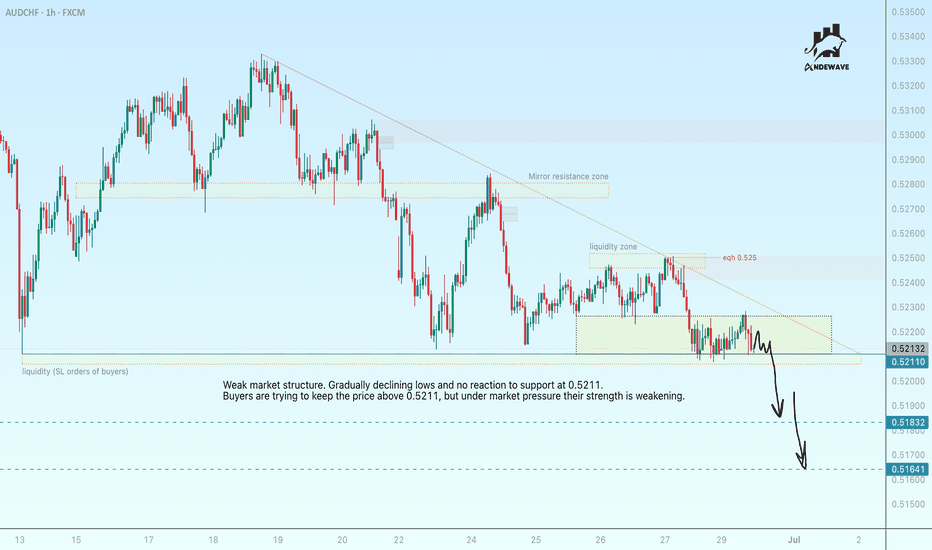

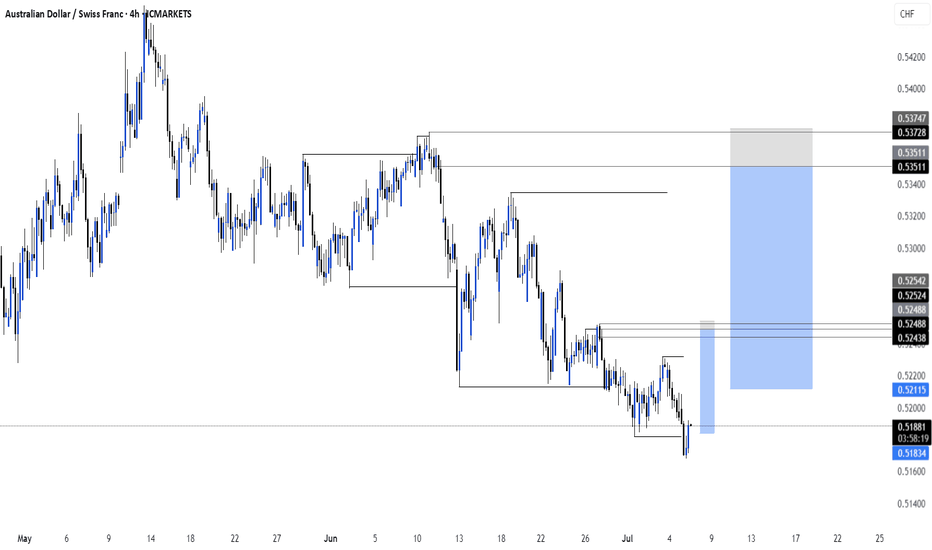

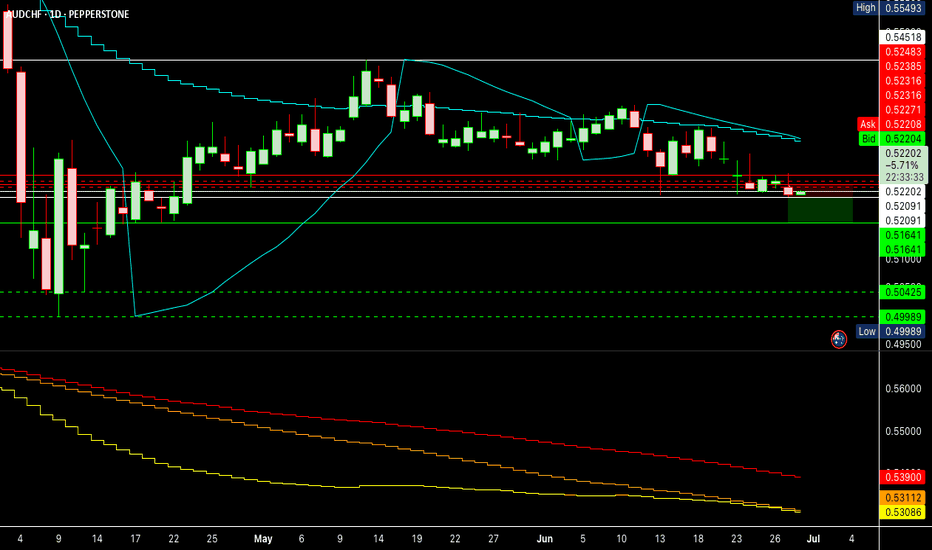

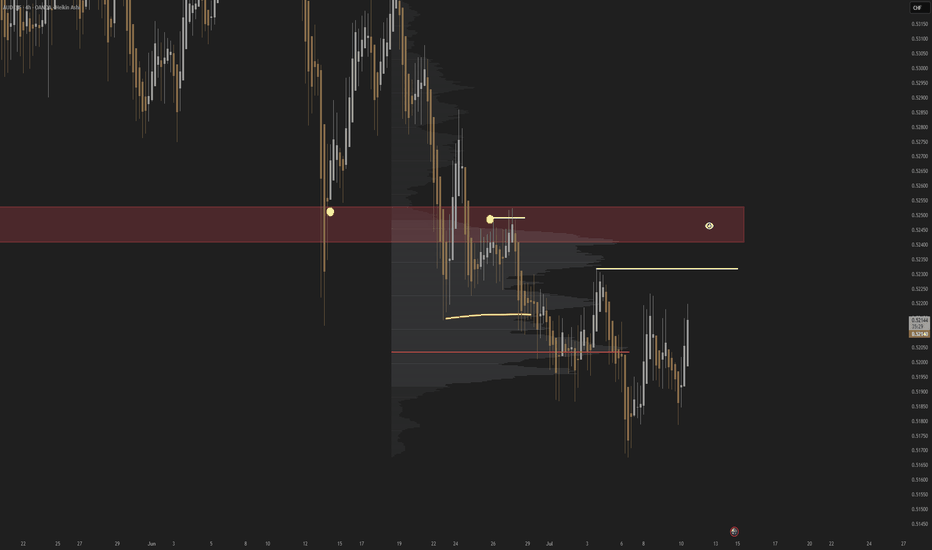

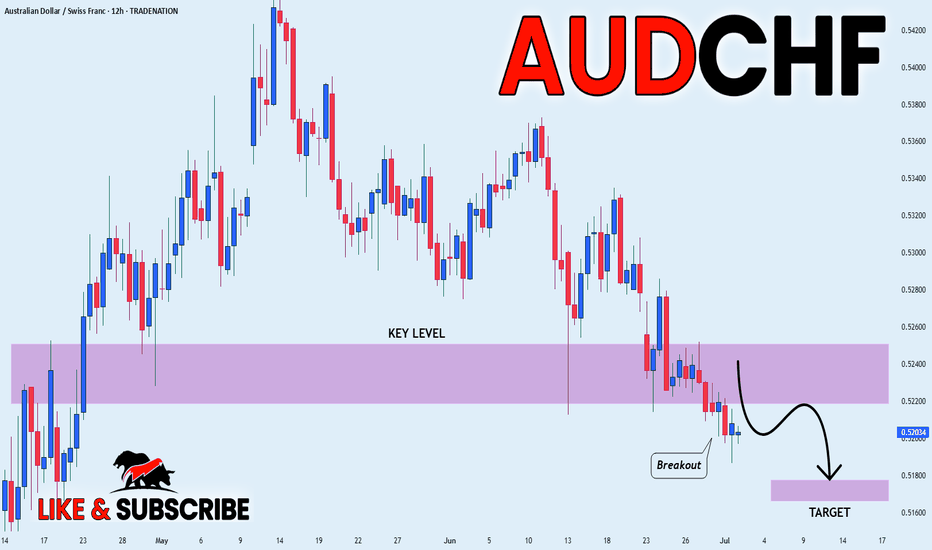

AUDCHF AUDCHF is preparing to break through support and fallWeak market structure. Gradually declining lows and no reaction to support at 0.5211. Buyers are trying to keep the price above 0.5211, but under market pressure their strength is weakening.

Relative to 0.5211, we see the formation of consolidation, which is of a “pre-breakdown” nature.

Accordingly, a break below the 0.5211 support level could trigger the activation of buyers' SL orders, leading to liquidation and a downward price distribution.

Potential targets include 0.518 and 0.5164.

