AUDGBP trade ideas

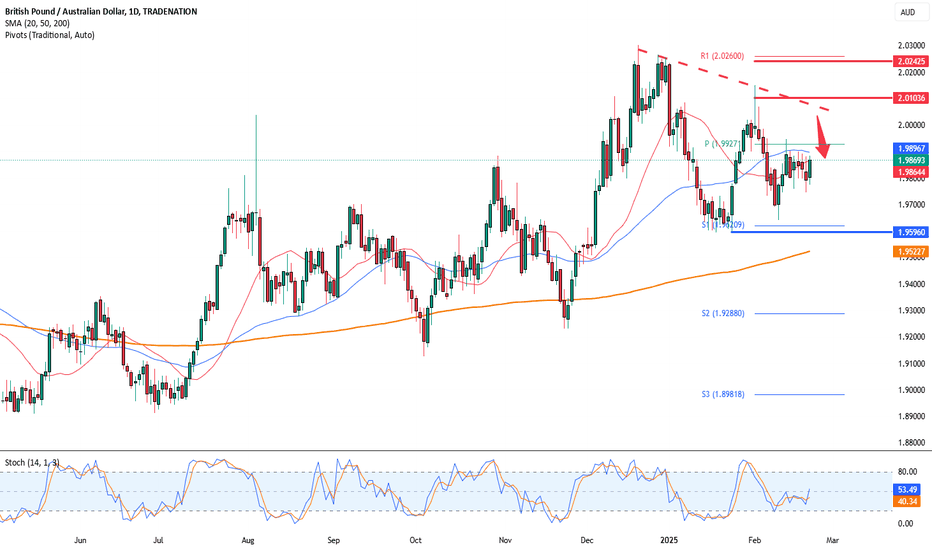

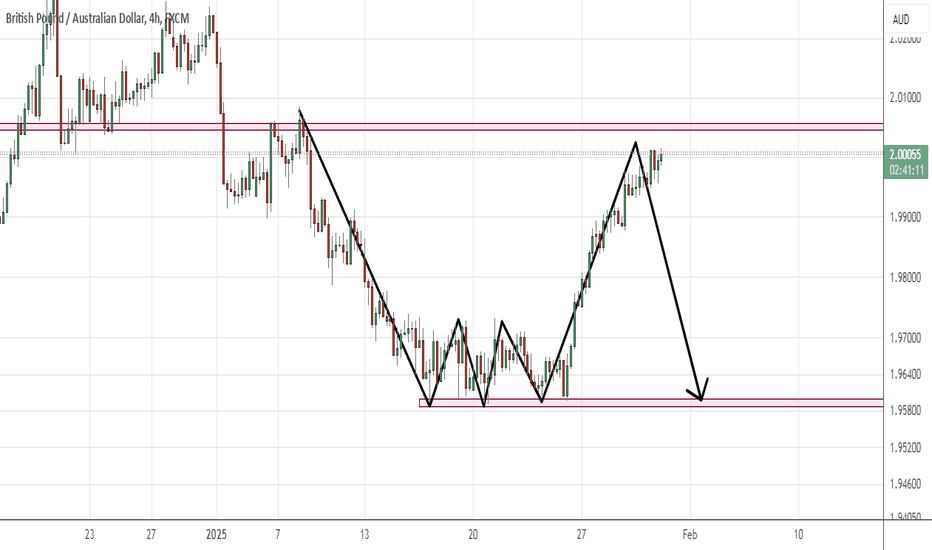

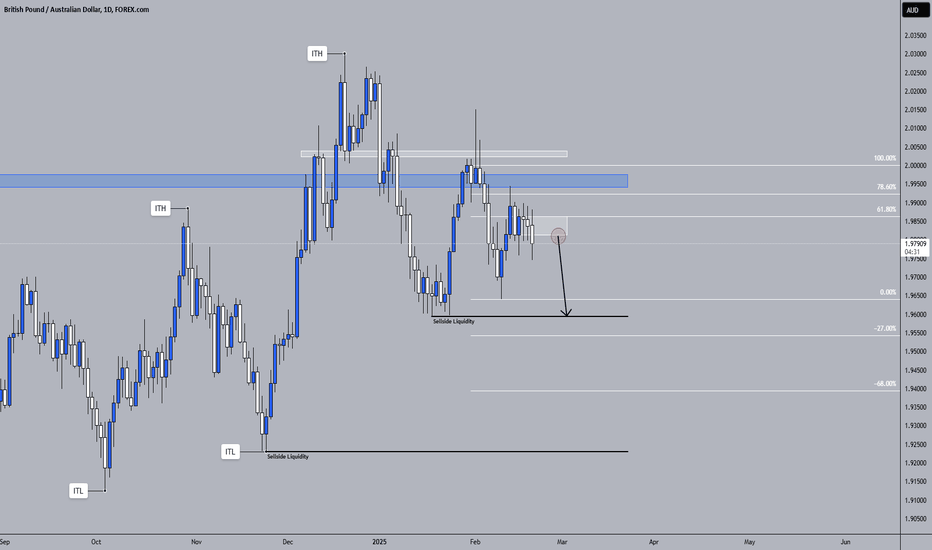

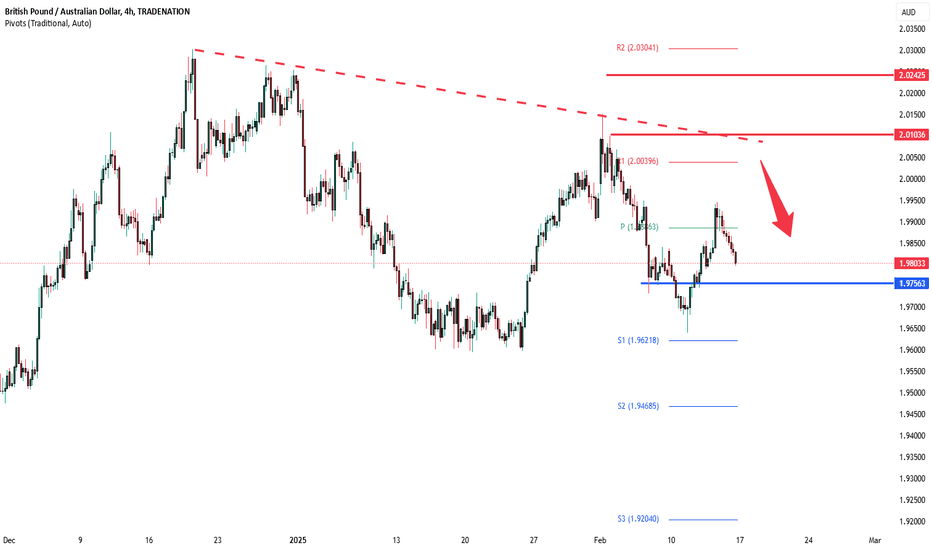

GBPAUD consolidation, The Week Ahead 24 Feb ‘25The GBPAUD currency pair price action sentiment appears bearish, supported by the longer-term prevailing downtrend.

The key trading level is at 2.010, which is the current swing high from Monday 03rd February’25. A bearish rejection from the 2.010 level could target the downside support at 1.975 followed by 1.960 and 1.946 levels over the longer timeframe.

