FEAR PRESENTS A BUYING OPPORTUNITYThe deteriorating sentiment over the last 3 years has created a substantial buying opportunity.

The negative sentiment can be attributed to 4 main things- decreased EPS/ Net Income since 2022/2023 (end of COVID $$), increased debt levels post-Seagen acquisition and revenue challenges due to upcoming patent expirations.

While these concerns are not unwarranted, it is important to note that Pfizer has been through several patent cliffs before while simultaneously growing dividends .

The notable upcoming expirations include the pneumonia shot Prevnar in 2026 and the cancer drugs Ibrance and Xtandi, both in 2027. Pfizer has an exceptional history of capital preservation and therefore will continue to take action to address any potential revenue shortfalls including aggressive cost-cutting measures already in progress.

From a valuation perspective, PFE's shiller PE is currently 9.51 or 94% as low as it has been in the last 10 years and also 89% better than 462 companies in the drug manufacturing industry.

Seeking Alpha gives PFE a grade of F on Growth, but when looking at the individual characteristics not 1 is below a D and only two are D's, and in aggregate looks much better than SA is portraying with a grade of F. Pfizer should not usually be expected to be a grower as it is a mature company.

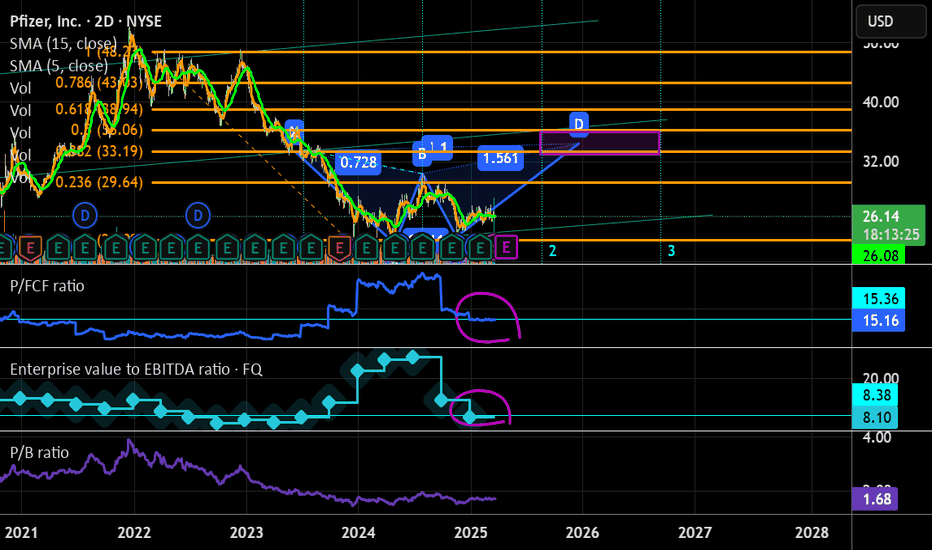

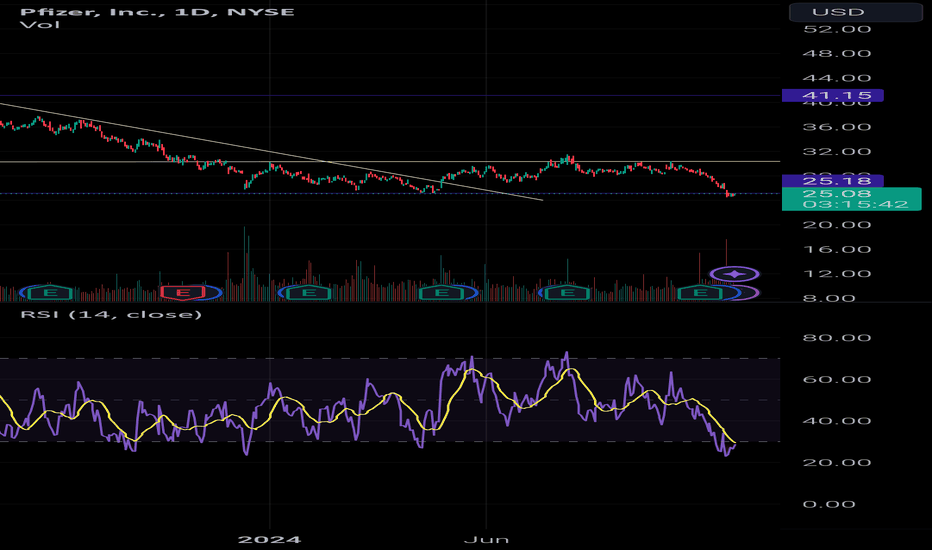

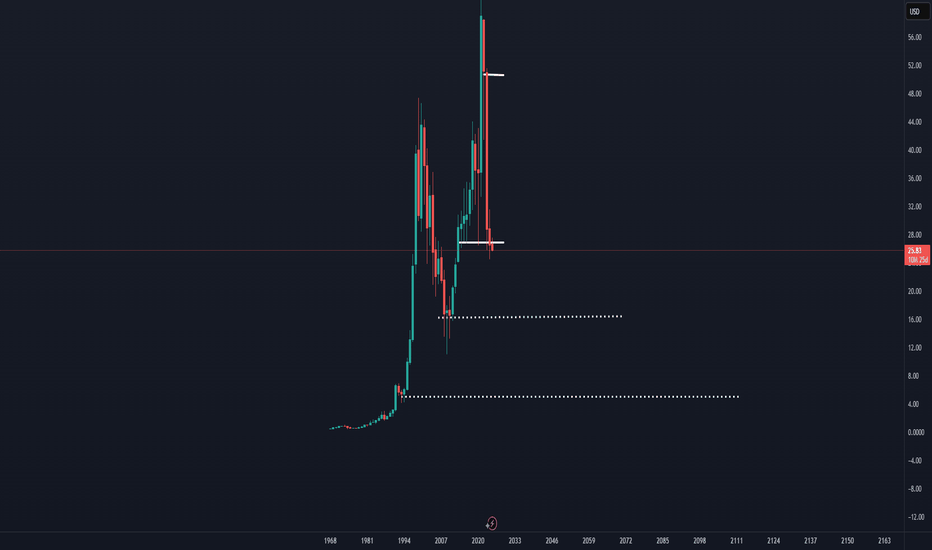

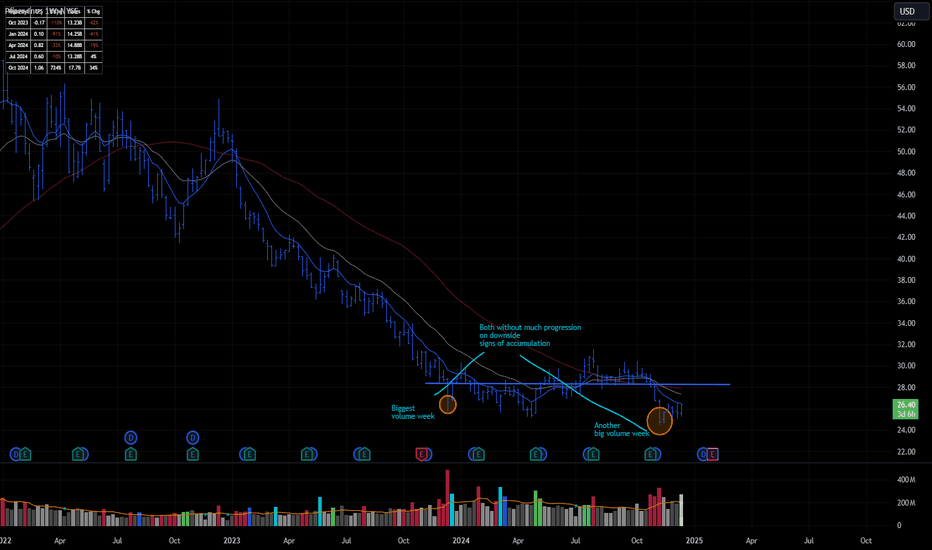

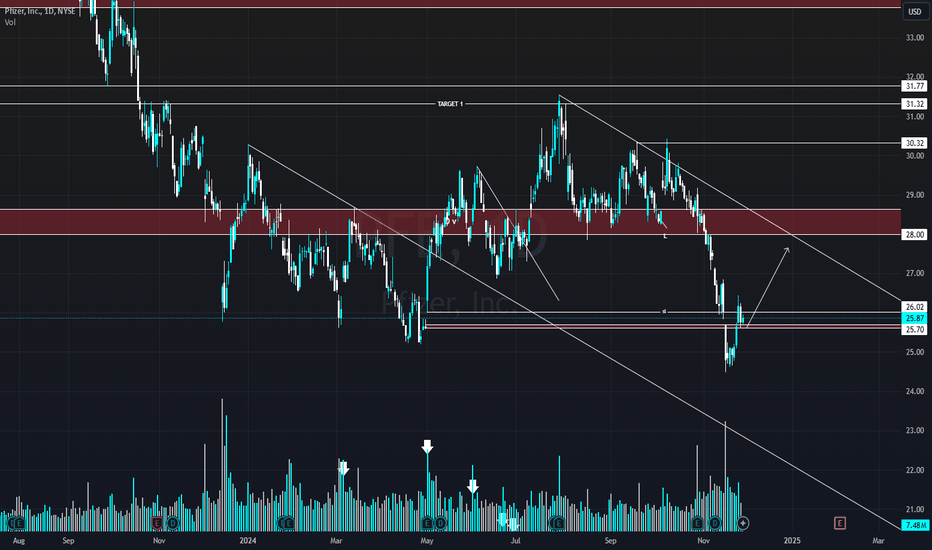

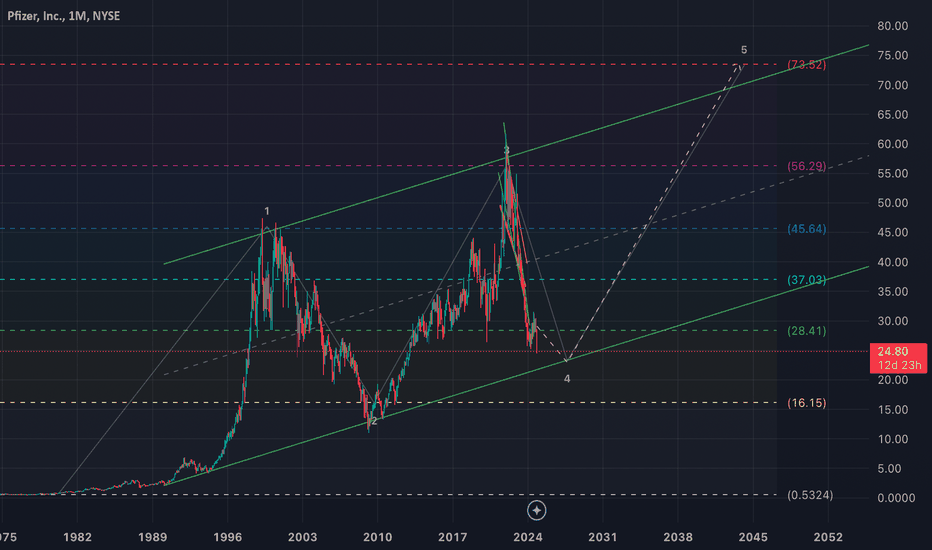

From a technical standpoint it looks like a double bottom is forming at the bottom of a 12 year trend line.

