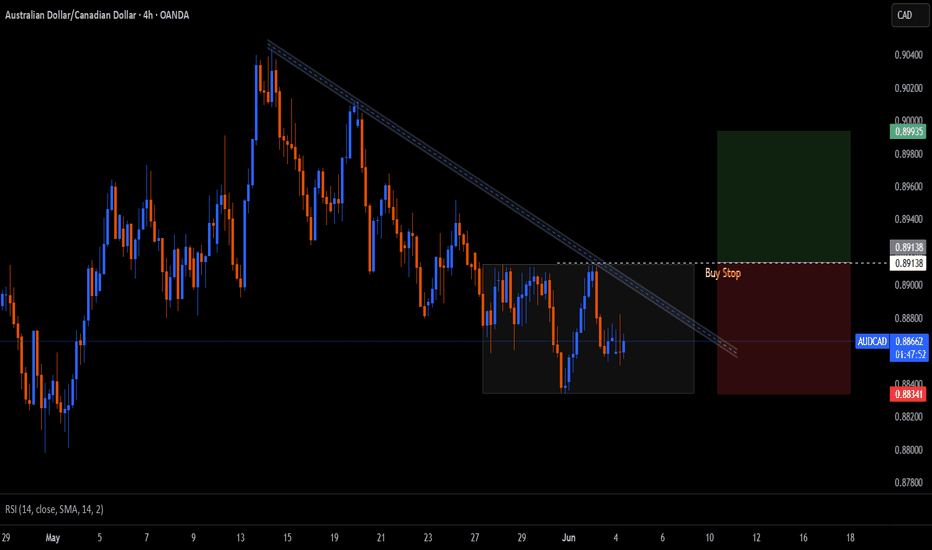

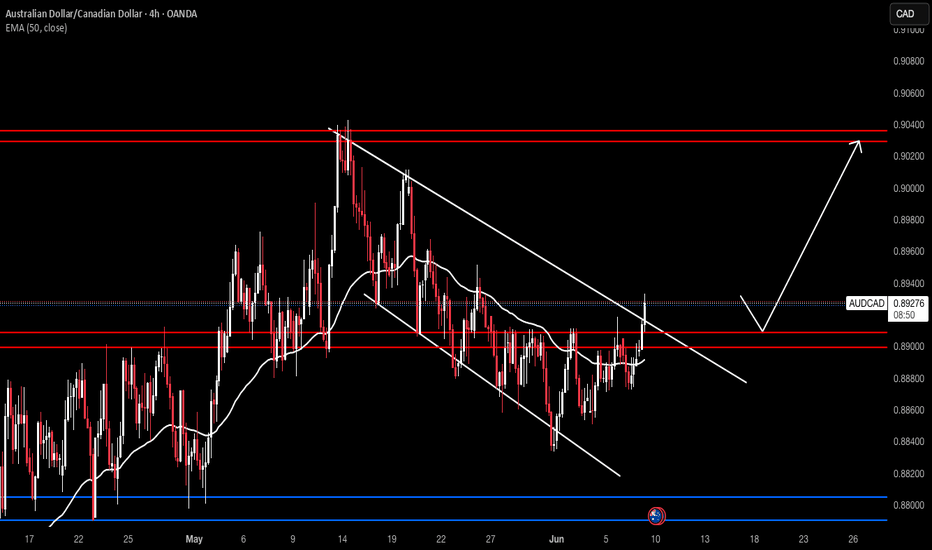

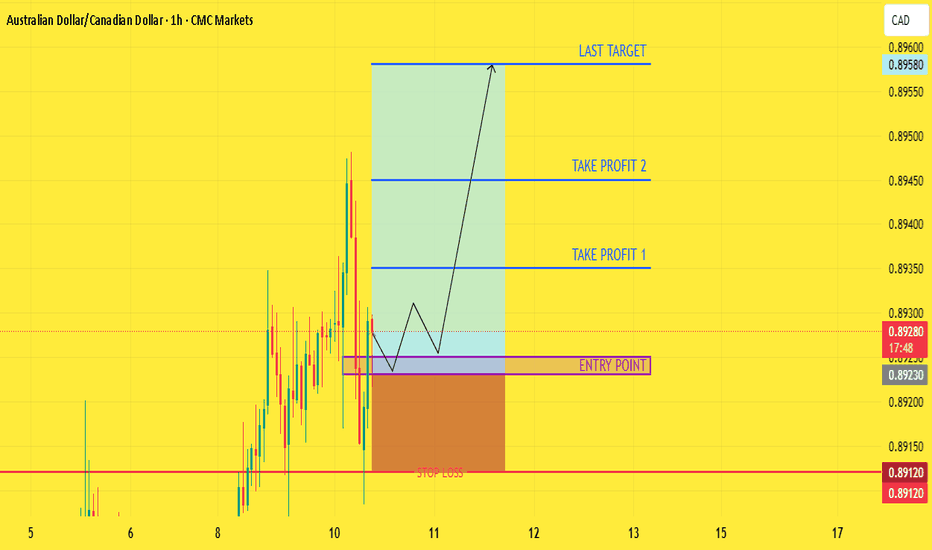

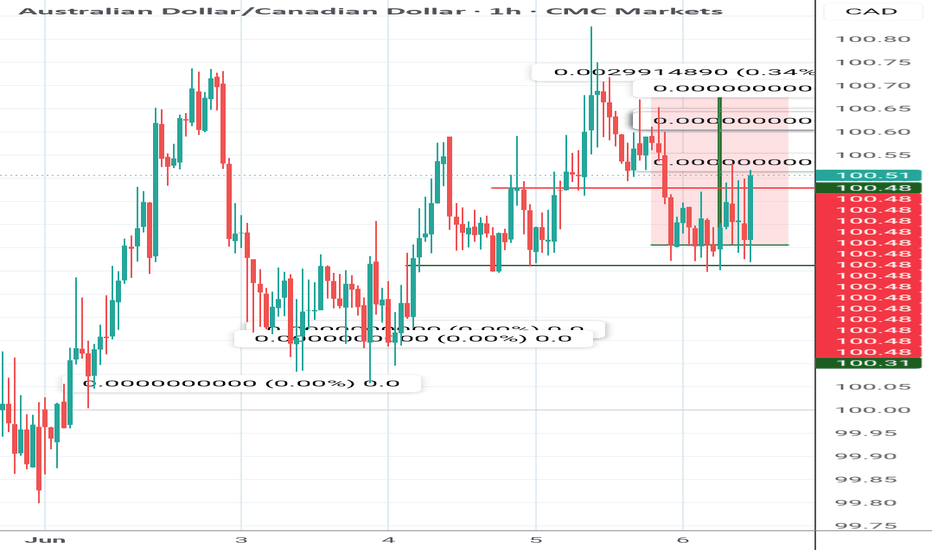

AUDCADRange Breakout: The pair has been trading within a range, and the breakout from this range signals potential bullish momentum. A breakout indicates that the price is ready to move out of its consolidation phase, with buyers now in control.

Trendline Breakout: The price breaking above a key trendline further confirms a shift from a bearish or neutral market sentiment to a more bullish one. This is a strong signal that upward momentum is building.

AUDCAX trade ideas

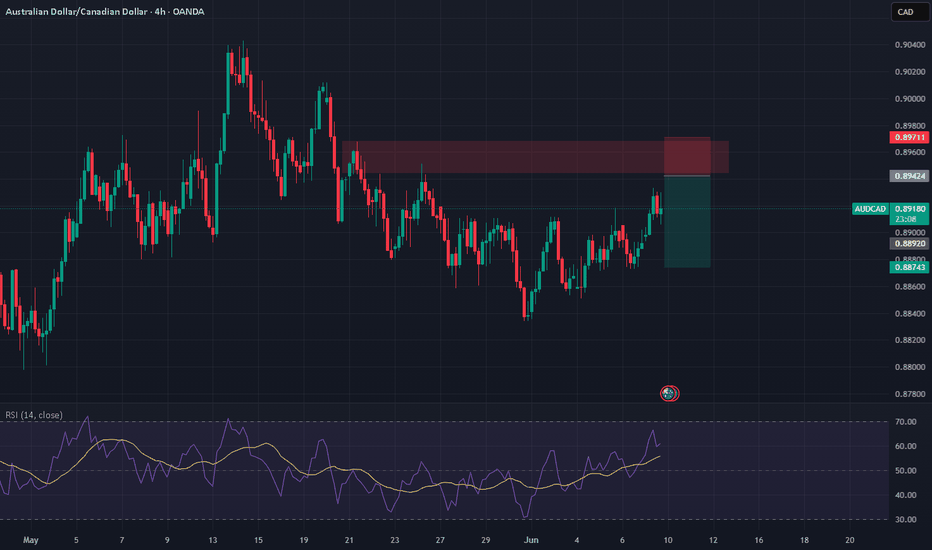

AUDCAD - Fundamentals vs Momentum – Betting on CAD🕓 Timeframe: 4H | ⚠️ Bias: Bearish From Supply Zone

AUDCAD is rejecting the 0.8940–0.8960 supply zone, a key resistance that's been respected multiple times. With RSI turning over near overbought and CAD fundamentals improving, this looks like a clean short opportunity.

📊 Technical Confluence

🔴 Resistance Zone: 0.8940–0.8960 (historical supply zone)

📉 Bearish Structure Intact: Still in a broader HTF downtrend (lower highs)

⚠️ RSI Divergence: Slowing near 62, suggesting momentum exhaustion

🕯️ Price Action: Current candle showing indecision – early signs of rejection

🌍 Fundamental Confluence

🇦🇺 AUD Weakness:

RBA paused rates, inflation easing → Dovish

AUD overextended after sentiment shift (conditional score ↑ too fast)

AUD vulnerable if sentiment shifts risk-off

🇨🇦 CAD Strength:

BoC holding firm on rates, hawkish tone

Oil production recovering → CAD-positive

COT net long position + seasonal strength

🎯 Trade Plan

📍 Entry: 0.8940–0.8955 (on bearish confirmation: engulfing/pin bar)

🛑 Stop Loss: 0.8975 (above resistance zone)

🎯 Take Profit 1: 0.8870 (mid-range)

🎯 Take Profit 2: 0.8830 (into demand zone)

⏱️ Optional: Partial entry now, scale in at 0.8960 if tapped

🧠 “Don’t chase the move. Sell the retest when momentum fades and fundamentals align.”