Alternatively, a confirmed breakout above 2.010 resistance and a daily close above that level would negate the bearish outlook opening the way for further rallies higher and a retest of 2.020 resistance followed by 2.030 levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

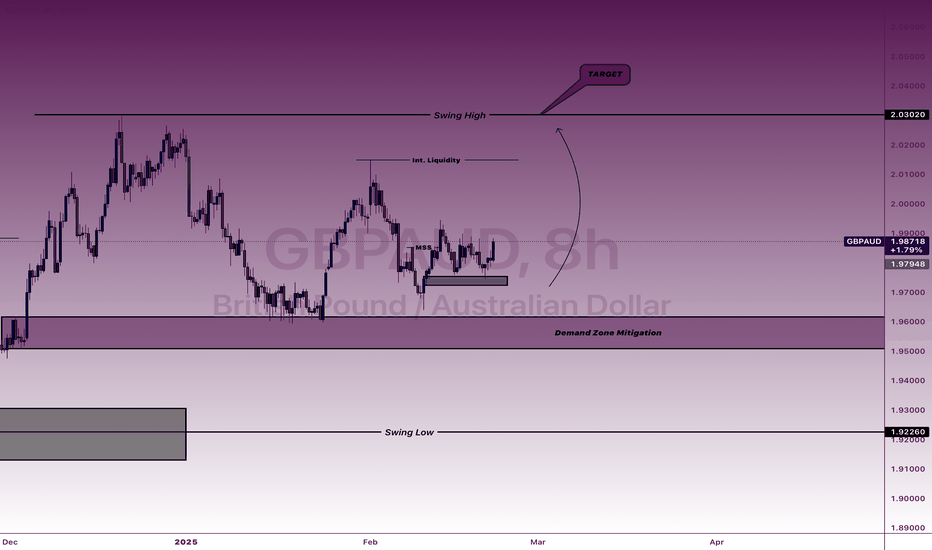

GBPAUD LongGBPAUD has been having a lot of price action in between the HTF Swing High and Swing Low. After HTF (Higher Time Frame) and Internal Demand Zone Mitigation, GBPAUD should be heading towards the next Buyside Internal Liquidity and the Swing High. This is just an analysis and forecast. Trade it at your own risk.

