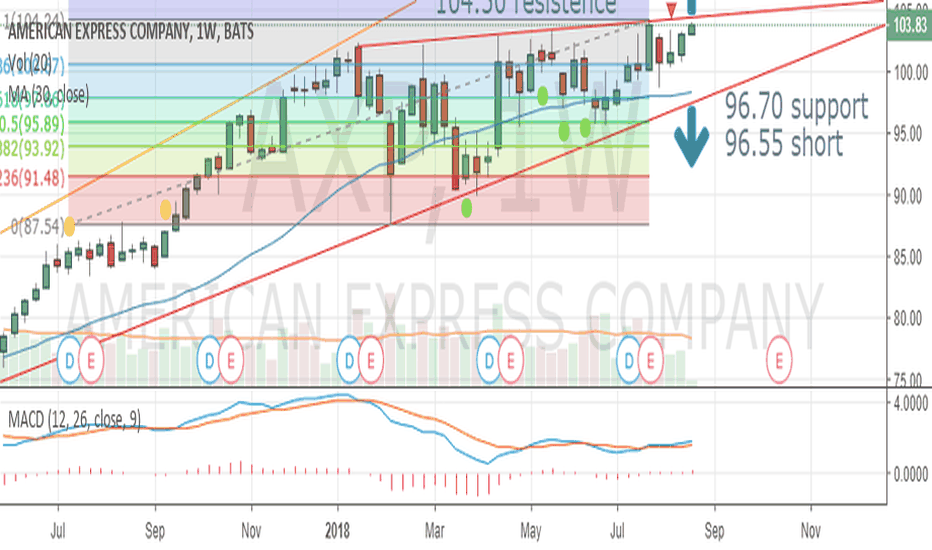

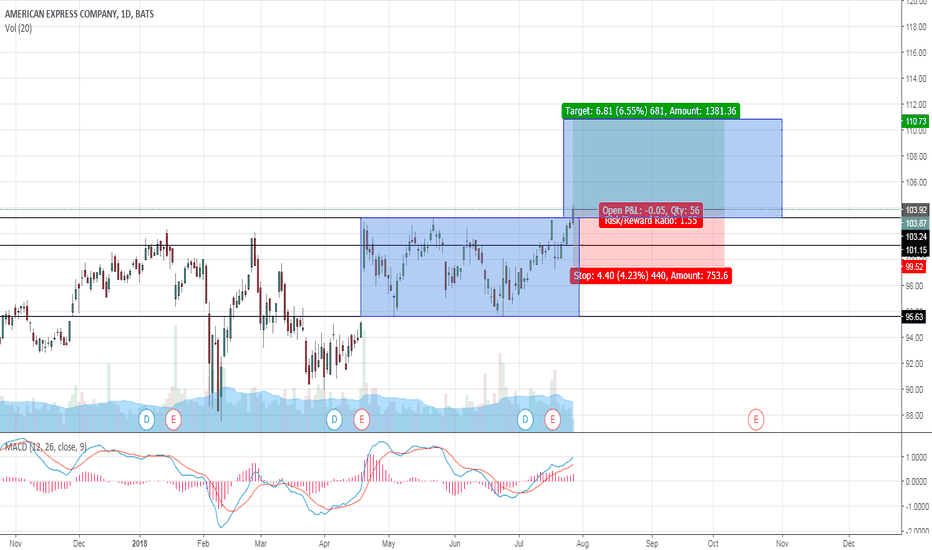

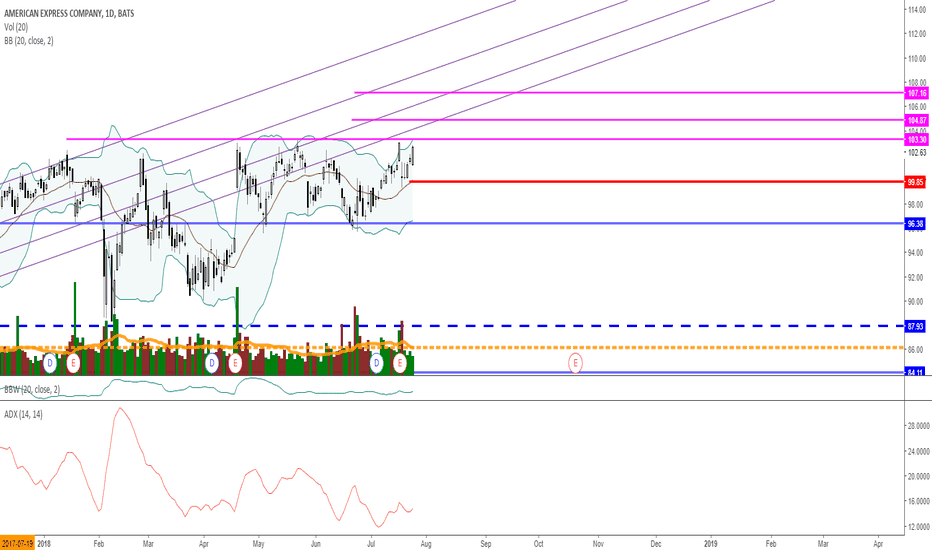

AXP testing resistance lineI see in the last three weeks have been bullish and we are testing a 104.50, resistance line tested many times dated back to 2014. There is bullish indications of current trading above it's 30 wk MA. MACD is positive, but not very large and MA cross 3 weeks ago. It all indicates that it turning bullish but not a very strong. I would like to see a greater buying volume going past 104.50 resistance line to for it to be a stronger buy indication.

