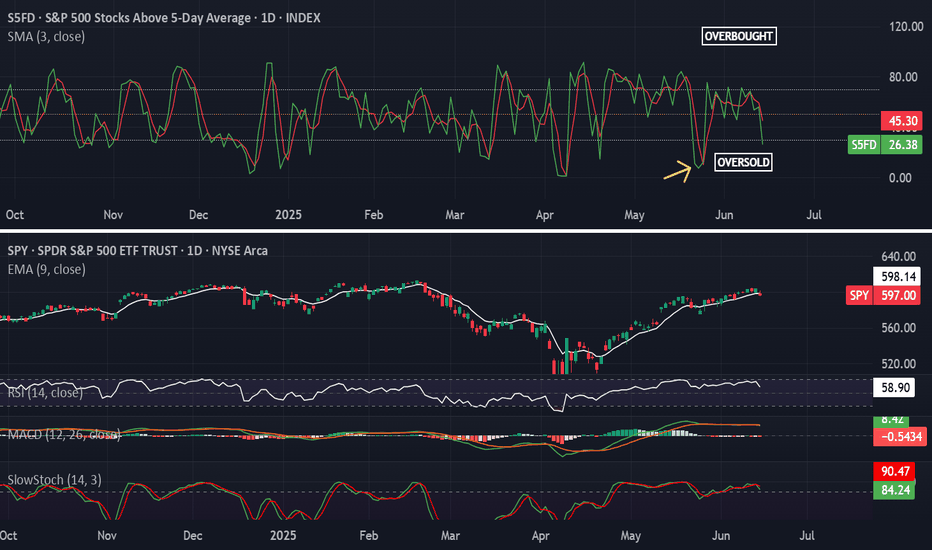

$SPY Watchlist Plan: Week of 6/17Watchlist Plan: Week of 6/17

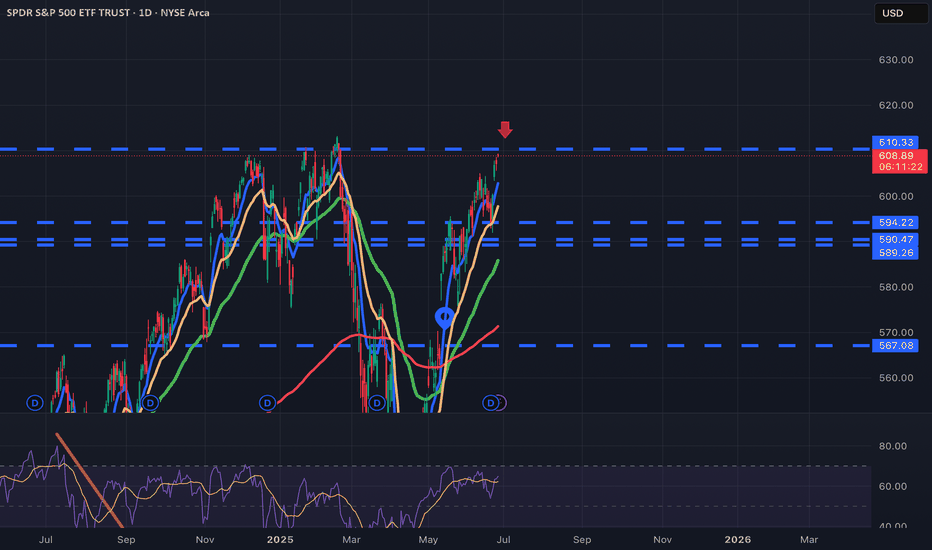

Stock Near All-Time High

Approaching ATH at 613.23 — key pivot zone

Break and hold above: Look for calls targeting momentum continuation (e.g., 620, 630 psychological levels)

Rejection off ATH: Look for puts targeting a retracement toward 599, then 568

Retracement and Support Zones

599: Micro support on smaller timeframes (15m/1h). Watch for intraday bounce or breakdown.

568: Key downside target if rejection at ATH confirms and 599 fails. Consider swing puts toward this level.

Also monitor the 585–590 range for potential consolidation or minor support.

Game Plan Triggers

Bullish confirmation:

Clean break and hold above 613.23 with strong volume

Market-wide risk-on tone (SPY, QQQ green)

Bearish setup:

Strong rejection at or below ATH

Market-wide pullback or macro weakness (especially in tech or consumer sectors)

Catalysts

June 17 (Monday): Retail Sales Report — gauge of consumer strength

June 18 (Tuesday): Unemployment Claims — snapshot of labor market health

Strong data may fuel market optimism

Weak data could tilt market bearish

Additional Notes

Watch for volume divergence near ATH — breakout with low volume can trap longs

Use pre-market action to frame bias: gap up with follow-through = strength; gap up followed by fade = weakness

Keep an eye on VIX and bond yields for macro pressure indicators

SPY trade ideas

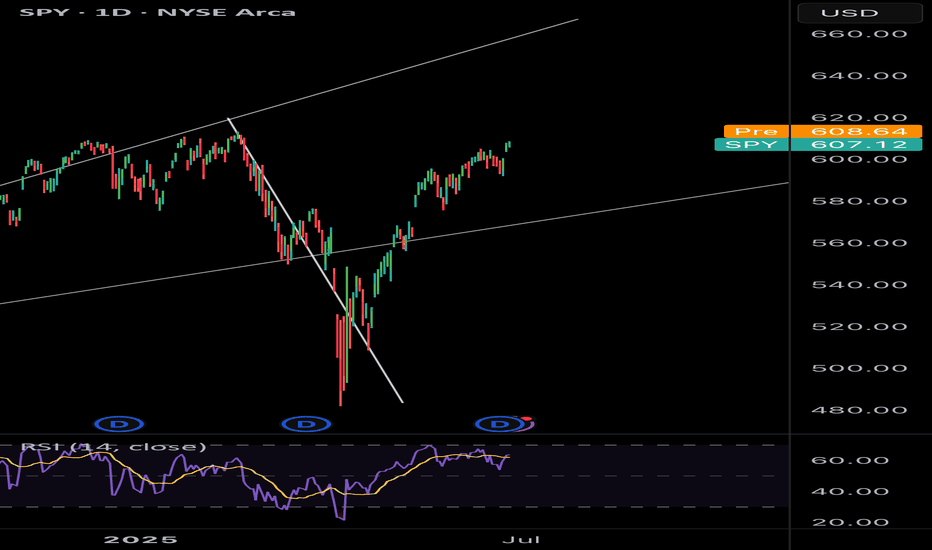

SPY: Expecting Bullish Movement! Here is Why:

