AUDCAD trade ideas

AUDCAD Long Term Selling Trading IdeaHello Traders

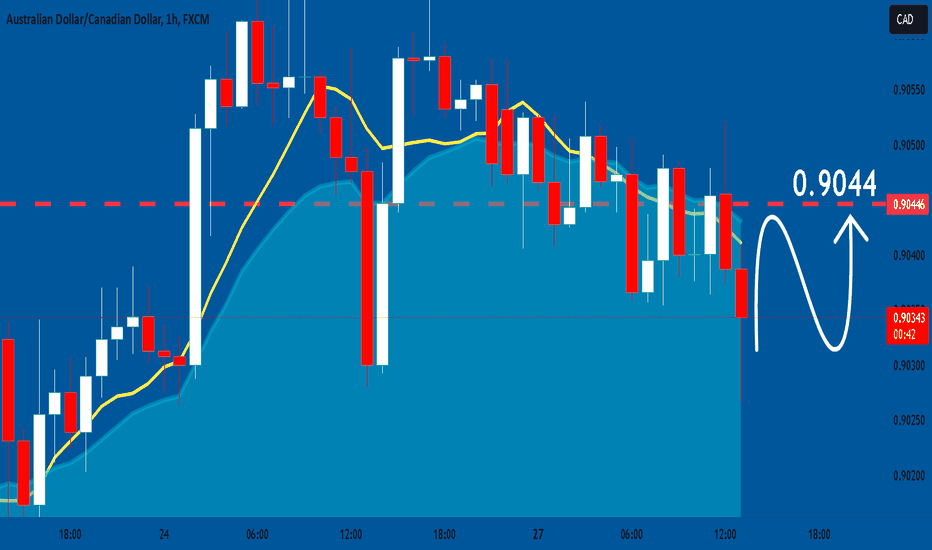

In This Chart AUDCAD HOURLY Forex Forecast By FOREX PLANET

today AUDCAD analysis 👆

🟢This Chart includes_ (AUDCAD market update)

🟢What is The Next Opportunity onAUDCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

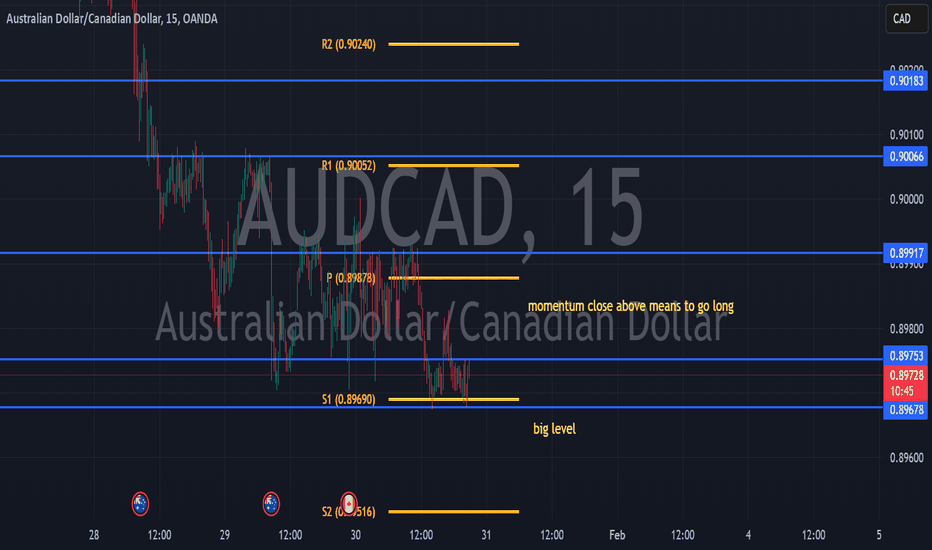

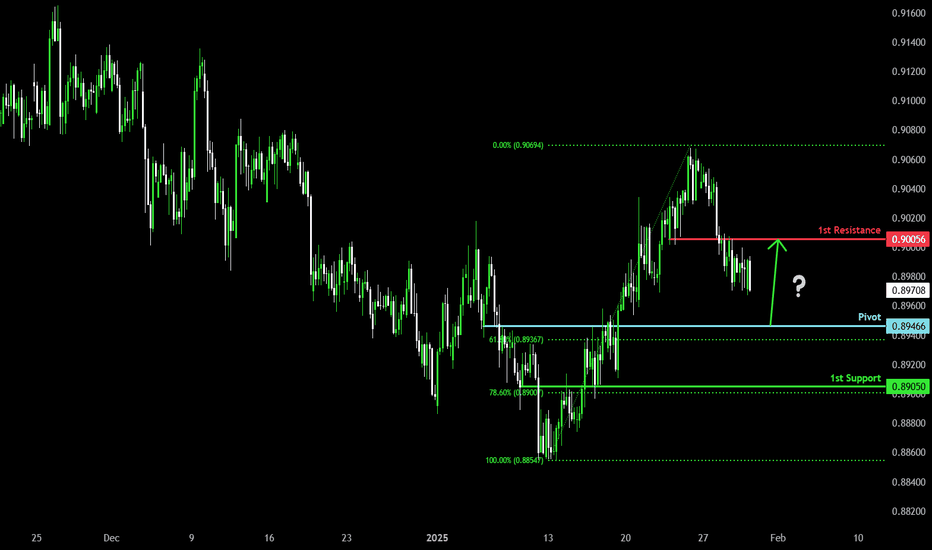

Bullish bounce off pullback support?AUD/CAD is falling towards the pivot which is a pullback support and could bounce to the 1st resistance.

