Crypto Market - 1 month (30 days) left until #ALTSZN endsSometimes, the market forces you to take a pause. The last few weeks have been exactly that for me. Health issues knocked me off my game, and my first thought, of course, was that it was due to the nerves and immense responsibility of this public #AltsznLive experiment. But after some self-reflection, I realized - it's not the trading stress. I've been in this game for 11 years and learned how to handle the pressure long ago.

This experience only reminded me of the most important rule in our profession: the ability to take a step back. To step away from the charts, to rethink your strategy, to do something completely different. Over the years, I've taken such breaks many times, and each time I returned stronger, with a clearer vision. And this latest pause has led me to some profound thoughts that I simply must share with you.

Everyone is searching for a Holy Grail in indicators, signals, and other people's opinions. But the only true grail is found within yourself. Success in trading is a direct consequence of deep and brutally honest self-analysis.

In February of this year, I decided to tackle a big task: completely updating my educational Academy. This has always been a point of growth for me - structuring knowledge, learning new things. I created a detailed course plan, wrote down all the current relevant topics, and when I got to the section on "AI Agents," I stopped. And I disappeared. I went down that rabbit hole for four months, completely absorbed.

I realized that the old format of education no longer works. It doesn't even inspire me anymore. So, I postponed the Academy update indefinitely. Instead, I focused on AI Agents. I saw in them not just a topic for a lesson, but the future - an army of personal assistants that can radically improve efficiency. I started creating them for myself, for my tasks, for my analysis.

And I don't plan on stopping. In the coming bear market, I will dedicate even more time to this. Perhaps, a completely new, previously unimaginable format for the Academy will be born from this. I won't be publishing detailed content about the development process, but I will certainly share the most interesting developments with my community.

Why I Still Believe in September

This final push, which I've called "Altszn Live," fits perfectly into the market vision I formed long before it began. My core thesis remains unchanged: I believe the current growth cycle will end in September 2025. As in, next month.

Right now, amidst the rally, I'm getting a flood of messages telling me I'm wrong, that the real altseason will be pushed to Q4, that everything is just getting started. And you know what? Maybe they're right. I fully admit that I could be wrong. I'm not trying to win a prediction contest. I won't get a medal for being right, and I won't be devastated if I'm mistaken - in 11 years, I've been wrong thousands of times, and there's nothing terrible about it.

But I trust my system and my analysis more than the market noise. I will exit my positions in September and I will not re-enter the market until the end of the year, even if it goes to the moon. This site is called TradingView. A place where people share their vision. And this is my vision. The market is a living, pulsating organism. And I am here to study it, not to prove that I am right.

A Deep Dive into Aptos ( AMEX:APT )

So why am I betting on it again, on the supposed "loser"? Let's break it down.

- The Counter-Argument and My Rebuttal: Yes, in the L1 narrative war, Aptos lost to SUI. Yes, it has complex tokenomics with constant unlocks that put pressure on the price. I see all of this. I am not betting on the obvious favorite. I am betting on market inefficiency.

– The Entry Point: In trading, what matters is not just being right, but the price at which you enter. And right now, the entry point for Aptos looks far more attractive and safer to me than many other "overheated" projects that are already on everyone's lips.

– The Behavioral Pattern: Aptos is slow. It's always late to the party. It doesn't lead the charge. BUT. When it starts to move, its growth becomes abnormally strong. Every single correction, no matter how small, is bought up instantly and aggressively. It just goes up, and up, and up. That's how it was last time. I am betting that the psychology of major players and the behavior of this asset have not changed.

– The RWA Conviction: I will be blunt. I am deeply disappointed in 99% of altcoins. The more I research, the more I understand that most of these tokens are useless and provide no real value. My long-term conviction lies in the tokenization of real-world assets (RWA). And Aptos is one of the TOP 3 blockchains leading this narrative.

