FDXD trade ideas

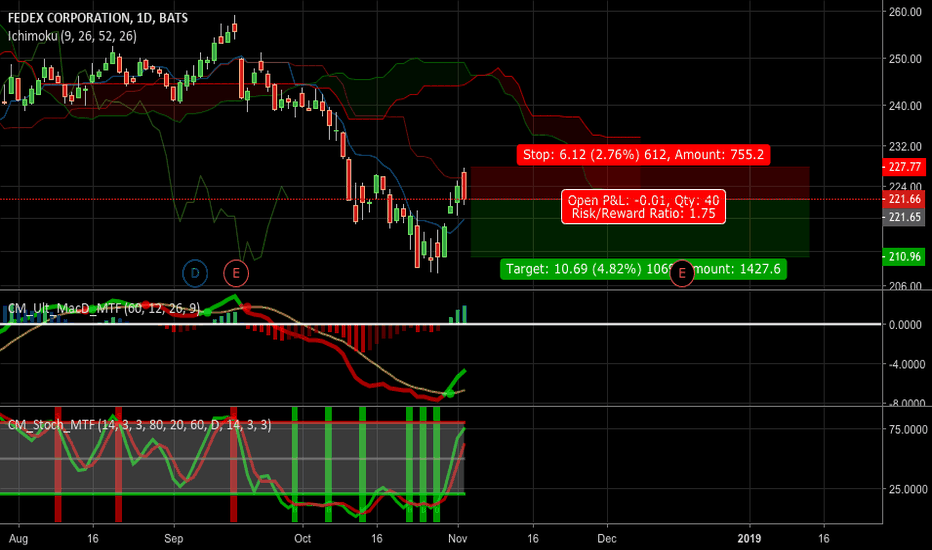

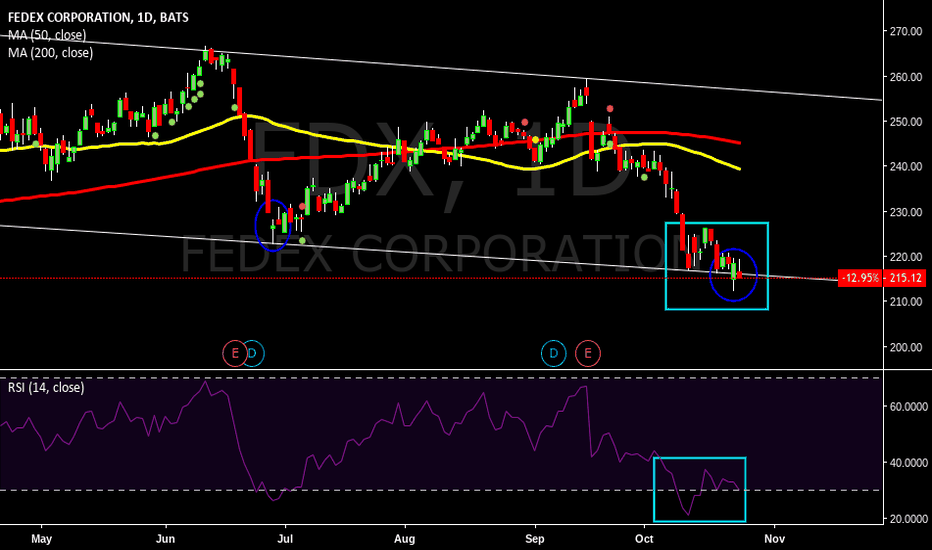

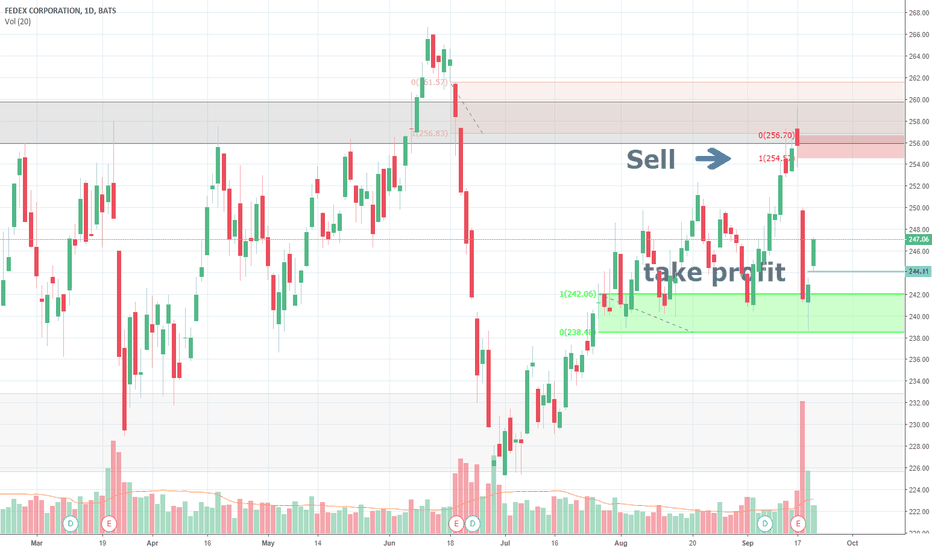

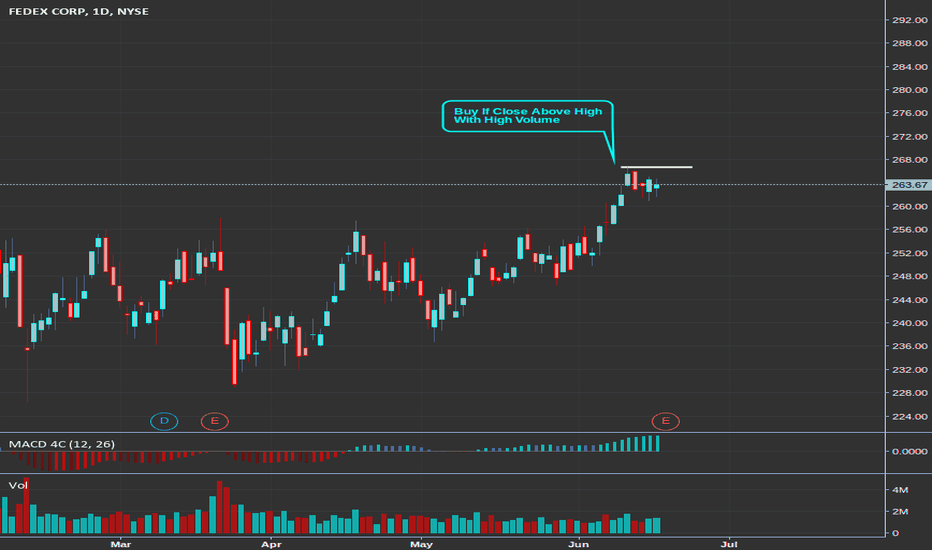

