AUDNZD trade ideas

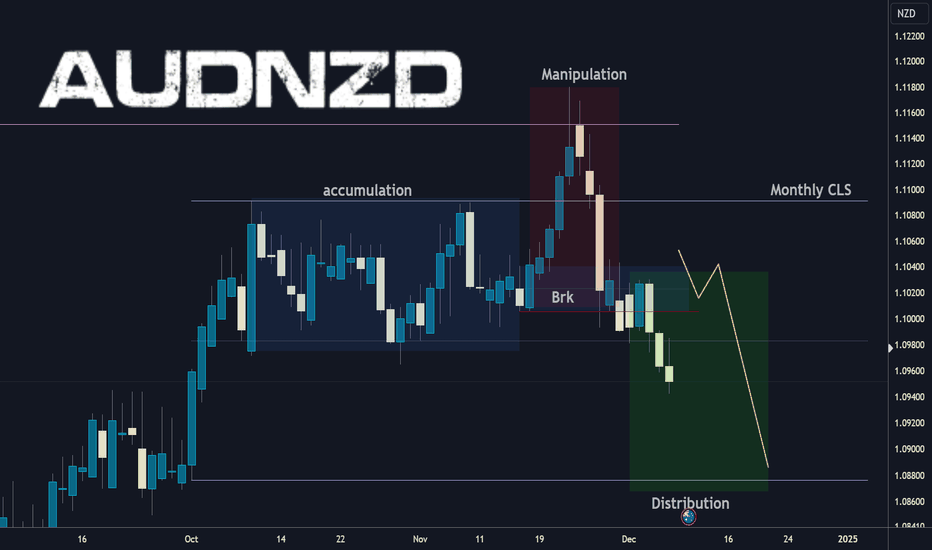

Monthly CLS range. AMD playing out. Shors in Distr. StageMonthly CLS range. AMD playing out. Short in the distribution phase

you are welcome to comment with your thoughts and share your charts or questions below, I like any constructive discussion.

What is CLS?

This company is trading for the biggest investment banks and central banks. They trade over 6.5 trillion daily volume. They are smart money of the all markets.

CLS operates in the specific times which will give you huge advantage and precisions to you entries. Focus on that. Its accuracy is amazing.

Good luck and I hope this educational post helps to become a better trader

“Adapt what is useful, reject what is useless, and add what is specifically your own.”

