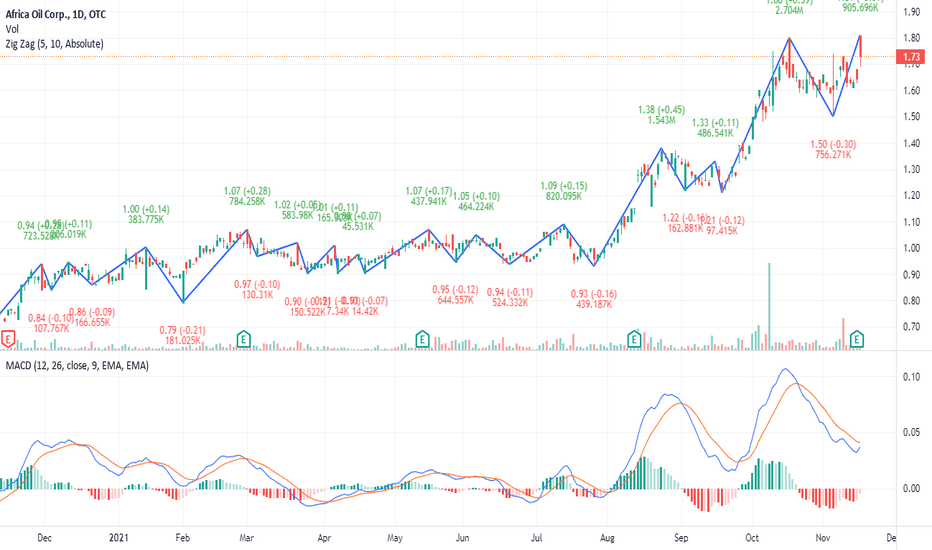

Continuation Wedge A Continuation Wedge (Bullish) represents a temporary interruption to an uptrend, taking the shape of two converging trendlines both slanted downward against the trend. During this time the bears attempt to win over the bulls, but in the end the bulls triumph as the break above the upper trendline s

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−5.000 SEK

−2.95 B SEK

0.00 SEK

641.58 M

About MEREN ENERGY INC

Sector

Industry

CEO

Roger Tucker

Website

Headquarters

Vancouver

Founded

1993

FIGI

BBG016G276X6

Meren Energy, Inc. is an oil and gas company, which engages in the acquisition, exploration, development, and production associated with oil and gas assets. It focuses on producing and development assets in deep-water offshore Nigeria, and development assets in Kenya. Its portfolio of exploration assets includes Guyana, Kenya, Namibia, Nigeria, South Africa, and in the Senegal Guinea Bissau Joint Development Zone (AGC). The company was founded on March 29, 1993 and is headquartered in Vancouver, Canada.