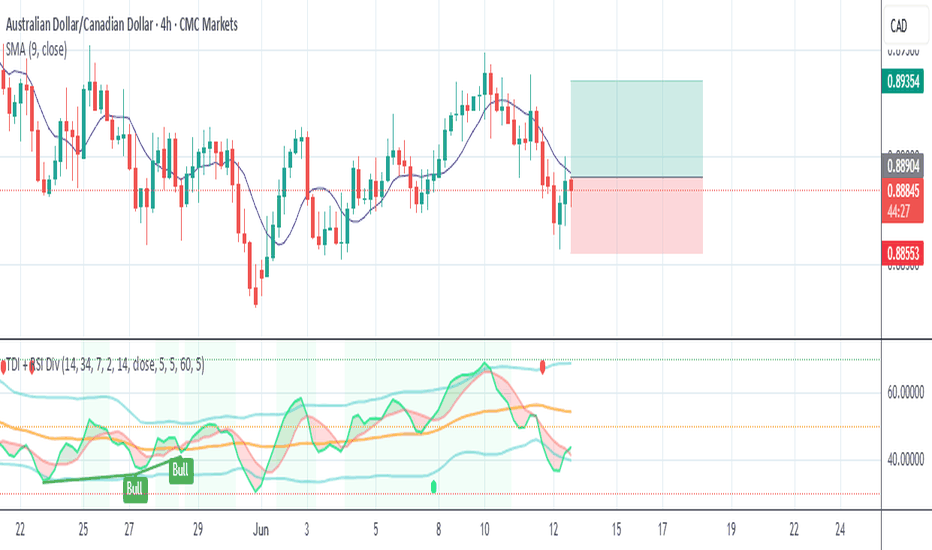

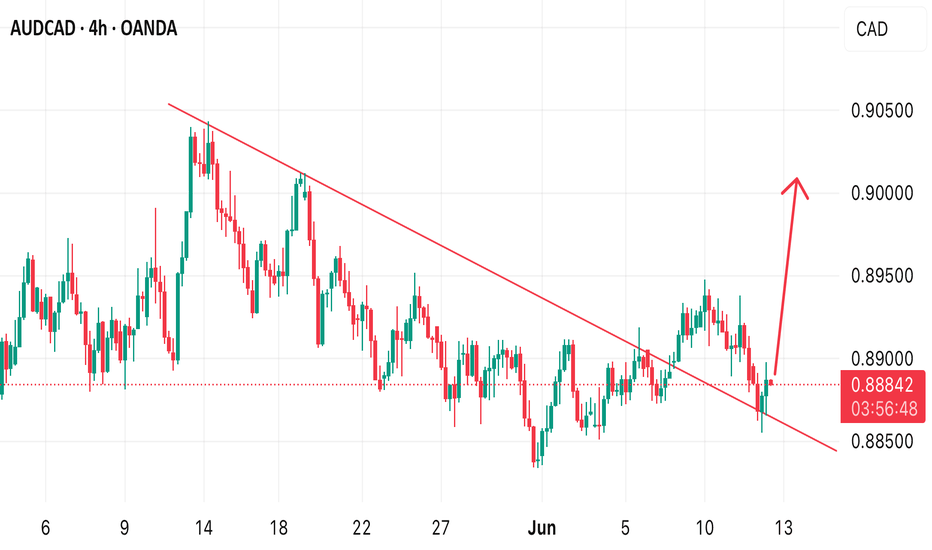

AUDCAD SIMPLE TRENDLINE BREAK & RETEST!I just identified a simple trendline break and retest in H4 timeframe. In this trading strategy, it’s advisable to long AUDCAD as this will increase the probability of this asset making more bullish move. Therefore, a buy opportunity is envisaged from the current market price. Target is 0.9012

