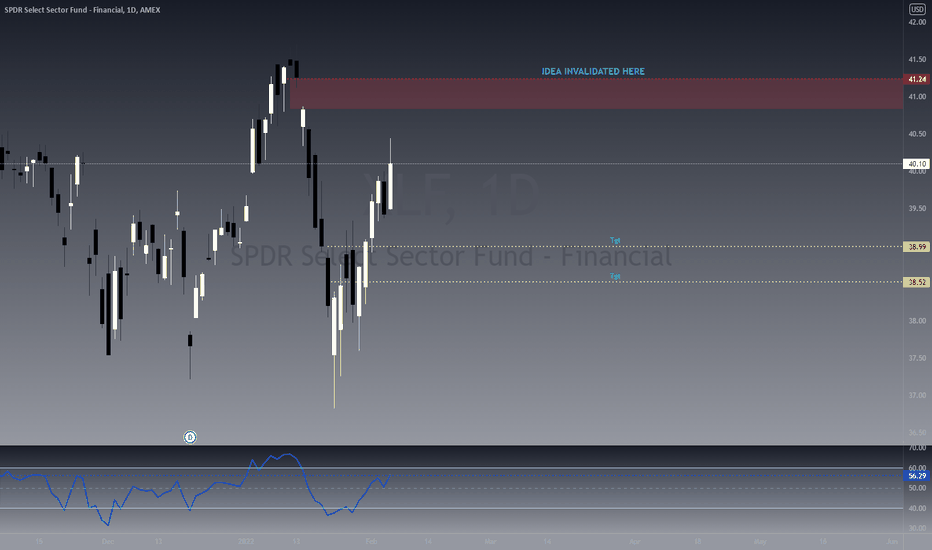

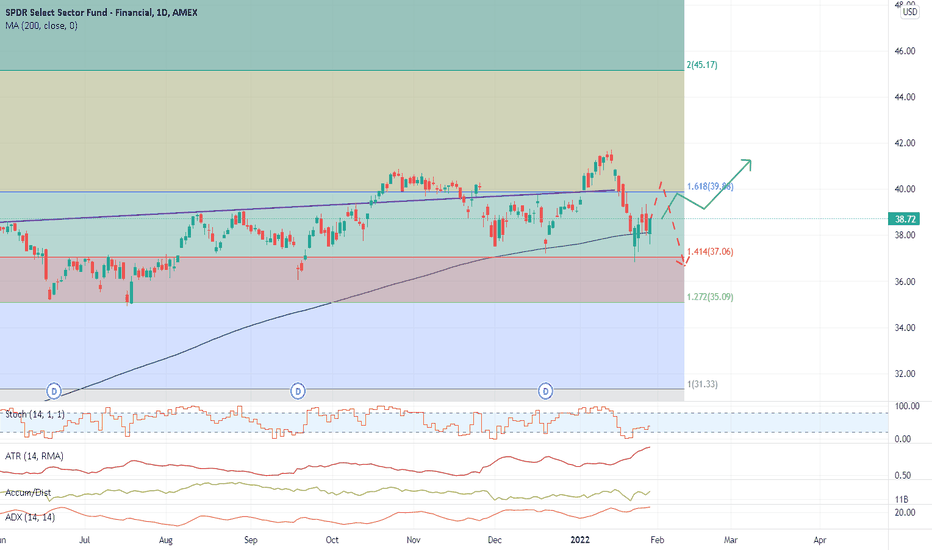

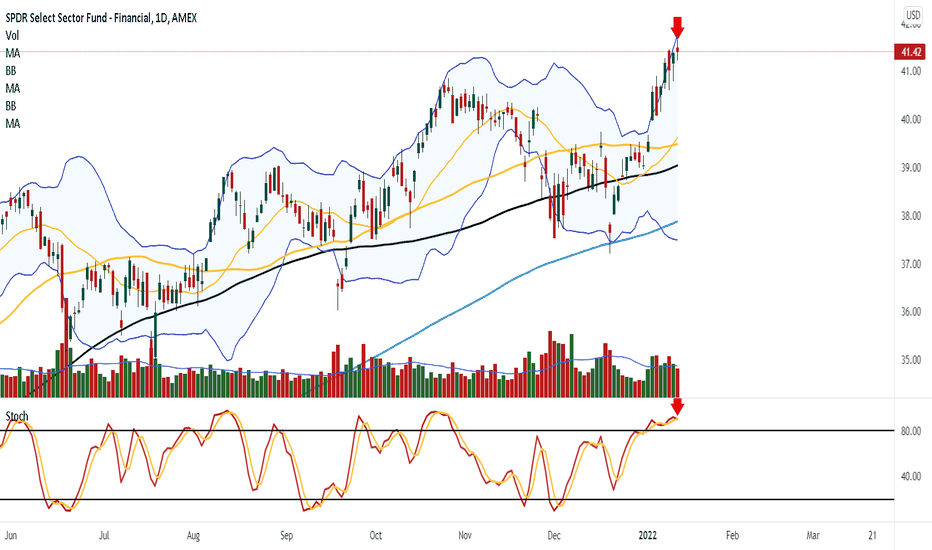

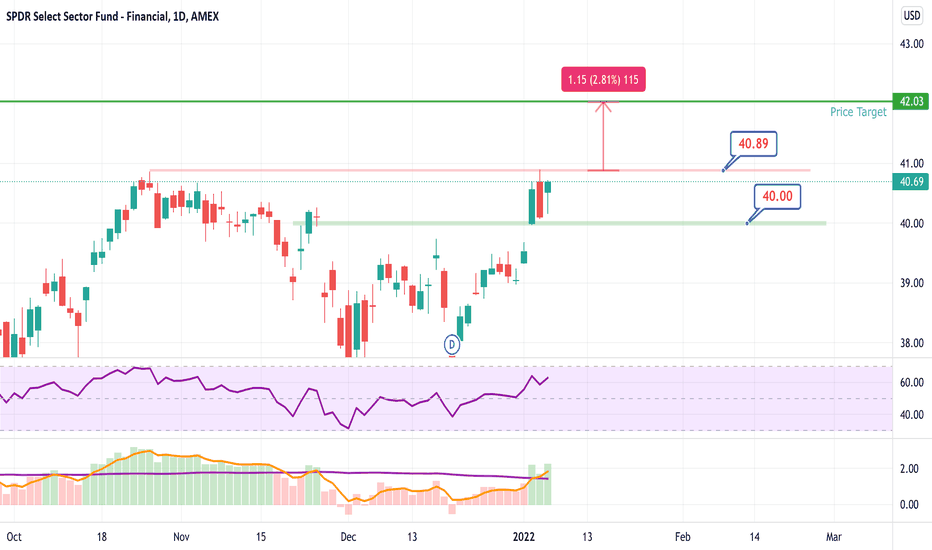

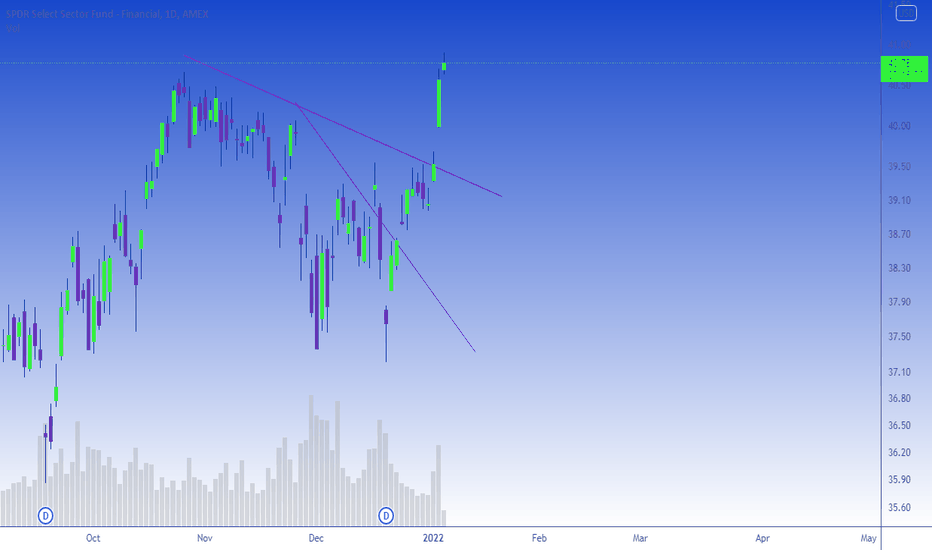

XLF Short Set Up Following this retracement there is a chance the XLF will push lower to test the established support area. There's no way no where the top of the current swing will be, but I like to enter these patterns using a set up on a smaller timeframe which allows me to place a much tighter stop-loss and maximizing my R. I wont enter the trade until I see a set up on a smaller timeframe, and if price action reaches the invalidation point, the trade idea is reevaluated.

Not a recommendation.

