Natural Gas Commodity USA Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

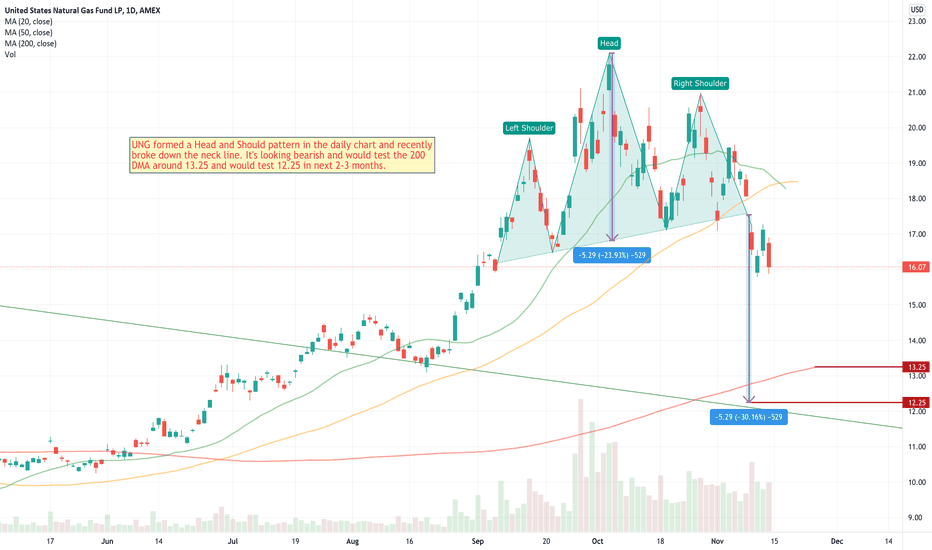

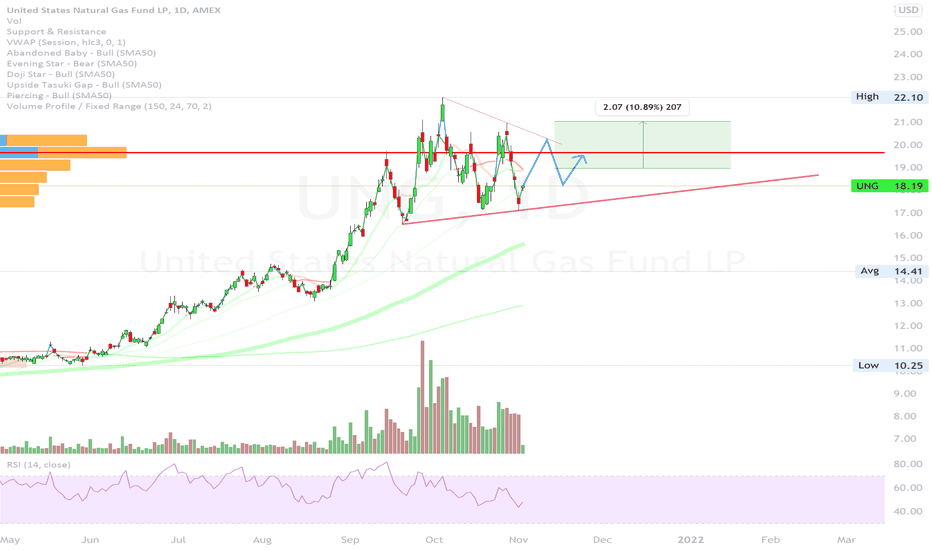

UNG trade ideas

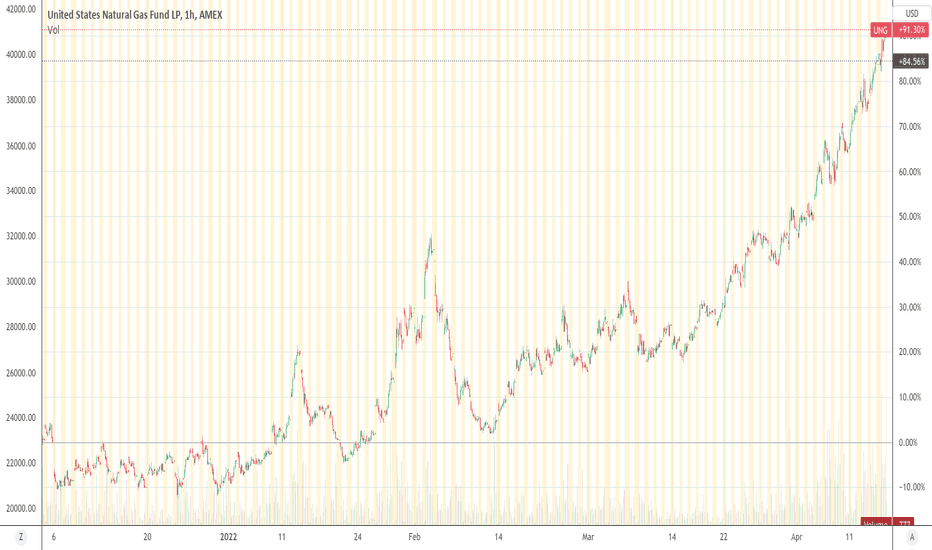

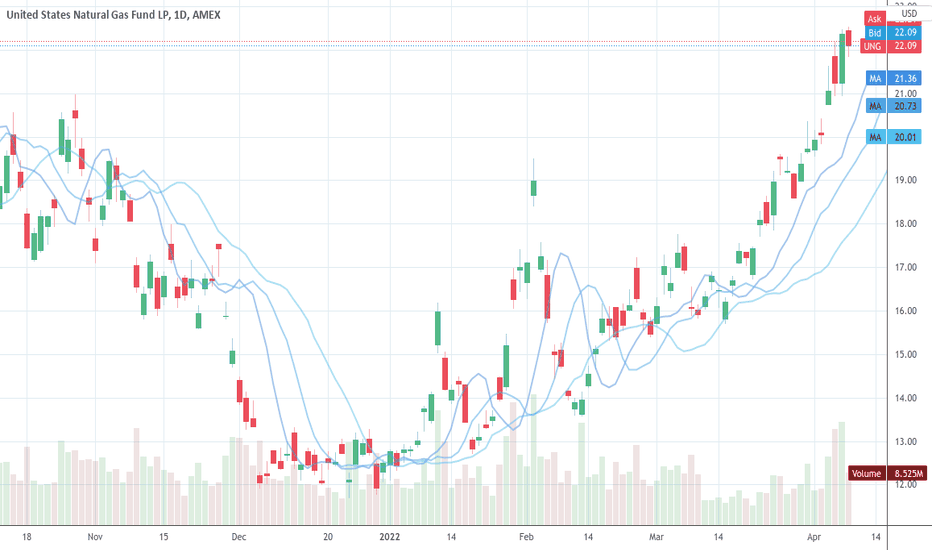

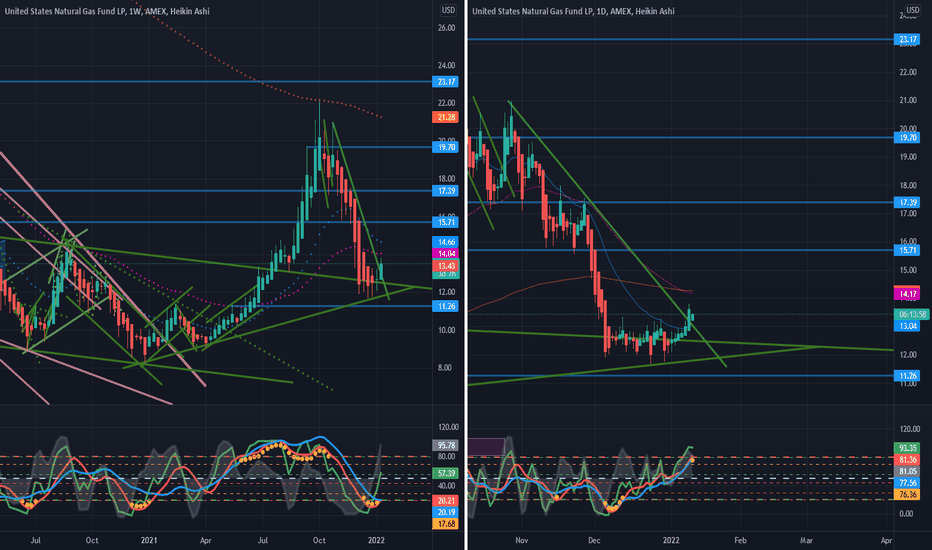

$UNG$UNG -> US natural gas etf shown here on the weekly chart. New highs made on declining volume with drives of bearish divergence shown on both On balance volume & RSI when compared to price. Also note volatility indicator signaling exhaustion from this previous upside move....UNG seems to be getting overextended.

