Consumer staples are the best of all possible worlds right nowSo we've got macroeconomic forces pulling in a couple different directions right now. One the one hand, the Fed is talking about pumping trillions of dollars more liquidity into the market, which should further inflate equity prices. On the other hand, with coronavirus cases continuing to rocket, we're starting to see economic data fall off a cliff. Consumer staples and metals are the natural havens.

Today, the University of Michigan measure of US consumer sentiment for July came in at 73.2 versus the consensus expectation of 79. This was the largest negative surprise on record, and it's going to have a big negative effect on the consumer discretionary sector. And what's bad for retail is also bad for banks, as CMBS delinquency reached 10.32%. We also got a large negative surprise on housing starts today, up only 2.1% vs. the 4.9% consensus expectation. Home building has been the one bright spot in the economy as Americans flee the cities for the suburbs, so this is a concerning deterioration in that market. The ECRI leading index has been flattening, and mobility is falling as scared consumers remain at home even in states that haven't reclosed. California's reclosure this week was a huge deal, since the state accounts for nearly 15% of US GDP.

Consumer confidence chart:

twitter.com

Mobility chart:

www.dallasfed.org

Meanwhile, the Fed's balance sheet grew this week for the first time in four weeks, which means that liquidity-- and the accompanying asset price inflation-- is on the upswing again. Congress is actively working on as much as $3.5 trillion in new stimulus, and Lael Brainard of the Federal Reserve is signaling that the Fed may get more aggressive about trying to hit its 2% inflation target, even to the point of "overshooting" that target to make up for years of weak inflation. (Current CPI is about 1.2%.)

See Brainard's remarks here:

www.federalreserve.gov

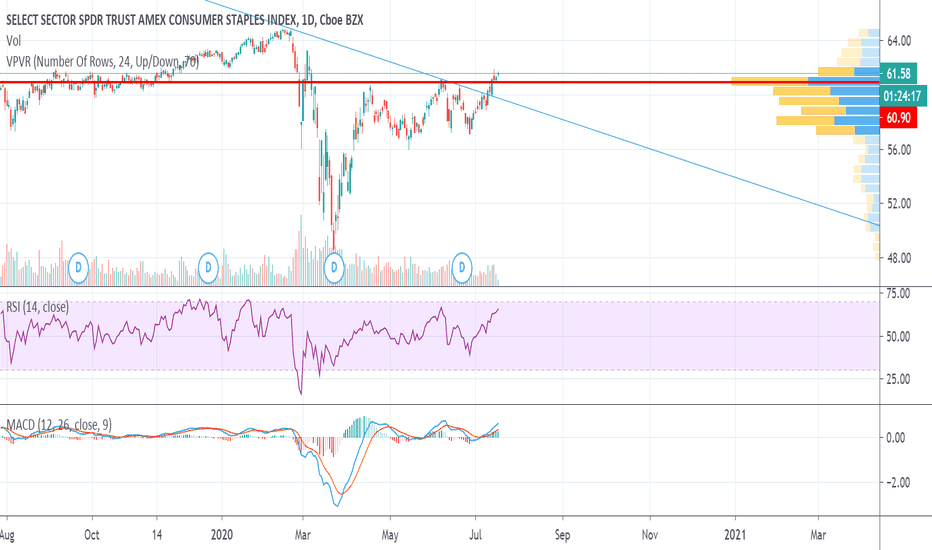

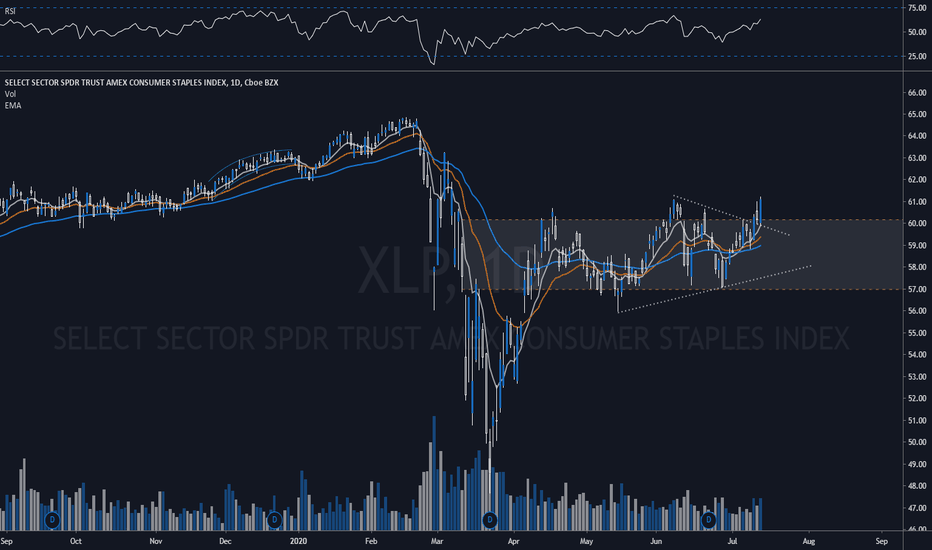

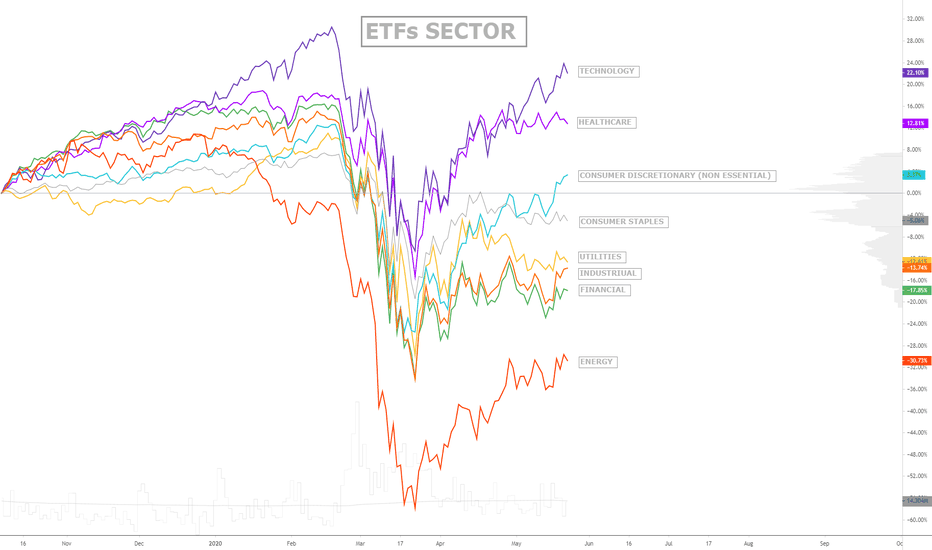

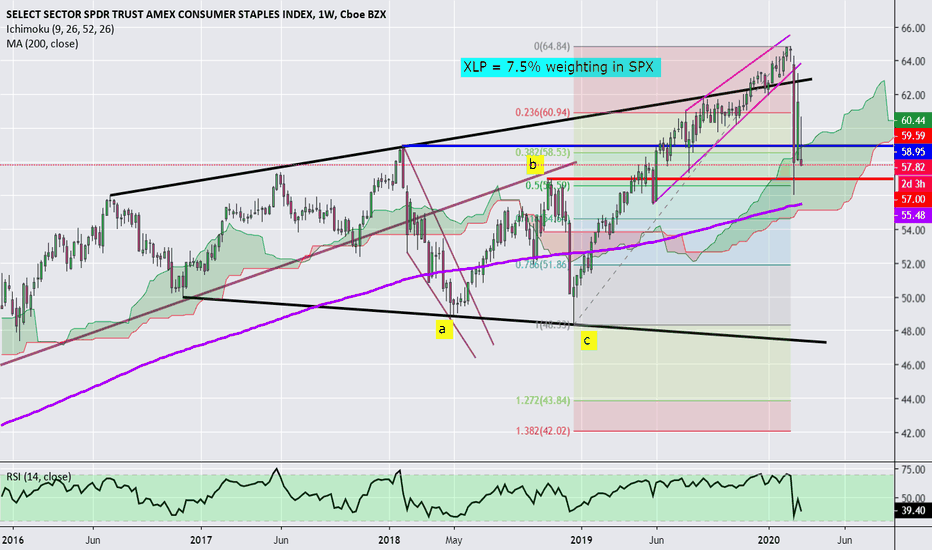

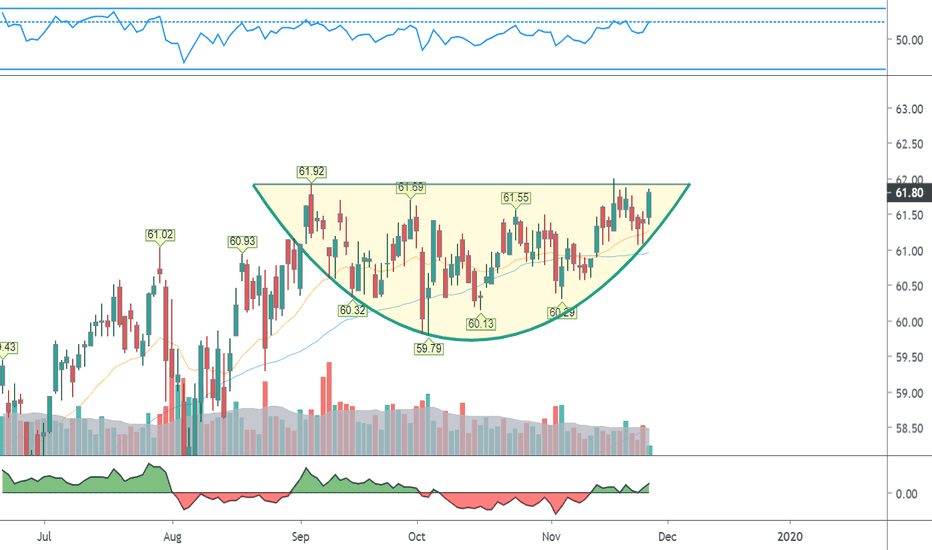

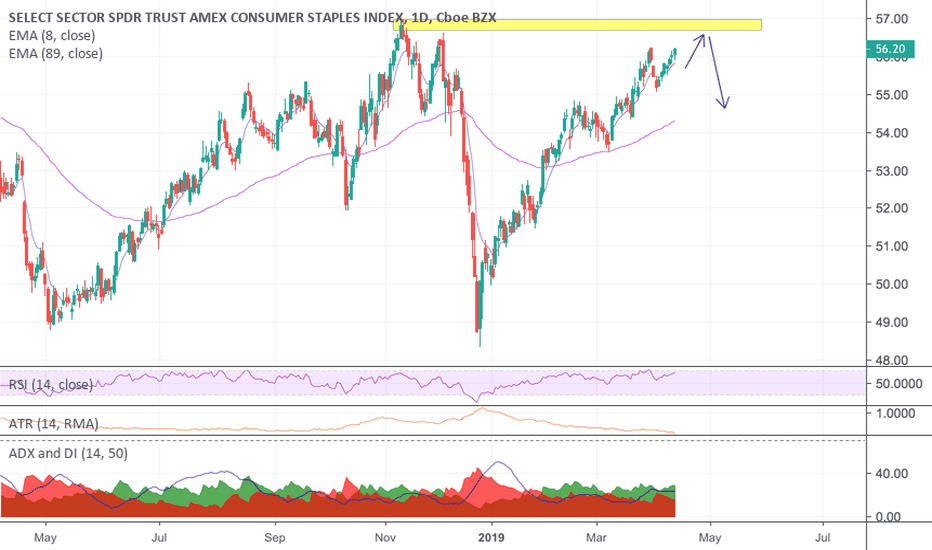

With economic data starting to sour, I don't really want to be in equities. But with more liquidity coming, I don't really want to be out of equities, either. My solution is to hide out in metals and consumer staples. A fall-off in mobility will be bad for nearly every sector of the economy, but it should be bullish for consumer staples and grocery store stocks, some of which report earnings in the next few weeks. That makes the consumer staples sector a natural safe haven as California recloses and frightened consumers stay home. Consumer staples also pay dividends, and they're a little more reasonably valued than technology, which is the other sector that might conceivably benefit from reclosing. As you can see on the chart, staples recently made a bullish trend line break (which I alerted before it happened), and they have continued to strengthen since.