AUDCHF trade ideas

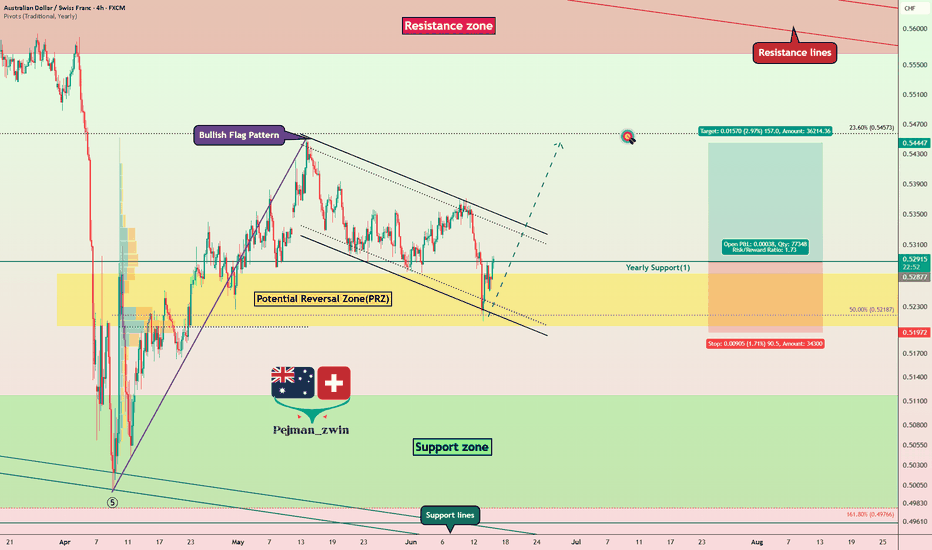

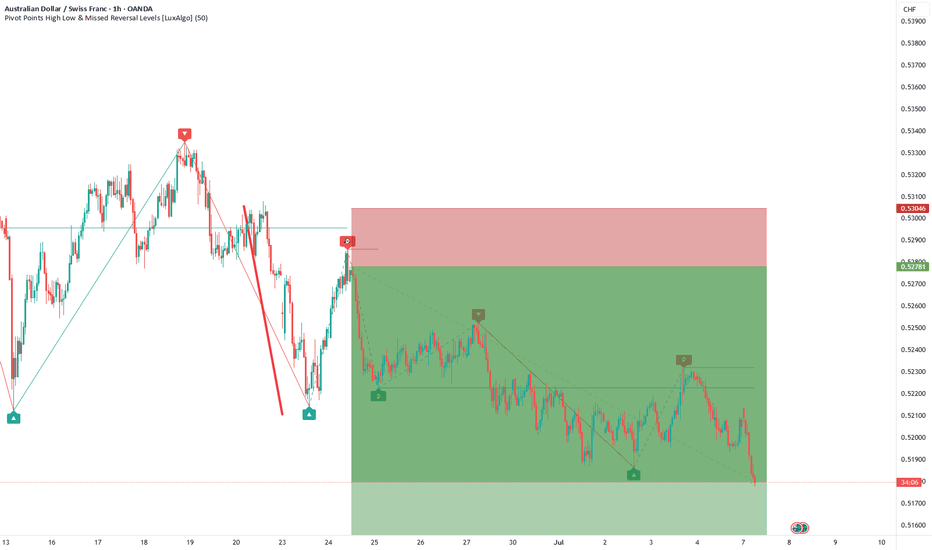

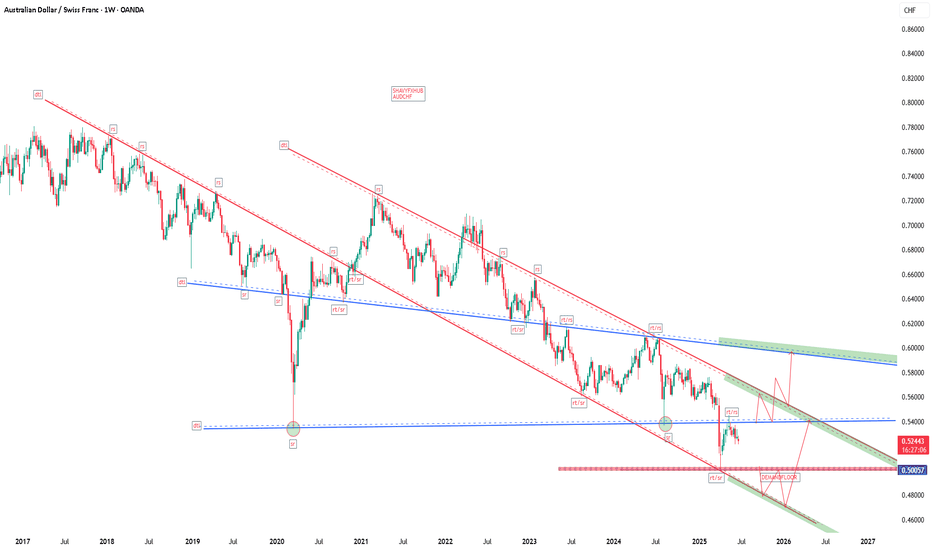

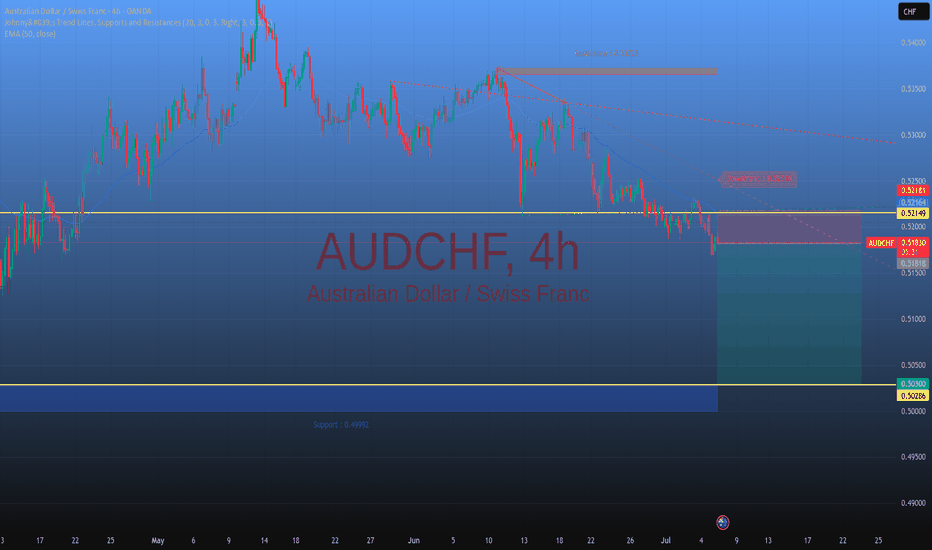

AUDCHF: Bullish Flag from PRZ — Rally to 0.54444?AUDCHF ( OANDA:AUDCHF ) bounced from the Potential Reversal Zone (PRZ) , which aligns with the Yearly Support(1) and the 50% Fibonacci level of the previous bullish impulse.

From a Classic Technical Analysis perspective , AUDCHF appears to be breaking out of a Bullish Flag Pattern , which may suggest the continuation of the previous uptrend .

This bullish reaction also confirms the importance of the Support zone(0.51166 CHF-0.49773 CHF) , where buyers stepped in aggressively.

In terms of Elliott Wave theory , it seems that AUDCHF has completed the bearish waves and we should wait for the bullish waves .

I expect AUDCHF to continue rising after a successful breakout from the flag’s upper boundary . If momentum sustains, the target could be around 0.54444 CHF .

Note: Stop Loss (SL) = 0.51972 CHF

Australian Dollar/ Swiss Franc Analyze (4-hour time frame).