The analysis of the SPY chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

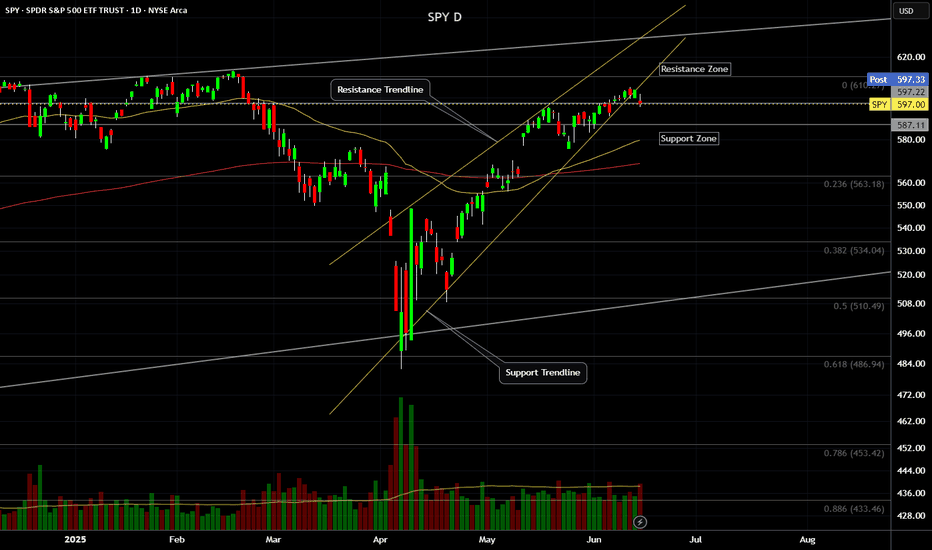

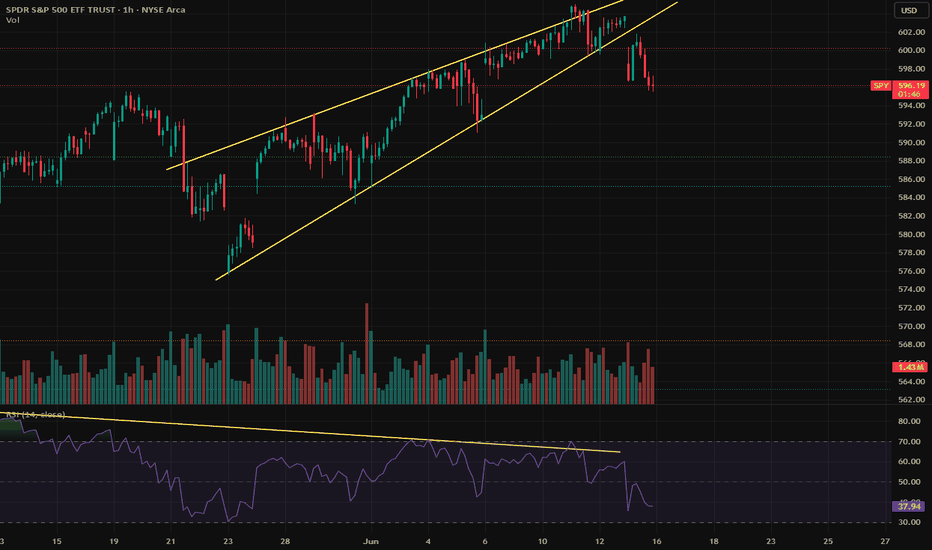

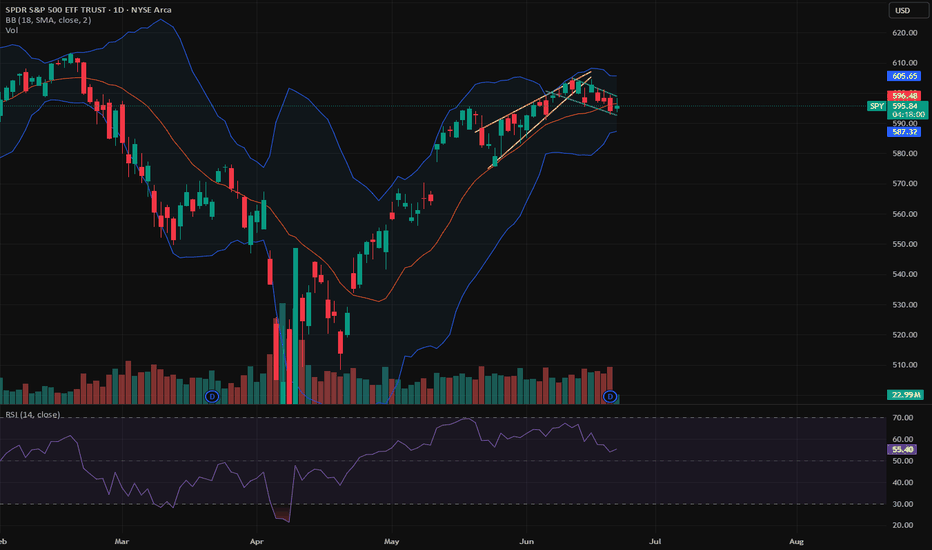

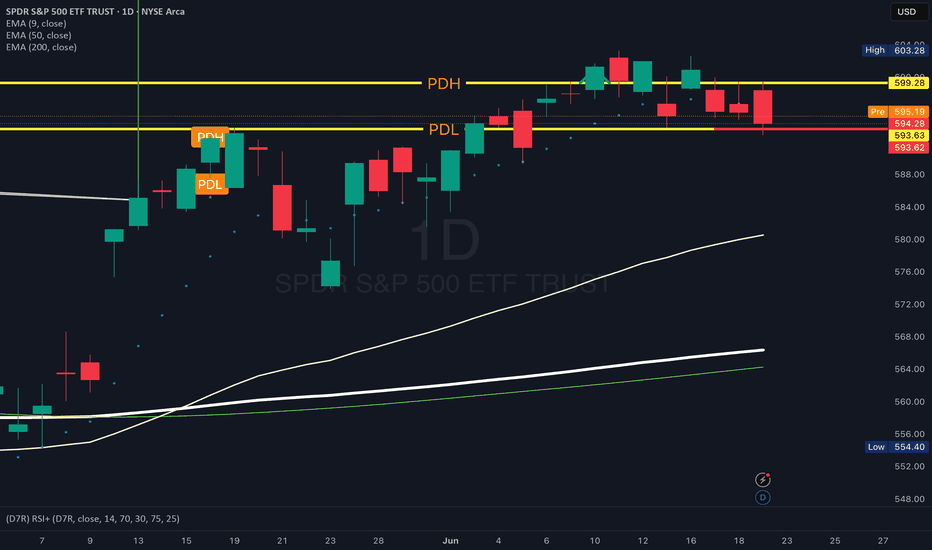

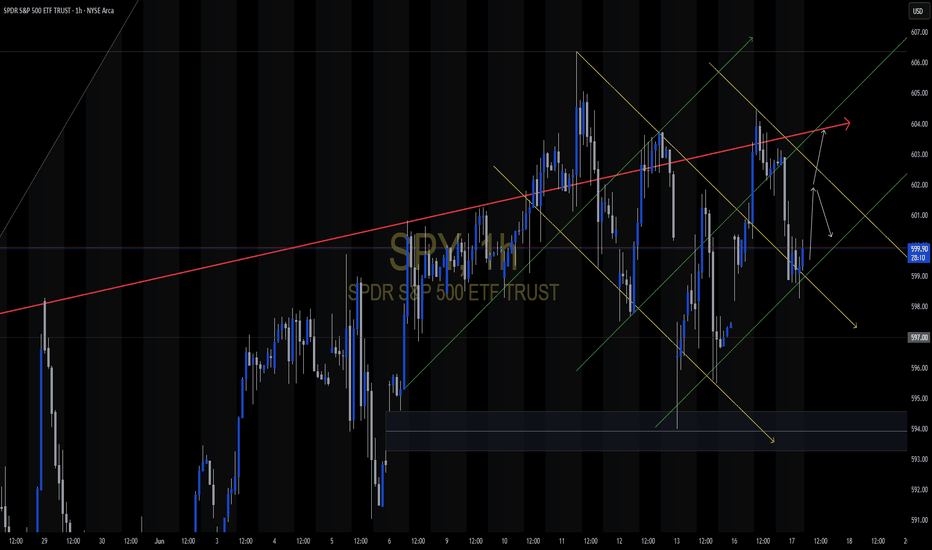

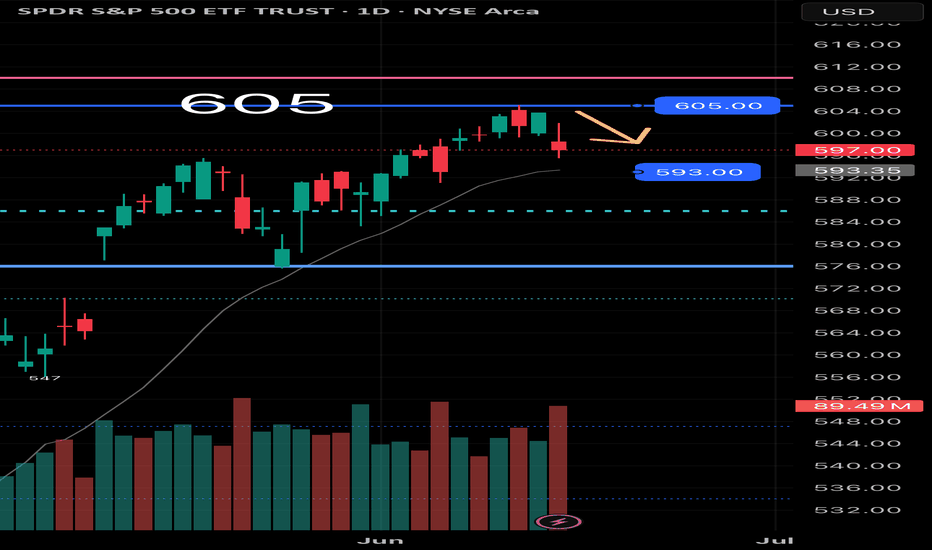

SPY (S&P500) - Price Testing Support Trendline - Daily ChartSPY (S&P500 ETF) price has just closed below $600 and is currently under a support trendline.

If price cannot breakout above the $600 and $605 resistance level this month, a pullback could occur down to the support zone.

SPY price could potentially pullback to various levels of support due to:

-USA domestic conflict

-International military conflicts

-Technical chart bearish divergence

-USA federal reserve interest rate news

-Government and corporate news

Support Levels: $595, $590, $585, $580.

Resistance Levels: $600, $605, $610, $615.

The 50EMA/200EMA Golden Cross is still on-going, and support prices of $580 and $568 have yet to be tested significantly.

