FDX long

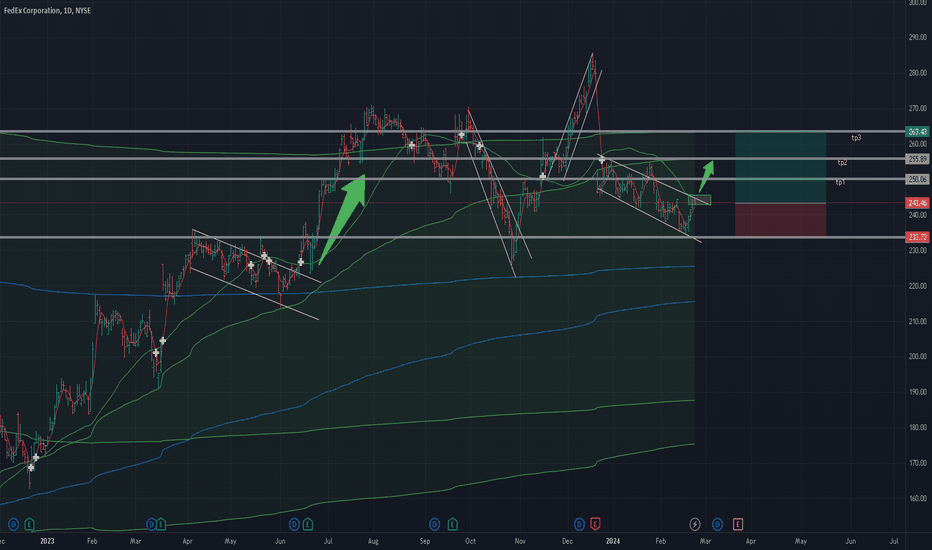

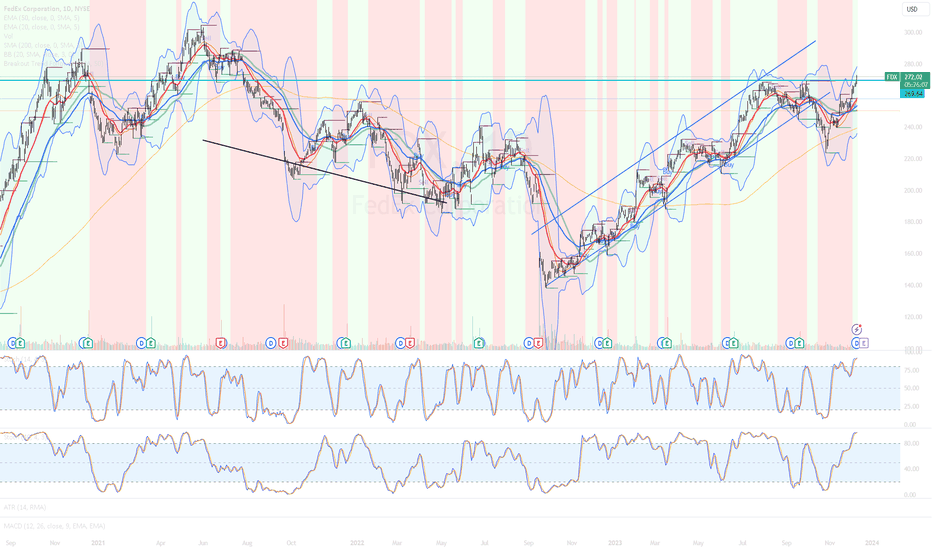

FDX looks great for a breakout to the upside it has been in a descending channel

that is close to breaking, I would look for a 4 over 40 moving average cross to confirm

the break the 3 targets would be 200em target 1 , anchored vwap 1 target 2 , anchored vwap target 3. the risk to reward ratio on this trade is not the best but at target 3 it would be a 2:1

I would place stops beneath the low shown by the long positon box.

I would wait for the 4/40 moving average to cross before entering long.

FDXD trade ideas

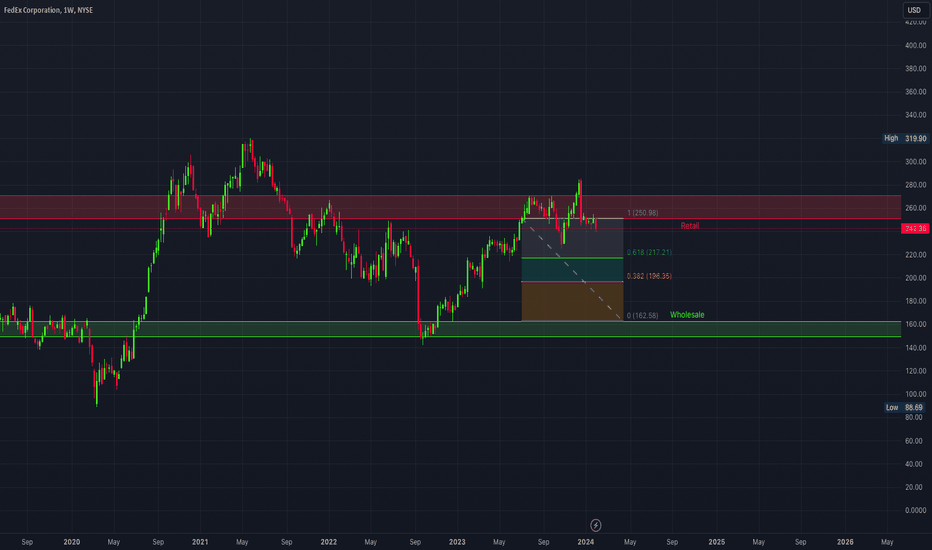

A Simplified Approach to Trading $FDAlright, let's make understanding NYSE:FDX (FedEx Corporation) stocks as easy as possible. It's like going shopping, but with stocks instead of groceries. Here's the breakdown:

- Wholesale prices for NYSE:FDX stocks range from $148 to $162 per share.