Dave FX Hunter ⚔

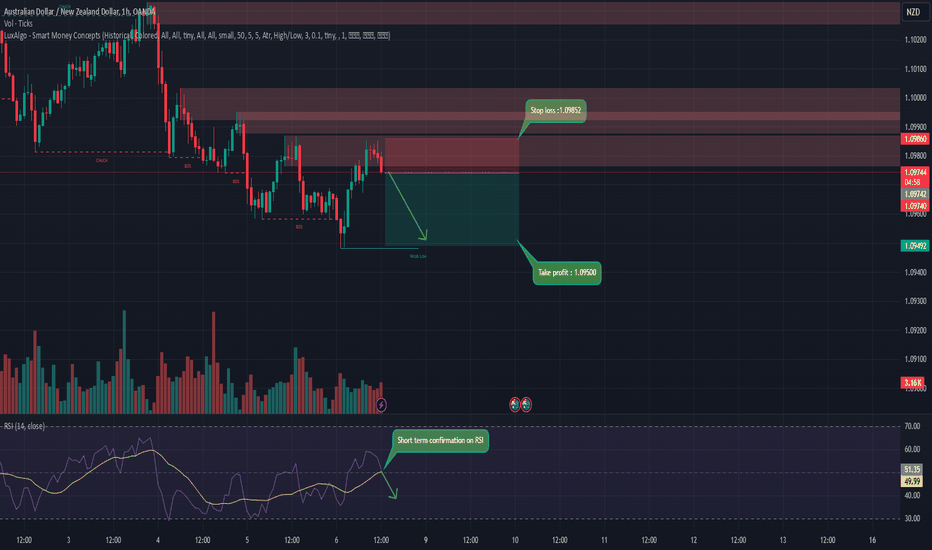

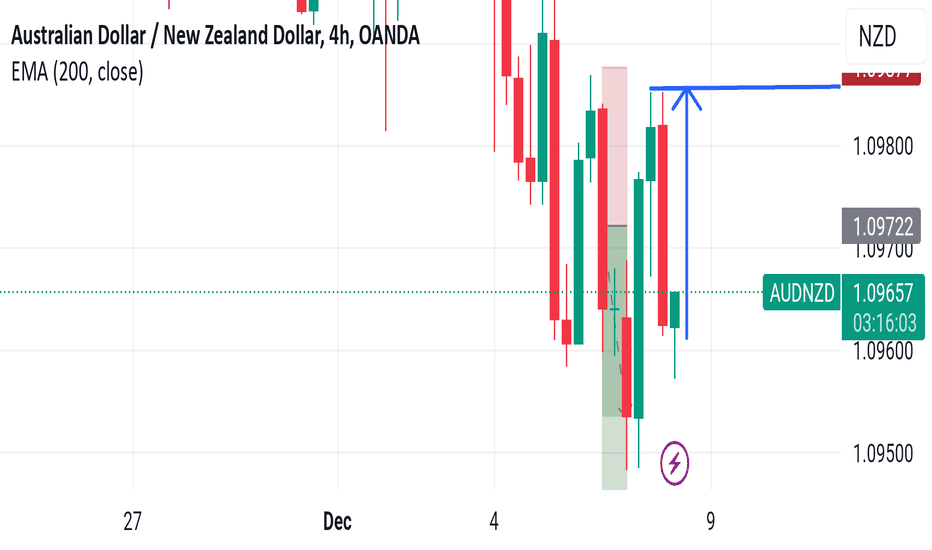

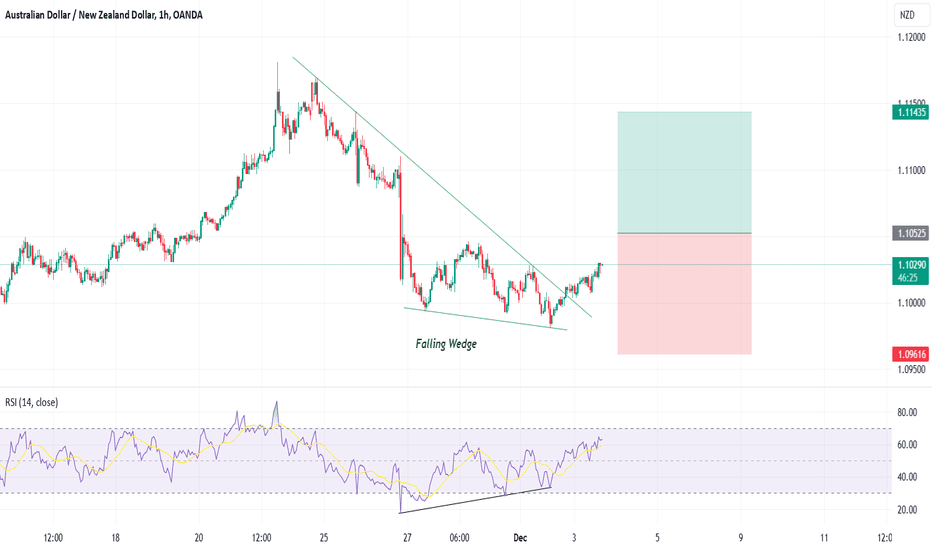

AUD/NZD Short term sell great potential.Hi dear friends, we would be looking at the AUD/NZD which has formulated a short term descending channel on the RSI ,

Entry : 1.09744

Take profit : 1.09500

Stop loss : 1.09852

As always my friends happy trading!

P.S. If you have questions or inquiries about one of my existing set-ups or personal questions / 1 on 1 sessions consider joining my channel so you can follow up with me in private!