XLP trade ideas

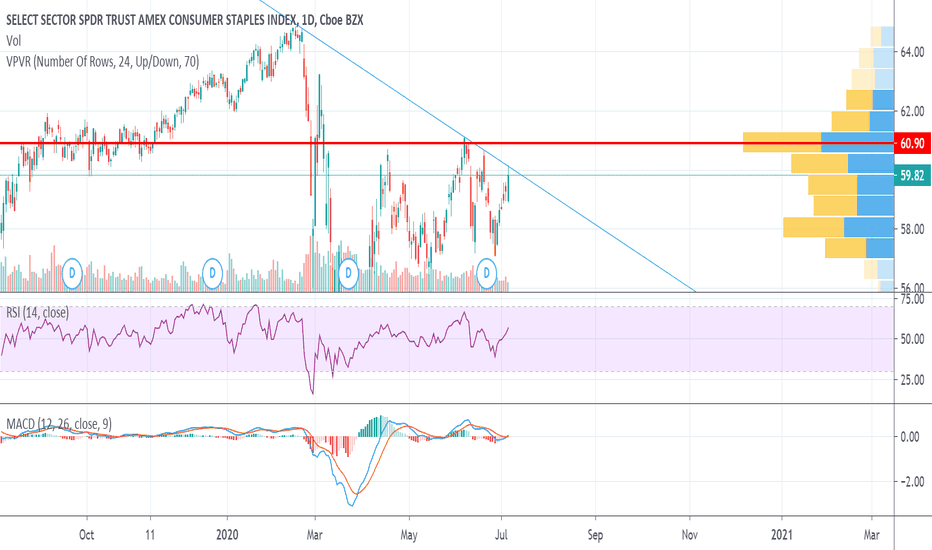

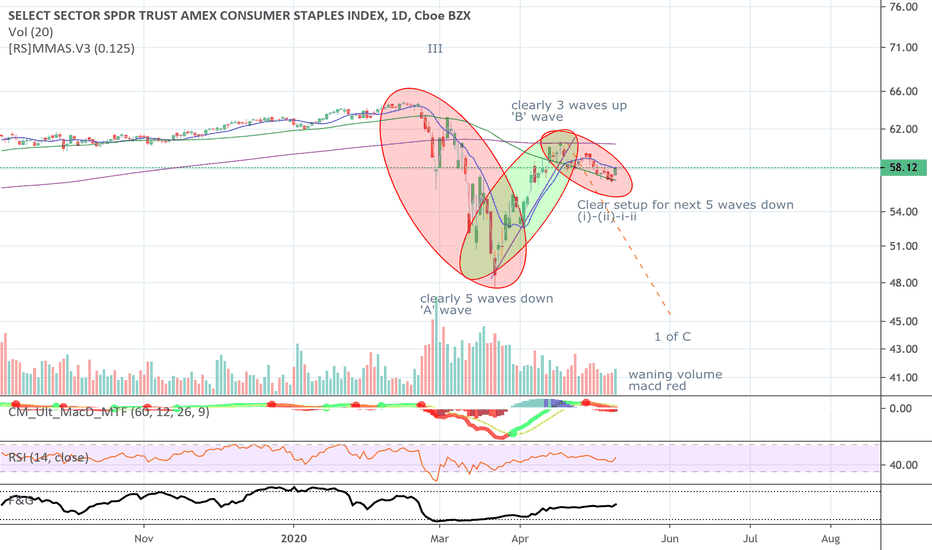

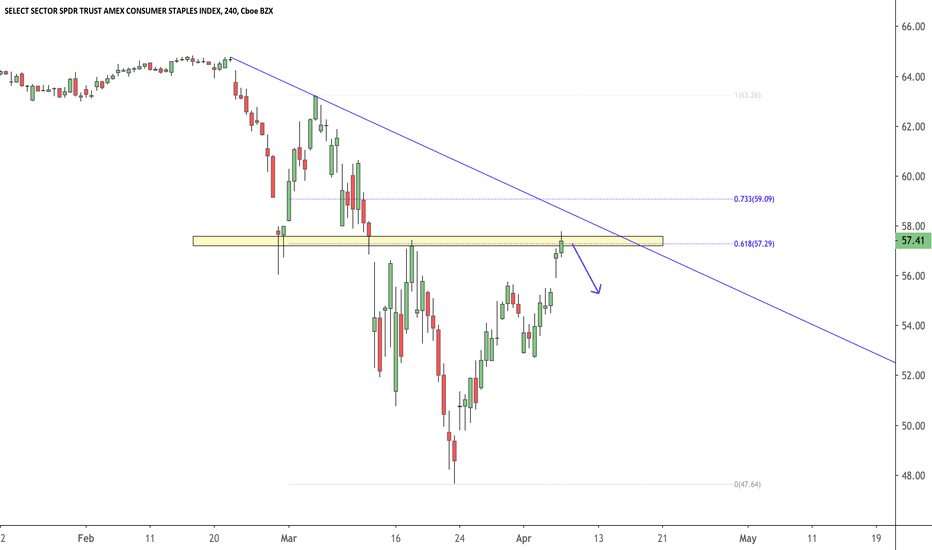

Consumer staples testing trend line on reclosing & stimulus newsConsumer staples tested and got rejected from a critical trend line this afternoon. The sector has been strengthening due to demand for groceries as economies reclose. Today it also got a bump thanks to news that people with incomes less than $40,000/year may get a second round of stimulus checks. This ought to help juice consumer demand a little. I've also been impressed with the staples sector's performance on earnings reports so far, and I'm expecting the sector to continue to beat analyst expectations.

The staples sector has been beneath a downward sloping trend line since February, but it has tested the trend line three times in fairly rapid succession and may be gearing up for a breakout. I've set an alert on the trend line and will be watching for a cross with good volume as my buy signal.