- Retail prices, where we want to sell, are between $250 and $262 per share.

Now, let's simplify things even more:

- **Orange Zone:** This is when NYSE:FDX stocks are super cheap, like a great deal, between $148 and $162 per share.

- **Blue Zone:** Prices are fair here, not too cheap but not too expensive either. It's like buying something at a regular price.

- We don't want to buy when prices are too high; it's not a good deal for us.

So, what about NYSE:FDX right now?

Currently, NYSE:FDX is selling at around $250 per share, which is right in the retail price range. It's neither a steal nor too expensive. So, it's in a zone where it's worth considering.

Looking at past patterns, selling around this price range seems like a smart move, considering what buyers and sellers have done before.

To sum it up:

- Keep an eye on NYSE:FDX when it's in the retail price range.

- Avoid buying when it's too expensive.

- And if you're thinking of selling, the current price range of $250 seems like a good option based on past trends.

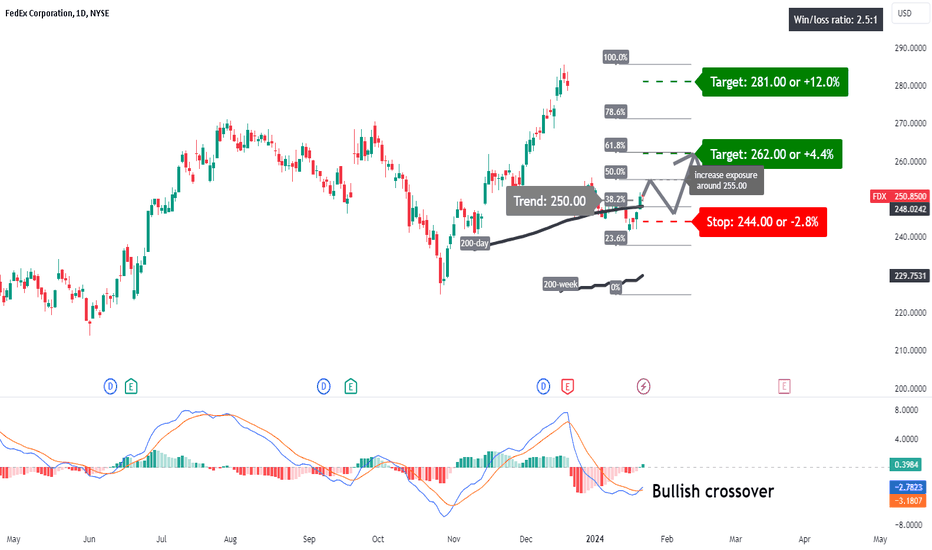

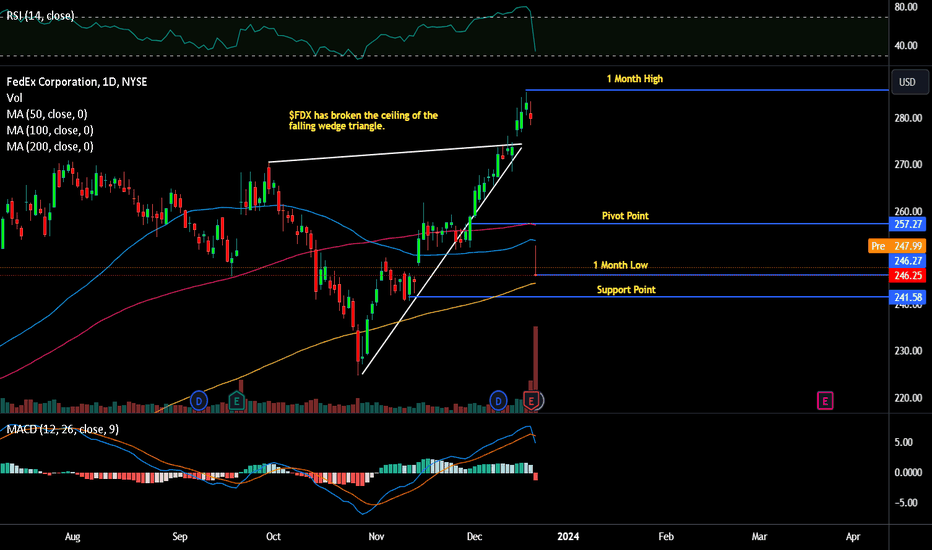

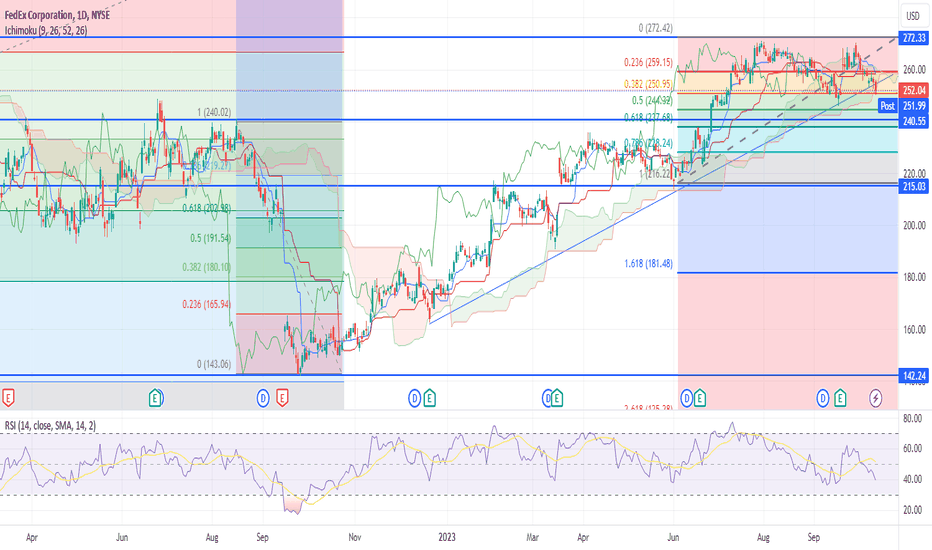

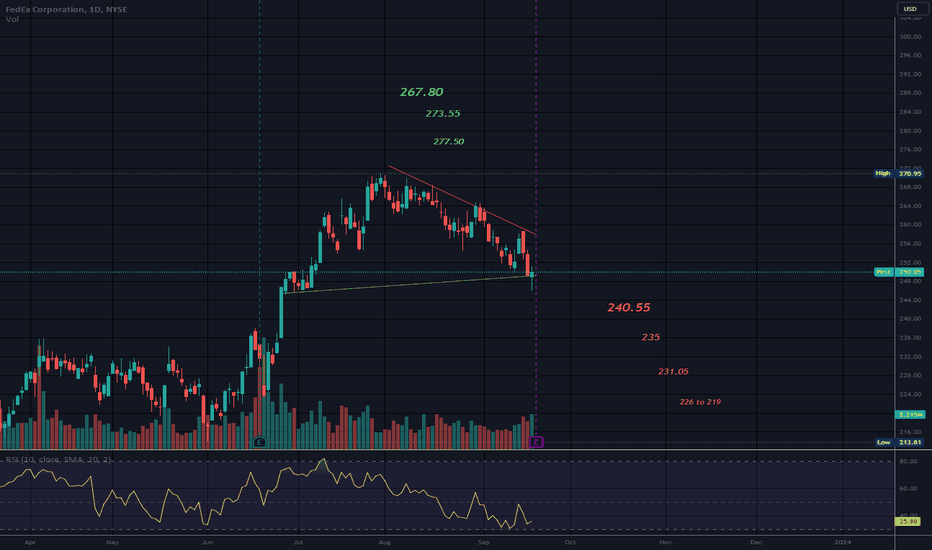

FDX: change in trend direction?A price action above 250 supports a bullish trend direction.

Increase long exposure for a break above 255.

The first target price is set at 262 (at its 61.8% Fibonacci retracement.

The second target price is set at 281.

The stop-loss price is set at 244.00

Recently crossed above its 200-day simple moving average.

The MACD bullish crossover (see the lower panel) supports a change in trend direction to bullish.