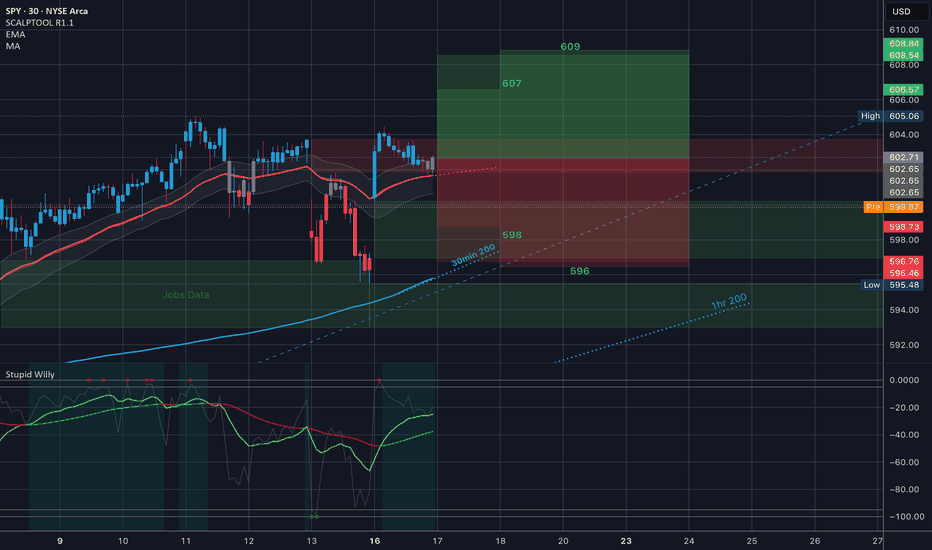

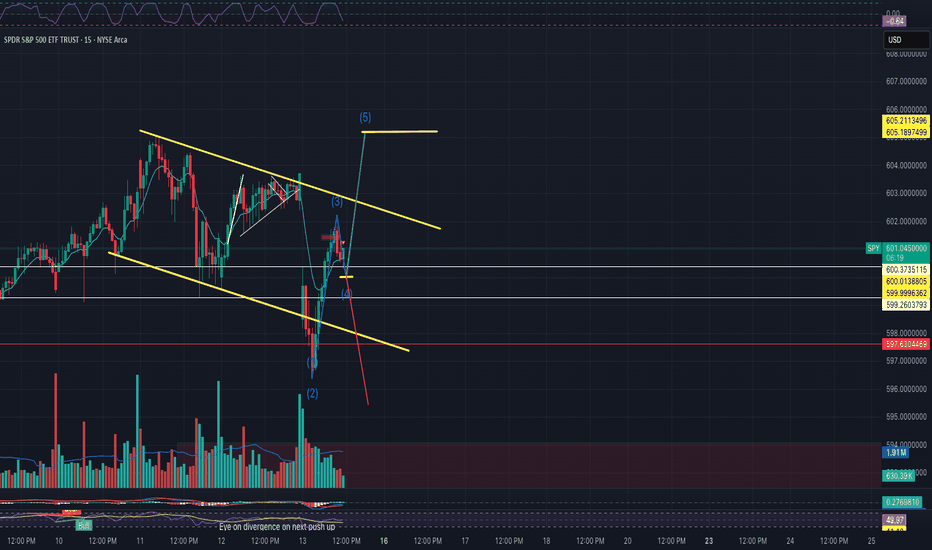

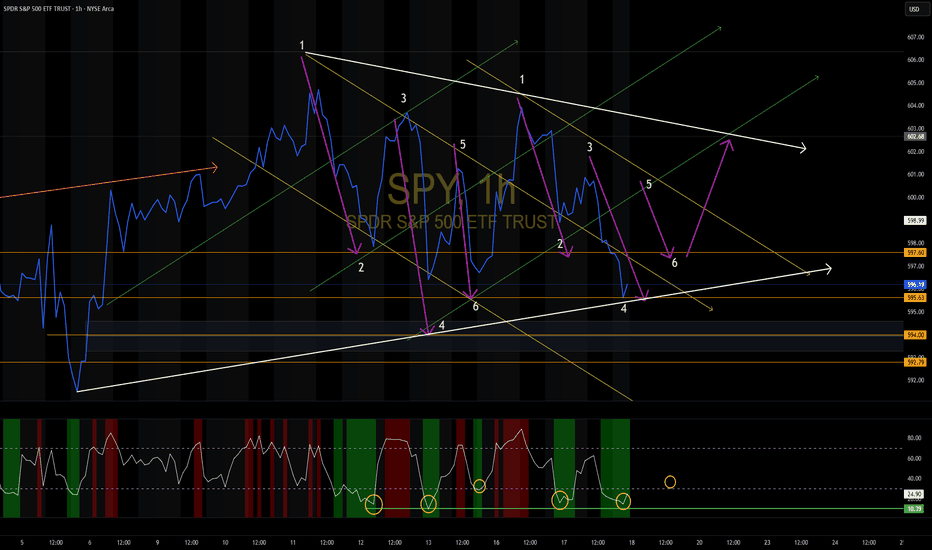

Spy Prediction Potential breakout of bull flag if it bounces back after retest of 200 SMA. Could see an attempt for new ath.

Spy needs to reach 602.23 and hold that floor before the breakout. Watch for volume spike and close above 603. Watch for confirmation on the breakout.

Potential entries based on risk - 603.61 & 602.95

If volume or momentum declines, we could see a potential breakdown back towards 598.

Watch out for fakeouts.