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

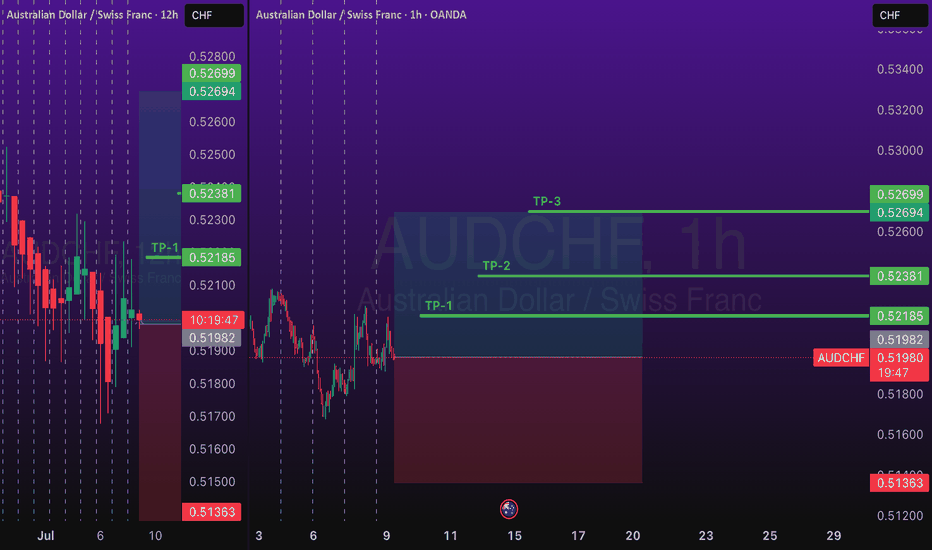

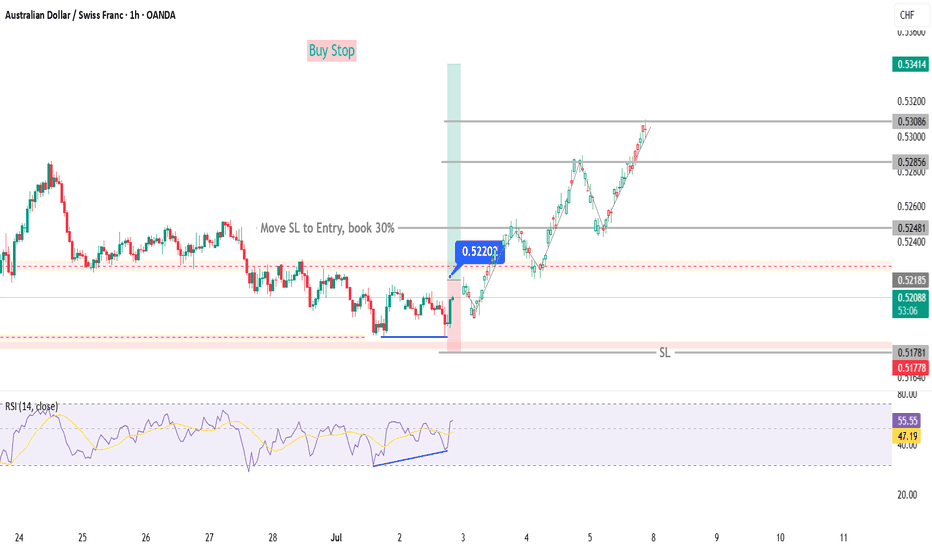

AUDCHF Long Trade OANDA:AUDCHF Long trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