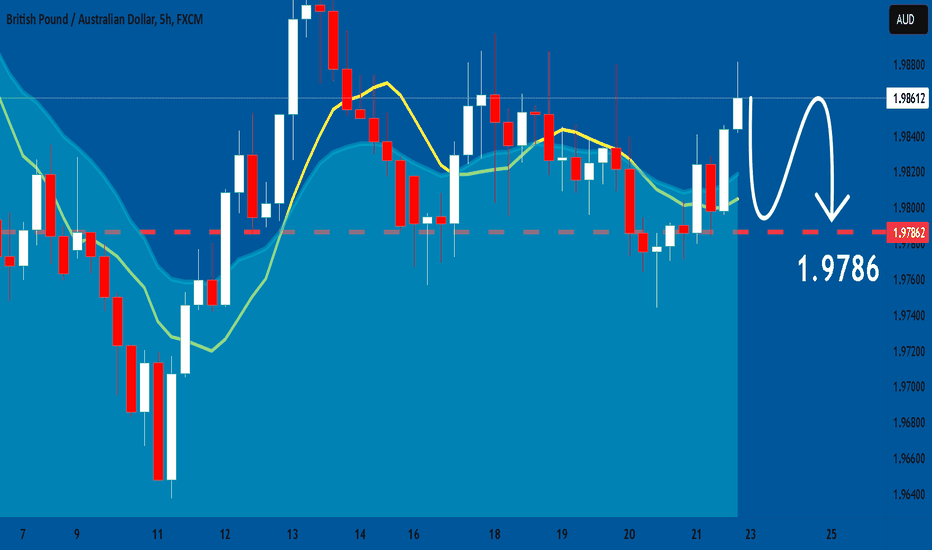

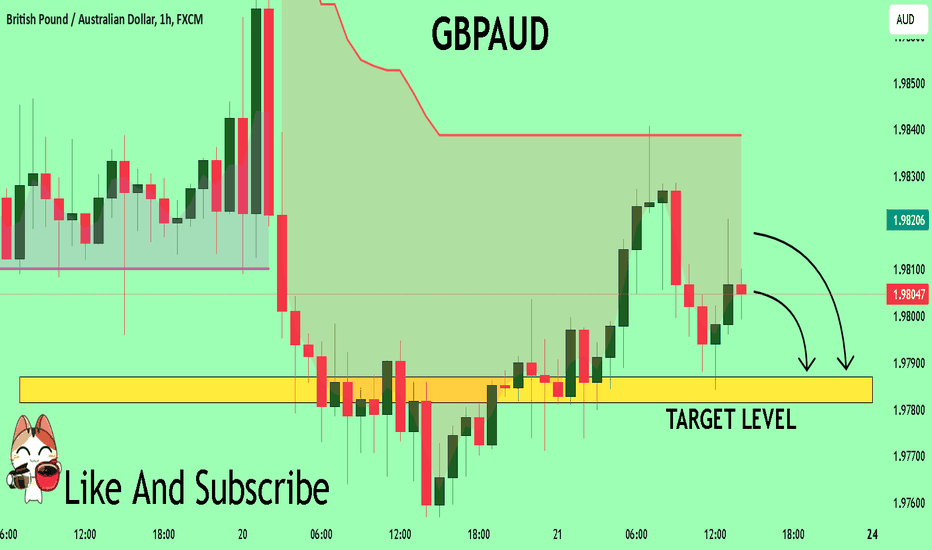

GBPAUD Technical Analysis! SELL!

My dear friends,

Please, find my technical outlook for GBPAUD below:

The instrument tests an important psychological level 1.9805

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.9787

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

———————————

WISH YOU ALL LUCK

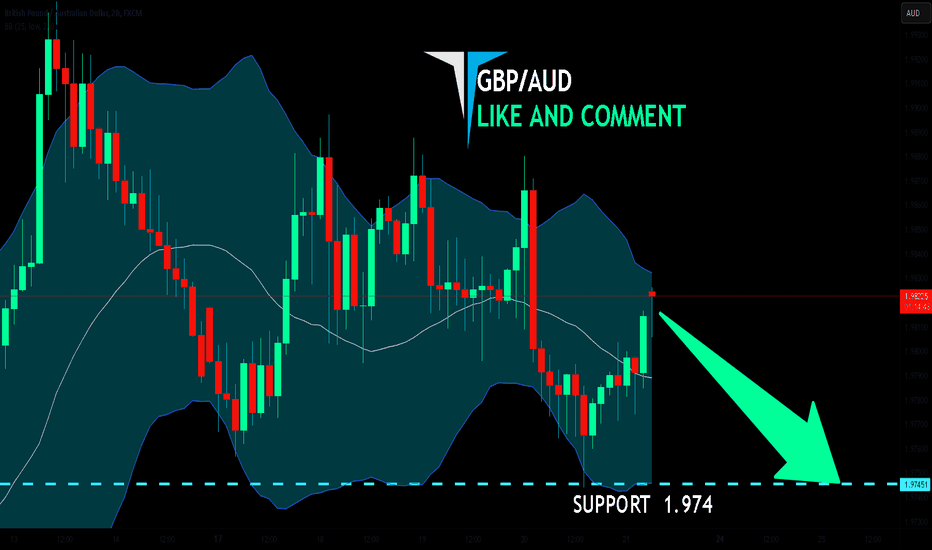

GBP/AUD SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are targeting the 1.974 level area with our short trade on GBP/AUD which is based on the fact that the pair is overbought on the BB band scale and is also approaching a resistance line above thus going us a good entry option.