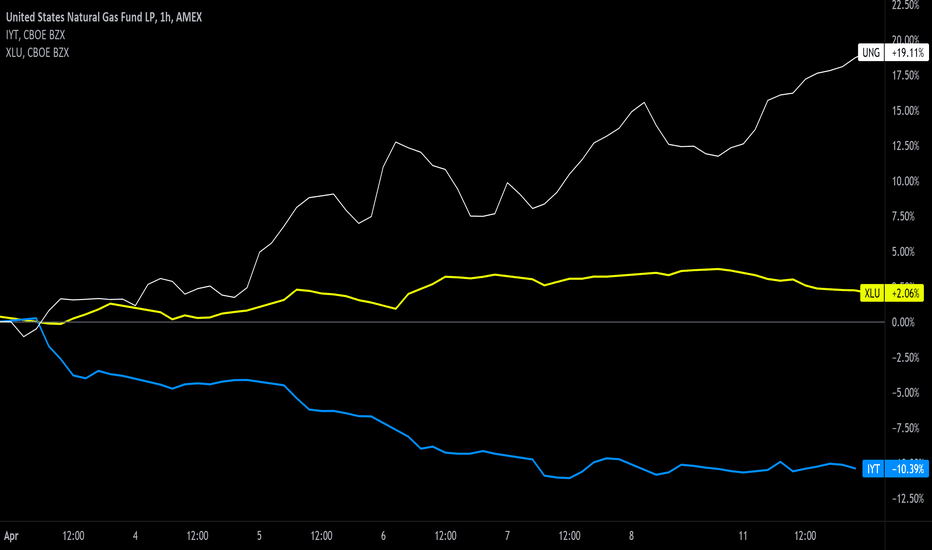

April Performance so farApril 1-11 performance of selected global stock indexes, bond ETFs, fiat currencies and commodities:

Natural Gas

17.7%

Orange Juice

14.5

Wheat

7.5

Coffee

4.5

Kazakhstani Tenge

4.4

Sugar

4.2

S&P 500 Consumer Staples

3.5

Swiss Market Index

3.0

S&P 500 Health Care

2.3

Soybeans

2.3

Corn

2.1

S&P 500 Utilities

2.0

IBEX 35 (Spain)

1.7

Dow Jones Utility Average

1.5

WSJ Dollar Index

1.4

S&P 500 Real Estate

1.4

FTSE 100 (U.K.)