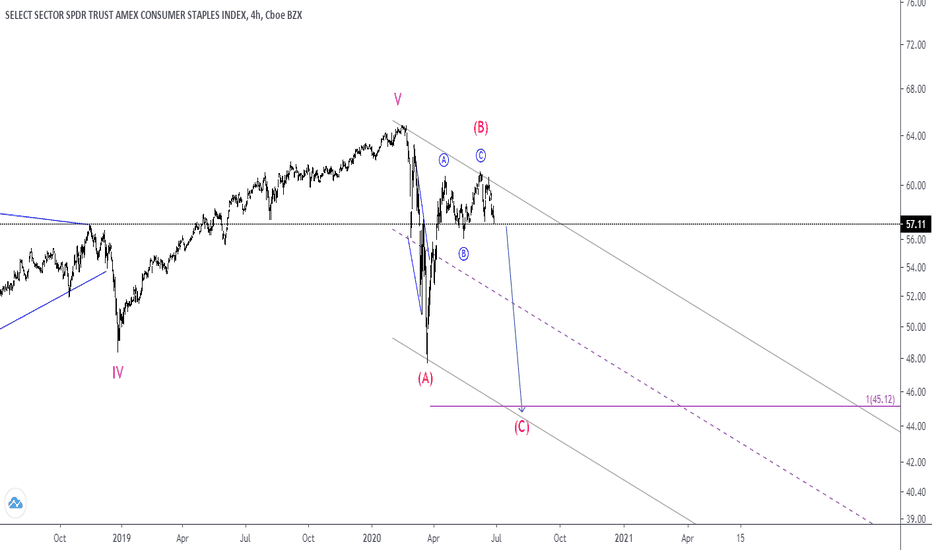

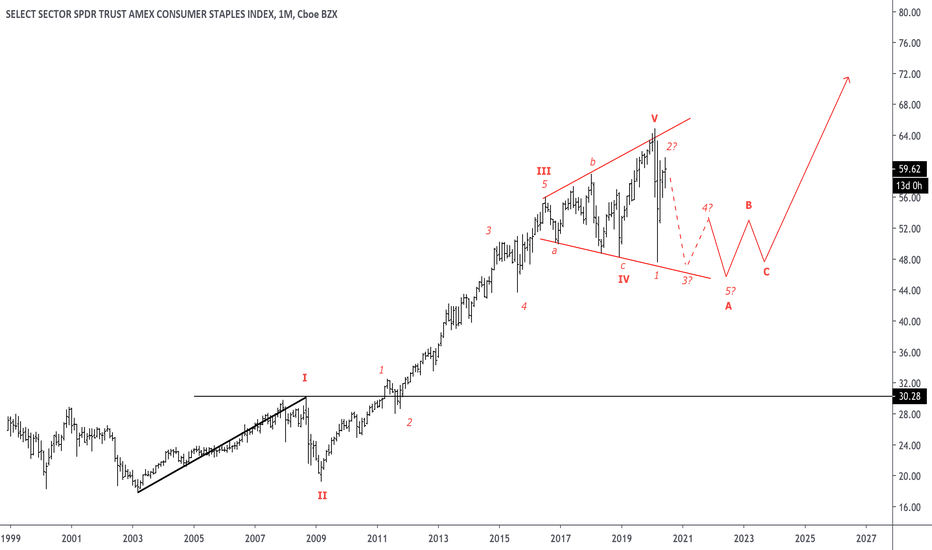

ridethepig | Consumer Staples (Chapter 2)The following diagram illustrates the breakup of a globalisation advance:

Since the retrace in VIX has found a hard floor into the 25 lows, we may characterise the advance as an endgame for our economic cycle purposes.

Now the erroneous nature of Volatility advancing can be seen. The effect of demobilising the consumer will weigh heavy on Equities, not to mention how companies position capital more defensively going forward.

Consumers are uncomfortable (at least from Q3/Q4 onwards) right on time for the stimulus to fade.

The following swing, which will also be quoted in the previous leg in DAX is another example. I will go over the flows briefly at this point:

Equities have now lost all sense of reality, the concussion in addition to Fed conceding far too much mobility; so this may rightfully be classified as the end of an economic cycle, or at least until capitalism returns from its sabbatical.