✅LIKE AND COMMENT MY IDEAS✅

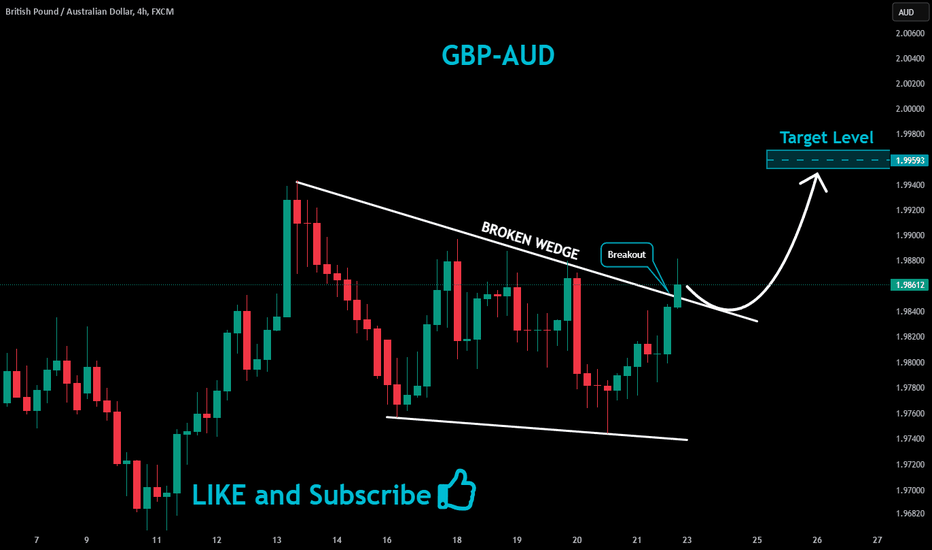

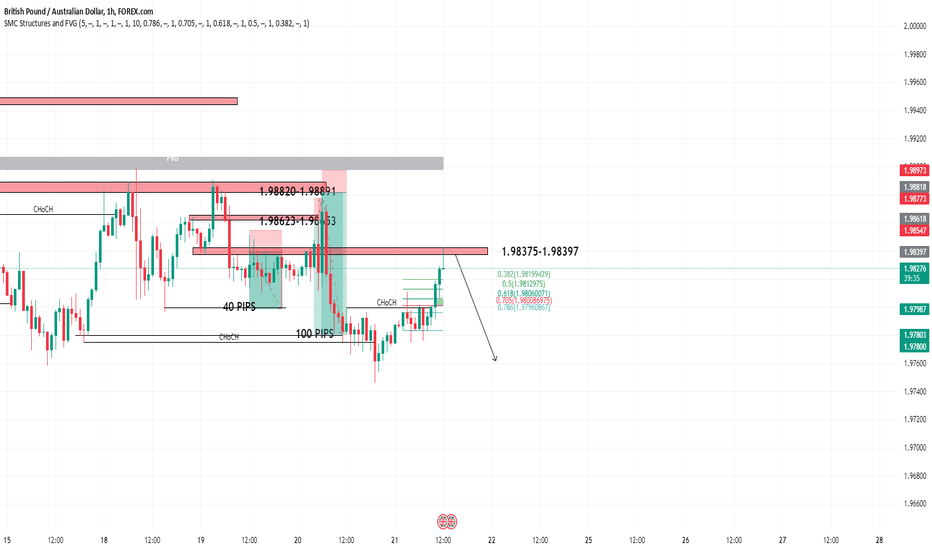

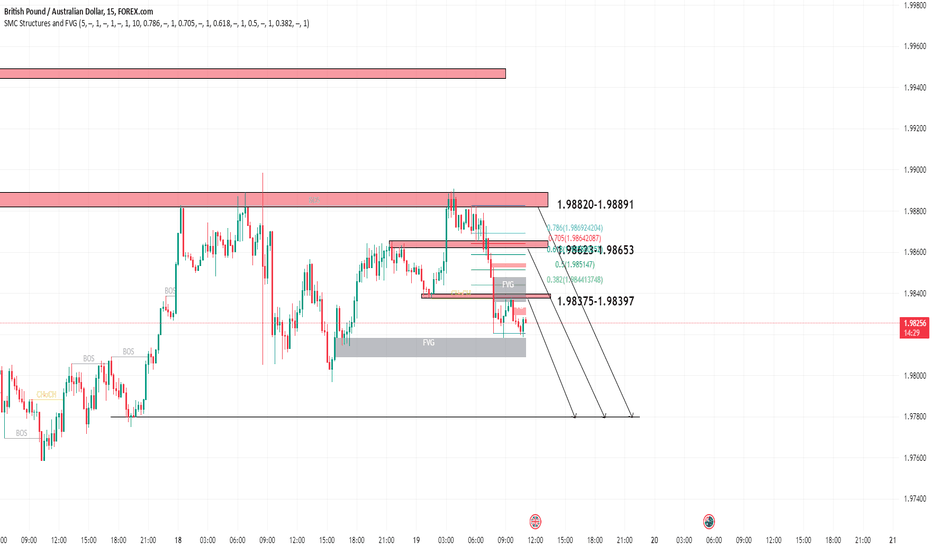

GBP/AUD - 1H Analysis & Trade Plan📊 GBP/AUD - 1H Analysis & Trade Plan

🔹 Market Structure:

✅ Break of Structure (BOS) confirms trend continuation.

✅ Change of Character (ChoCH) signals potential reversals.

✅ Fair Value Gaps (FVG) highlight imbalance zones.

🔹 Key Levels:

✅ Resistance Zones:

• 1.98820 - 1.98891 (Major resistance)

• 1.98623 - 1.98553 (Lower resistance zone)

• 1.98375 - 1.98397 (Current reaction zone)

✅ Fibonacci Retracement Levels:

• 0.382 (1.9819), 0.5 (1.9812), 0.618 (1.9806), 0.705 (1.9800), 0.786 (1.9796)

📌 Trade Idea:

🔹 Bearish bias remains valid if price rejects from 1.98375 - 1.98397 zone.

🔹 A break above 1.98547 may lead to further bullish momentum.

🔹 Potential downside targets: 1.97803 - 1.97700 region.

#FXFOREVER #GBPAUD #ForexAnalysis #SmartMoney #LiquidityHunt #BOS #FVG #PriceAction

