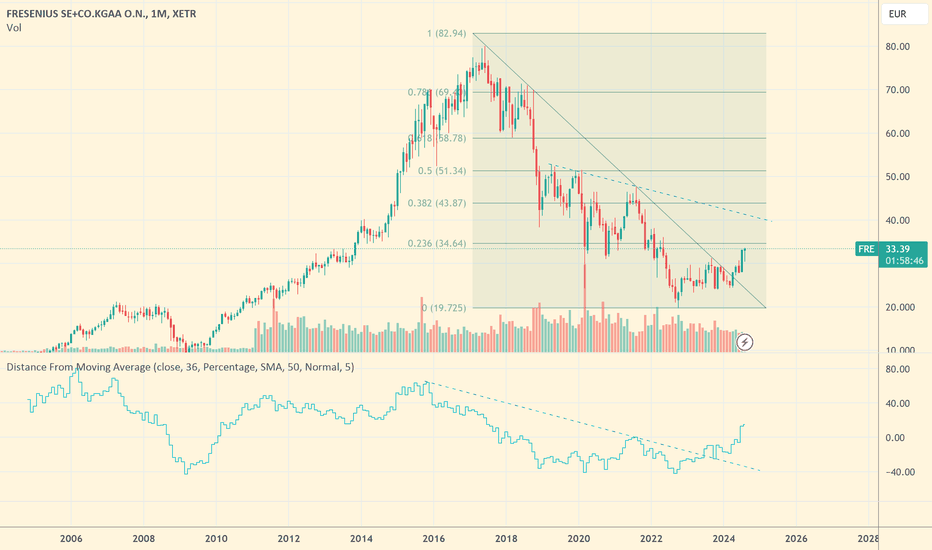

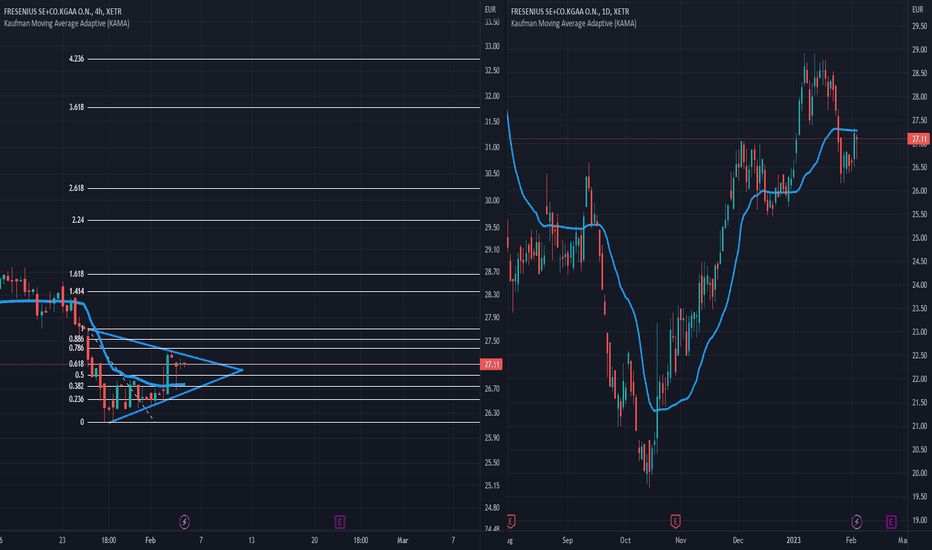

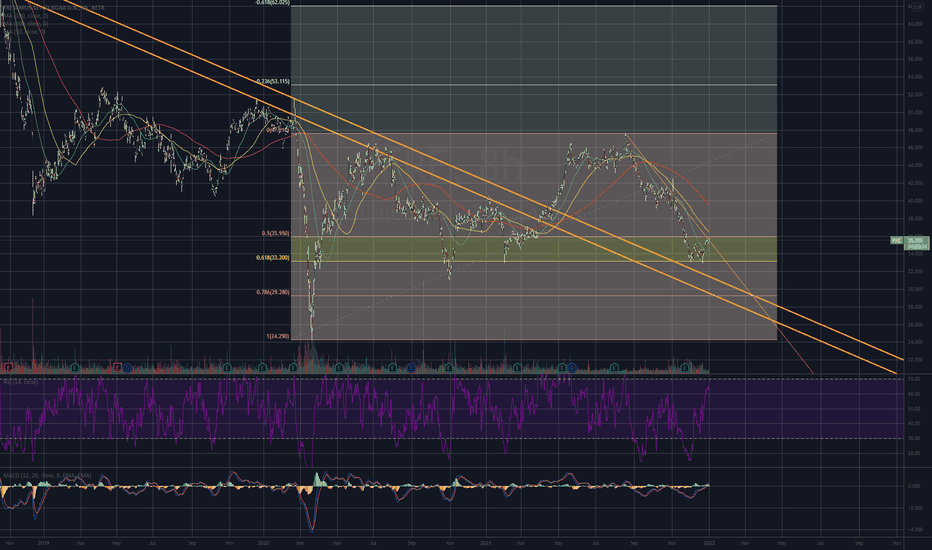

FreseniusGood monthly setup for Fresenius. Broke up descending channel, then confirmed. Now we have beautiful monthly candle giving probabilities for an upside move (hopefully above 34.60). The 3 years distance from MA shows almost the same (broke up, retest, now moving).

Very clear Fibonacci resistances a

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.75 EUR

471.00 M EUR

21.83 B EUR

411.39 M

About FRESENIUS SE+CO.KGAA O.N.

Sector

Industry

CEO

Michael Sen

Website

Headquarters

Bad Homburg

Founded

2011

ISIN

DE0005785604

FIGI

BBG00NL2SF25

Fresenius SE & Co. KGaA is a healthcare group, which engages in the provision of products and services for dialysis, hospitals, and outpatient medical care. It operates through the following segments: Fresenius Medical Care, Fresenius Kabi, Fresenius Helios and Fresenius Vamed. The Fresenius Medical Care segment caters to individuals with renal diseases. The Fresenius Kabi segment specializes in lifesaving medicines and technologies. The Fresenius Helios offers expertise in inpatient and outpatient care as well as in telemedicine. The Fresenius Vamed segment manages projects and services for hospitals and other healthcare facilities. The company was founded by Eduard Fresenius on October 1, 1912 and is headquartered in Bad Homburg, Germany.

