 Monday, July 21

Quiet session ahead of a packed week of speeches and data.

📅 Tuesday, July 22

8:30 AM ET – Existing Home Sales (June):

Measures signed contracts on previously owned homes—a key housing indicator.

After Market Close – Nvidia Q2 Earnings:

Market will watch guidance and China commentary.

📅 Wednesday, July 23

8:30 AM ET – Leading Economic Indicators (June):

An early gauge of U.S. economic momentum.

📅 Thursday, July 24

8:30 AM ET – Initial & Continuing Jobless Claims:

Labor-market health indicator.

📅 Friday, July 25

8:30 AM ET – Durable Goods Orders (June):

Signals demand for long-lasting goods, often driven by business spending.

8:30 AM ET – New Home Sales (June):

Follows existing home data for housing sector insight.

4:00 PM ET – Fed Chair Powell Speech at Jackson Hole:

Expect commentary on inflation, growth, and rate-path clarity.

⚠️ Disclaimer:

This content is for educational and informational purposes only and should not be construed as financial advice. Consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #Fed #earnings #housing #durablegoods #JacksonHole #technicalanalysis

hihiThe convergence of artificial intelligence and decentralized finance presents a paradigm shift in global economic systems, where algorithmic governance, autonomous agents, and smart contracts could redefine trust, efficiency, and access. This fusion offers transformative potential but raises critical ethical, regulatory, and socio-technical challenges demanding interdisciplinary exploration and resilient systemic safeguards.

Ask ChatGPT

SPY: Market of Sellers

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to sell SPY.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