Sell FDXDaily dark cloud cover

Stoch looking to be flatline

MACD showing divergence

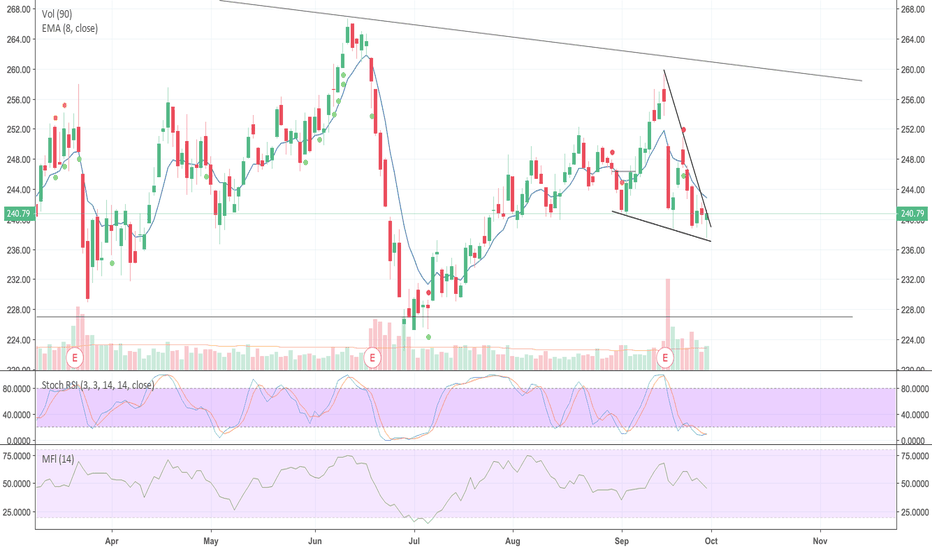

Chikou span showing lower high, quasi double topish formation... look left!