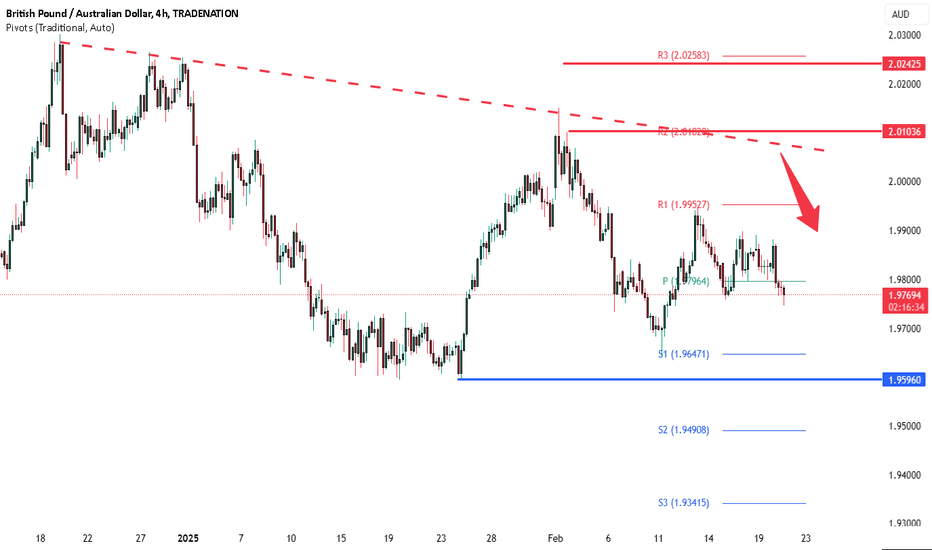

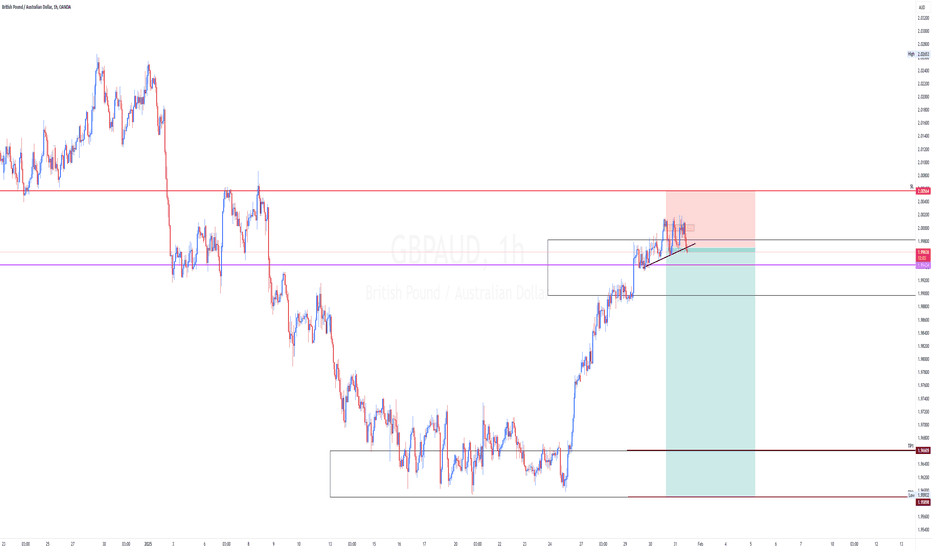

GBPAUD sideways consolidation The GBPAUD currency pair price action sentiment appears bearish, supported by the longer-term prevailing downtrend.

The key trading level is at 2.010, which is the current swing high from Monday 03rd February’25. A bearish rejection from the 2.010 level could target the downside support at 1.975 followed by 1.960 and 1.946 levels over the longer timeframe.

Alternatively, a confirmed breakout above 2.010 resistance and a daily close above that level would negate the bearish outlook opening the way for further rallies higher and a retest of 2.020 resistance followed by 2.030 levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBP/AUD - 15M Analysis & Prediction📉 GBP/AUD - 15M Analysis & Prediction

🔹 Key Levels & Market Structure:

🔴 Supply Zones:

1.98820 - 1.98891 (Major resistance, potential strong rejection)

1.98623 - 1.98653 (Lower supply zone, possible mitigation)

🟢 Demand Zones:

1.98375 - 1.98397 (First support, weak reaction expected)

📊 Possible Scenarios:

1️⃣ Bearish Continuation: If price respects the supply zones and fails to break higher, expect further downside continuation towards liquidity levels below.

2️⃣ Temporary Retracement: A short-term pullback towards the FVG or supply zone before continuing lower.

💡 Trading Plan:

✅ Watch for bearish confirmations at the supply zones for potential short entries.

✅ Look for possible retracement into fair value gap (FVG) before continuing lower.

✅ Break and close below 1.98375 confirms bearish momentum.

#fxforever #GBPAUD #SmartMoney #PriceAction #ForexTrading #LiquidityHunt #OrderBlock

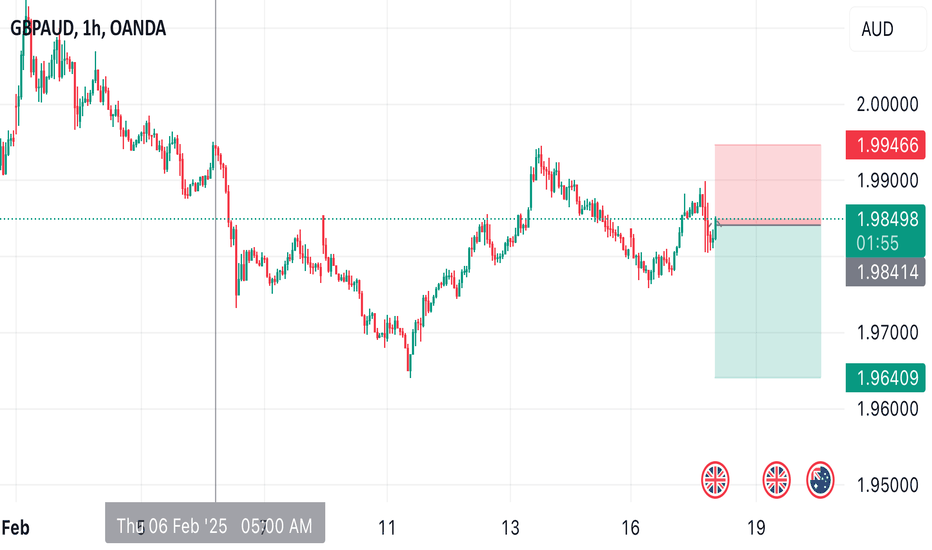

Wed 19th Feb 2025 GBP/AUD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/AUD Buy. Enjoy the day all. Cheers. Jim