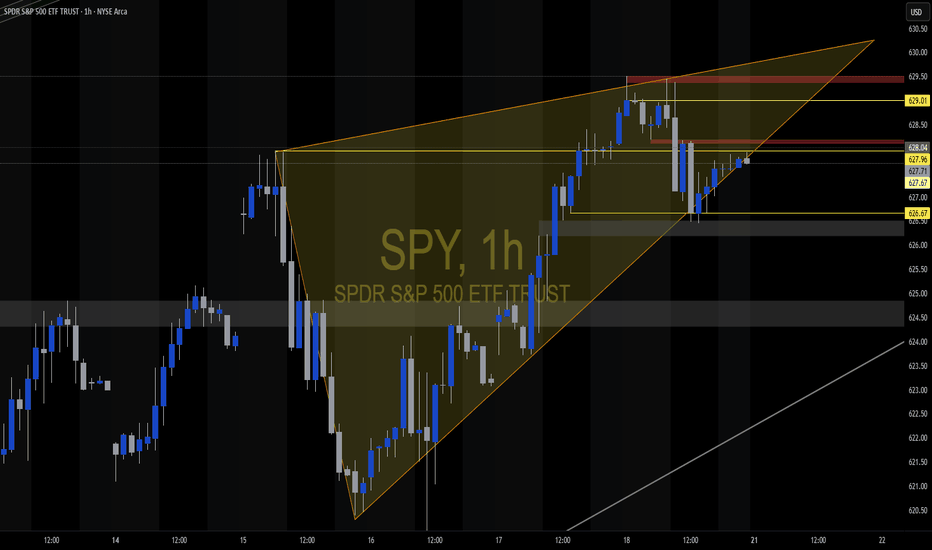

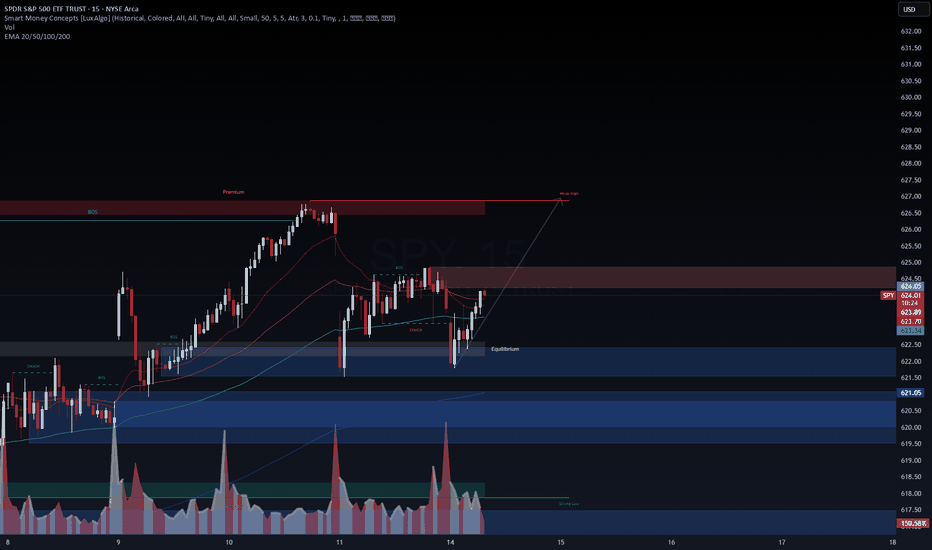

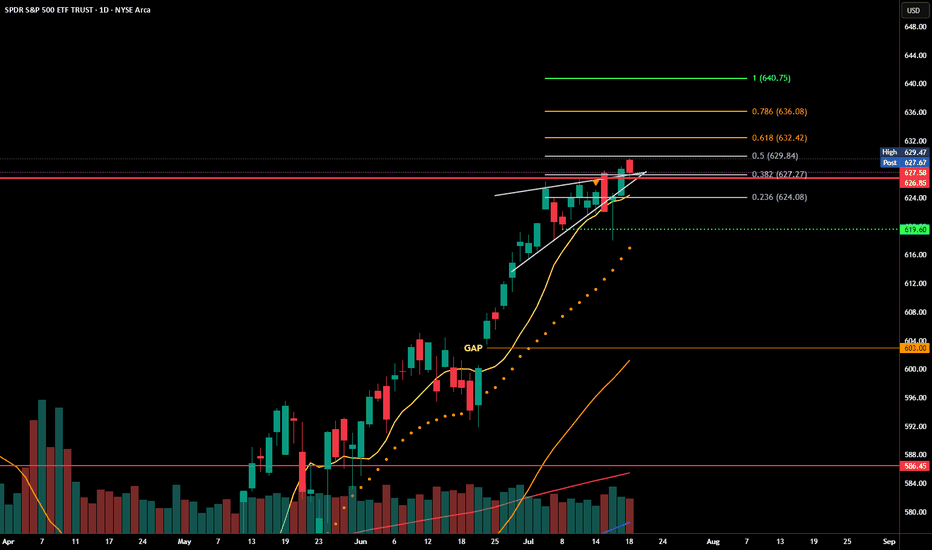

SPY Reclaims Rising Wedge Support - Bear Trap or Breakout Setup?SPY dropped below its rising wedge earlier this week, but that move may have been a bear trap. Price quickly reversed, reclaiming the wedge trendline and closing just below a key Fibonacci level at 629.84.

Buyers stepped in aggressively near the 0.382 and 0.236 retracement zones, defending short-term support. The bounce came on increased volume, signaling strength behind the recovery. Momentum remains intact as long as SPY holds above 626.

Now, bulls need to confirm with a breakout above 629.84–631.96 to open the door to the next levels at 635.63 and 640.30. Failure to break through could lead to another rejection and revisit lower support zones.

Levels to watch:

Support: 626.64, 623.62, 619.60

Resistance: 629.84, 631.96, 635.63

SPY is at a decision point. Reclaiming wedge support is a bullish signal, but bulls need follow-through to avoid another fakeout in the opposite direction.

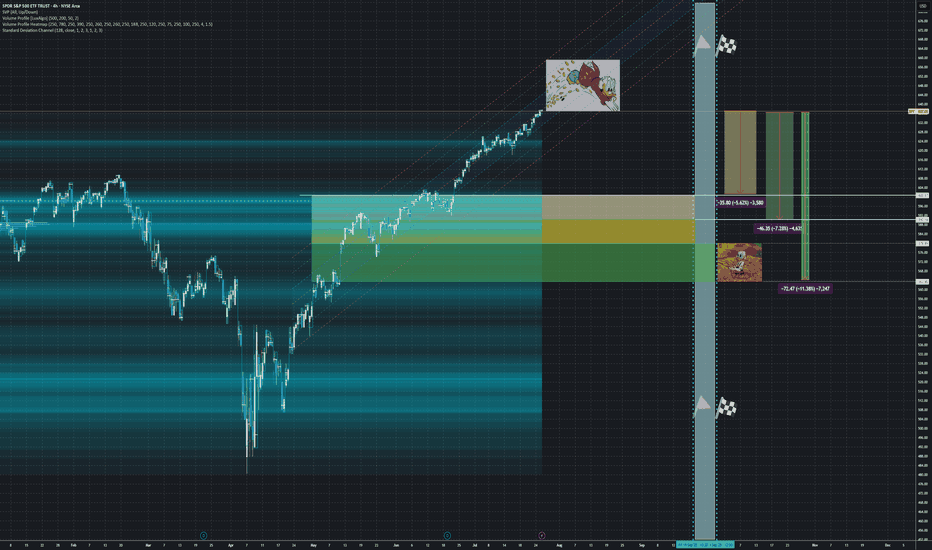

Earnings Heat Up - 6300 and 6200 SPX Key Levels RemainMarket Update

SPX Key Levels

-SPX poked 6300 Tuesday, Thursday, and poked higher Friday (but settled back to 6300)

-6200 support remains a key level

-6050/6000/5800 next floor levels, I'll be looking for dips

I can see the market slowly (and I mean SLOWLY) grinding higher but preparing for a

reasonable seasonal selloff through end of July into end of September window

July 28-August 1 is a monster week in the markets

-Megacap Earnings (MAG7 Tue/Wed/Thu)

-Wed July 30 - FOMC (Pause expected but Powell's Press Conference is important)

-Friday August 1 - Non-Farm Payroll, Tariff Deadline

I'm hitting fresh YTD highs so I'm not complaining about this melt-up and grind, I'm simply wanting to allocate positions and add to my positions at better levels and with a slightly

higher VIX to help take advantage of the expected move being greater than the actual move

Have a great weekend and thank you watching!!!