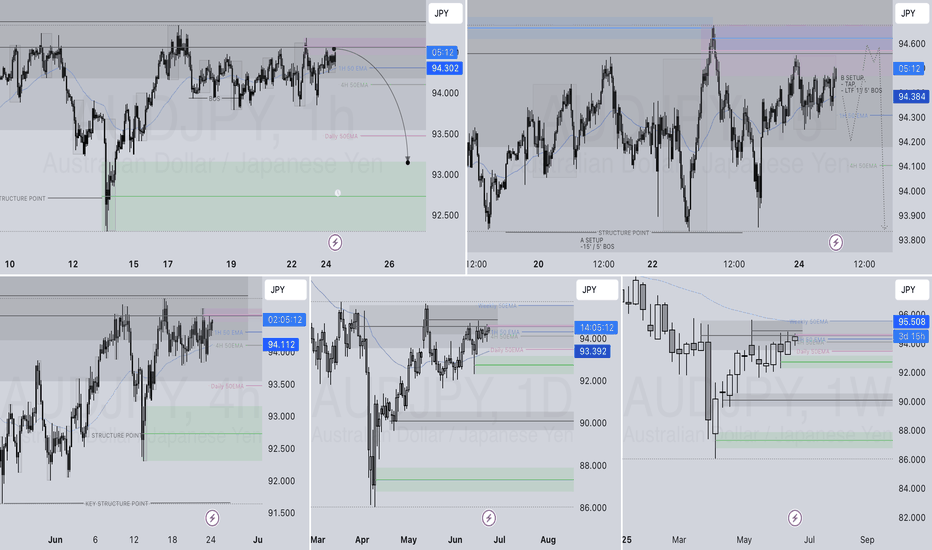

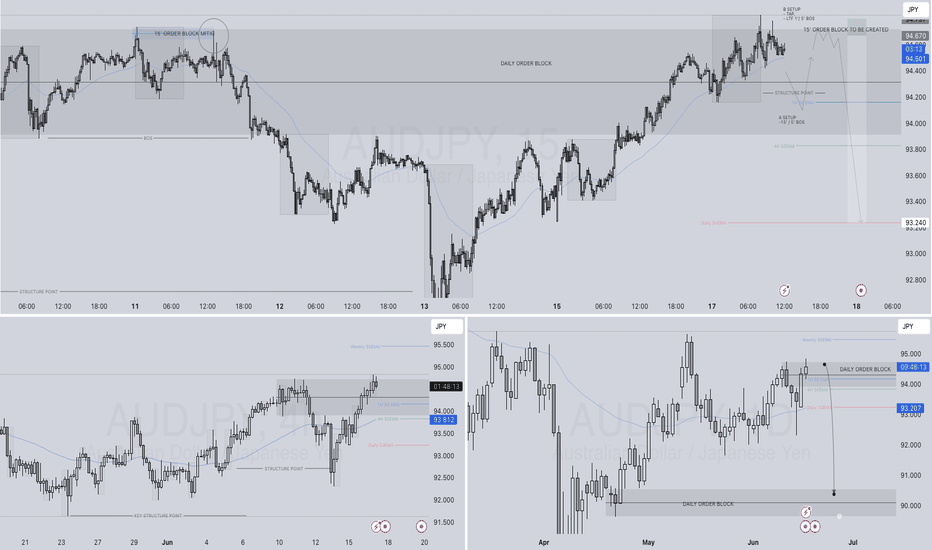

AUDJPY SHORT FORECAST Q2 W26 D24 Y25AUDJPY SHORT FORECAST Q2 W26 D24 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