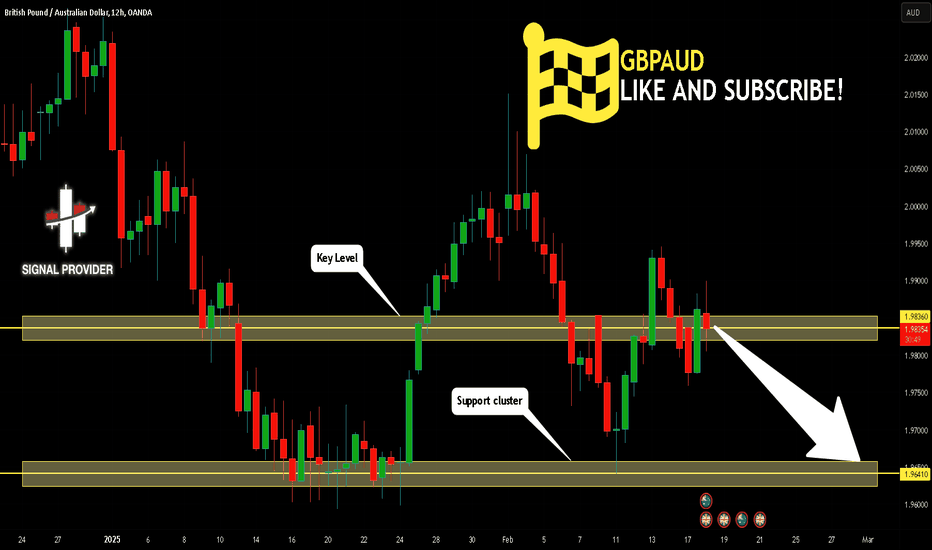

GBPAUD Will Move Lower! Sell!

Take a look at our analysis for GBPAUD.

Time Frame: 12h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 1.983.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 1.964 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

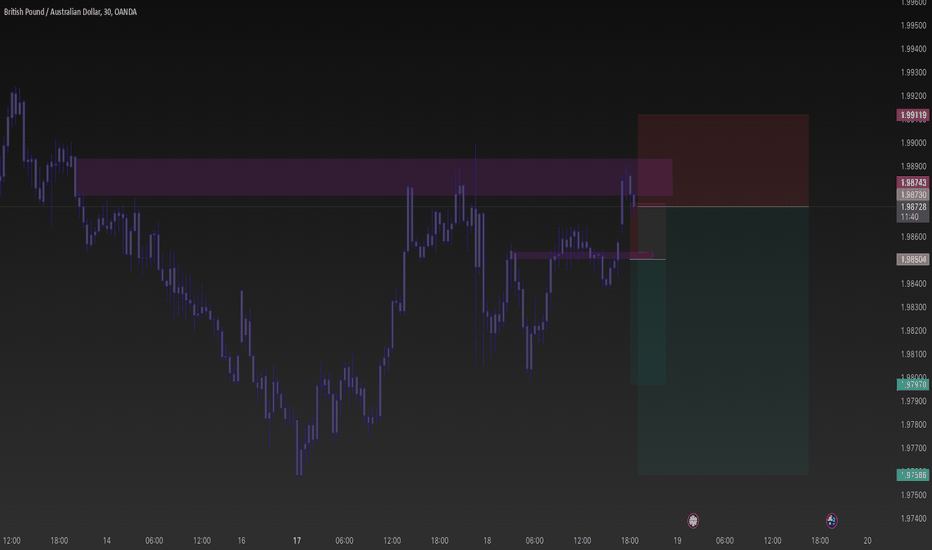

GBPAUD MARKET OUTLOOKPrice maintains a downward flow from the H1 chart. Price recently pulled back to a resistant level of 1.98832. A sell opportunity is envisaged from the current price. Fundamentally, UK unemployment report just came out better than expected but price is yet to reflect it. For the meantime, I’d be selling on short-term.