Pivot: 0.89466

1st Support: 0.89050

1st Resistance: 0.90056

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

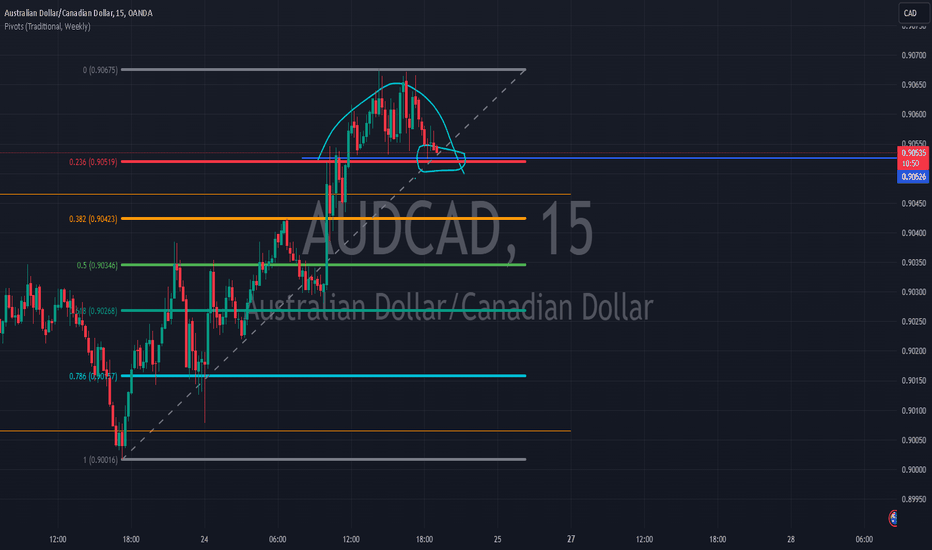

AUDCAD: We may see the Bullish reversal on 1 hour TF.The pair had a good bullish run on daily time frame. It us retracing trendline resistance, as expected. On 1H chart it has shown the bullish divergence on RSI and price is in between 0.38 & 0.5 Fib. level which creates a bullish bias.

If price closes above the last High we may initiate a long position. Potential TPs have been marked on the chart.

What is your opinion.