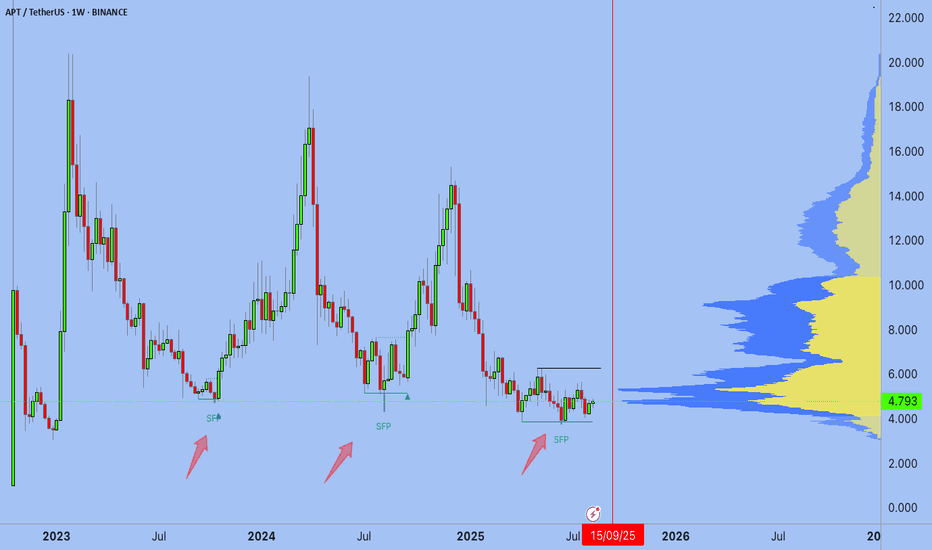

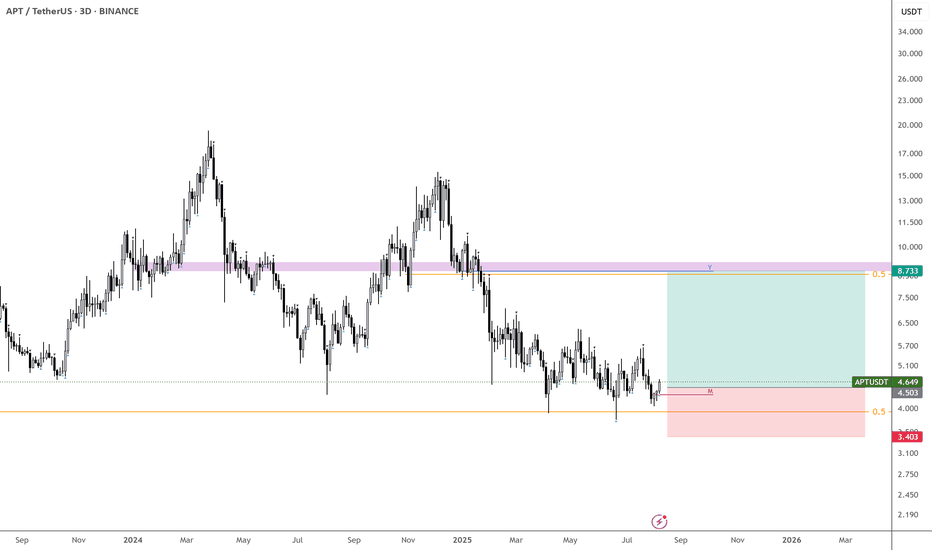

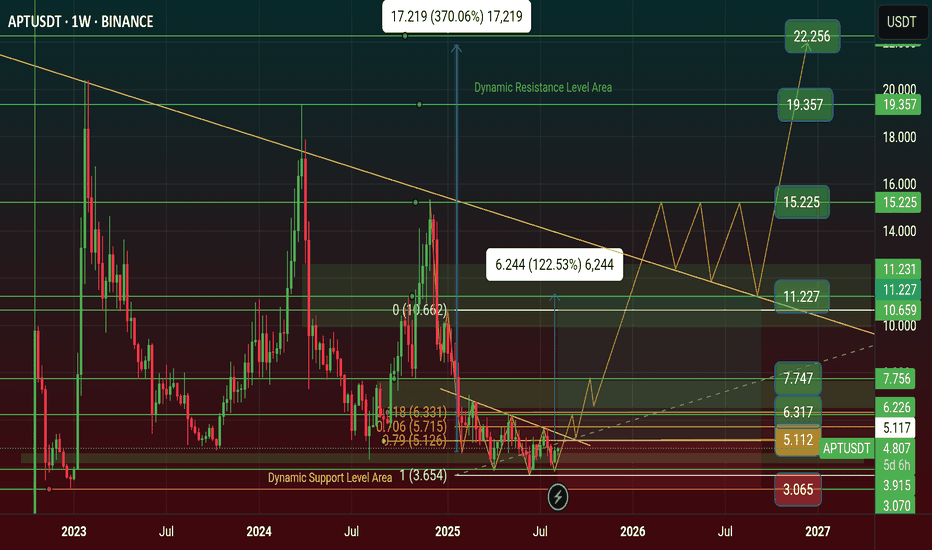

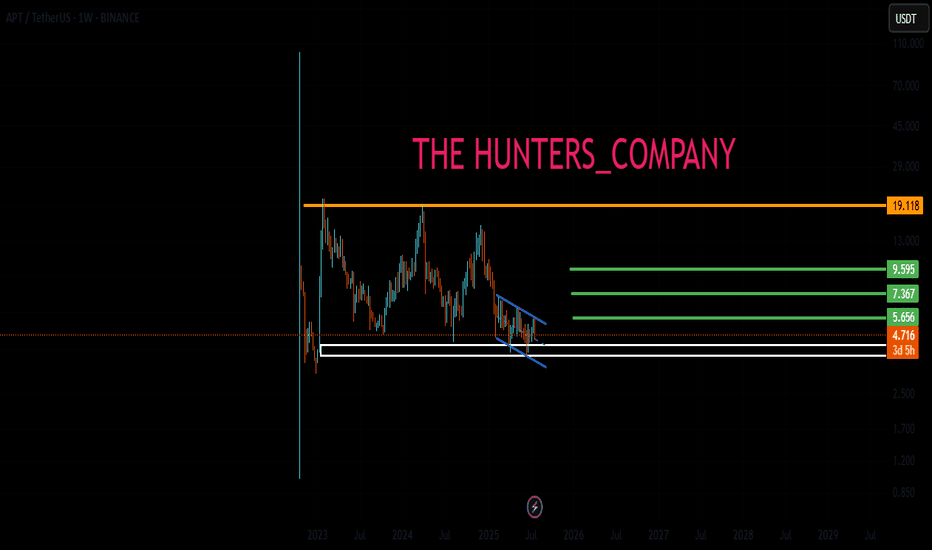

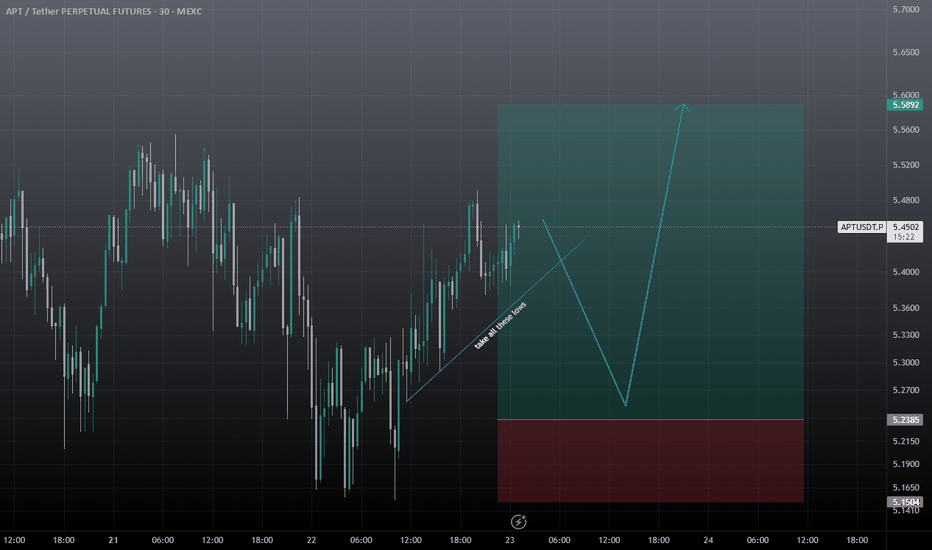

Technically

- Unverified SFP

- APTBTC potential reversal

- APTETH I don't see any signs of a reversal

- APTUSD in my area of interest

- after the 6.25 break a rally should start

Fundamental:

Aptos is a project with extremely high potential but with corresponding risks. It can be described as a "blue-chip venture bet." The technology, team, and investors are top-tier (10/10). However, the weak and initially non-transparent tokenomics (4/10) is a major deterrent.