S/L 227.94

T/P 210.96 used gap to fill on hourly for better R/R, strong structure(support) at these price actions levels also

R/R 1.75

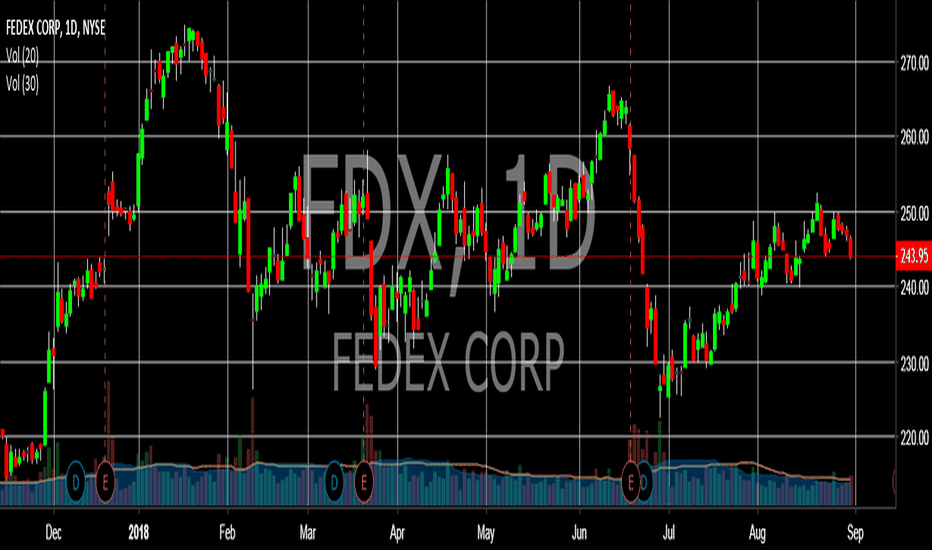

Profit Trading