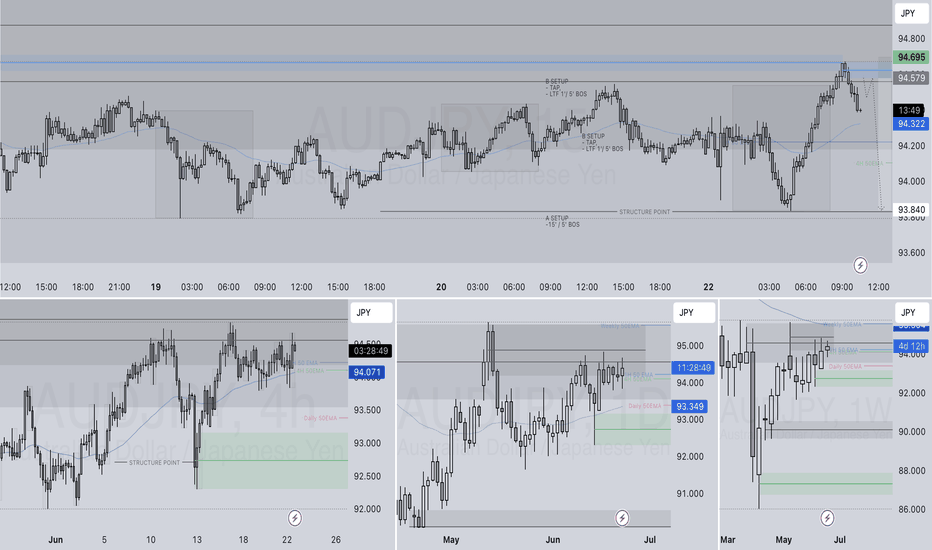

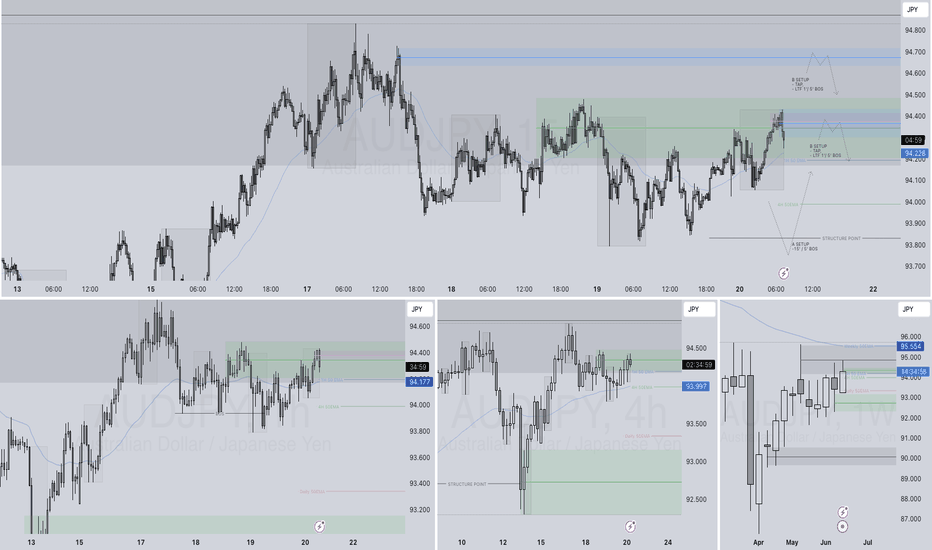

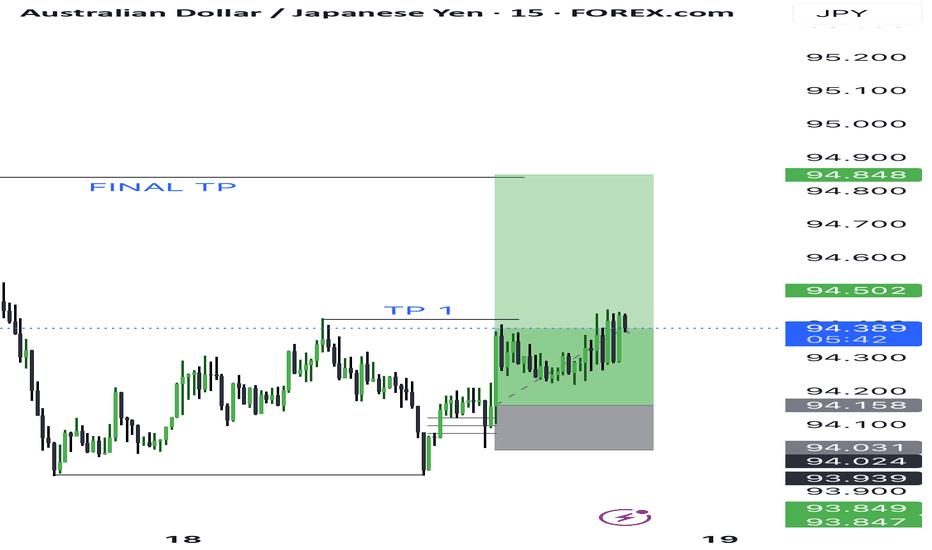

✅Weekly Order Block Identified

✅Daily Order block identified

✅4H Order Block identified

✅15' Order block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDJPY trade ideas