The project is fairly valued by the market as a high-risk, high-reward asset. It is not a "hidden gem" due to its fame, nor is it a "scam," given its strong fundamentals. It is recommended for consideration as part of a diversified portfolio for investors with a high risk tolerance who are betting on the team and the long-term adoption of the Move technology.

I plan to hold all my spot and futures positions until September 13th.

Let's see together how it plays out.

What's Next?

Many of the coins I've mentioned before - LINK, ETH, and others-have already taken off. I am intentionally not publishing a flood of ideas this season. As I said, I'm disappointed with most of the market.

After September, when I close this challenge, I will report back on the results - both the wins and the losses. And I will be sure to share my plans for what I'll be doing with my stablecoins next.

I'm not the kind of author who publishes ten posts a day. I only share my thoughts when I truly have something to say. If you're interested in my journey, my approach, and my ideas - just leave a like on this post. Follow me if you want, don't if you don't. I am here to share my analysis; that's just how it's been since the beginning of my journey on TradingView.

Much love to you all.

With love, your EXCAVO.

APTUSDT trade ideas

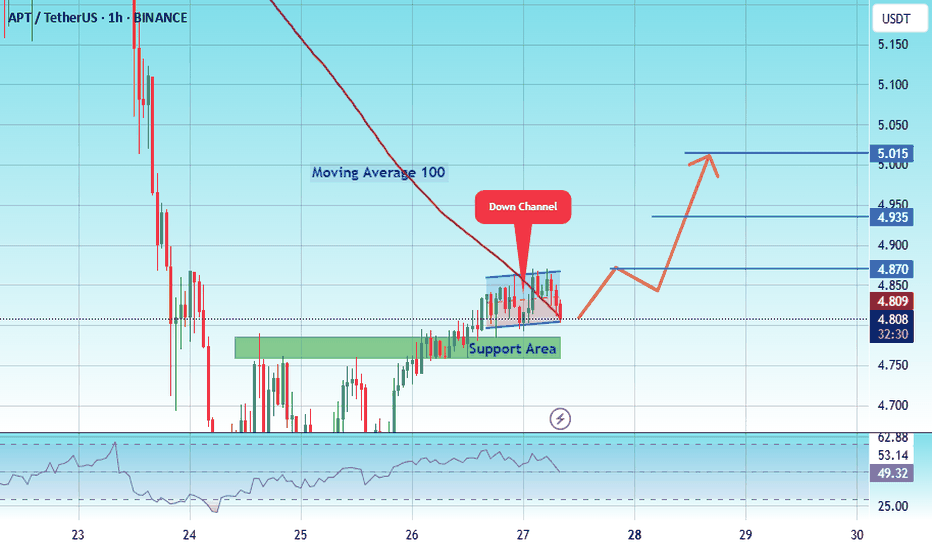

#APT/USDT Buyers Need To Establish Support Zone#APT

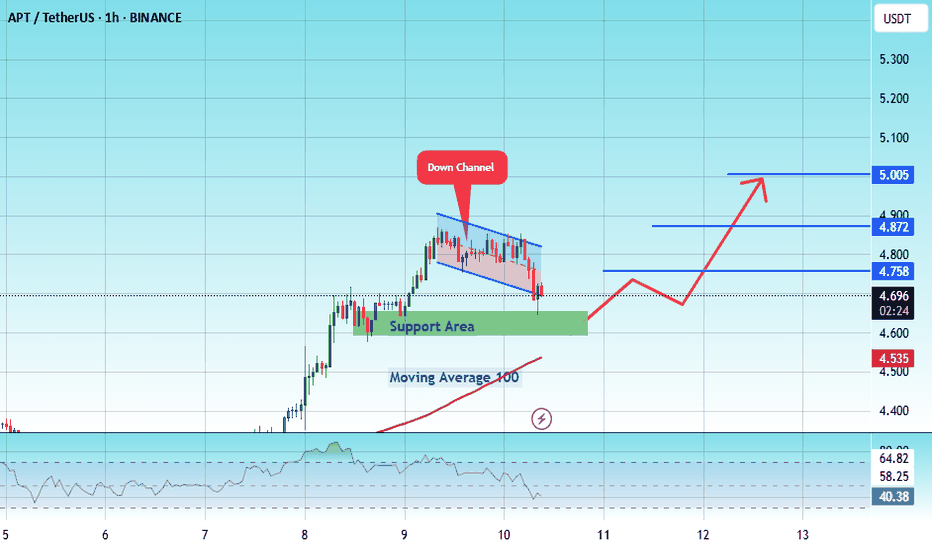

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 4.68.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 4.63, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 4.70.

First target: 4.75.

Second target: 4.87.

Third target: 5.00.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

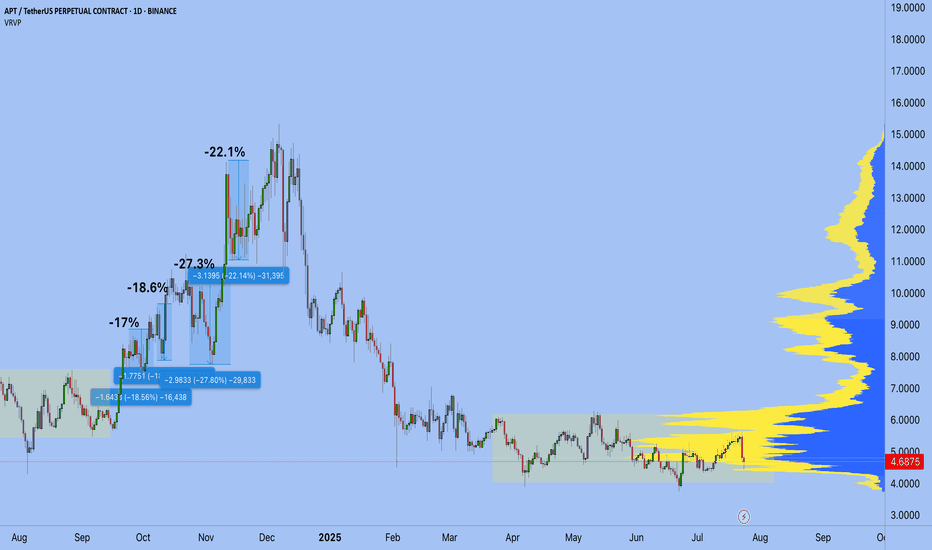

APT/USDT – Price Tests Critical Historical Demand Zone!📌 Quick Summary:

APT is now at a crucial technical crossroad. After a prolonged downtrend from its previous highs, price action is once again testing the strong demand zone that historically acted as a key accumulation area. Is this the start of a new rally, or a breakdown toward uncharted lows?