AUDNZD Buy### Trade 1 - Buy AUDNZD Analysis

#### Factors Overview:

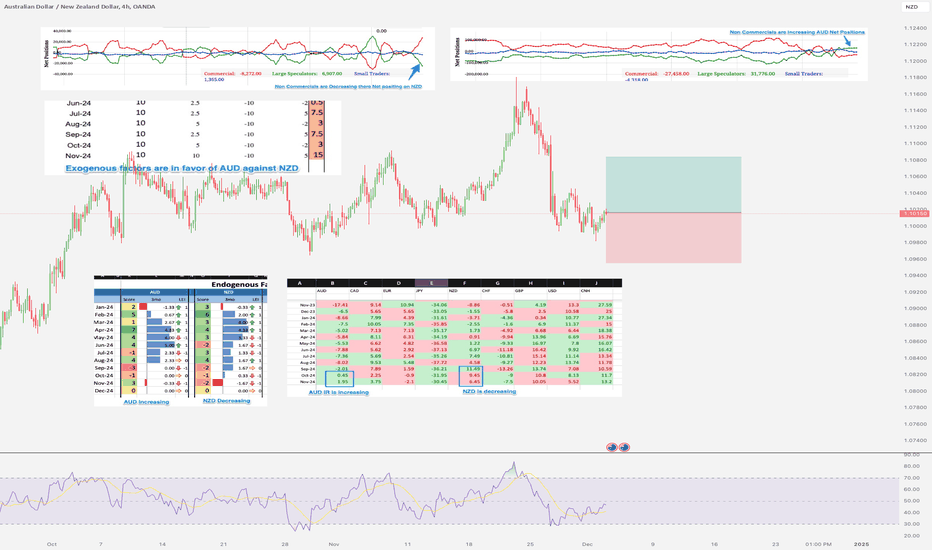

1. **Seasonals**:

- NZD is bullish (25 Nov - 11 Dec), while GBP is neutral.

- **Bias**: Slightly favors NZD.

2. **COT Index**:

- NZD at the bottom, GBP near the top.

- **Bias**: Favors AUD due to stronger relative COT positioning.

3. **Non-Commercials**:

- GBP shows "Buy," while NZD indicates "Sell."

- **Bias**: Favors AUD.

4. **Endogenous Factors (Endo)**:

- NZD is decreasing, while GBP remains neutral.

- **Bias**: Supports AUD.

5. **Exogenous Factors**:

- **GDP**: Positive for GBP, negative for NZD → Favors AUD.

- **BOP Change**: Negative for GBP, positive for NZD → Favors NZD.

- **Stocks**: Positive for GBP, negative for NZD → Favors AUD.

- **IR (Interest Rates)**: Positive for GBP, negative for NZD → Favors AUD.

- **Overall Exogenous Score**: GBP (32.5), NZD (-150).

- **Bias**: Strongly supports AUD.

6. **Conditional Scoring**:

- Positive: GBP (10), NZD (13).

- Negative: GBP (5), NZD (5).

- **Bias**: Slight advantage to NZD on positivity score, but largely neutral.

---

#### Final Bias:

Despite the seasonals favoring NZD, the combined COT, endogenous, and exogenous factors strongly favor AUD.