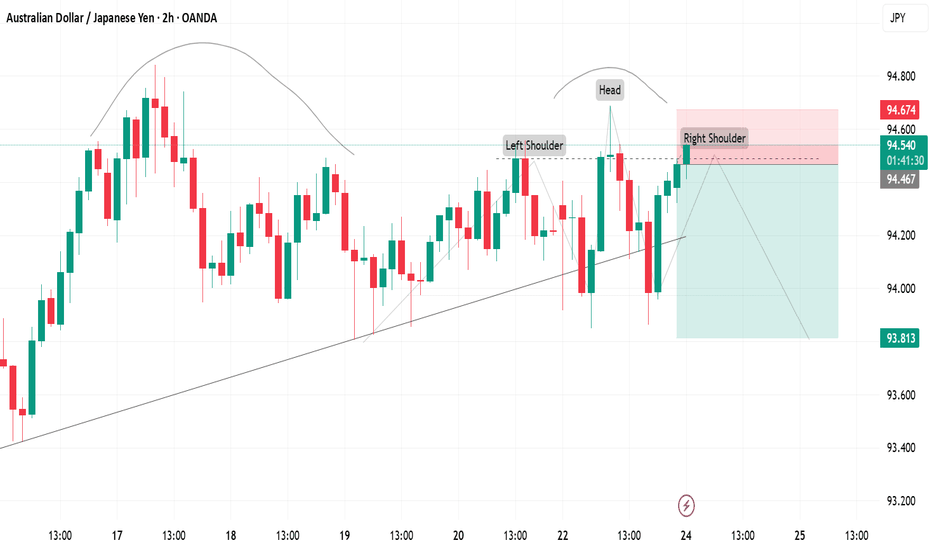

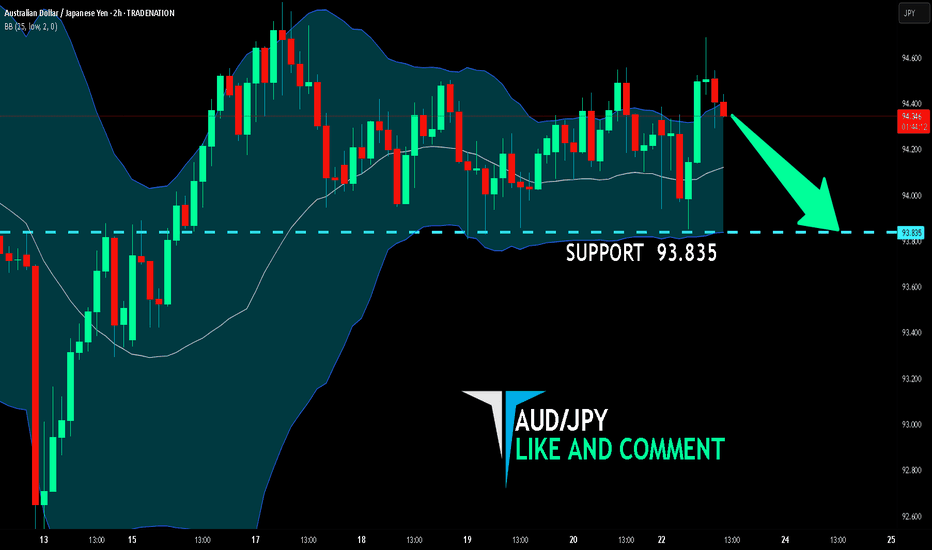

AUD/JPY SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

Previous week’s green candle means that for us the AUD/JPY pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 93.835.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

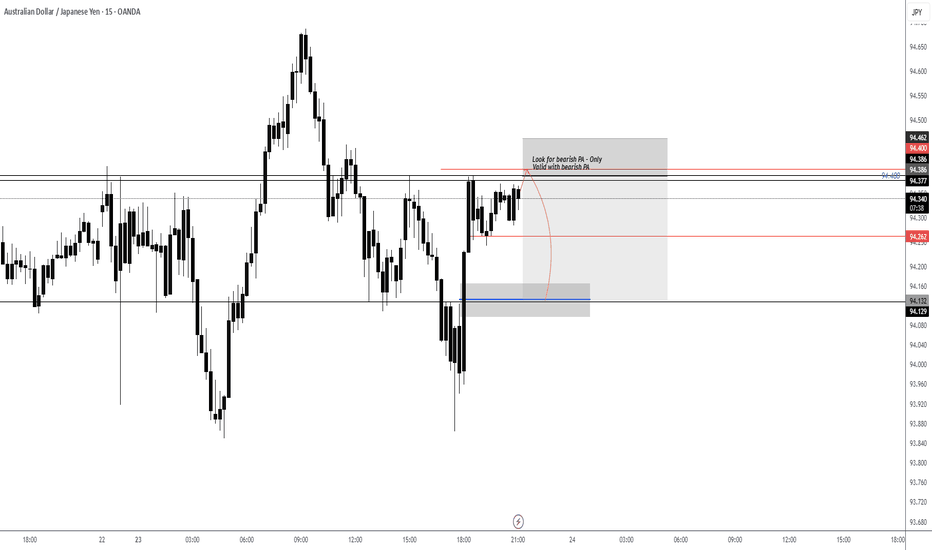

AUDJPY SHORT FORECAST Q2 W26 D23 Y25AUDJPY SHORT FORECAST Q2 W26 D23 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly Order Block Identified

✅Daily Order block identified

✅4H Order Block identified

✅15' Order block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

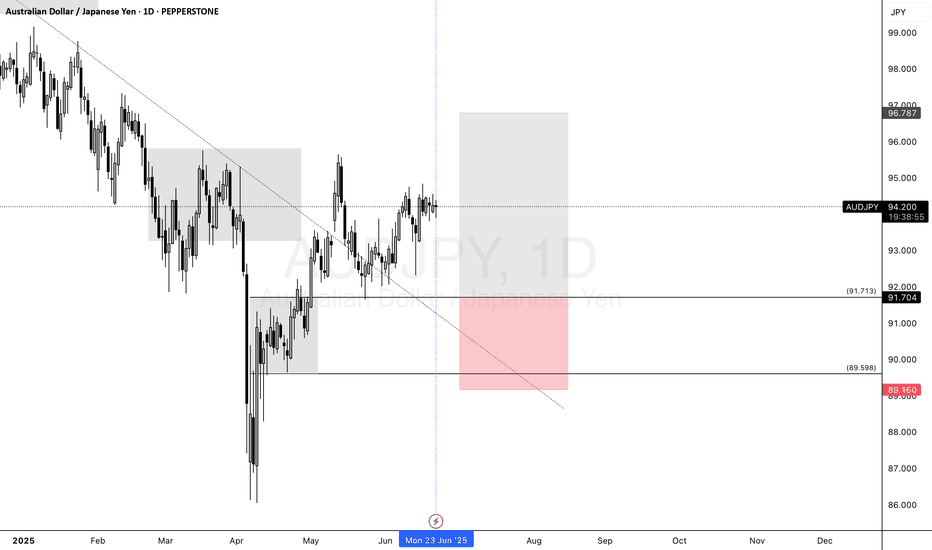

AUDJPY daily/ weekly cp wow 📈 AUDJPY Swing Trade Setup

🔹 Buy Limit: At Weekly/Daily Demand Zone

🔹 Bias: Bullish (COT-supported)

🔹 Reason:

Price is sitting inside a key weekly/daily demand zone, offering a strong long opportunity.

