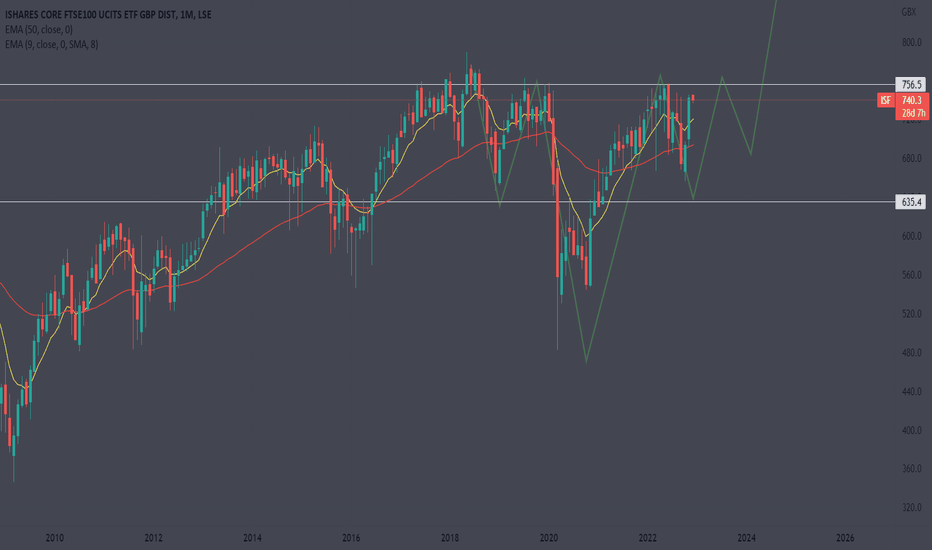

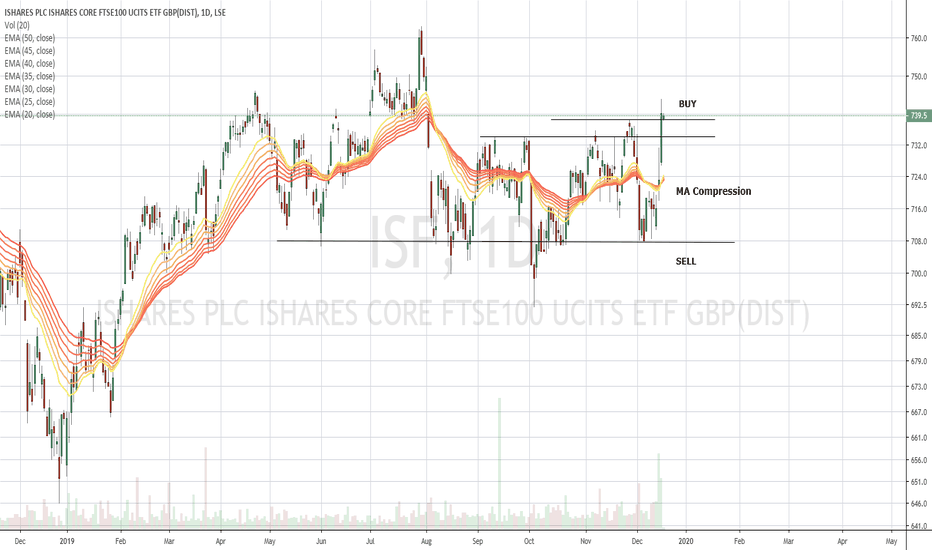

$FTSE - Where to next? Longer term.$FTSE - Where to next? Longer term.