1.4

Bloomberg Commodity Index

1.2

Brazilian Real

1.0

S&P 500 Energy

0.9

Pakistani Rupee

0.8

BEL-20 (Belgium)

0.7

S&P BSE Sensex (India)

0.7

Stoxx Europe 600

0.5

Cattle

0.5

South African Rand

0.2

Tel Aviv 35

0.1

Indian Rupee

0.1

Turkish Lira

0.1

Icelandic Krona

0.0

Indonesian Rupiah

0.0

Ukrainian Hryvnia

0.0

Vietnamese Dong

–0.1

Macanese Pataca

–0.1

S&P 500 Materials

–0.1

S&P/ASX 200 (Australia)

–0.2

Gold

–0.3

Kuwaiti Dinar

–0.3

Norwegian Krone

–0.3

Cotton

–0.3

1-3 Yr. U.S. Treasuries

–0.3

Mexican Peso

–0.4

IPSA (Chile)

–0.4

S&P/TSX Composite (Canada)

–0.5

DJ Select REIT Index

–0.5

Chinese Yuan

–0.5

Silver

–0.6

Philippine Peso

–0.6

Malaysian Ringgit

–0.6

Israeli Shekel

–0.6

Singapore Dollar

–0.7

British Pound

–0.9

Australian Dollar

–0.9

Swiss Franc

–0.9

Thai Baht

–1.0

Argentine Peso

–1.0

Canadian Dollar

–1.0

Dow Jones Industrial Average

–1.1

FTSE MIB (Italy)

–1.1

Swedish Krona

–1.1

Cocoa

–1.3

Municipal Bonds

–1.3

Amsterdam AEX

–1.3

FTSE Straits Times (Singapore)

–1.3

Croatian Kuna

–1.4

Euro Stoxx

–1.4

New Taiwan Dollar

–1.5

DAX (Germany)

–1.5

New Zealand Dollar

–1.5

CAC-40 (France)

–1.6

Uruguayan Peso

–1.6

South Korean Won

–1.6

Euro

–1.6

Romanian New Leu

–1.6

Danish Krone

–1.6

S&P 500 Financials

–1.7

Bulgarian Lev

–1.7

Czech Koruna

–1.7

Platinum

–1.9

Polish Zloty

–2.0

International Bonds

–2.0

Russian Ruble

–2.1

Kospi (South Korea)

–2.3

Copper

–2.4

Treasury Inflation-Protected Sec.

–2.5

Bovespa Index (Brazil)

–2.5

S&P 500

–2.6

Shanghai Composite

–2.6

Japanese Yen

–2.9

U.S. Bonds Total Market

–2.9

High-Yield Corporate Bonds

–3.2

S&P Mid Cap 400

–3.3

Lean Hogs

–3.3

S&P 500 Comm. Services

–3.5

7-10 Yr. U.S. Treasurys

–3.6

S&P 500 Industrials

–3.6

Hang Seng (Hong Kong)

–3.6

Nikkei Stock Average (Japan)

–3.6

Taiwan Weighted Index

–3.6

IPC Index (Mexico)

–3.7

Chilean Peso

–3.7

Emerging-Markets Bonds

–3.8

Investment-Grade Corp. Bonds

–4.0

S&P Small Cap 600

–4.1

Russell 2000

–4.3

Hungarian Forint

–4.5

S&P 500 Cons. Discretionary

–4.9

Nasdaq Composite

–5.7

Nasdaq 100

–5.7

Gasoline

–5.8

Crude Oil

–6.0

S&P 500 Technology

–6.7

20+ Yr. U.S. Treasuries

–6.8

DJ Transportation Average

–10.8

Diesel

–11.5

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tickerTracker - MFI Oscillator