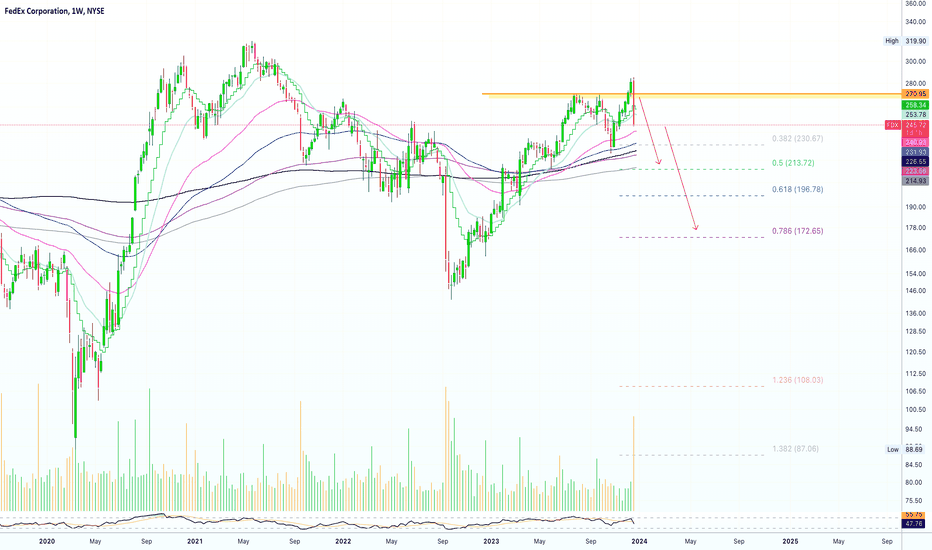

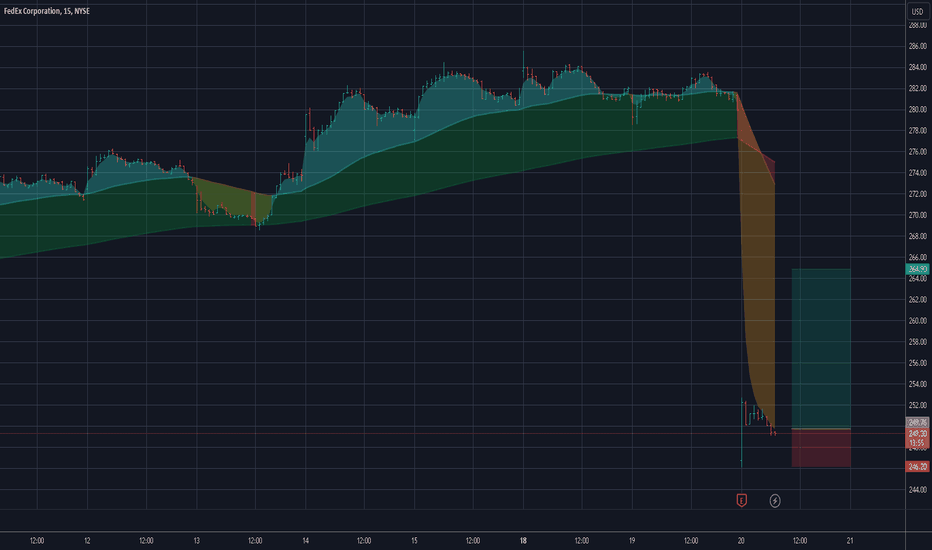

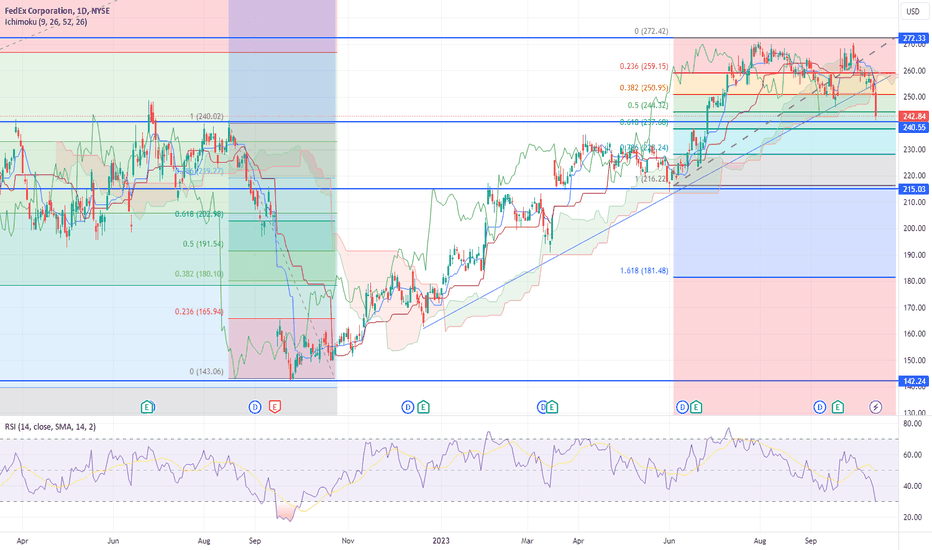

📊 FedEx Corporation Breaks Down (Strong Bearish Confirmation) This is a major confirmation signal for related markets and industries... A massive breakdown happening on the FDX chart supports the end of the bullish trend.

This weekly session pushed below EMA10 and EMA21 in one go, producing the highest selling pressure since September 2022 which was the worst week in many years.

➖ The first or immediate target is around 215-210.

➖ The RSI is already below 50 and the volume is just too great, so it might go much lower in the medium to long-term.

Maybe this is a warning signal of what is coming to the SPX.

I am not very familiar with these stocks but the chart says bearish, prepare accordingly.

Namaste.

FedEx's Resilience and Strategic Moves Position it for Growth

In the face of various challenges, FedEx Corporation (NYSE: NYSE:FDX ) showcased resilience and strategic adaptability during the second quarter of fiscal year 2024. The company reported a mixed performance across its segments, with some facing revenue declines while others experienced growth. Here's a detailed analysis of the key factors influencing FedEx's current status and a glimpse into why the company may see a spike in the future.

Segmental Performance:

1. FedEx Express:

- Revenues fell by 6% YoY to $10,254 million, primarily due to volume declines, lower fuel surcharges, and a shift towards lower-yielding services.

- Operating income dropped by 60% YoY, reflecting lower revenues, but partially offset by reduced operating expenses.

2. FedEx Ground:

- Revenues increased by 3% YoY to $8,639 million, driven by higher yield.

- Operating income surged by 51% YoY, attributed to yield improvement, cost reductions, and higher volumes.

- Cost per package declined by 2%, thanks to lower line-haul expenses and improved productivity.

3. FedEx Freight:

- Revenues declined by 4% to $2,360 million, while operating income grew by 11% YoY, supported by higher yield and increased efficiency despite lower shipments.