The Price/ FCF and EV/EBITDA ratios have decreased back to 2023 and prior levels indicating it is no longer overvalued as it was in 2024.

Reverse DCF based on EPS w/out NRI and an 11% discount rate show thaf Pfizer's fair value is $35.89, indicating a 27% margin of safety.

The recent volume shows large-scale buying, probably by institutions.

Overall I believe the negative sentiment mostly due to the upcoming patent expiration and the realization of loss of revenue from COVID era $ is currently baked into the price and presents a decent buying opportunity.

PFED trade ideas

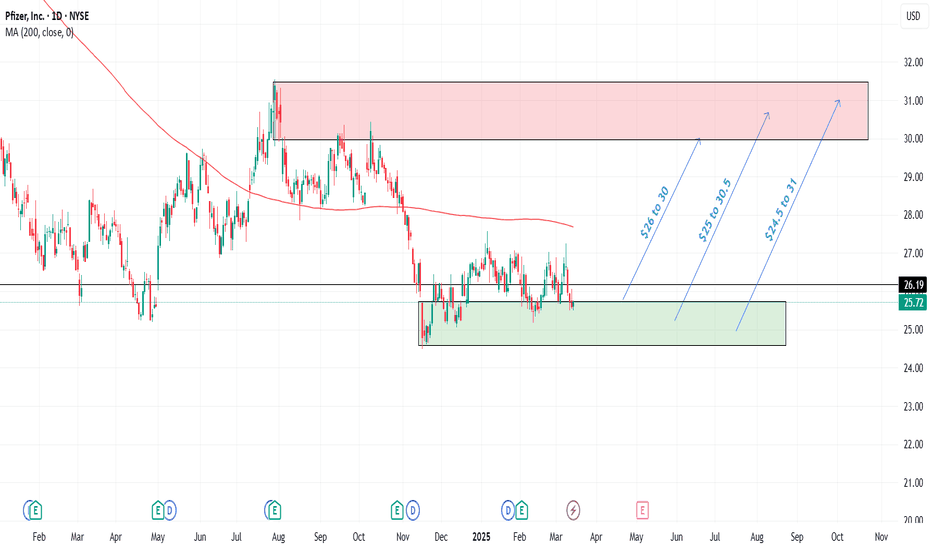

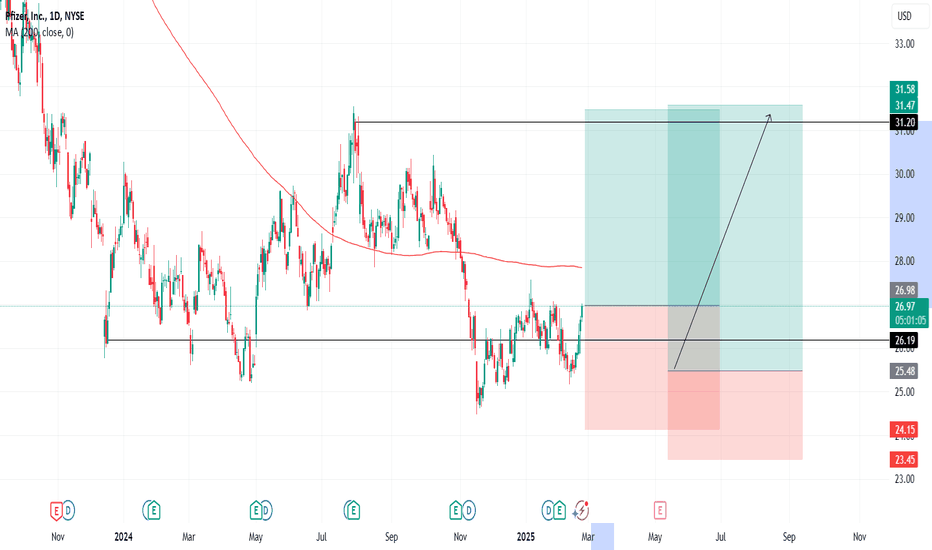

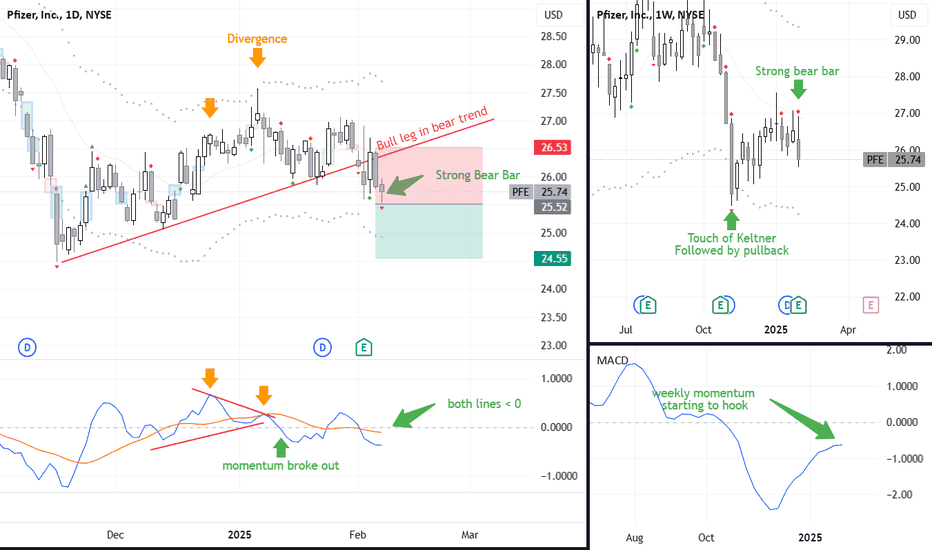

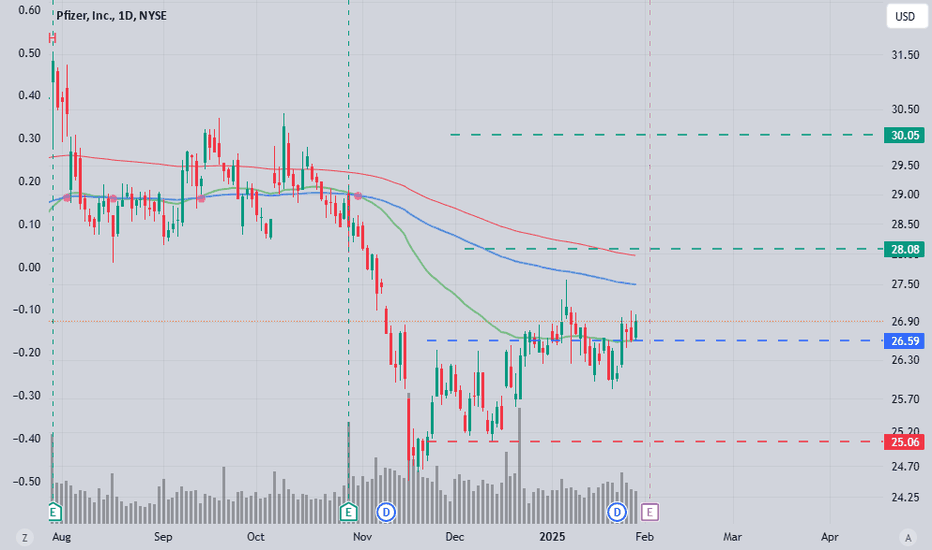

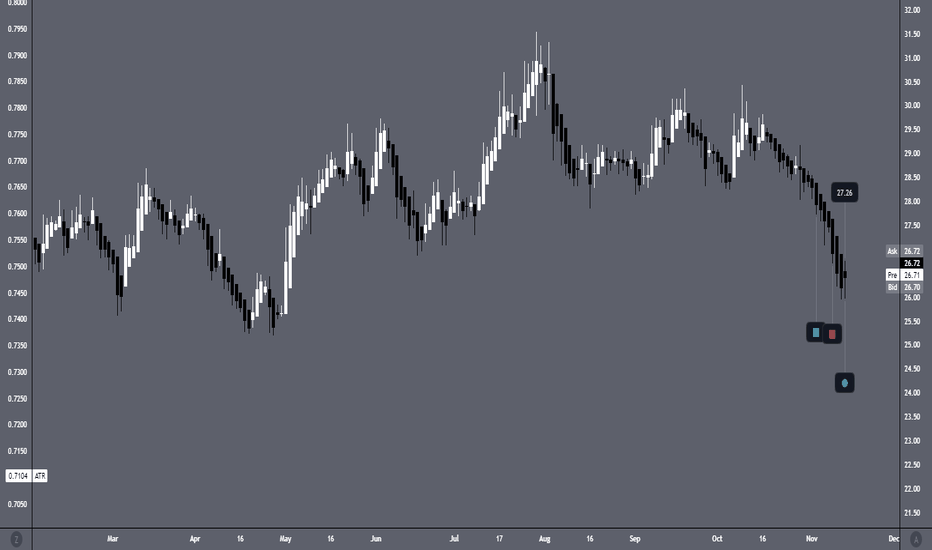

PFE Operation PlanFor this trade on Pfizer (PFE), we will implement a staggered entry strategy with three designated entry points at $26, $25, and $24.5. This approach allows for a cost-averaging method and improved risk management as the market fluctuates.