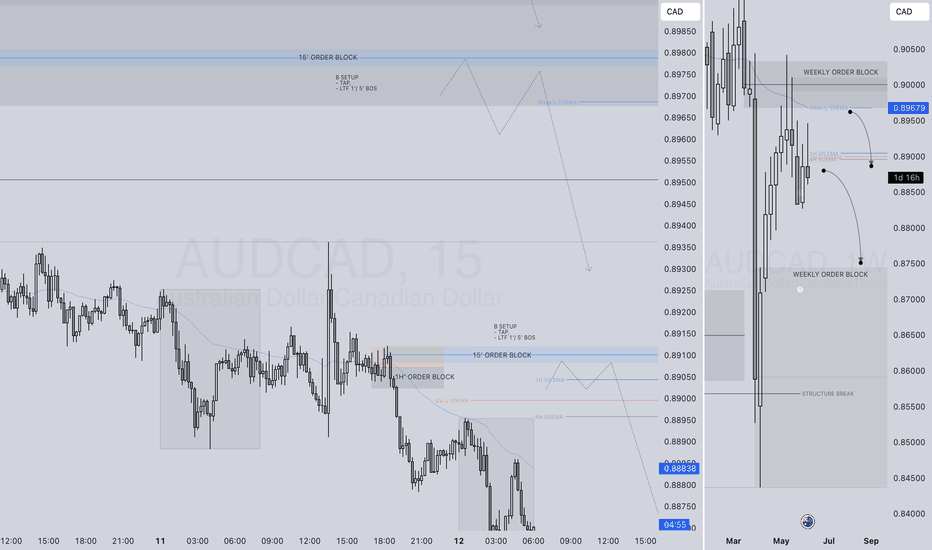

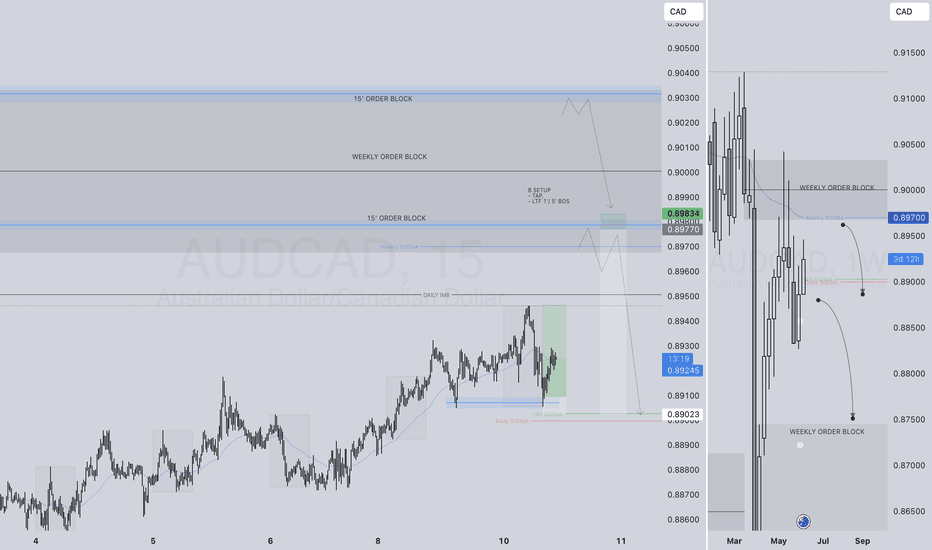

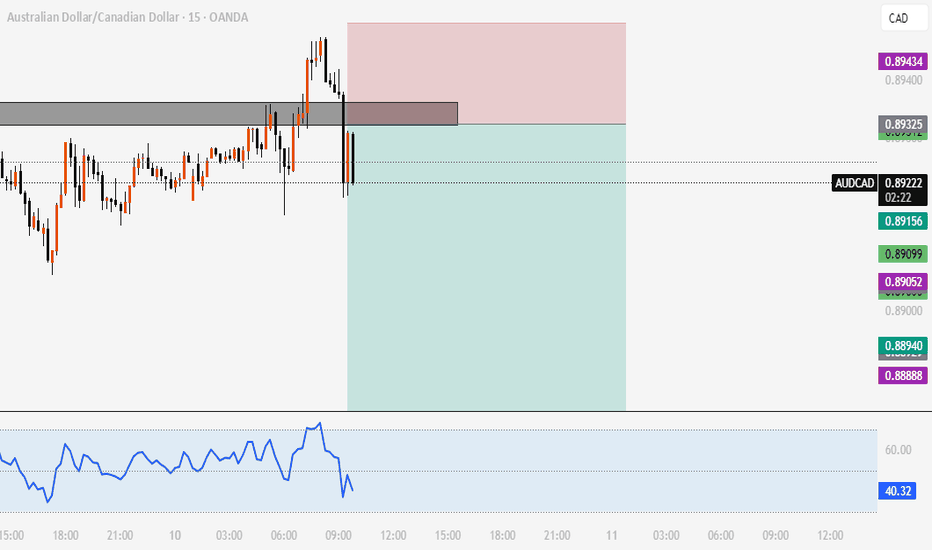

AUDCAD SHORT FORECAST Q2 W24 D12 Y25AUDCAD SHORT FORECAST Q2 W24 D12 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