Liquidity:

- FedEx ended Q2 FY2024 with $6,729 million in cash and cash equivalents.

- Long-term debt stood at $20,193 million.

Strategic Moves:

- Completed a $500 million accelerated share repurchase (ASR) transaction, reducing outstanding shares and positively impacting Q2 results.

- Capital expenditures for Q2 FY2024 were $1,305 million.

Outlook and Guidance:

- Revised guidance for 2024 includes an expected decline in revenues by a low-single-digit percentage.

- Adjusted earnings per share (EPS) are projected to be in the range of $15.35-$16.85, with a continued focus on business optimization initiatives.

- Capital spending for fiscal 2024 is anticipated to be $5.7 billion.

- The company aims to repurchase an additional $1 billion of common stock during fiscal 2024.

Strengths of FedEx:

- Diversified Portfolio: The company operates in multiple segments, mitigating risks associated with fluctuations in specific markets.

- Cost Efficiency: FedEx's focus on cost reductions and operational efficiency contributed to improved operating income in certain segments.

- Strategic Repurchases: The recent share repurchase and the plan for an additional $1 billion buyback demonstrate confidence in the company's value.

Why FedEx May Rise Again:

- Resilience Amid Challenges: Despite headwinds, NYSE:FDX has demonstrated resilience and adaptability in optimizing operations.

- Strategic Guidance: The company's revised guidance, with an increased EPS range, signals confidence in its ability to navigate challenges and capitalize on opportunities.

- Share Repurchase Program: The ongoing commitment to repurchasing shares reflects management's belief in the company's long-term prospects.

FedEx's strategic moves, financial resilience, and diversified portfolio position the company for future growth. While challenges persist, the company's proactive measures and revised guidance suggest a positive outlook, potentially paving the way for a resurgence in market confidence and a spike in FedEx's performance.

