AUDGBP trade ideas

GBPAUD is Holding above the Support , All Eyes on BuyingHello Traders

In This Chart GBPAUD HOURLY Forex Forecast By FOREX PLANET

today GBPAUD analysis 👆

🟢This Chart includes_ (GBPAUD market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

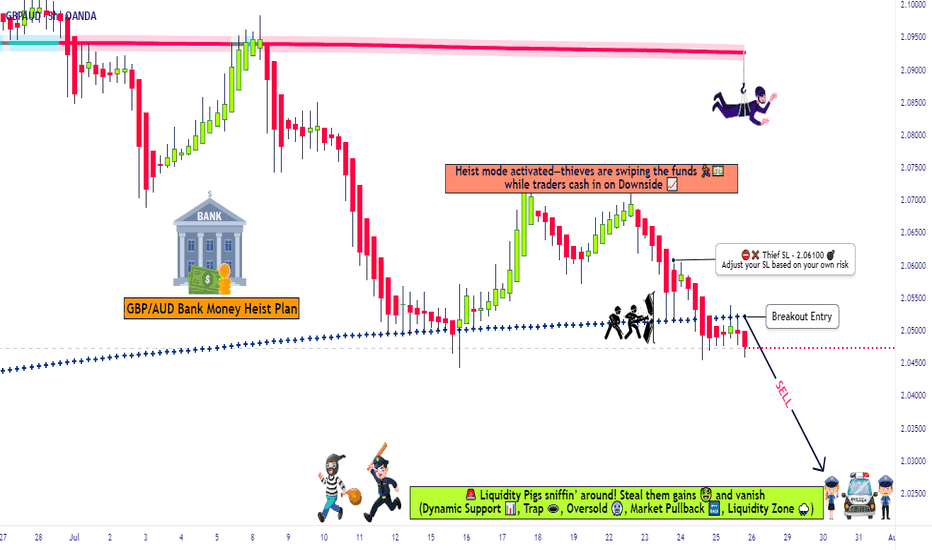

High-Stakes GBP/AUD Short Plan – Grab the Bag & Escape Early!💥🔥GBP/AUD HEIST OPERATION: The Pound vs Aussie Bear Trap Masterplan 🔥💥

(Thief Trader Exclusive TradingView Drop – Smash Boost If You’re Ready To Rob The Market!)

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

Welcome, Money Makers & Market Robbers! 🤑💰✈️

This isn't just analysis — it's a high-stakes forex heist, engineered using Thief Trading Style's elite blend of technical, macro, sentiment, and quantitative insights. We're cracking the GBP/AUD vault with sharp bearish setups targeting a major liquidity zone — aka the Police Barricade Support Area! 🚨🔫

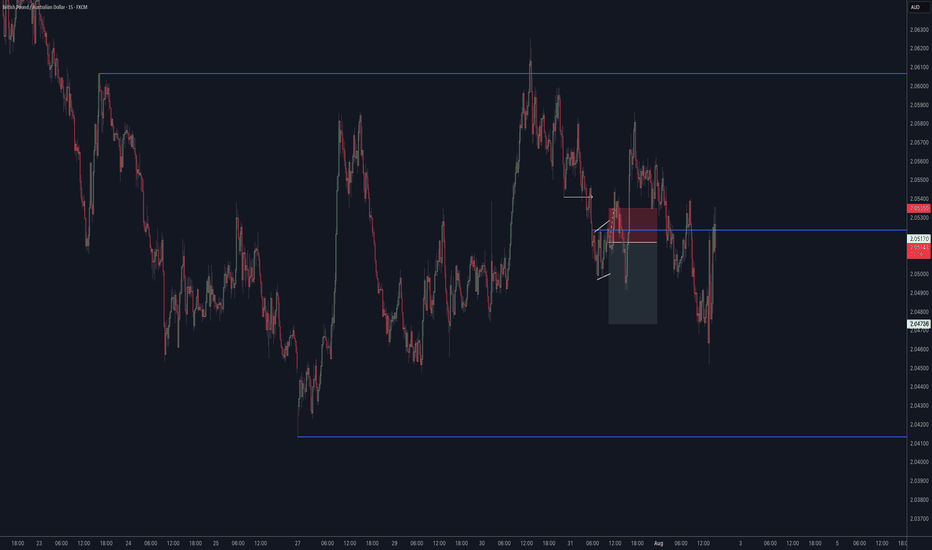

📉 Plan of Attack – Short Entry Setup

This isn’t your typical chart — this is blueprint-grade precision. Here's the GBP/AUD short strategy for Day & Swing Traders:

🚪 ENTRY ZONE

Initiate bearish positions at or near recent highs (wick level).

Use limit orders stacked (layering/DCA style) on the 15m or 30m retest zones for sniper entries.

Look for wicks with rejection — that’s where the fake bullish robbers get trapped!

🛑 STOP LOSS

Place SL just above recent 4H swing highs (2.06100 as a reference).

Adjust according to position size and the number of orders you’re layering.

🎯 TARGET ZONE

Aim for 2.02500, or book partial profits earlier if the heist gets heat.

Escape before the alarms ring! Secure the bag and vanish like a pro.

🔍Fundamental & Sentiment Heist Intel 📚

This bearish pressure on GBP/AUD isn’t random — it’s triggered by a perfect storm:

COT Positioning flips 📊

Aussie strength from commodities & RBA commentary 📈

GBP uncertainty from macro tightening & economic data ⚖️

Sentiment exhaustion at highs + false bullish trap 📉

Consolidation zone breakdown = smart money move! 💼

Wanna go deep? 🧠

Tap into COT, Macro Trends, Intermarket Analysis & Thief’s proprietary scoreboardsss 📡🔗

⚠️ News & Position Management Alert 🚧

📰 Avoid entry around key news drops

🔒 Lock in profits with trailing SL

💼 Secure capital > Chase greed

🔥 SHOW SOME LOVE 🔥

💖 Smash that ❤️ BOOST button — it powers our next big heist!