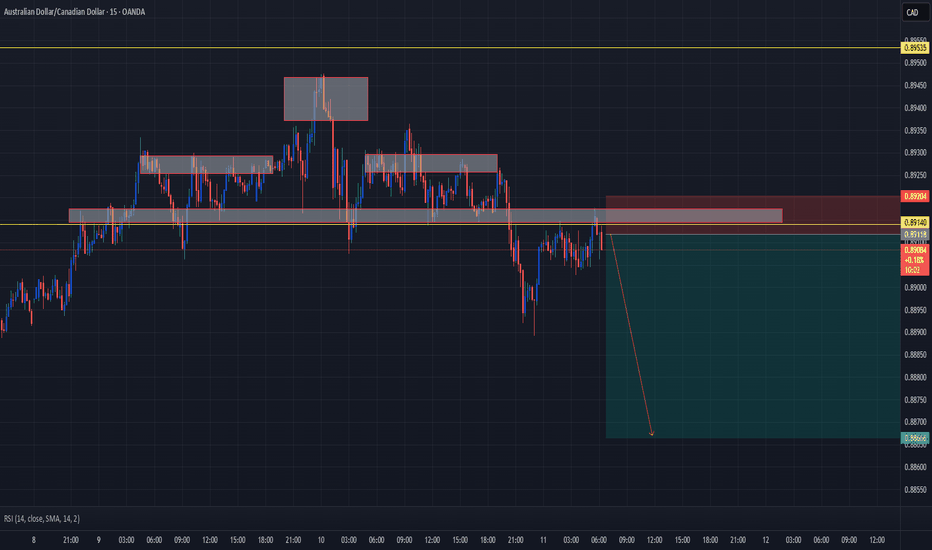

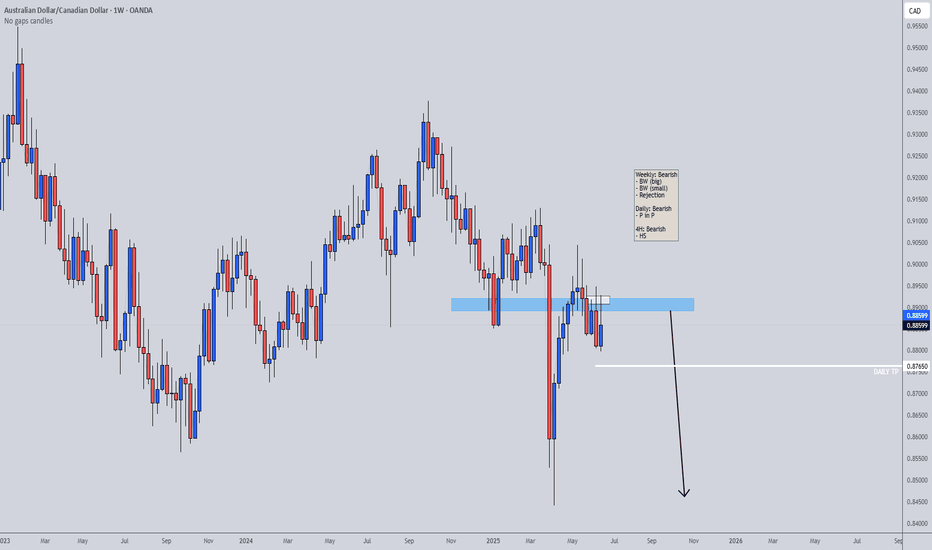

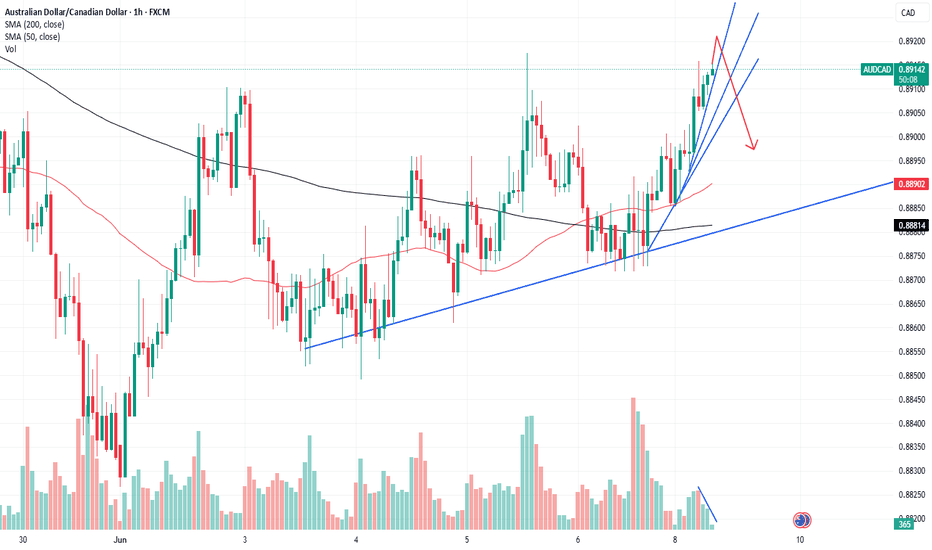

AUDCAD SHORT FORECAST Q2 W24 D10 Y25AUDCAD SHORT FORECAST Q2 W24 D10 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

