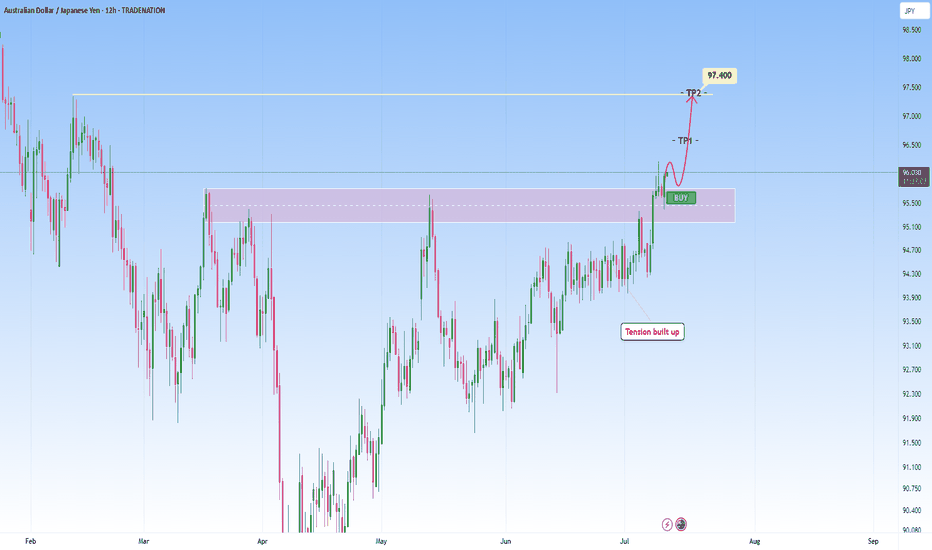

AUDJPY Technical Breakout - Targeting 97.400 Next?TRADENATION:AUDJPY has recently broken decisively above a key resistance zone that had previously capped price for several months. This breakout was preceded by a period of compression and range-bound price action, where bullish momentum steadily built up, indicated by higher lows pressing against the resistance level. This type of structure typically leads to an explosive breakout, which we are now seeing unfold.

After the breakout, price came back for a clean retest of the broken resistance zone, which has now flipped into support. The retest held firmly, suggesting strong buyer interest at this level and confirming the validity of the breakout.

With this structure in place, the bullish momentum is likely to extend further toward the next target zone around 97.400, provided price remains above the current support.

As long as the price holds above the retested zone, the bullish outlook remains intact. A breakdown back below this area, however, would be a warning sign and could open the door to a deeper pullback.

Remember, always wait for confirmation before entering trades, and maintain disciplined risk management.