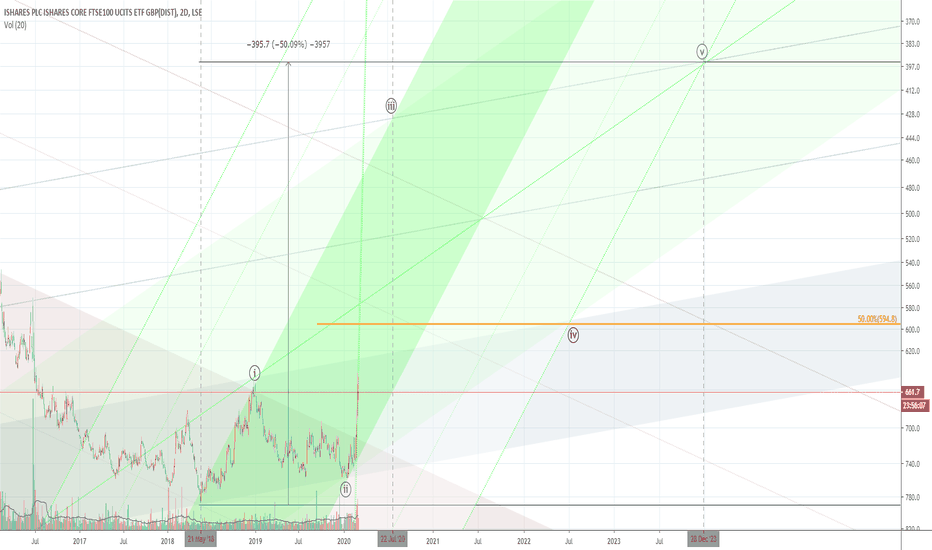

Here's a look of what could happen with the ftse going forward.

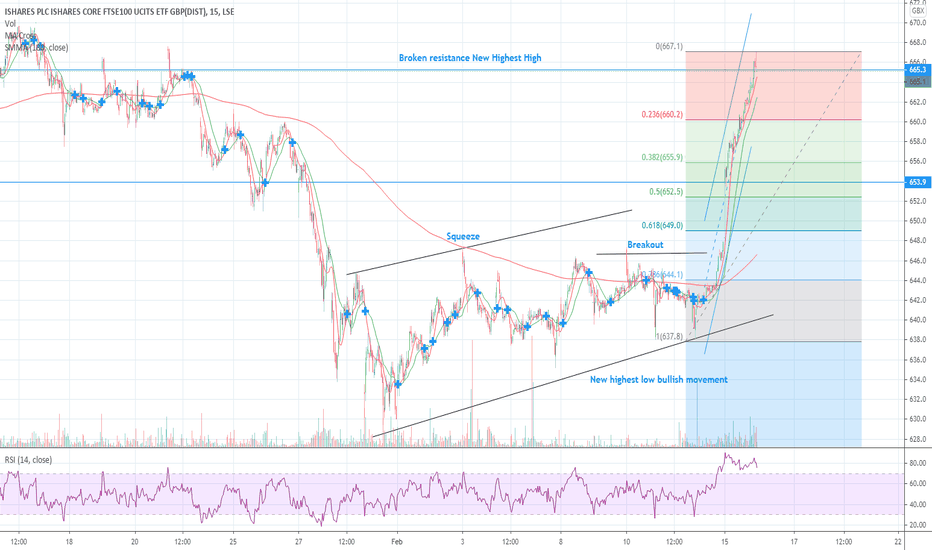

Technical view:

Got a stocks and share ISA? Take advantage of the great price points. As we are getting towards end of the year adjusting portfolio and to seek out further long term positioning.

Key stats

About iShares Core FTSE 100 UCITS ETF

Home page

Inception date

Apr 27, 2000

Structure

Irish VCIC

Replication method

Physical

Dividend treatment

Distributes

Primary advisor

BlackRock Asset Management Ireland Ltd.

ISIN

IE0005042456

The investment objective of this Fund is to provide investors with a total return, taking into account both capital and income returns, which reflects the return of the FTSE 100 Index.