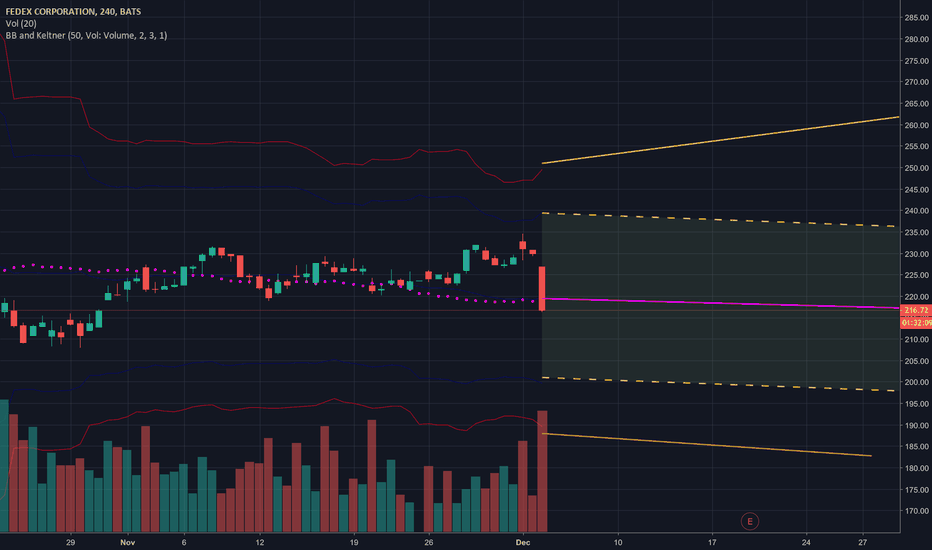

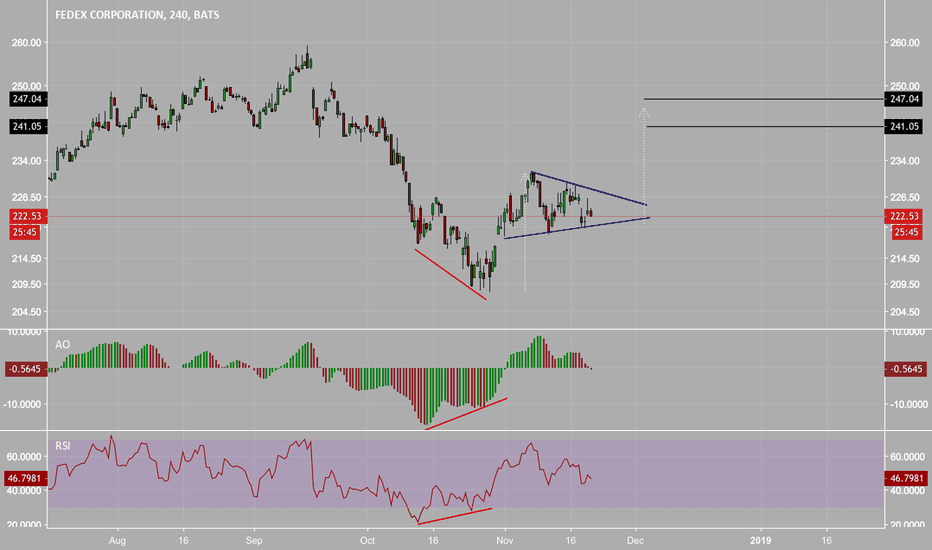

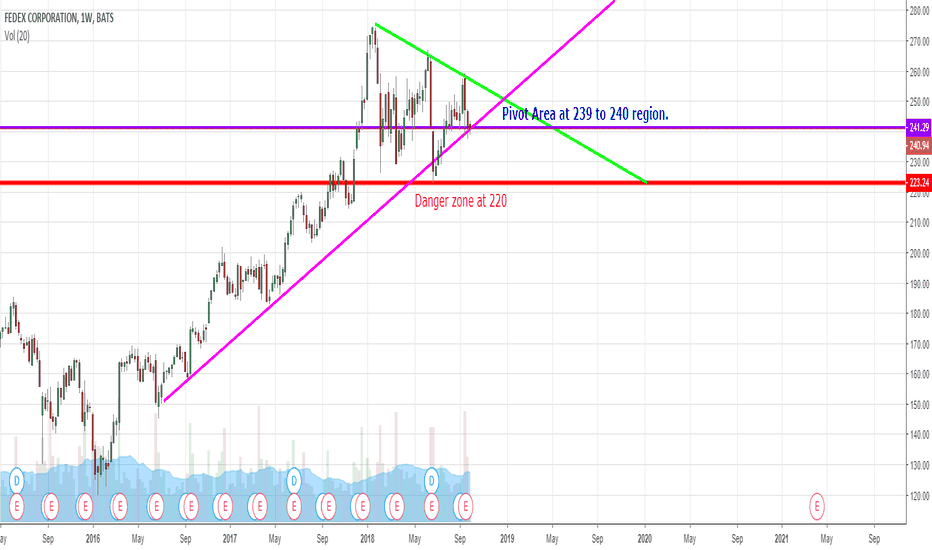

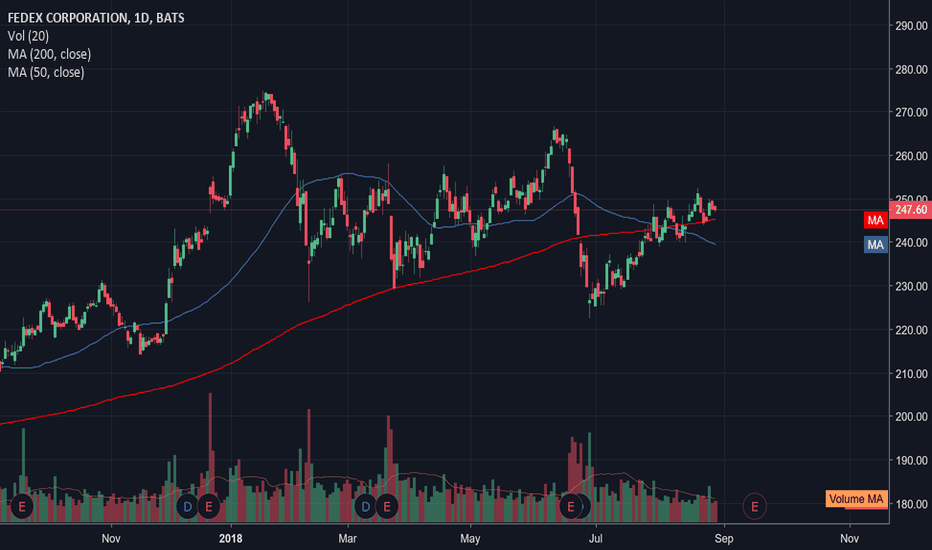

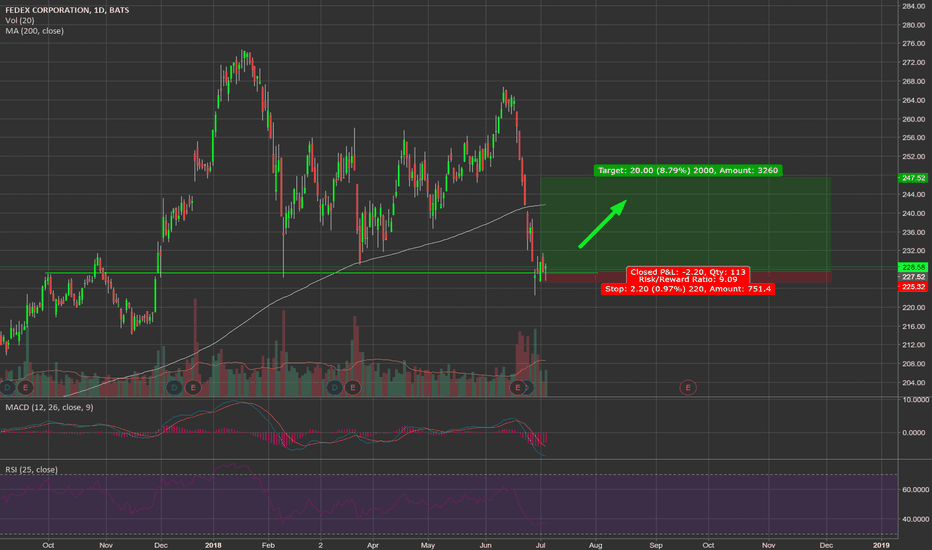