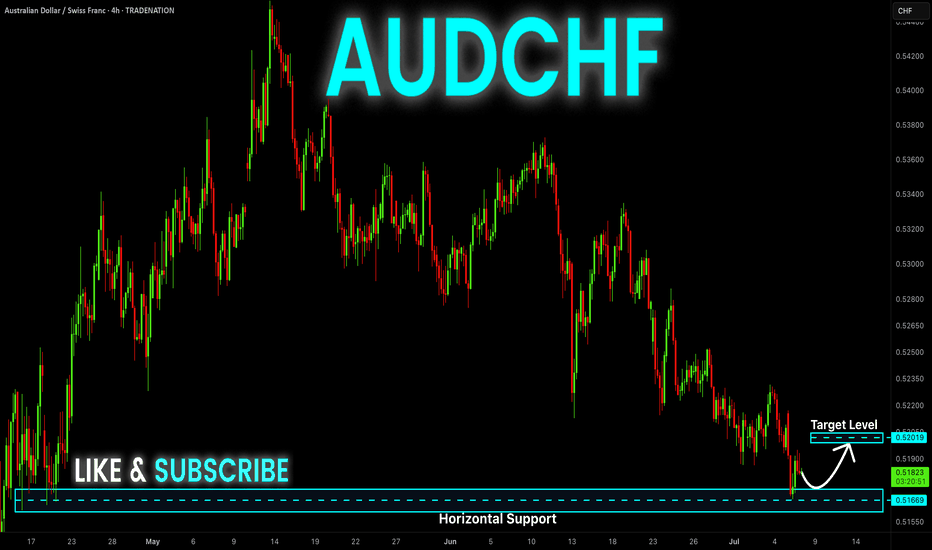

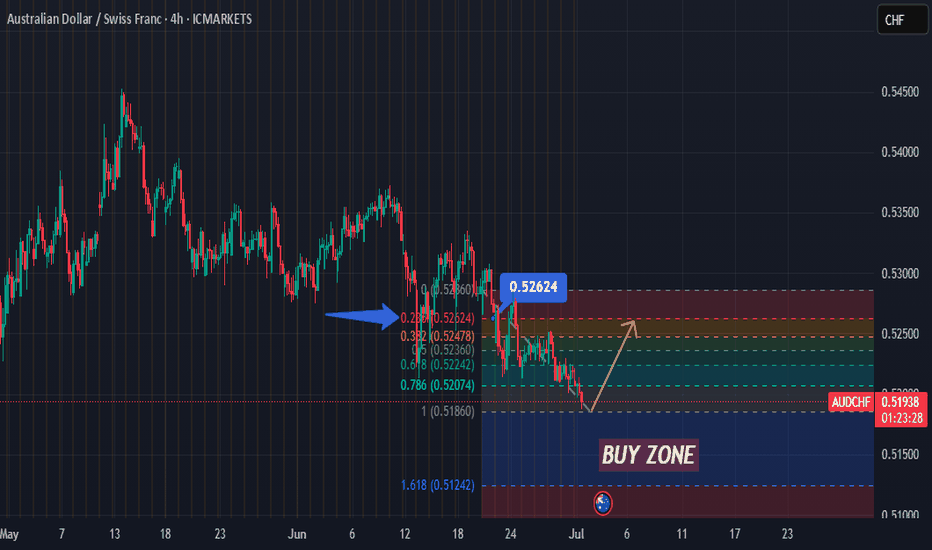

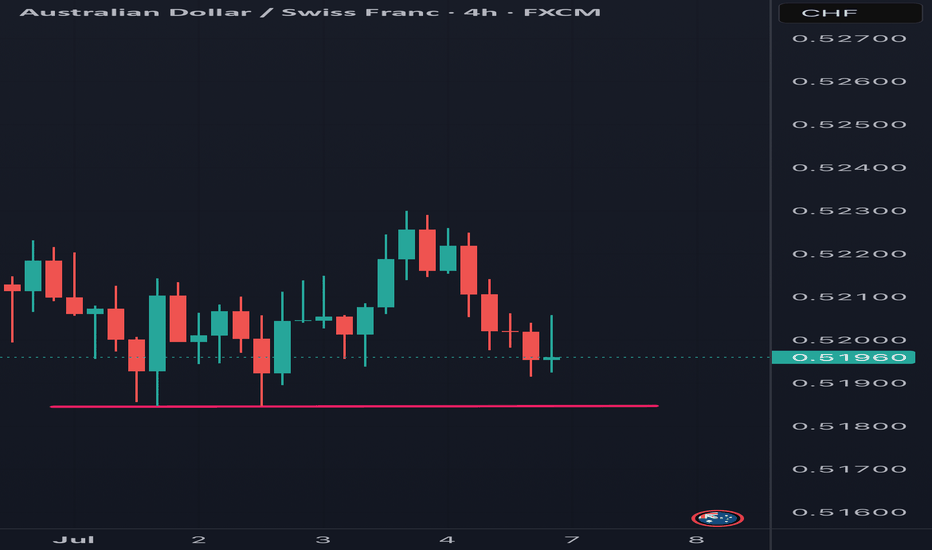

AUD-CHF Rebound Ahead! Buy!

Hello,Traders!

AUD-CHF keeps falling but

A horizontal support level

Is ahead around 0.5160

And as the pair is locally

Oversold we will be expecting

A local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDCHF Trade UpdateAUDCHF is sliding smooth — lower highs holding, candles picking up pace, volume staying calm but steady. Structure’s intact, momentum’s leaning down.

Looks like sellers are in control, no panic from buyers yet 🚪

I’m still in. Letting it breathe.

⚡

AUDCHF short from last week’s plan — trade doing its job.

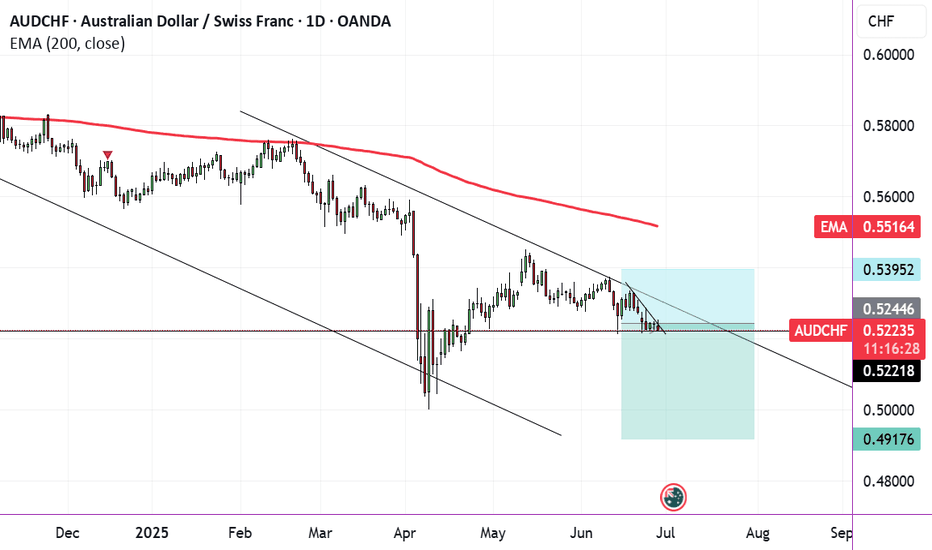

AUDCHF — What’s Going On with the CHF?In this pair, there’s currently a good opportunity to open a short position.

Looking at the weekly and daily timeframes, the price reached the 0.54518 area and started to reverse.

On top of that, it seems to be forming a triangle on these timeframes, which could suggest the price may continue to drop. This idea is confirmed by the indicators I usually use: a 45-period exponential moving average, two simple moving averages of 70 and 95 periods, and the Parabolic SAR.