Related stocks

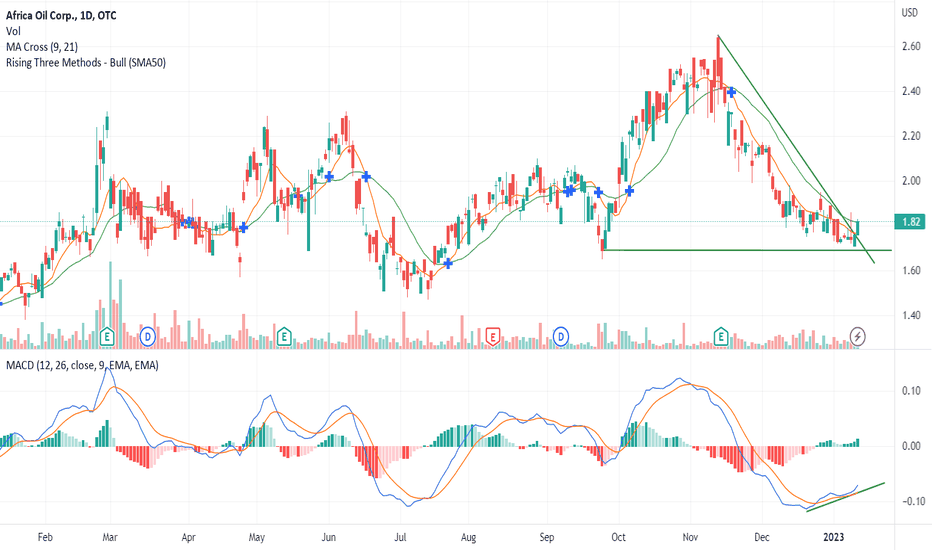

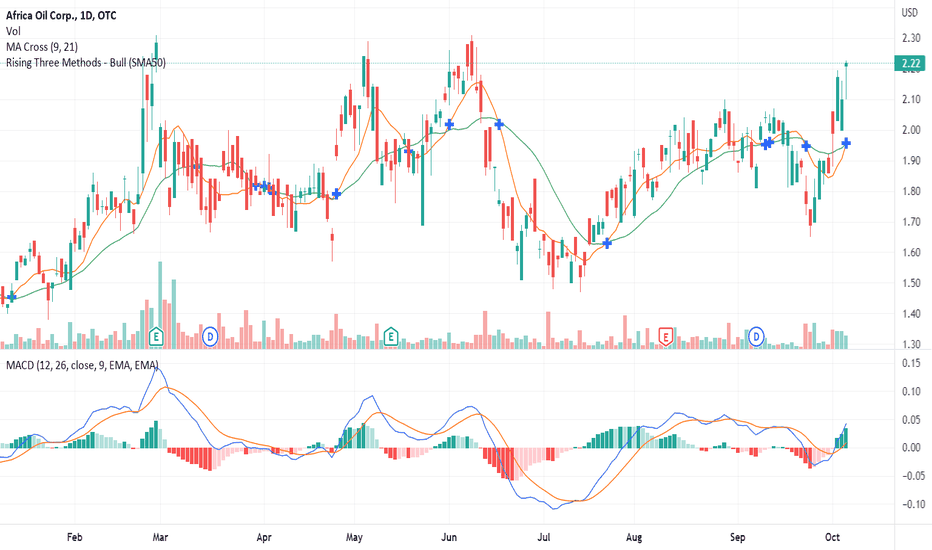

African Oil AOIFFTechnically we have a break out new high and higher volume. This will take the stock to $2.00 But the stock is grossly undervalued and in 2022 we are looking for $6.

Oil is a commodity that is price controlled and AOIFF was selling it at $55 per barrel and making a profit. With oil now selling

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on AQUISUK exchange Meren Energy Inc stocks are traded under the ticker MERS.

We've gathered analysts' opinions on Meren Energy Inc future price: according to them, MERS price has a max estimate of 31.19 SEK and a min estimate of 17.44 SEK. Watch MERS chart and read a more detailed Meren Energy Inc stock forecast: see what analysts think of Meren Energy Inc and suggest that you do with its stocks.

Yes, you can track Meren Energy Inc financials in yearly and quarterly reports right on TradingView.

Meren Energy Inc is going to release the next earnings report on Aug 12, 2025. Keep track of upcoming events with our Earnings Calendar.

MERS earnings for the last quarter are 1.08 SEK per share, whereas the estimation was 0.08 SEK resulting in a 1.30 K% surprise. The estimated earnings for the next quarter are 0.09 SEK per share. See more details about Meren Energy Inc earnings.

Meren Energy Inc revenue for the last quarter amounts to 748.95 M SEK, despite the estimated figure of 100.74 M SEK. In the next quarter, revenue is expected to reach 1.24 B SEK.

MERS net income for the last quarter is 511.55 M SEK, while the quarter before that showed 66.94 M SEK of net income which accounts for 664.14% change. Track more Meren Energy Inc financial stats to get the full picture.

Yes, MERS dividends are paid quarterly. The last dividend per share was 0.36 SEK. As of today, Dividend Yield (TTM)% is 8.28%. Tracking Meren Energy Inc dividends might help you take more informed decisions.

As of Jul 12, 2025, the company has 25 employees. See our rating of the largest employees — is Meren Energy Inc on this list?

Like other stocks, MERS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Meren Energy Inc stock right from TradingView charts — choose your broker and connect to your account.