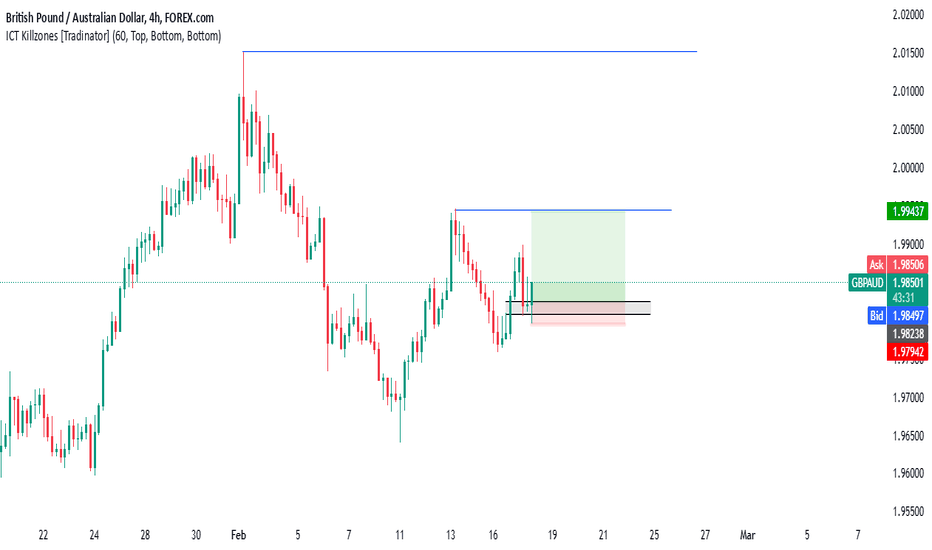

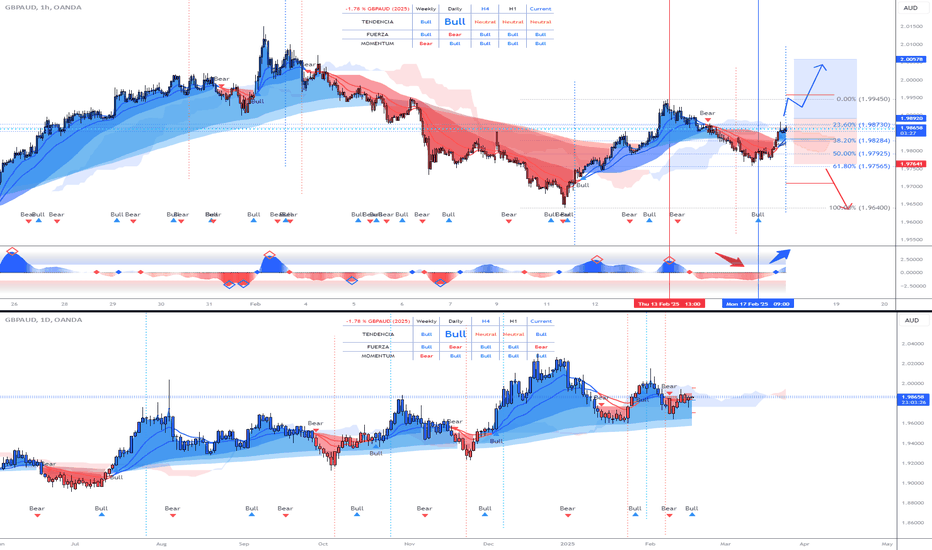

GBPAUD: Going for the highs!! Pay attention this morning!!If we look at the daily chart (chart below), we clearly see that the GBPAUD pair has a stable bullish (Bull) technical aspect, respecting its dynamic supports (blue zones) at all times.

--> To see the technical detail, we will analyze the chart above which is in H1 time frame.

Since February 13, when the overbought appeared in the oscillator and the MOMENTUM turned bearish (Bear), the price did not stop falling reaching the Fibonacci zone of 61.8% (1.97565). Once that key zone was reached, and respected, the price began to gain bullish strength (Bull) until today.

It is currently in a key zone, which if surpassed, will go directly to attack its previous highs in the 1.99450 area

--> What risks do we face?

High-impact news that will affect both the AUD (at 4:30) and the GBP (at 8:00)

Here are the high-impact news that will be released this morning and the time:

04:30 AUD RBA Monetary Policy Statement Report

04:30 AUD RBA Interest Rate Statement Report

04:30 AUD RBA Interest Rate Decision Forecast (4.1%) Previous (4.35%)

05:30 AUD RBA Press Conference Speech

08:00 GBP Change in Employment (Dec.)

08:00 GBP Change in Jobless Claims (Jan.)

08:00 GBP ILO Unemployment Rate (Dec.)

10:30 GBP Speech by BoE Governor Andrew Cuomo Bailey

---------------------------------------------------------

If our investor profile is CONSERVATIVE, we will have to wait until 8:00 for all the news that affect both the AUD and the GBP to be published. But if our profile is AGGRESSIVE, we can use the following strategy:

ENTRY: We will open 2 long positions if the price exceeds 1.98900

POSITION 1 (TP1): We close the first position in the 2.00550 zone (165 pips)

--> Stop Loss at 1.97600 (127 pips).

--> Ratio (1:3)

POSITION 2 (TP2): We open a Trailing Stop type position.

--> Initial dynamic Stop Loss at (-127 pips) (coinciding with the 1.97600 of position 1).

--> We change the dynamic Stop Loss to ( -20 pips ) when the price reaches TP1 ( 2.00550 ).

-------------------------------------------

SET UP EXPLANATIONS

*** How do we know which 2 long positions to open? Let's take an example: If we want to invest 2,000 euros in the stock, what we do is divide that amount by 2, and instead of opening 1 position of 2,000, we will open 2 positions of 1,000 each.

*** What is a Trailing Stop? A Trailing Stop allows a trade to continue gaining value when the market price moves in a favorable direction, but automatically closes the trade if the market price suddenly moves in an unfavorable direction by a certain distance. That certain distance is the dynamic Stop Loss.

-->Example: IF the dynamic Stop Loss is at -1%, it means that if the price drops by -1%, the position will be closed. If the price rises, the Stop Loss also rises to maintain that -1% on increases, therefore, the risk is increasingly lower until the position becomes profitable. In this way, very solid and stable price trends can be taken advantage of, maximizing profits.

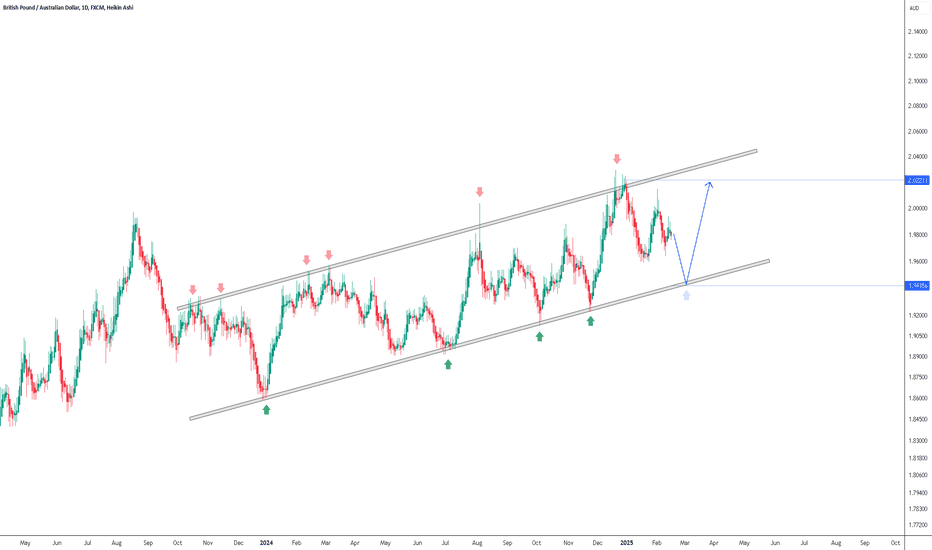

GBP/AUD: Potential Rebound from Support ChannelIn this analysis, the GBP/AUD pair is trading within an ascending channel that has been confirmed by multiple bounces off both resistance and support levels. The price is currently undergoing a downward correction after previously reaching the resistance area around 2.02. Based on the historical pattern within this channel, there is a possibility that the price will decline further toward the support area around 1.94 before rebounding back upward.