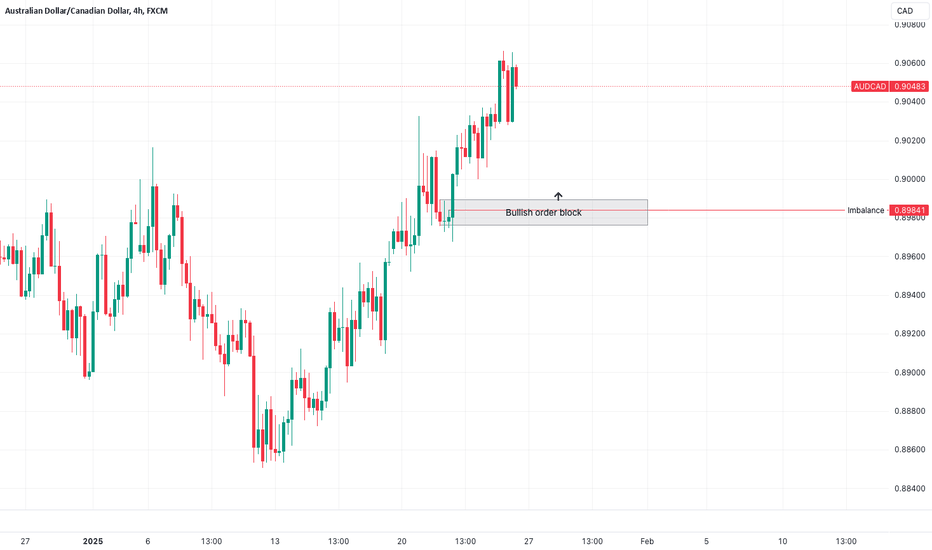

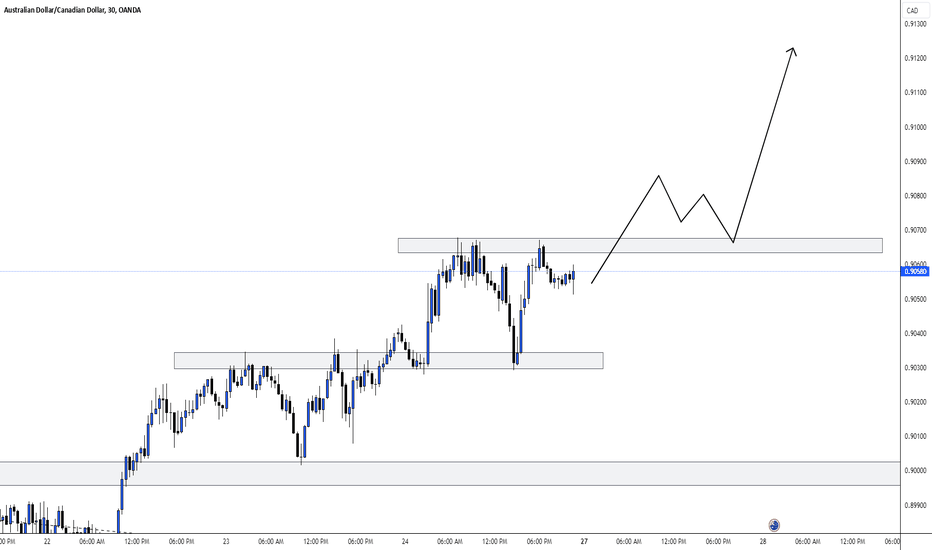

AUDCAD - Look for a long !!Hello traders!

‼️ This is my perspective on AUDCAD.

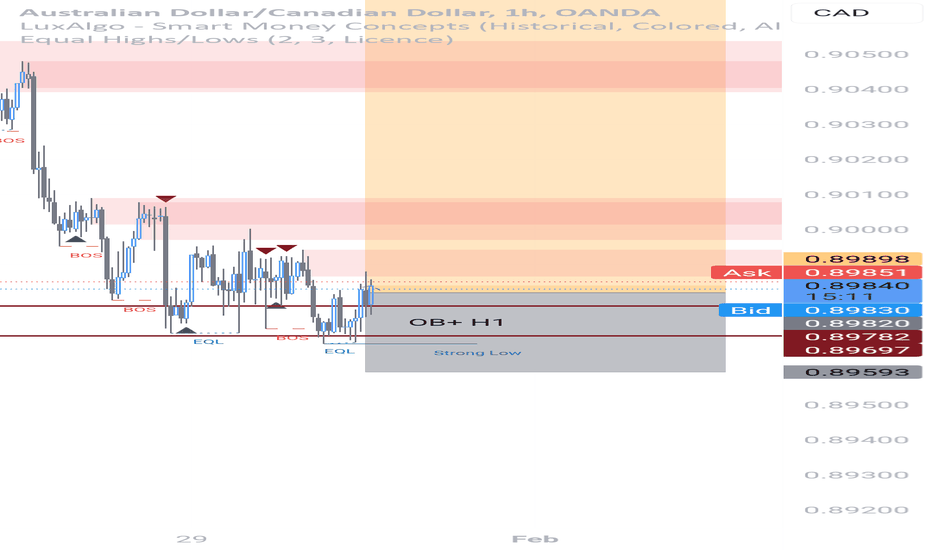

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I look for a long. My point of interest is imbalance filled + rejection from bullish OB.

Fundamental news: Upcoming week on Wednesday (GMT+2) we will see results of CPI on AUD and Interest Rate on CAD. News with high impact on currencies.

Like, comment and subscribe to be in touch with my content!