Related stocks

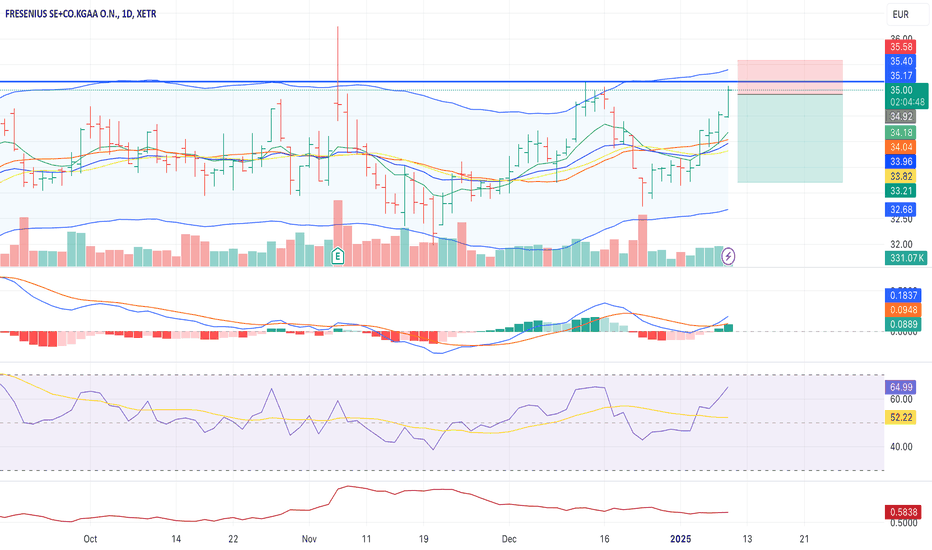

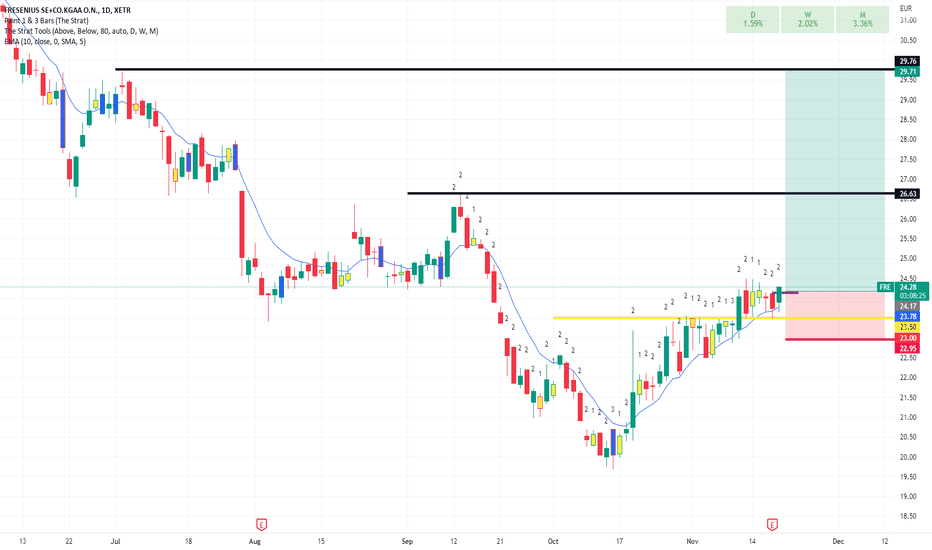

FRE Mean Reversion ShortRally has moved to range-bound market on weekly chart since September 24. RSI near 70 on the daily, and although MACD looks slightly bullish, volume behind this latest move towards the upper channel line doesn't seem strong enough.

Short position near channel line with a tight stop (c. 1.0x ATR). T

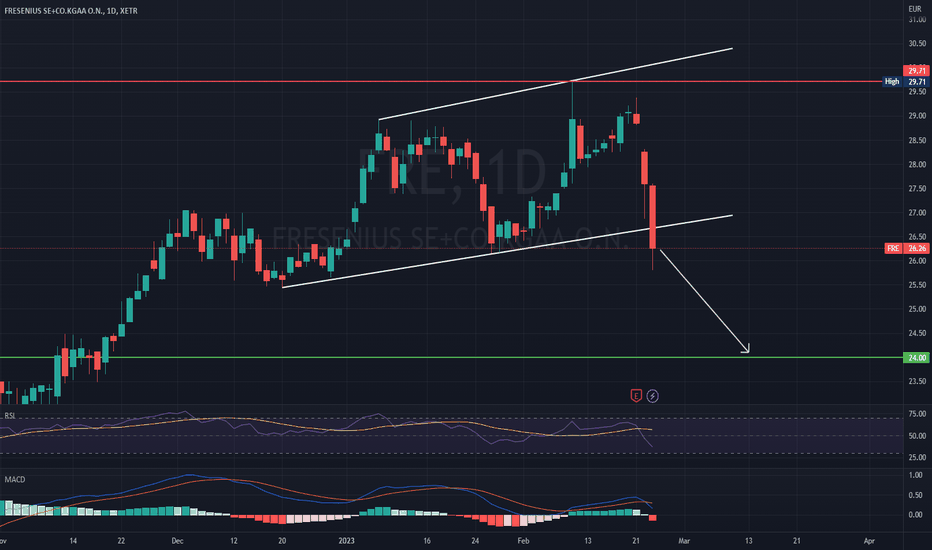

Fresenius (FRE.de) bearish scenario:The technical figure Channel Up can be found in the daily chart in the German company Fresenius SE & Co. KGaA (FRE.de). Fresenius SE & Co. KGaA is a European multinational healthcare company. It provides products and services for dialysis in hospitals and inpatient and outpatient medical care. It is

#FRE Long ideaHello dear Traders,

Here is my idea for #FRE

Price closed above yellow line (previous month high)

Price closed (15min Chart) above purple trigger line to enter trade.

Targets marked in the chart (black lines)

Invalidation level marked with red line

Good luck!