XLF trade ideas

XLF Long

XLF

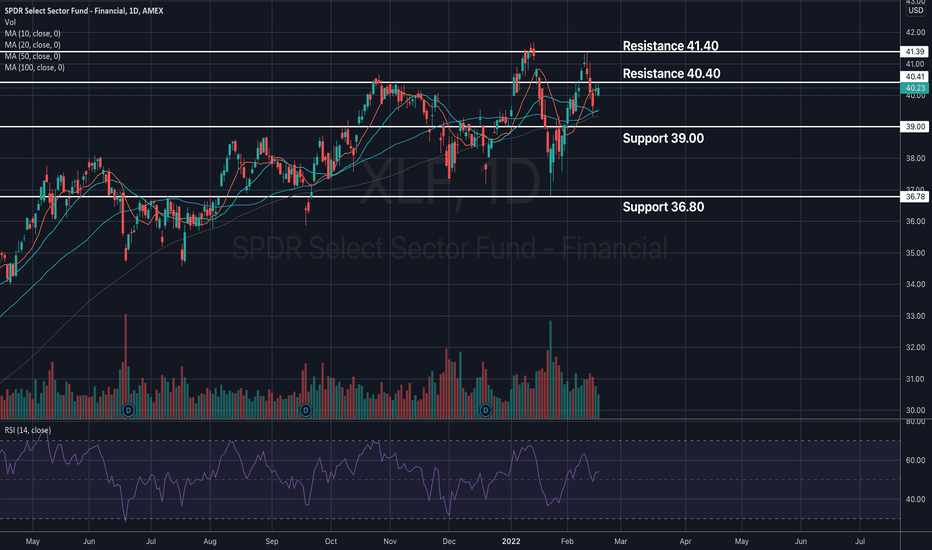

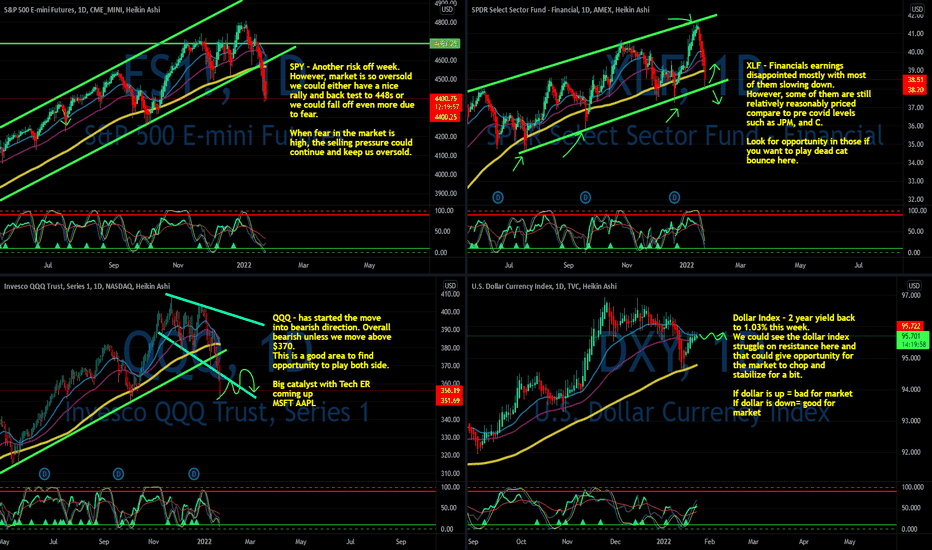

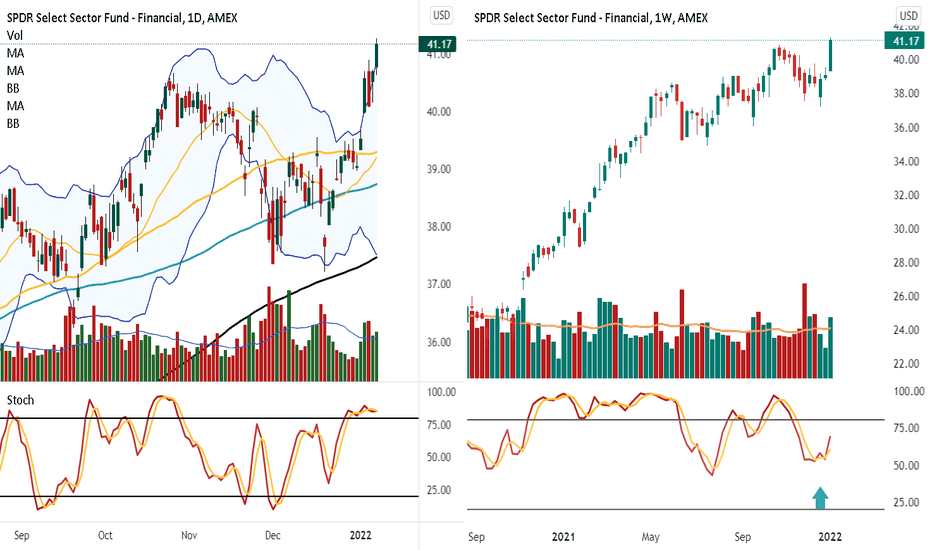

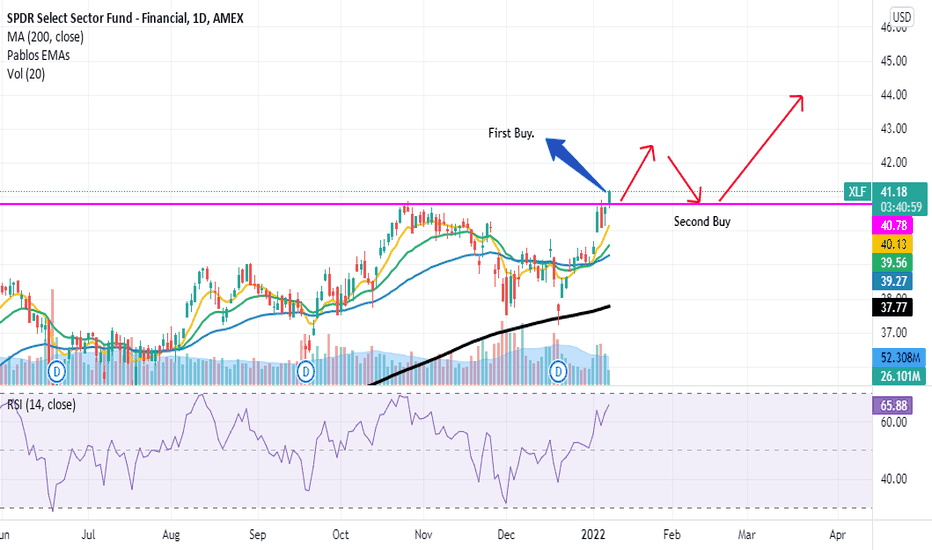

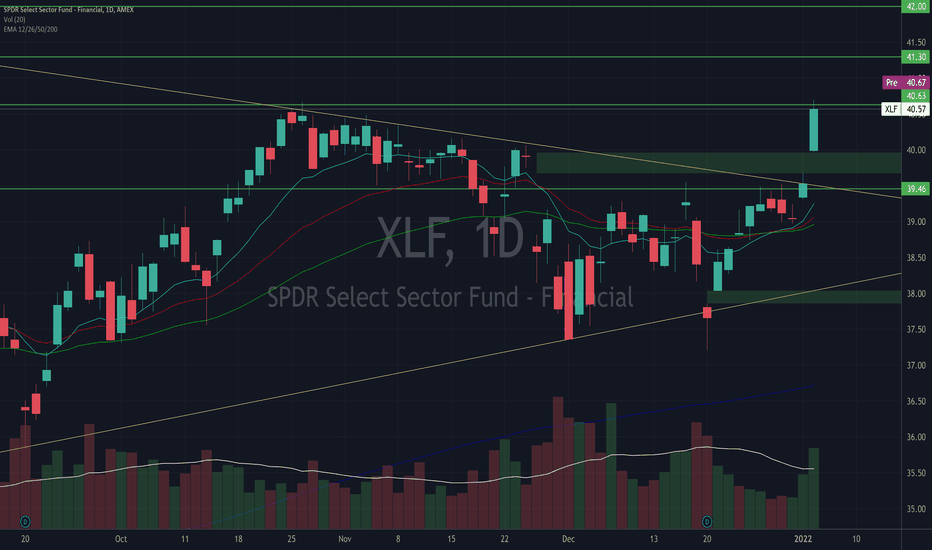

Analysis done on daily candles. The financial sector has been one of the more resilient sectors on the stock market in 2022, with most stocks managing to hold their key levels and not declining as severely as major markets. When analyzing bank stock performances, we see that they have lagged way behind many other industries since the Covid crash in recovery, but this year may bring change to that. With interest rates expected to increase starting in March, banks and other financial companies are projected to benefit from this monetary policy change. We’ve been primarily focused on the XLF ETF to gauge overall health in the financial sector; this is an ETF (exchange traded fund) that holds assets such as Berkshire Hathaway, JPMorgan, Back of America…etc. Keeping an eye on this ETF is critical if you’re interested in trading or investing in the financial sector considering it allows you to see how the overall industry is performing. Keep in mind that banks are known to be slow movers, so their breakouts may not be as robust as a tech stock breakout would be, but the patient will be rewarded in the long run.