Together, we rob the market with style, skill, and precision.

See you on the next breakout robbery mission, legends!

Stay dangerous. Stay profitable. Stay Thief. 🐱👤💵🚀

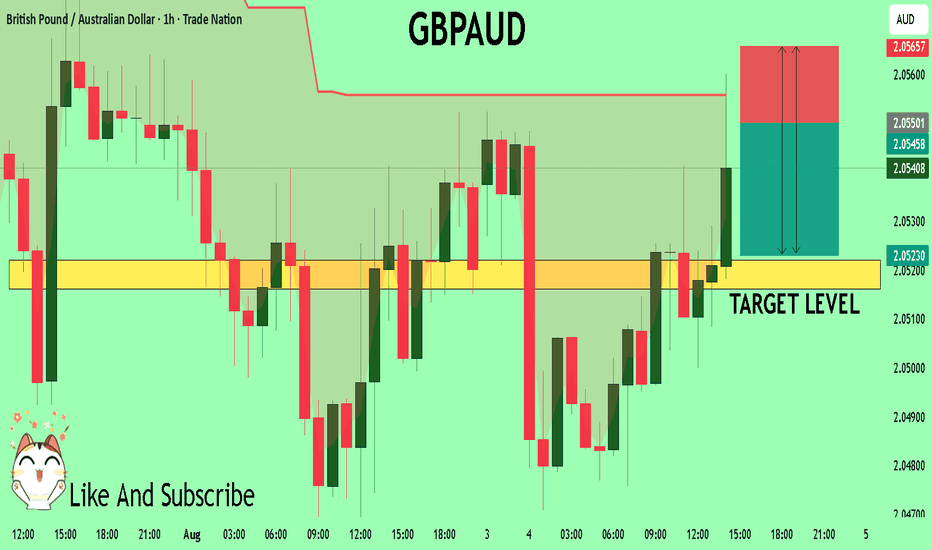

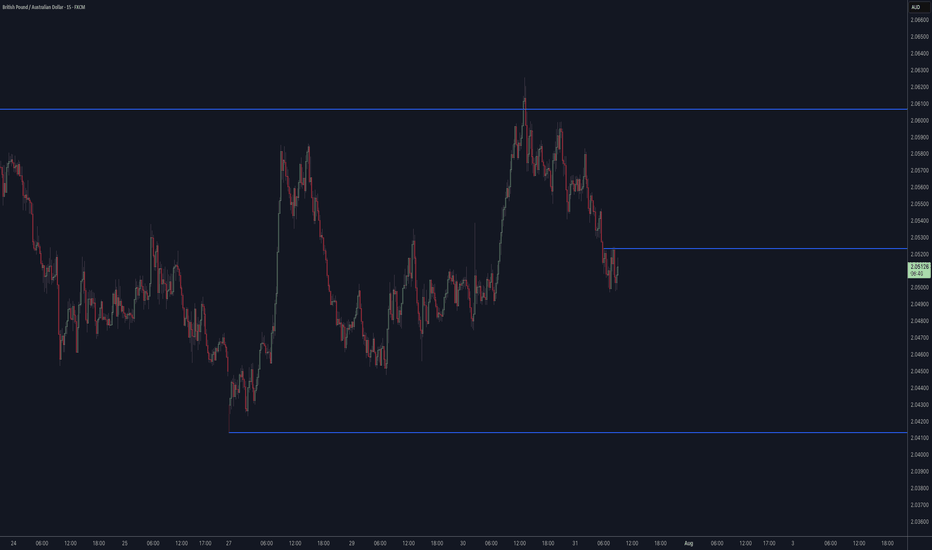

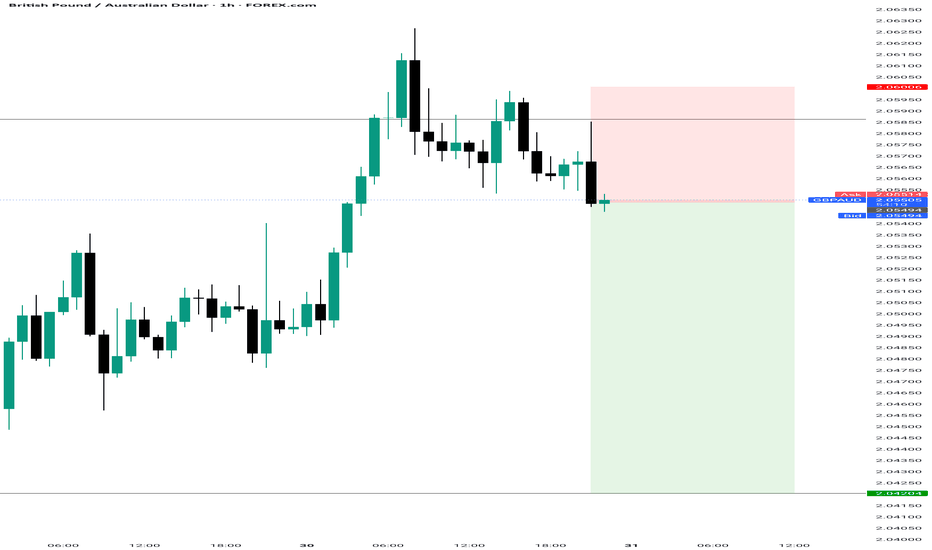

GBPAUD Technical Analysis! SELL!