Related funds

Classification

What's in the fund

Exposure type

Finance

Consumer Non-Durables

Health Technology

Energy Minerals

Stock breakdown by region

Top 10 holdings

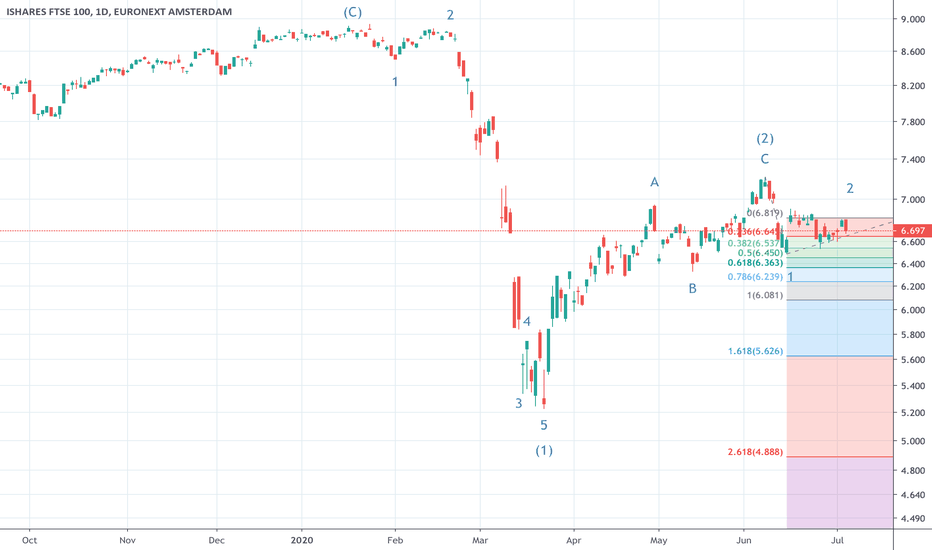

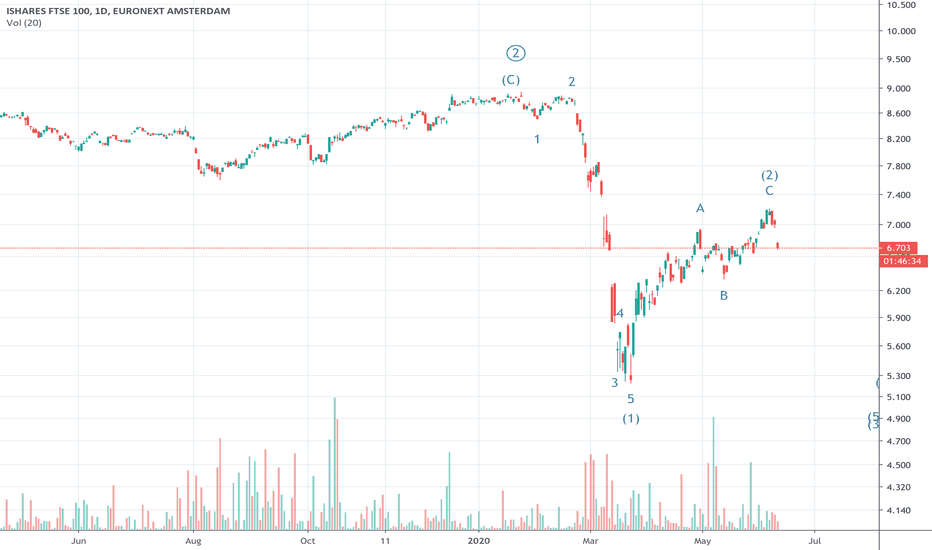

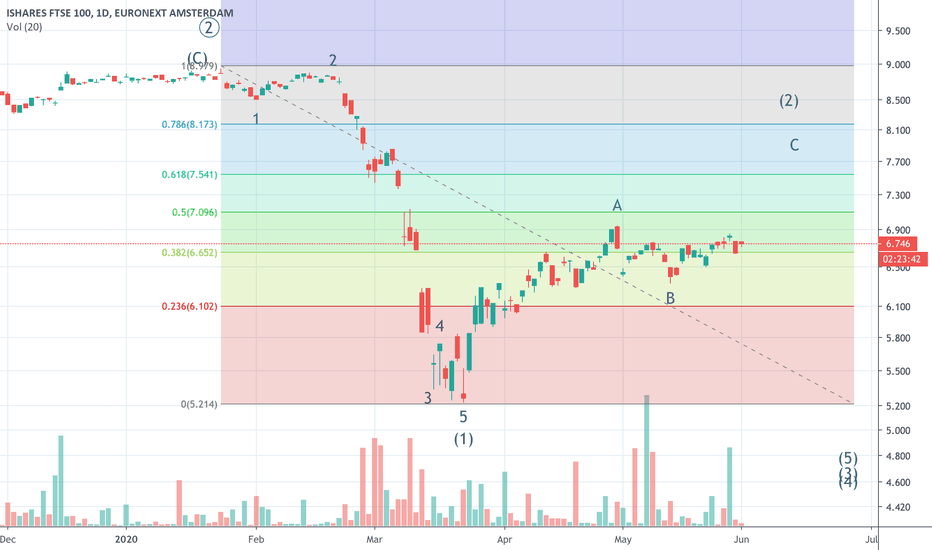

ISFA (FTSE100 ETF) - downtrend to new lows continuesISFA continues on its way down to new lows. In the shorter term view, it seems to have finished, or nearly so, minor counter-trend wave 2. The next move should be minor 3, where the most probable target is is below 5,900. If prices crosses up 7,220, this analysis should be reviewed. FOLLOW SKYLINEPR