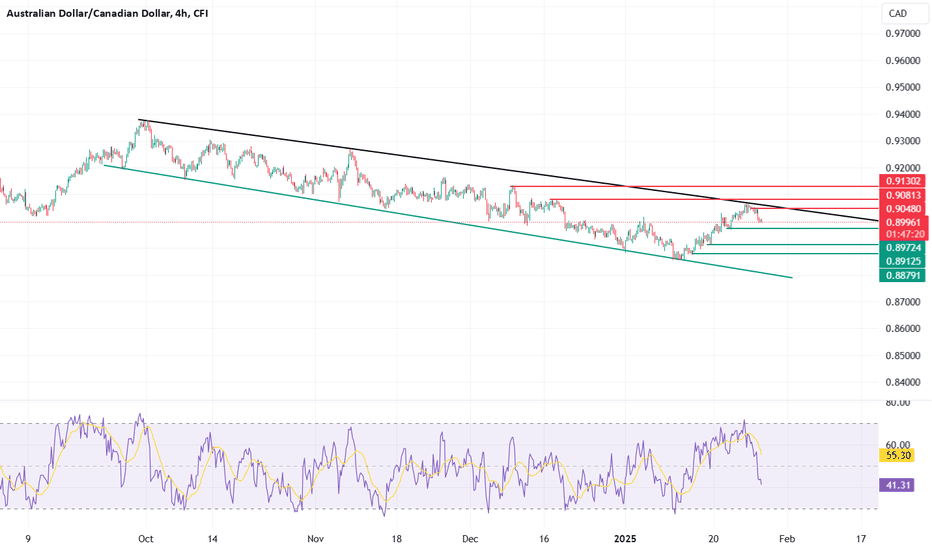

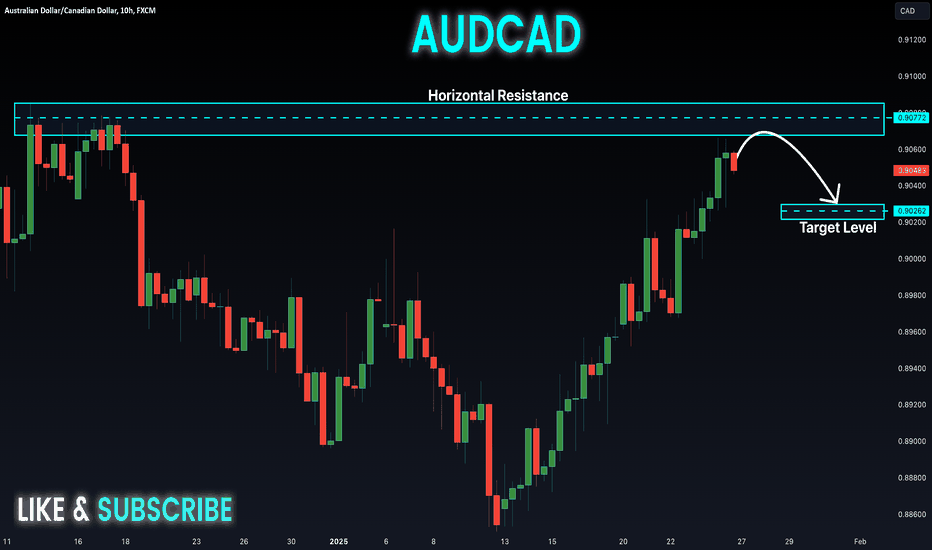

AUDCAD MOVES WITHIN CHANNELOn Monday, January 27, reports showed China’s manufacturing activity contracted for the first time in four months, with the PMI dropping to 49.1 from 50.1 in December. The decline was attributed to the Lunar New Year holidays, as factory production slowed due to worker absences.

Given China's role as Australia's largest trading partner, particularly for commodities like iron ore and coal, reduced industrial demand impacts Australia's economy. Consequently, the Aussie weakened, causing AUDCAD to decline by around 0.40% following the data release.

UPCOMING CATALYST

On Wednesday, Australia's inflation data is set for release, with a projected quarter-over-quarter increase of 0.1% from 0.2% to 0.3%, and a year-over-year rise of 0.2%. However, the trimmed mean CPI is anticipated to dip to 0.6% from the previous 0.8%. This data will likely influence market sentiment around the Reserve Bank of Australia's policy stance.

Later in the day, attention will shift to the Bank of Canada (BoC), which is expected to cut its benchmark interest rate from 3.25% to 3.00%. The decision will be accompanied by a press statement that could offer insights into the central bank's future monetary policy direction.

TECHNICAL VIEW

On the 4-hour timeframe, price continues to trade within a channel, with the black trendline acting as resistance and the green lower band as support. The psychological 0.9000 level currently serves as minor support, awaiting a market catalyst for direction.

In view of these data point’s if we see a positive reading on AUD, buyers may target 0.9048, 0.9081, and 0.9130. Conversely, weaker or mixed data could see sellers pushing prices toward 0.8972, 0.8912, and 0.8879. Breakouts beyond these levels are also possible. Meanwhile BoC rate decision is expected to drive prices later in the day.