---

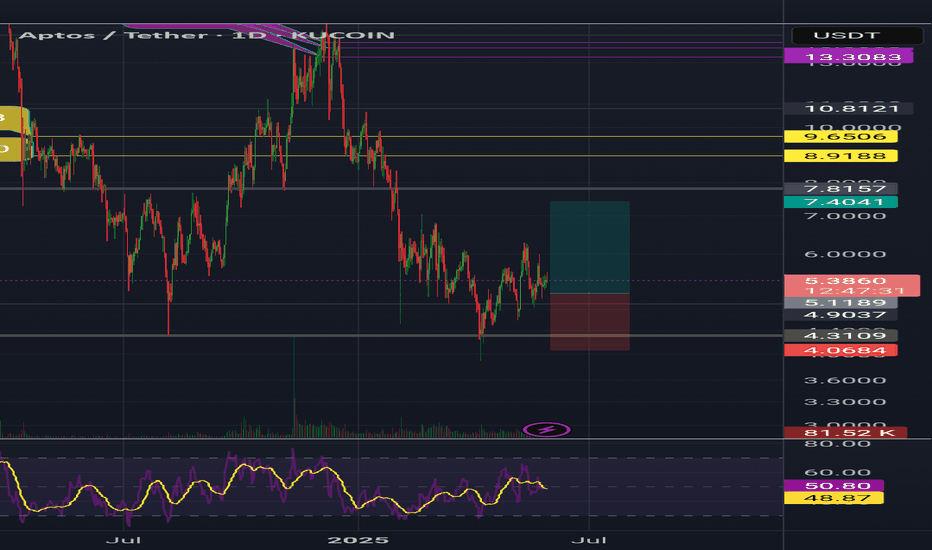

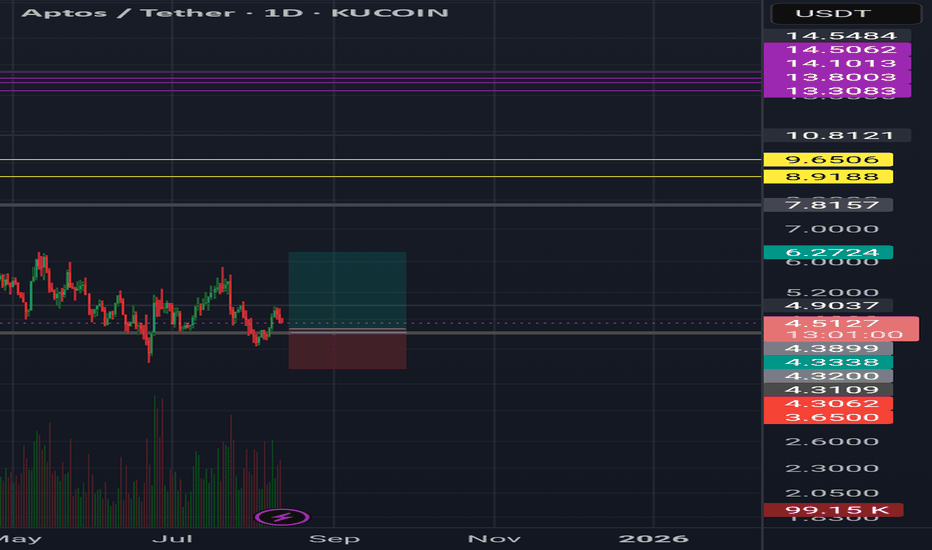

🧱 Major Support / Demand Zone (High-Value Buy Area)

📍 $3.00 – $4.50 zone has acted as a major defensive wall since early 2023. This range represents a high-interest area for smart money accumulation, as shown by multiple strong rejections in the past.

> 🔎 Note: If this zone fails to hold, the long-term structure will flip fully bearish.

---

🧭 Key Resistance Levels (Bullish Targets):

These levels will act as challenges in any bullish recovery:

🔹 $4.49 – Minor resistance, first breakout confirmation.

🔹 $5.14 & $5.86 – Intermediate resistance; breaking above signals mid-trend strength.

🔹 $7.63 & $8.50 – Critical zones where past distribution occurred.

🔹 $10.18 – $12.50 – Gateway to the upper structure.

🔹 $14.51 – $18.27 – Long-term targets, last known macro resistance levels.

---

📈 Bullish Scenario: Rebound from Strong Foundation

Bullish momentum may build up if:

Weekly candlestick closes show bullish reversal patterns (hammer, engulfing, strong wicks),

Increasing buy-side volume on H4, D1, and W1 timeframes,

Clean breakout and retest of the $5.14 – $5.86 zone.

This could initiate a new bullish leg with mid-term targets around $8.00 – $10.00, and potentially higher if market conditions improve (e.g., BTC and ETH uptrending).

> 🎯 Bullish Validation: Weekly close above $7.63.

---

📉 Bearish Scenario: Full Breakdown Risk

If the $3.00 – $4.50 demand zone fails:

Price could drop toward the psychological level of $2.80 and potentially revisit the historical low of $1.00.

The major downtrend structure will be confirmed: lower highs and lower lows.

This may signal a full capitulation phase before the next cycle begins.

> ⚠️ Bearish Risk Trigger: Weekly close below $3.00 with strong volume.

---

🧠 Market Structure & Pattern Watch:

Sideways Accumulation: Multi-week tight range consolidation suggests accumulation by smart money.

Potential Double Bottom: A strong bounce from the $3.00 – $3.50 range could form a bullish reversal base.

Volume Compression: Decreasing volume suggests a buildup phase before a major move.

---

🔮 Strategic Takeaway:

APT is sitting at a make-or-break level. The $3.00 – $4.50 zone is critical for both short- and long-term structure. For swing traders and investors, this zone offers a high risk-reward opportunity — but confirmation is key.

> ⏳ Patience in the demand zone can lead to the best trades. Wait for confirmation, not hope.

#APTUSDT #AltcoinAnalysis #DemandZone #CryptoReversal #TechnicalAnalysis #PriceAction #SwingTrading #CryptoMarket

Feeling Optimistic About $APTI know… it’s been over 8 months. And truth be told, AMEX:APT and I have had our ups and downs—especially between June and Oct 2023. Our relationship isn’t perfect.

