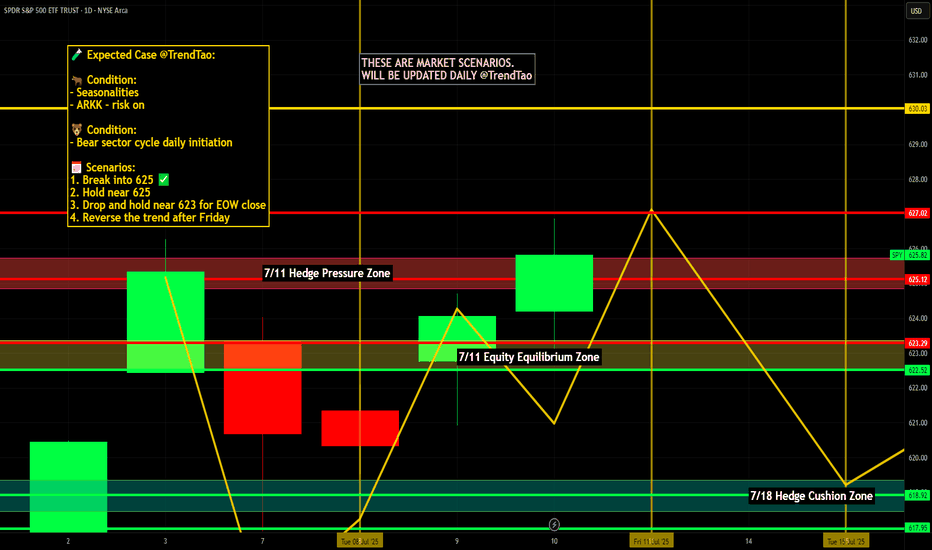

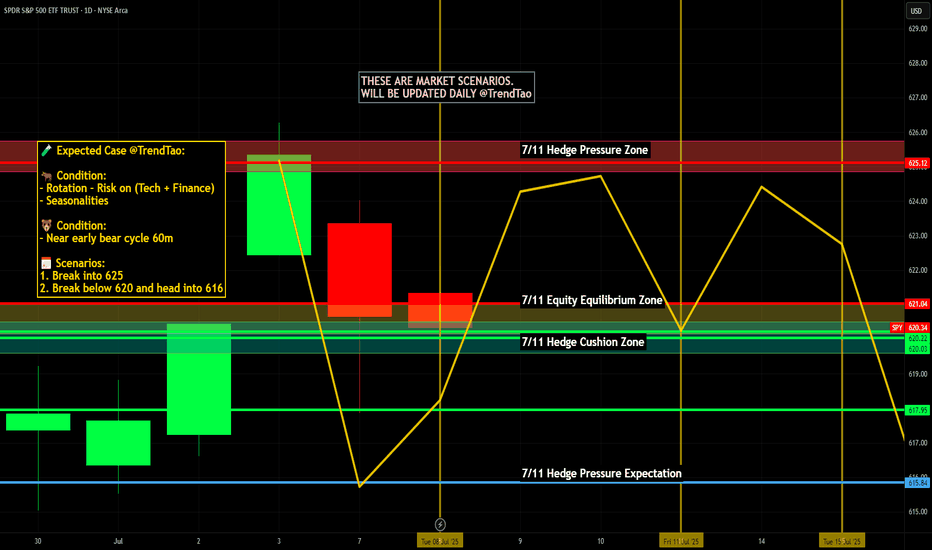

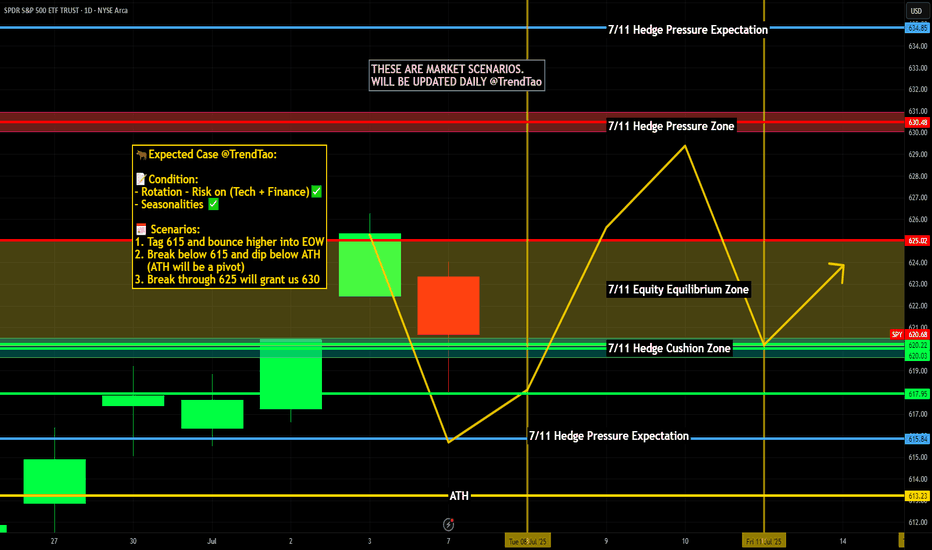

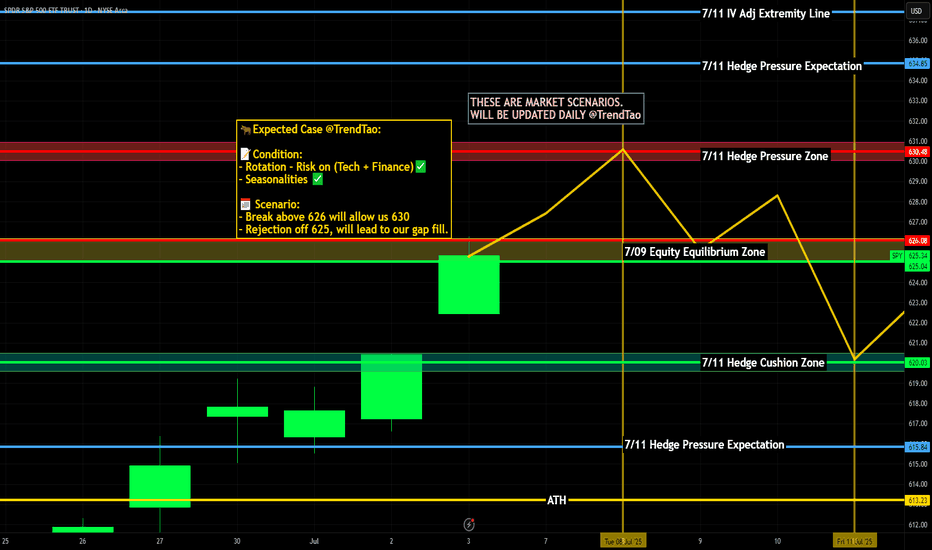

Nightly $SPY / $SPX Scenarios for July 11, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 11, 2025 🔮

🌍 Market-Moving News 🌍

🏦 Strong Bank Earnings Amid Tariff Churn

Next week’s Q2 forecasts point to robust earnings from U.S. banks—JPMorgan, Citi, Bank of America, Goldman Sachs, Morgan Stanley, and Wells Fargo—as trading and investment-banking revenue recover, offsetting uncertainties from ongoing tariffs

💬 Dimon Flags Fed Risk Pricing

JPMorgan’s Jamie Dimon cautioned that markets may be underestimating upside in interest rates. He sees a 40–50% probability of higher U.S. rates, driven by inflation from tariffs, migration, and fiscal deficits

⚖️ Tariff “Scattergun” Sparks Sector Disconnect

Trump’s plans to levy up to 200% tariffs on pharma and 50% on copper triggered uneven market reactions—copper prices rose 30% in six months, while European drugmakers remain flat, highlighting divergent sector sensitivities

📉 Tech & Macro Still Bullish

Despite policy turbulence, Nvidia climbed back above a $4 trillion valuation, and JPMorgan projects a $500 billion inflow into equities in H2—supporting gains even as broader macro pressures linger

📊 Key Data & Events

📅 Friday, July 11:

(No major U.S. economic data scheduled)

Markets will focus on bank earnings previews, tariff headlines, and the hold of the tech rally into a thin summer trading week.

