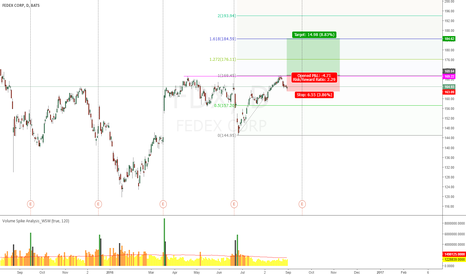

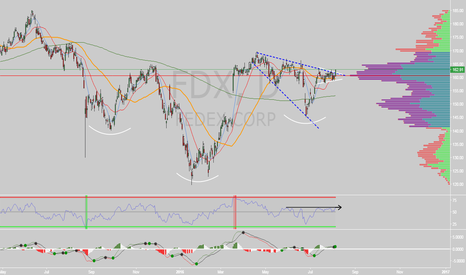

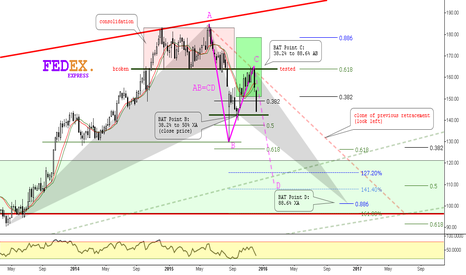

FDXD trade ideas

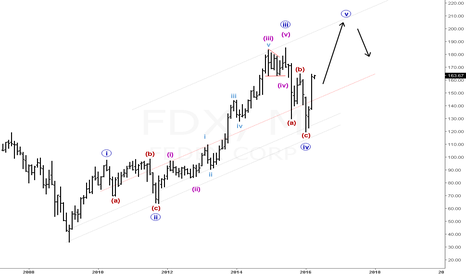

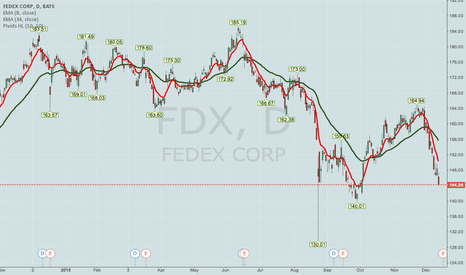

Bullish update on FDXFDX has started another rally that has more to go short term and long term. We need to move above 185 to end something. We are not there yet thus rally not over. How exactly we will get there is another story.

Short term it appears we need at least another push up but it would look better the way I labeled the climb as shown here on this weekly chart. Doing just that going into May then that would be a case of "Sell in May and go Away".

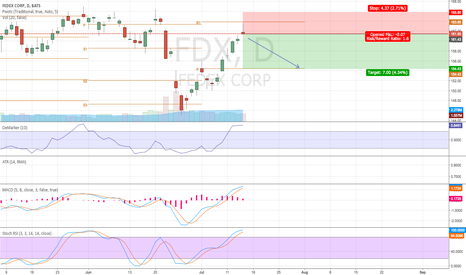

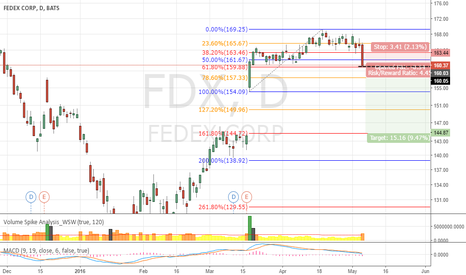

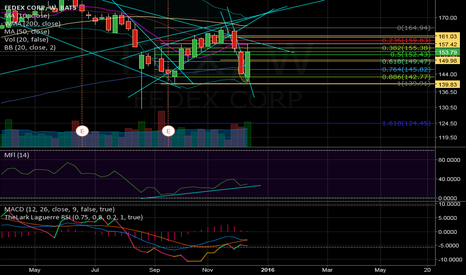

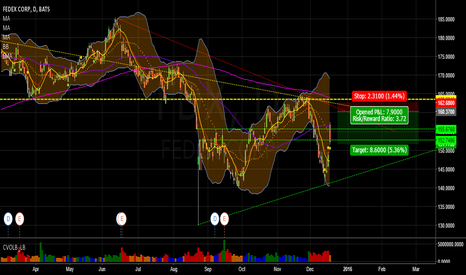

EARNINGS PLAYS THIS COMING WEEK -- FDX, ORCLOnly two earnings plays stick out to me this coming week -- FDX and ORCL, both of which announce earnings on 12/16 (Wednesday) after market close, so look to put on setups before NY close on Wednesday.

Currently, FDX's 52 week IVR is at 54 (IV 34), which isn't stellar, but it's at 92 for the past six months. Moreover, there is pretty good credit to be had whether you go short strangle or iron condor, so I imagine I'll play that one way or another if the IV sticks in there.

ORCL (IVR 75/IV 35) isn't looking all that hot, frankly, because I can't get 1.00 in credit with either a short strangle or iron condor (a Dec 24 34.5/39.5 short strangle will only get you a .61 credit at the mid price right now, which isn't anything to go crazy over; a same expiry iron condor just isn't worth it). Nevertheless, we could see a greater volatility pop toward earnings that makes it a little bit more worthwhile such that I'll play just because there isn't that much else worthwhile to do ... .

(Of course, there is that all FOMC thing next week, too).