tradingview.sweetlogin.com

Natural Gas Commodity USA Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

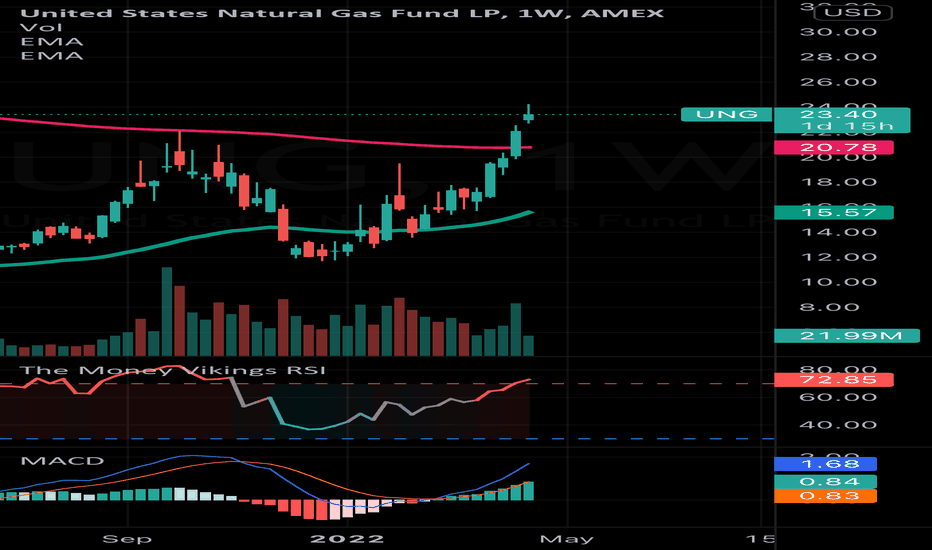

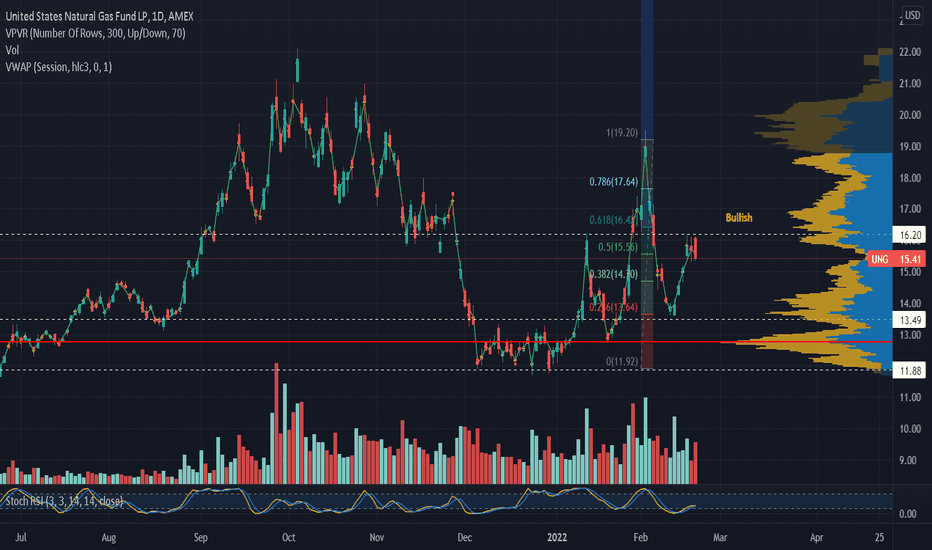

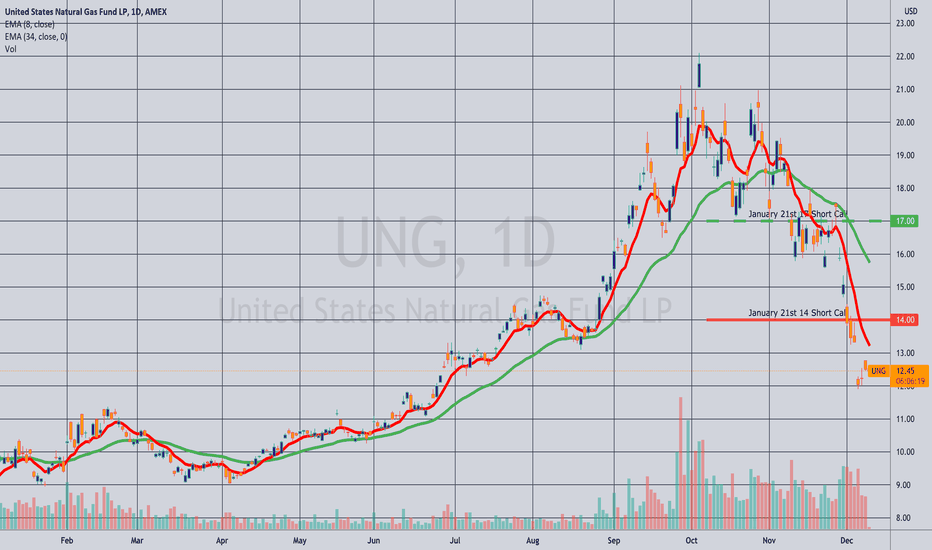

UNG - Direction depending on PutinSorry, I started a new job and haven't been actively trading.

UNG - Nat gas has been very volatile lately and partially connected to Russia war news / European supply. Bearish view - Head and shoulders on daily.

Bullish view - Break over $16.20. *Russia controls a Nat Gas supply to 15 Euro countries.

Have a great long weekend!