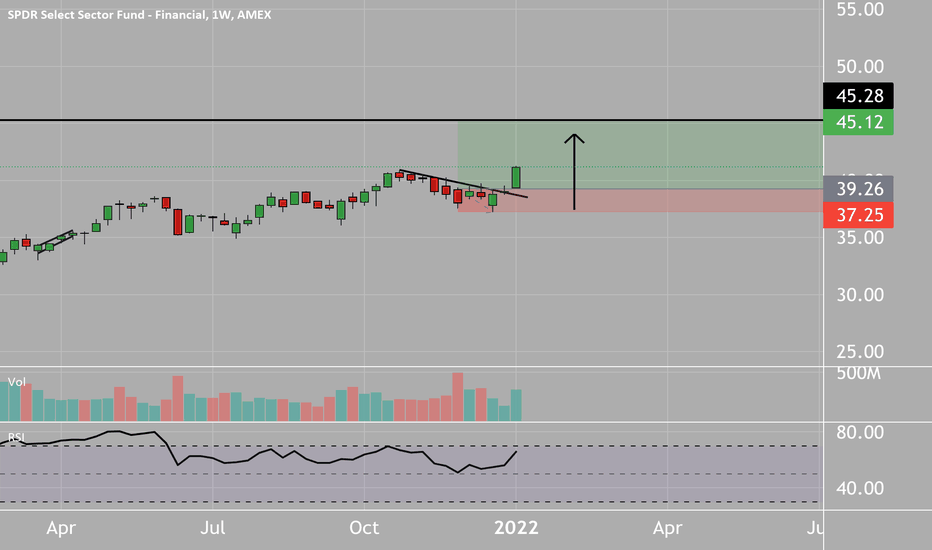

$XLF long idea in a higher rate environmentWith the Federal Reserve announcing rate hikes starting in March, financials should prosper. Higher interest rates ($TNX) means that it costs more to borrow money which is a bullish sign for banks. The economy is also not showing any signs of slowing down, commodities continue to move higher and job reports signal a strong economy. This can be translated to assuming that consumer spending will not slow down; low supply on high demand shows that they will continue to spend and borrow money.

Also, if we look at Treasury Bonds ($TLT), we see some serious selling even though the Federal Reserve continues to purchase. This could lead to a stronger Dollar ($DXY) and a move from growth equities ($ARKK, $QQQ) into cash or savings accounts. During rate hikes, history shows an inflow into companies with high cash reserves, cash flow, and high dividends.

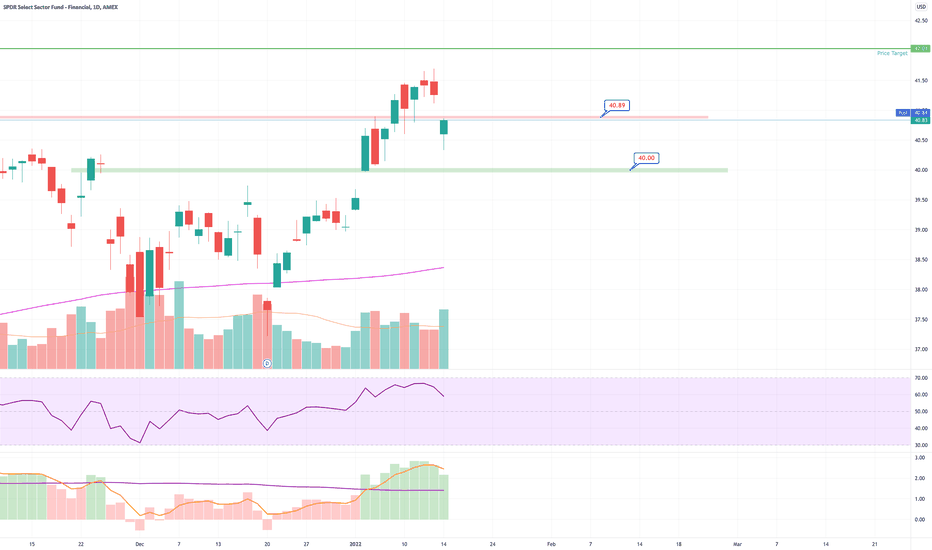

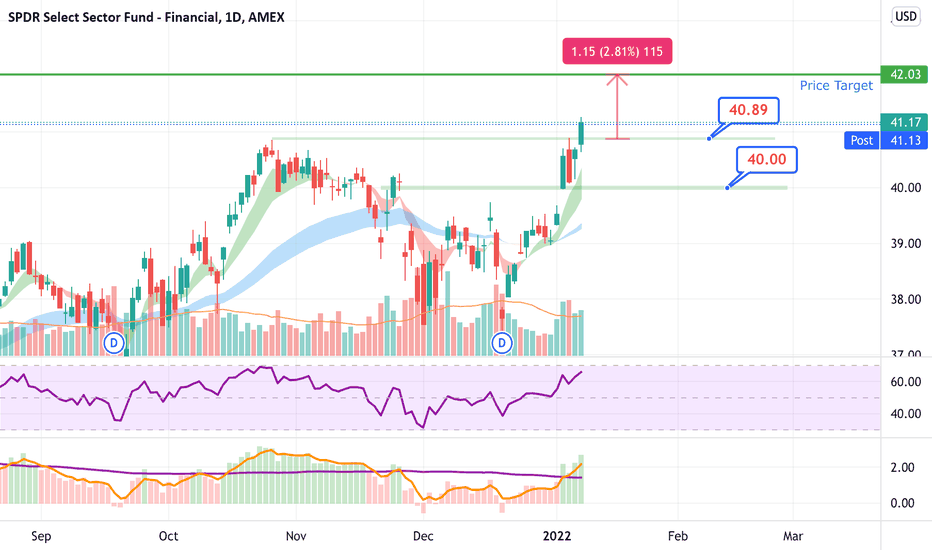

The technical side of $XLF shows relative strength while indices continue to fall. On the weekly timeframe, we can see a clear bull flag pattern that has broken out and if we close above $40 today, we have confirmation. MACD shows a bullish crossover is near and RSI is healthy.