Our profit targets are set at $28, $30.5, and $31, ensuring we capture gains incrementally as the price moves upward. These targets are based on our technical analysis and current market dynamics. Additionally, strict stop-loss protocols will be in place to mitigate downside risks.

Disclaimer:

This information is provided for educational and informational purposes only and should not be considered financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research or consult a professional financial advisor before making any investment decisions.

Pfizer ($PFE): Undervalued Pharma Giant with Growth Potential?(1/9)

Good afternoon, everyone! 😊

Pfizer ( NYSE:PFE ): Undervalued Pharma Giant with Growth Potential?

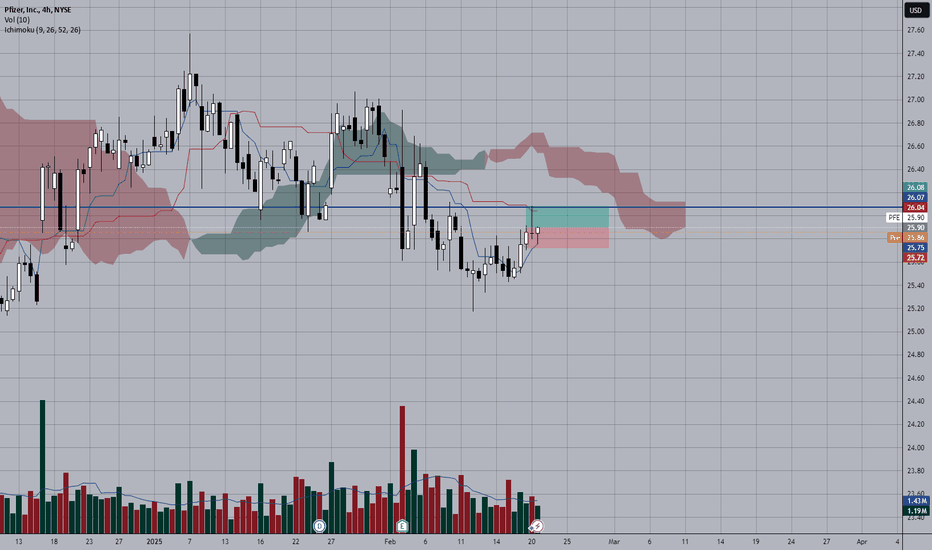

With PFE at $25.90, is this the time to buy into this pharmaceutical powerhouse? Let’s dive in! 😎