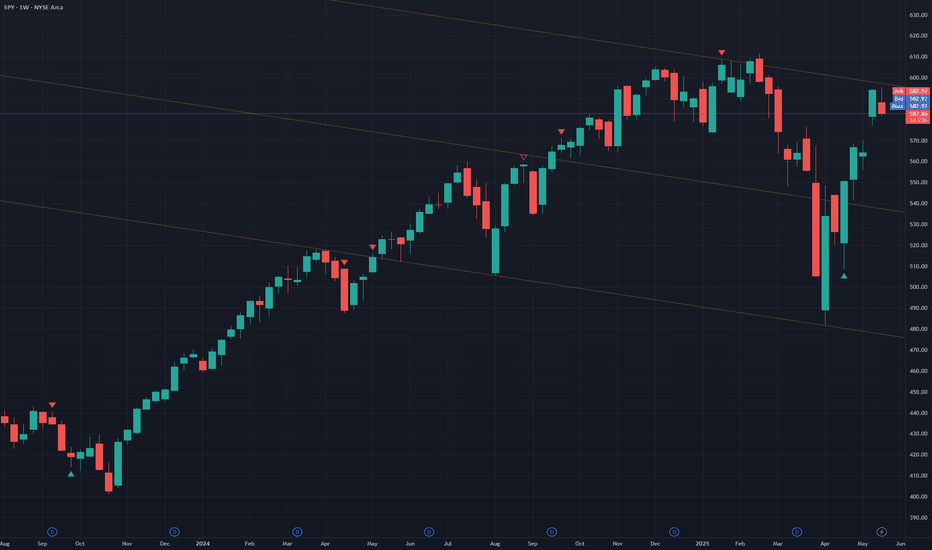

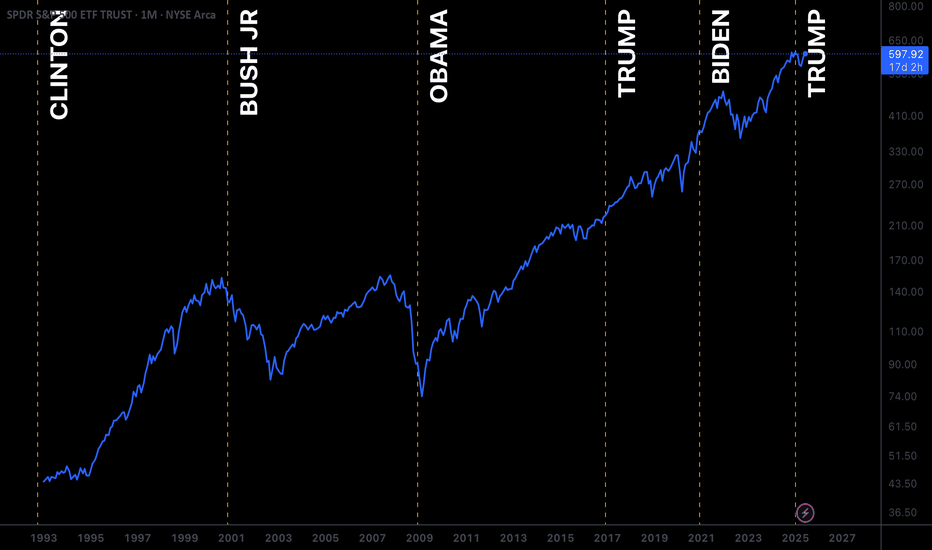

SPY . Market Corrections IncomingHey Guys it's been a long time but I'm going to be more consistent in publishing more. The S&P 500 has hit a level of resistance 4 times on the daily chart. which is very very telling. Yes I understand we have news and war being a major catalyst in the stock market rallying a lot lately but this is only temporary. This previous witching was last Friday if you weren't aware which also caused the small pull back. So for further bullishness to continue let's look at the earnings for the magnificent 7 and the rest of the tech sector. More war means more money for the market . we have the next witching in September . and so here are my projections. We take a step higher in July as we go into the peak of SOLAR Maximum . please do your research. and then after that by September we go into pull season . Happy trading

SPY soars to new all time highsThere has been a lot of speculation about where SPY is going next. I believe a significant correction will happen in the near future. However, today SPY is creeping back into the strong uptrend it once had. Looking at chart patterns, SPY is building momentum once more and will be hitting another yet another all time high.

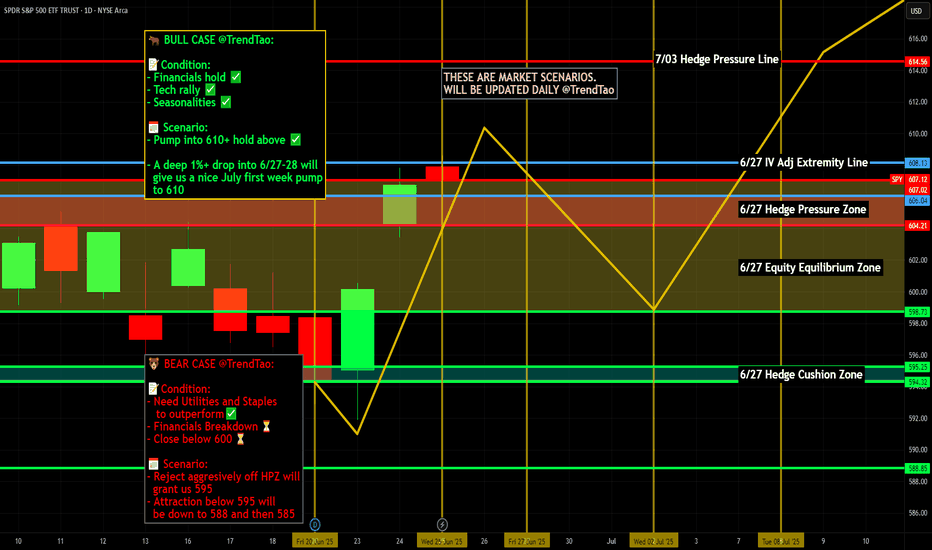

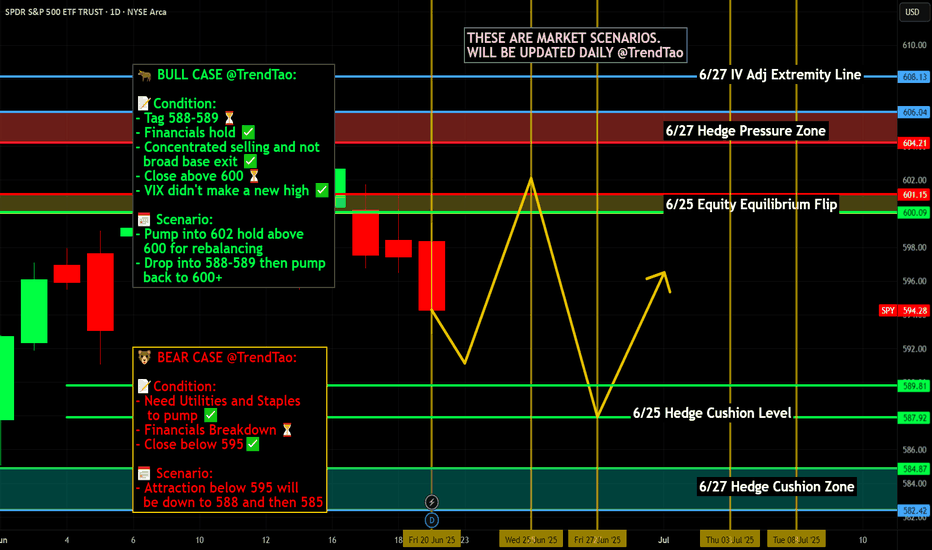

Nightly $SPY / $SPX Scenarios for June 26, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for June 26, 2025 🔮

🌍 Market-Moving News 🌍

💱 Dollar Mounts Decline on Fed Credibility Concerns

The U.S. dollar dropped to a 3½-year low against the euro after reports that President Trump is considering replacing Fed Chair Powell as early as September or October. The move fueled market concern about the Fed’s independence and prompted traders to raise the likelihood of a July rate cut to 25%, with nearly 64 bps of rate cuts priced in by year-end

📉 Markets Stay Cautious Ahead of Powell’s Testimony

Traders remain on edge as Fed Chair Powell’s Capitol Hill testimony continues. He reiterated caution, noting inflation risks tied to tariffs despite growing calls for easing, keeping interest-rate expectations in limbo .