Targets are 43, 45 and 47.

OptionsSwing Analyst

Daniel Betancourt

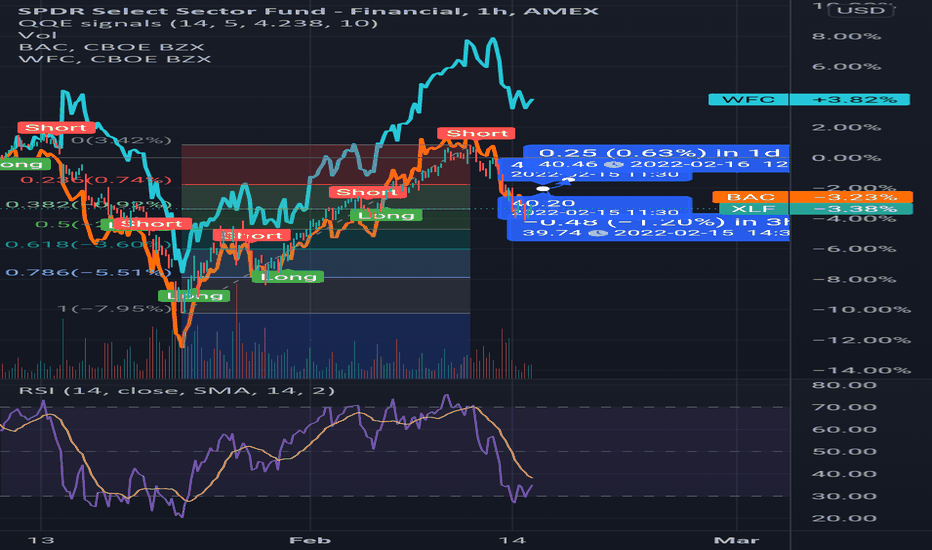

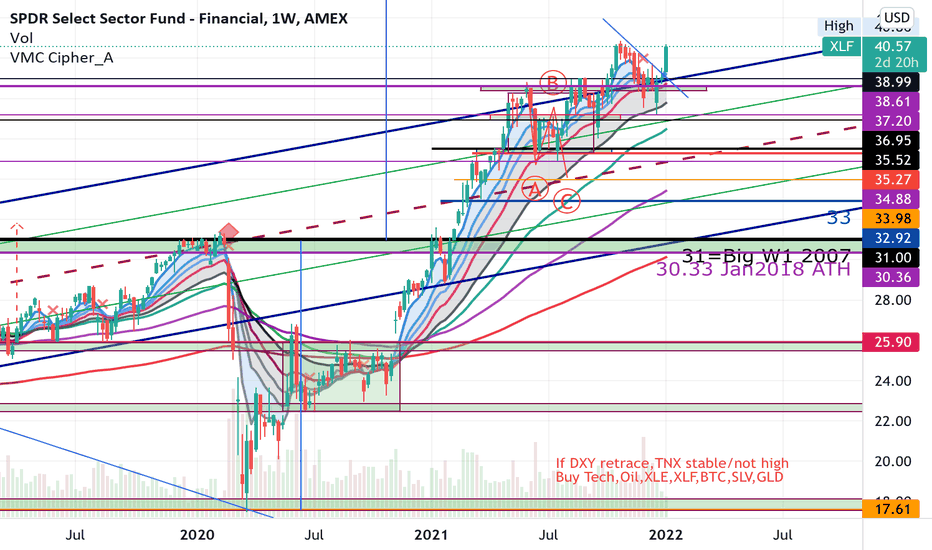

financials sector enjoying a lead on indices (XLF)XLF is one of the instruments whose sectore had a larger terminal upthrust than others, and is enjoying a more sizeable bounce than others after the current peak in volatility.

big names like V, PYPL and BAC are putting up enoughbof a struggle to say that they have tolerance to attract inflow from key players (sm, mm, tutes, pros).

it will be interesting to see if we can confirm a higher low before tech returns to help carry the market, making way for a larger comeback that could enjoy a solid outperformance on indices; at least for the time being.