COT report shows commercials (smart money) are net long AUD and speculators are net short, indicating potential for a reversal or continued upside.

Aligns with the Set & Forget swing strategy — no confirmation needed.

📊 Structure supports a clean risk-to-reward setup with confluence from both technicals and sentiment.

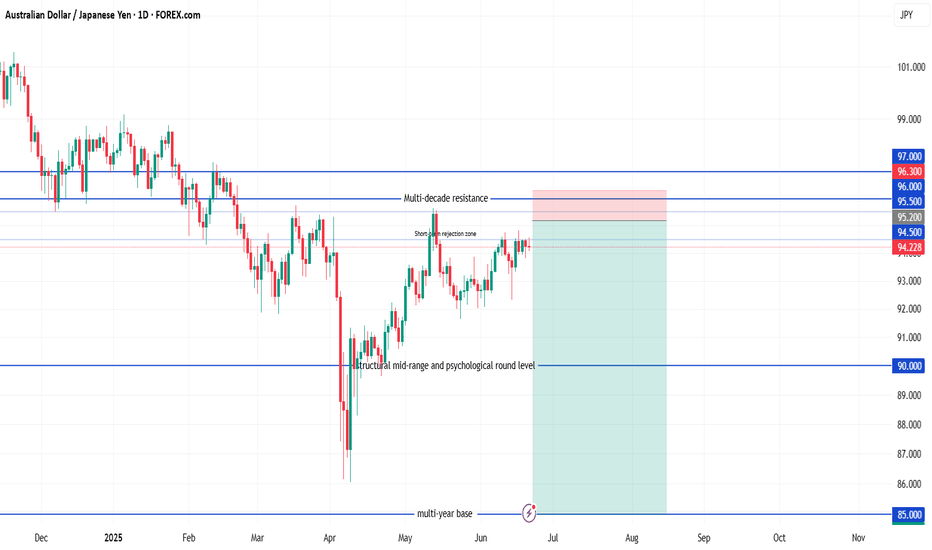

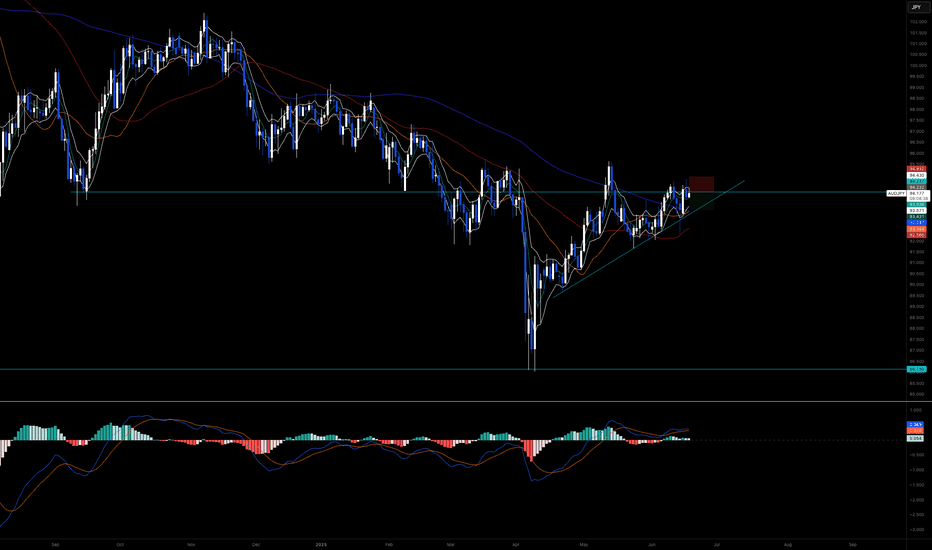

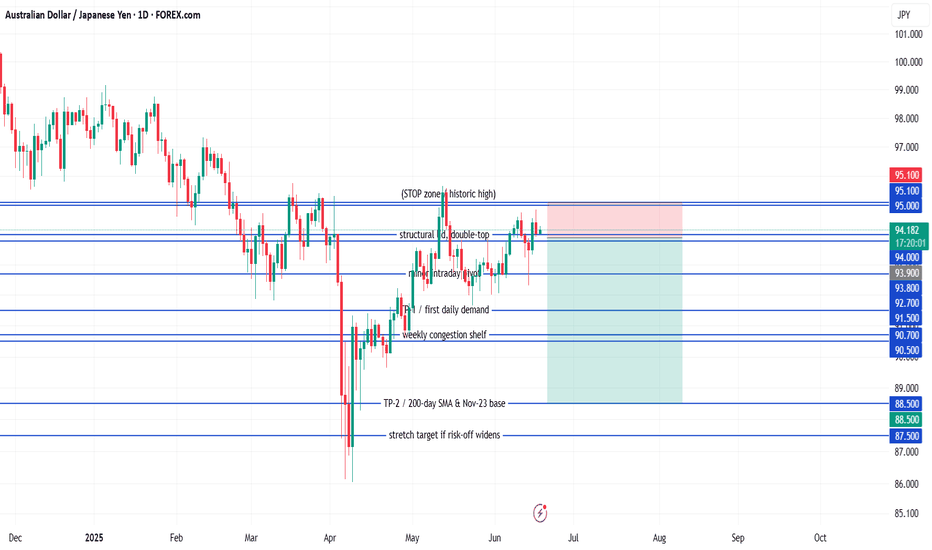

AUD/JPY Short Trade Plan Options

✅ Standard Entry

Sell Limit: 94.80

Stop Loss: 96.10

Take Profit 1: 90.00

Take Profit 2: 85.00

Why: Clean entry inside rejection zone, just under multi-decade resistance. Gives room for price to wick higher without being stopped prematurely.