📈 S&P 500 Nears All-Time Highs in Second-Biggest Bi‑Monthly Rally

The S&P 500 has notched its second-largest May–June rally on record (6.2% in May, further gains in June), bolstered by cooling inflation, easing Middle East tensions, and strong AI earnings momentum led by Nvidia. Bull-case scenarios could push the index to fresh highs

📊 Key Data Releases 📊

📅 Thursday, June 26:

(No major U.S. economic release—markets are focused on Powell’s remaining testimony and global risk dynamics.)

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #Fed #inflation #geopolitics #technicalanalysis

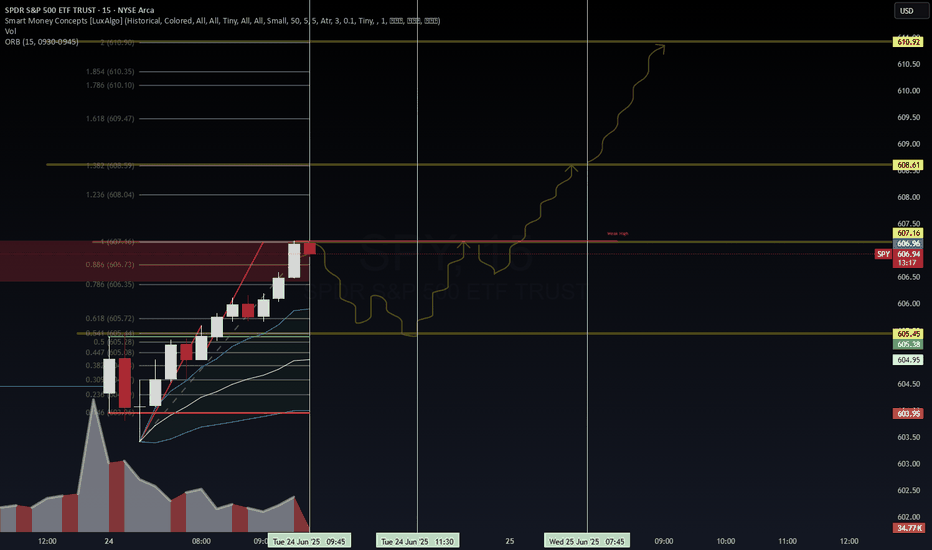

SPY 15-Min — Weak-High Sweep in Play• Discount BOS at 603.95 → impulsive leg to 606.7 (0.886)

• Weak high tagged at 607.16 – expecting continuation to 1.382 ≈ 608.61 then 1.854 ≈ 610.92

• Invalidation if price closes below 605.45 session VWAP band

• Targets: 608.61 → 610.92

• Risk: stop 604.9 (below 0.5 Fib)

VolanX bias remains risk-on while micro structure stair-steps above the 9-EMA channel.

Educational only – not financial advice

#SPY #SMP500 #OrderFlow #Fib #VolanX #WaverVanir

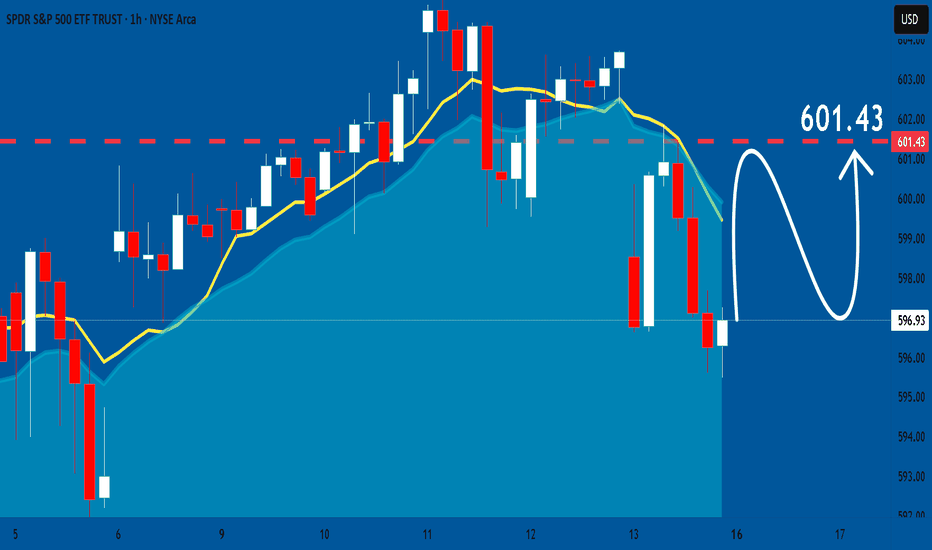

SPY- Premarket readPre-Market Read – June 23

AMEX:SPY

Premarket High: 595.15

Premarket Low: 592.15

Bias: Leaning Bearish

Price got rejected again at that 600–602 zone — that’s been a wall.

All the EMAs (9/50/200) are stacked tight, which usually means something’s brewing.

Institutions bought heavy down around 572–579 — they’re already green, so they might start selling into strength.

I’m expecting chop between 593–595 off the open.

I’ll probably wait out the first 15 min and let the ORB build.

If we break out, I’m watching both sides, but I lean put.