❤️Please feel free to ask any question

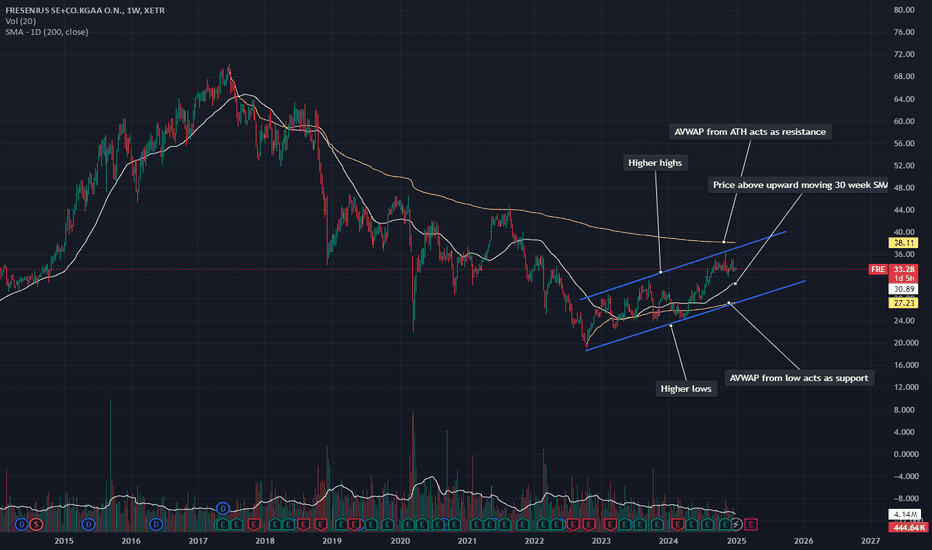

Fresenius ready to go!Hello altogether!

Fresenius looks ready to go up.

- We roughly tested the previous long-term descending trendline (care!: maybe this was not the test we want to see and we will come back and really test it!)

- The short-term descending trendline is broken

- Our fibo level held nicely

We are enteri

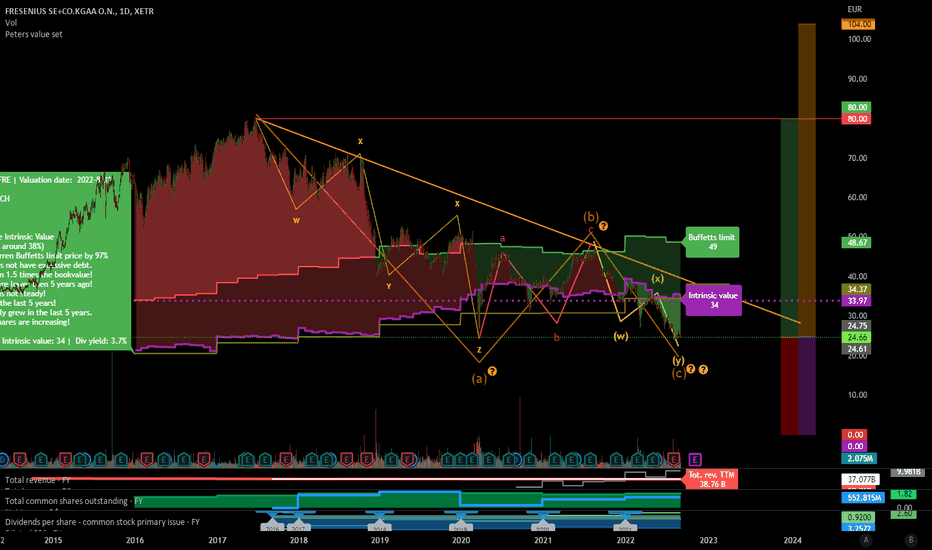

FRE w24 2021. Wait for clear uptrend.Weekly

Consolidation in downtrend

No Divergency

Price above criticial level of 50.

Will test and if break will up to 100.