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #tariffs #banks #tech #Fed #investing

SPY trade ideas

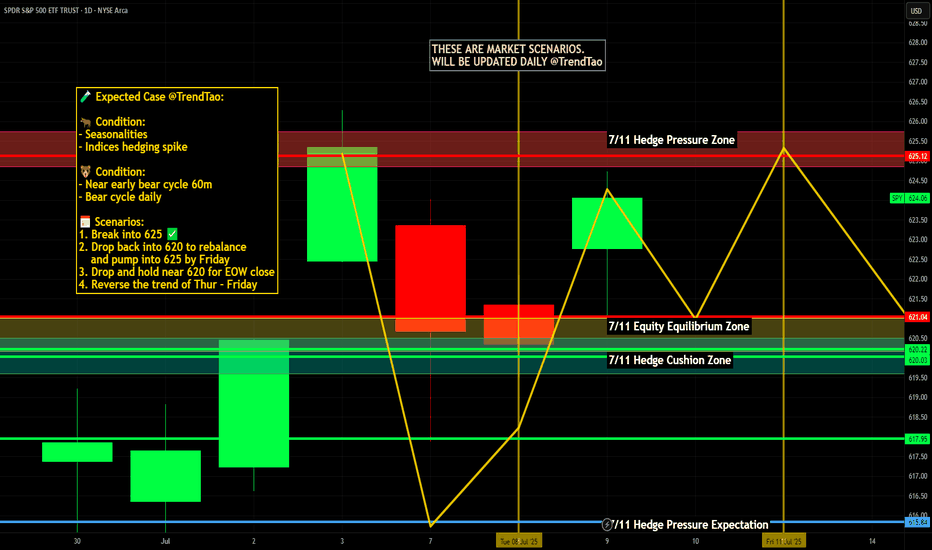

SPY Approaches Gamma Wall-TA for July 10SPY Approaches Gamma Wall: Key Zones to Watch for Tomorrow’s Trade 🔥

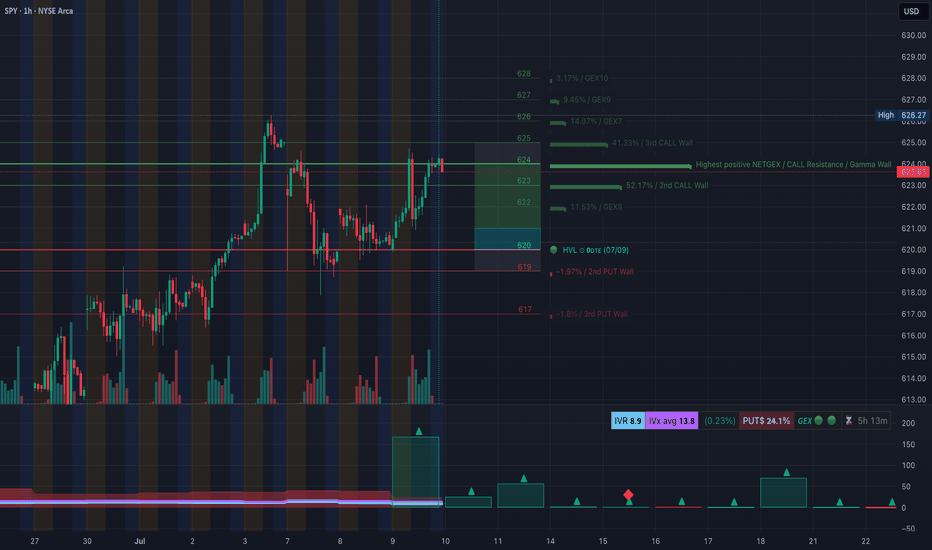

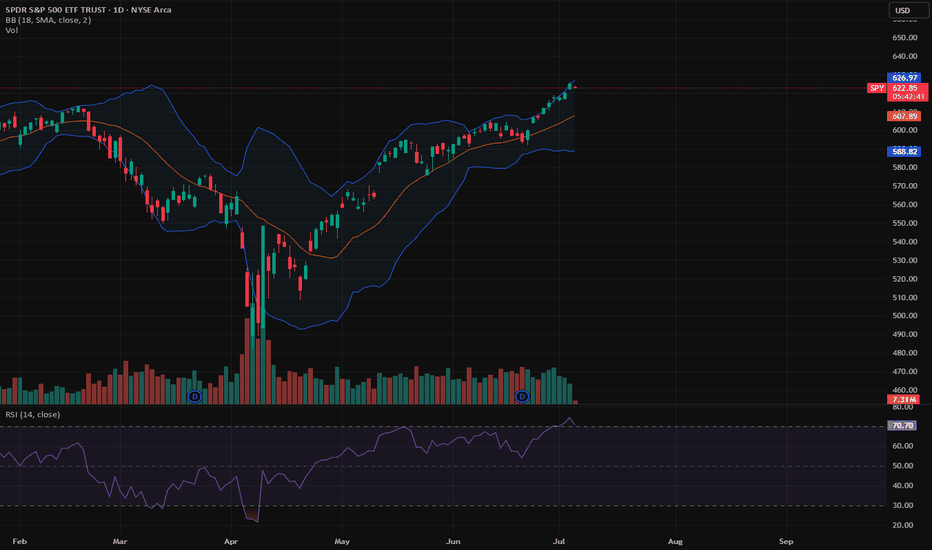

GEX Options Sentiment Analysis:

SPY is currently hovering just below the major GEX resistance zone around 624–626, where the highest positive GEX and gamma wall overlap with strong call walls (52.17% and 41.33%). This region has historically capped upside momentum, so traders should prepare for potential rejection or breakout scenarios.

Downside has modest protection around 620 (HVL level), with negative GEX zones building near 619–617, marking a weak PUT wall. The lack of deep PUT dominance signals limited downside hedging pressure.

* IVR: 8.9 (low), IVx avg: 13.8

* Options Flow Sentiment: 24.1% PUTs

* GEX Bias: Mildly bullish unless 623 fails

Options Strategy Suggestions:

* If price breaks and holds above 626.5, consider buying CALL spreads (e.g., 626c/630c) targeting a gamma squeeze into 628+.

* If 623 breaks, look for short-dated PUT spreads (e.g., 623p/620p) targeting a fade back into 620 or even 617.