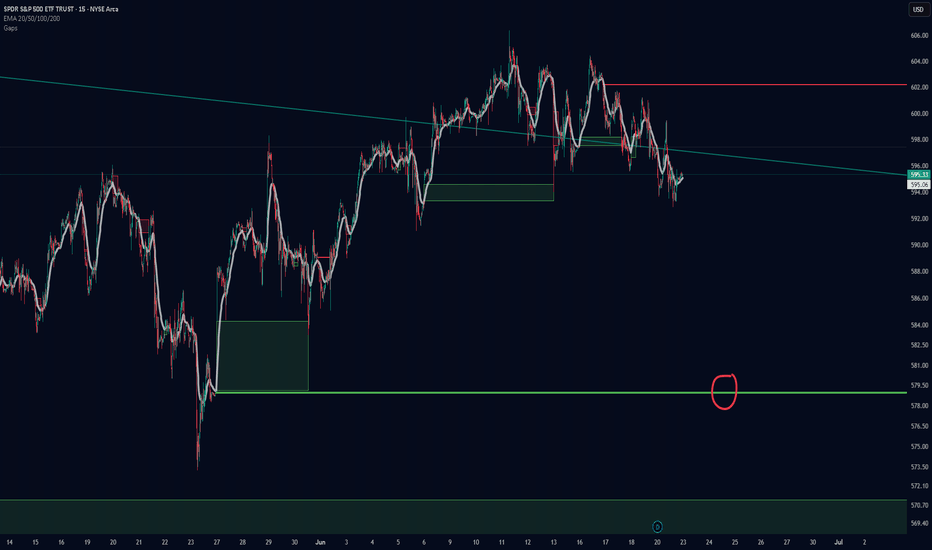

579 spy incoming?I posted this a week or so ago. I think we are finally going to have the momentum, or lack thereof, to make it down to fill the rest of that gap. I have noticed that large gaps that leave a small gap below(you must adjust the indicator to show it) almost always get filled before continuing up. This 579 level also matches up perfectly with the 20ema on the weekly which should provide further support. I will be looking for this level all week while being aware of any short squeezes that could occur on the way down. Will definitely go long at this 579 level as I think we will have a very green July.

Weekly $SPY / $SPX Scenarios for June 23–27, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for June 23–27, 2025 🔮

🌍 Market-Moving News 🌍

🌐 Geopolitics Add to Risk Aversion

The S&P 500 is up about 0.9% so far in June, but analysts warn it’s facing a “precarious” phase amid renewed Middle East conflict and looming U.S. tariff deadlines in July–August. Elevated oil prices could fuel inflation, while fiscal and debt ceiling pressures weigh on sentiment

🎙️ Powell Heads to Capitol Hill

Fed Chair Powell will testify before Congress this week. His remarks on inflation and rate outlook—particularly regarding the Fed’s recent dot-plot revisions and monetary policy uncertainty—will be central to market direction

📈 Nike, FedEx & Micron Earnings Under Focus

Key corporate earnings (Nike, FedEx, Micron) could provide fresh insight into how tariffs and supply-chain disruptions are impacting major U.S. businesses

🛢️ Oil Prices Elevated

Oil remains range-bound at multi-week highs near $75–80/bbl following U.S.–Israel military action in Iran, which briefly spiked prices ~7–11%. Continued dependence on Middle Eastern supply may keep energy complex volatile

⚖️ NATO Summit Tightens Security Focus

NATO leaders meet in The Hague, marking an elevated global defense posture amid geopolitical uncertainty. Defense and aerospace stocks may remain pressured or volatile depending on summit outcomes

📊 Key Data Releases & Events 📊

📅 Monday, June 23

9:45 AM ET: S&P Global Flash U.S. Services & Manufacturing PMI (June)

10:00 AM ET: Existing Home Sales (May)

📅 Tuesday, June 24

10:00 AM ET: Consumer Confidence Index (June)

Testimony: Fed Chair Jerome Powell appears before Congress

📅 Wednesday, June 25

10:00 AM ET: New Home Sales (May)

📅 Thursday, June 26

8:30 AM ET: Advance Q1 GDP (Final Estimate)

📅 Friday, June 27

8:30 AM ET: Core PCE Price Index (May) — Fed’s preferred inflation gauge

⚠️ Disclaimer:

This is for educational and informational purposes only. It does not constitute financial advice. Always consult a licensed financial advisor before investing.

📌 #trading #stockmarket #economy #geopolitics #Fed #oil #charting #technicalanalysis

