AUDNZD trade ideas

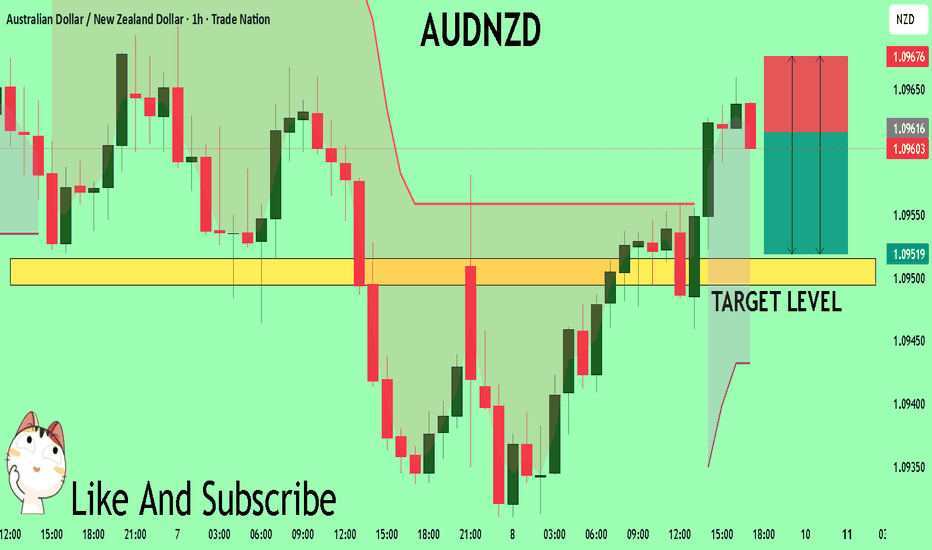

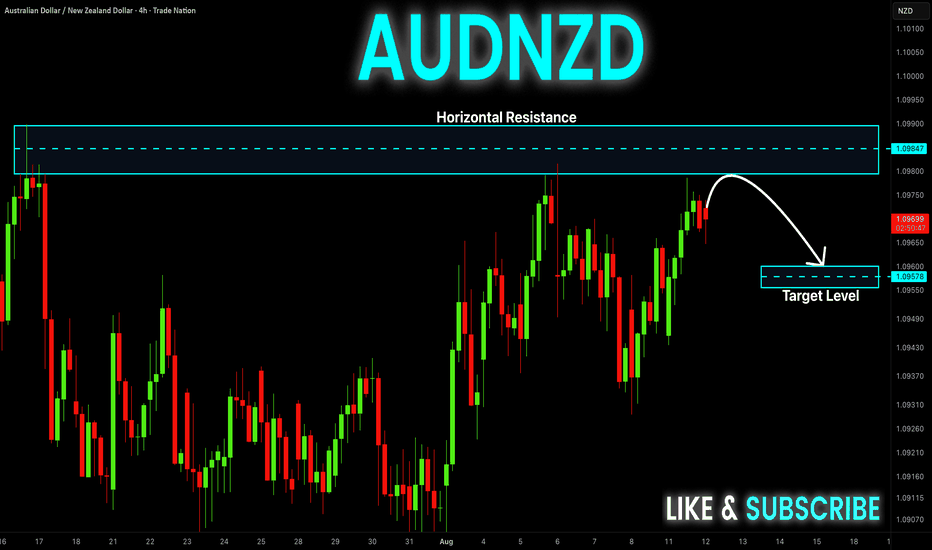

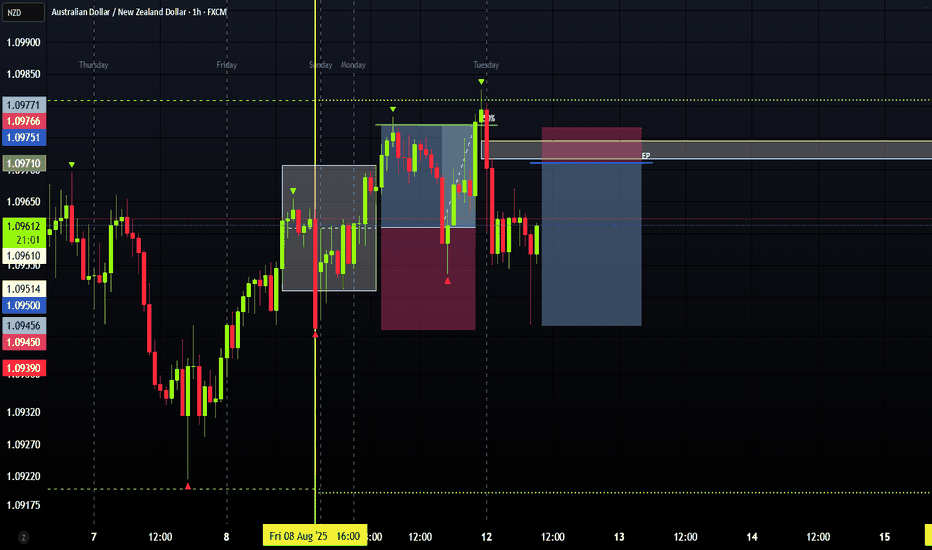

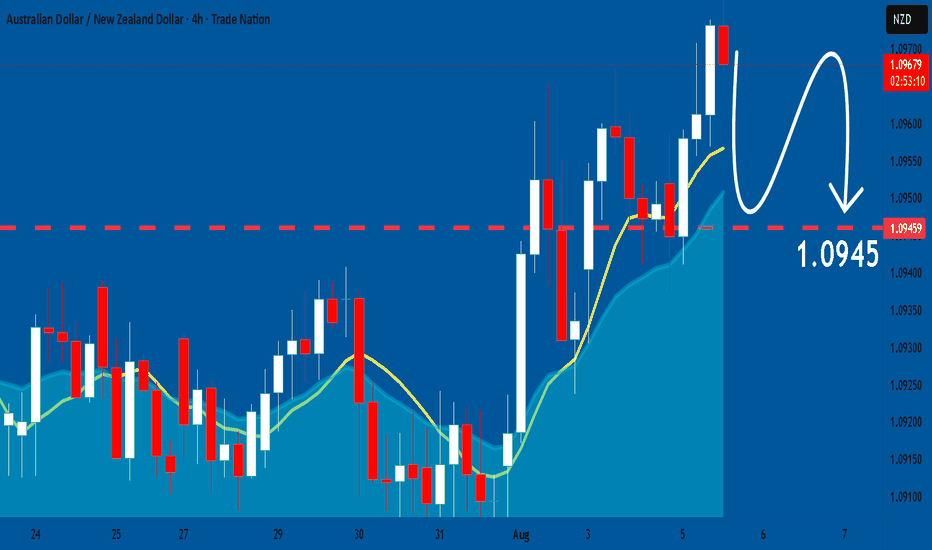

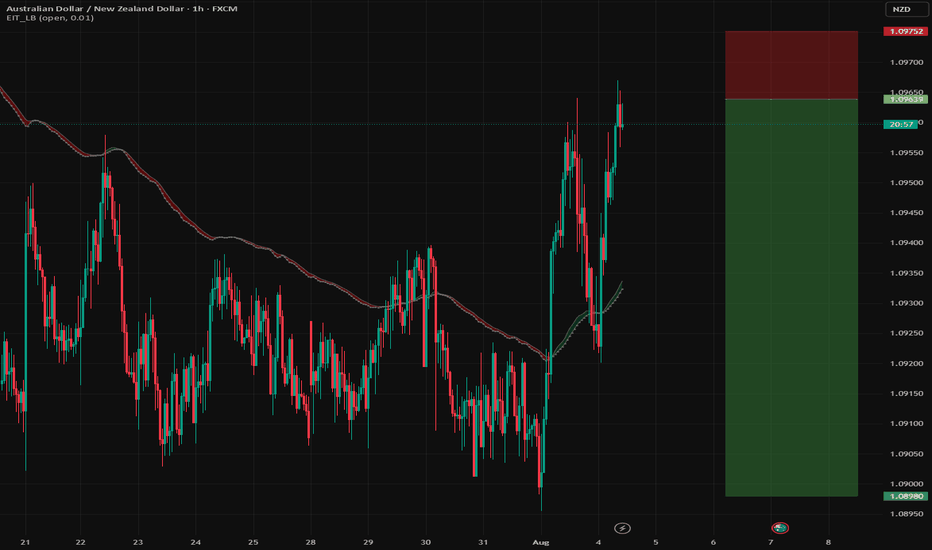

AUDNZD Trading Opportunity! SELL!

My dear friends,

Please, find my technical outlook for AUDNZD below:

The instrument tests an important psychological level 1.0961

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.0951

Recommended Stop Loss - 1.0967

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

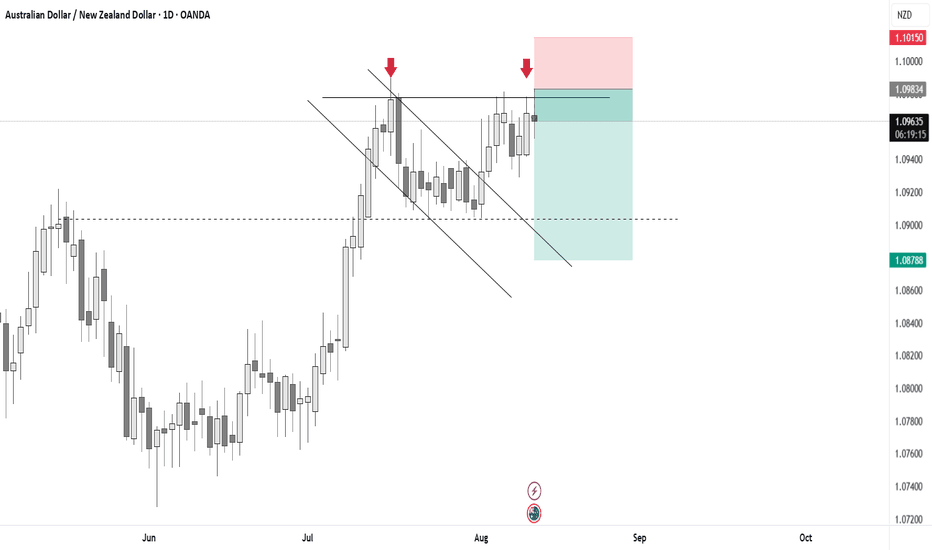

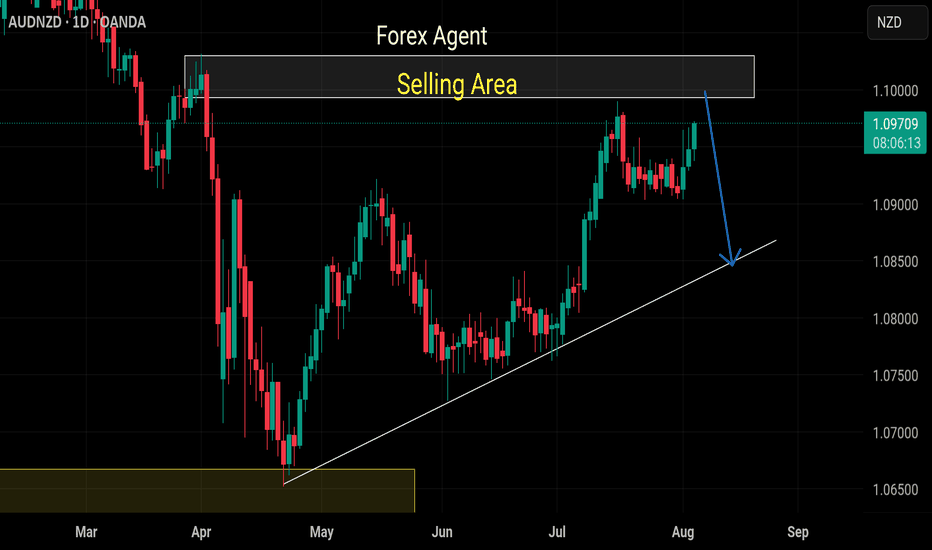

AUD-NZD Resistance Ahead! Sell!