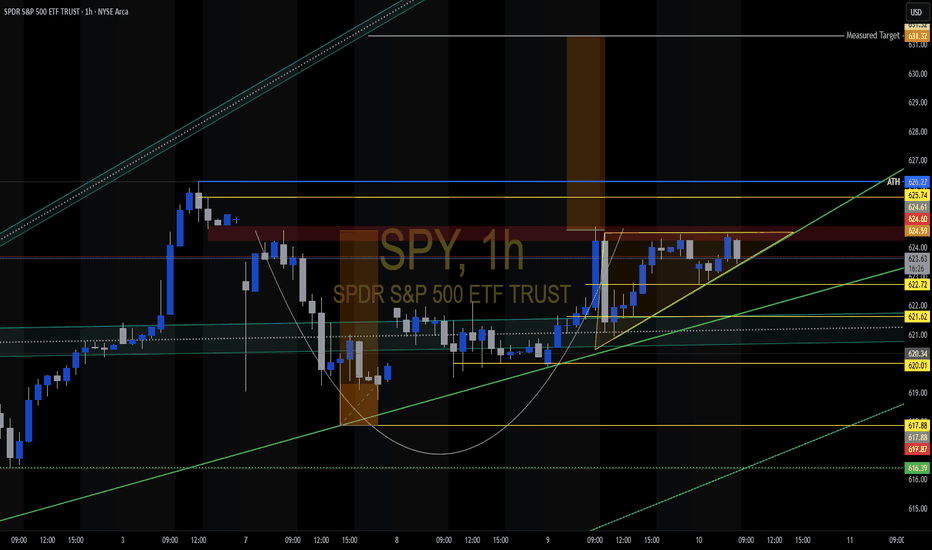

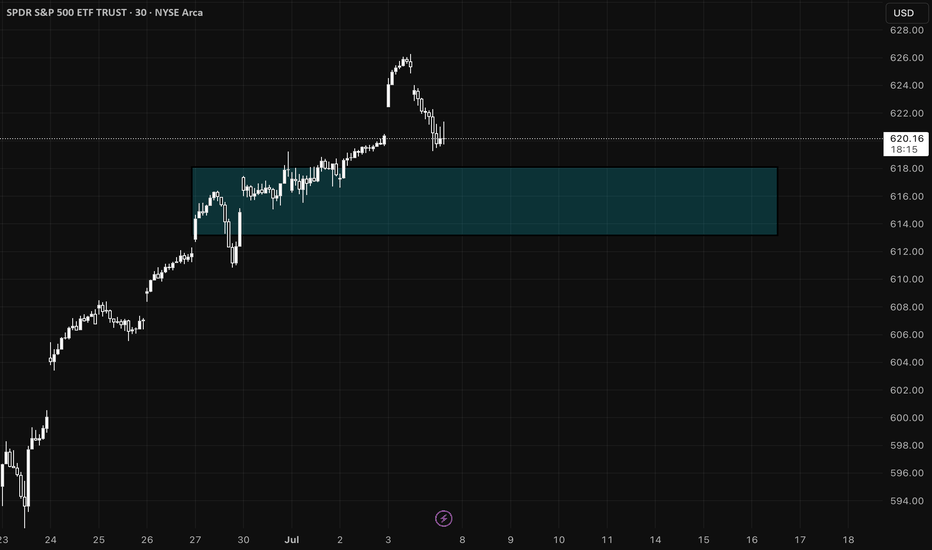

1-Hour Chart Price Action Analysis:

SPY has reclaimed a bullish posture after the CHoCH (Change of Character) on July 8 and is pushing into a supply zone just beneath the prior swing high. The price structure now forms a clean ascending channel, supported by higher lows and rising demand.

* Support Zones: 622.00, 620.34

* Resistance Levels: 624.72, 626.27

* BOS (Break of Structure): Confirmed earlier, adding bullish confluence

Watch for a breakout above the current supply zone to continue momentum toward 628+. However, failure to break and a rejection near 625 could lead to a retest of 620–622 as the next demand zone.

Trading Outlook for Thursday:

* Bullish Case: Break and close above 626 opens the door to a squeeze into 628+. Use pullbacks to 623–624.2 as entry zones.

* Bearish Case: Rejection at current levels with a breakdown below 622.5 could pull SPY into the 620.3 and possibly 617.9 levels.

* Scalp Setup: Long above 625 with tight stop below 623. Short below 622.5 targeting 620, risk above 624.

This analysis is for educational purposes only and does not constitute financial advice. Always manage risk and follow your own plan.

Nightly $SPY / $SPX Scenarios for July 10, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 10, 2025 🔮

🌍 Market-Moving News 🌍

🏦 Global Banks Profit from Tariff Volatility

Major banks like JPMorgan, BofA, and Citigroup are expected to see ~10% growth in trading revenue in Q2, fueled by volatility from President Trump’s tariff policy shifts. Treasury trading volumes hit record highs as markets priced in policy swings

📈 S&P 500 Nears Lull Amid Bull Market Strains

Despite record highs in 2025, investors are warning that the rally may be reaching its limit. Bullish sentiment is strong, but analysts caution that sluggish consumer spending, rising inflation from tariffs, and few rate-cut signals from the Fed could cap downside momentum

🐻 Bear Case Gains Ground

Stifel’s Barry Bannister projected a potential ~12% correction in the second half of 2025. Key risks include slowing consumer spending, weak capital investment under tariff uncertainty, and persistent core inflation above 3%, negatively impacting earnings and growth outlooks

⚖️ “One Big Beautiful Bill” Could Add Trillions in Debt

The new fiscal package signed July 4 will add $3–4 trillion to national debt over the next decade while extending tax cuts and revising EV incentives. Bond market and Fed policy implications may become more pronounced if growth fails to keep pace

📊 Stocks vs Bonds: Diverging Signals

While equities climb and megacaps extend gains, Treasury yields have risen five days straight—signaling growing caution over real growth prospects. The yield curve steepening hints at mixed signals: growth optimism in stocks, but bond market signaling economic risk ahead

📊 Key Data & Events

📅 Thursday, July 10:

No major scheduled economic releases. Markets remain driven by tariff headlines, bank earnings reactions, and evolving Fed signals.

⚠️ Disclaimer:

This is for informational and educational purposes only—not financial advice. Consult a licensed advisor before making investment decisions.

📌 #trading #marketvolatility #tariffs #banks #Fed #debt #technicalanalysis

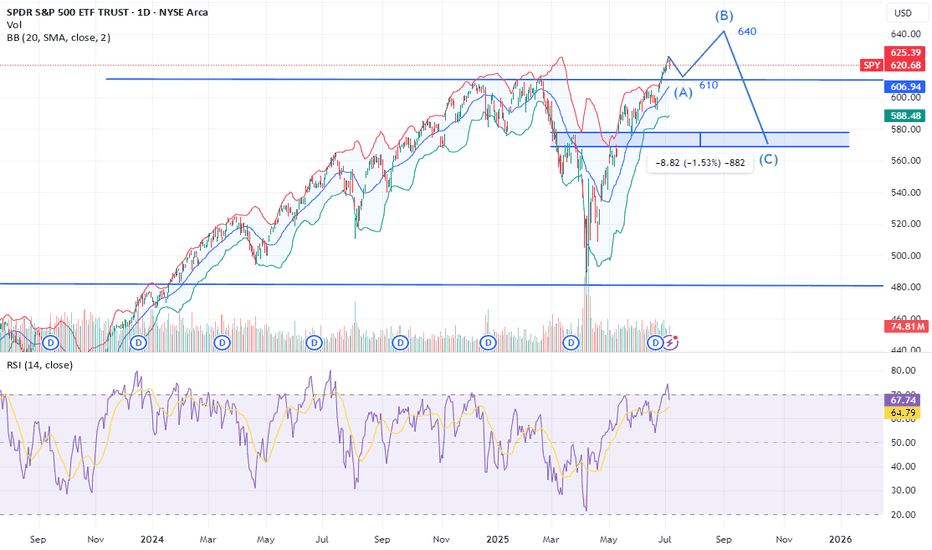

Multi Market Update 7-9-2025SPY likely put in a C wave this morning, I expect a further move down for the rest of the week. Gold starting to look bullish again. Natural Gas likely keeps dropping towards 2.5. BTC at the top of it's range. USOIL is at resistance. The stock I'm trading - aapl - is showing a bear flag on small time frames