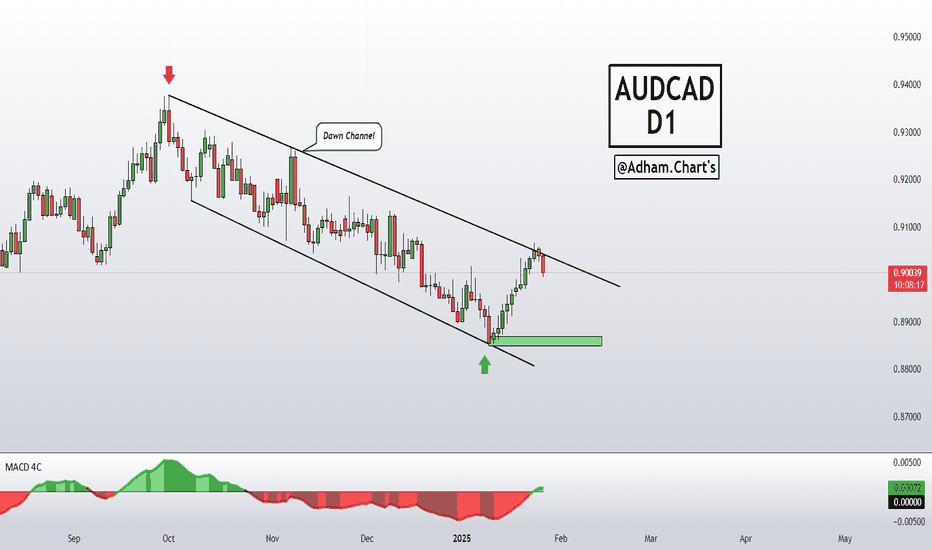

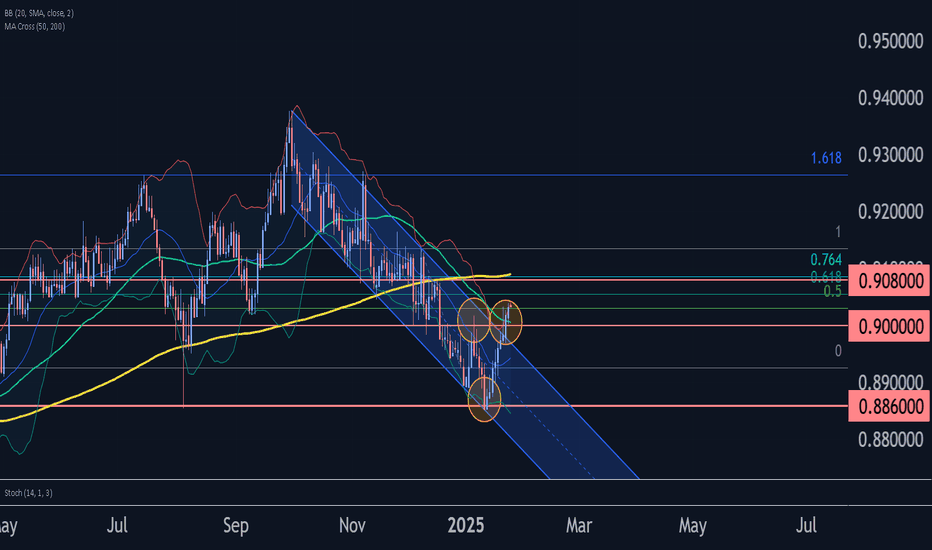

AUDCAD💡The chart shows a technical analysis of the AUD/CAD currency pair On the daily time frame D1. The price appears to be moving within a descending price channel The price reached the upper border of the descending channel and started to decline, which may indicate a continuation of the downtrend unless the channel breaks higher. The MACD indicator is showing the negative momentum weakening and turning positive, which supported the recent rise. However, there may be weak purchasing power currently.

⛔️It is not investment advice for educational purposes only.