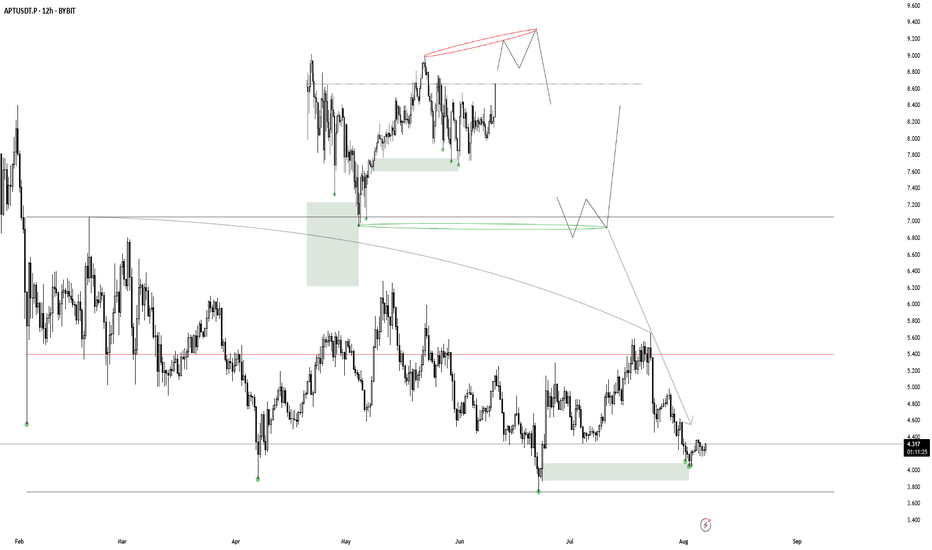

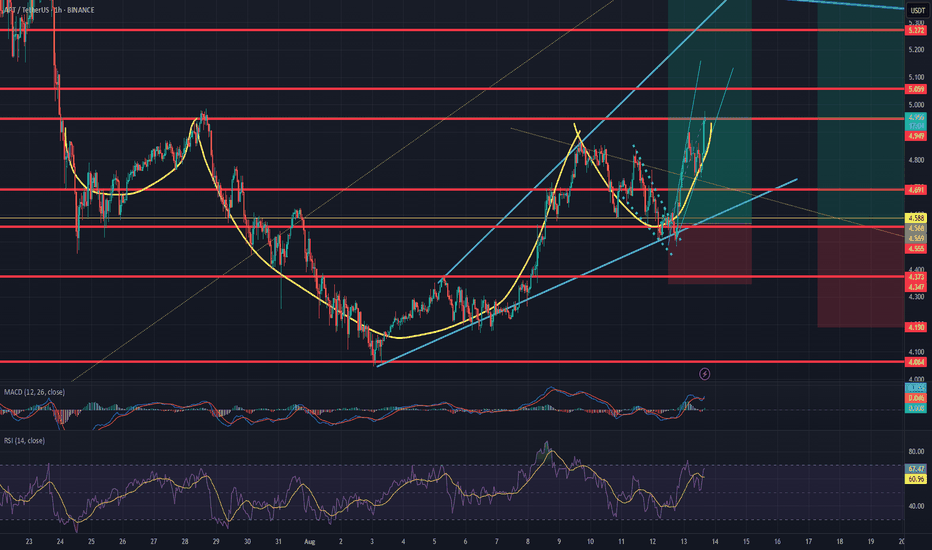

But right now? This is a great technical spot. Trend is still technically down, but we’re finally seeing signs of a reversal into a key supply zone. Worth granting a small allocation here.

Main point—just putting some attention on BINANCE:APTUSDT as the market keeps looking better and better.

Apt/usdt Bull Analysis AMEX:APT holders will be smiling very soon ❤️

AMEX:APT is forming a beautiful rounded bottom, showing signs of a potential trend reversal. 📈

I’ll be watching closely for a breakout above the descending trendline — but my entry will only be on confirmation in the marked red zone.

If it plays out, the path toward $6.5–$7.5 could be wide open. 🚀🚀

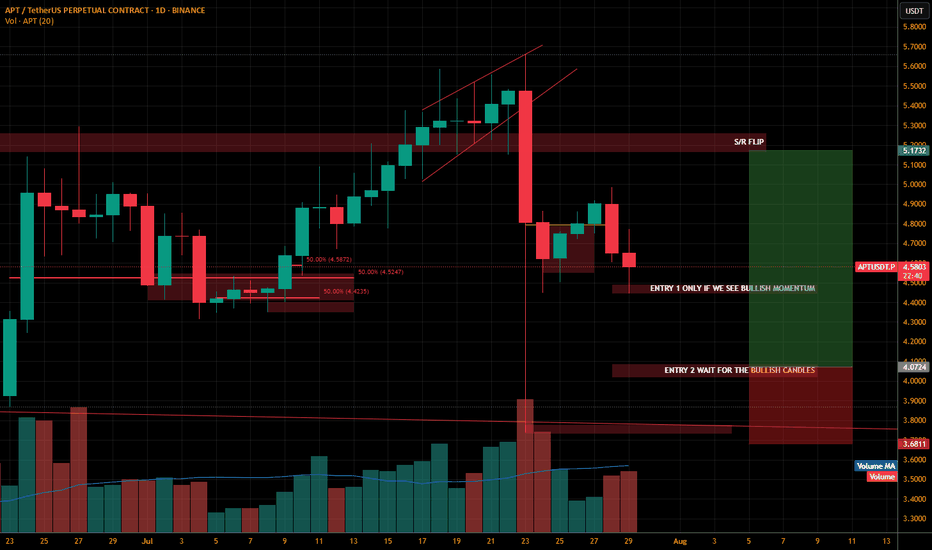

APTUSDT.PThis coin is also sleeping can be the bottom of the coin.

Lets wait for the bullish confirmation always wait.. patience is the game changer. Always wait for the confirmation on the entry level. Just dont take trade as soon the price touches the level we need to wait for the confirmation ALWAYS..

If entry 1 is solid i will update and tell you guys the t.p and s.l accordingly.

Entry 2 will be sure shot as soon we will see some bullish momentum.

Follow me guys support me to post more and more.