SPY at a Key Inflection Point GEX and Price Action Setting Up the Next Move 🎯

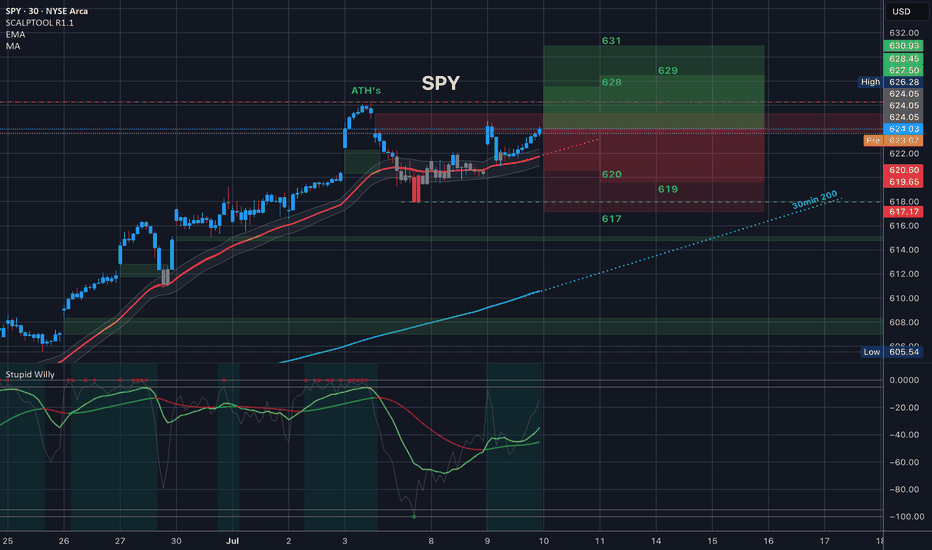

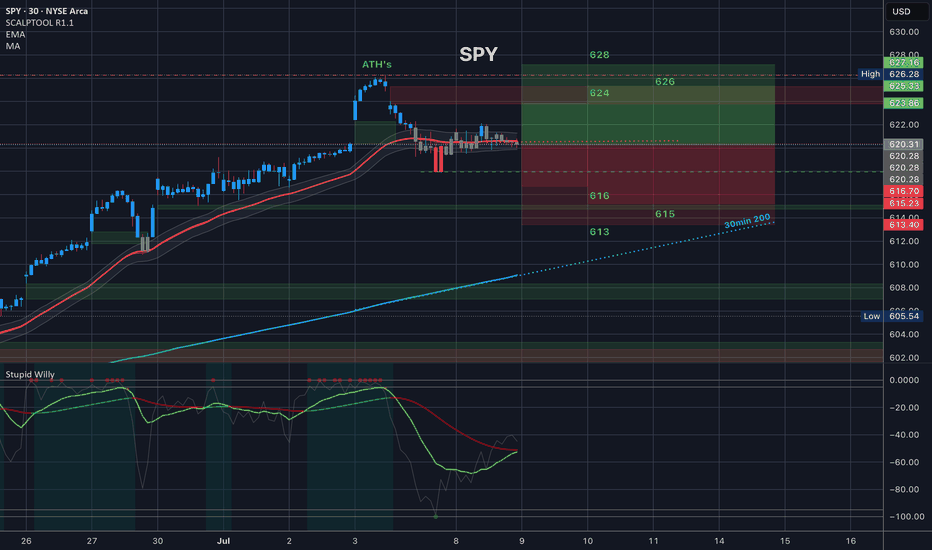

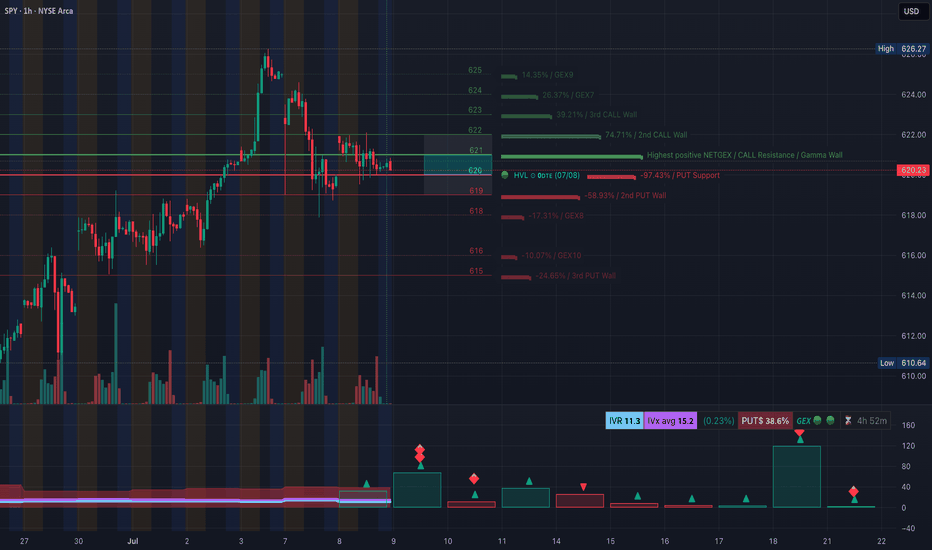

🧠 GEX-Based Options Analysis (For Option Traders)

SPY's current positioning in the options market reveals a heavy concentration of gamma and hedging pressure near 620. This level is acting as the Gamma Wall (Highest positive NETGEX / Call Resistance), which typically limits upside unless dealers are forced to unwind hedges.

* Call Walls sit densely at 622 and 624, with diminishing strength up to 626.25.

* Put Walls are stacked below at 618, 616, and most aggressively near 615.

* Notably, today's HVL expires at 620, adding pressure to keep price pinned around that level into the close.

* GEX readings are turning neutral to slightly bearish, with PUT flow dominating at 38.6% vs CALLS at 12.6%.

* IVR is still low at 11.3, which means option premiums are cheap — favoring debit strategies or directional plays if a breakout occurs.

Option Trade Ideas:

🟩 Bullish Setup (Break above 621.5)

Buy 622C or 624C (weekly or next Friday expiration).

Target: 626–628 (into light gamma zone), Stop below 620.

🟥 Bearish Setup (Break below 617.5)

Buy 618P or 615P, targeting 613–610.

Stop above 620. Time the move for IV expansion and gamma acceleration.

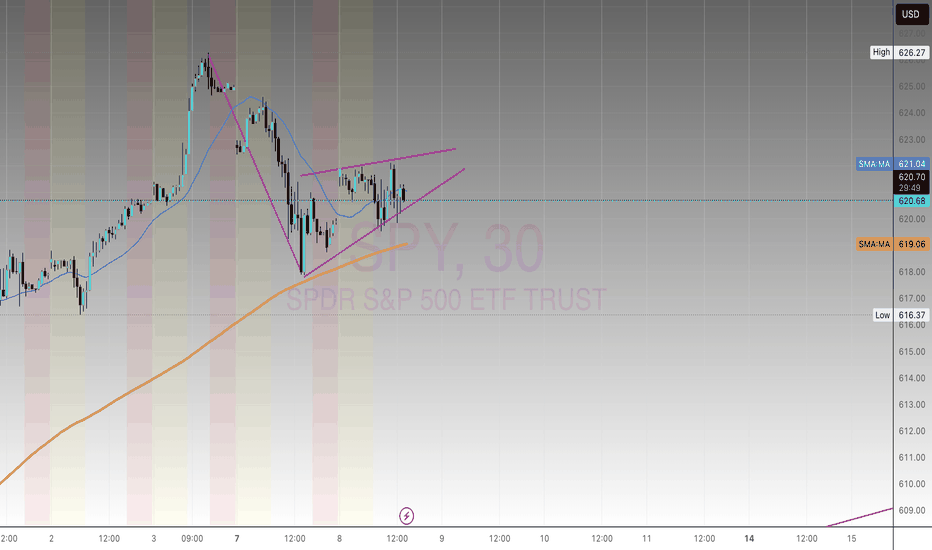

📈 Technical Analysis – 1-Hour Chart (For Intraday & Swing Traders)

The chart shows SPY compressing into a wedge pattern just above ascending trendline support from July 2nd. The price action is stuck between declining supply from the 626–628 rejection zone and strong demand at 617.88–615.

* Structure: Price has formed a CHoCH (Change of Character) at the top, followed by BOS confirming bearish pressure. However, price has been resilient above 617, building potential for a spring trap.

* Support: 617.88 → key zone. If lost, next support is near 613–610.

* Resistance: 622–624 remains the magnet for a breakout attempt if bulls take over.

* Volume: Declining, indicating a volatility expansion is likely soon.

Scenarios to Watch:

🔼 Bullish Breakout:

If price reclaims 621.50 and breaks above the recent wedge resistance, look for a squeeze toward 624 then 626. Use tight stops and look for volume confirmation.

🔽 Bearish Breakdown:

A clean break below 617.88 could unleash sellers toward 613. This aligns with GEX pressure and heavy PUT walls.

🧭 Final Thoughts

SPY is sitting on top of a coiled spring — both gamma and price structure are ready for release. This is not the time to guess; let price break from the wedge and follow the momentum. With IV still low and GEX polarity neutralizing, this is a perfect setup for directional options plays only after confirmation.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk responsibly.