On the 1-hour timeframe, there’s also a descending continuation triangle forming, backed by the same indicators.

That said, it’s worth keeping in mind that, despite this technical analysis, it’s important to stay on top of news, economic data, and other factors that could affect this pair, since this analysis is based purely on technicals.

The short position tool shown on the chart is just an extra aid to help decide on the entry.

AUDCHFChina’s offshore gold vault strengthens its role in global gold pricing, potentially supporting AUD through higher gold demand. However, CHF’s safe-haven status and Switzerland’s stable fiscal policies could counterbalance this, especially if global risk aversion rises.

China's offshore gold vault in Hong Kong and its push for yuan-based gold pricing could indirectly impact AUD/CHF. As Australia is a major gold exporter, rising gold prices (influenced by China's de-dollarization efforts) may support the AUD. However, the CHF remains a safe-haven currency, gaining strength during global uncertainty, which could pressure AUD/CHF downward.

The current RBA (Reserve Bank of Australia) cash rate is 3.85%, and the SNB (Swiss National Bank) policy interest rate is 0.00%. The SNB recently lowered its key interest rate by 25 basis points to 0% on June 19, 2025. The RBA last adjusted its cash rate in May, lowering it by 25 basis points to its current level.

Impact on AUD: The RBA’s steady rate policy supports AUD stability but limits aggressive appreciation unless inflation spikes or commodity exports (e.g., gold, driven by China’s vault) boost economic outlook.

Outlook: The RBA may hold rates steady through 2025 unless China’s demand for Australian commodities (e.g., iron ore, gold) significantly increases, potentially strengthening AUD.

Swiss National Bank (SNB) 0% rate

Impact on CHF: The low rate reinforces CHF’s safe-haven appeal, especially amid global uncertainties (e.g., US trade policies, geopolitical tensions). This strengthens CHF, capping AUD/CHF upside.

Outlook: The SNB is likely to maintain low rates, with potential cuts if deflationary pressures emerge, further supporting CHF strength.

AUDCHFChina’s offshore gold vault strengthens its role in global gold pricing, potentially supporting AUD through higher gold demand. However, CHF’s safe-haven status and Switzerland’s stable fiscal policies could counterbalance this, especially if global risk aversion rises.

China's offshore gold vault in Hong Kong and its push for yuan-based gold pricing could indirectly impact AUD/CHF. As Australia is a major gold exporter, rising gold prices (influenced by China's de-dollarization efforts) may support the AUD. However, the CHF remains a safe-haven currency, gaining strength during global uncertainty, which could pressure AUD/CHF downward.

The current RBA (Reserve Bank of Australia) cash rate is 3.85%, and the SNB (Swiss National Bank) policy interest rate is 0.00%. The SNB recently lowered its key interest rate by 25 basis points to 0% on June 19, 2025. The RBA last adjusted its cash rate in May, lowering it by 25 basis points to its current level.

Impact on AUD: The RBA’s steady rate policy supports AUD stability but limits aggressive appreciation unless inflation spikes or commodity exports (e.g., gold, driven by China’s vault) boost economic outlook.

Outlook: The RBA may hold rates steady through 2025 unless China’s demand for Australian commodities (e.g., iron ore, gold) significantly increases, potentially strengthening AUD.

Swiss National Bank (SNB) 0% rate

Impact on CHF: The low rate reinforces CHF’s safe-haven appeal, especially amid global uncertainties (e.g., US trade policies, geopolitical tensions). This strengthens CHF, capping AUD/CHF upside.

Outlook: The SNB is likely to maintain low rates, with potential cuts if deflationary pressures emerge, further supporting CHF strength.