My dear friends,

Please, find my technical outlook for GBPAUD below:

The instrument tests an important psychological level 2.0550

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 2.0522

Recommended Stop Loss - 2.0565

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

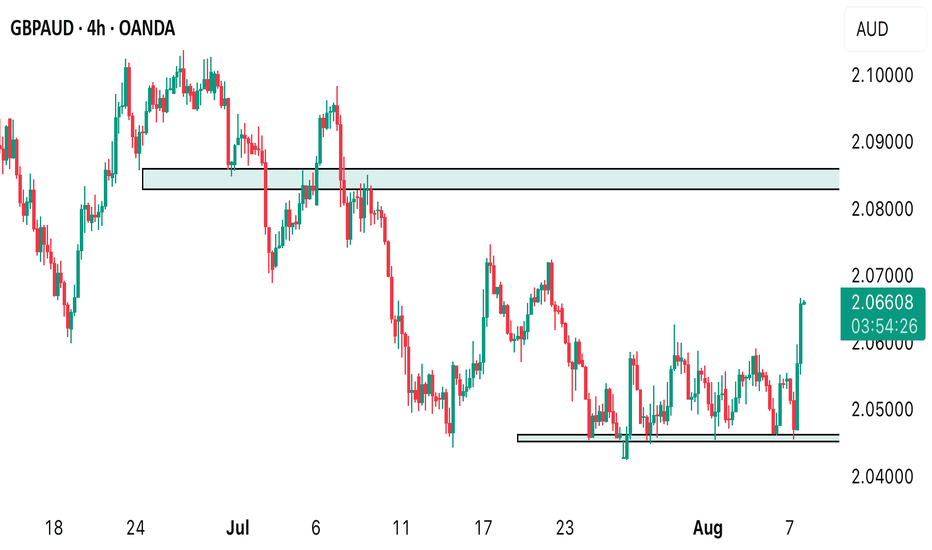

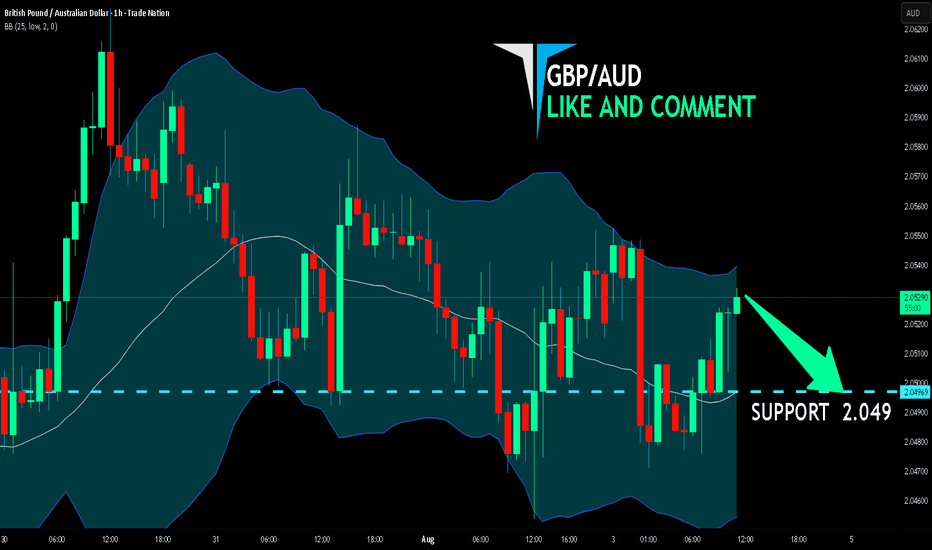

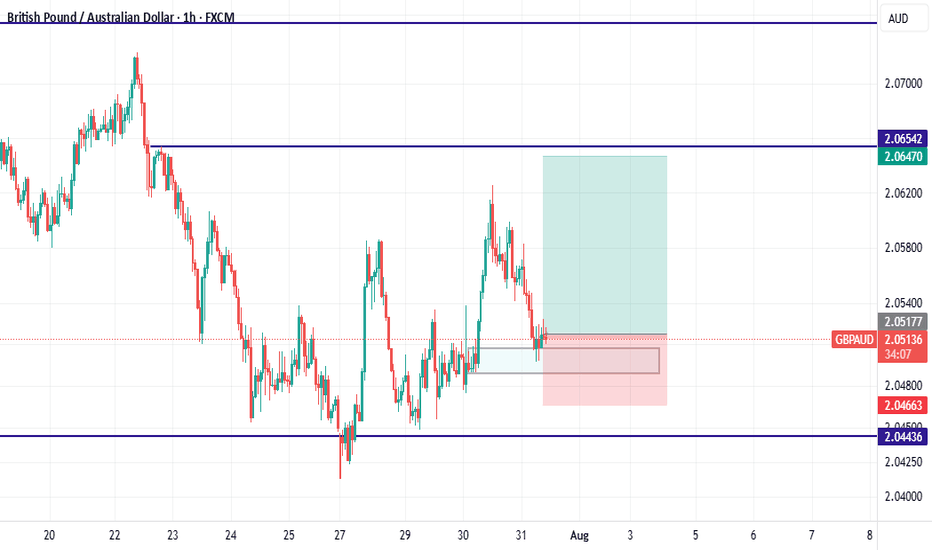

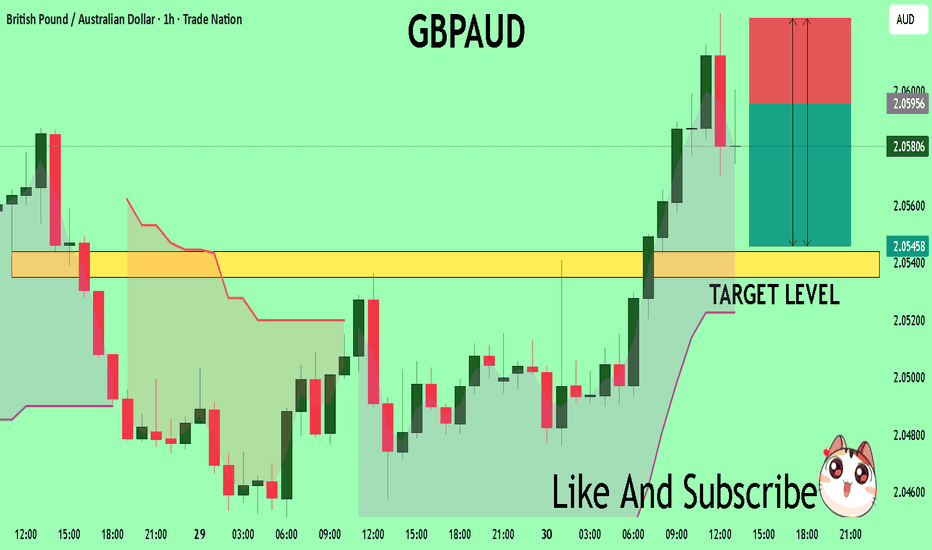

GBP/AUD SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

GBP-AUD uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 2.049 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the GBP/AUD pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