---

#### Trade Bias: **Buy AUDNZD**

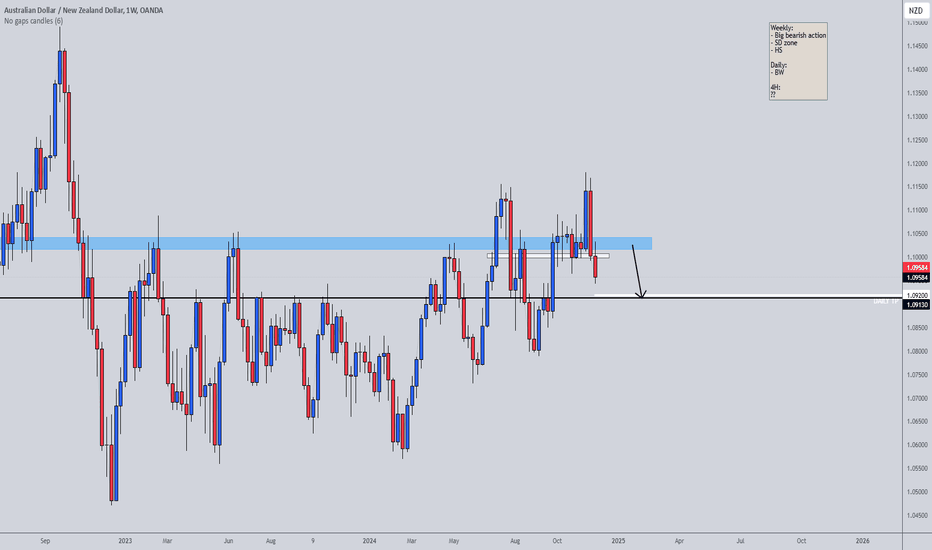

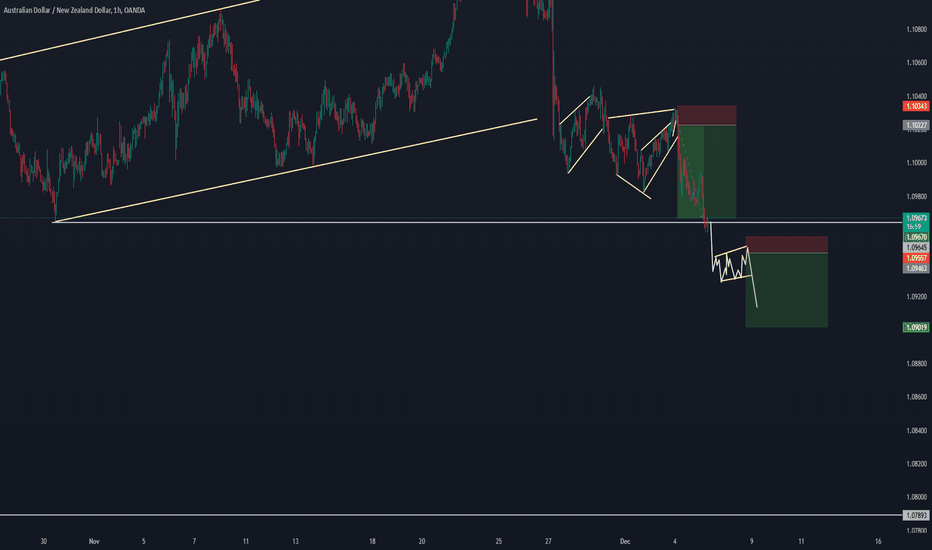

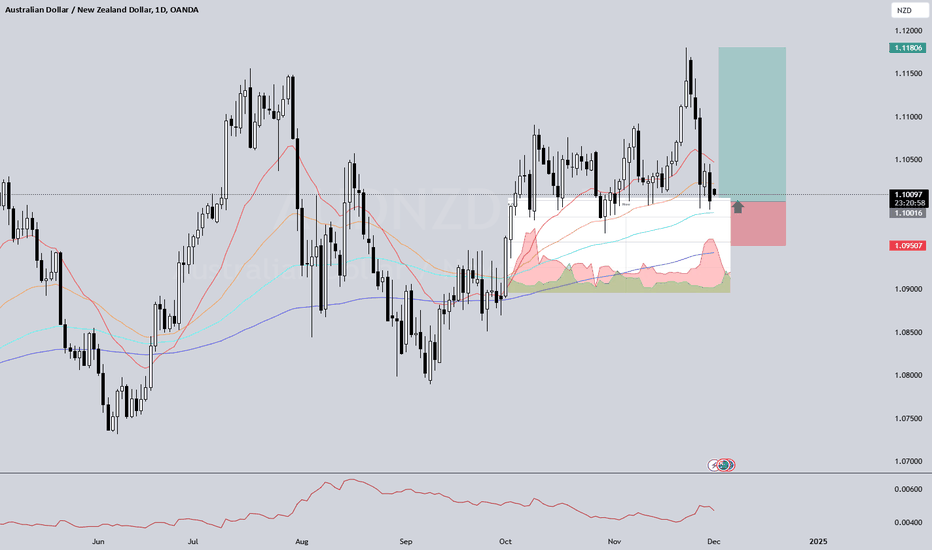

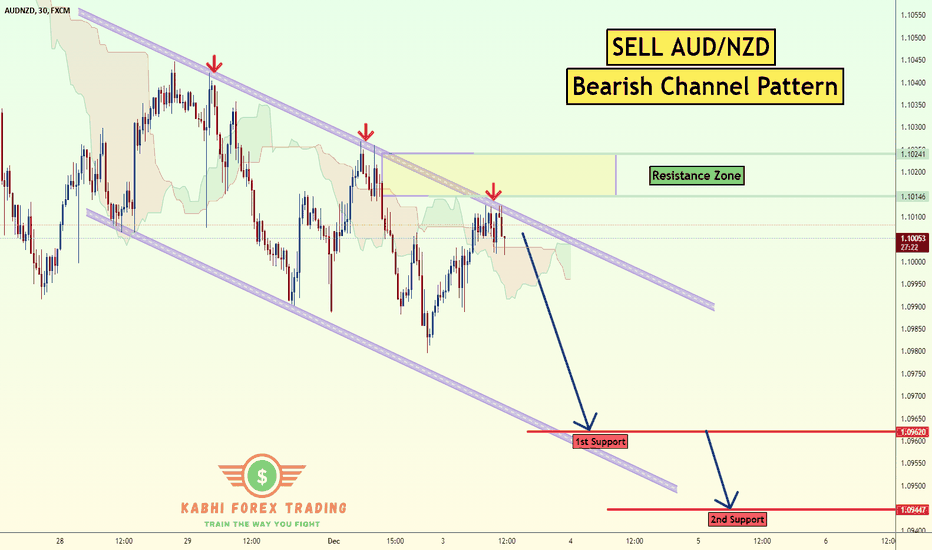

AUDNZD - Look for a short !!Hello traders!

‼️ This is my perspective on AUDNZD.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. My point of interest is imbalance filled + rejection from bearish OB.