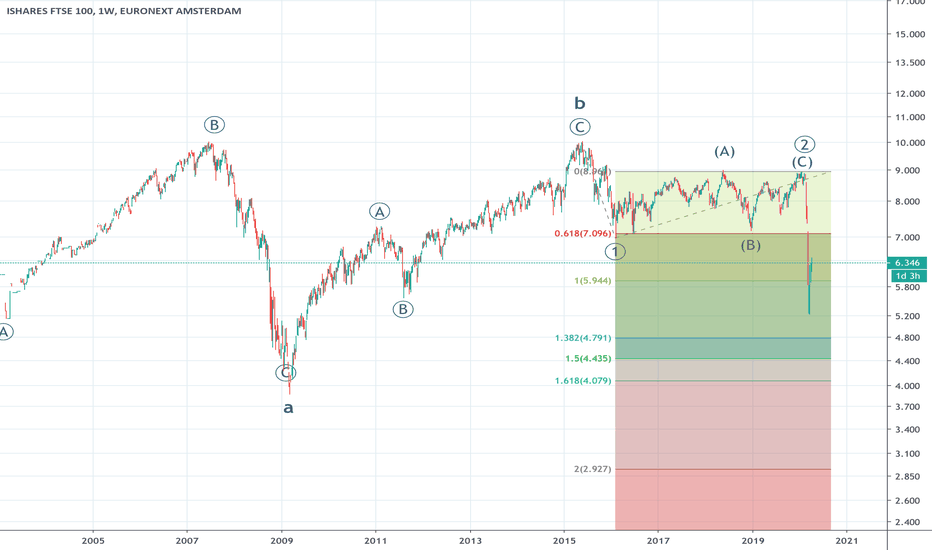

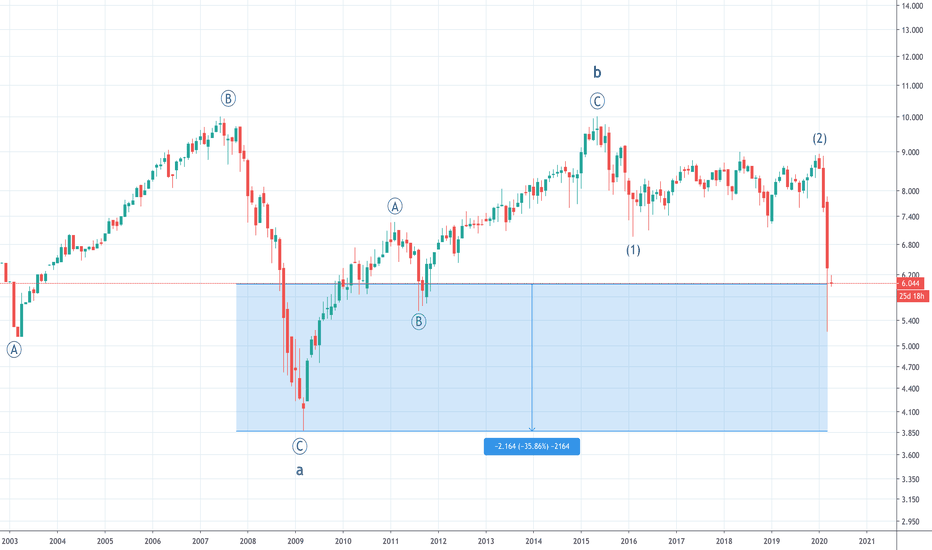

ISFA - FTSE 100 ETF - more than 35% down aheadFTSE 100 represented by its ETF is tracing down a cycle wave C that should bring prices down to around and additional 35% reaching its bottom in one to two years ahead. Retracements with opportunities for returns in the upside should occur during its path and we will be posting them here. The short

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

ISFL assets under management is 12.42 B GBX. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

ISFL invests in stocks. See more details in our Analysis section.

ISFL expense ratio is 0.07%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, ISFL isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

Yes, ISFL pays dividends to its holders with the dividend yield of 3.40%.

ISFL shares are issued by BlackRock, Inc.

ISFL follows the FTSE 100. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Apr 27, 2000.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.