UNG trade ideas

WHAT I'M LOOKING AT THIS COMING WEEK: FOMC, FOMC, FOMCEven though I don't anticipate doing much trading this coming week running into FOMC, old habits die hard, so, as usual, I'm running through underlyings for possible premium selling setups.

With exchange traded funds, I'm looking for a rank >70 and general implied volatility >35; with individual stocks -- rank >70, implied volatility >50%.

Top Implied Volatility Rank/Implied Volatility Exchange Traded Funds

IYR 71/20

TLT 68/15

XLU 67/19

EWZ 66/38

XLF 66/22

GDX 54/47

XRT 48/21

XLI 40/16

Top Implied Volatility Rank/Implied Volatility Individuals

UNG 97/56

GM 93/31 (Earnings in 52)

GLD 58/20

CSX 85/30 (Earnings in 30)

ORCL 84/25 (Earnings in 4)

GS 82/30 (Earnings in 38)

FXE 71/11

As you can see, there isn't much there that meet my general criteria: EWZ and UNG. When I've played UNG, it is usually as a directional seasonality play, and as you can see by the chart, we've already passed the seasonal low, which historically occurs in Oct/Nov. With EWZ, I'm already in a play.

ORCL announces in four days, so that might be playable, assuming implied volatility ramps up dramatically.

All that being said, it's FOMC week, which usually militates in favor of hand sitting. My guess is that the rate hike's already priced in here, so market movement will be, if anything, "all about the talk" of how the Fed views the economy moving forward. Frankly, this can't really be known at this point. For example, some of the recent market movement in various sectors depends on speculation that a good deal of these stimulatory programs the new U.S. President is proposing come to pass. The reality is that many of these proposed programs (e.g., massive infrastructure improvement) will cost and cost big; set against a backdrop of a now majority Republican Congress that has repeatedly bemoaned the size of the US deficit, it remains to be seen whether these proposals will go anywhere, meet substantial Congressional spending concern headwinds, and have the kind of effect the market is anticipating on the time frame that the market is satisfied with.

One thing's for sure: the US government is a bureaucracy and stuff just never has a tendency to happen "overnight." The question is how patient the market will be ... .

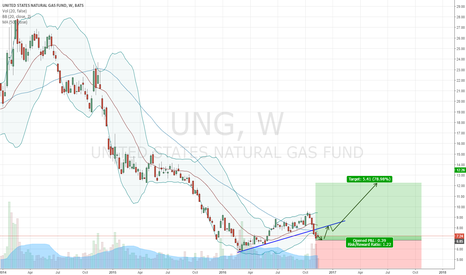

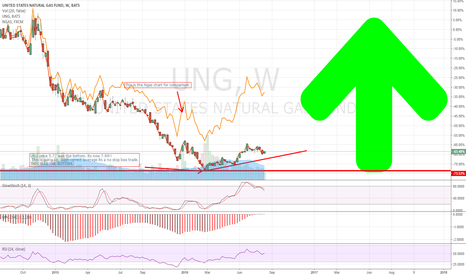

UNG & NG swing trade set-upI plan to let this one set up, but eyeing a long entry for the heart of presumed wave 3 off the lows. Retrace may not be as deep as I've depicted. Taking out the recent high after an initial 3-wave correction could indicate the rally has begun. Higher high could also be a (b) wave in a flat, so I'd put my stop at whatever low is forming.

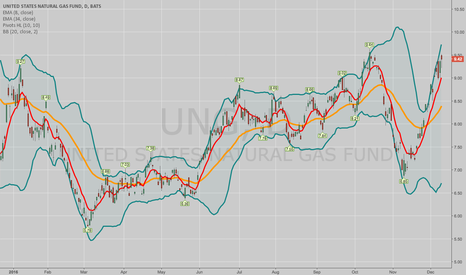

I'm In! Nat Gas $UNG. See The Trade HereWhat an epic fall on natural gas lately. The commodity tracking ETF $UNG has collapsed from $9.65 to its current $7.00 in the last month. This is a whopping drop of 27%. I love collapses like this because it means there will be a big bounce. If an investor or trader can analyze the commodity chart correctly, there is huge money to be made. I did it. After analyzing the chart, natural gas is a buy here. I am in fact buying $UGAZ, a 3X Long Natural Gas ETF. This is riskier but gives you more payout on a hard bounce. Note the stock chart below to see the awesome support level being hit.

View my verified track record performance here: verifiedinvesting.com

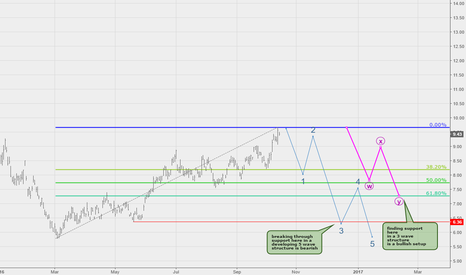

the state of UNGFirst, here is how I see the current uptrend unfolding.