Daily

Range

Weak power of trend = will continue range

Only if price will break and confirm 50 then buy

Open 50

SL 45

TP 80

RR 4

I expect it as very long trade. If you look

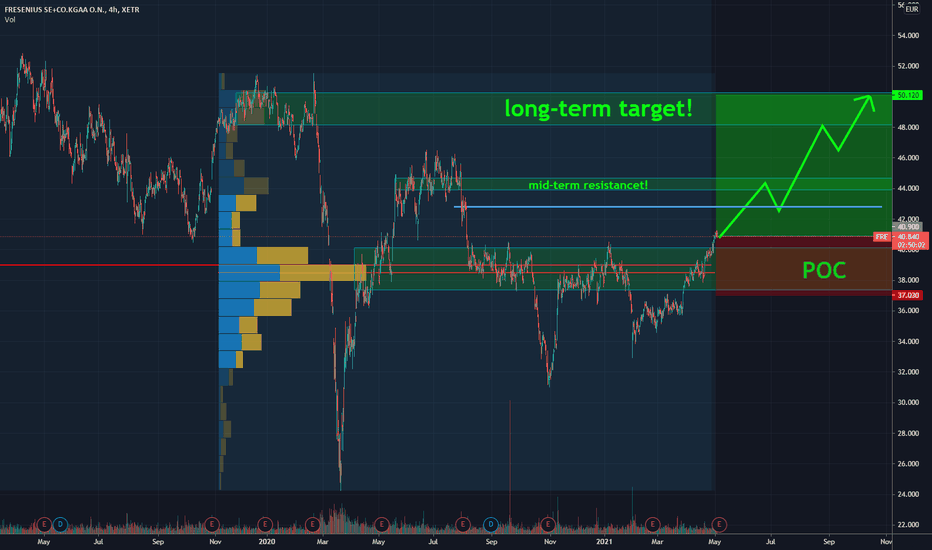

Trading Idea - #Fresenius SEBUY

ENTRY: 40.85 EUR

TARGET: 50.00 EUR (+22%)

STOP: 37.00 EUR

1.) Fresenius is breaking out of the POC box (Point of Control/Point of Interest). Technicall, an upward movement is expected.

2.) 42.80 EUR level needs to fall, so that an attack on the mid-term resistance (44.00 EUR) can occure.

3.)

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on AQUISEU exchange Fresenius SE and Co KGaA stocks are traded under the ticker FRED.

We've gathered analysts' opinions on Fresenius SE and Co KGaA future price: according to them, FRED price has a max estimate of 53.00 EUR and a min estimate of 42.00 EUR. Watch FRED chart and read a more detailed Fresenius SE and Co KGaA stock forecast: see what analysts think of Fresenius SE and Co KGaA and suggest that you do with its stocks.

FRED reached its all-time high on Jun 15, 2018 with the price of 71.30 EUR, and its all-time low was 19.69 EUR and was reached on Oct 14, 2022. View more price dynamics on FRED chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

Yes, you can track Fresenius SE and Co KGaA financials in yearly and quarterly reports right on TradingView.

Fresenius SE and Co KGaA is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

FRED earnings for the last quarter are 0.87 EUR per share, whereas the estimation was 0.77 EUR resulting in a 12.89% surprise. The estimated earnings for the next quarter are 0.77 EUR per share. See more details about Fresenius SE and Co KGaA earnings.

Fresenius SE and Co KGaA revenue for the last quarter amounts to 5.63 B EUR, despite the estimated figure of 5.43 B EUR. In the next quarter, revenue is expected to reach 5.42 B EUR.

FRED net income for the last quarter is 229.00 M EUR, while the quarter before that showed 240.00 M EUR of net income which accounts for −4.58% change. Track more Fresenius SE and Co KGaA financial stats to get the full picture.

Yes, FRED dividends are paid annually. The last dividend per share was 1.00 EUR. As of today, Dividend Yield (TTM)% is 2.45%. Tracking Fresenius SE and Co KGaA dividends might help you take more informed decisions.

As of Jul 21, 2025, the company has 176.49 K employees. See our rating of the largest employees — is Fresenius SE and Co KGaA on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Fresenius SE and Co KGaA EBITDA is 3.06 B EUR, and current EBITDA margin is 13.92%. See more stats in Fresenius SE and Co KGaA financial statements.

Like other stocks, FRED shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Fresenius SE and Co KGaA stock right from TradingView charts — choose your broker and connect to your account.