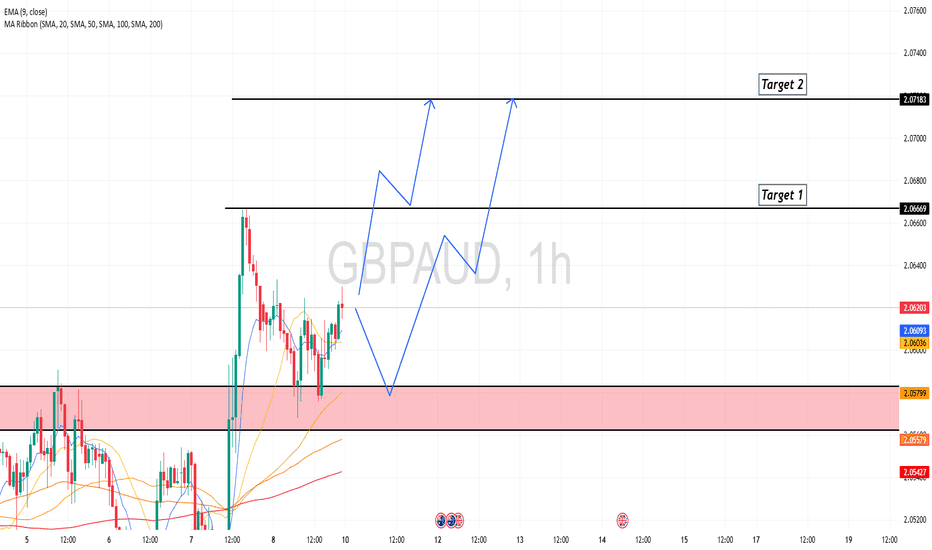

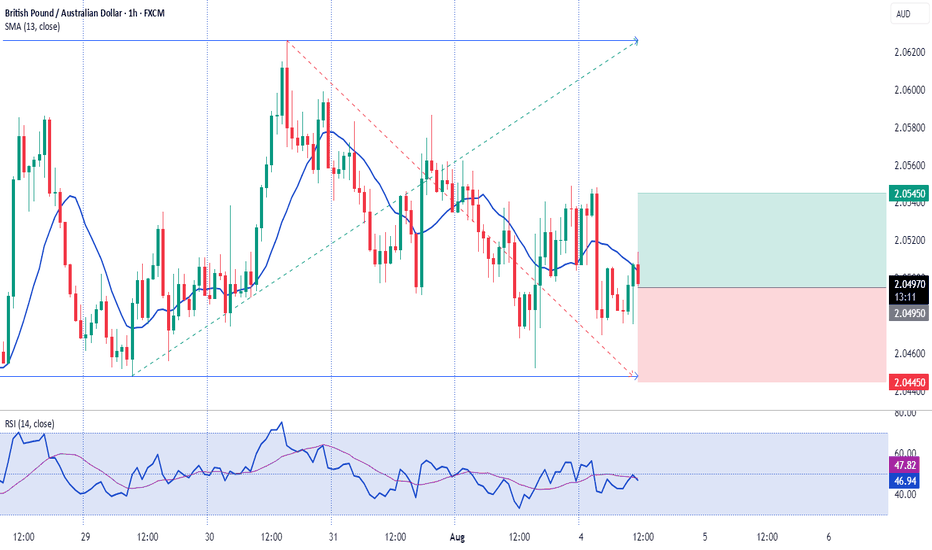

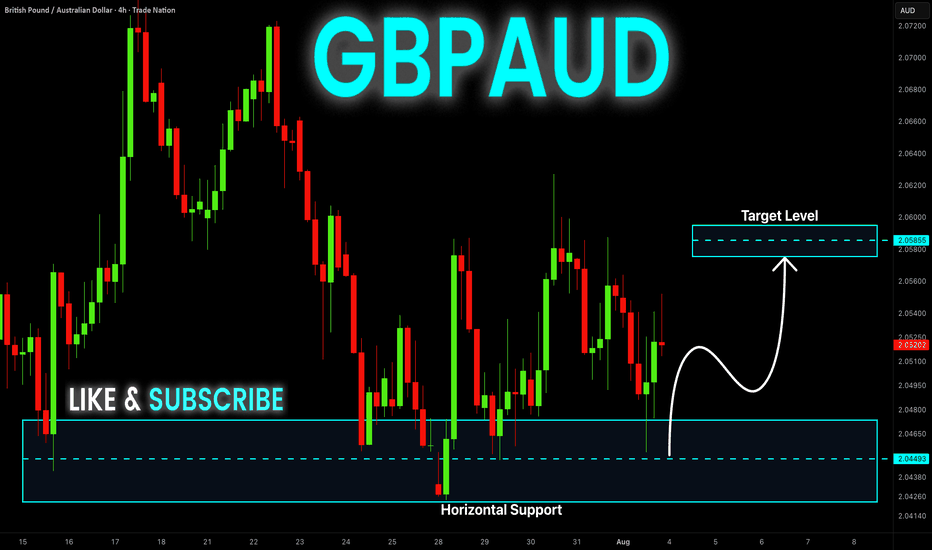

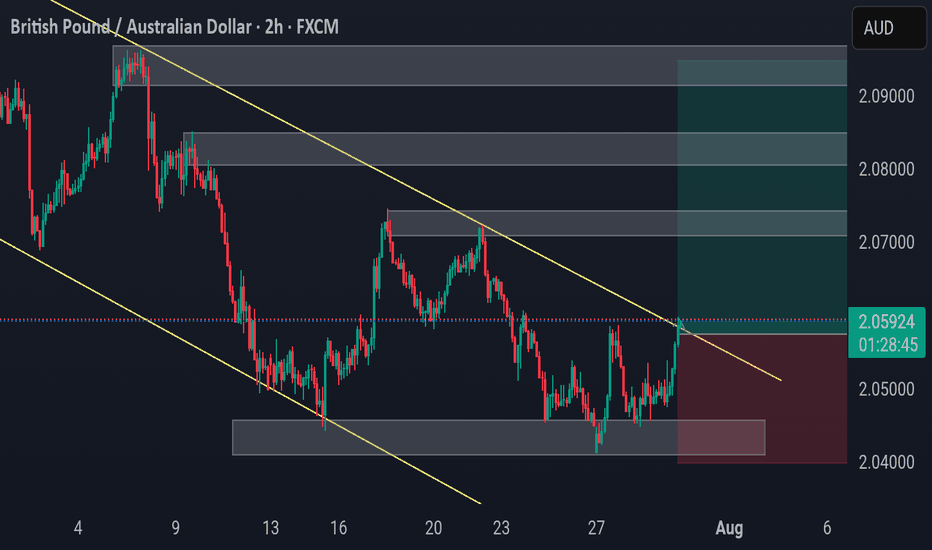

GBP-AUD Growth Ahead! Buy!

Hello,Traders!

GBP-AUD made a retest

Of the horizontal support

Of 2.0420 and we are

Already seeing a bullish

Rebound so we will be

Expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDCAD / GBPAUD Trade Recaps 01.08.25A tester trade on AUDCAD with the reasons explained as to why this was a test position, and a short position executed on GBPAUD. Solid setup that this time around just didn't commit.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