$UNG - natgas - naturalgaswinter storm warning for much of the east coast this weekend + production setbacks from Texas deep freeze +Florida deep freeze + Greece/ Turkey blizzards + Iran cutting all exports + Russia/Nato Nordstream tensions

look at the energy sector and tell me that nat gas is not overlooked

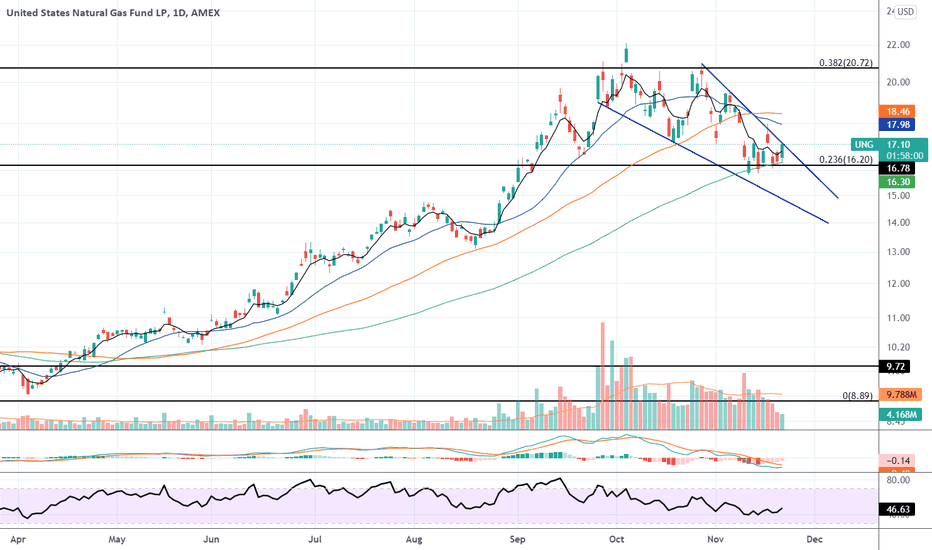

Squeeze Short in a downtrendUNG retraced to the 78.6% Fibonacci level before consolidating into a squeeze.

1. Solid orange compressed squeeze

2. Still has negative momentum.

3. No propulsion dots requires a more conservative entry.

4. Vprofile levels offer entry levels and resistance.

5. 18 Feb 22 13 Put Entries ($12.80, $13.20, $13.80)