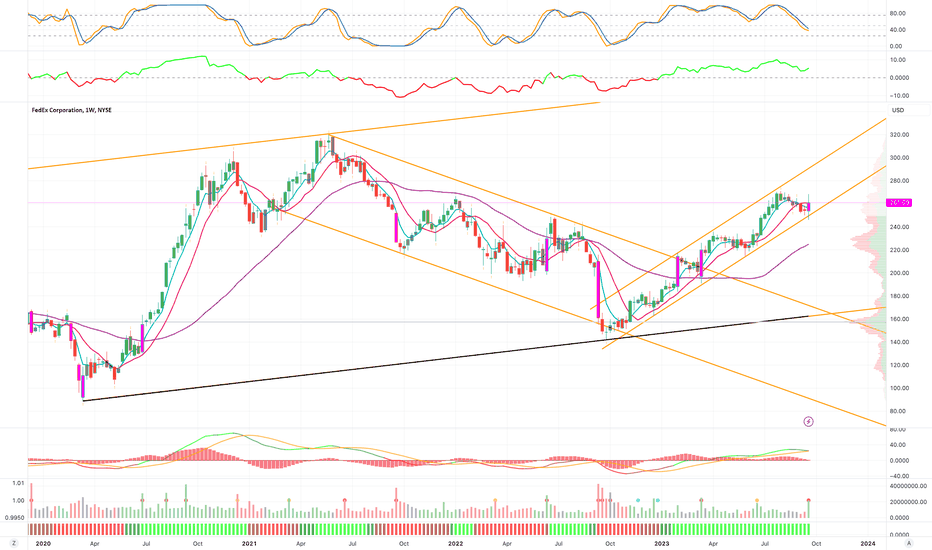

Technical Analysis

Investors have paid higher prices over time to buy FedEx and the stock is in a rising trend channel in the medium long term. This signals increasing optimism among investors and indicates continued rise. The stock is moving within a rectangle formation between support at 232 and resistance at 282. A decisive break through one of these levels indicates the new direction for the stock. The stock has support at dollar 230 and resistance at dollar 268. Negative volume balance weakens the stock in the short term.

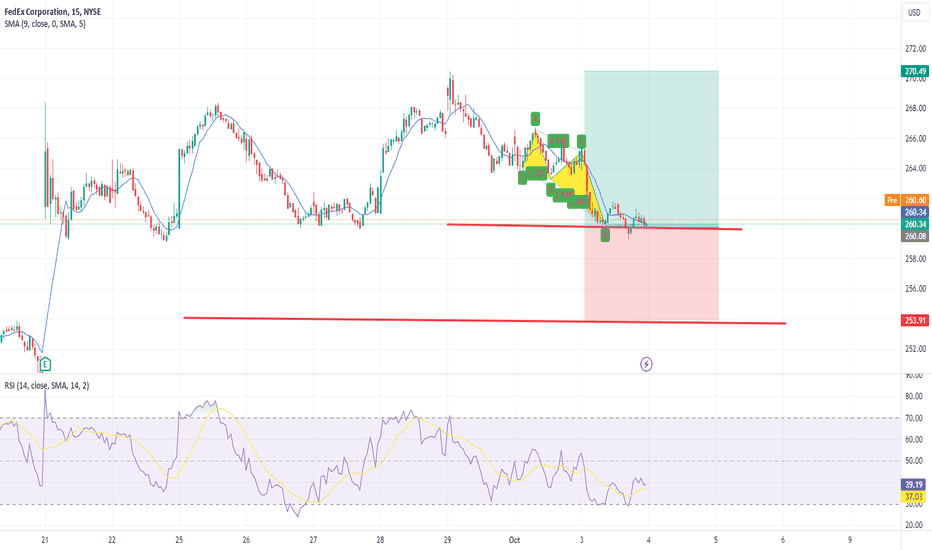

FDX - BEARISH SCENARIO

FedEx reduced its yearly revenue forecast due to tough competition with UPS and other delivery rivals in a slow holiday season, causing its shares to drop nearly 8%. The company now expects a slight revenue decline instead of previously anticipated steady results. FedEx shares fell to $258.30 in after-hours trading from $280 at Tuesday's close. To protect profits, FedEx cut costs and gained business from UPS before the expiration of UPS's contract covering about 340,000 Teamsters-represented workers. UPS fought back by covering early termination fees for customers who switched to FedEx. Additionally, FedEx plans to buy back $1 billion of common stock in fiscal year 2024.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