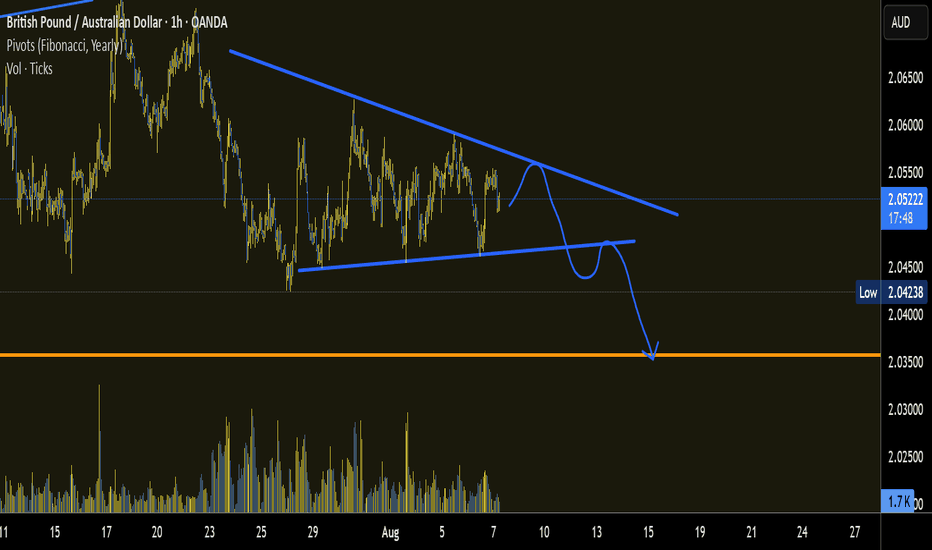

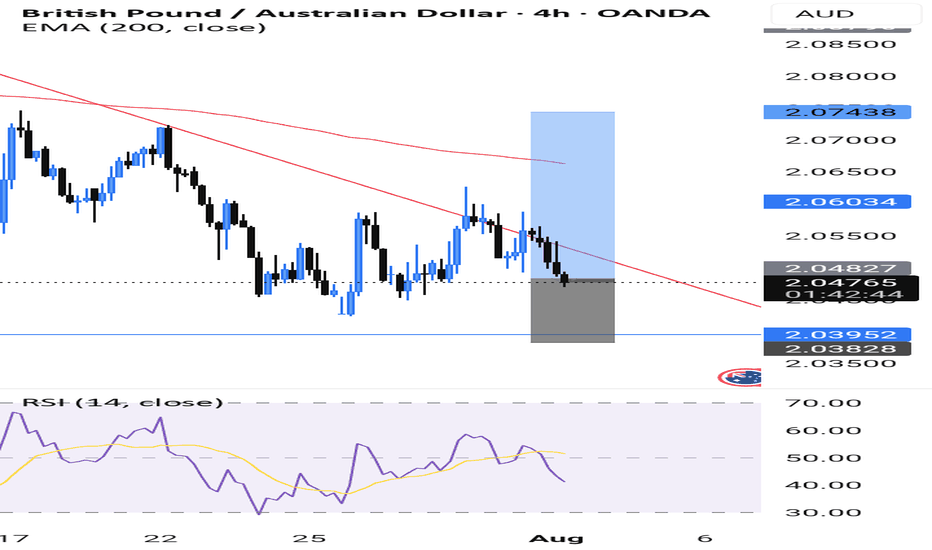

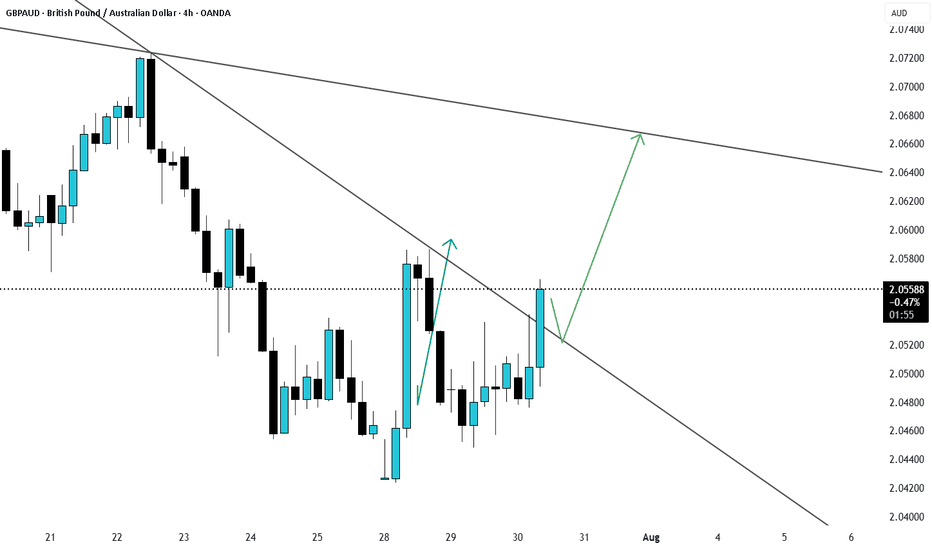

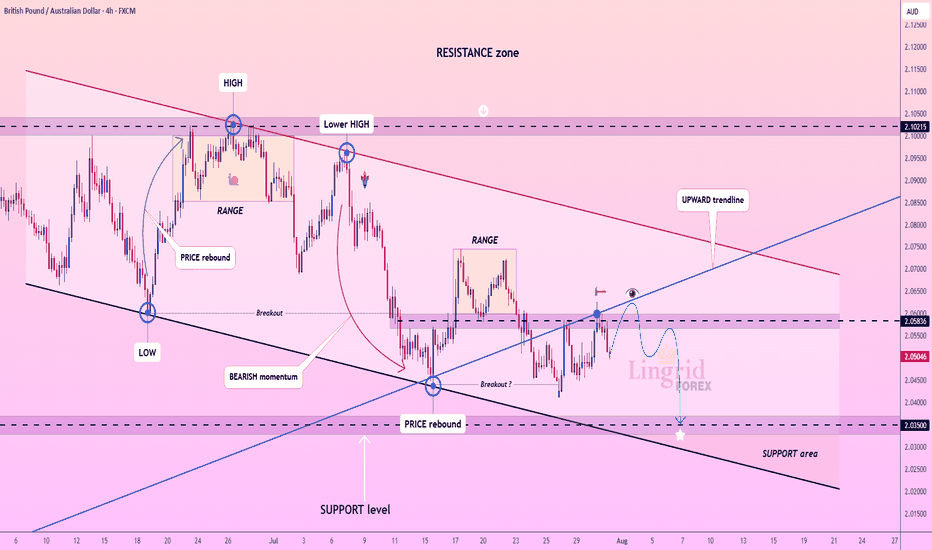

Lingrid | GBPAUD Bearish Pressure. Potential ShortThe price perfectly fulfilled my previous idea . FX:GBPAUD rebounded from support and has climbed into a tight resistance zone near 2.05836, but momentum remains weak near the downward trendline. The price structure shows a sequence of lower highs and a tight range below resistance, suggesting sellers are still in control. A rejection at this level would confirm another failed breakout attempt. If confirmed, the pair could revisit the 2.03500 support area with bearish continuation pressure.