AUDJPY trade ideas

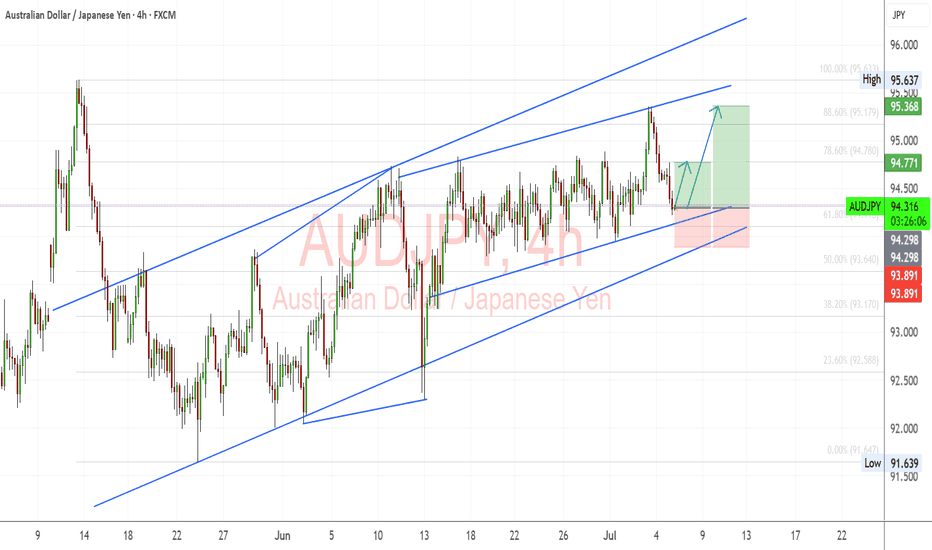

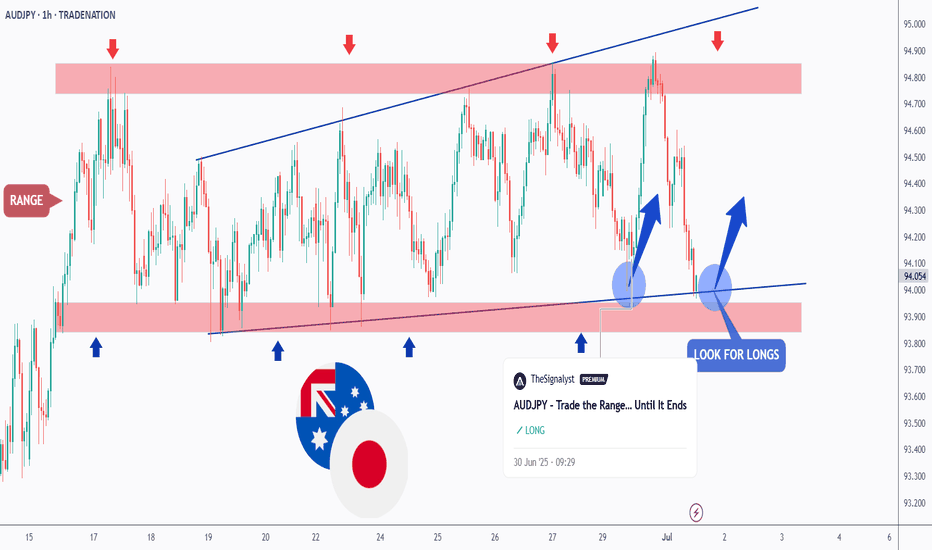

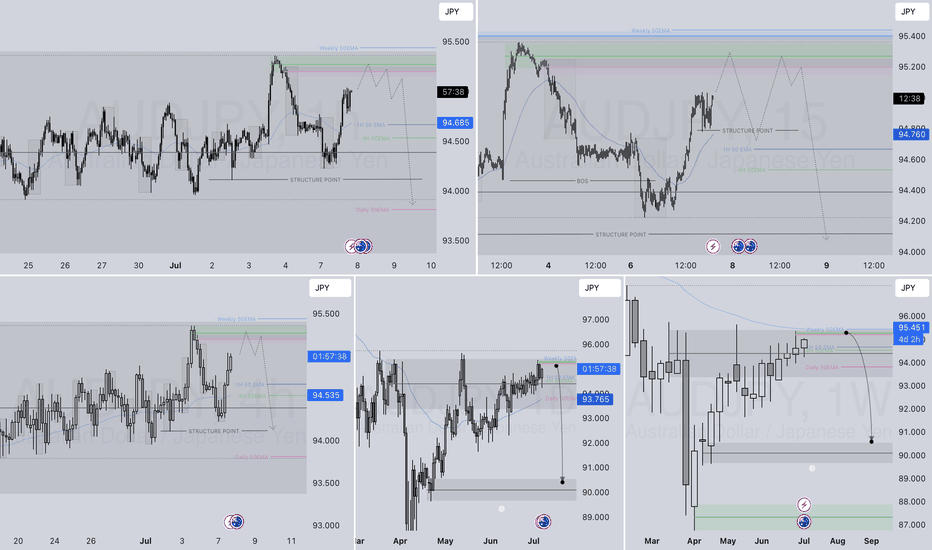

AUDJPY Bullish Channel Still Intact, Eyeing Breakout Above 95.00AUDJPY continues to respect its ascending channel, with the current bounce occurring right at the 61.8% Fibonacci retracement and lower trendline support. The structure supports further upside as long as price holds above the 94.00–93.80 zone, with targets set toward 94.77 and 95.36, potentially extending to 95.63 highs.

🧠 Fundamentals:

AUD Strength Drivers:

RBA remains relatively hawkish vs other G10 banks.

Australia's data this week (retail sales, NAB confidence) were mixed, but no rate cut pricing in the near term supports AUD.

Iron ore demand showing resilience despite Chinese slowdown concerns.

JPY Weakness Drivers:

BoJ remains ultra-dovish. No action expected in July.

Japan’s inflation remains tame; the yield gap with other majors keeps widening.

Risk-on sentiment reduces demand for safe-havens like JPY.

🔍 Technical Structure:

Strong upward channel since early June remains valid.

Current pullback held the 61.8% Fib retracement of the June-July leg.

Bullish engulfing near support confirms entry.

Immediate resistance at 94.77 → 95.36 → potential breakout to 95.63.

Invalid if price closes below 93.80 (channel break).

⚠️ Risk Factors:

Risk-off shift (e.g., geopolitical escalation or U.S. CPI surprise) may boost JPY.

China growth fears can weigh on AUD.

A sudden dovish shift from the RBA would invalidate bullish fundamentals.

🔁 Leader/Lagger Dynamics:

AUDJPY typically leads other yen crosses (e.g., NZDJPY, CADJPY) during risk-on moves. It’s also a barometer for broader risk sentiment, often following moves in equity indices like US500 or commodity-linked assets.

✅ Trade Bias: Bullish

TP1: 94.77

TP2: 95.36

TP3 (aggressive): 95.63

SL: Below 93.80

Event to Watch: China data this week + U.S. CPI (Jul 11)

📌 Watch for a strong bullish daily candle above 94.77 for continuation confirmation. Stay nimble around key global risk events.

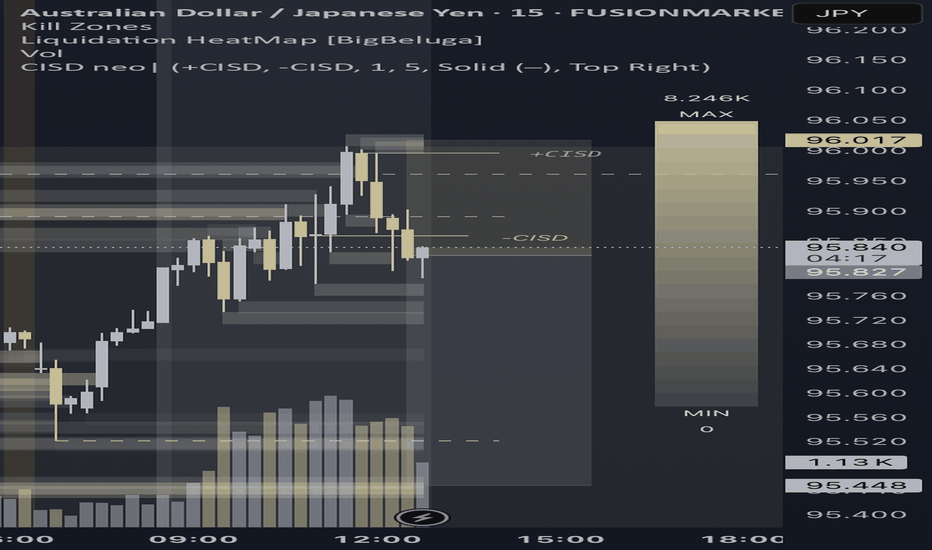

AUDJPY – Liquidity Trap Short Setup

Box framed between 95.961–94.719, with layered buyside liquidity swept at 95.859 and 95.961. Price printed a bearish body below structural shift (-CISD), confirming trap activation.

Entry executed post-shift → targeting sellside liquidity at 95.521, with extended draw potential toward 94.719.

Liquidation heatmap shows dim clusters above, bright gold clusters below = strong directional bias.

Narrative: smart money sweep complete → trap symmetry locked → discount magnet engaged. 📉🎯