🛡️ Conservative Entry

Sell Limit: 95.20

Stop Loss: 96.30

Take Profit 1: 90.00

Take Profit 2: 85.00

Why: Waits for deeper retracement into top of range. Better R:R, but may not trigger if price weakens early in the week.

🔐 Optional Manual Confirmation Strategy

Watch for a bearish daily candle (pin bar, engulfing) inside 94.50–95.50

Enter at close of that candle with stop above candle high

Gives added confirmation but may reduce reward slightly

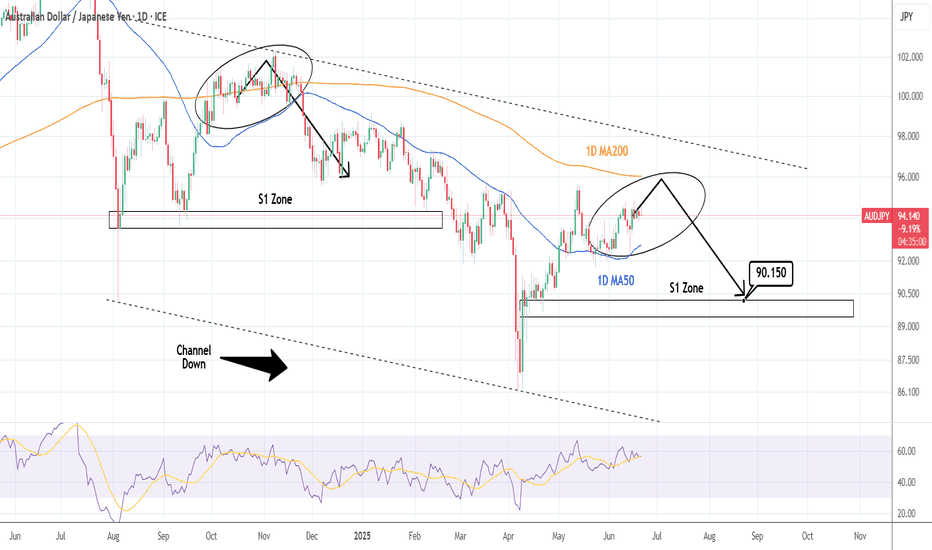

AUDJPY: Sell opportunity.AUDJPY is basically neutral on its 1D technical outlook (RSI = 56.422, MACD = 0.430, ADX = 19.989), ranging inside the 1D MA200 and 1D MA50 since the start of May. The last bullish wave top of the Channel Down got rejected around those levels and targeted the S1 Zone. Short, TP = 90.150.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

AUDJPY SHORT FORECAST Q2 W25 D20 Y25AUDJPY SHORT FORECAST Q2 W25 D20 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly Order block rejection