Hello,Traders!

AUD-NZD keeps growing

And the pair will soon hit

A horizontal resistance level

Of 1.0990 from where we

Will be expecting a local

Pullback and a move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

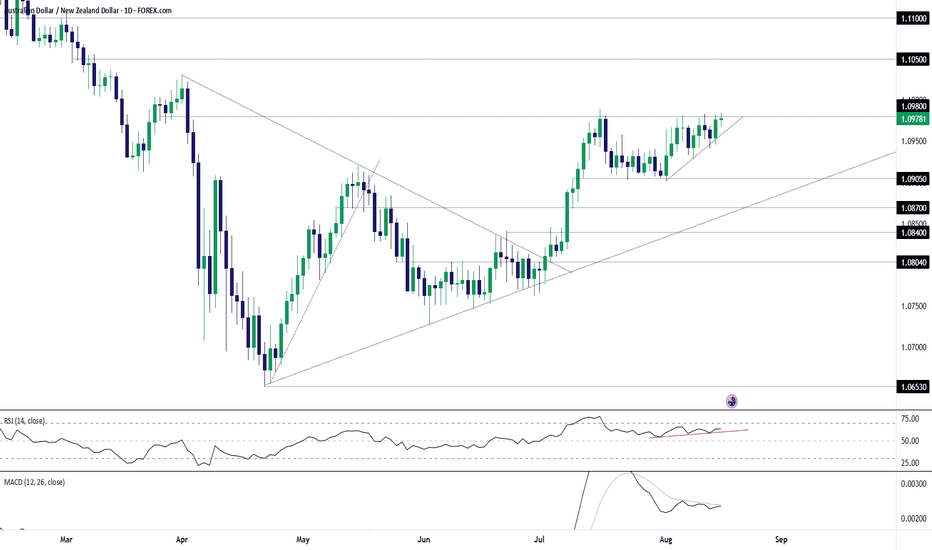

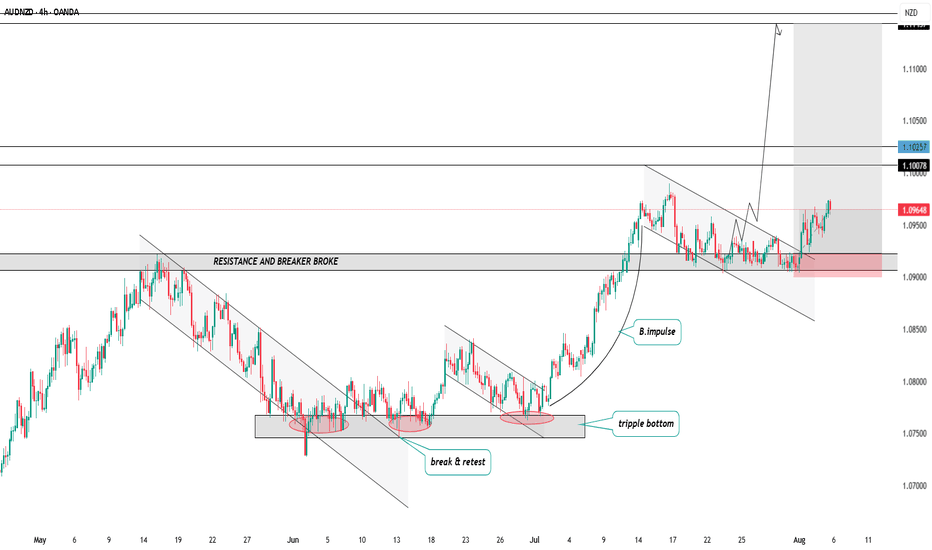

AUD/NZD: Bulls stalk breakout above 1.0980Sitting in an ascending triangle and having just printed a bullish engulfing candle on the daily chart, upside may be beckoning for AUD/NZD.

We’ve seen multiple failed attempts to overcome resistance at 1.0980, so a close above the level—or at least a meaningful break above the August 16 high—would be preferable before considering a bullish setup.

If that occurred, longs could be established above 1.0980 with a stop beneath for protection. 1.1000 provides an early psychological hurdle, although the April 1 high of 1.1030, 1.1050 or 1.1100 screen as more appealing as targets unless you’re an ultra-short-term player.

Momentum indicators marginally favour a bullish bias, although price action should take precedence when assessing the setup.

If the price cannot overcome 1.0980, the bullish bias would be invalidated, opening the door for setups looking to play the existing range down to 1.0905 support.

Good luck!