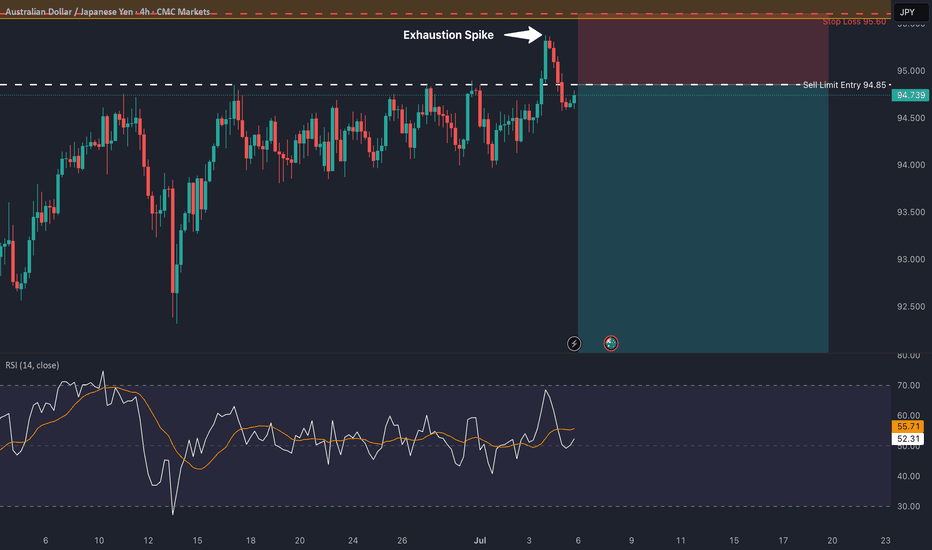

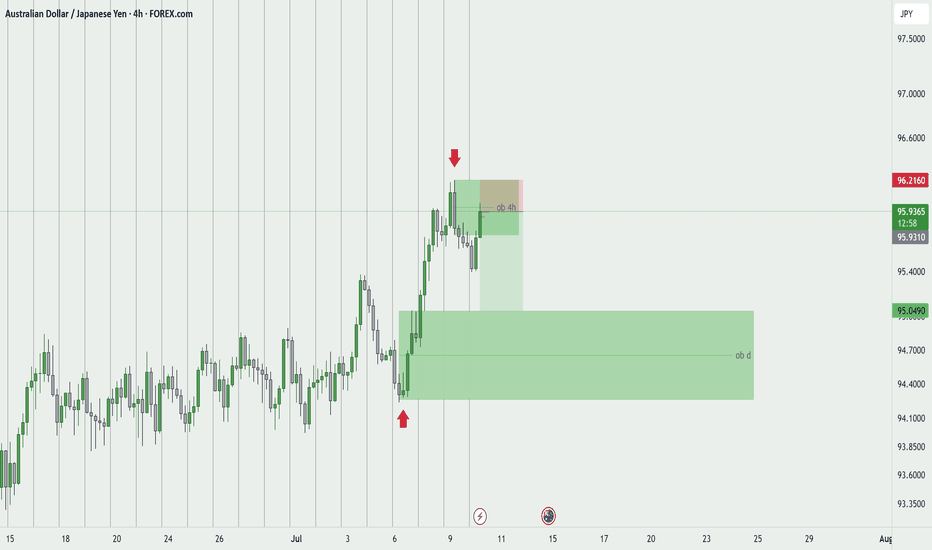

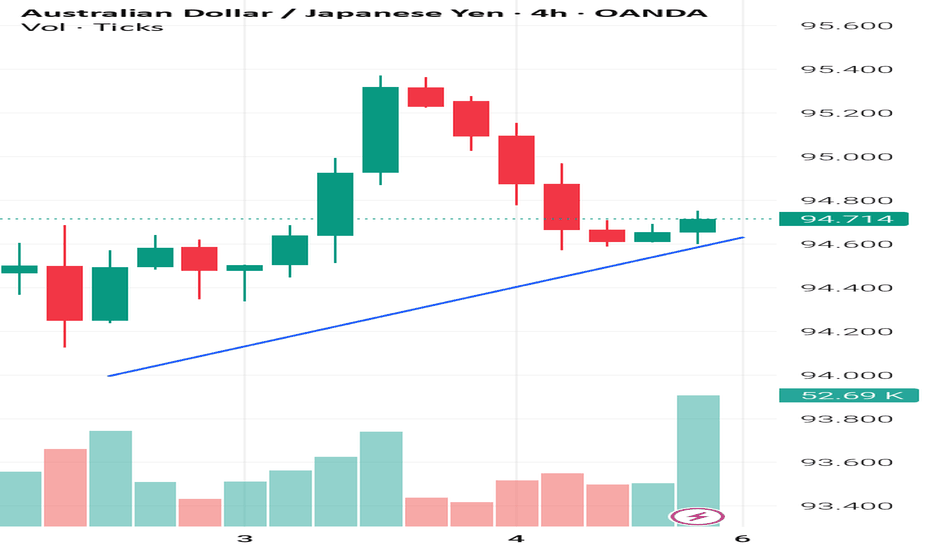

AUD/JPY: Rejection at Key ResistanceThis is a high-conviction short setup on AUD/JPY based on a powerful rejection pattern that has formed on the 4-hour chart. As you can see, the price spiked into the critical resistance zone between 95.00 and 95.55 but was immediately and forcefully rejected, leaving behind a long "Exhaustion Spike."

This is a classic sign of buyer exhaustion and seller dominance. It tells us that despite the recent rally, there is significant supply waiting at these higher levels. This price action provides a clear opportunity to short the pair in anticipation of a significant move down.

🏦 Fundamental Analysis

The fundamental backdrop provides a strong tailwind for this trade, with two key drivers:

1️⃣ Central Bank Divergence: The Reserve Bank of Australia (RBA) is in an easing cycle, having recently cut rates to 3.85% with more cuts expected. In stark contrast, the Bank of Japan (BoJ) is on a path of normalization, having already raised its rate to 0.50%. This divergence in monetary policy is structurally bearish for AUD/JPY.

2️⃣ Imminent Catalysts: This week is packed with event risk that is skewed to the downside for this pair. We have the RBA interest rate decision on Tuesday, July 8th , and the U.S. tariff deadline on Wednesday, July 9th . A dovish RBA or a "risk-off" move from the tariff news would likely accelerate the decline in AUD (a risk currency) and strengthen the JPY (a safe-haven currency).

📊 Technical Analysis

The price action on the chart confirms the bearish bias:

1️⃣ 4-Hour Rejection: The "Exhaustion Spike" at the 95.00 - 95.55 supply zone is the primary signal. It shows a clear failure by buyers and a strong takeover by sellers at a key level.

2️⃣ Long-Term Trend: On the daily chart, the price is trading below the critical 200-day moving average , confirming the long-term trend remains bearish.

3️⃣ Waning Momentum: There is a clear bearish divergence on the daily RSI. The price made a higher high, but the momentum indicator made a lower high, signaling that the rally is internally weak and losing steam.

📋 Trading Setup

This is a swing trade designed to capture a significant correction with a simple "set and forget" plan.

📉 Direction: SHORT / SELL

👉 Entry: Sell Limit @ 94.85

⛔️ Stop Loss: 95.60

🎯 Take Profit: 91.10

💡 Rationale: The entry is placed strategically to capitalize on a potential retest of the rejection area. The stop loss is placed safely above the rejection wick and the major resistance zone. The take profit targets the major structural support from the May 2025 lows, offering an excellent risk-to-reward ratio.