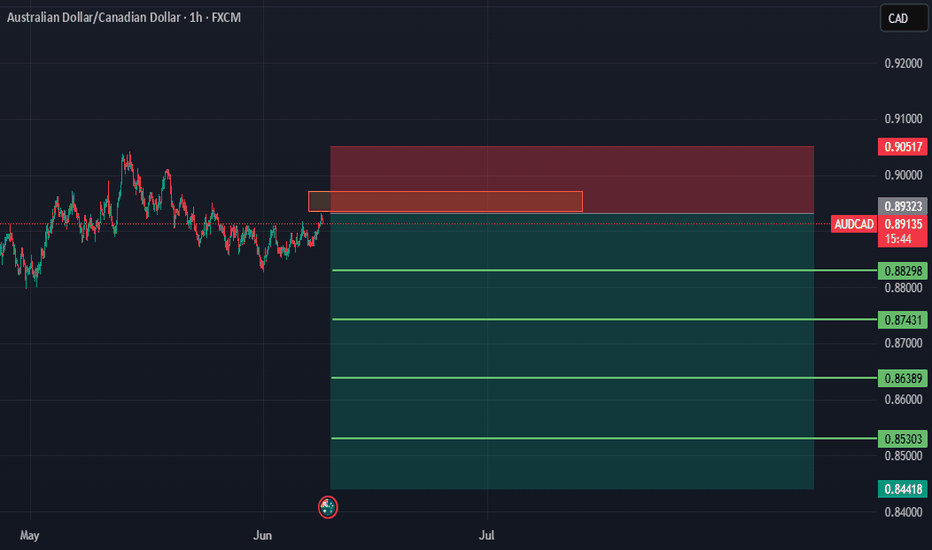

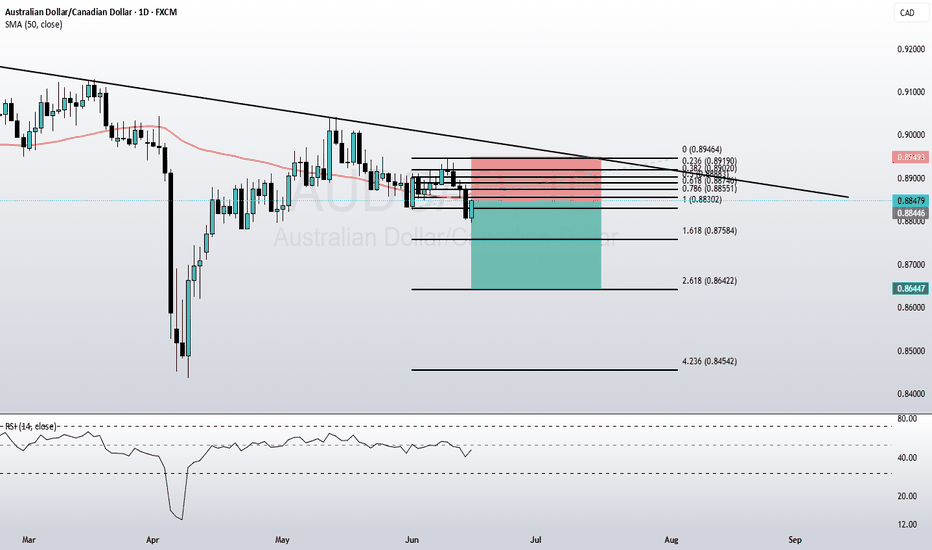

AUDCAD shortSwing Trade Idea – AUD/CAD

The price is currently trading below the 50-day moving average, indicating bearish momentum. Recently, a strong bearish candle broke the previous market structure, confirming downside pressure. Based on this, I expect the price to move lower towards the target area, which aligns with the 261.8% Fibonacci extension level.

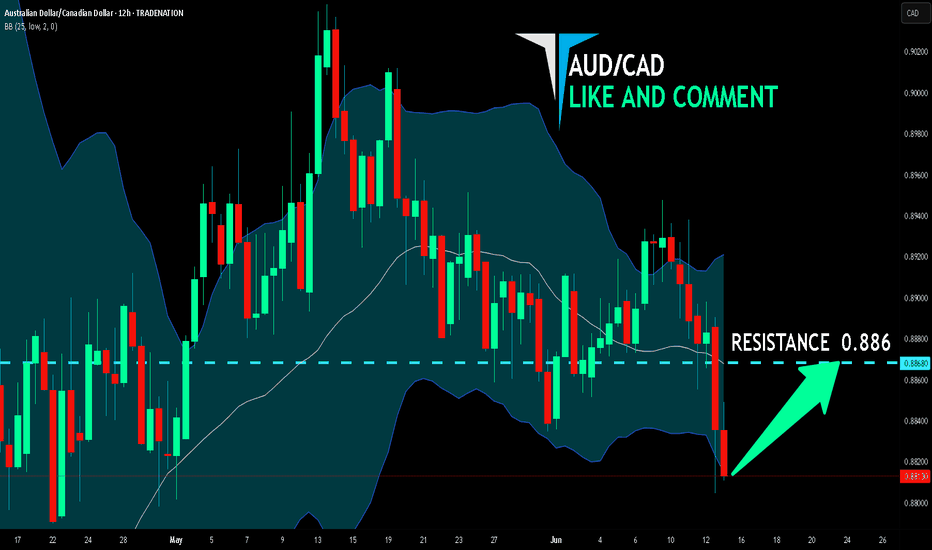

AUD/CAD BEST PLACE TO BUY FROM|LONG

Hello, Friends!

AUD-CAD downtrend evident from the last 1W red candle makes longs trades more risky, but the current set-up targeting 0.886 area still presents a good opportunity for us to buy the pair because the support line is nearby and the BB lower band is close which indicates the oversold state of the AUD/CAD pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDCAD - Parabolic Exhaustion, Volume DivergenceAUDCAD is appearing to want to test the previous pivot high on low volume.

If there is no new volume and a failed test of this previous high, it could signal a bearish retracement.

Be patient as a successful retest could signal a continuation of the bullish activity.

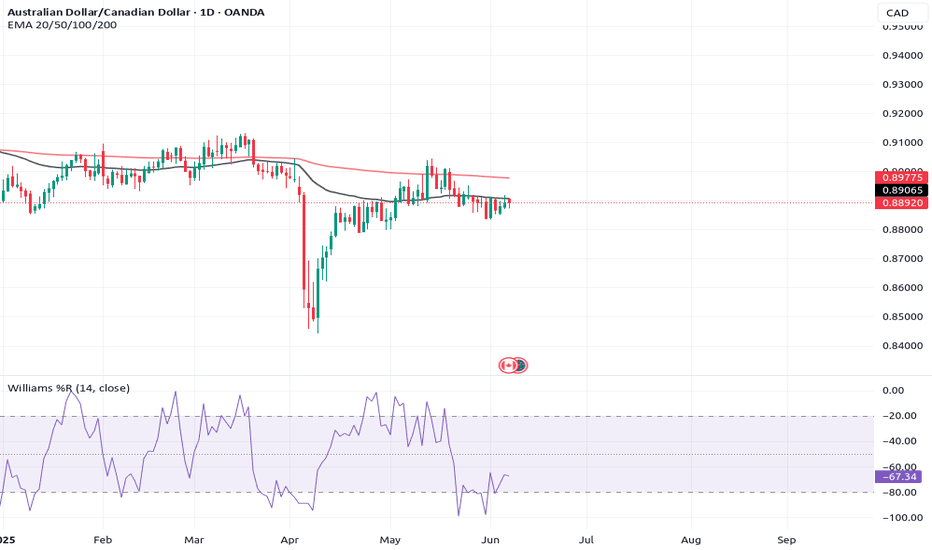

These 5 Steps Will Show You How To Short SellBased on the weekly chart this forex pair

is going down.