DS

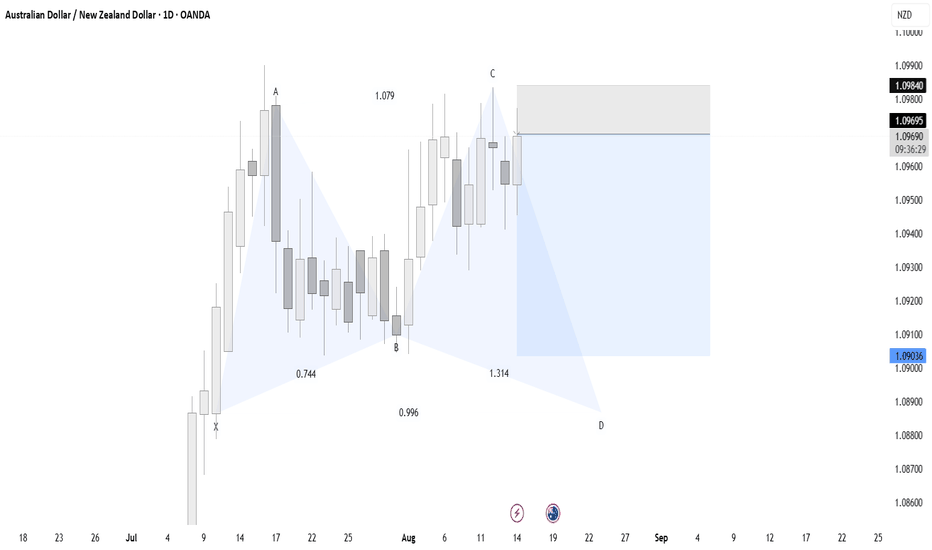

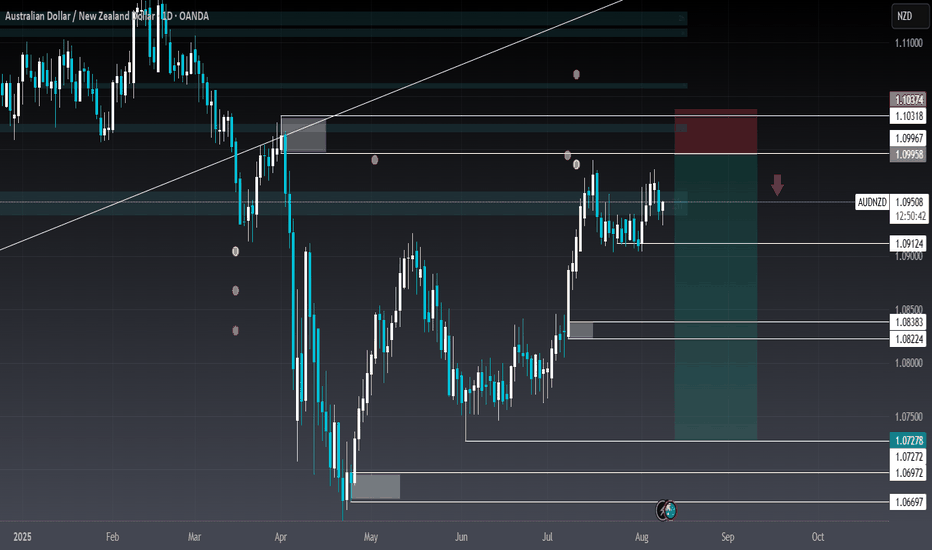

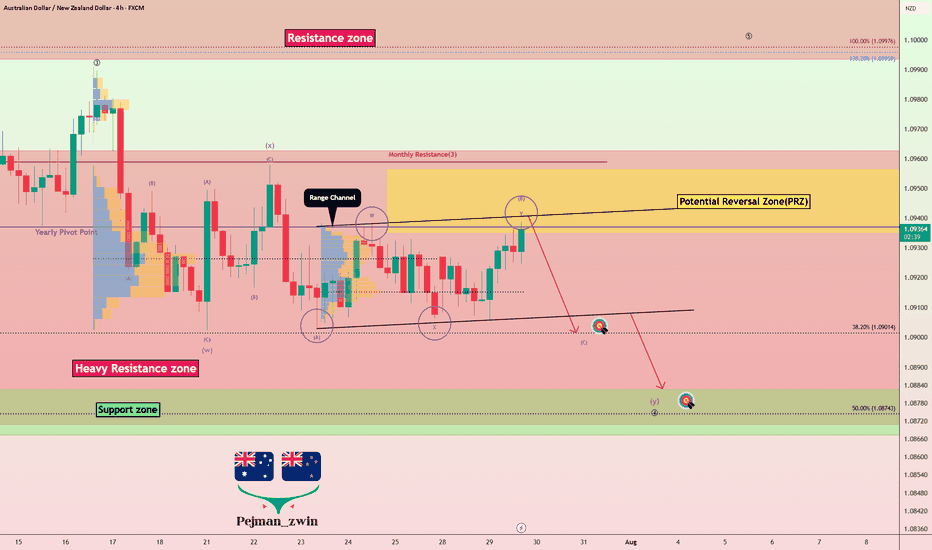

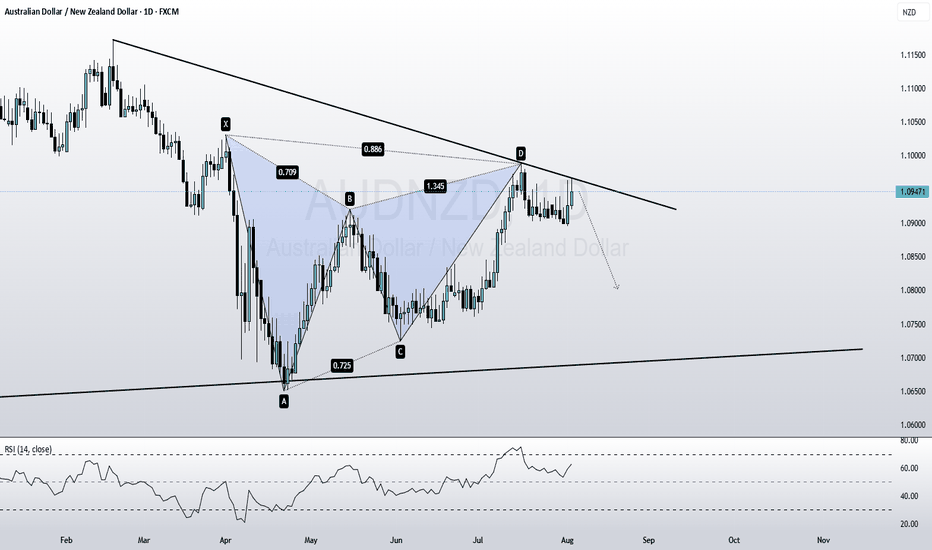

AUDNZD Technical + Fundamental Align for DownsideToday I want to analyze a short position on the AUDNZD ( OANDA:AUDNZD ) pair, first, let's look at it from a fundamental analysis perspective .

Fundamental View on AUDNZD

Key reasons to short AUDNZD:

Australian weakness:

Recent data show weakening consumer sentiment and declining building approvals. The RBA seems hesitant to hike further, putting pressure on the Aussie.