The price structure shows strong reactions each time the price touches the support channel (marked by green arrows) and the resistance channel (marked by red arrows). This indicates that the market still respects this uptrend structure. Therefore, the most probable scenario is to wait for the price to approach the support area before considering a buy position. The potential target for the next upward move is a return to the resistance channel around 2.02. However, if the price successfully breaks below the 1.94 support level with high volume, this bullish scenario may become invalid.

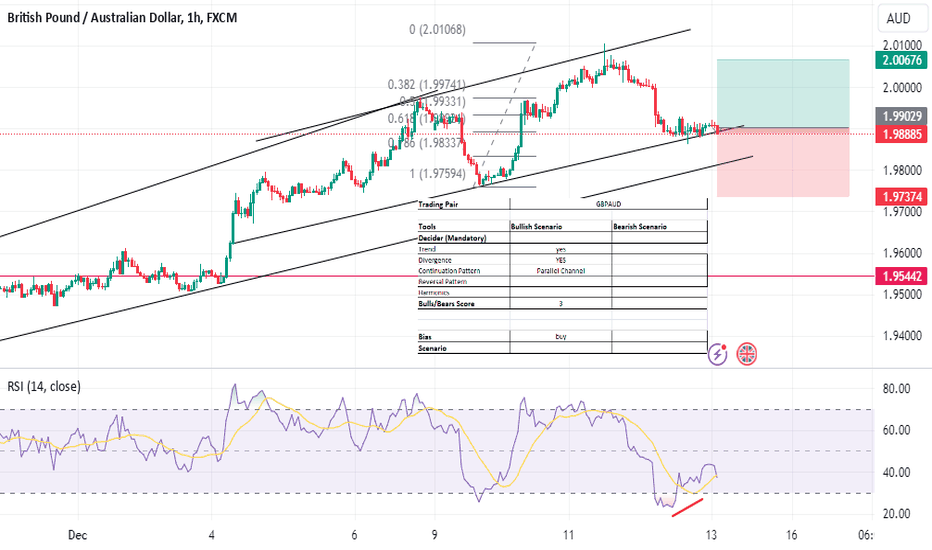

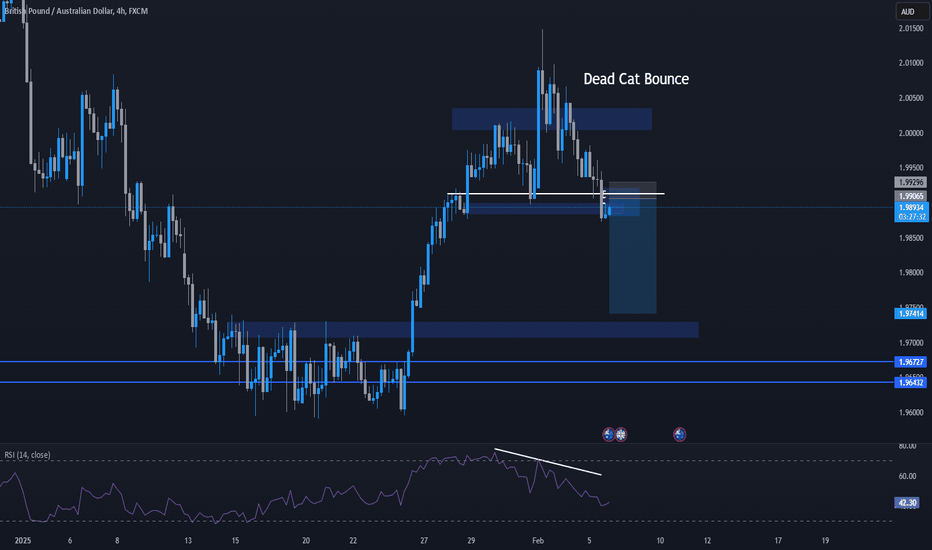

GBPAUD - Bearish Reversal Pattern + SetupHello traders,

GBPAUD has been in an uptrend since last week. But now it is showing bearishness with the break of the demand zone.

Add to this the RSI divergence which makes this trade a higher probability setup.

My entry, sl and tp are as marked on the chart.

GBPAUD - Look for Reversal Short (SWING) 1:4!After a strong bullish move, which can be seen as a correction before continuing the HTF downtrend, we've observed a clear confirmation of a triple top on the LTF. This suggests a potential opportunity to ride the trend south.

Additionally, the price has been in accumulation for a few days, likely collecting orders within the marked supply zone.

Let’s see how the market plays out — hopefully, it triggers our targeted TP1 and TP2.

Disclaimer:

This is simply my personal technical analysis, and you're free to consider it as a reference or disregard it. No obligation! Emphasizing the importance of proper risk management—it can make a significant difference. Wishing you a successful and happy trading experience!

GBPAUD The Week AheadThe GBPAUD currency pair price action sentiment appears bearish, supported by the longer-term prevailing downtrend.

The key trading level is at 2.010, which is the current swing high from Monday 03rd February’25. A bearish rejection from the 2.010 level could target the downside support at 1.975 followed by 1.960 and 1.946 levels over the longer timeframe.

Alternatively, a confirmed breakout above 2.010 resistance and a daily close above that level would negate the bearish outlook opening the way for further rallies higher and a retest of 2.020 resistance followed by 2.030 levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.