6. Profit Target #1 @ 12.05.

7. Stop Loss is 25% of the option price.

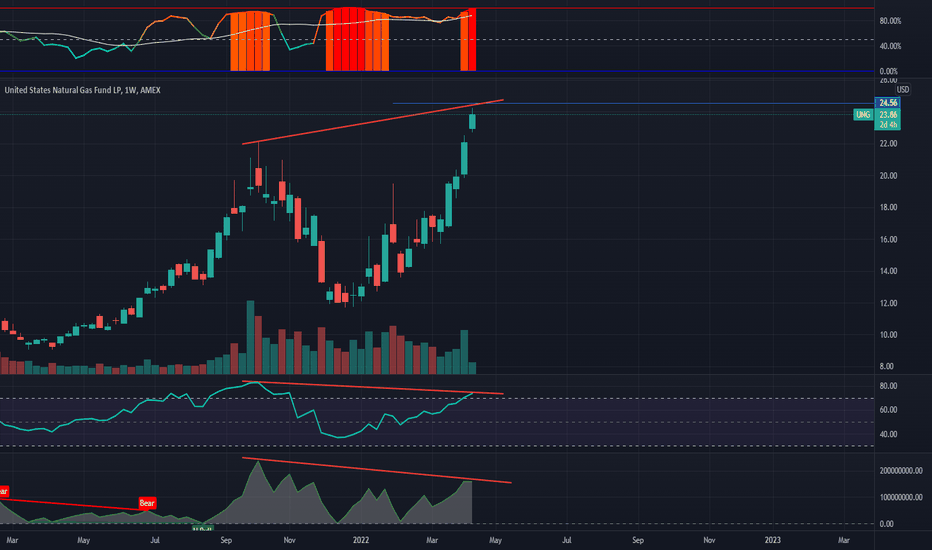

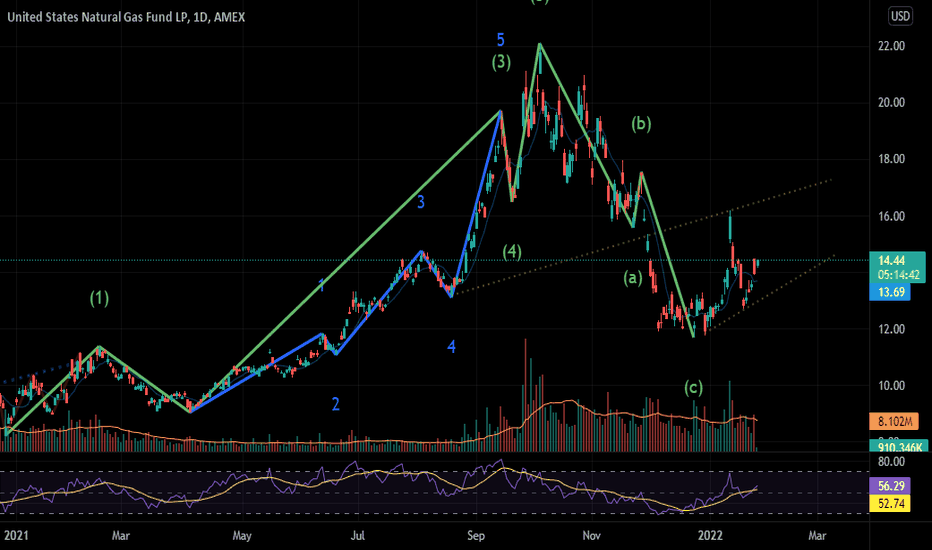

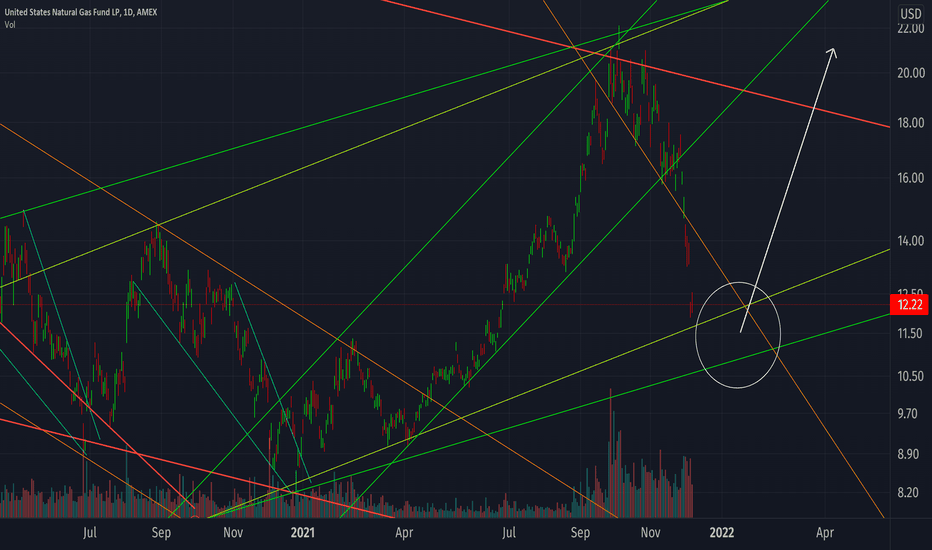

Well this interesting...Certain geopolitical events, rising prices in Europe and cold snaps across North America seem to be pushing Natural Gas higher. It's broken a key overhead resistance but upside will be limited. You can see some of the previous support lines which do correspond rather nicely with the last move downwards. This is strictly a short-term play unless other resistances and a falling dollar pickup pace.

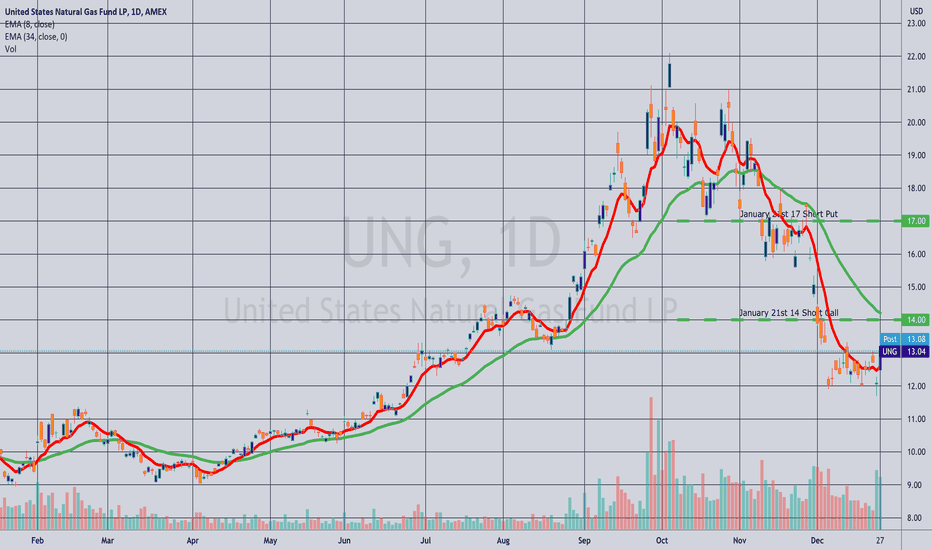

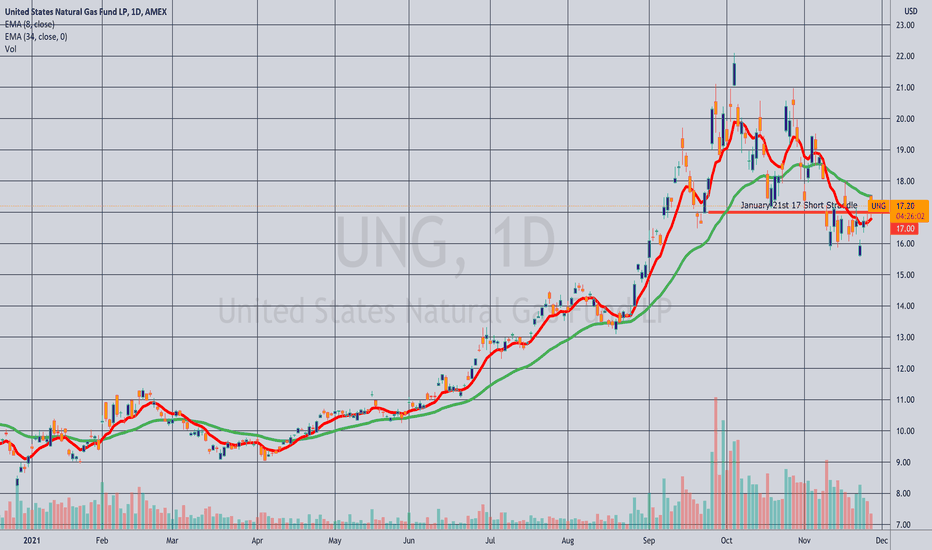

Closed: UNG January 21st 14C/17P Inverted Short Strangle... for a 4.86 debit.