I was trying to learn how to buy gold and silver.

So i thought i try to trade it on

the weekly chart.Even though on this chart OANDA:AUDCAD

the daily chart for this forex pair looks

like its in an over sold zone.But if you flip

this chart to a weekly chart

you will see an over bought zone.

The overbought zone will appear on

the William.If i had the full professional

tradingview membership

I would have shown you 2 time frames back to back.

This would have been on a split chart layout.

But since i only have a free version i can

only show you how a bearish divergence looks

On the daily chart.If i had the professional membership

i would have shown you 2 layouts.

So what you need to do is the following:

1-Open the layout.

2-Put daily chart on left

3-Put weekly chart on right

4-Use the rocket booster strategy

5-Use the william% indicator

Have you notice the bearish divergence?

its overbought on the week

and the oversold

on the day chart

This is a powerful strategy and my hope is

that it will serve you well.

Rocket boost this content to learn more

Disclaimer: Trading is risky please do not use margin

and learn risk management and profit taking strategies.

Also use a simulation account before you trade with real money.

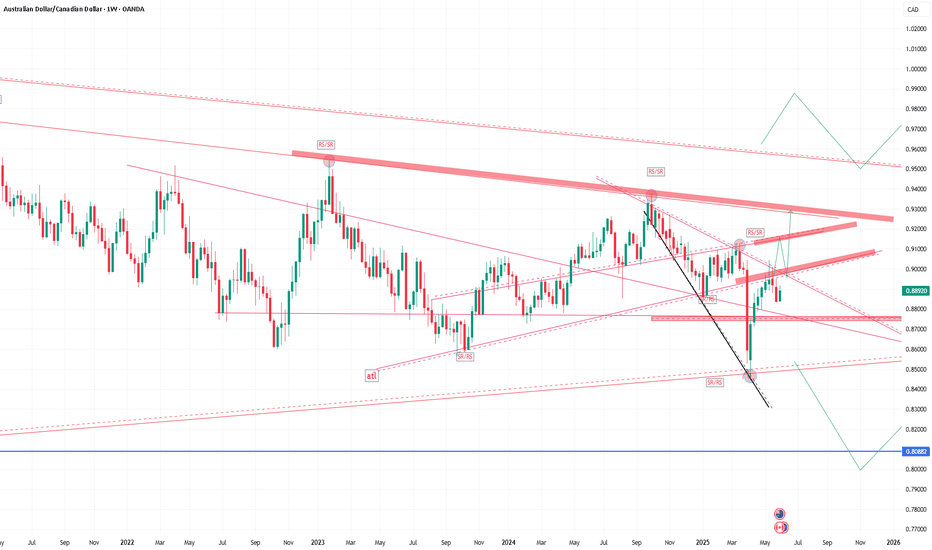

AUDCADThe 10-year bond yield differential between Australia and Canada currently stands at 1.15% (4.53% vs. 3.38%) as of May 21, 2025 . This gap significantly influences the AUD/CAD exchange rate through interest rate parity dynamics and market positioning.

Key Analysis

Yield Spread Impact

Theoretical Basis: Uncovered Interest Rate Parity (UIP) suggests the AUD should depreciate by 1.15% annually to offset its yield advantage. However, historical patterns show yield spreads often drive currency appreciation for the higher-yielding currency due to carry trades .

Current Reality: Australia’s yield premium supports AUD demand, but recent RBA rate cuts (to 3.85%) and weak GDP growth (+0.2% Q1 2025) counterbalance this effect .

Diverging Central Bank Policies

Australia: Rate cuts signal dovishness despite elevated yields, creating a "lower-for-longer" perception.

Canada: Steady rates (2.75%) and oil-price resilience (WTI ~$64.75) bolster CAD stability .

Market Behavior

Carry Trade Dynamics: A 1.15% spread historically correlates with AUD/CAD appreciation

Risk Factors: Australia’s economic stagnation and China-linked commodity exposure introduce downside risks, potentially weakening AUD despite yield advantages.

AUD/CAD Outlook

Factor AUD Impact CAD Impact

Yield Spread Bullish Bearish

Growth Outlook Bearish Neutral

Commodity Prices Mixed (Iron Ore) Bullish (Oil)

While the yield spread nominally favors AUD, conflicting fundamentals suggest limited upside. Traders should monitor:

RBA/BoC policy shifts (next meetings in July 2025)Australia's rate cut cycle vs. Canada's neutral stance creates bearish AUD bias

Iron ore vs. oil price trends

China’s economic data (critical for AUD demand)AUD's sensitivity to China growth vs. CAD's US trade links

Global Risk Sentiment

In the short term, AUD/CAD may test resistance , but sustained breaks require stronger Australian growth or hawkish RBA signals .