(2/9) – PRICE PERFORMANCE

• Current Price: $25.90 as of March 12, 2025 😏

• Recent Moves: Trading within a range of $24 to $28, currently near the middle 😬

• Sector Vibe: Pharma sector remains stable, with new drug approvals driving growth 📈

Short commentary: The stock seems to be consolidating. Is this a good entry point? 🤔

(3/9) – MARKET POSITION

• Market Cap: Approximately $147.2 billion (assuming 5.67 billion shares outstanding) 💰

• Operations: Global pharmaceutical company with a diverse product portfolio 🛡️

• Trend: Strong Q4 2024 earnings and reaffirmed 2025 guidance 🚀

Short commentary: Pfizer’s fundamentals are solid, with consistent revenue and earnings projections. 😉

(4/9) – KEY DEVELOPMENTS

• Reaffirmed 2025 revenue guidance of $61-64 billion and EPS of $2.80-3.00 📈

• Continued focus on new drug developments and expanding into emerging markets 🌐

• Achieved cost savings goals and ongoing optimization programs for improved margins 💡

Short commentary: The company is managing its costs effectively and looking to future growth. Let’s watch closely. 👀

(5/9) – RISKS IN FOCUS

• Legal challenges related to past products ⚙️

• Competition from generic manufacturers and patent expirations 📉

• Economic conditions affecting healthcare spending ⚠️

Short commentary: These risks are known, but Pfizer’s diverse portfolio should help mitigate them. Stay vigilant! 🕵️

(6/9) – SWOT: STRENGTHS

• Diverse product portfolio across multiple therapeutic areas 🏆

• Strong R&D capabilities and pipeline of new drugs 🌈

• Global presence and distribution network 🌟

Short commentary: Pfizer’s strengths position it well for long-term growth. Keep up the good work! 👍

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Dependence on key products, legal issues ⚠️

• Opportunities: New drug approvals, expanding into emerging markets 🌐

Short commentary: Opportunities abound, but weaknesses need to be monitored. Let’s hope they nail it! 📈