✅15' Order block to be confirmed

✅4H Order block

✅1H Order block

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

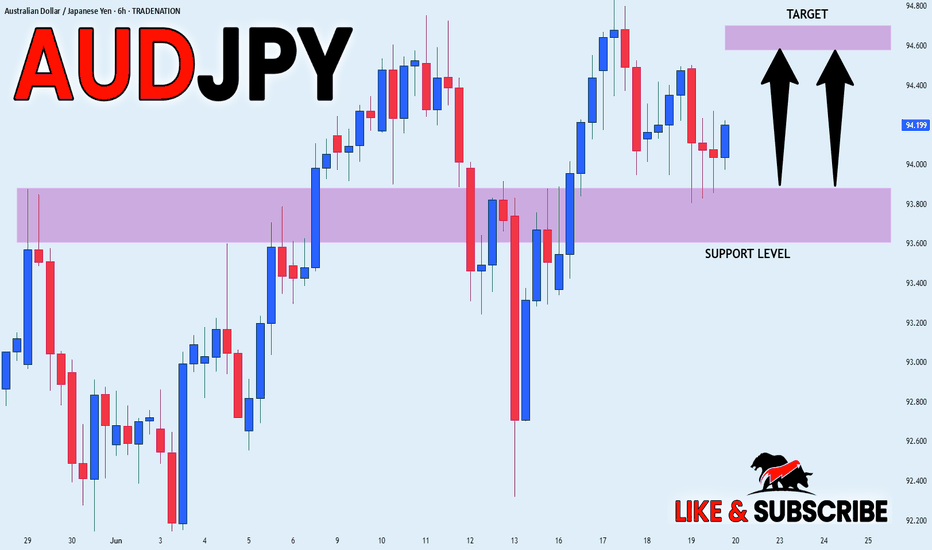

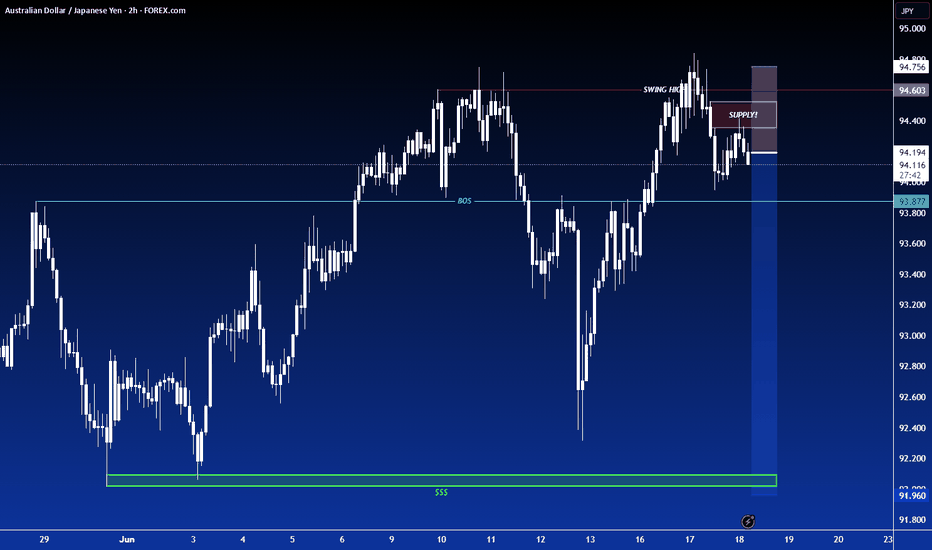

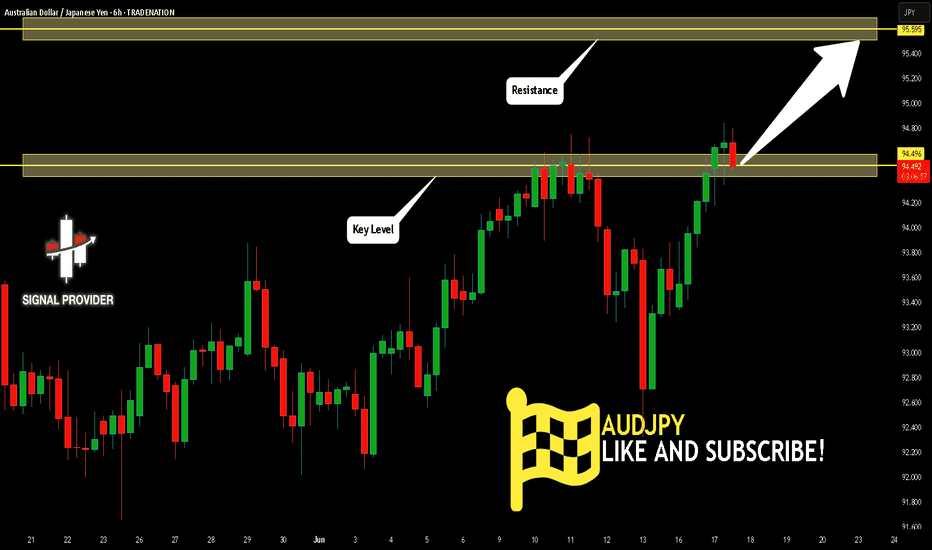

AUD_JPY GROWTH AHEAD|LONG|

✅AUD_JPY has retested a key support level of 93.800

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 94.600 is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Markets in Motion: Fed, Geopolitics, and the Next Big Move This week’s midweek market review dives into the critical catalysts shaking global markets—just ahead of the pivotal FOMC decision.

📉 Is the U.S. dollar heading for a deeper slide?

🏆 Will gold break past its all-time highs again?

₿ Can Bitcoin sustain momentum amid geopolitical risk and Fed uncertainty?

We unpack:

Key economic data driving DXY

Gold’s safe-haven surge and central bank demand

Bitcoin’s resilience, ETF flows, and macro headwinds

Geopolitical flashpoints in the Middle East and their market implications

Stay ahead of the curve with real-time insights to help you navigate the markets confidently into the weekend and beyond.

🔔 Don’t forget to like, subscribe, and hit the bell to stay updated with our weekly outlooks!