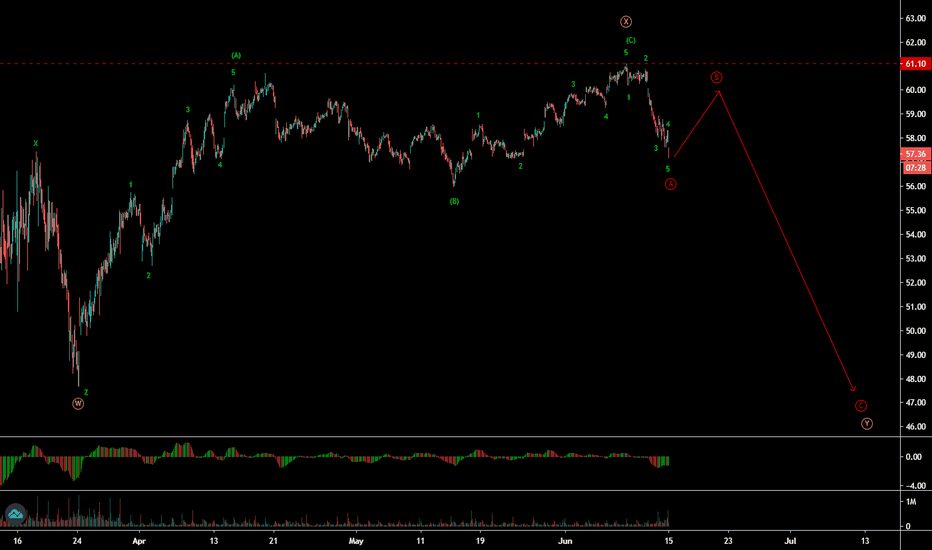

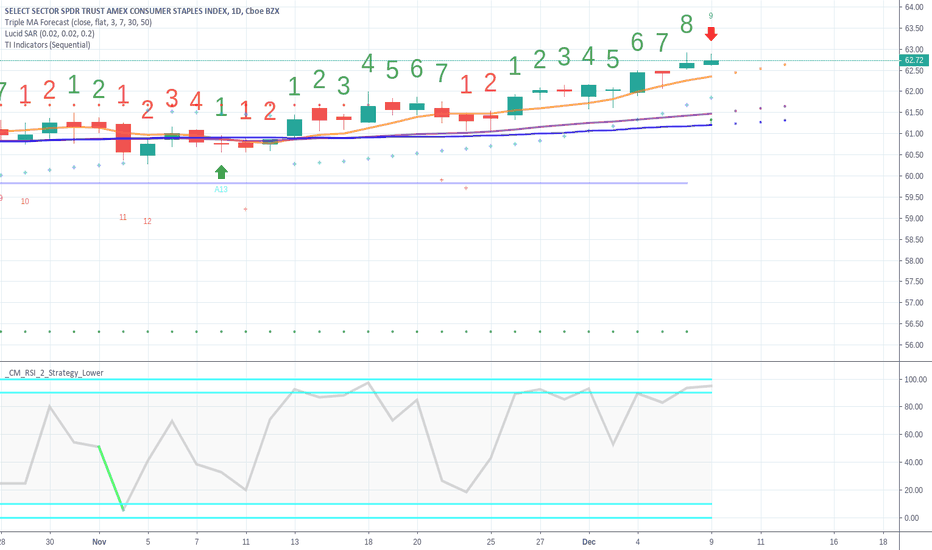

XLP - ABC wave patternXLP : Price action confirmed bearish cycle on the way after completing simple ABC in (X) wave. It started moving down in (Y) wave, So bounce can be used to sell for Y wave.

It dropped in five wave A today along with SPX and other sectors, so pull back of wave B will be good sell for C down. Wait for 2-3 days to pull back in wave B.

Clear as mud or crystal clear?Are you dizzy and nauseated by the market action this week?

Are you a bear feeling like you are a wreck and on the wrong side of the camp?

Are you a bull feeling like the 'V' shaped super recovery is grinding into high gear?

Well, that's how bear market rallies are supposed to make us feel.

It's dizzying because of the divergence.

It's nauseating because of the high magnitude moves in both directions.

Bears feel rotten because the market wants us all expelled.

Bulls feel fantastic because the market needs to reel them all in until the last moment.

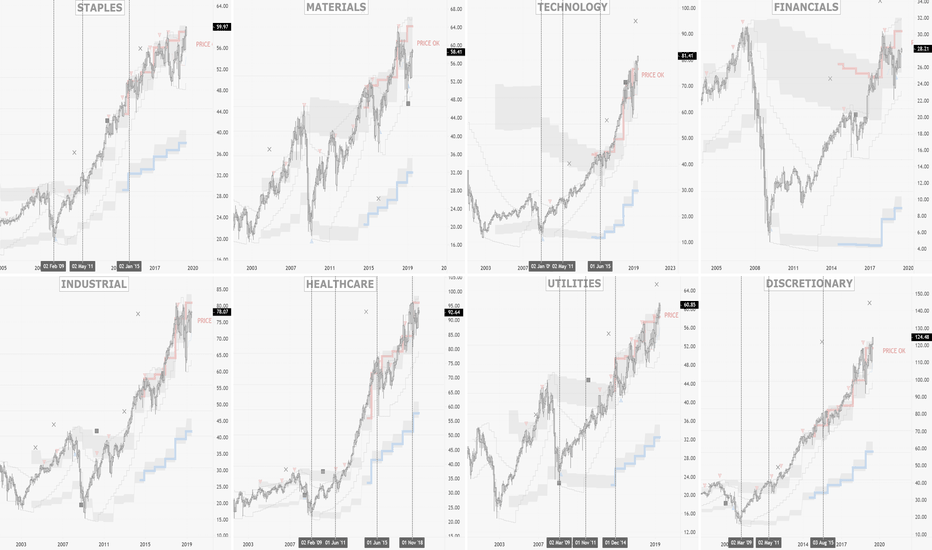

Every sector is clear as mud except for this one.

XLP tells me, I have made an impulsive move down, clearly in 5 waves,

I have made a powerful corrective rally, clear in 3 waves.

I have started setting up the next impulsive move down, so be prepared.

The big boys have fooled most of us and are about to hit EJECT.

Good luck all!

XLP - trade for the reopening of the economy If you don't want to pick food stocks this stock has 6 industries in it. Beverages Industry, Food & Staples Retailing Industry, Food Products Industry, Household Products Industry, Personal Products Industry, Tobacco Industry. This is everything everyone horderd or business that needed to shut down that will need to reorder once open. I see a nice move in this coming soon if we get the go ahead to open over time.

XLP - when staples down as much as market you know it's troubleSimilar story to Utilities

When defensives are down as much as the market (-5%) you know you are in trouble

Again, I would have to say this seems like throwing the bay out with the bath water type of investor selling (indiscriminate) so we may be getting closer to a short term oversold low