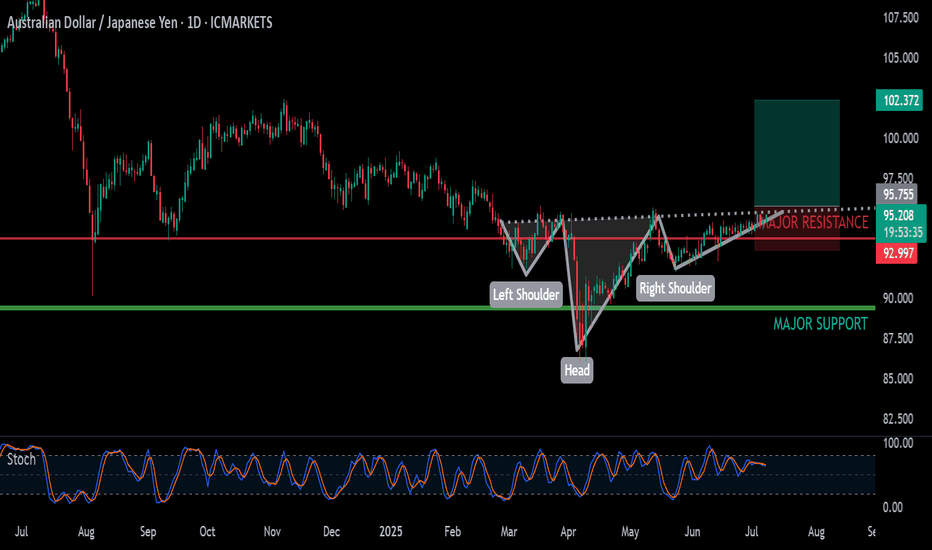

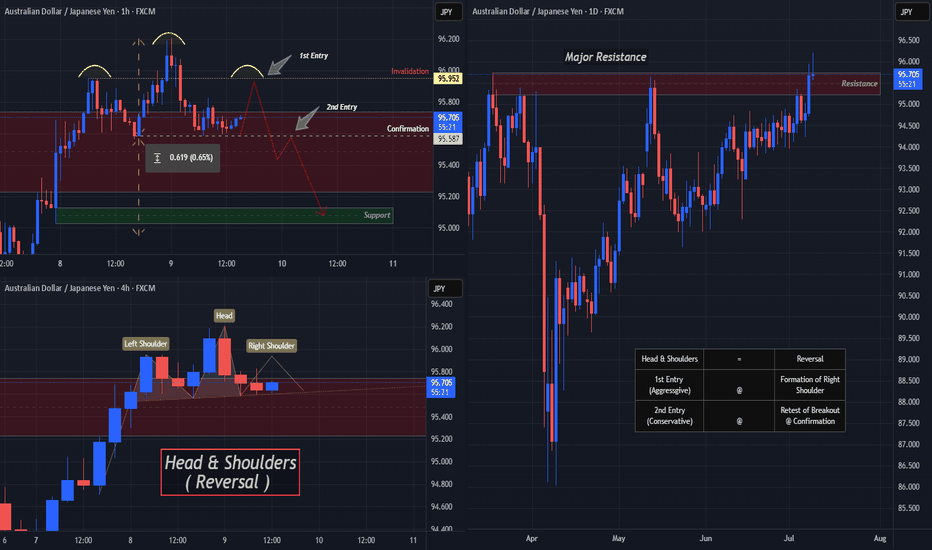

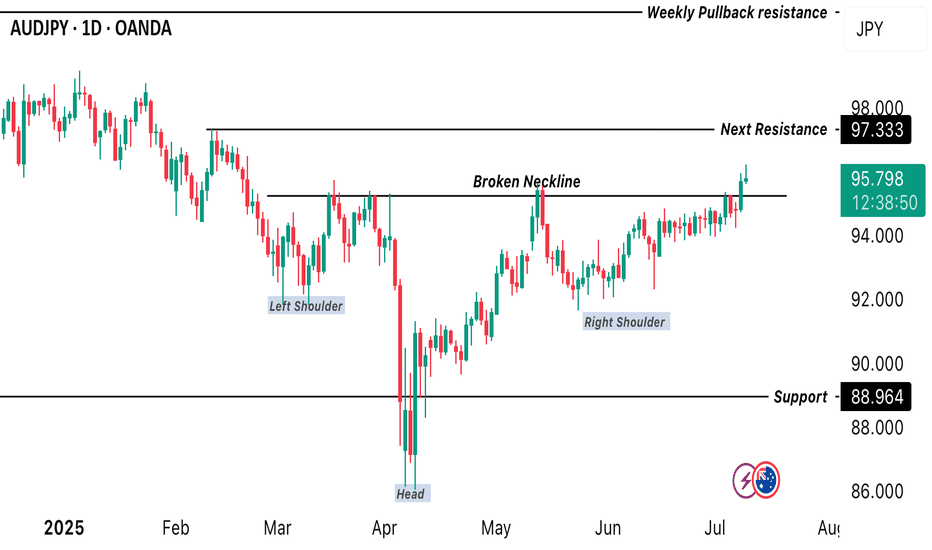

AUDJPY Ready To "Drop A Shoulder"? Multi-Timeframe May Help!OANDA:AUDJPY is beginning to form a very convincingly strong Reversal Pattern, the Head & Shoulders!

Starting with the Daily Chart we can see that Price is Forming a Doji Candle just after trying to Breakout of a Major Resistance Zone created from the Highs of March 18th and if Price is unable to close above this level, this strengthens the Bearish and Reversal Bias.

Now the 4 Hr Chart shows both the "First Shoulder" or Previous Higher High that was surpassed by the "Head" which is the New Higher High, has formed quite quickly with a slightly Ascending "Neckline" or Support Line where Bulls were able to make their Last Stand.

With a Reversal Pattern, you want to see a Change in Trend, in this case, would be a Lower High then that of the Higher High or "Head" @ 96.204.

*If Bulls are able to Push Price above the "Left Shoulder" or Previous Higher High @ 95.952, this will Invalidate the Head & Shoulders Set-up!

**If Bulls are unable to Break Above 95.952 and Price is pushed back down to the Confirmation or "Neckline" for a 3rd time, this Confirms the Head & Shoulders Set-up!!

Based on the Distance between the Head and Neckline, we can project a potential drop down to the next Support Level as a Price Target @ 95.00 once:

1) Pattern is Confirmed

2) Breakout is Validated

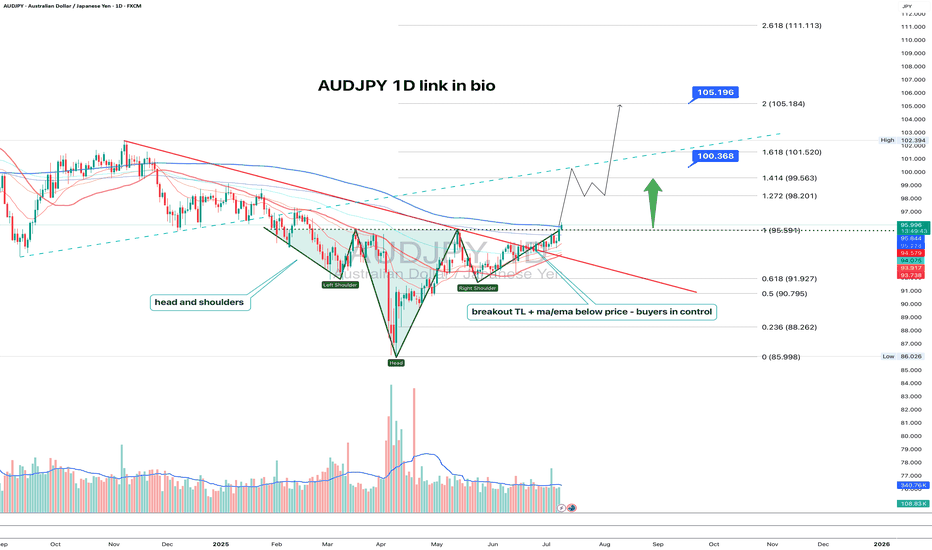

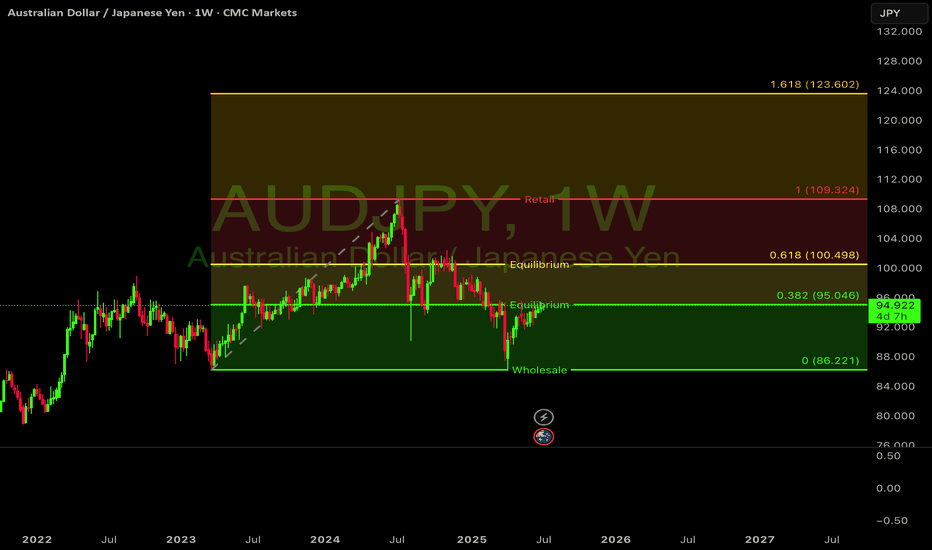

AUDJPY 1D: breakout toward 100–105AUDJPY has confirmed an inverse head and shoulders breakout on the daily chart, with a strong move above the neckline. All key moving averages, including MA50 and MA200, remain below the current price — confirming bullish momentum. Volume increased on the breakout, and price has held above the 95.6 neckline zone. As long as that level holds, the setup remains valid. Targets are set at 100.36 (1.618 Fibo) and 105.19 (2.0 Fibo).

RBA in focus: AUD JPY to continue up? It's a week bereft of major US data. In the main it'll be up to the 'risk environment' to determine proceedings (which currently means tariff headlines).

But we do have the RBA and RBNZ rate decisions to potentially create opportunities.

First up, during Tuesday's Asian session is the RBA, a central bank with a preference for high interest rates (hawkish).

*Reminder: (risk environment aside) high interest rates 'generally' equals strong currency.

Analyst concencious is for a 0.25bp cut.

I can envision two scenarios:

A rate cut with 'hawkish narrative' (non or limited cuts on the horizon).

No rate cut (hold), with data dependent forward guidance.

Both scenarios 'should' be AUD positive. Possibly creating another AUD JPY long trade.

Of course, especially after Friday's NFP, we know that anything can happen and the RBA could deliver a 'dovish cut'. But considering inflation is still relatively high in Australia, I would be surprised with that outcome.

And, of course, a lot depends on the overall 'risk environment'. We could very well have 200% tariffs across the board in 12 hours time. And I would only long the AUD in a 'positive risk environment'.

*Side note: With the S&P 'near all time highs', it's only natural that it could pull back a little. So, I'm more focused on the actual narrative at the moment rather than correlations.

**Second side note: I'm slowly starting to revisit the ' buy / sell stop anticipation trade'. And arguably, an 'AUD long' pre-rate decision is viable. (Whereby you place an 'AUD long' stop order pre event, if it's a dovish outcome the order doesn't trigger). It's not something I endorse in a 'live account' but it's a strategy worth considering. Particularly as I suspect 'red flag' US releases could become important moving forward.

Ultimately, no matter the type of trade you take, it's very important to remember that 50% will hit profit and 50% will stop out. That's why we use a higher risk/ reward per trade.