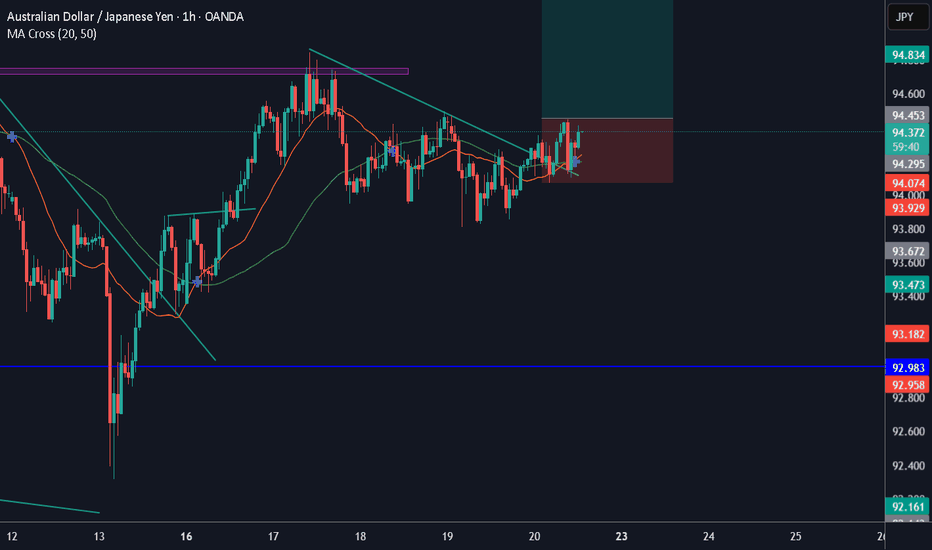

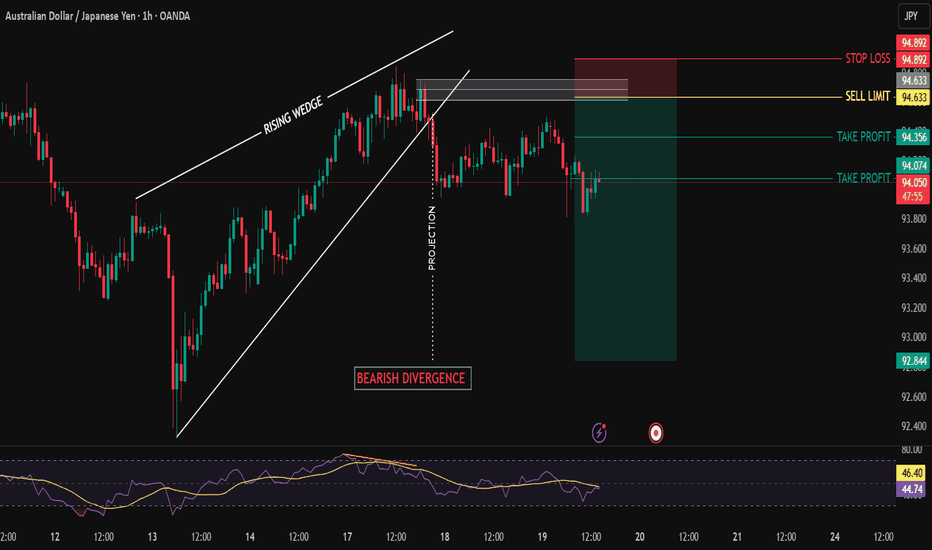

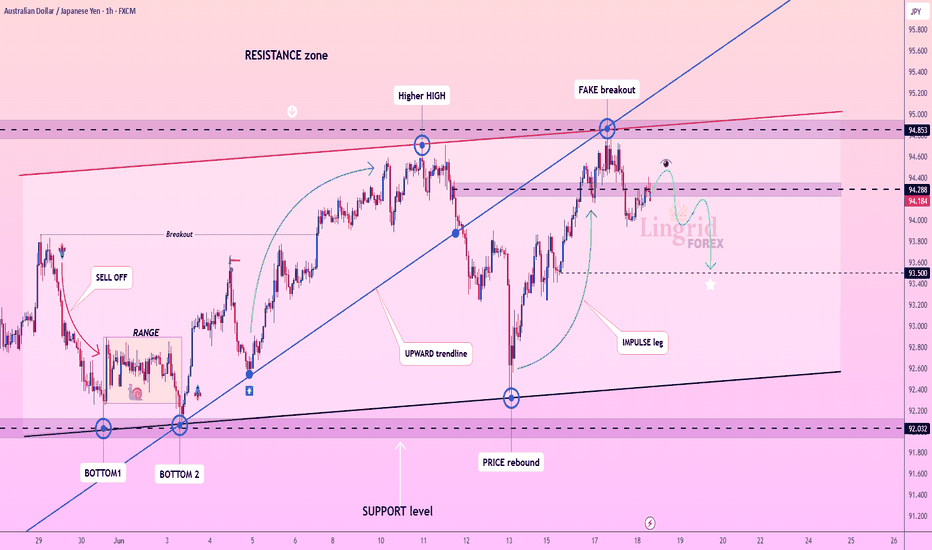

Lingrid | AUDJPY Short-Term Bearish Move from ResistanceFX:AUDJPY posted a strong rally to a new Higher High, but the recent breakout above resistance at 94.85 proved to be false, with price pulling back beneath the resistance zone. The pair is now consolidating just below this level, showing early signs of potential weakness. A confirmed rejection and breakdown below 94.20 would reinforce the bearish case for a move back toward 93.50.

📈 Key Levels

Buy zone: 93.50–93.70

Sell trigger: loss of 94.00–94.20 support

Target: 93.50

Buy trigger: strong reclaim of 94.85 resistance

💡 Risks

Re-entry above the broken resistance could revive bullish momentum

Price structure remains within a broader uptrend unless 93.50 breaks

Lower volatility could limit short-term follow-through

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

AUD/JPY ShortSell-limit (primary) 93.90 — front-runs the twin highs at 94.00 (May and again last week).

Stop-loss 95.10 — just above the 2024 YTD peak and round-number 95; if price closes above, the breakout is real.

Take-profit 1 91.50 — first daily support shelf; locks ~240 pips (≈ 1.6 R) and is often the first bounce zone.

Take-profit 2 88.50 — November-2023 base / 200-day SMA; full mean-reversion target (~540 pips, ≈ 3.6 R).

Filter to keep order Only leave the order active while the daily candle closes ≥ 93.80 (shows the lid is still respected).

GTC Cancel the order if unfilled after 5 trading days; reassess next week.

Quick rationale

Fundamentals: RBA leaning dovish; JPY could firm on BoJ hawkish hints & intervention risk.

Technical: Double-top near 94; bearish RSI divergence on daily; room down to 91s/88s.

Risk-reward: 120-pip risk vs. 240 / 540-pip reward = 1.6 R and 3.6 R pay-offs.

Place the limit, set the filter alert on daily closes, and let the trade come to you—no need to babysit intraday moves.