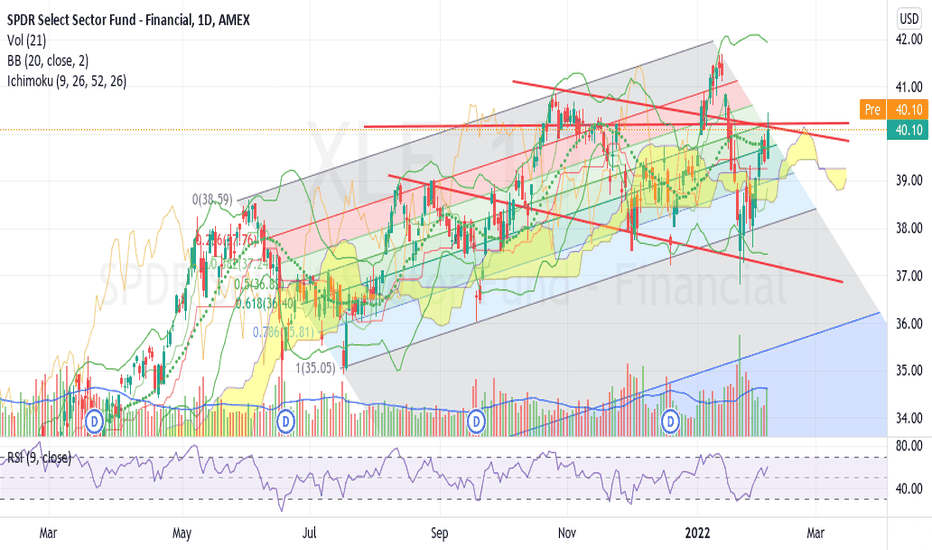

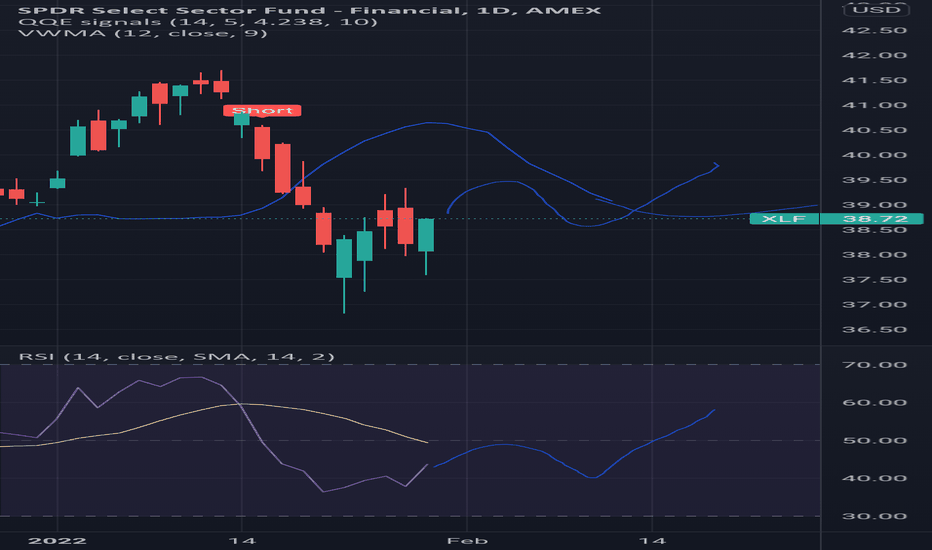

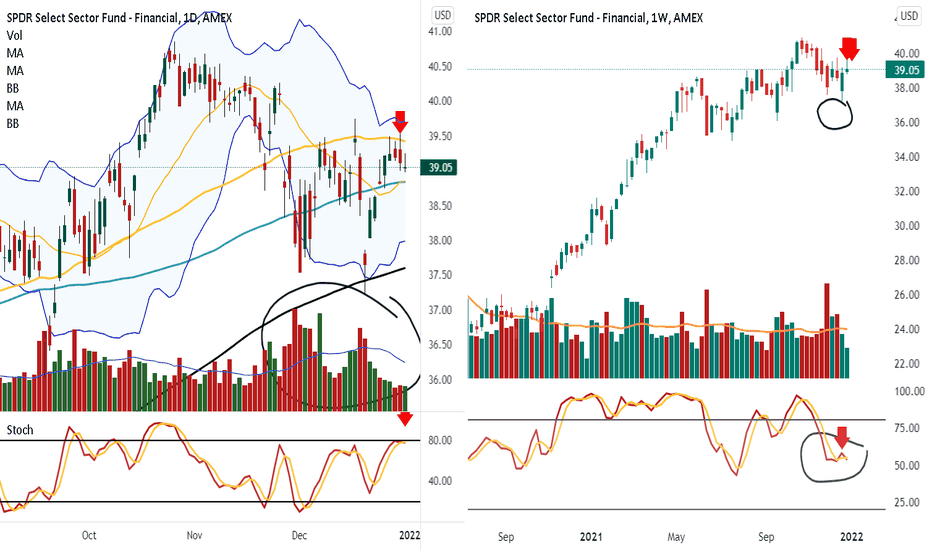

XLFDaily Chart Report

XLF gapped down below support and failed to capture the support back. Since banks earnings season has started usually banks tend to drop after earnings. So we could see XLF retrace back to $40 gap support level next week. Also there has been plenty of put buying on the bank stocks and XLF going out to Feb exp.