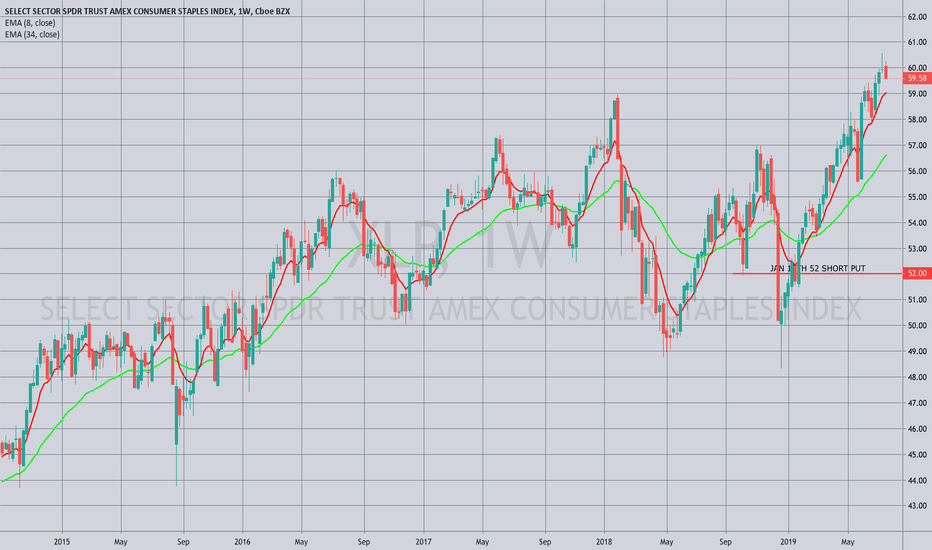

OPENING (IRA): XLP JAN 17TH 52 SHORT PUT... for a .40 credit.

Notes: Another "not a penny more" short put with a resulting cost basis of 51.60/share if assigned. As with my XLU and HYG not a penny mores (See Posts Below), will look to roll "as is" for a credit on at least a quarterly basis until assigned or that's no longer productive. Current yield of 2.99%; $178 annualized on a one lot ... .

This trade kind of rounds out what was on the remainder of my IRA shopping list which has focused on dividend yielders like IYR, HYG, XLU, and XLP. I'm already in IYR covered calls and in HYG and XLU short put plays.

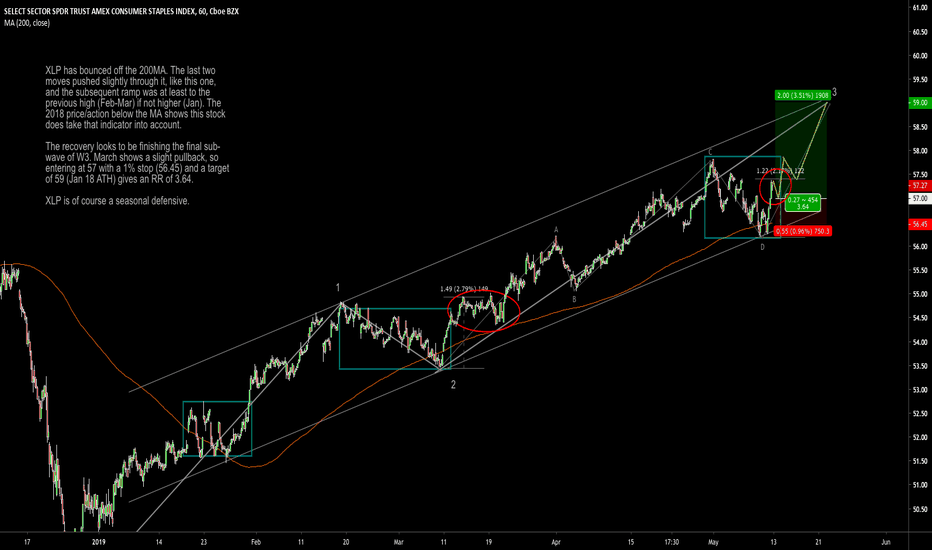

XLP 200MA Trade and Seasonal DefensiveXLP has bounced off the 200MA. The last two moves pushed slightly through it, like this one, and the subsequent ramp was at least to the previous high (Feb-Mar) if not higher (Jan). The 2018 price/action below the MA shows this stock does take that indicator into account.

The recovery looks to be finishing the final sub-wave of W3. March shows a slight pullback, so entering at 57 with a 1% stop (56.45) and a target of 59 (Jan 18 ATH) gives an RR of 3.64.

XLP is of course a seasonal defensive.