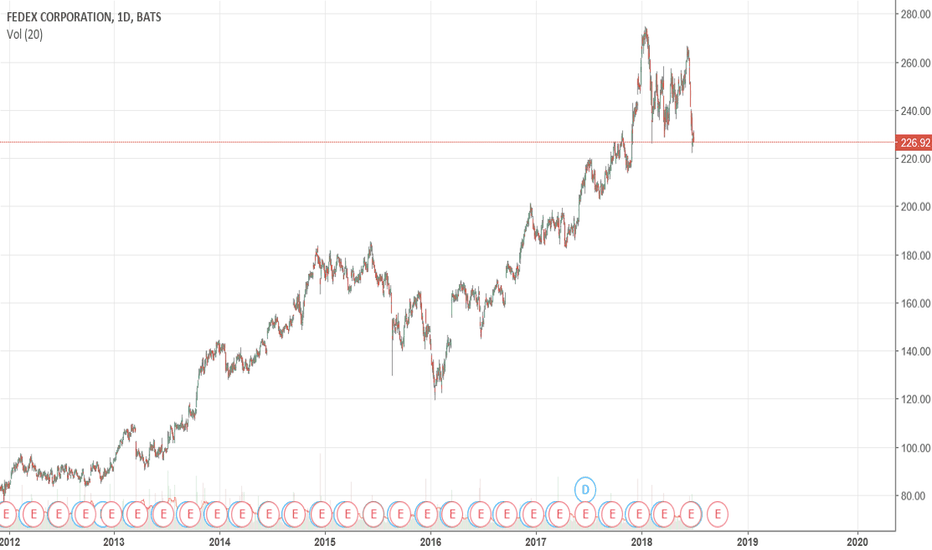

FEDEX Trapped Logistics is one of the sectors that RT favors. However with oil prices making new highs, FEDEX's prices are suppressed within this channel.