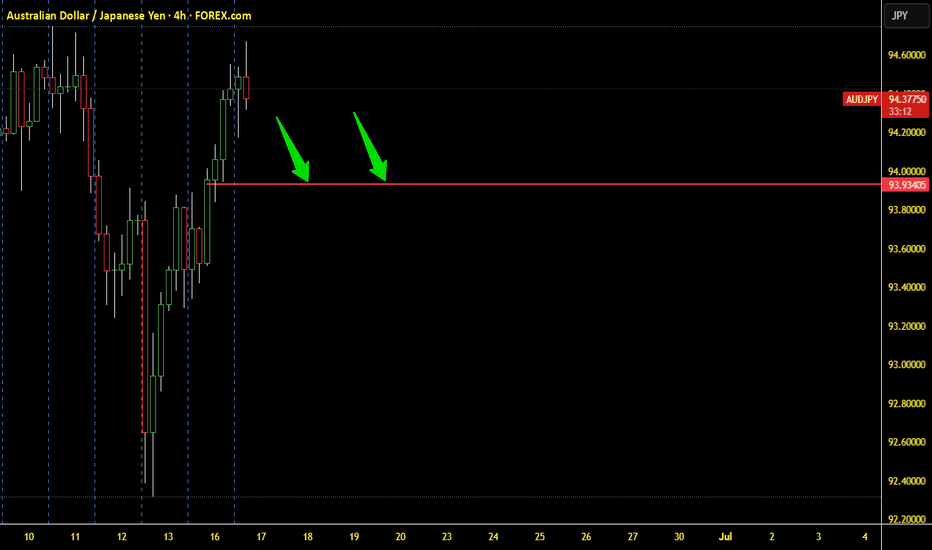

AUDJPY 4H Short Setup📕 Smart Money Trade Breakdown

🔻 AUDJPY 4H Short Setup

This is a short entry on AUDJPY, taken from a premium price zone within an Order Block (O-B) and Supply & Demand (S&D) area, showing strong bearish rejection after internal market structure shift.

📉 Entry: 94.096

🎯 Take Profit: 90.136

🛡️ Stop Loss: 95.399

⚖️ Risk-Reward Ratio: ~1:3

🔍 Key Confluences:

Entry within a well-defined Order Block and S&D zone

Price reacted to upper supply with a visible wick rejection

Break of internal structure (M15-H1) shows bearish intent

Bearish engulfing on confirmation candle

Trendline break suggests end of bullish wave

This setup aims to catch the institutional distribution phase before price retraces to discount demand around the 90.100 zone or lower.

⚠️ Disclaimer: This is for educational purposes. Apply proper risk management and strategy validation before live execution.

AUDJPY SELL SIGNAL – GLOBAL HORNS🦘 AUDJPY SELL SIGNAL – GLOBAL HORNS

🕰️ Timeframe: 4H

📉 Direction: SELL

📍 Entry: 94.40 (active)

🎯 Target: 93.94

⏳ Duration: usually within a few days max

📊 Context:

Price surged into a key reaction zone and is now stalling. I'm looking for a short-term pullback to the 93.94 area, which aligns with recent structural retests (see arrows). Trade is already active.

📌 No stop loss — this is managed by time and price behavior. If target isn't hit by the window, I’m out.

🧠 As always, this is not financial advice. Just showing what I’m doing.

#GlobalHorns #AUDJPY #Forex

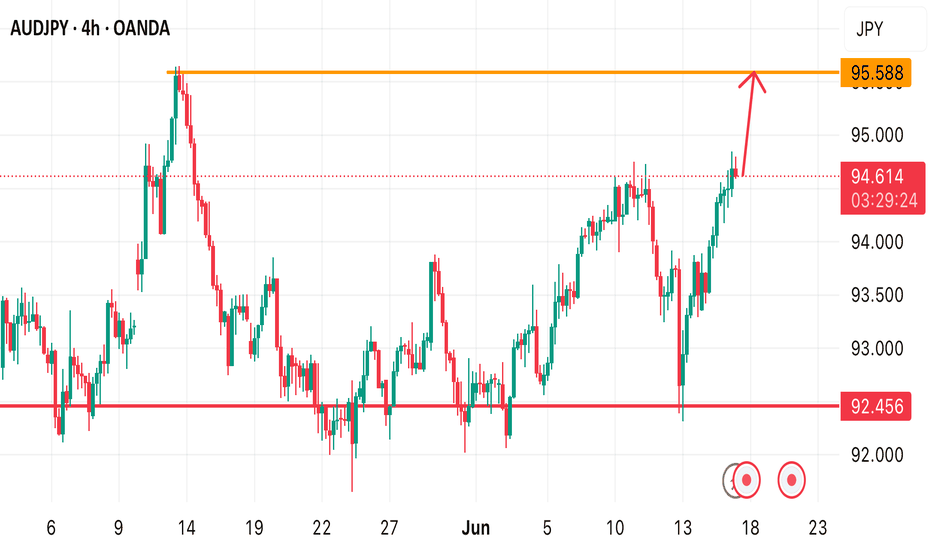

AUDJPY Will Go Higher! Buy!

Here is our detailed technical review for AUDJPY.

Time Frame: 6h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 94.496.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 95.595 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUDJPY SHORT FORECAST Q2 W25 D17 Y25AUDJPY SHORT FORECAST Q2 W25 D17 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly Order block rejection

✅15' Order block

✅Daily order block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X