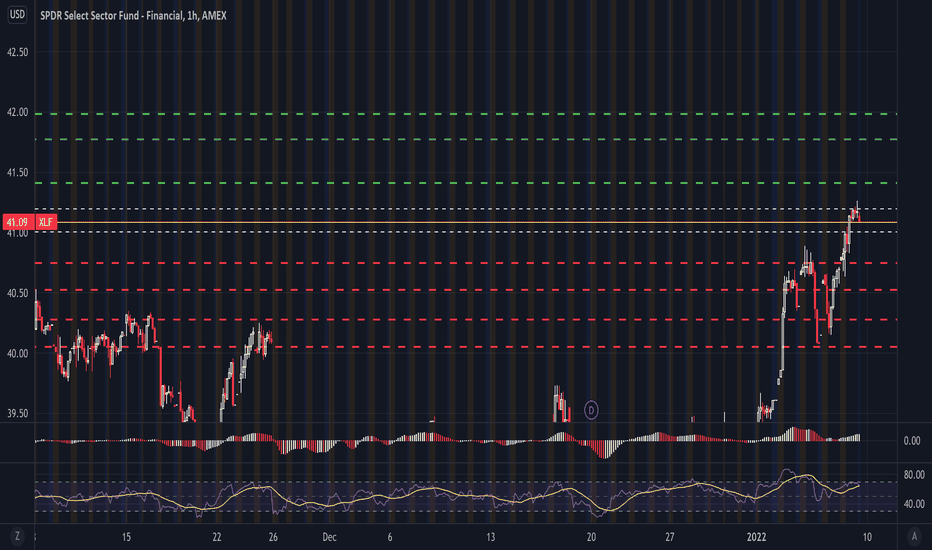

$XLF continuation play$XLF displaying good relative strength last few sessions with a break out of trendline resistance and good reaction off the 9ema daily retest/resistance turned support confluence. CPI numbers Wednesday and bank earnings starting Friday with $JPM, $C, $WFC followed by $BAC, $MS, $GS among others the week after. Continuation play, calls above 41.3 PT 41.7, 42, 42.3, 42.6. Can play individual tickers too.

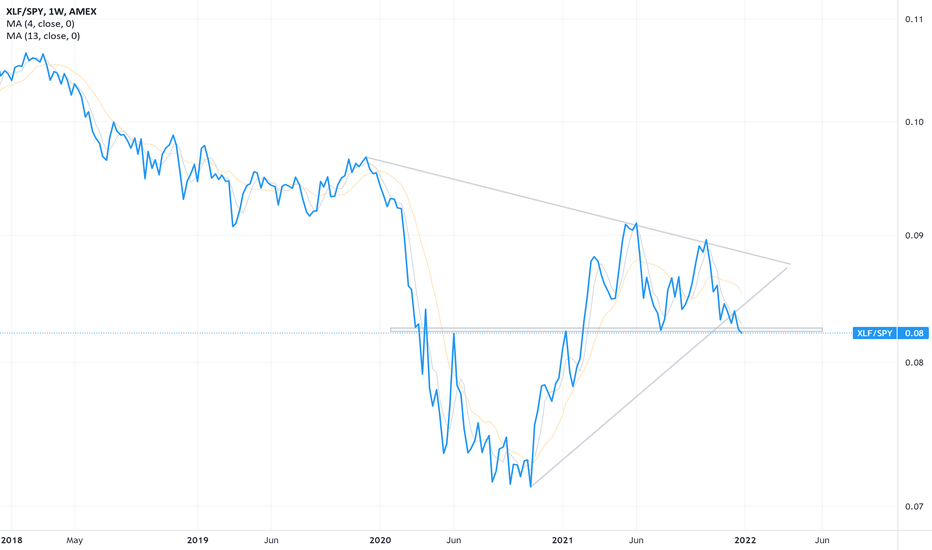

Interest Rates - Inflection Point?As interest rates rise, it would typically be a positive for $XLF. Yet here we see the Financial sector XLF trailing against SPY and reaching an important resistance point (SPY itself is also stalling against other defensives). Keep an eye on this one for clues as to market rate expectations.

XLFThe Financial Select Sector SPDR Fund seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the Financial Select Sector Index. The Index seeks to provide an effective representation of the financial sector of the S&P 500 Index Seeks to provide precise exposure to companies in the diversified financial services; insurance; banks; capital markets; mortgage real estate investment trusts (REITs); consumer finance; and thrifts and mortgage finance industries Allows investors to take strategic or tactical positions at a more targeted level than traditional style based investing