AUDJPY SHORT FORECAST Q3 D10 W28 Y25AUDJPY SHORT FORECAST Q3 D10 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

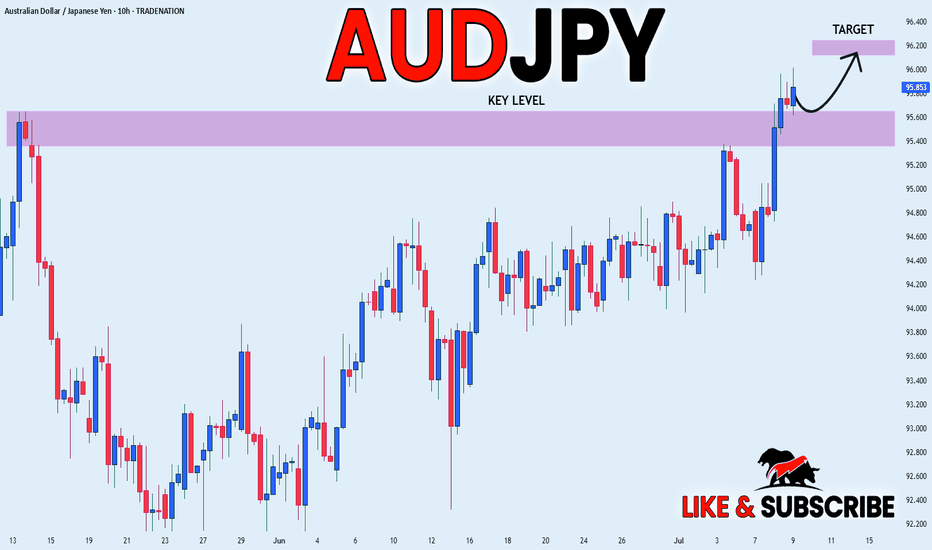

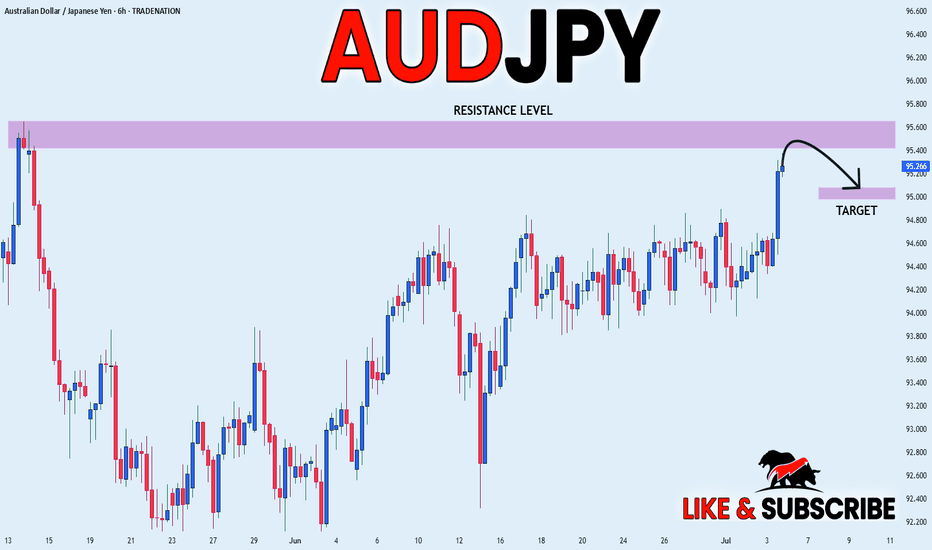

AUD_JPY WILL KEEP GROWING|LONG|

✅AUD_JPY is going up

Now and the pair made a bullish

Breakout of the key horizontal

Level of 95.600 and the breakout

Is confirmed so we are bullish

Biased and further growth

Is to be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

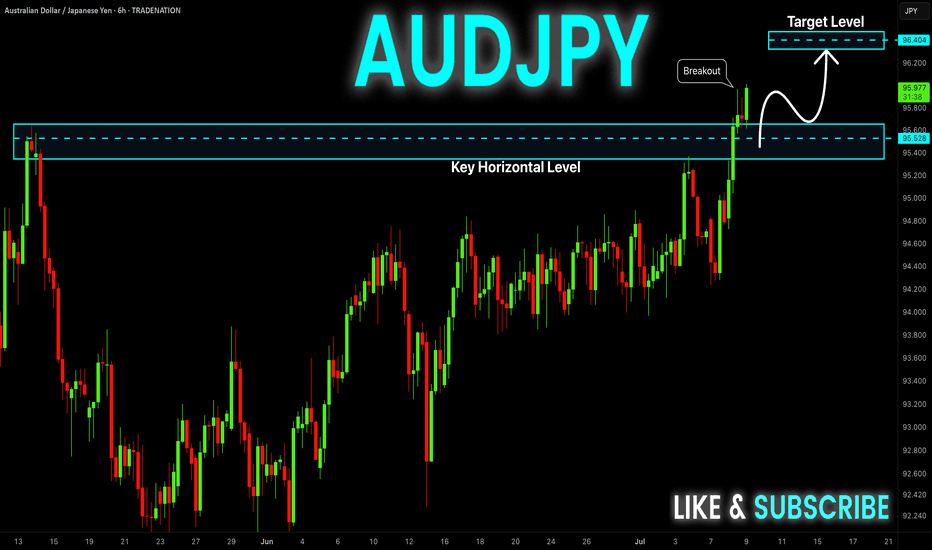

AUD-JPY Bullish Breakout! Buy!

Hello,Traders!