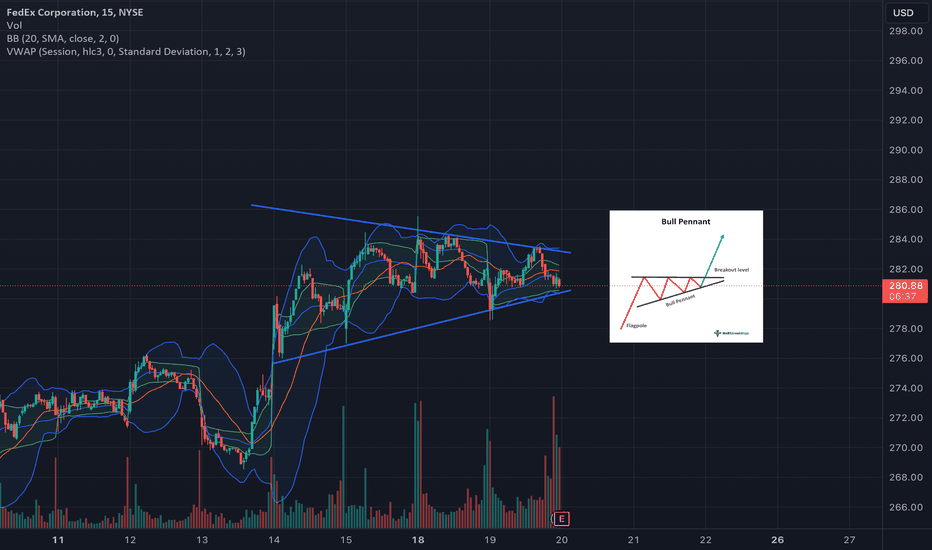

FDX "FedEx" EarningsI see FDX forming a Bullish Pennant after surpassing a 52-week high and going into earnings. We have also seen record highs in online sales which signify an exceptional increase in Shipping/Transportation. I see this benefitting both FDX and UPS for their upcoming earnings reports and forward guidance. Let's see how this plays out!

[b] Navigating FedEx's Earnings with an Iron Condor[/b]FedEx Corporation (NYSE: FDX) will release its earnings for the third quarter of 2023. With the market expectations high, investors are eagerly awaiting the company's performance. Amidst this anticipation, an iron condor strategy can be a prudent approach to navigate FedEx's earnings and potential post-earnings volatility.

Understanding an Iron Condor

An iron condor is a versatile options trading strategy that aims to profit from a narrow price range. It involves buying a put option and selling a call option with the same strike price but different expiration dates. Additionally, it also involves simultaneously buying a call option and selling a put option with the same strike price but different expiration dates.

In this specific case, an iron condor with strike prices of $240, $245, $315, and $320 expiring on December 22, 2023, can be considered.

Potential Outcomes

If FedEx's stock price remains within the range of $245 to $315 on the expiration date, the iron condor will expire worthless, and the investor will keep the entire premium earned.

Considering Earnings Announcement

As FedEx's earnings release approaches, market volatility is expected to increase AND AFTER DROP.

Conclusion

An iron condor can be an effective strategy for navigating FedEx's earnings and potential post-earnings volatility. By limiting the maximum loss and offering moderate profit potential, it can help investors manage their risk while still capturing potential upside. As the earnings announcement approaches, carefully monitoring the stock price and market sentiment can aid in making timely adjustments to the position.

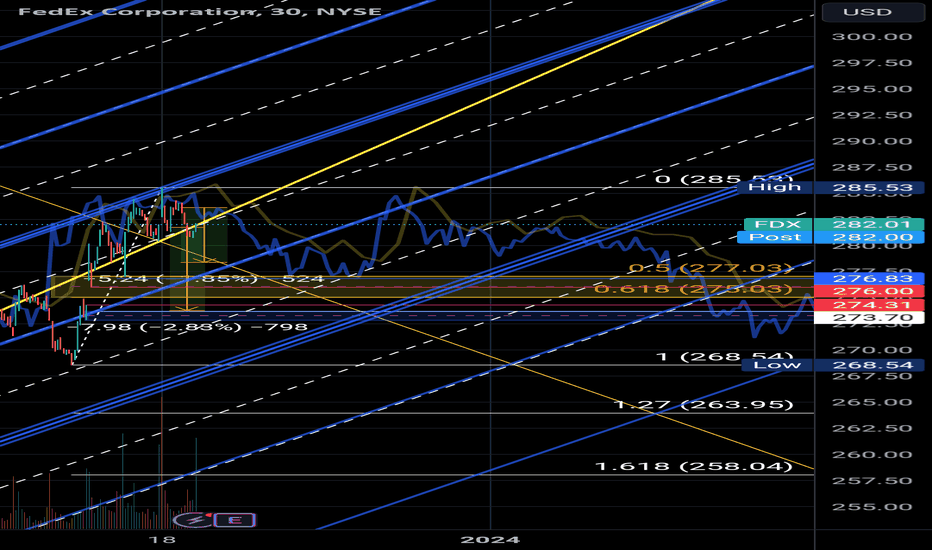

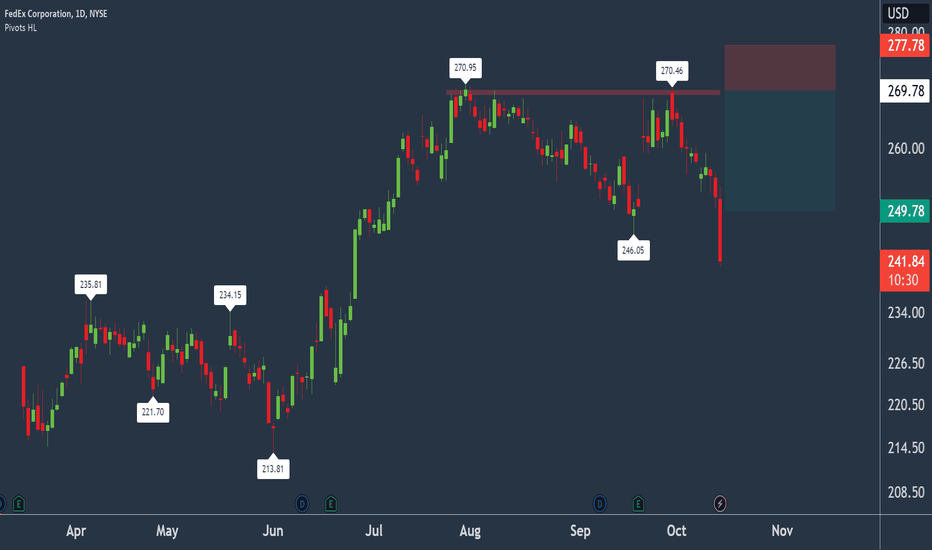

FedEx has posted a double top.FedEx Corporation - 30d expiry - We look to Sell at 269.78 (stop at 277.78)

Posted a Double Top formation.