#AUDCAD

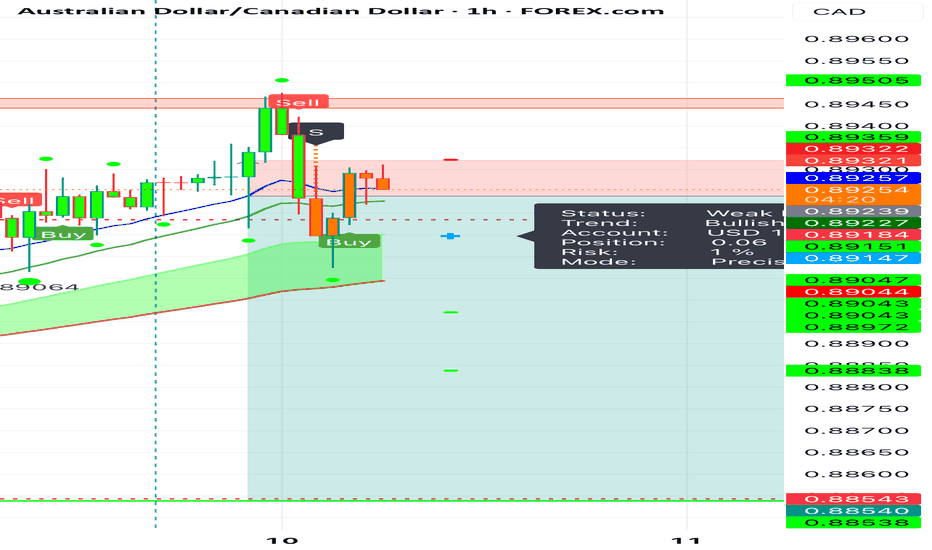

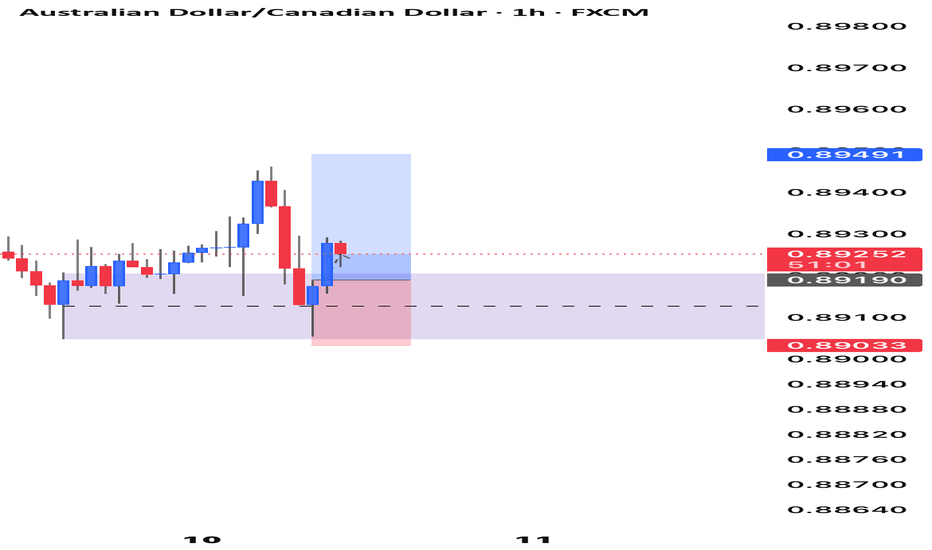

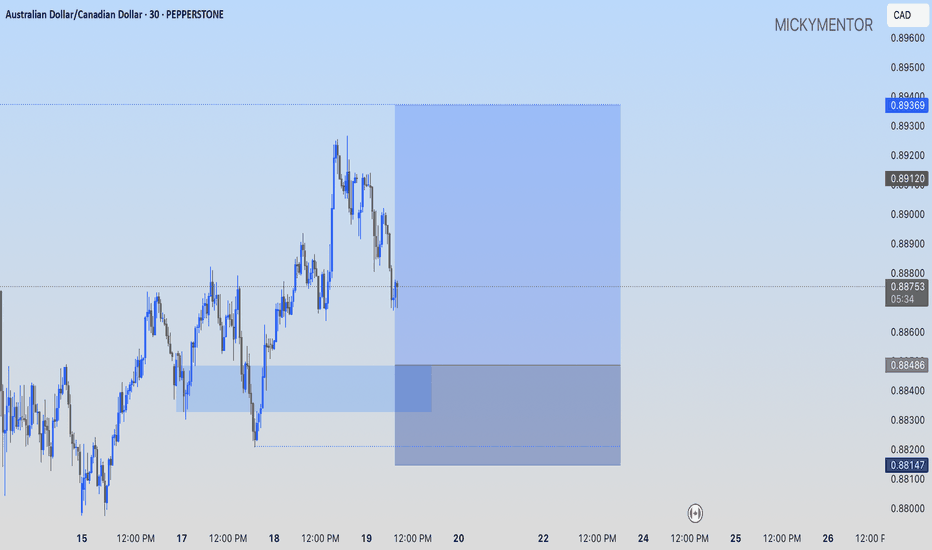

AUDCAD 1H Short 📕 Smart Money Trade Breakdown

🔻 AUDCAD 1H Short Setup

This is a short position on AUDCAD, entered at 0.88940, after price tapped into a bearish FVG (Fair Value Gap) and failed to break above the internal BOS.

📉 Entry: 0.88940

🎯 Take Profit: 0.88190

🛡️ Stop Loss: 0.89191

⚖️ Risk-Reward Ratio: ~1:3

🔍 Key Confluences:

Price tapped into FVG supply zone

Strong internal BOS confirms bearish intent

Clean trendline and liquidity sweep just before entry

Price rejecting lower high structure

This setup leverages institutional concepts like FVG + BOS rejection with proper RR alignment.

⚠️ Disclaimer: For educational purposes only. Trade with a clear risk management plan.