Comments: I collected a total of 5.44 in credits for this setup. (See Post Below). It started out as a 17 short straddle, after which I rolled the 17 short call down defensively to cut net delta, resulting in an inverted strangle (i.e., short call below the short put). Closed it out here for a small winner on this up move; 5.44 - 4.86 = .58 ($58).

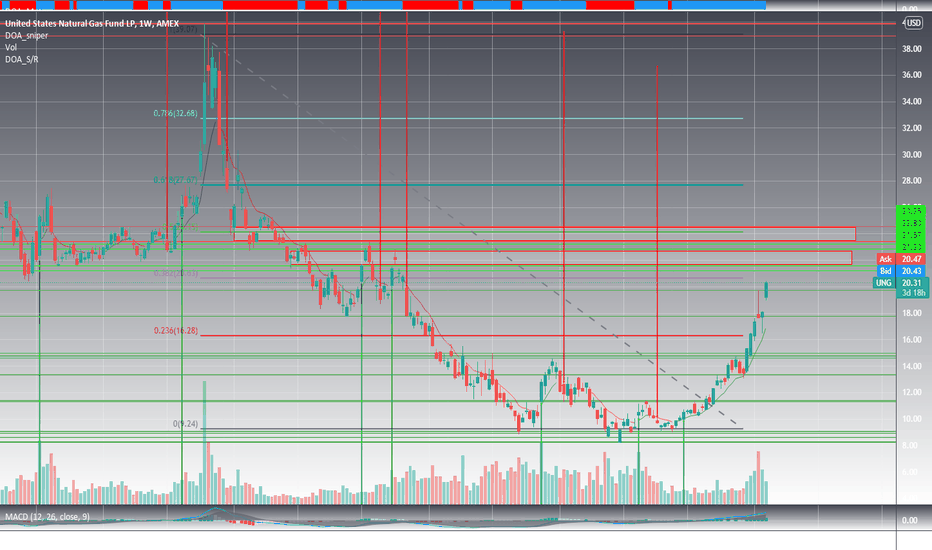

UNG (Natural Gas ETF) - 2021 - Support, Resistance, TrendlinesUNG (United States Natural Gas Fund) - 2021 - Support, Resistance, Trendlines:

-Resistance Price Levels (colored horizontal lines above current price)

-Support Price Levels (colored horizontal lines below current price)

-Trendline Resistances (diagonal grey lines above current price)

-Trendline Supports (diagonal grey lines below current price)

note: chart is on log scale.

Rolling: UNG January 21st 17 Short Call to 14 Short Call... for a .42/contract credit.

Comments: Rolling down the short call of my UNG straddle to reduce net delta directionality and improve my break evens. The resulting setup is a 3-wide inverted 14C/17P for which I've collected a total of 5.44 in credits -- 5.02 for the original short straddle (See Post Below) -- plus an additional .42 here. This also cuts net delta about in half, with the 17 short put clocking in at around 79 delta and the 14 short call around -39. The setup remains net delta long (40.81), leaving room for a potential bounce should that occur. A "perfect finish" for an inverted setup is basically the mid point between the inverted strikes -- in this case, 15.50. I will probably money/take/run if the opportunity presents itself, since there is seasonality with UNG, and I'd rather not roll this out for duration as I would with just about everything else since seasonality favors lower post-winter.

My original price target was a 3.76 debit to close (25% of max profit), so I'm revising that to 3.76 plus .42 or 4.18.

UNG ETF USA Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

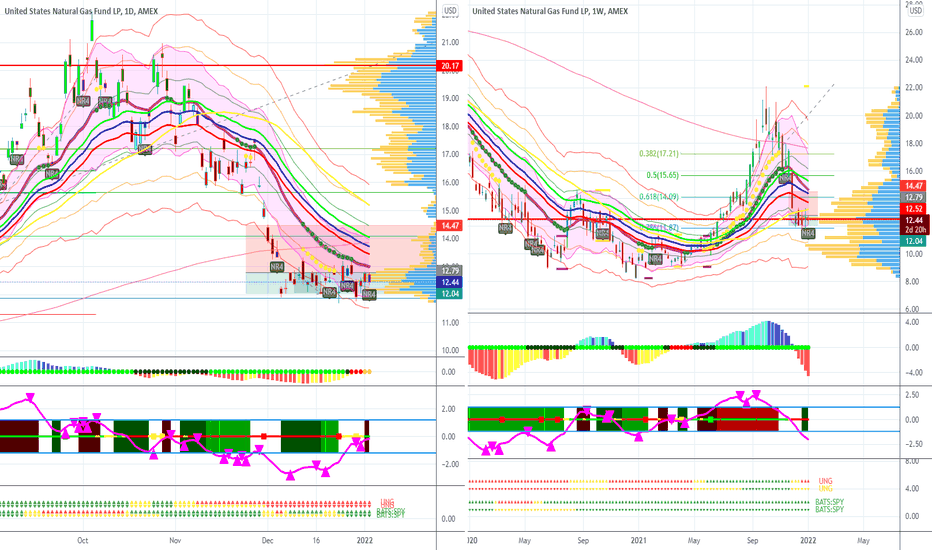

Opening (Margin): UNG January 21st 17 Short Straddle... for a 5.02 credit.