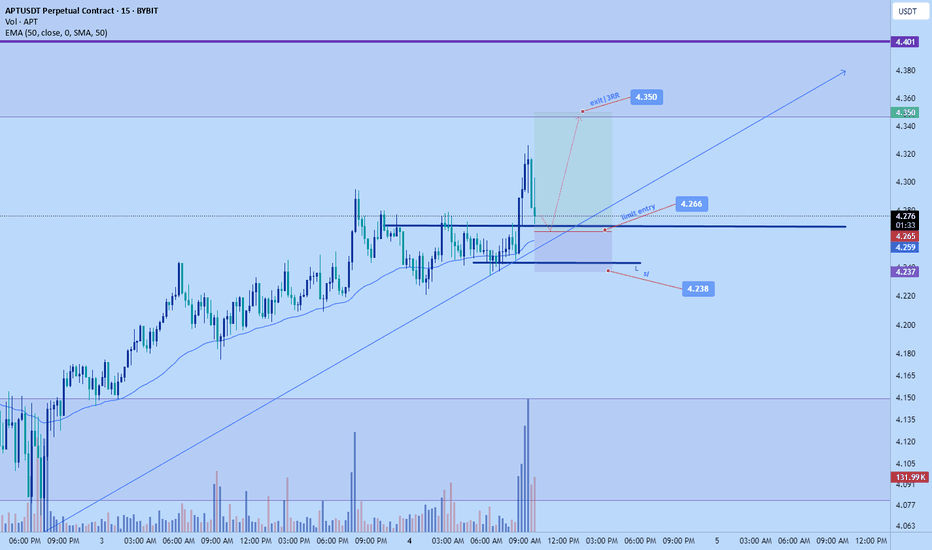

#APT/USDT Buyers Need To Establish Support Zone#APT

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on its way to break strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 4.10.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 4.05, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the Moving Average 100.

Entry price: 4.25.

First target: 4.35.

Second target: 4.46.

Third target: 4.05.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

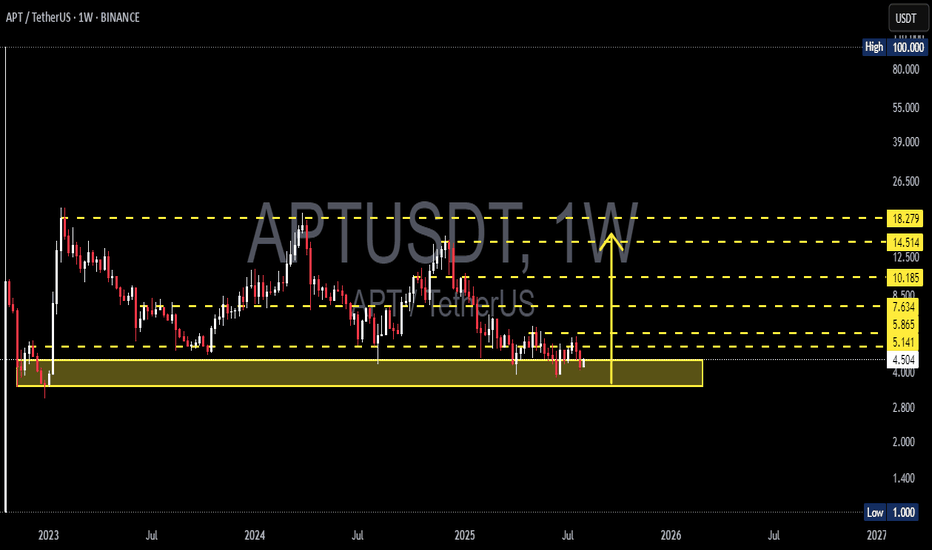

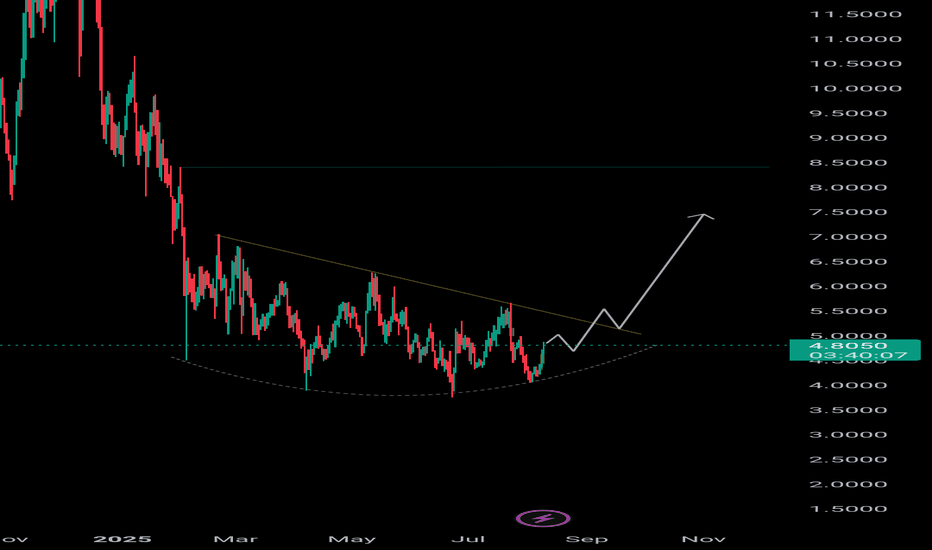

$APT Price Prediction will be reach $22 this Year 2025APT price is Showing Triple Bottom Pattern on Chart. it's a Reversal Pattern for APT price Manipulation. Time for Bull Run on APT and 12 aug unlocked 11.31M APT token and 2.20% of released supply $51.35M Dollar.

APT Price now Bottom area of Major Support Level area. At first the price will Hit $7 and if it's touch $11 price and if it's Breakout this Resistance it will be happened APT $22 Price.

🚦Aptos (APT) - 11.31M Token Unlocked worth of $51.35M - 12 Aug 2025

On 12 August 2025, Aptos will unlock 11.31 million new tokens. This event adds more APT tokens into the market supply at one time. Many traders watch token unlocks because more supply can bring price down if holders decide to sell quickly. Also, if most tokens go to teams or early backers, there might be more selling.

However, if unlocks are well planned and market demand is high, the price may not fall much. This event could be a catalyst for price change based on how the market reacts.

🚦 Aptos’ DEX trading volume reached $9 billion in the first half of the year, and the market value of stablecoins increased to $1.2 billion

PANews reported on August 12th that a Messari report showed that Aptos made significant progress in on-chain performance, DeFi ecosystem, and technological innovation in the first half of 2025. Transaction fees dropped to $0.00052, DEX trading volume reached $9 billion, and the stablecoin market capitalization increased to $1.2 billion.