Nightly $SPY / $SPX Scenarios for July 9, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 9, 2025 🔮

🌍 Market-Moving News 🌍

📦 Tariff Pause Extended to August 1

President Trump delayed the July 9 tariff deadline, pushing negotiations into early August. Markets reacted with muted volatility, suggesting growing comfort that deals will be struck—yet widespread uncertainty remains

💵 Junk Bonds Rally Amid Tariff Tangling

Despite ongoing tariff risks, investors are doubling down on U.S. high-yield (junk) bonds. They anticipate the Fed may refrain from tightening further—favoring spread-tightening to around 7–8% yields—reflecting confidence in credit quality

🏦 Fed Faces Tough Call on Rate Path

New business surveys show conflicting signals: mixed revenue outlooks, cautious spending, and ongoing tariff pressures. The Fed must weigh slower growth against inflationary risks—keeping the door open to rate cuts in the autumn but unlikely before September

📊 Equities Firm Amid Tariff Uncertainty

Stocks showed resilience—S&P 500 and futures held position—after Monday’s tariff-triggered dip. Dip-buying and expectations of extended trade talks kept markets steady despite policy noise

📊 Key Data Releases & Events 📊

📅 Wednesday, July 9:

All Day – Ongoing U.S.–tariff negotiations; markets focused on any progress toward formal deal-making or extension terms.

Midday – Watch for headlines on tariff letters to 14 countries and any movement in trade discussions.

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #tariffs #Fed #fixedincome #credit #technicalanalysis

SPY July 8th 2025SPY July 8th 2025

Day 2 of journaling my trades. Ended Monday green but not without mistakes. I am heading into Tuesday with more of a neutral outlook. Previous resistance will be tested as support and could find buyers or fail to do so. As I did yesterday, I will give a breakdown of what I’m seeing on all of my charts for both strategies.

+++++++++++++++++++++++++++

Bullish Analysis

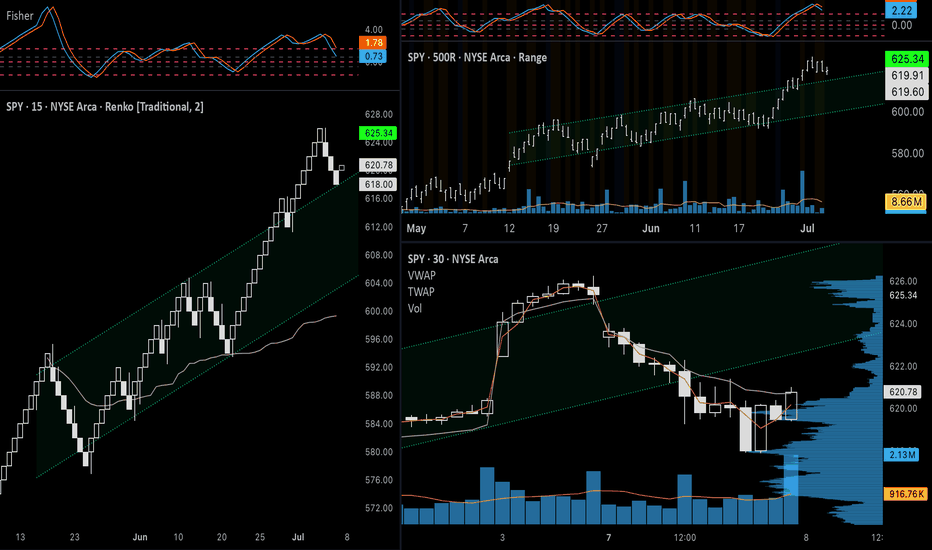

Renko: The price pulled back on Monday, as expected, and may continue lower to retest the top of the channel (around $615). Fisher Transform is still in positive territory and strong support at that level could lead to the price reaching higher highs.

500R ($5) chart: Similar structure to the Renko chart. I’m using a higher range here to compensate for volatility. Just like with the Renko chart, a bounce on the top of the channel would be a healthy pullback before higher highs. There is a high volume node on the volume profile, so interest from buyers here could be strong enough to prevent the price from falling back into the channel.

4h chart: The last three candles have the appearance of a healthy pullback. There was declining volume and

the most recent candle is somewhat of a bullish hammer. I also have an anchored VWAP going back to June 30 that the price seems to be respecting. The price bounced off of it in the first 4h candle on Monday and managed to close above it after a dip during the formation of the second candle.

+++++++++++++++++++++++++++

Bearish Analysis

Renko: Same chart with a lower box size ($1 instead of $2). As you can see, there is bearish divergence on Fisher Transform. The price also found likely temporary support before reaching the top of the channel, suggesting that it could make at least one more wave down if a larger corrective trend unfolds. The 1.382 ($614) and 1.618 ($612) Fibonacci extensions will be important reference points to watch. I would feel less confident about the strength of the bullish trend if the price goes beyond the 1.618 extension.

200R ($2) Range: The Range chart in this layout is the only one that I am including extended hours data on, so the channels have slightly different levels. On this chart I am using two trend lines on the upper level to illustrate the possible areas of support/previous resistance. If the price breaks back into the channel and below the 34VWMA, it could signal a trend failure and the price could return to $600 or lower. Volume bars on range charts also offer a different perspective than on time-based candlesticks. Here, since each bar represents a $2 move up or down, the volume inside of each bar can show the level of effort it took to move the price either direction, whereas the time-based charts are simply showing the level of interest during a particular time period. For this reason, consistently high volume during this last move up could be a sign that there is a larger presence of sellers. Lastly, there is Fisher Transform divergence here as well.

1h chart: CME_MINI:ES1! is green overnight, signaling continuation of the bounce we saw at the end of the day on Monday. With a tighter channel, the top was rejected in a classic bearish reversal candle pattern above the channel and made a clean break down below the channel. The price found support just above the anchored VWAP from the start of the channel, so there could still be institutional interest around $617 and below. If this correction were to unfold into three distinct waves, a 0.618 pullback (to the 0.382 level of the fib extension; $623) would retest the previous demand of the channel. A rejection here could have the price looking for support in a lower volume zone. A (c) wave could take the price down to $615-$611.

+++++++++++++++++++++++++++

Options Analysis

As I have explained, I think it is possible that we will see the price hit $623 during the Tuesday session, so it could be an important level for ATM options. TVC:VIX held its level on Monday after the gap up but failed to make progress - finding resistance at the 200MA on the 1h chart. The rounding bottom and bullish candles on the 30m AMEX:SPY chart looks better than other timeframes. From a Wyckoff Method perspective, however, it looks like puts are in a distribution pattern and calls are in accumulation. Volume is low for both of these contracts, but especially lower on the Put option, indicating lack of interest.

If the put contract makes a lower low on Tuesday (below $3.55 or above $620.75 for SPY), this particular contract could break into a downtrend. Calls seem to be the safer bet since the price has already made a higher high and has wider support. An ideal entry would be a false breakout at $0.95 ($621.00 for SPY) or a retest of the top of the channel after a true upside breakout at $1.50 ($622.50 for SPY) The upside breakout possibility would have stronger confirmation, so it would be worth the higher premium price. This movement would need to be accompanied by high volume, of course.

For puts, I would like to see higher volume at the bottom of the range, since it seems like the underlying price will open higher. I would probably switch to a contract with a lower strike since $623 would be ITM but for the sake of this idea, I would target entry of $623p around $3.65 ($620.75 for SPY).

+++++++++++++++++++++++++++

Targets

Calls: Enter $622.50, Target $628-$630, Stop Loss $621

Puts: Enter: $620.75, Target $615, Stop Loss $621.50

To summarize, I like the risk/reward and volume better for calls, and it fits my original thesis, however if volume increases on puts at these elevated levels, it will be important to get in at a price that minimizes risk exposure to take advantage of a deeper correction.

SPY July 7th 2025SPY July 7th 2025

Day 1 of journaling my day trades on SPY. I am going to start journaling my ideas every night if possible in order to fine tune my setup and to analyze my wins and losses. I will be using Renko (Traditional, 2 box size, 1m) as my main chart, Range Bars (50R, 100R, 200R, or 500R), and candle sticks (various timeframes) to identify supply/demand, price ranges, and trends - placing a high emphasis on volume as it applies to the Wyckoff Method. I will also occasionally refer to real time options charts and VIX, however I will primarily use those for my entries during the day.

Each day I will provide setups for a bullish and bearish bias, which should help minimize instances where the price moves against me - with slow reactions leading to holding losing trades and hesitating to enter a trade on the side of the new trend. I’ll try to come up with a consistent format as time goes on. For today, I will go down the list of my indicators and provide notes that fit the bias of each trading strategy.