Like, comment and subscribe to be in touch with my content!

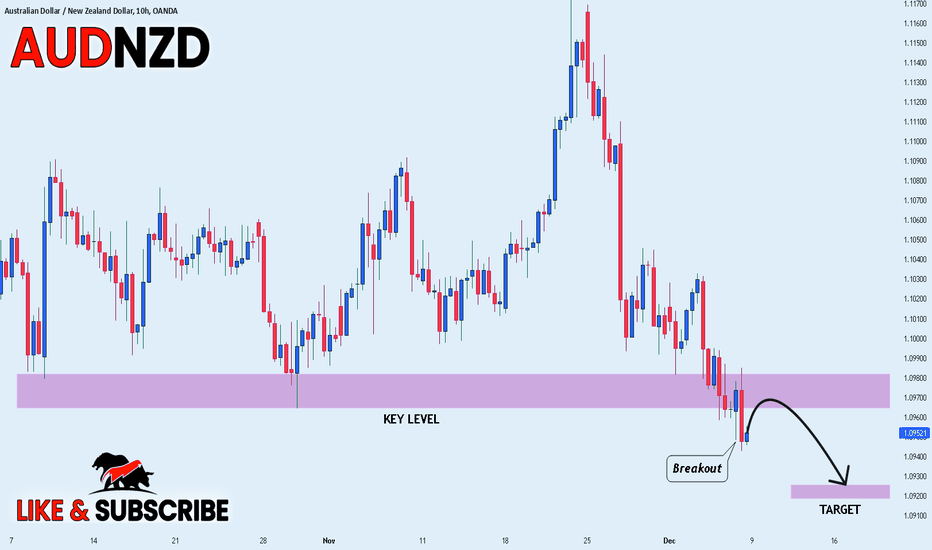

AUD NZD**🚀 T.Y.L.A. Family, Let’s Celebrate! 🏆**

We’ve done it again, team! Despite some challenges with the **XRPUSD** and **Gold** setups, we’ve officially recovered, and *all setups have come into profit!* 🙌 This is the consistency and resilience that sets us apart.

Here’s a quick breakdown of a setup we haven’t revisited in a while:

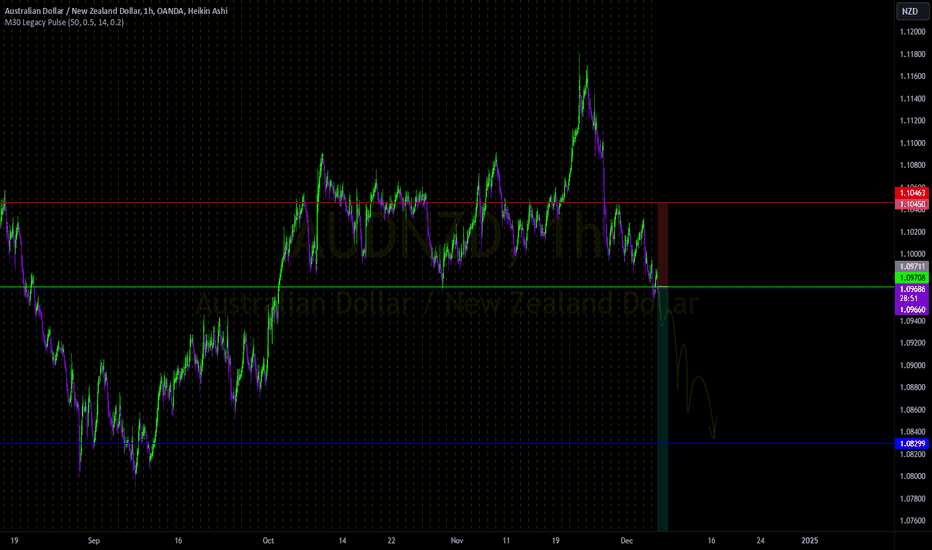

**Pair:** AUDNZD

📌 Entry: 1.09708

📌 Stop Loss: 1.10463

📌 Take Profit: 1.08299

This week, we’re back on track with it, showing steady progress. As always, **trade cautiously**—especially this week, because it’s **NFP Week!** 🗓️

NFP (Non-Farm Payrolls) tends to bring high volatility, so let’s stick to our strategy and remain disciplined. The market rewards patience, and we’re here to grow, not gamble. 💯

Remember, every setback is just a setup for a stronger comeback. Let’s keep pushing forward, staying consistent, and maintaining our focus on steady, sustainable growth.

Cheers to another successful week! 🎉

**Stay locked in and trade smart, T.Y.L.A. fam!**

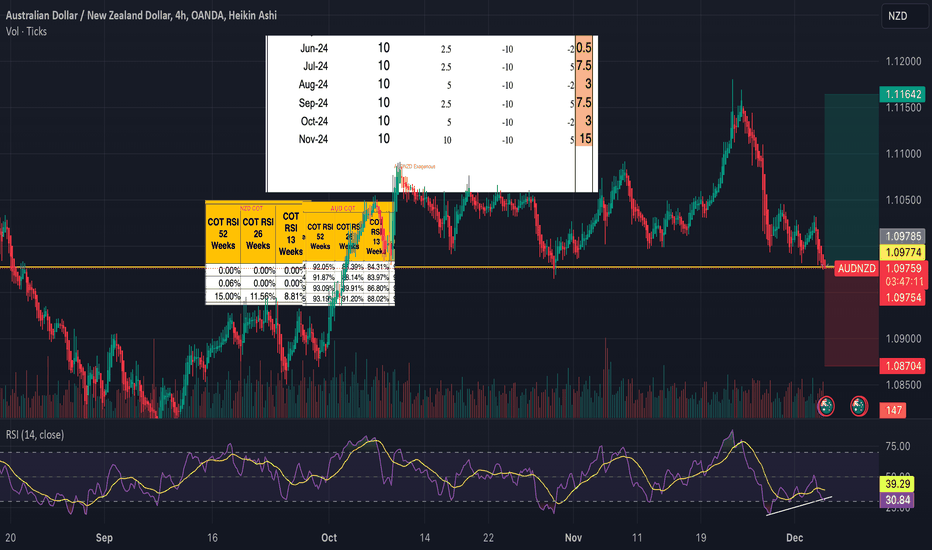

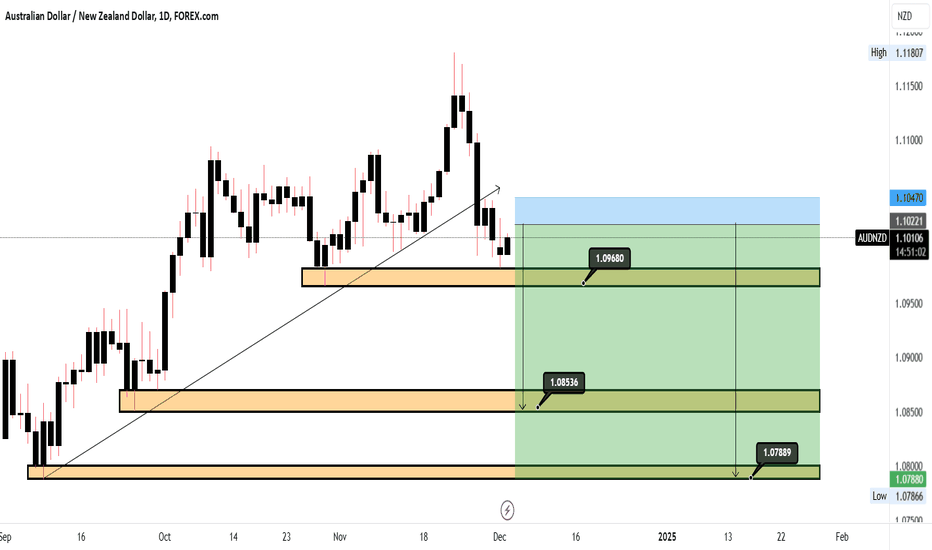

AUDNZD Analysis - Bullish - Trade 07AUDNZD Analysis Overview

---

1. Seasonality

AUD: Strong **buy** signal for the first week of December, suggesting upward momentum.