On the technical side, projects such as Shelby and Decibel were launched to improve network performance. The Aptos Foundation invested $200 million to promote ecosystem development and consolidate its position as a global transaction engine.

🚦 UPCOMING EVENTS APT 11 SEPTEMBER

Total 11.31M APT Token Unlock worth of $54.51M and 2.15% of released supply

#Write2Earn #BinanceSquareFamily #BinanceAlphaAlert #APT #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks.

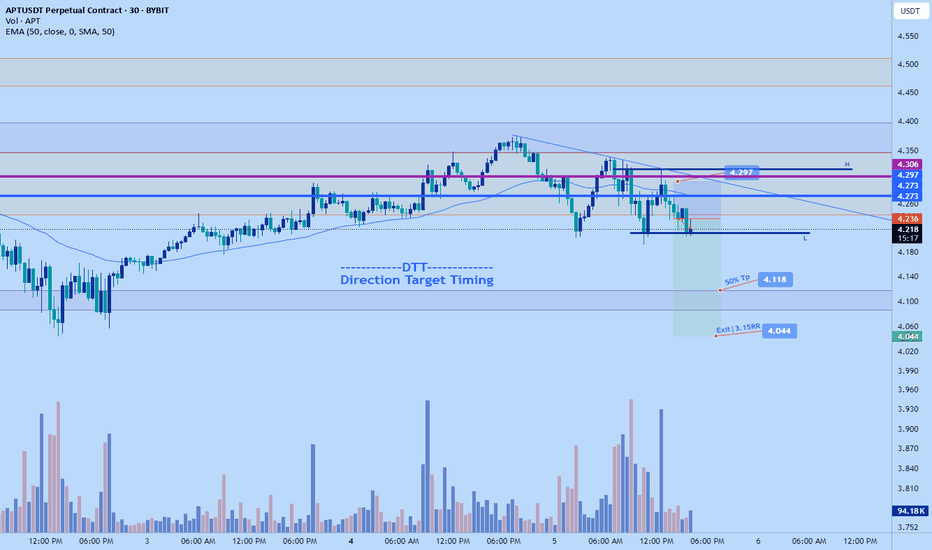

AptusApt usdt Daily analysis

Time frame 4hours

Risk rewards ratio >1.8 👈👌

Technical analysis 👇

After a correction, ApTuS is gathering energy to start an upward movement.🕰🕰

The price has fallen to the gray uptrend line.

This gray line, which acts as a support, as well as another support level marked in dark blue on the chart, have created very strong support.

According to Elliott Wave Analysis, the three-point Elliott wave pattern has ended and we are now ready to start the impulse waves.

The volume chart gives us signs that an accumulation is forming in this area.

We conclude that, considering the three factors mentioned above,

1. The price is in a strong support area,

2. The Elliott wave correction has ended, and 3. Volume chart shows an accumulation area

👇👇👇👇

Based on this, we conclude that the right point and time for a price will increase and good Risk rewards ratio ~2 for traders 👌