+++++++++++++++++++++++++++

Bullish Analysis

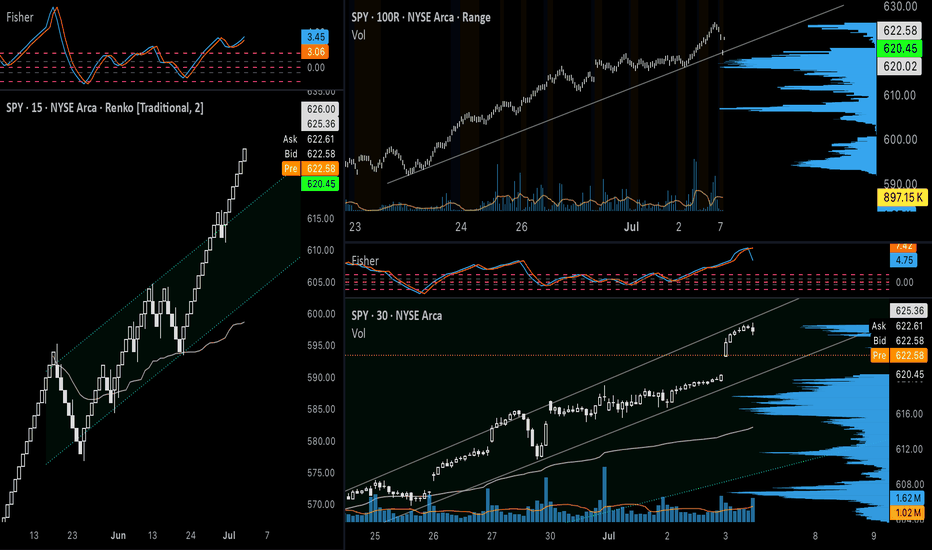

Renko: Strong breakout from ascending channel on June 30. Fisher Transform is signaling continuation. A retest of the top of the channel would take the price back to ~$618.

100R ($1) Chart: Price is in an uptrend being supported by high volume. 34VWMA (purple) is above 200MA (green). The bounce on July 2nd (around $616) was supported by a high volume node, indicating genuine interest pushing the price higher.

30m Chart: Price closed on July 3rd at the top of an ascending channel inside of a larger ascending channel. Since the larger ascending channel is one of strength, it can be assumed that the smaller one is a sign of strength as well. A break too far below the lower end of this smaller channel would be a sign of weakness, which does not seem to fit the current market structure after last week’s breakouts, but it is still possible that the trend fails. Fisher transform is forming a “hook” pattern that can signal continuation.

+++++++++++++++++++++++++++

Bearish Analysis

On a smaller scale, the price appears due for a pullback, which can fit both the bullish and bearish trading ideas depending on where the market opens.

Renko: The price closed at the top of an ascending channel on July 2nd and will find more buyers upon a test of the lower band and the anchored VWAP.

50R (50¢) Chart: If the price pulls back to the bottom of the channel (around $620) this would coincide with a retracement of 0.618 - which is a key fib level. A break below the 1.00 extension ($616) could signal a break of the uptrend - a $9+ drop if an entry can be found near the top of the channel, not too bad.

5m Chart: The price left a gap down to $620 on July 3rd. Filling this gap could provide important liquidity to propel the price higher. Additionally, The high volume at the start and end of Thursday’s flat trading day (with low volume in between) could be a sign of accumulation or lack of sellers.

1DTE ATM Put, 2m: If a more prolonged (and profitable) downward move is expected from smart money, we should see volume increase for ATM puts during the session. Depending on where things open, we could see a potential spring/false bearish breakout (below $2.20), or a true bullish breakout (above $2.80). Using an options calculator, $623.75 on AMEX:SPY would set up the Spring and a drop below $622.50 could confirm the put breakout.

+++++++++++++++++++++++++++

Targets

Calls: Enter $618-$620, Target $625-$628, Stop Loss $617.75

Puts: Enter $623-$625, Target $620, Stop Loss $626.25

To conclude, overnight action on CME_MINI:ES1! and the gap up on TVC:VIX shows that the price is already retracing. The top of the wedge for VIX would be just above $20 - a key level to watch for a reversal. Unless the upper part of the channel on SPY is tested and rejected again after the open, I will sit out and wait to hit the bullish targets. We are still in a strong uptrend after last week’s breakouts, so going short is the riskier bet anyway, as buyers could step in at any time.

Looking at ATM calls and puts side by side (bottom two charts), it is clear that calls were not heading into today with a good setup. It would be worth taking a chance on puts if a Spring forms (below $2.20), which, again, would correlate with AMEX:SPY hitting $623.75 during the session - and not much higher.

My main idea for the start of this week is to look for a good pullback for calls, so I will be patient and will try not to force anything. If smart money has a bullish sentiment, there will still need to be a short accumulation phase for calls so I will watch to see what the chart is doing for ATM calls around $620.

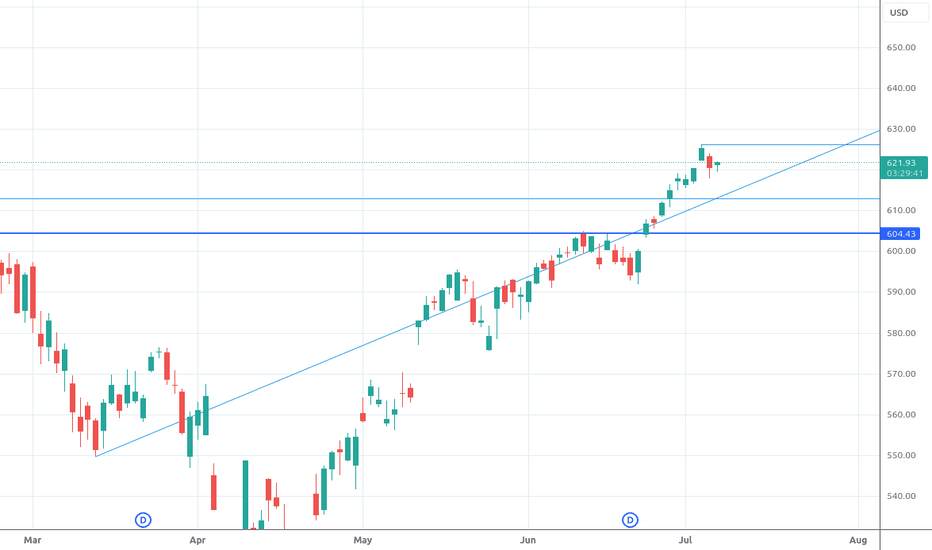

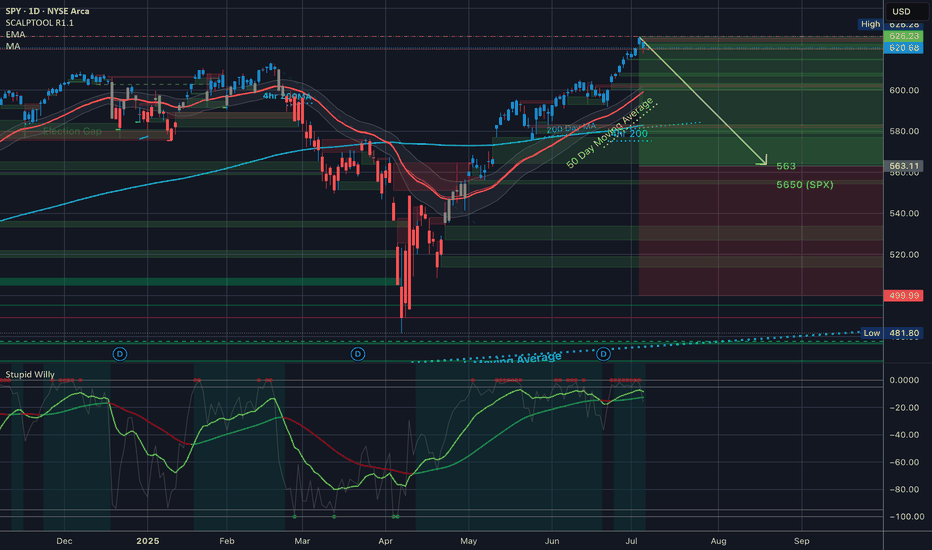

SPY: How are ya?Long time no talk.