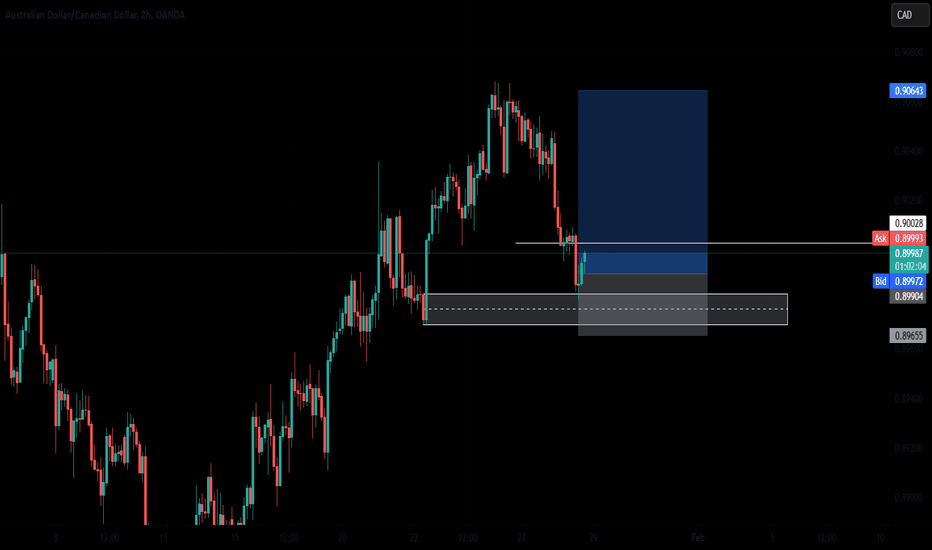

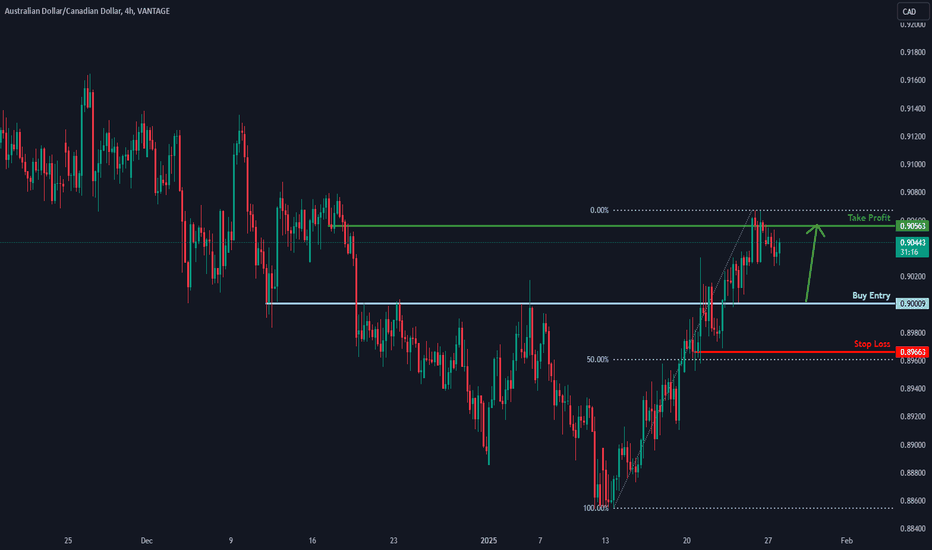

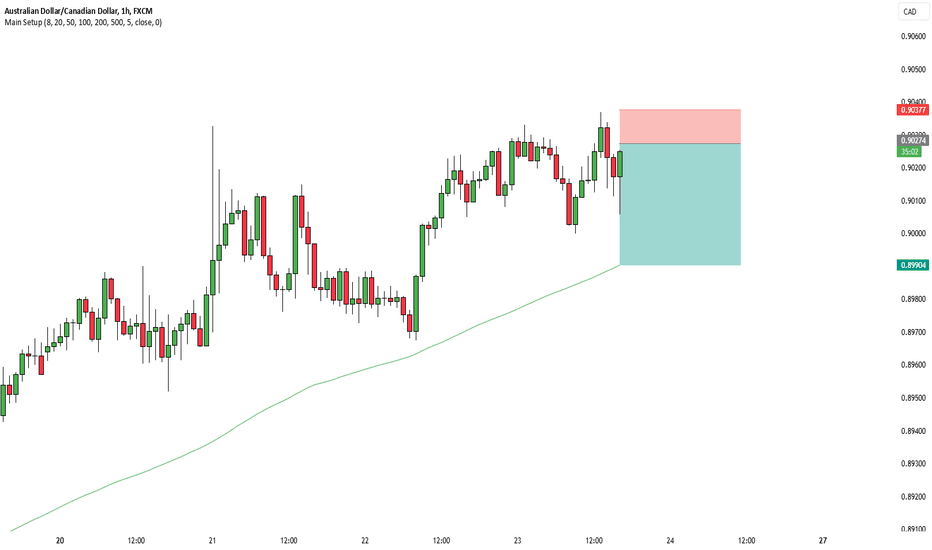

Falling towards overlap support?AUD/CAD is falling towards the support level which is an overlap support and could bounce from this level to our take profit.

Entry: 0.90009

Why we like it:

There is an overlap support level.

Stop loss: 0.89663

Why we like it:

There is a pullback support level that aligns with the 50% Fibonacci retracement.

Take profit: 0.90563

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

AUDCAD: Growth & Bullish Continuation

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the AUDCAD pair price action which suggests a high likelihood of a coming move up.

❤️ Please, support our work with like & comment! ❤️

AUDCAD after long time, can we see bullishness

OANDA:AUDCAD long period of bearishness, personally having long position from Jul. last year i am have already shared one idea on AUDCAD which is still actual and will attach her.

What here now we have is long DESCENDING CHANNEL, currently its breaked and we have some bounces on sup zones.

Technically picture is strong bullish. Here after long time of bearishness, having strong bullish expectations to start.

TO KNOW: We are have and upper DESCENDING CHANNEL(white lines), which is be breaked and price is start falling, currently if we see now bullish push, price is expected to come in "UPPER CHANNEL" if that happens, will share and new idea and will be same with bullish expectations.