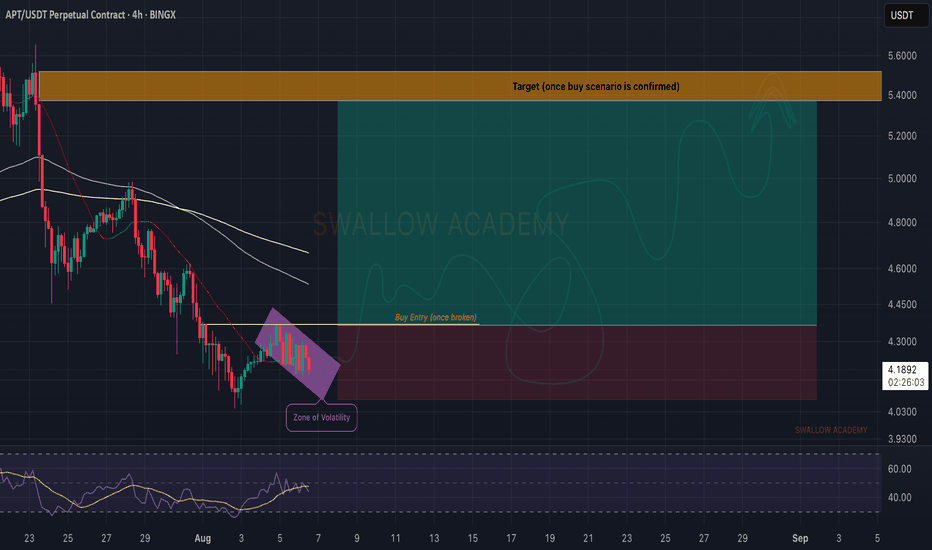

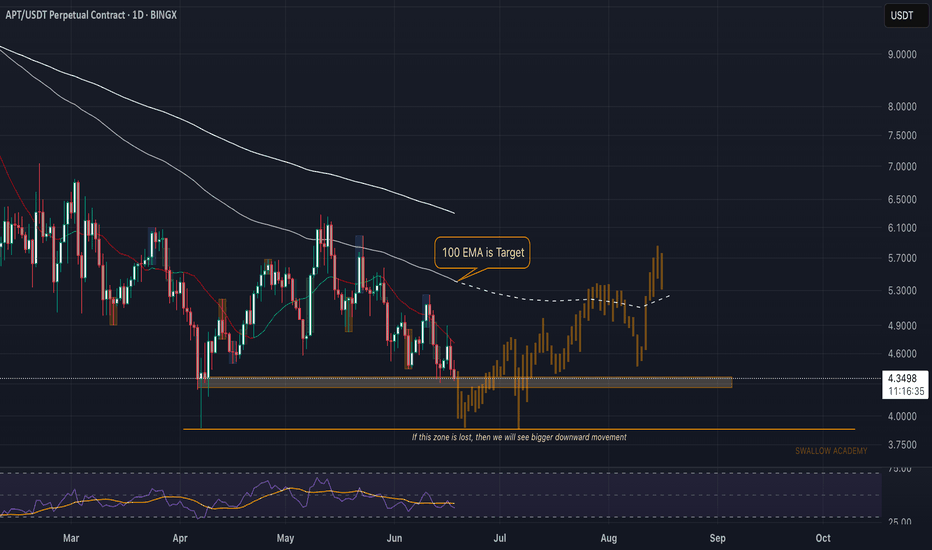

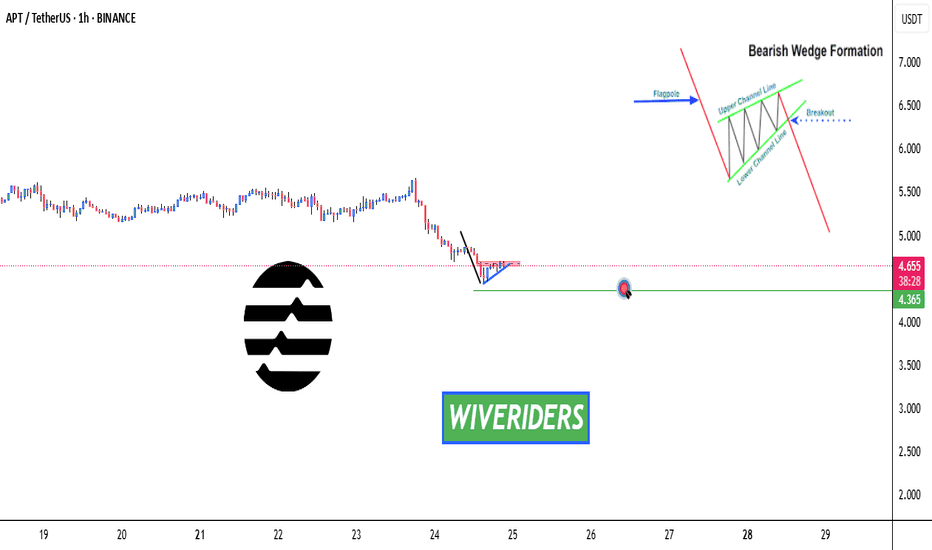

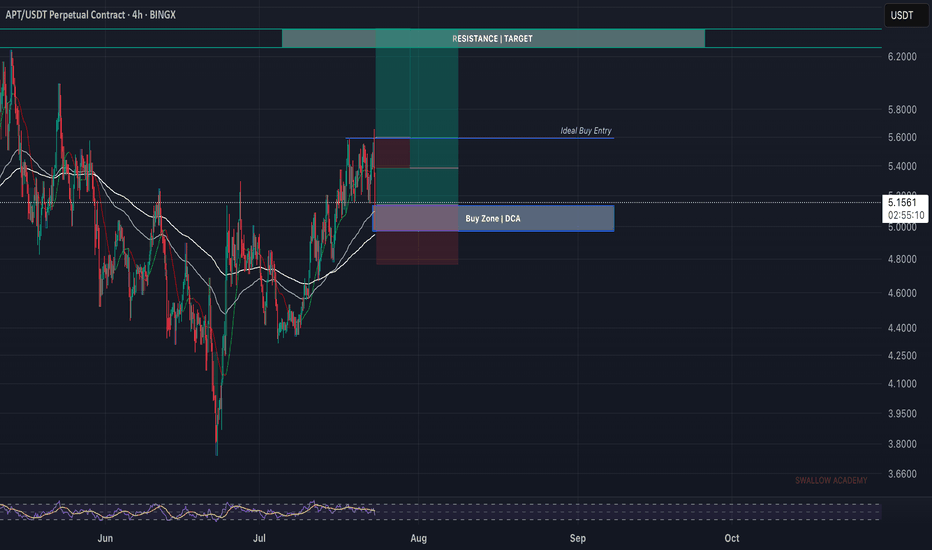

Aptos (APT): Buyers Need To Establish Support ZoneAPT is near a local support area where we will be looking now for some sort of upward bounce from here. We might see a smaller move to lower zones (towards the liquidity line below).

Now, as long as we are between those zones, we wait but overall, what we want to see is break of structure and proper upward movement towards 100 EMA.

Swallow Academy

#APT/USDT#APT

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.1560.

We have a bearish trend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.1555, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.1600

First target: 0.1640

Second target: 0.1677

Third target: 0.1719

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

APT : Long term purchaseHello friends🙌

👀You see that the price is in a range and now we are at the bottom of the range. The scenario is simple. The bottom of the range is a good buying opportunity that can be used because 80% of the failures in the range are fake.

⚠So we can buy with risk and capital management and move with it to the specified targets.

🔥Follow us for more signals🔥

*Trade safely with us*

APT Forming Bearish Wedge Pattern – Watch the Support! APT Forming Bearish Wedge Pattern – Watch the Support! ⚠️📉

APT is forming a bearish wedge pattern and is now testing the blue support trendline.

🔻 If the support breaks, we could see a move down to the first green line level.

📊 Stay alert — this setup could trigger soon. Wait for confirmation before reacting.

5/Altseason Live Psychology:My Core Principle,Learned Over Years

This experience is built on analyzing every previous altseason. And here is the main takeaway: altseasons are always short, but incredibly rapid. In this chaos, most people, driven by emotion, make the same mistakes:

- They open too many trades.

-They close a position on the first small move, hoping to "re-enter" another project that's "about to explode."

-They shift capital from a growing asset to one that hasn't moved yet. And it still doesn't move.

The problem is the mindset. You don't invest in what's falling or bet on "dark horses." You invest in what is already growing.

This might sound new to some, but the most important principle in trading, and in life, is to REINFORCE STRENGTH.

This is an attention market. And attention is captured by the speed and power of growth. Everyone is looking at what's pumping. That's where the money flows. Your job is to be in that flow, not to try and catch a falling knife.

And one more thing, the most critical rule for the next two months. I AM BEGGING YOU, DO NOT OPEN SHORT POSITIONS. Any 15-25% correction on a strong project is not a reason to short; it is your buying opportunity. Measure from the peak, and you will see these entry points. The strongest projects will correct even less. This system works.

Of course, this doesn't mean blindly buying everything that's green. You need to understand the narratives. But if your project is old and showing weakness while others are flying, maybe it's time to switch to a leader. As a subscriber wrote in the comments of my last post: in the previous cycle, SUI did a 10x, while APTOS did a 4x. This clearly shows where the market's attention was focused, and consequently, where the results were.

Best regards EXCAVO

Aptos (APT): Are We Ready To Bounce? | BullishAptos has a good chance for a reversal soon, where the price has had a proper correction currently, leading the price back closer to EMAs, which could be considered a good buying area.

Now we set 2 areas or 2 trades (call it however you want), where one is opening from the current market price, which would mean a lower leverage position with multiple entries.

And the second trade option is on upper zones, where we will be looking for a BOS, so choose for yourself which way you want to go, either a safer trade and more day trading or scalping on upper zones. Both trades are with a good R:R ratio.

Swallow Academy