New Zealand resilience:

The RBNZ maintains a relatively hawkish stance. Inflation is still a concern, and the central bank is committed to keeping rates high, supporting NZD strength.

Monetary policy divergence:

The divergence between RBA’s dovish stance and RBNZ’s hawkish approach supports further downside in AUDNZD.

----------------------

Now let's take a look at AUDNZD from a technical analysis perspective on the 4-hour timeframe .

AUDNZD is currently trading in a Heavy Resistance zone(1.0963 NZD-1.0870 NZD) near the upper line of the Range Channel , Potential Reversal Zone(PRZ) and Yearly Pivot Point .

In terms of Elliott Wave theory , AUDNZD appears to be completing microwave B of microwave Y of the main wave 4 .

I expect AUDNZD to drop to at least 1.0904 NZD(First Target) based on the above explanation .

Second Target: 1.0886 NZD

Note: Stop Loss(SL): 1.0963 NZD

Please respect each other's ideas and express them politely if you agree or disagree.

Australian Dollar/New Zealand Dollar Analyze (AUDNZD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

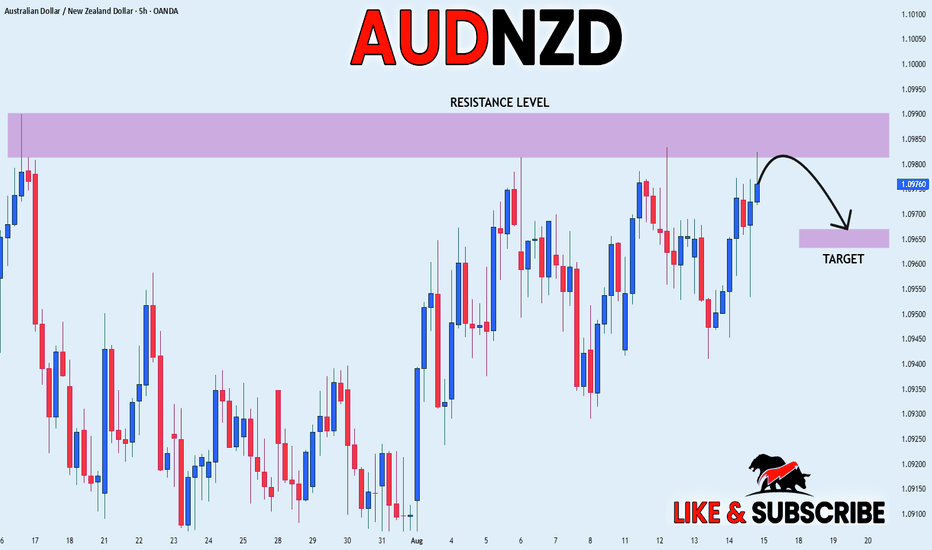

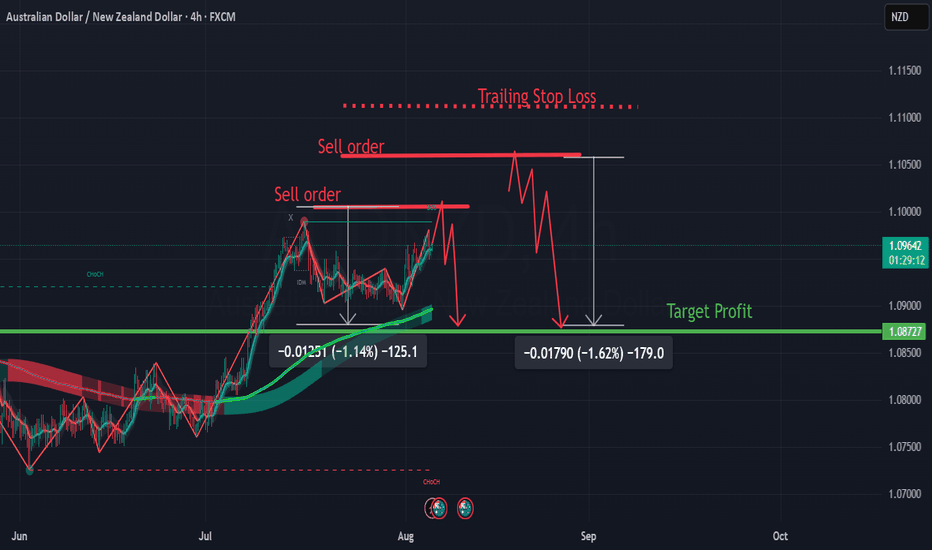

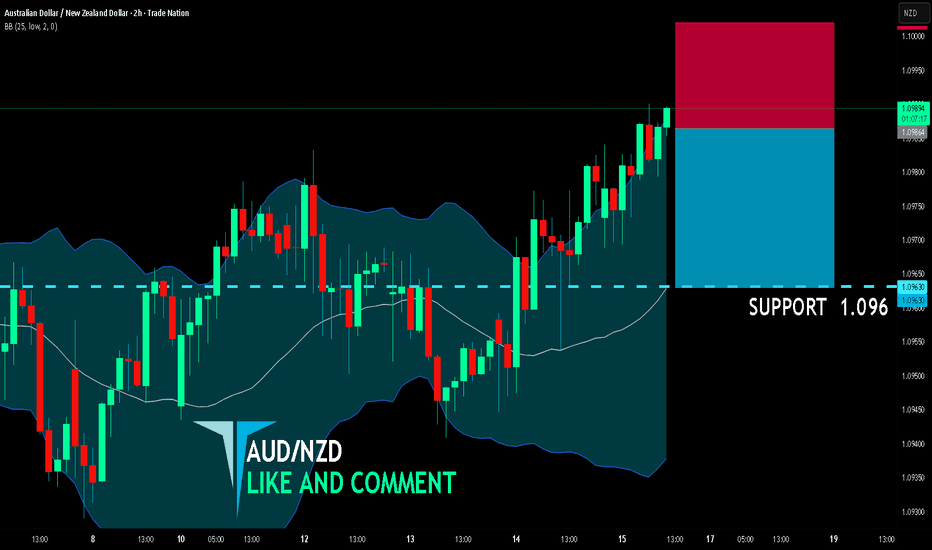

AUDNZD: Expecting Bearish Continuation! Here is Why:

Looking at the chart of AUDNZD right now we are seeing some interesting price action on the lower timeframes. Thus a local move down seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

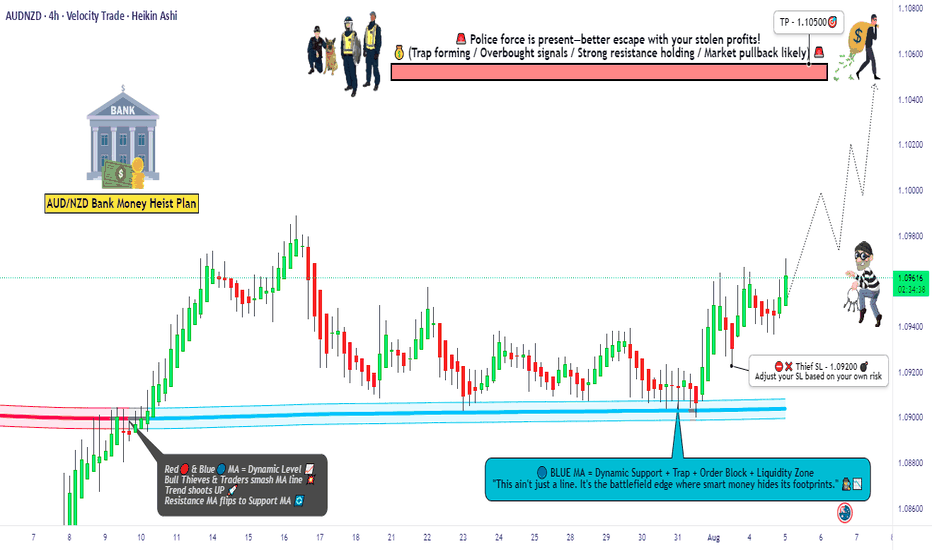

AUD/NZD Heist Loading... Will the Kiwi Surrender to the Aussie?🦘💵 AUD/NZD BULLISH LOOT RAID – THIEF TRADER ENTRY ACTIVE! 🔓🧠

🧭 Asset: AUD/NZD

📊 Plan: Bullish Heist in Progress

🎯 Entry: Thief dives in at any price – using layered limit orders to trap the perfect fill.

🛑 Stop Loss: 1.09200 – Emergency exit if alarms go off 🚨

💰 Target: 1.10500 – Vault full of pips awaiting collection! 💼💸

🕵️♂️ THIEF STRATEGY SNAPSHOT:

The Aussie is loading up the bags and the Kiwi’s guard is down 🐨🆚🥝.

This isn't just a trade—it’s a covert FX raid. Thief is stalking price silently, placing sneaky limit orders in layers—waiting for the market to slip up.

🚪 No fixed door in—every pullback is a crack in the vault.

⚔️ Patience is the blade—entries are stealthy, exits are explosive.

🧠 Using both market structure + sentiment, we sniff out the liquidity stash!

💡 TRADE TIPS FROM THE THIEF'S VAULT:

📉 Layer entries across minor dips (M15-H1 zones) – never chase.

🏃♂️ Price nearing reversal zones? Use tight stops and trail profits like a pro.

📰 Avoid entries during red news – get in before the crowd, not with them.

🧭 This pair respects structure. Don't fight momentum—ride it like a bandit horse.

🔔 THIEF CODE: “We don’t predict—we prepare.”

🎯 Lock in, layer deep, loot fast.

💬 Drop your setup thoughts below 💣

❤️ Like this? Smash that 👍 and join the thief crew!

📌 Save this plan & follow for more stealth market raids.

🕶️ Stay sharp. Stay hidden. Stay profitable.

💼 Next vault breach loading... 👇

📍#ThiefTrader #AUDNZD #LayeredLootPlan #ForexHeist #MarketRaiders

AUDNZD: Waiting for the Kangaroo to SlipThe trend is up — but I’m not buying the bounce. AUDNZD is pushing into resistance, and while the bulls still have short-term control, I’m watching closely for a sell signal. I want to short this pair — but not until the chart tells me the rally is running out of steam.

📉 Trade Bias: I’m looking to short AUDNZD at resistance — once price action confirms weakness.

Here’s why I’m eyeing this setup:

🇦🇺 AUD strength is driven by global optimism, not domestic momentum

🇳🇿 NZ business confidence is booming — 11-year high

🔄 Both central banks are cautious, but the RBA is closer to cutting

🔮 RBA’s next move (August 12) could trigger AUD downside

📊 COT data shows flat AUD bets and a tilt toward NZD shorts reversing

AUD’s recent rally has little to do with fundamentals. It’s been lifted by risk-on flows tied to global trade headlines — but under the hood, things don’t look so hot. Inflation is softening, and the RBA is likely to cut rates soon. Meanwhile, domestic spending and investment remain weak.

NZD isn’t flying, but it’s holding firm. Confidence is building slowly, and although more rate cuts may come later, the RBNZ is taking its time. Traders seem to be shifting away from NZD shorts, showing a slow turn in sentiment.

If AUDNZD stalls here, this could be a fading opportunity. But I won’t jump in without confirmation.