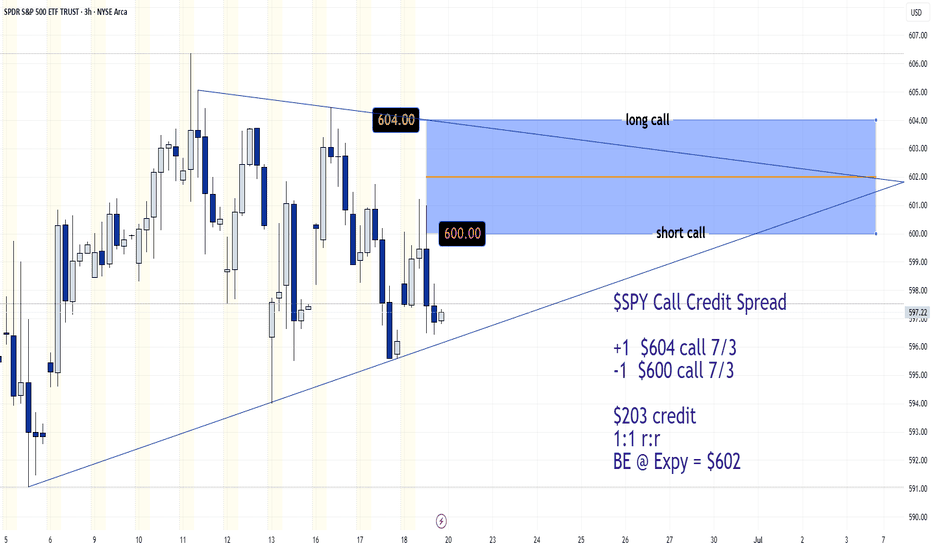

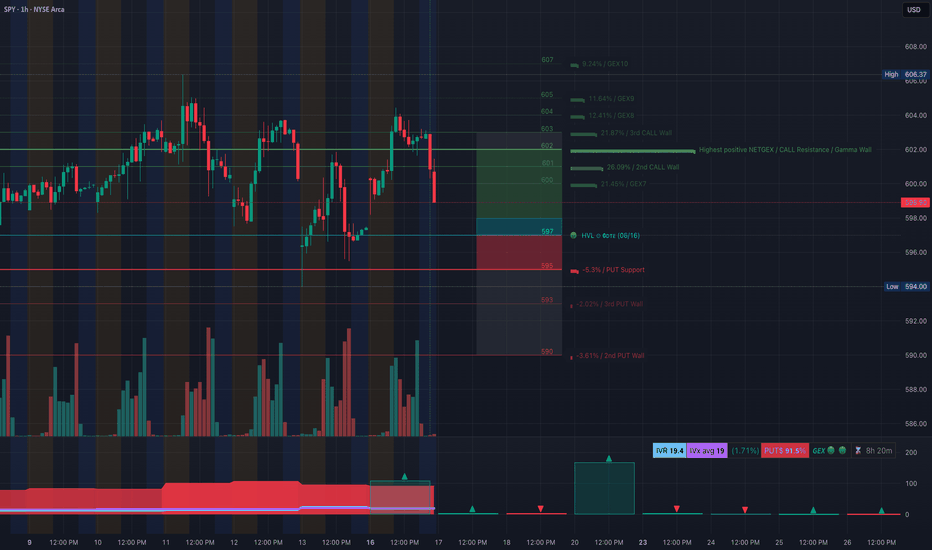

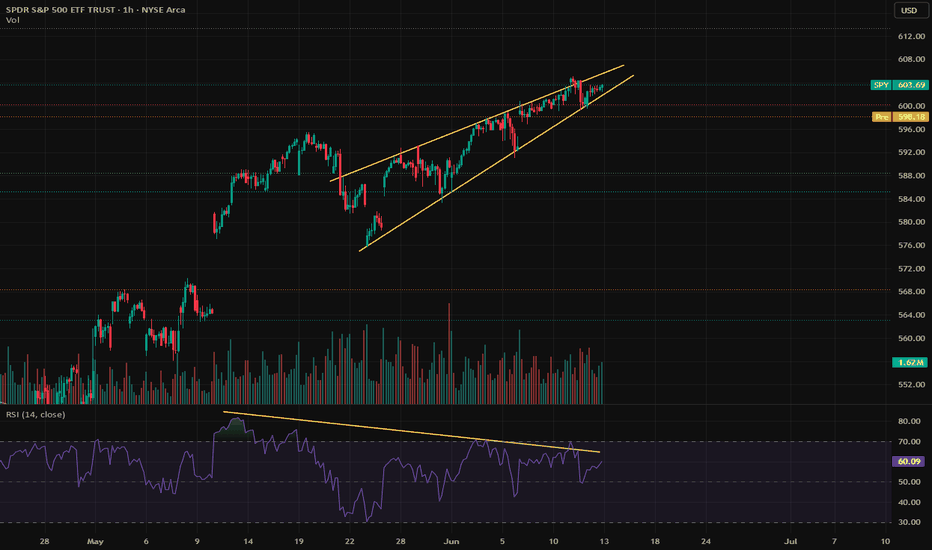

SPY Breaks Rising Wedge! Gamma Wall Rejected. Jun 17SPY Breaks Rising Wedge! Gamma Wall Rejected — Bearish Momentum Building Into OPEX 🔻

🔬 GEX (Gamma Exposure) Sentiment Breakdown:

* Gamma Resistance Above:

* Gamma Wall / Call Resistance: $602

* $603–$604.50 = additional CALL walls (2nd & 3rd tier resistance)

* $606.37 = Local high; unlikely to reclaim without macro tailwind

* PUT Walls / Downside Zones:

* $597 = HVL + Key Flip Level

* $595 = 1st Major PUT Support (Highest negative NET GEX)

* $593 / $590 = deeper GEX-supported flush zones

* Options Flow Metrics:

* IVR: 19.4 (slightly below avg)

* IVx avg: 19

* PUT Flow: 91.5% 🟥

* GEX Sentiment: 🔴🔴🔴 (Bearish dealer positioning + skewed delta exposure)

* Interpretation:

* Heavy call rejection at $602 combined with high PUT flow suggests dealers are short gamma.

* If SPY closes below $597, gamma exposure flips net negative — potential acceleration into $595/$593.

🧠 15-Minute SMC Breakdown:

* Current Price: $598.00

* Structure Overview:

* Clean rising wedge break

* Two CHoCHs confirmed at top → shift from bullish to bearish control

* Price broke into demand box (~$597–$598), testing support

* Volume spiked on breakdown = institutional participation confirmed

* Trend View:

* Uptrend is broken.

* Now entering potential distribution-to-downtrend transition phase

🧭 Trade Scenarios:

🟥 Bearish Breakdown Setup (High Probability):

* Trigger: Clean breakdown below $597

* Target 1: $595 (GEX Put wall)

* Target 2: $593 / $590

* Stop-loss: Above $600.50

Gamma flip + SMC structure shift supports downside. Dealer flows likely exacerbate drop under $597.

🟩 Bullish Reclaim Setup (Low Probability):

* Trigger: Reclaim of $602 with volume

* Target 1: $604.50

* Target 2: $606.50 (high)

* Stop-loss: Below $597.50

Only possible with major market strength, such as dovish Fed cues or macro catalysts.

📌 My Thoughts:

* SPY is showing signs of weakness across the board — structure, options flow, and volume confirm sellers stepping in.

* Put flows are extreme (>90%), so bounces may be brief and used to reload shorts.

* This is not a dip to buy blindly — best play is momentum PUTs under $597, tight risk control.

* Ideal setup for zero-day or 1DTE options trades with defined exits.

📉 Conclusion:

SPY failed to hold $602 Gamma Wall, rejected hard, and now tests $597 support. With options sentiment flipping negative and SMC structure breaking down, a drop to $595 or lower is increasingly likely.

Disclaimer: This analysis is for educational purposes only. Always manage risk and trade based on your plan.