AUD-JPY is trading in a

Strong uptrend and the pair

Made a bullish breakout of

The key horizontal level

Of 95.650 which is now a

Support and the breakout

Is confirmed so we are bullish

Biased and we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

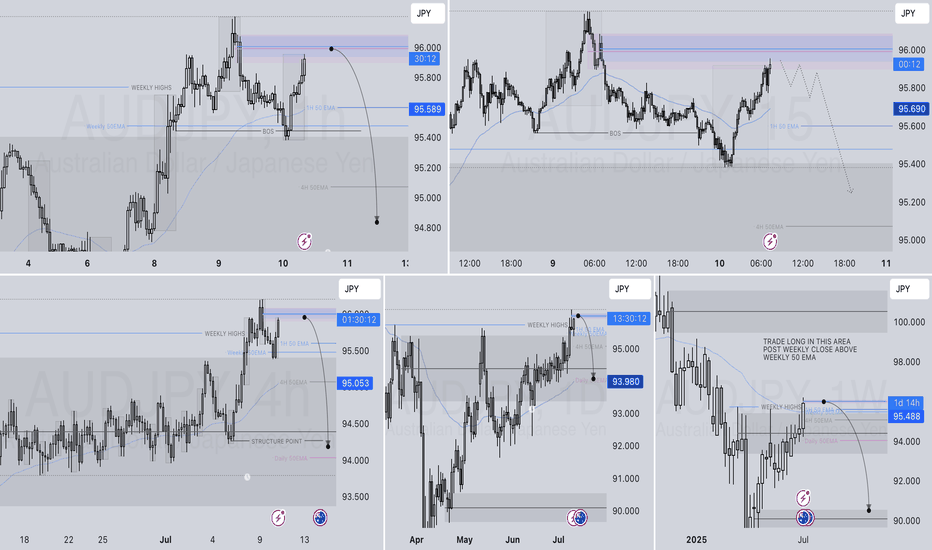

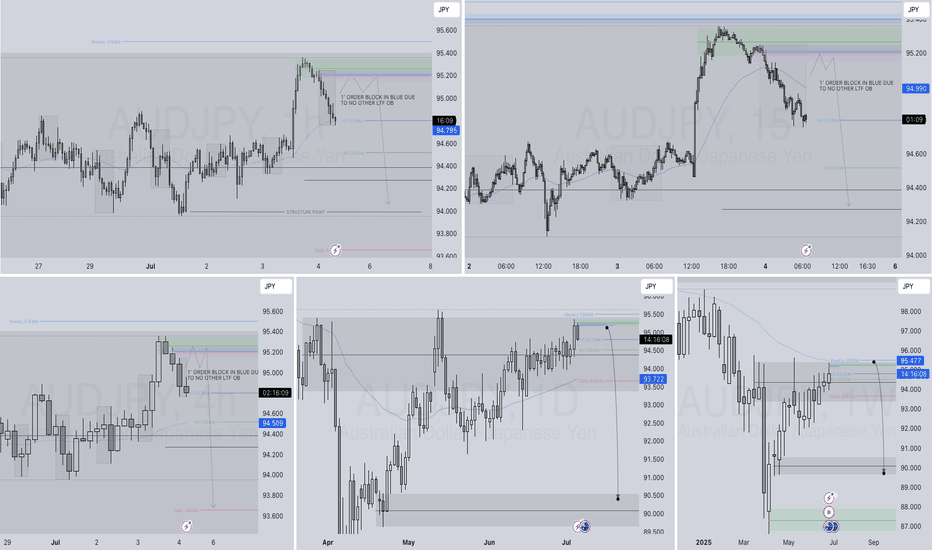

AUDJPY SHORT FORECAST Q3 D8 W28 Y25AUDJPY SHORT FORECAST Q3 D8 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

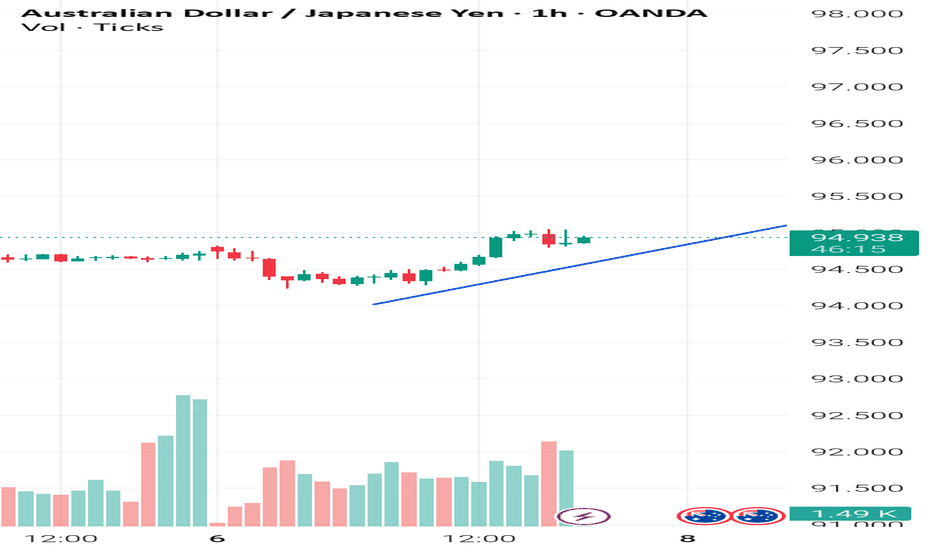

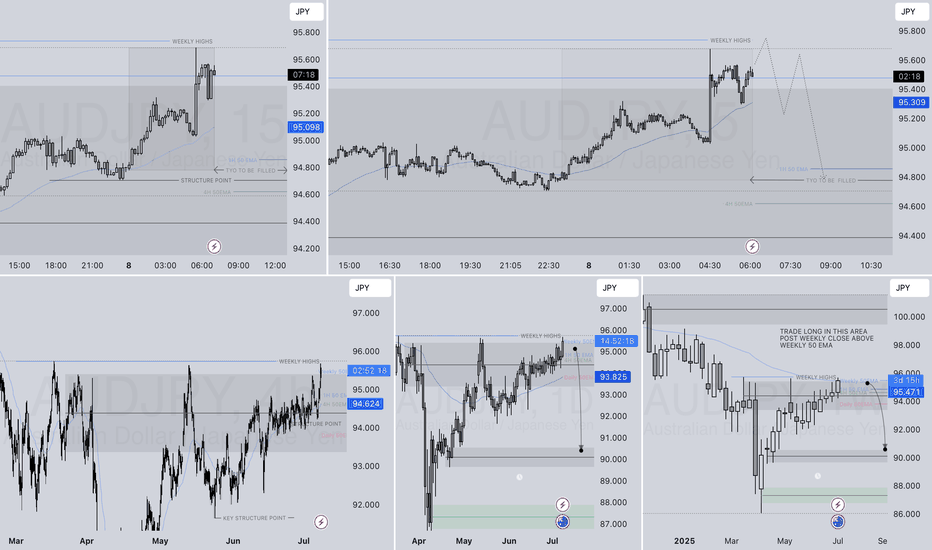

AUDJPY - let's do it again!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

As per our last AUDJPY analysis (attached on the chart), it rejected the first blue circle zone and surged in a parabolic manner.

📈AUDJPY is currently retesting the intersection of the blue trendline and red support.

📚 As per my trading style:

As #AUDJPY is around the latest blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_JPY RISKY SHORT|

✅AUD_JPY is set to retest a

Strong resistance level above at 95.600

After trading in a local uptrend for some time

Which makes a bearish pullback a likely scenario

With the target being a local support below at 95.081

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

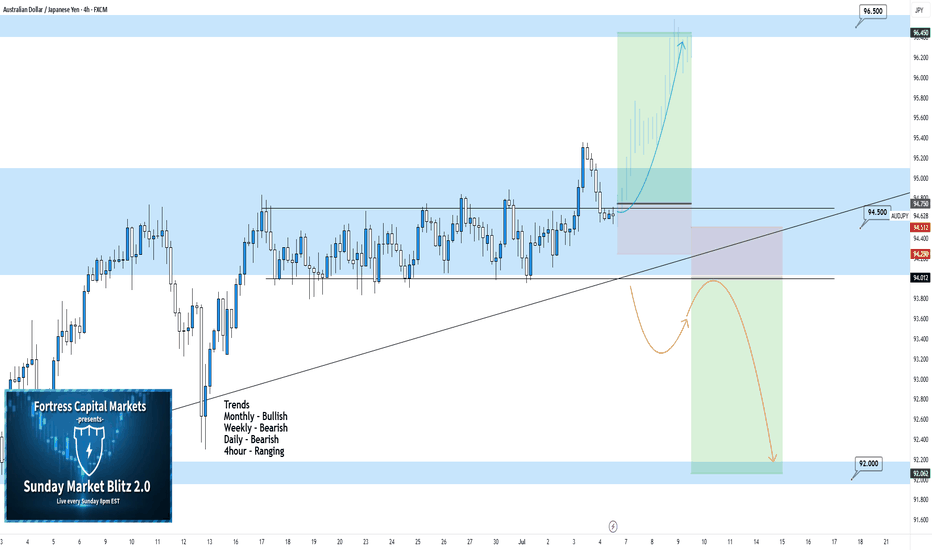

AUDJPY 4Hour TF - July 6th, 2025AUDJPY 7/6/2025

AUDJPY 4hour Neutral Idea

Monthly - Bullish

Weekly - Bearish

Dailly - Bearish

4hour - Ranging

We’re getting some mixed signals here on AJ so i’ll keep this as a neutral idea as we need more info from price action. Most of the major trends seem bearish but the 4hour trend seems to have some bullish pressure. Let’s see how this could play out this week:

Bullish Breakout - We already saw a pretty significant bullish attempt to break out of this range around 94.500. If we can spot some bullish conviction, now that we're retesting what seems to be a broken range, then we can confirm a bullish 4hour trend and prepare for potential long scenarios. I’ll be looking higher toward key resistance around 96.500 if this happens.

Bearish Breakout - For us to consider comfortable bearish scenarios, we would need to see price action fall back through our 94.500 zone and form a lower high. If we see structure formed below 94.500 we can begin targeting lower for potential short positions. Look toward key support levels as targets.

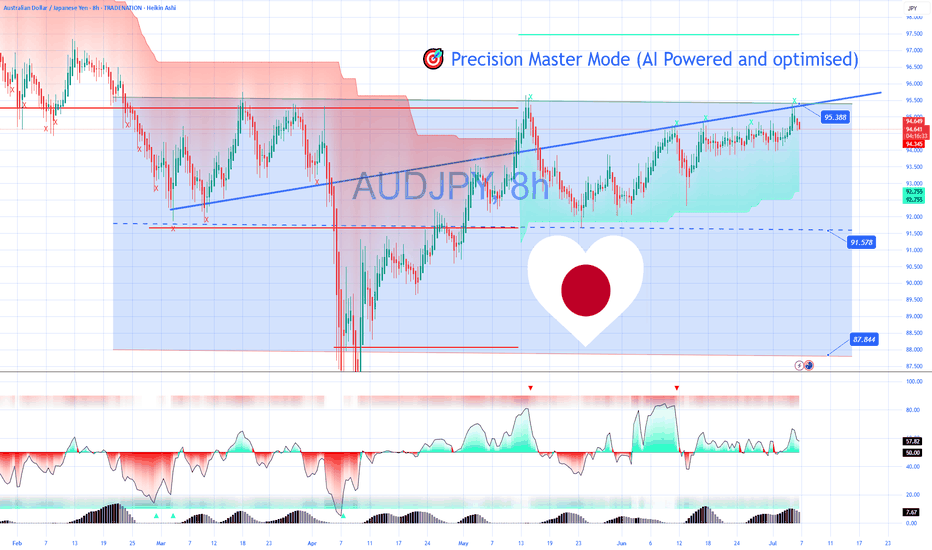

The Chart Says ''Cheer Up Japan'' – JPY Looks Safe📊🇯🇵 The Chart Says "Cheer Up Japan" – JPY Looks Safe 💙✨

There’s been talk, worry, even viral prophecy this week… but I’m here to say:

I read charts — not fear.