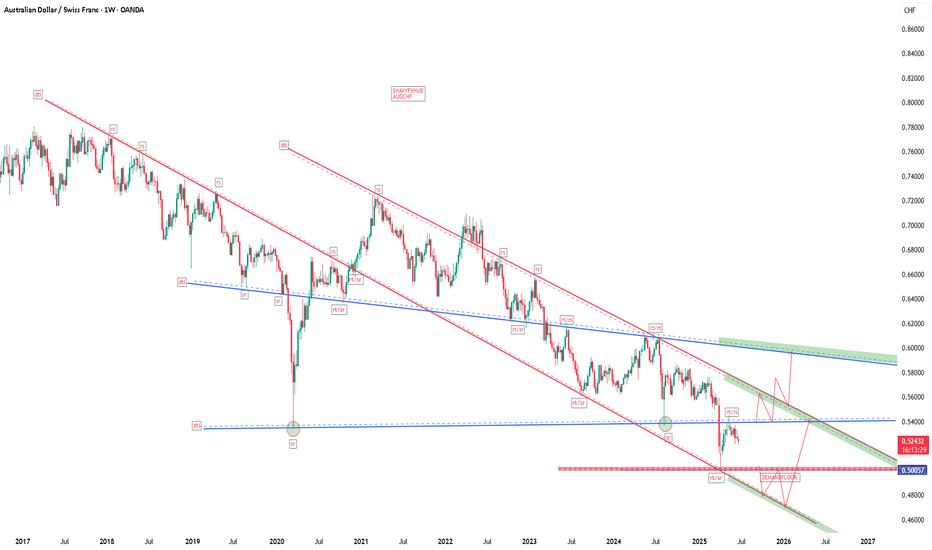

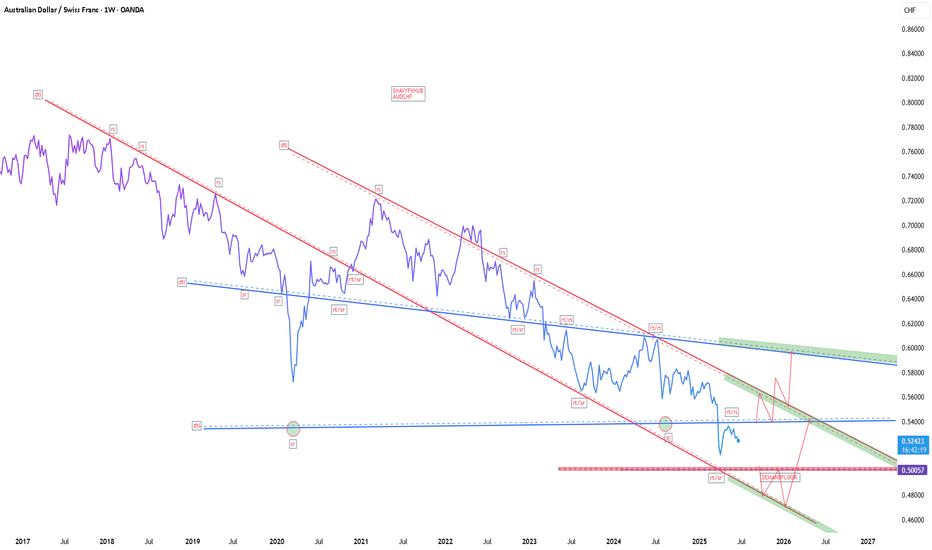

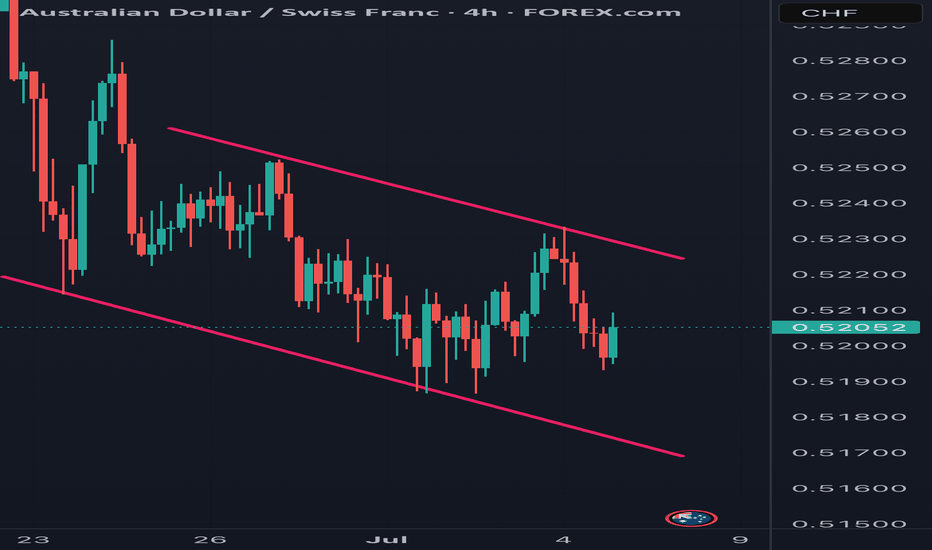

AUDCHF - ShortI have been short on AUDCHF for a few days. Here's my breakdown:

Technical:

- Descending channel

- Strong resistance on the upper channel line

- Potential descending triangle forming, suggesting continuation of this downtrend

- Following the overall trend of this pair, which is bearish

Fundamental:

- Risk off mood globally, CHF is a safe haven currency

- Dovish RBA

- Commodity pressure on AUD

- SNB stability

AUDCHFChina’s offshore gold vault strengthens its role in global gold pricing, potentially supporting AUD through higher gold demand. However, CHF’s safe-haven status and Switzerland’s stable fiscal policies could counterbalance this, especially if global risk aversion rises.

China's offshore gold vault in Hong Kong and its push for yuan-based gold pricing could indirectly impact AUD/CHF. As Australia is a major gold exporter, rising gold prices (influenced by China's de-dollarization efforts) may support the AUD. However, the CHF remains a safe-haven currency, gaining strength during global uncertainty, which could pressure AUD/CHF downward.

The current RBA (Reserve Bank of Australia) cash rate is 3.85%, and the SNB (Swiss National Bank) policy interest rate is 0.00%. The SNB recently lowered its key interest rate by 25 basis points to 0% on June 19, 2025. The RBA last adjusted its cash rate in May, lowering it by 25 basis points to its current level.

Impact on AUD: The RBA’s steady rate policy supports AUD stability but limits aggressive appreciation unless inflation spikes or commodity exports (e.g., gold, driven by China’s vault) boost economic outlook.

Outlook: The RBA may hold rates steady through 2025 unless China’s demand for Australian commodities (e.g., iron ore, gold) significantly increases, potentially strengthening AUD.

Swiss National Bank (SNB) 0% rate

Impact on CHF: The low rate reinforces CHF’s safe-haven appeal, especially amid global uncertainties (e.g., US trade policies, geopolitical tensions). This strengthens CHF, capping AUD/CHF upside.

Outlook: The SNB is likely to maintain low rates, with potential cuts if deflationary pressures emerge, further supporting CHF strength.