The point of this post is to show my thought process. It's not to predict either a top or a bottom here, but merely to point out the current probabilities based on the pattern. The fact that the variations of the count on 4H have opposite implications on direction mean it's not worth risking money here at this juncture.

Looking at the daily chart, what I plan to do is to see how the next major correction (which has not started yet) unfolds. Because it can certainly continue higher, I don't want to get in front of the correction. Where and how the correction terminates, however, should help to provide more clarity in defining the nature of this uptrend.

Finding support around the prior wave 4 or the 61.8% retrace level, and with a corrective abc structure will go a long way toward a bullish outcome.

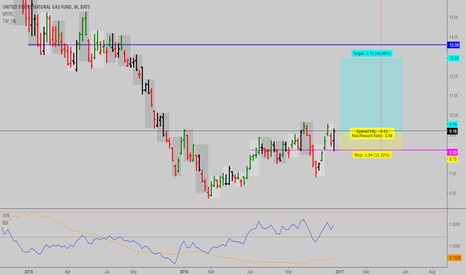

UNG Short on technical resistance and bearish fundamentalsShort UNG at 8.45 with a price target of 7.30 and a stop of 9.30. There is long term lateral resistance around ~$9.00 and broadening wedge resistance at this current level. I wouldn't hesitate either to put a shallower stop on this trade. Lately much of the bull move can be attributed to weather concerns in the Gulf. As of this writing the only current TS's trajectory is into the North Atlantic and the investigation (L99) which could enter the Gulf late Sunday is currently looking weaker. In addition the reliance on Gulf natural gas production has subsided substantially in the last decade so the effect of storms on domestic production is much less than it was a decade ago when hurricanes would cause violent pops in Henry Hub natural gas prices. Lastly, as we enter the shoulder months demand for power burn should subside some and the forward futures roll yields a gain on the ETF when short as forward months are in contango going into the winter. (If you follow my 10000 USD base account recommendations I recommend shorting 300 shares of UNG)

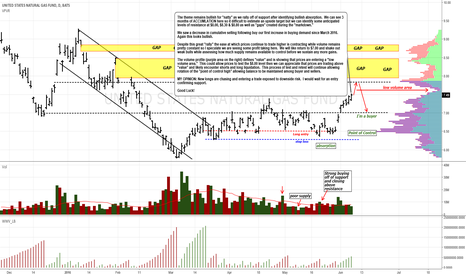

Closing the overgap likely to create resistance $UGAZ We seeing bullish rotation of the "point of control." Be aware of the overhead "gap" that remains as it will be an opportunity for trapped longs to exit trades with minimal losses.

We will likely see longs who accumulated through Mar/Apr/May take some profits. These actions are likely to create some near term resistance. This may also result in prices dropping to confirm support and build additional market structure around $8 base before attempting higher price discovery.

Good Luck!

bulls attempting to absob supply $UGAZ $DGAZ $NG_FBulls are attempting absorb the supply evidence by the higher lows present. The theme remains that demand exceeds supply.

Given that prices closed on support I believe a LONG entry is reasonable with a "tight stop" as shorts are buying into resistance.

I believe we are seeing strong hands maintain their positions while new entries respect that they are chasing while a few shorts sneak in.

I still don't feel rushed to enter carelessly into the "widow maker."

My re-entries are noted below.

Good Luck!

UNG retake look with technical analysis It appears at this point, the price may drop to where the arrows are pointing at, before going back up. Fundamentally, oil prices are on the rise and the use of natural gas is falling due to the hot weather of summer.

Stay tuned for both technical and fundamental, because you need both to analyse

Theme remains bullish but are longs buying risk here The theme remains bullish for "natty" as we rally off of support after identifying bullish absorption. We can see 3 months of ACCUMLATION here so it difficult to estimate an upside target but we can identify some anticipated levels of resistance at $8.00, $8.30 & $8.80 as well as "gaps" created during the "markdown."

We saw a decrease in cumulative selling following buy our first increase in buying demand since March 2016. Again this looks bullish.

Despite this great "rally" the ease at which prices continue to trade higher is contracting while volume remains pretty constant so I speculate we are seeing some profit taking here. We will like return to $7.00 and shake out weak bulls while assessing how much supply remains available to control before we sustain any more gains.

The volume profile (purple area on the right) defines "value" and is showing that prices are entering a "low volume area." This could allow prices to test the $8.00 level then we can appreciate that prices are trading above "value" and likely encounter shorts and long liquidation. This process of test and retest will continue allowing rotation of the "point of control high" allowing balance to be maintained among buyer and sellers.

MY OPINION: New longs are chasing and entering a trade exposed to downside risk. I would wait for an entry confirming support.

Good Luck!