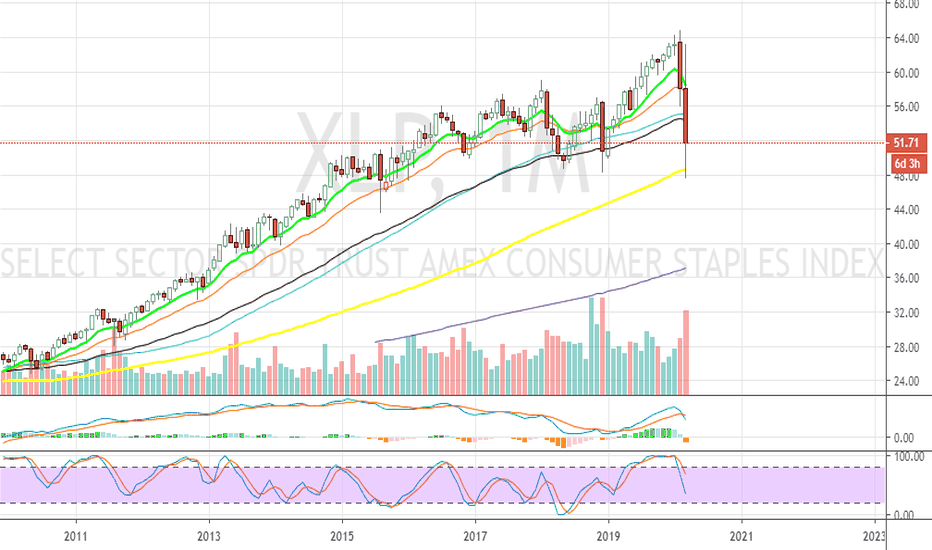

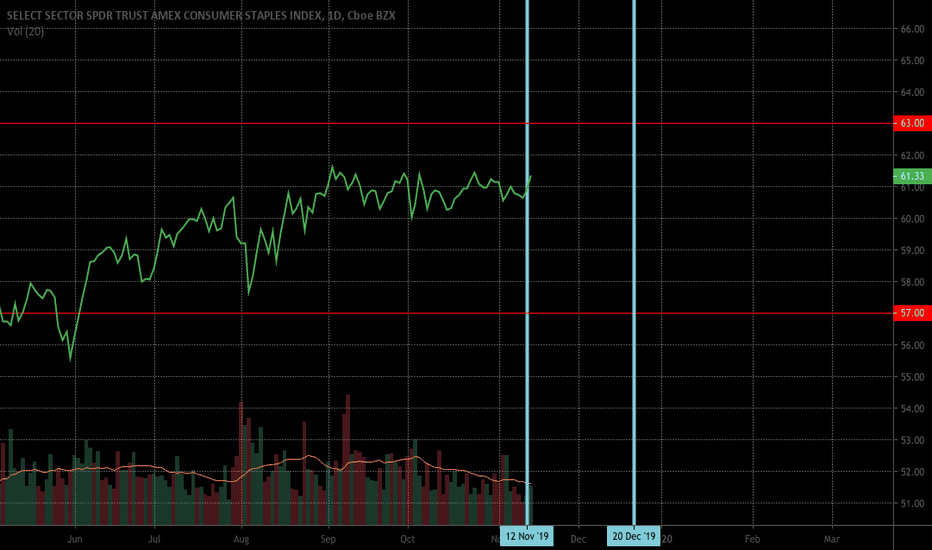

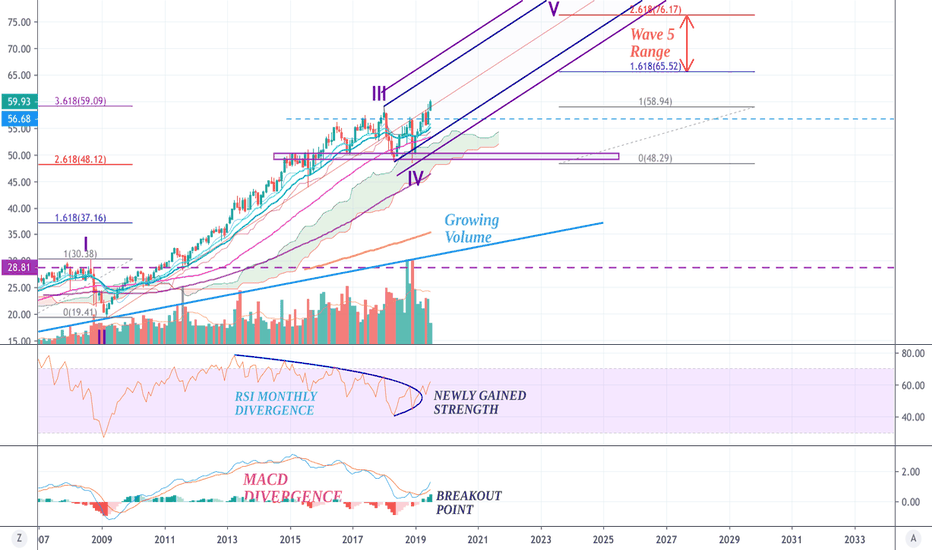

EPISODE 8/11: US CONSUMER STAPLES:WAVE+CHANNEL&INDICATOR TA(XLP)Episode 8/11 : US (SPX) Sectors Technical Analysis Series - 18th of July 2019

Brief Explanation of the chart:

XLP : Consumer Staples has relatively been one of the worst performing sectors since the last recession. However, recently due to the many uncertainties in the economy(US/CHINA Trade relations), staples have performed quite well (+18.1% for 2019 so far) .

Moreover, this newly found bullish strength can be observed in the Monthly breakout from the RSI/MACD divergence . The potential upside would be in the range of 65-75$ based on Wave 5 variations . There is one major structural support which is marked by the purple square( range of 48-51$) .

Key note from this technical analysis is the growing volume, which can be an indication of several factors. The most outstanding factor to me would be the recent growth in volume . This means that there is an increasing number of investors who are looking for "defensive" stocks that primarily constitute the staples sector. Obviously, this is not a good sign for the future of the economy.

This is just a brief "free" and very detailed analysis. Perhaps in the future I might form a premium group, to whose members I will provide all the details of my research.

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and get informed in the greatest of details, every thumbs up or follow is greatly appreciated !

-Step_Ahead_ofthemarket-

Check my Previous episodes on the US Sectors:

EPISODE 7 : US CONSUMER DISCRETIONARY( XLY) :

EPISODE 6 : US MATERIALS ( XLB ):