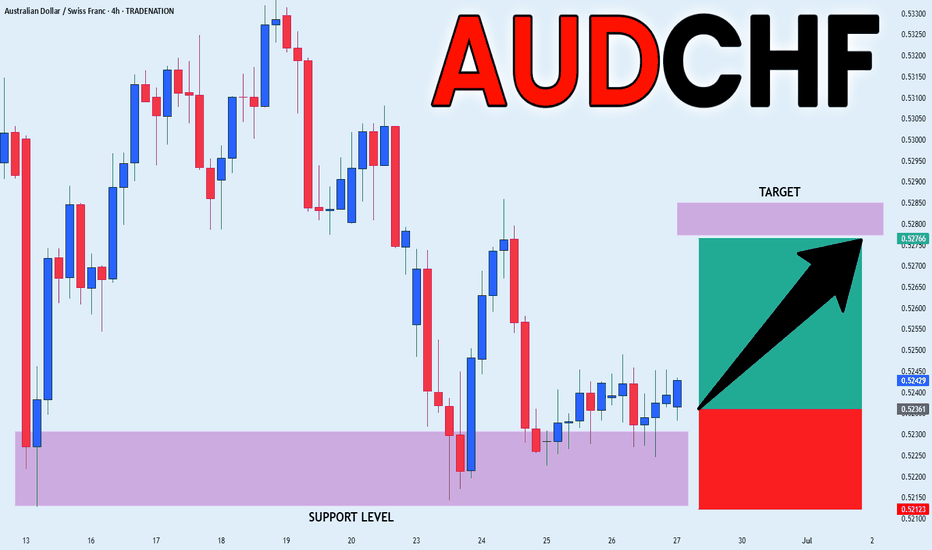

AUD_CHF LONG SIGNAL|

✅AUD_CHF was trading in a

Strong downtrend but then

Has reached a strong horizontal

Demand area around 0.5215

And failed to break the level

Which means that the bearish

Impulse might be absorbed

And we will finally see a

Bullish move up so we can

Enter a long trade with the

TP of 0.5276 and the SL of 0.5212

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDCHF Technical Analysis! SELL!

My dear subscribers,

My technical analysis for AUDCHF is below:

The price is coiling around a solid key level - 0.5226

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 0.5205

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

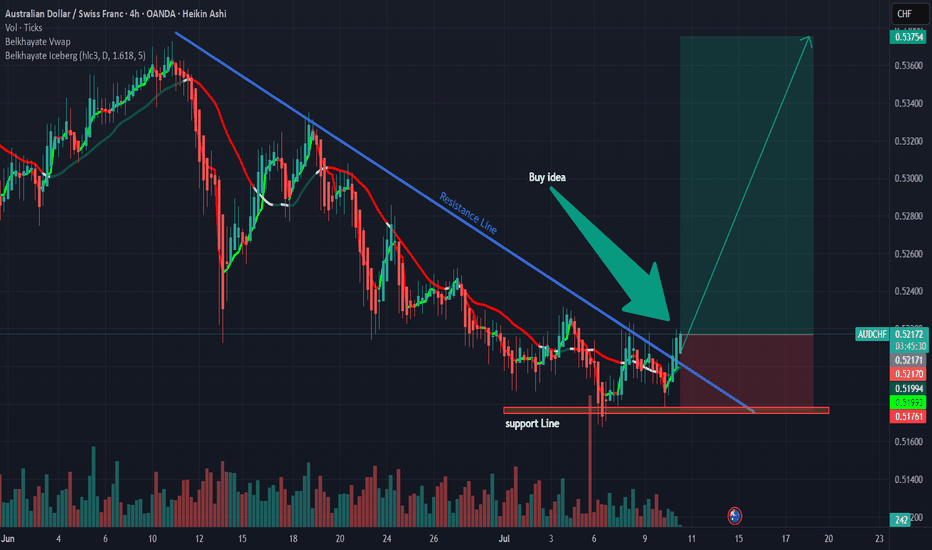

AUDCHF; Heikin Ashi Trade IdeaOANDA:AUDCHF

In this video, I’ll be sharing my analysis of AUDCHF, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

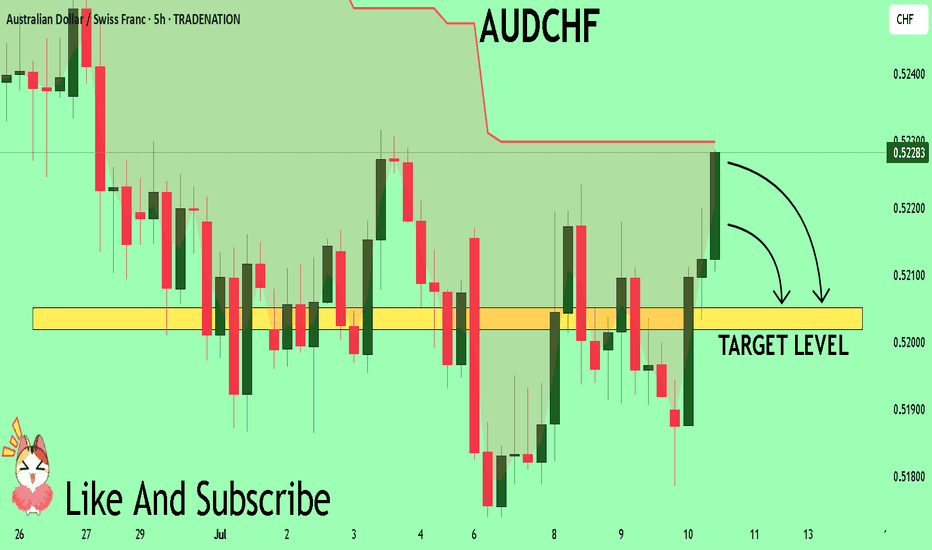

AUD_CHF BEARISH BREAKOUT|SHORT|

✅AUD_CHF is going down currently

As the pair broke the key structure level of 0.5240

Which is now a resistance, and after the pullback

And retest, I think the price will go further down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.