Just an update to appease some people requesting updates haha.

Mostly going over the larger term outlook for SPY, the quarterly and some discussions on the weekly.

As always, not advice and remember to follow your strategies and risk management approaches!

Safe trades everyone!

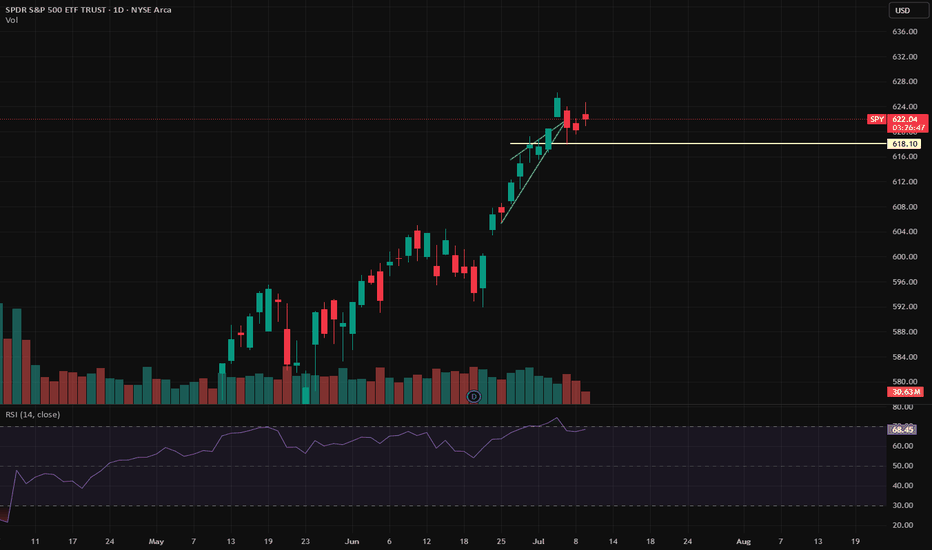

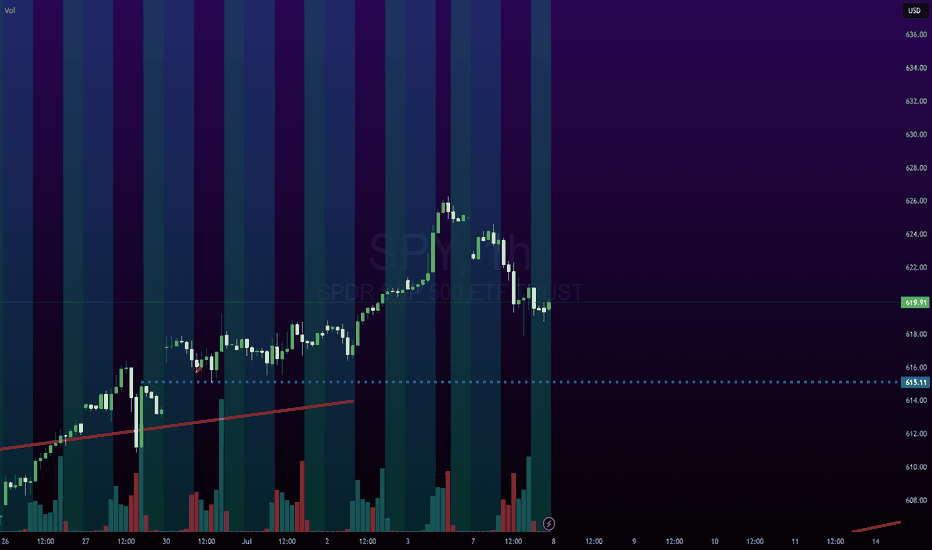

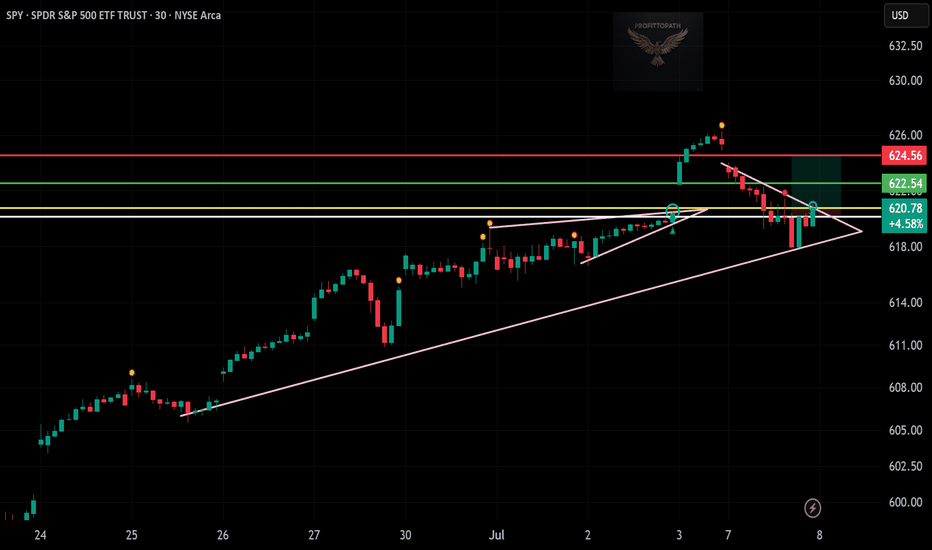

SPY Breakout Setup – Bullish Pattern Watch! 📈 🟢

SPY has formed a clear ascending triangle with strong support at $616. After a pullback, it’s now breaking out above $620.78 with a bounce from trendline support and rejection of lower prices.

📌 Trade Details:

🔹 Entry: $620.78

🔹 Stop Loss: $616.00

🔹 Target: $624.56

🔹 Pattern: Ascending Triangle Breakout

This setup aligns with market momentum and breakout structure. Great risk-reward for bulls watching major index movement.

—

📊 Posted by: ProfittoPath

#SPY #SP500 #ETFTrading #BreakoutSetup #MarketUpdate #ProfittoPath #TechnicalAnalysis #StockTrader #ChartAnalysis