We look for a temporary move higher.

The trend of lower lows is located at 270.

270.46 has been pivotal.

We are trading at overbought extremes.

Our profit targets will be 249.78 and 245.78

Resistance: 250.00 / 258.00 / 270.95

Support: 241.04 / 234.00 / 230.00

Please be advised that the in formation presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group

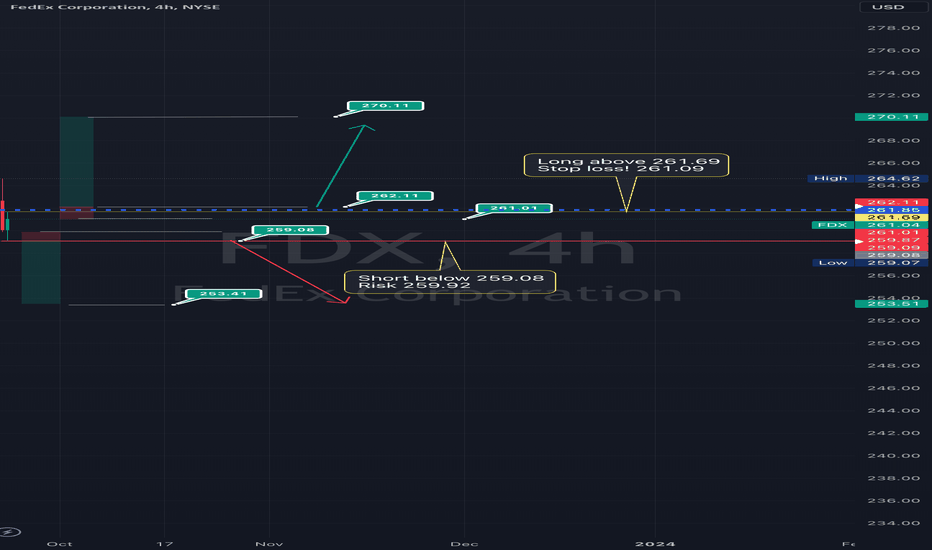

FDX Long/short View! NYSE:FDX -

FedEx stock has a support level at $258.40, which may present buying opportunities when tested.

The stock is known for its controlled movements and low liquidity risk.

Daily volatility is around 2.19%, while weekly volatility averages 2.33%.

No specific stop-loss recommendation is provided at this time.

Trading Expectations for Monday, 25th:

FedEx is expected to open at $261.64.

During the trading day, the stock may range between $255.63 and $266.55, with a potential range of +/- $5.46 (+/- 2.09%).

Given its proximity to the resistance at $261.85 (0.29%) compared to the support at $258.40 (1.03%), it's advised to consider trades closer to the support level.

Insider Trading Activity:

Insiders have been selling more shares (608.98 thousand) than buying (497.45 thousand) in the last 100 trades, indicating a preference for selling.

Is FedEx Corporation stock a Buy?

FedEx currently exhibits negative signals and is expected to perform weakly in the short term.

The stock's analysis conclusion has been downgraded from Hold/Accumulate to a Sell candidate due to some technical weaknesses.