📌 Key Levels

Sell trigger: Rejection at 2.05836 and break of 2.05000

Sell zone: 2.05800–2.06000

Target: 2.03500

Invalidation: Strong break and close above 2.06000

💡 Risks

Bullish breakout above trendline resistance

Fundamental surprise (UK/AU economic data)

Shift in broader risk sentiment or AUD weakness

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

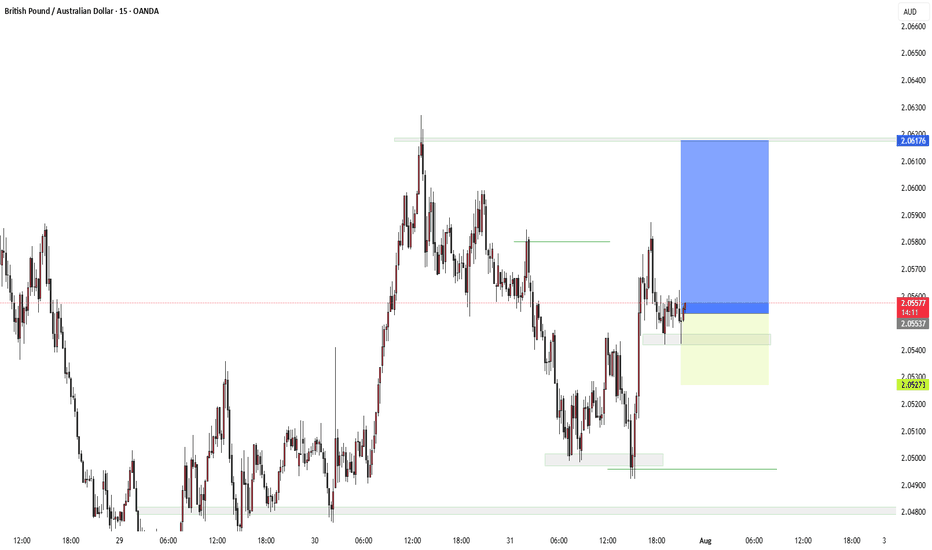

GBPAUD Massive Short! SELL!

My dear subscribers,

My technical analysis for GBPAUDis below:

The price is coiling around a solid key level - 2.0596

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 2.0543

My Stop Loss - 2.0626

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

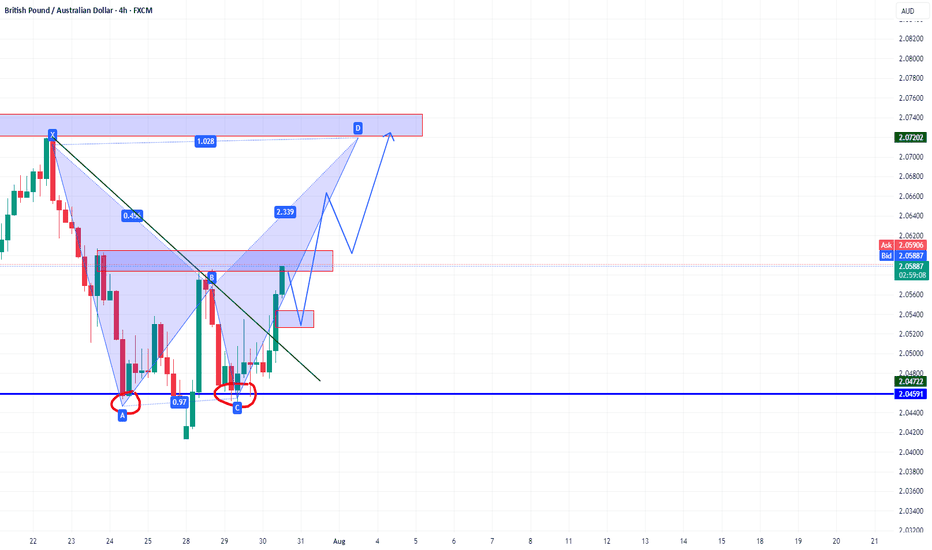

GBPAUD bullish potentialGBPAUD is showing bullish potential after forming a double bottom around the key support zone at 2.0459. A bullish harmonic pattern is unfolding, with a potential move toward the 2.0720–2.0740 resistance zone. The break of the downtrend line adds confirmation, and a pullback to 2.0530–2.0550 could offer a good re-entry area. As long as price stays above 2.0450, the bullish setup remains valid. The key target is the harmonic D completion zone.