Patience first, then action. Are you watching this zone too — or still riding the bull? 👇

AUDNZD: Will Start Falling! Here is Why:

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the AUDNZD pair price action which suggests a high likelihood of a coming move down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

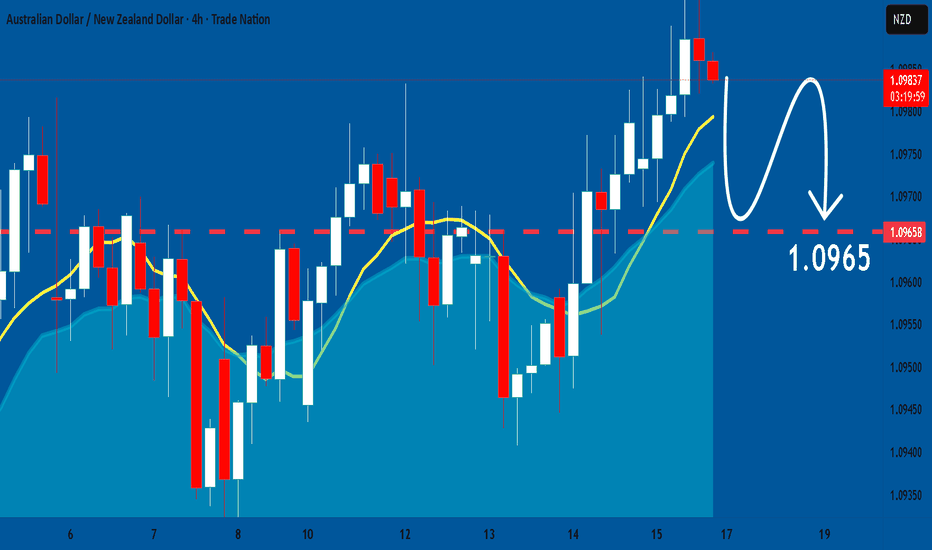

AUD/NZD BEARS WILL DOMINATE THE MARKET|SHORT

AUD/NZD SIGNAL

Trade Direction: short

Entry Level: 1.098

Target Level: 1.096

Stop Loss: 1.100

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

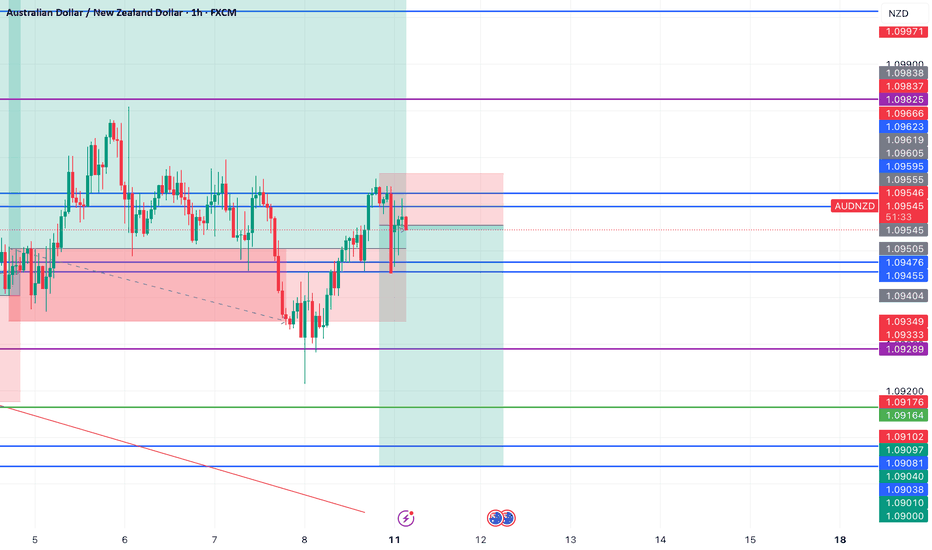

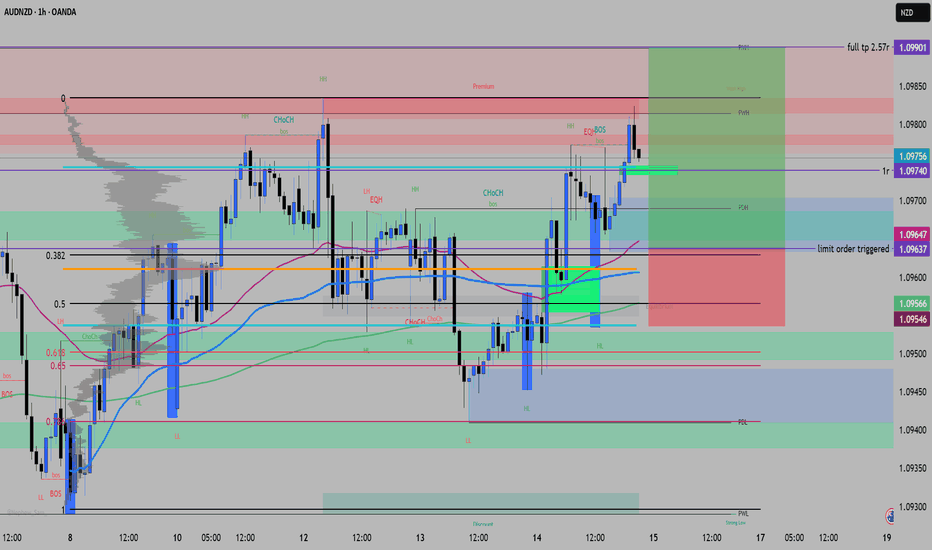

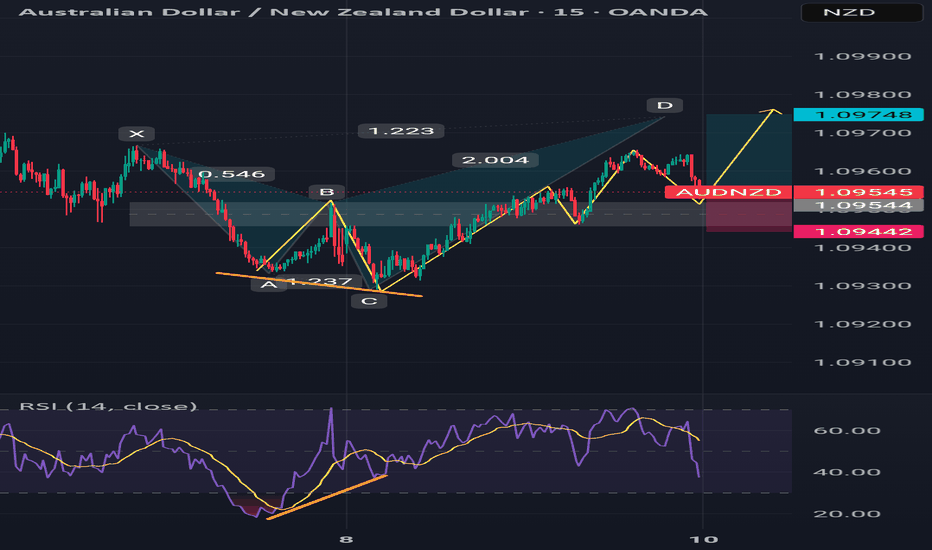

Aud/NZD long set up ideaAUDNZD – Long Trade Plan

Bias: Bullish

Timeframes: Daily + 1H alignment

Confluences:

Daily bullish structure and candle close above EMAs.