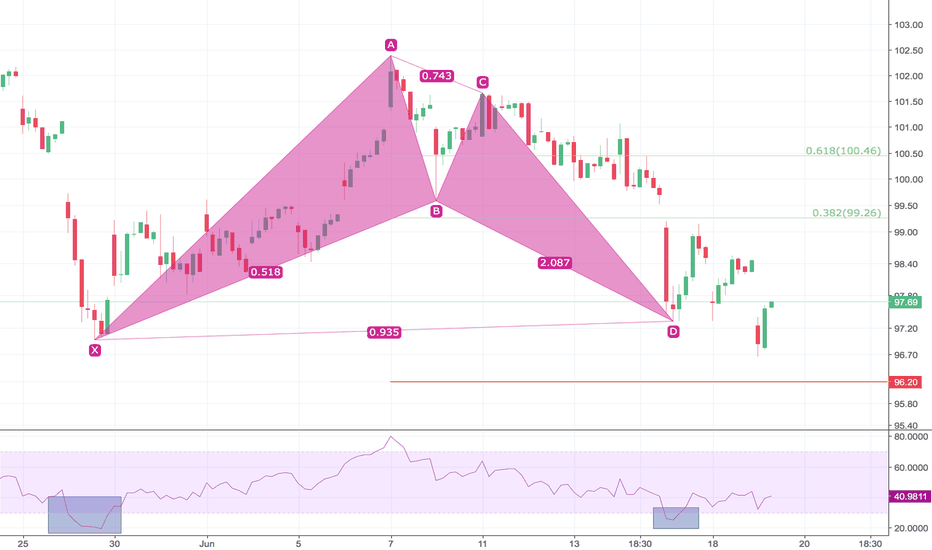

AEC1D trade ideas

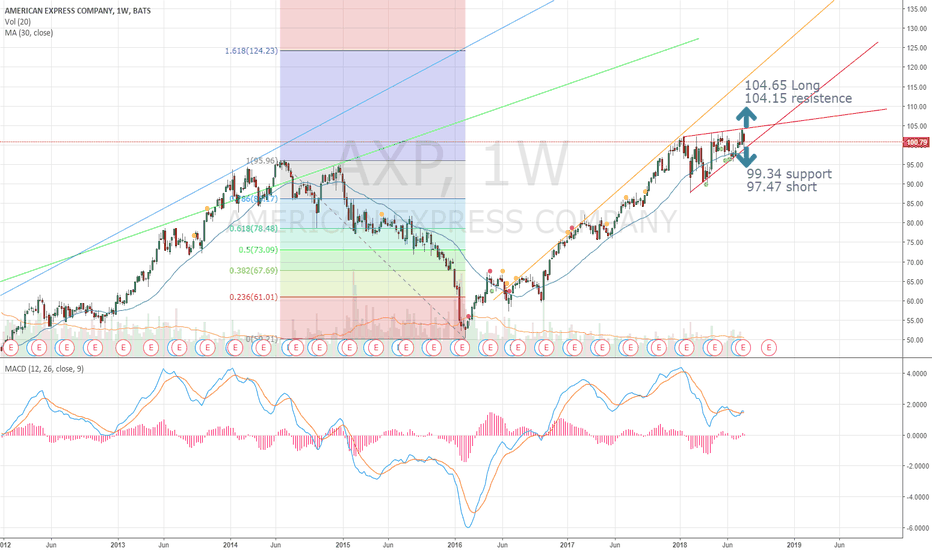

AXP approaching either a Bull or Bear LongMy techinical observations with no holdings in stocks. On the weekly MA (30) was in a bullish positive slope but steadly decreasing. The trading range has establishing a closing pendant with support at 99.34 and resistance at 104.15 for next week. Breaking of either is going to tell whether this is going to be bullish or bearish. The slow MACD currently saying bearish and will indicate bearish when trading