(8/9) – PFE at $25.90 – what’s your call? 🗳️

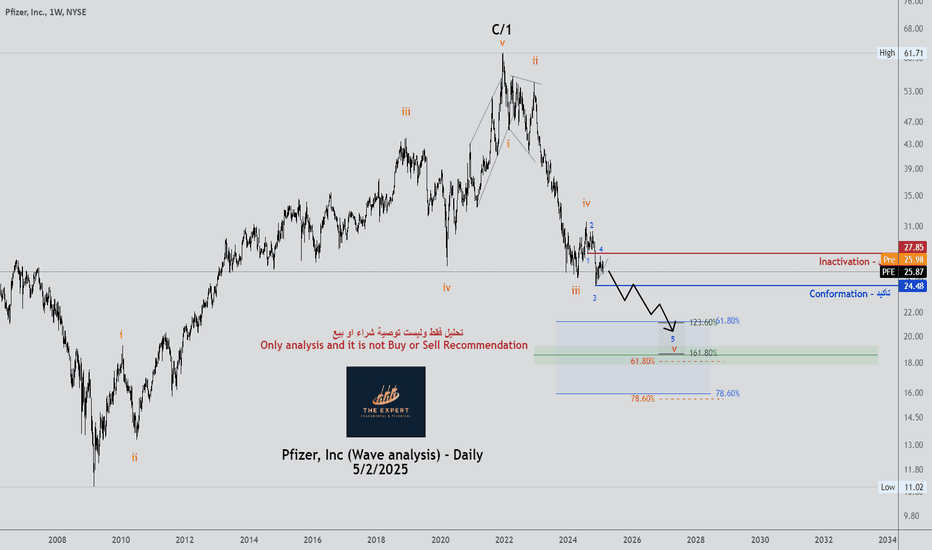

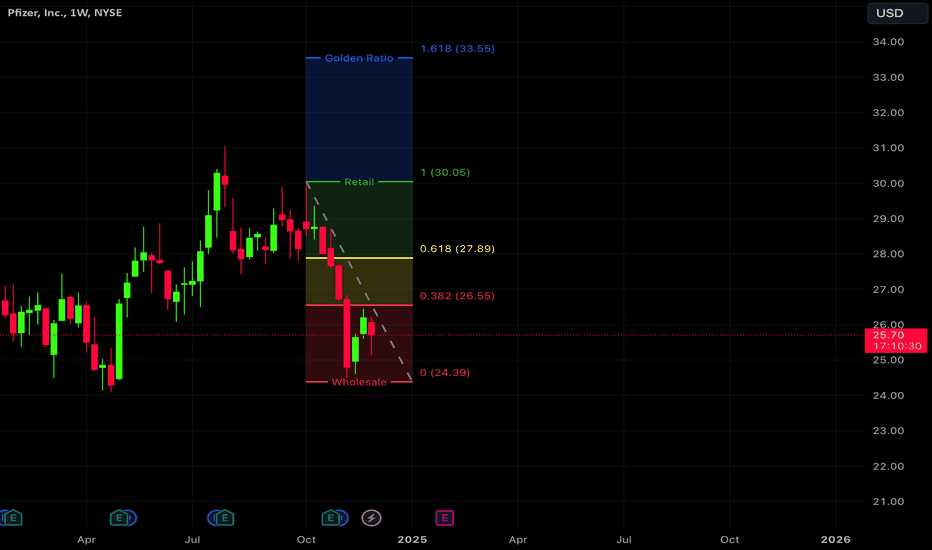

• Bullish: Price could rise to $30+ if it breaks above $28 🚀

• Neutral: Price remains between $24 and $28 😐

• Bearish: Price could drop to $22 if it breaks below $24 📉

Drop your pick below! 💬

(9/9) – FINAL TAKEAWAY

Pfizer’s $25.90 stance shows a company with solid fundamentals and a fair valuation at a P/E of approximately 8.93. With a strong pipeline and cost management, it’s an attractive option for value investors. Keep an eye on resistance at $28 for potential upside movement. Snag low, hold long!

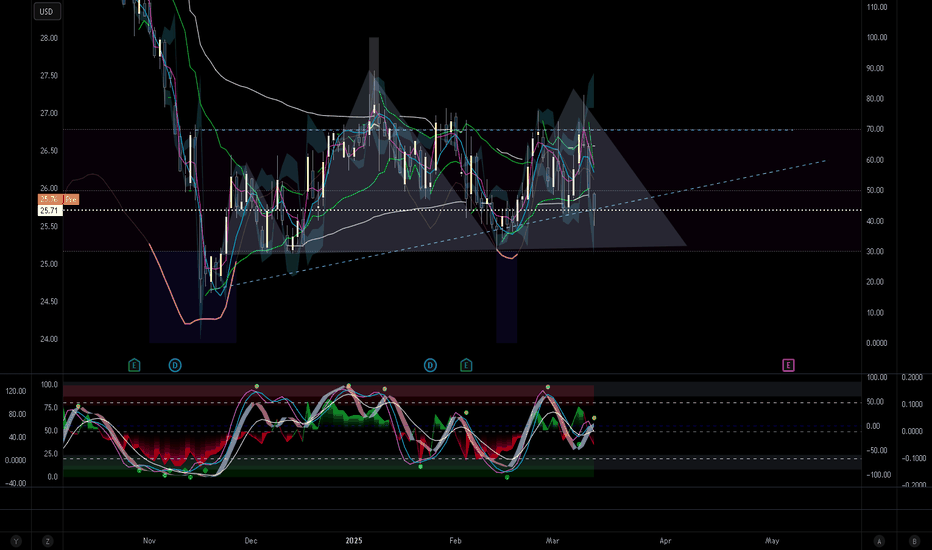

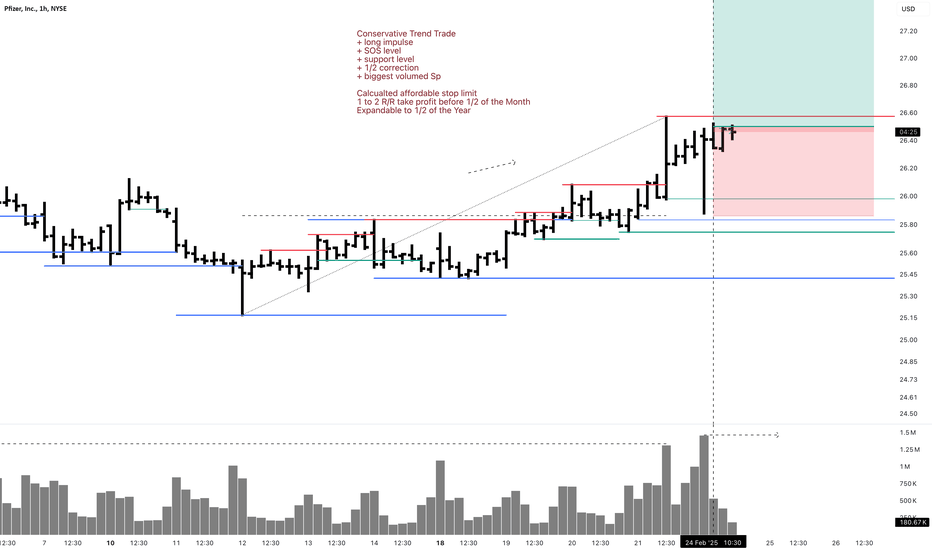

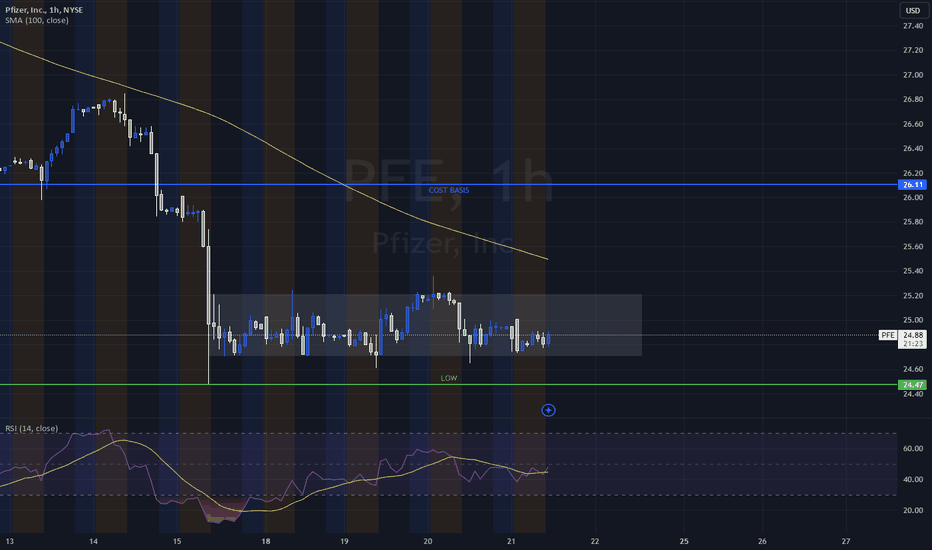

PFE 1H Long Swing Conservative Trend TradeConservative Trend Trade

+ long impulse

+ SOS level

+ support level

+ 1/2 correction

+ biggest volumed Sp

Calculated affordable stop limit

1 to 2 R/R take profit before 1/2 of the Month

Expandable to 1/2 of the Year

Daily Trend:

"+ long impulse

+ neutral zone

+ close to 1/2 correction"

Monthly CounterTrend

"- short balance

+ unvolumed expanding ICE

+ volumed 2Sp-

+ weak test"

Yearly Trend

"+ long impulse

+ 1/2 correction

+ exhaustion volume?"

Will add more if corrects to 1/2 of 1H wave.

PFE Operation PlanFor this trade on Pfizer (PFE), we will implement a staggered entry strategy with three designated entry points at $27, $26, and $25. This approach allows for a cost-averaging method and improved risk management as the market fluctuates.

Our profit targets are set at $29, $30, and $31, ensuring we capture gains incrementally as the price moves upward. These targets are based on our technical analysis and current market dynamics. Additionally, strict stop-loss protocols will be in place to mitigate downside risks.

Disclaimer:

This information is provided for educational and informational purposes only and should not be considered financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research or consult a professional financial advisor before making any investment decisions.

Swing trade with 15%+ upside potentialBased on RSI and price action, it seems that $25 is a good entry for a swing trade with TP at $29.50+, before next earnings report. The stock has done that move two times from December 2023. The only alarming factor is the sharp fall of OBV, but the risk-reward ratio of the play is very attractive.

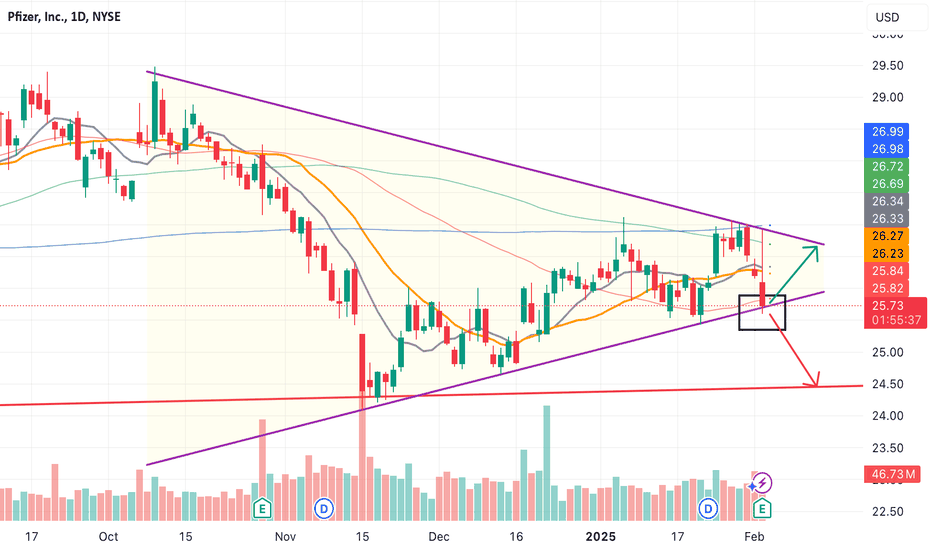

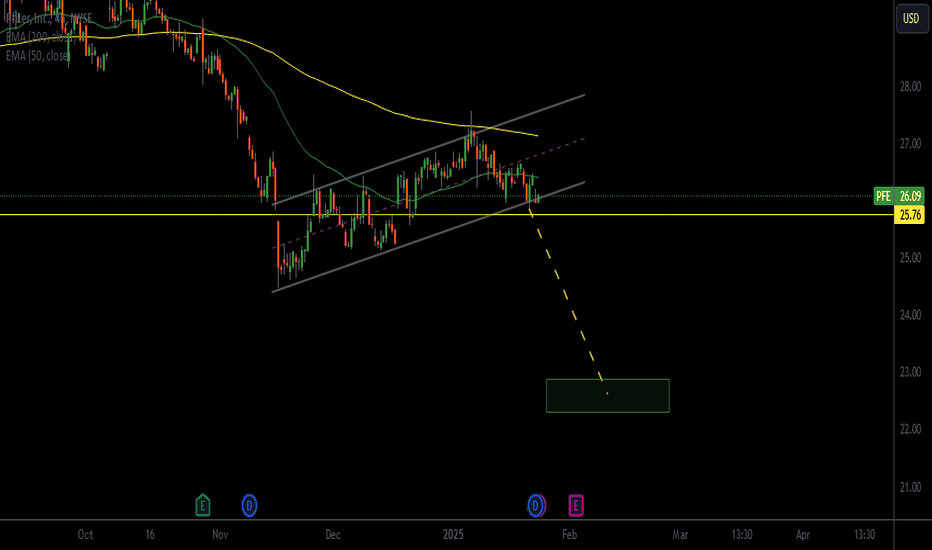

Time to get out or.. to get in?The price reaches the bottom of the symmetrical compression triangle in which it has been moving for weeks.

A break downward brings the price back to the lows for a retest, while a possible (and I would say probable) rebound brings it back to the upper edge to attempt a breakout.