Comments: High IVR/high IV here. I looked at various ways to get around the awful call side skew and decided to just short straddle it. Break evens at 11.98 and 22.02 with delta/theta at -16.85/4.32. Will look to take profit at 25% max.

I'm indicating that it's "short" because of the net delta metric, but it can wander around anywhere between 11.98 and 22.02 and still be profitable.

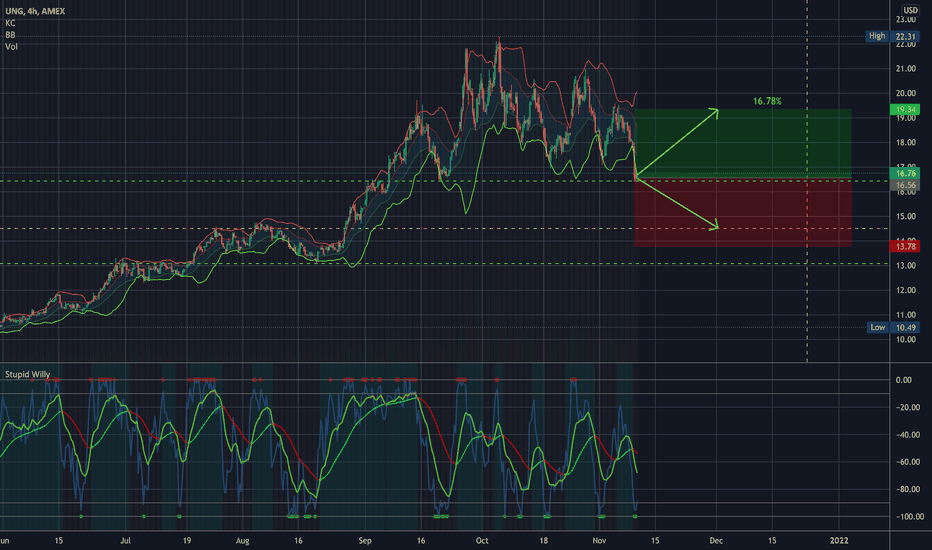

NEW POSITION $UNG looking for 19.34 fro 16.78% (NatGas)NEW POSITION $UNG looking for 19.34 fro 16.78%

Started a 1% position here… Looking to either sell at 19.34

Or Double my position at 14.50

Let’s go, NatGas traders…

——————

I am not your financial advisor, but I will happily answer questions and analyze to the best of my ability but ultimately the risk is on you. Check out my ideas, but also do your own due diligence.

If you want me to analyze any stock or ETF just leave me a comment and I’ll do it if I can.

Have fun, y’all!!

(\_/)

( •_•)

/ >🚀

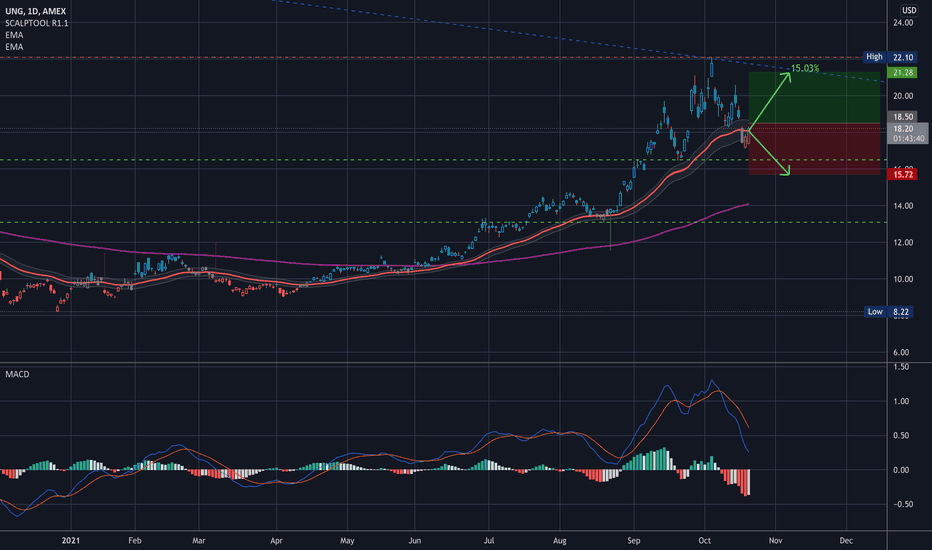

$UNG - Key Levels and Analysis$UNG - Key Levels and Analysis

Would love to get one more good natty swing…

Sell target 21.28

Or

Double target 15.72

——————

I am not your financial advisor, but I will happily answer questions and analyze to the best of my ability but ultimately the risk is on you. Check out my ideas, but also do your due diligence.

If you want me to analyze any stock or ETF just leave me a comment and I’ll do it if I can.

Have fun, y’all!!