range crosses the MA (30) 98.02. MACD is on a bearish path and area below MACD is closing along with crossing zero to go below zero belonging to bearish trading.

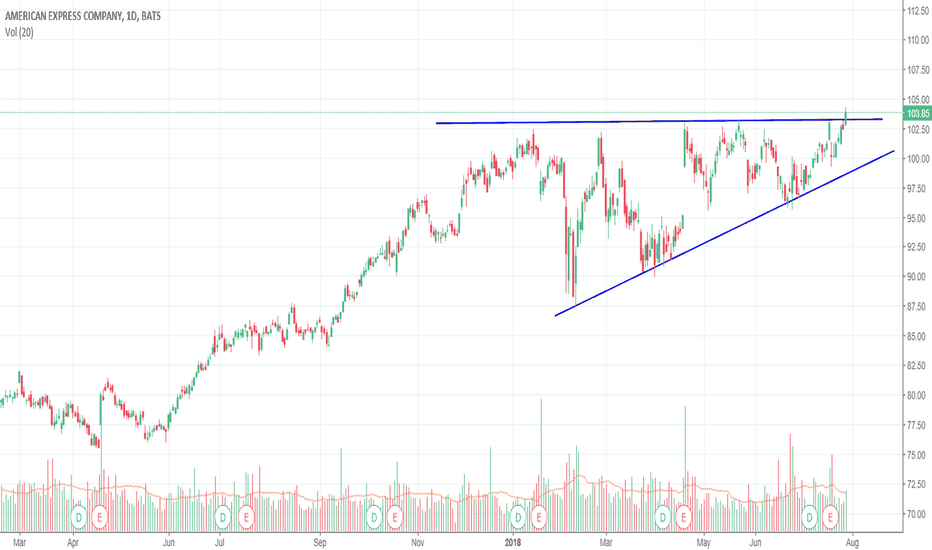

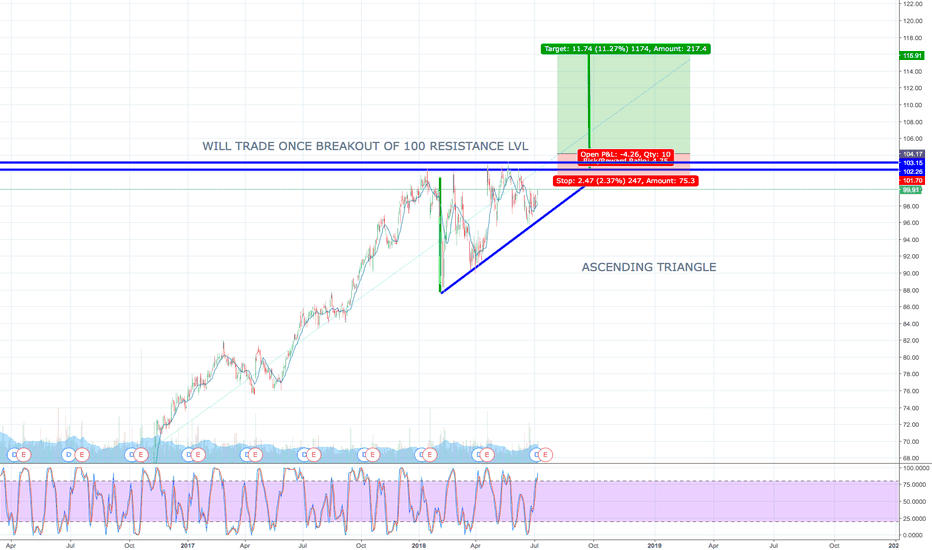

$AXP $AXP is forming a bullish ascending triangle (similar to the $NKE break out pattern I posted last week) after a strong gap up a couple weeks ago closing at ATHs. Look for a solid candle closing above $102 for entry spot or a re-test and old of the $100 level. Target levels are 106, 112, and 126.