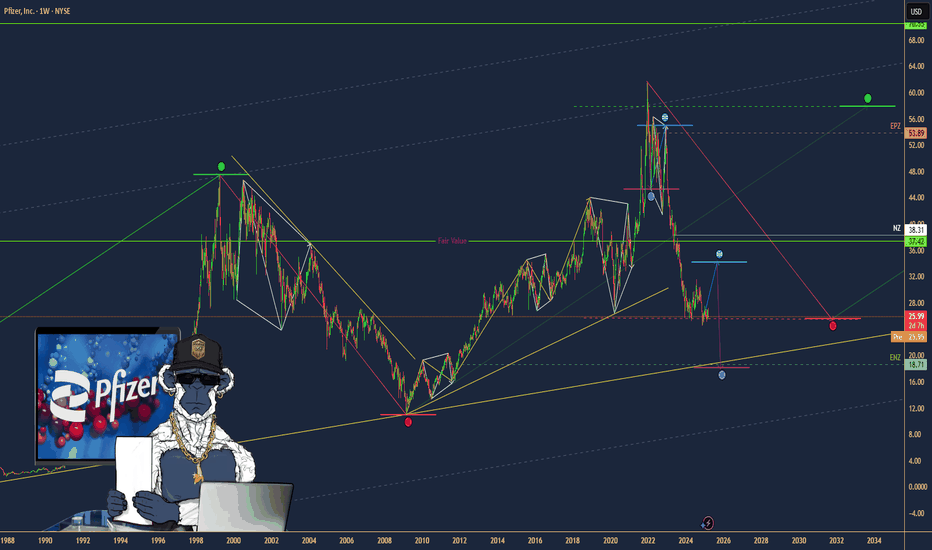

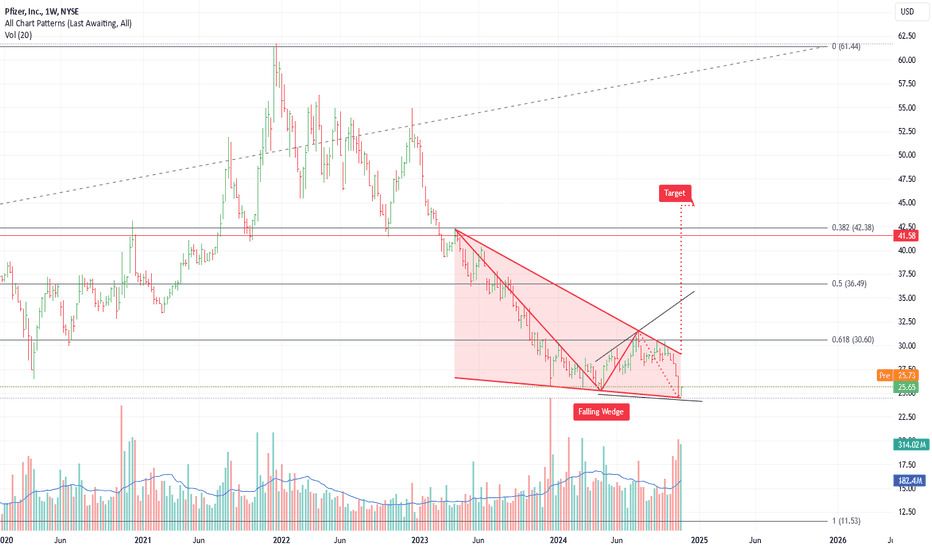

PFE - Is There Any Value Here?After achieving the pinnacle of success during the Covid vaccine era, PFE has struggled to recover from falling vaccine sales. I had considered abandoning my core holdings but on further investigation, I liked what they were doing with their cancer drugs and continued to hold. A hefty dividend, albeit not supported much by earnings, continued also to be an attraction. The current washout with the nomination of Robert Kennedy Jr for a cabinet position could have been the last. AI generated pattern finder offers tempting long term gains.

Tempting opportunity for those with patience.

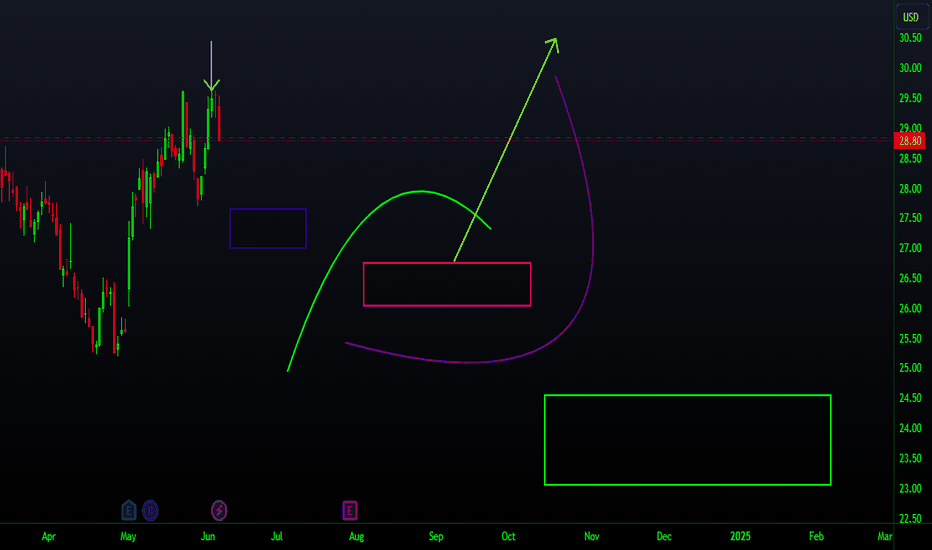

Pfizer Combo3 simple potential zones of influence I will be interested in if the price will start descending, for both types of scenarios: consolidations or complete reversals. Also interested in the green curve in case the price finds support there and doesn't look like it can penetrate decisively below after earnings report.