Long term trend is still up and prices have been hovering around 239 and 240 region.

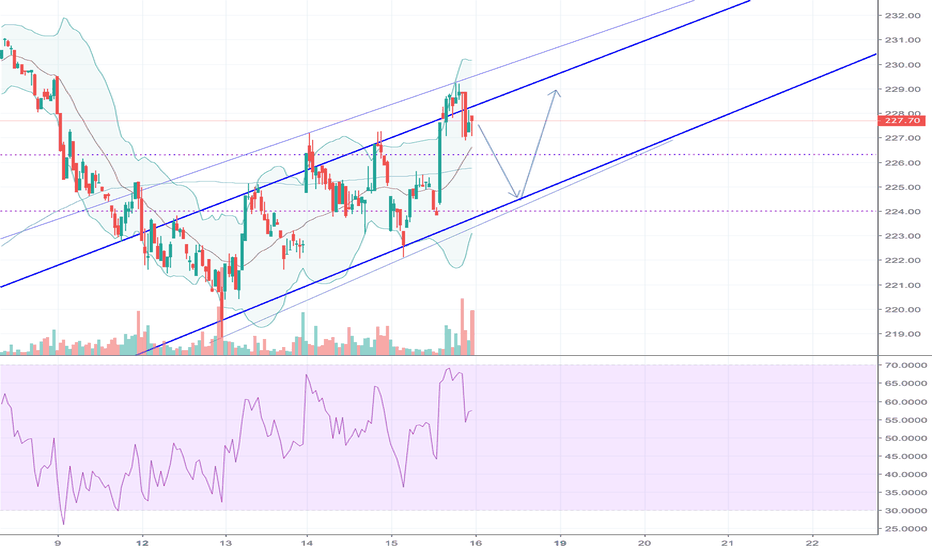

Just waiting for 2 scenarios to play out at the moment.

1. Break below the trendline to test the 220 region

2. Break above 252 to start a new uptrend.

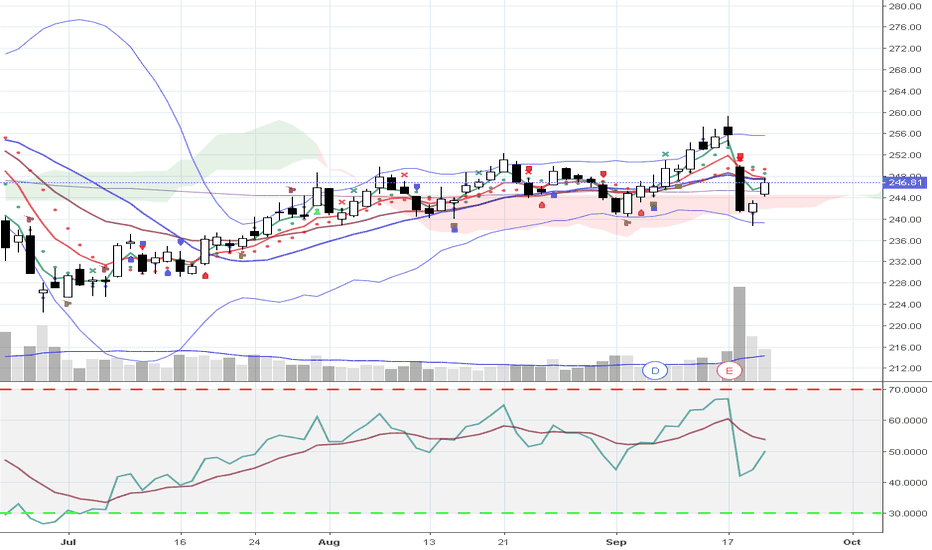

Reflection: Effectively carrying out a well thought out plan equals to making money eventually:)