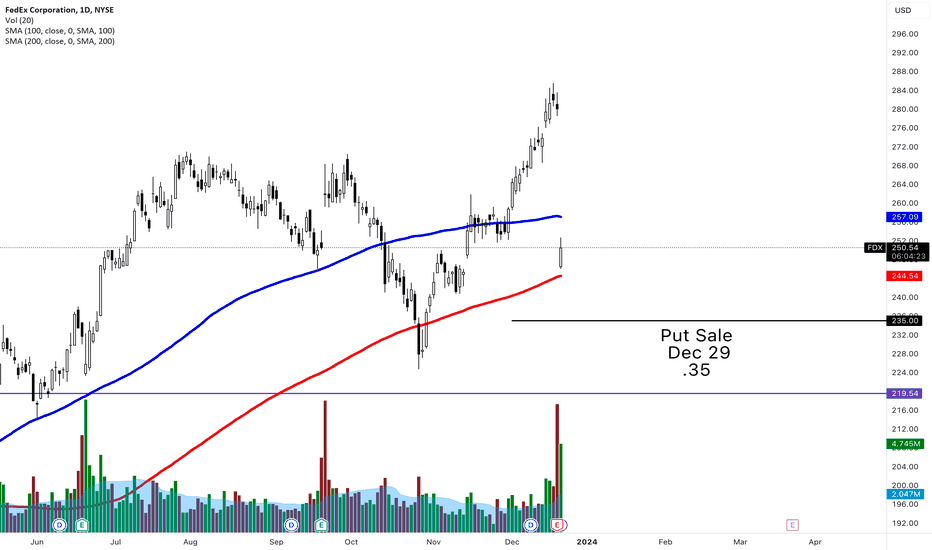

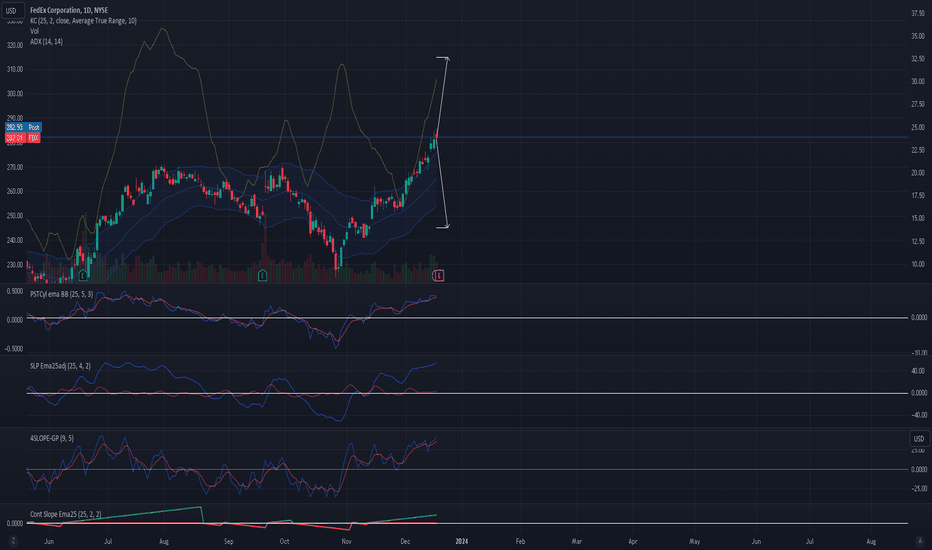

FDX primed to reward traders 20%FedEx Corp. (FDX) presently testing meaningful support, able to absorb weekly selling pressures.

From here, (FDX) can gain bullish momentum and turn higher into later year, eliciting gains of 20% over the following 3-5 months.

Inversely, if a weekly settlement below this support level occurs, (FDX) would be placed into a sell signal where losses of 20% would be expected over the same time horizon.

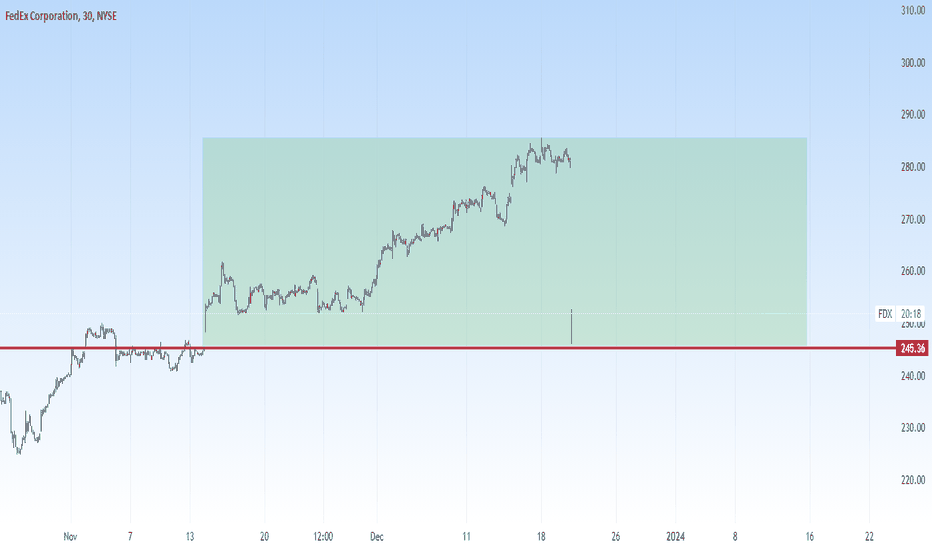

FEDEX ignoring the market jitters & offers a strong opportunityFedex opened higher today following the favorable fundamentals, ignoring the overall weakness on the market in the Fed aftermath.

Two days ago it achieved a rebound on the MA100 (1d), exactly at the bottom of the Channel Up that started exactly 1 year ago.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 292.00 (-0.382 Fibonacci extension, same as the April 6th High).

Tips:

1. The MACD (1d) just formed a Buy Cross. Every such formation inside the Channel Up has started a rally to a Higher High.

Please like, follow and comment!!

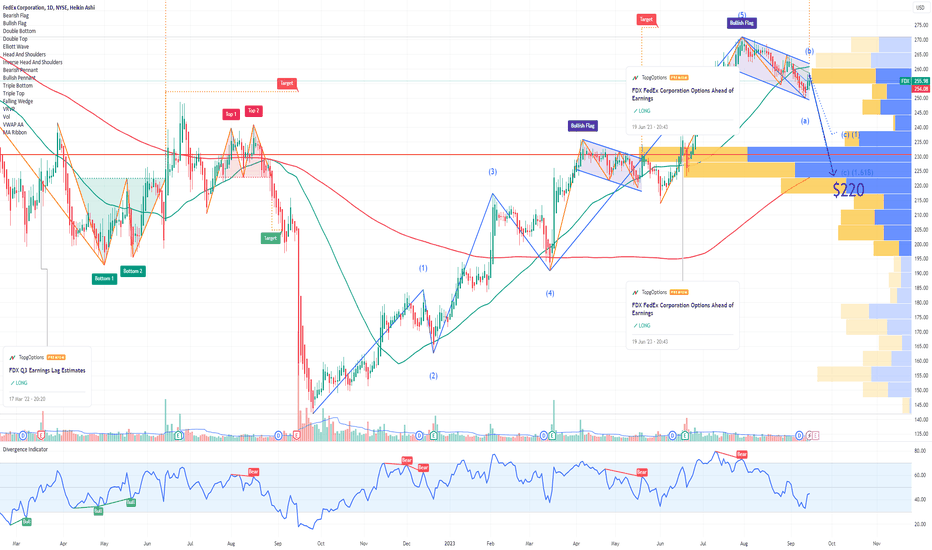

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t bought FDX here:

or ahead of the previous earnings:

Then analyzing the options chain and the chart patterns of FDX FedEx prior to the earnings report this week,

I would consider purchasing the 220usd strike price Puts with

an expiration date of 2023-11-17,

for a premium of approximately $1.96.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.