1H bullish CHoCH + BOS confirming trend continuation.

Entry aligned with FVG, NPOC, AVWAP, and value low.

Clear liquidity target at PMH.

No USD news risk impacting pair.

Execution Plan:

Entry: Limit order at 1.09637

Stop Loss: 1.09536 (below FVG + EMA cluster).

Target: 1.09901 (PMH liquidity draw).

Risk/Reward: 2.57R.

Management:

Alert on entry trigger.

Alert at 1R for partial management decision.

Let remainder run to full TP unless price structure changes significantly.

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice, it is for my trading record.

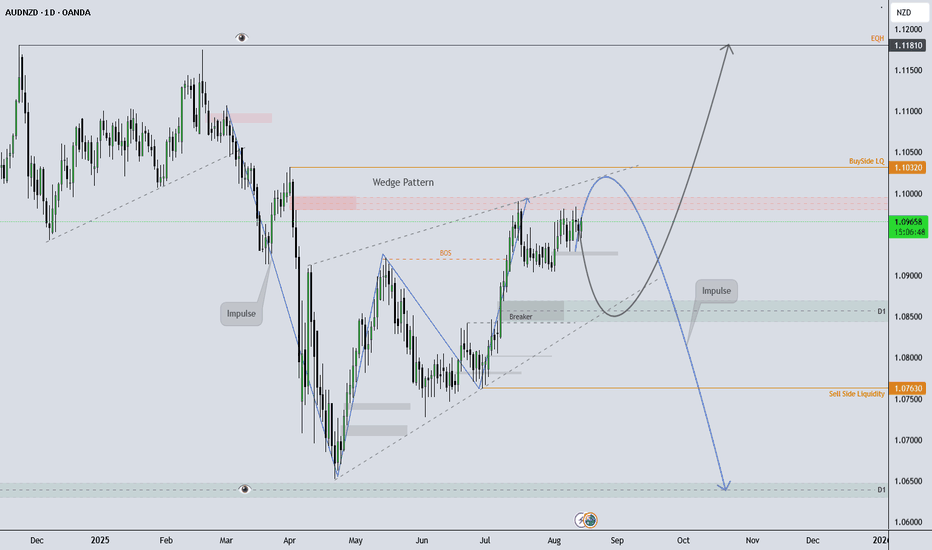

AUDNZD Technical OutlookWhat I See!

AUDNZD is showing a rising wedge formation after an extended move higher from the May swing low. Price is reacting around the 1.1000 psychological level, which overlaps with a daily Fair Value Gap (FVG) and a prior supply zone.

From a structural perspective, a move toward the bullish daily FVG near 1.0850 is a possible short-term development. If this zone holds, the chart could continue to build toward the equal highs around 1.1181.

Alternatively, invalidation of the 1.0850 daily FVG could open the door for a deeper decline, potentially completing the wedge pattern and drawing price toward lower demand areas.

This chart is presented for educational discussion of market structure and technical patterns only. It is not a trade signal or financial advice.

💬 Got questions? You’re welcome to share your thoughts in the comments.

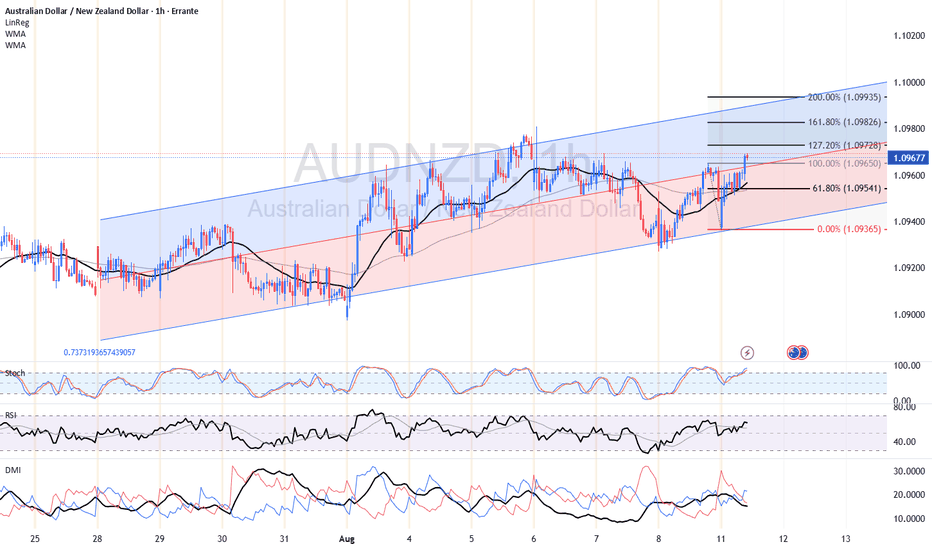

AUD/NZD Holds Up Within Ascending Channel Amid Rate-Watch MoodAUD/NZD continues its climb within a defined rising channel, backed by underlying bullish momentum. Breakout above ~1.0970 would likely open a run toward 1.099–1.100, contingent on supportive risk tone and central bank cues. Failing that, watch for a pullback toward 1.0954 or lower. Keep an eye on this week’s central bank updates for the next catalysts.

You can read the full article here:

erranteacademy.com