SUP zone: 0.88900

RES zone: 0.90400, 0.90700, 0.91000

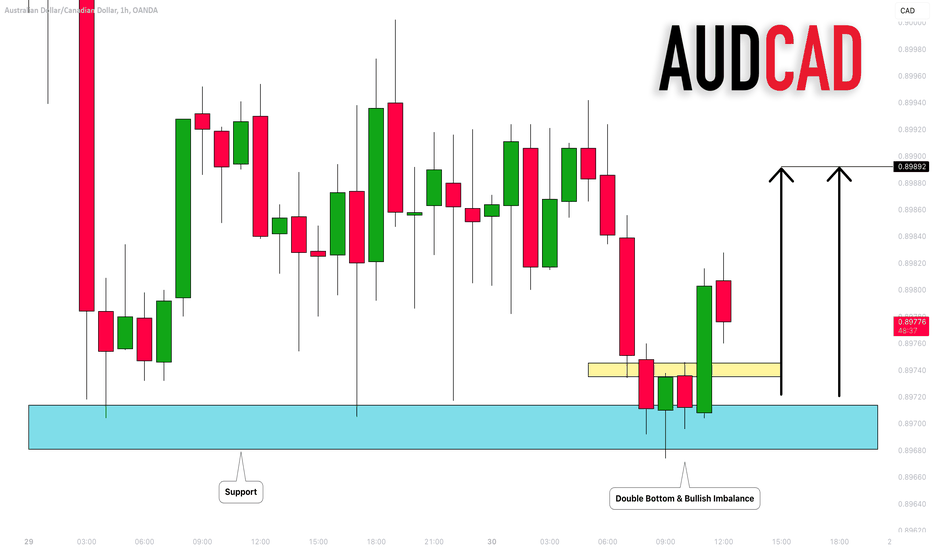

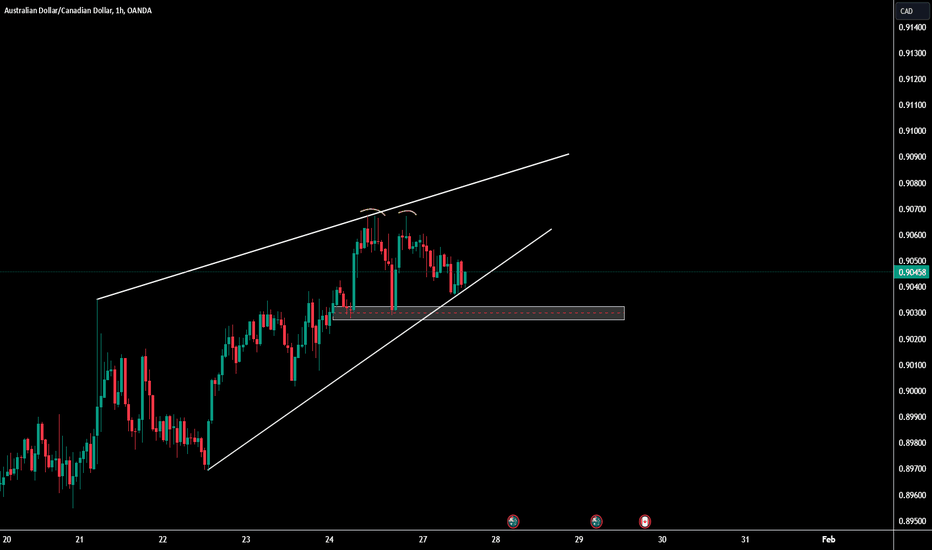

AUDCAD 30M AnalysisThe market structure shows a bullish bias with higher highs and higher lows forming.

🔹 Key Highlights:

Price is respecting demand zones, indicating strong buying interest.

Anticipating a pullback to the demand area around 0.9050 before a bullish continuation.

Targeting the resistance zone near 0.9120.

📈 Plan: Watch for confirmation at the demand zone to enter a long position.