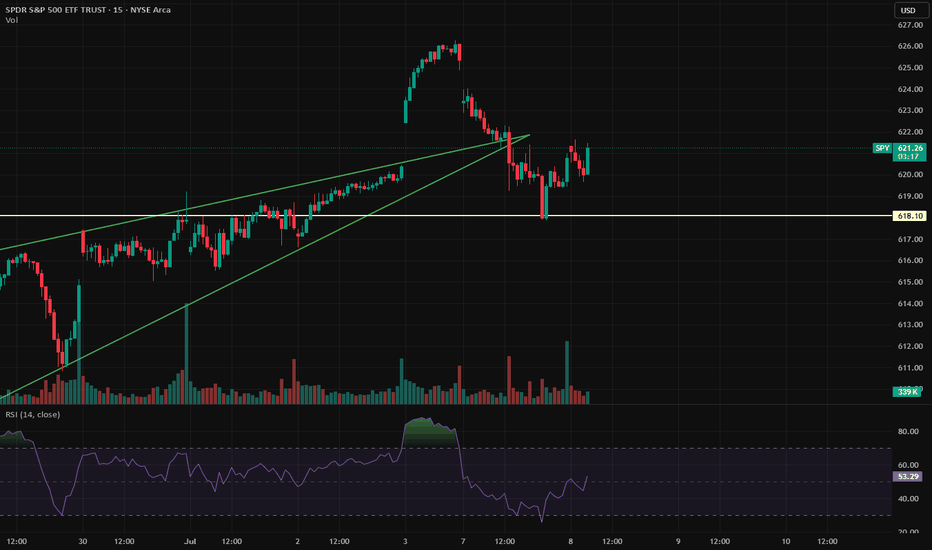

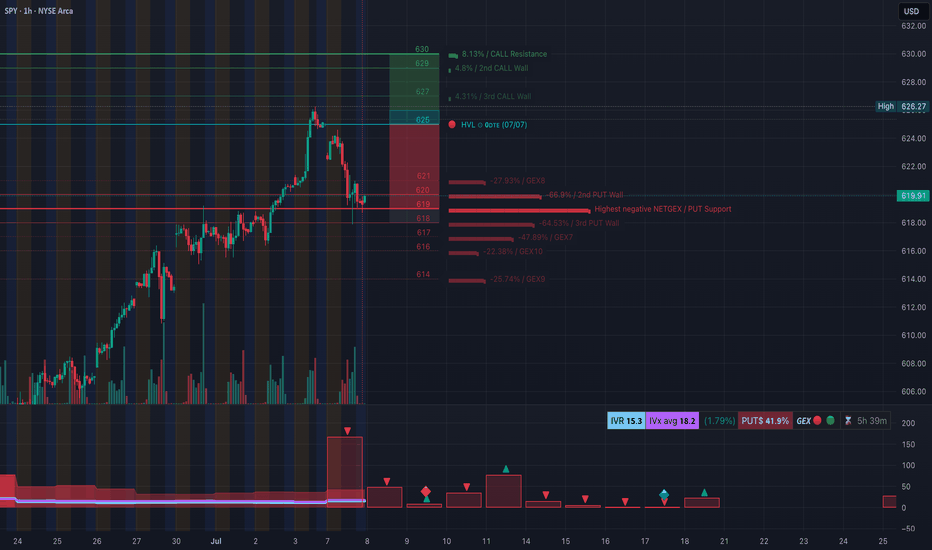

SPY Gamma Squeeze Fading – Key Put Wall Battles Ahead 🧨 GEX Options Sentiment (TanukiTrade GEX Chart)

* Current Price: 619.91

* Major Support Wall:

* GEX Cluster Support: 618 → 617 (Highest Negative Net GEX + 3rd PUT Wall)

* Additional GEX Floor: 616.37 (PUT support overlap with SMC zone)

* Resistance Levels:

* 625.34 → First CALL Wall

* 627 → 2nd CALL Wall

* 630 → Top of CALL Gamma Resistance

* Put Wall Dominance:

* GEX7–GEX10 blocks show heavy negative pressure (-47% to -66%) centered between 617–620

* Options Flow Insight:

* PUTS OI: 41.9% – Signaling downside hedges are still dominant

* IVR: 15.3 (low), IVX avg: 18.2 – Implied volatility suggests premium selling could get tricky unless directional trend returns

🔸 Interpretation:

This is a “put-heavy zone” — large GEX support clusters below price (617–618) are temporarily halting further drop, but unless SPY can reclaim 625.34, there's still gamma-driven downside risk.

🟢 1-Hour SMC Price Action

* Recent Structure:

* BOS confirmed → 626.27

* CHoCH to downside below 620 → confirmed rejection

* Current Setup:

* Price is hovering at minor demand between 617–620

* If 616.37 breaks, it opens room toward SMC demand zone at 604–606

* Strong resistance overhead at 625–627 (OB + GEX call wall + CHoCH retest)

🔸 Scenario 1 – Bullish Reclaim:

* Entry: Above 621

* Target: 625.34 → 627

* Stop: Below 616.00

* Setup: Break/retest of CHoCH + reclaim trendline

🔸 Scenario 2 – Bearish Breakdown:

* Entry: Below 616.37

* Target: 606 → 600

* Stop: Above 620

* Setup: Breakdown from demand + confirmed CHoCH retest

📌 Thoughts & Recommendations:

* Scalpers: Watch 620.50–621.00 as intraday pivot.

* If reclaimed, we may see short squeeze into 625–627

* Below 616.37, put flows will likely accelerate

* Swing Traders: Bearish bias unless 625.34 flips → consider spreads or directional puts

* Neutral Edge: This is a gamma battle zone — don’t overcommit, let price pick a side

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trade based on your risk profile and always use a stop-loss.

Nightly $SPY / $SPX Scenarios for July 8, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 8, 2025 🔮

🌍 Market-Moving News 🌍

📉 U.S. Stocks Slip on New Tariff Threats

President Trump announced plans to impose 25% tariffs on imports from Japan, South Korea, Malaysia, Kazakhstan, South Africa, Laos, and Myanmar starting August 1, reigniting trade jitters. The Dow fell ~0.9%, the S&P 500 dropped ~0.8%, and the Nasdaq slid ~0.9% on the news, while bond futures rallied and the dollar strengthened

⚖️ Tariff Pause Deadline Looms

Markets are focused on the July 9 deadline for the current tariff pause, which now hinges on imminent trade negotiations. Investors are balancing the risk of reimposition against progress with agreements involving the U.K., Vietnam, and Canada

💵 Consumer Credit Moderates

June’s consumer credit increase slowed to $10.60 billion vs. April’s $17.87 billion—still strong, but a cooling sign in household borrowing patterns. This tempered the dollar’s rise amid mixed signals on consumer resilience.

🛢️ Oil Drops on Rising OPEC+ Supply

Oil prices fell, with Brent dipping to ~$68.00/barrel and WTI to ~$65.30, after confirmation of OPEC+’s August supply hike—adding to bearish cues for energy stocks .

📊 Key Data Releases & Events 📊

📅 Tuesday, July 8:

3:00 PM ET – Consumer Credit (June)

Moderation in borrowing signals possible easing in consumer-driven growth.

4:30 PM ET – API Weekly Crude Inventories

A key indicator for energy markets; lower inventories lift oil prices, while builds push them down.

Throughout the Day – Tariff Pause Deadline

Market stability hinges on whether trade agreements materialize before the break expires.

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #tariffs #consumercredit #oil #technicalanalysis

Weekly $SPY / $SPX Scenarios for July 7–11, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for July 7–11, 2025 🔮

🌍 Market‑Moving News 🌍

📈 From Panic to "Goldilocks" Rally

The S&P 500 and Nasdaq hit fresh record highs, surging ~20% from April lows. Markets rallied on a combination of easing Middle East tensions, the 90‑day tariff pause, a new fiscal bill in Washington, and strong June jobs data. Still, strategists caution that optimism may be ahead of fundamentals, especially if trade volatility returns

💱 Dollar Weakness & Bond Market Watch

The U.S. dollar remains near 3.5‑year lows amid rate‑cut speculation and trade progress. Treasury yields are volatile this week, impacted by concerns over escalating debt issuance, upcoming tariff deadlines (July 9), and the Federal Reserve’s stance .

🏢 Tech Leadership Shifts

With the “Magnificent Seven” tech stocks near heights, growth is spreading: cyclical sectors, small‑caps, and industrials are gaining momentum. AI remains the primary engine, but resilience across a broader stock base is signaling a potentially sustainable rally

⚠️ Tariff Truce Deadline Looms (July 9)

The April tariff pause expires mid‑week. U.S. plans to extend exemptions via trade talks with partners like UK, Vietnam, and Canada—yet any delay or failure may shock markets. Watch for headlines that may trigger spillover effects .

📊 Key Data Releases & Events 📊

📅 Monday, July 7:

Independence Day markets resume. Light trading expected ahead of data and tariff deadline.

📅 Tuesday, July 8:

10:00 AM ET – Consumer Credit (June)

Gauges borrowing trends—an indicator of household health in a low‑rate environment.

📅 Wednesday, July 9:

EIA Crude Oil Inventories & MBA Mortgage Apps & Wholesale Inventories

Key mid‑week data points; oil builds may pressure energy stocks.

Tariff Pause Deadline – Expect market volatility on news of extension or reimposition.

📅 Thursday, July 10:

8:30 AM ET – Initial & Continuing Jobless Claims

10:00 AM ET – Natural Gas Inventories

Markets focus on labor health and energy trends.

📅 Friday, July 11:

10:00 AM ET – Treasury Budget Statement

Details on government borrowing and fiscal outlook—markets sensitive to deficit risks.

⚠️ Disclaimer:

These insights are for educational purposes only—not financial advice. Consult a licensed advisor before making investing decisions.

📌 #trading #stockmarket #economy #news #tariffs #Fed #AI #technicalanalysis