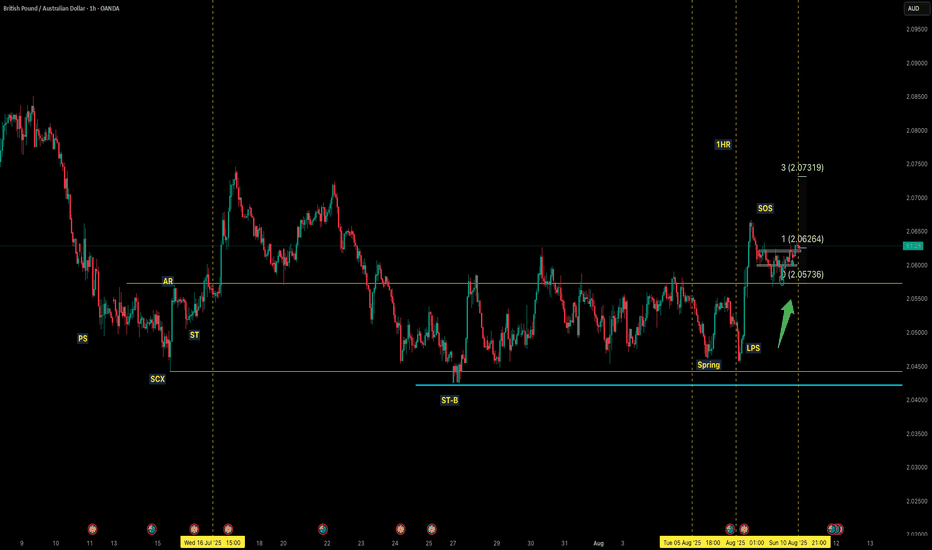

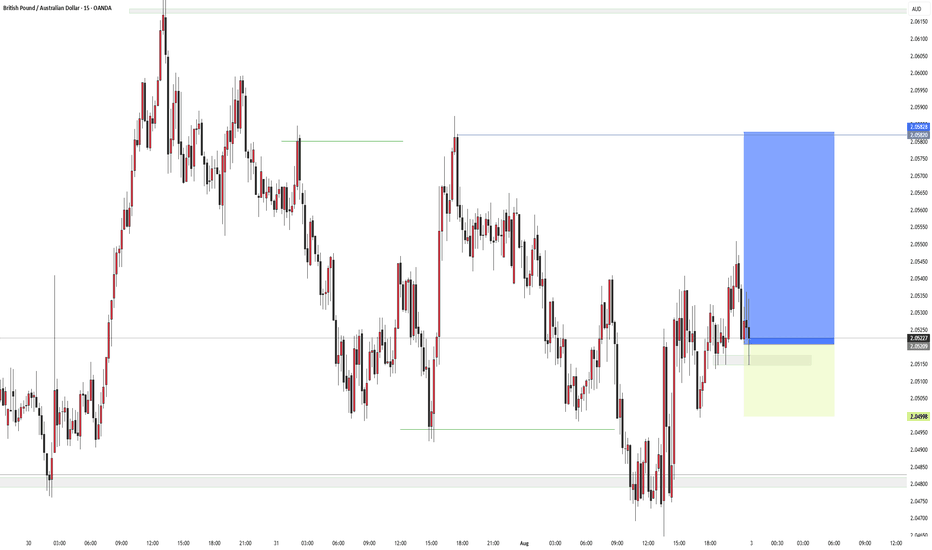

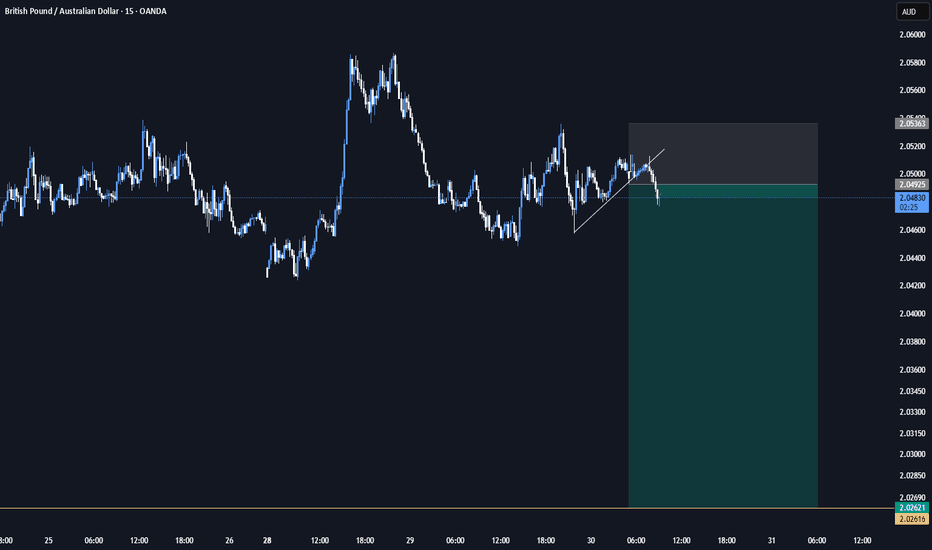

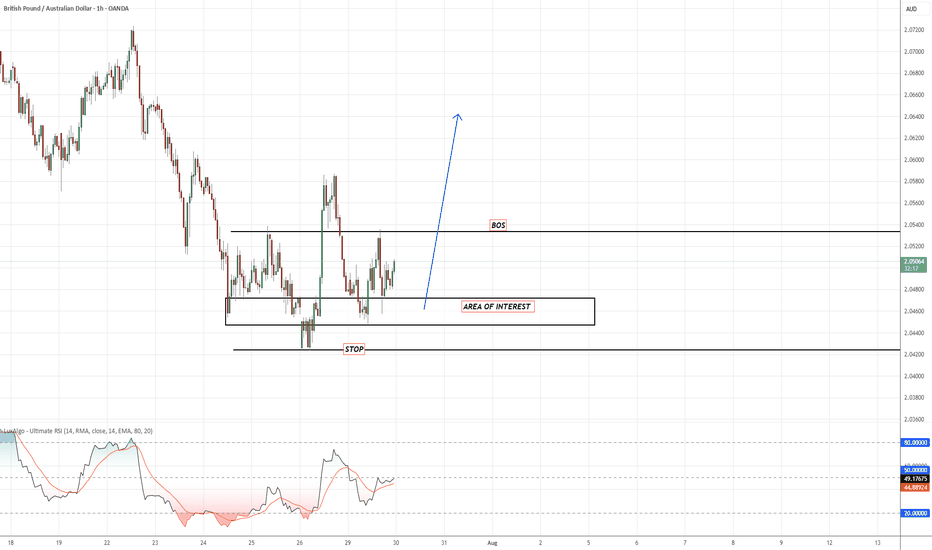

GBP AUD Price is showing strong signs of accumulation near the 2.0450–2.0470 demand zone, forming a clean range low sweep + BOS (Break of Structure).

🔹 Area of Interest: Watching for a retracement back into the marked zone for a potential long setup.

🔹 Confirmation: Break of structure confirmed at ~2.0535

🔹 Stop: Below the sweep low (~2.0420)

🔹 Target: Above previous supply zone (~2.0650–2.07), expecting a strong impulsive leg up if momentum sustains.