What’s your take on this setup? Let’s discuss in the comments! 👇

#ForexTrading #AUDCAD #TradingView #TechnicalAnalysis #ForexSetup #PriceAction

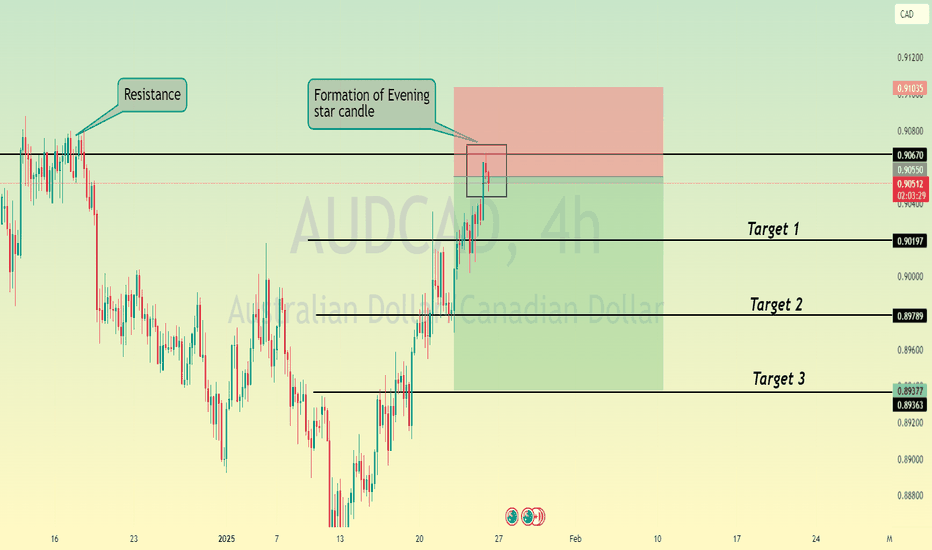

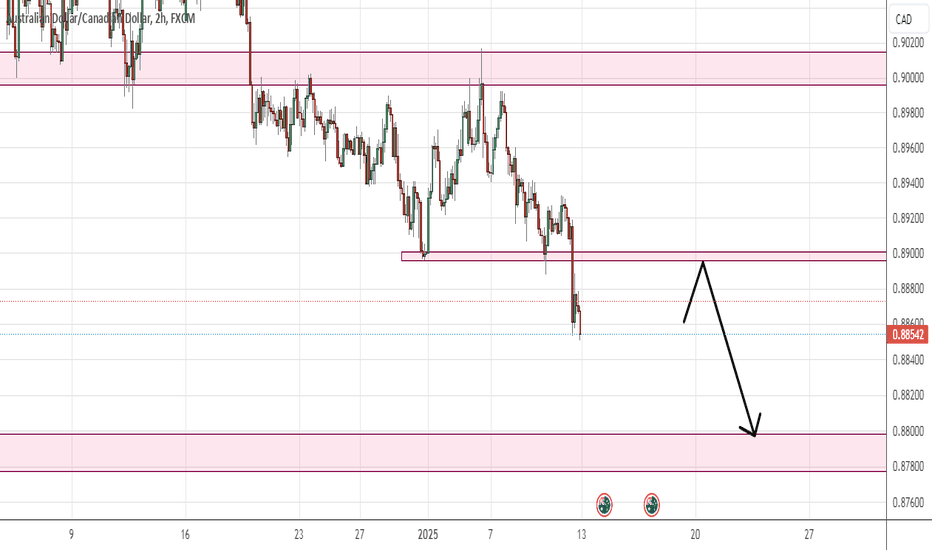

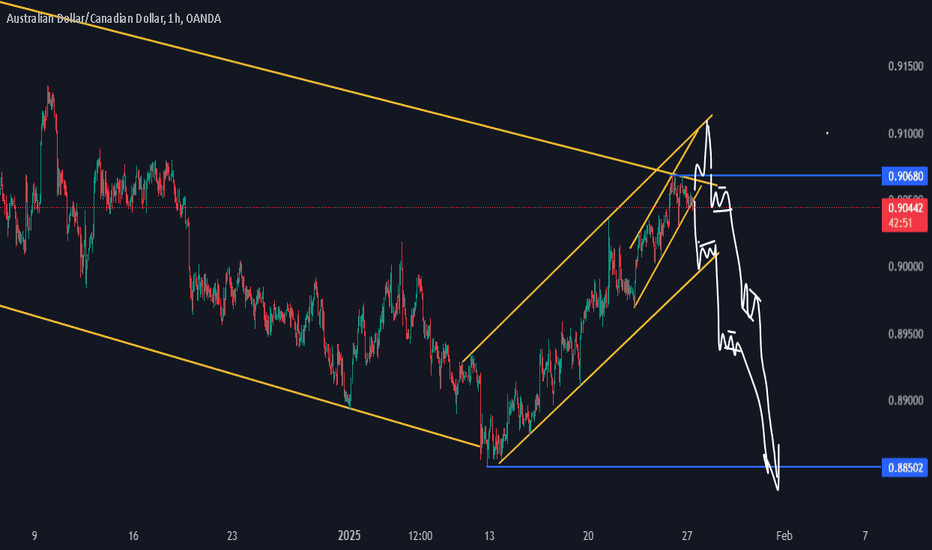

AUDCAD: Bearish Flag Signals Further DeclineAUDCAD has been consolidating within a well-defined bearish flag formation for the past two weeks, marked by small breakouts of key levels—a typical characteristic of this pattern.

This type of consolidation often acts as a continuation structure in a downtrend.

I anticipate that once the price breaks below the lower boundary of the flag and confirms the breakout through consolidation, the bearish scenario will likely play out.

Such a move would signal the market’s readiness to resume its downward trajectory, offering potential opportunities for short positions.

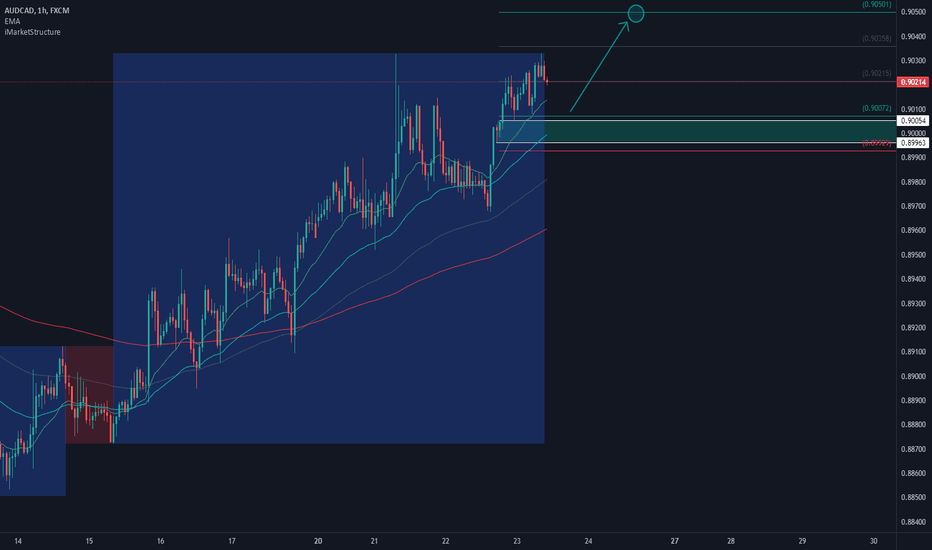

AUDCAD - 23 Jan 2025 SetupAUDCAD Now making a long billish rally and breaking the bear structure. Spotted demand area (Green Rectangle). its the first demand area after the price breaking bearish structure.

Entry Position : Long

Profit Target : 1:3 Shown on the chart image (Green Line)

Stop Loss : Slightly below demand area (Red Line)

Follow me if u guys making any gains from this idea.

Thanks

Coffee Trade Team

potential iron dome crash/pullbackaudcad had 10 days outperformance

potential profit takings to happen soon, before another major big run up or a reversal

wait for iron dome crash, only enter with ltf confirmations

mean reversion and counter trend play so be mindful of potential ATR and pip range/ profit range

AUDCAD Wave Analysis 23 January 2025

- AUDCAD broke round resistance level 0.9000

- Likely to rise to resistance level 0.9080

AUDCAD currency pair recently broke the round resistance level 0.9000 (which stopped the previous wave 4 at the start of January)

The breakout of the resistance level 0.9000 coincided with the breakout of the 50% Fibonacci correction of the previous downward impulse from December and the daily down channel from September – which accelerated the active impulse wave 1.

AUDCAD currency pair can be expected to rise toward the next resistance level 0.9080 (top of wave b from the middle of December).