And right now, the JPY is showing strength, not weakness.

After running a full scan with my AI-powered Precision Master Mode, the cleanest trade setup aligned with this view is:

AUDJPY SHORT 📉

🗾 Cheer up, Japan — the Yen’s got this.

No panic in the charts. Just structure, volume, and momentum confirming that JPY is holding its ground as a safe-haven currency.

🔍 TRADE SETUP – AUDJPY SHORT

ENTRY: Market (or 94.85 for better R:R)

STOP LOSS: 95.70 (above trap high)

TARGETS:

TP1: 93.50

TP2: 91.57

TP3: 87.84 (macro target)

📈 What the chart shows:

– Strong rejection from top channel zone (structure is King!)

– SuperTrend flip starting on multiple TFs

– VWRSI fading = momentum loss

– Volume Profile confirms resistance

So while the headlines play on emotions, my execution comes from structure.

Let’s ride this JPY strength into next week — calmly, confidently.

📸 Chart attached (8H view – AI tuned)

📰 Article on the 'prophecy' that sparked the buzz:

www.telegraphindia.com

Have a nice weekend Japan and all Asia! After a 'scary prophecy' troubling your minds the weekend can end up being a crazy happy one!

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

AUDJPY SHORT FORECAST Q3 W27 D4 Y25AUDJPY SHORT FORECAST Q3 W27 D4 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly Order Block Identified

✅Daily Order block identified

✅4H Order Block identified

✅15' Order block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

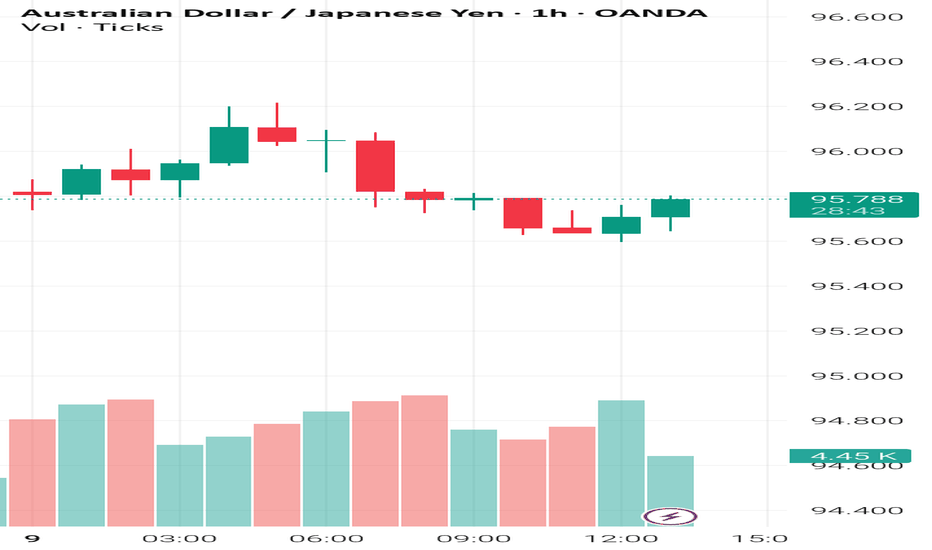

Live trade: AUD JPY long Entry 95.71

Nothing has happened to alter my 'risk in bias'. A, I've been waiting for a 'nice but of support' to place a stop loss behind. And I'm comfortable with the 1hr swings that have formed.

It's a 20 pip stop loss with 30 pip profit target.

The risk to the trade is a fresh bout of negative sentiment

Inverse head and shoulder pattern in AUDJPY - Daily Timeframe!Price just formed an inverse head and shoulder pattern in daily timeframe. Technically, this validates a chance of seeing more bullish price action development. Next resistance will be at 97.333 The higher timeframe (monthly) remains bullish so we’re expecting more of the bullish trend to continue.

AUDJPY SHORT FORECAST Q3 W28 Y25AUDJPY SHORT FORECAST Q3 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly Order Block Identified

✅Daily Order block identified

✅4H Order Block identified

✅15' Order block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Weekly Review: Risk remains positive, but tariffs in focus. The week starting Monday 30 June began with the USD on the back foot in a continuation of the previous week's narrative. With the market anticipating at least two cuts from the FED before year end.

Alongside USD weakness, the overall market mood remained positive, the S&P hovers near all time highs and the VIX remains well below 20 as Middle East concerns ebbed and tariff concerns are put to one side (how long for?).

The 'risk on / weak dollar' narrative remained throughout the week, at least until Fridays 'upside surprise' NFP data. Which is a reminder to expect the unexpected, many analysts predicted a below forecast number, especially given Wednesday's 'soft' ADP data. But a much stronger than forecast headline number gave the USD a boost. And hit the JPY particularly hard as we got an old fashioned stocks up / yields up = risk on day.

I'm doubtful NFP will be a game changer for the USD though. And I begin the new week with my 'risk on' bias intact, comparing the USD and JPY against each other to determine which currency is the best short option. Not ruling out the CHF as a potential short, but the Swiss franc is still having bouts of strength at odds with the overall positive tone.

The potential spanner in the works this coming week will be the tariff narrative. The 90 day reprieve ends on July 9 and we could get some fireworks.

It seems the market is 'hoping' for a blanket 10% across the board. I suspect the best we can hope for this week is a 'kicking of the can down the road'. The worst case scenario would be a resumption of the chaos we saw in April.

In other news, the GBP came under pressure as the government's fiscal policies are scurtinised. I suspect that the UK's relatively high interest rate and the overall 'risk on' market mood, stopped the pound from depreciating further. But it could be a bumpy road ahead for the GBP.

On a personal note. It was a week of 'only' one trade. But that was due to my busy schedule rather than a lack of opportunities. I missed Monday's USD weakness, the potential GBP short catalyst and Thursdays post NFP 'risk on' catalyst.

I did manage an AUD JPY long 'risk on' trade on Wednesday. Which I ultimately closed pre NFP for small profit.

Not ideal, I'd much rather get back to an average of three trades per week. But nonetheless, after a disappointing June, it was nice to get back to winning ways of sorts.

All eyes on the tariff narrative as we move into the new week.