NZD: Range-bound signal, indicating weaker performance compared to AUD.

Seasonality Bias: Buy AUDNZD.

---

2. COT Report

AUD:

COT RSI : Decreasing from the top but still indicates bullish positioning.

COT Index : Near the top, signaling strong institutional interest in AUD.

Net Non-Commercial : Increasing, aligning with a buy sentiment.

NZD :

COT RSI : At the bottom (0%), but overall positioning is weak.

COT Index : Bottomed at 0%, reflecting limited institutional support for NZD.

Net Non-Commercial : Decreasing, suggesting bearish momentum.

COT Bias: Buy AUDNZD.

---

3. Fundamental Analysis

Leading Economic Indicators (LEI) :

AUD : Increasing, pointing to improving economic conditions.

NZD : Increasing, but weaker overall impact compared to AUD.

Endogenous Factors:

AUD : Mix to decreasing, but seasonal strength supports AUD’s buy case.

NZD : Increasing, but weaker compared to AUD.

Exogenous Factors :

AUDNZD exogenous signal supports a buy AUD, sell NZD bias.

Fundamental Bias: Buy AUDNZD.

---

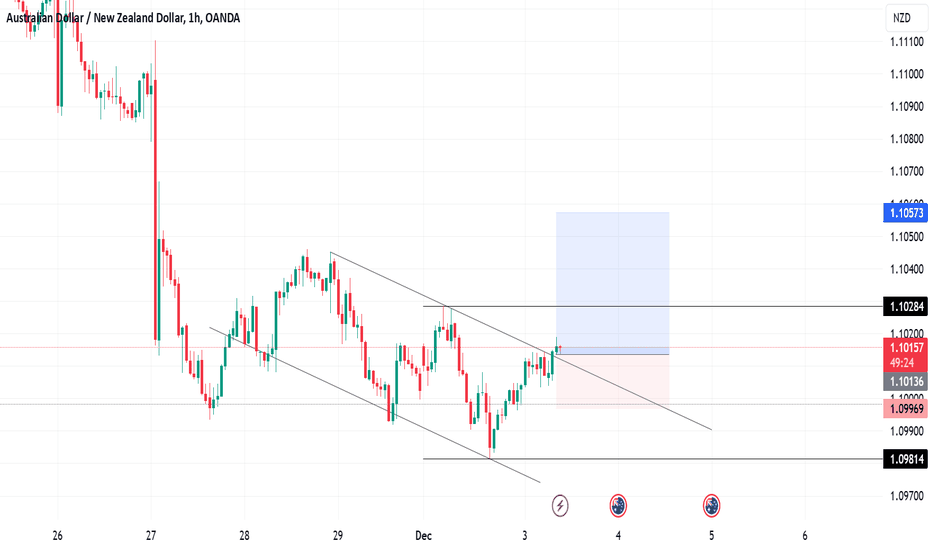

4. Technical Analysis

RSI Divergence: Bullish divergence spotted on the 4H timeframe, signaling potential upward movement.

Parallel Channel : Price is at the bottom of a bearish parallel channel, indicating possible reversal to the upside.

Daily Support : Currently holding above a strong daily support zone, reinforcing the bullish setup.

Technical Bias: Buy AUDNZD.

---

Final Bias: Buy AUDNZD

All factors—seasonality, COT data, fundamentals, and technicals—align in favor of a BUY setup for AUDNZD. This pair shows potential for upward movement, supported by strong economic and technical signals.

AUDNZD FORECASTTraders! The lesson that I want to give you today is, try to build the habit of strong reasoning before making any decision to execute position. Make sure you have a good thought process by starting to build the portifolio of evidence from the higher timeframe to lower timeframe. Always trade process is key.

AUDNZD BullishTechnical Analysis

Divergence:

The RSI divergence on the 4-hour AUD/NZD chart suggests a potential reversal or slowing of the downtrend.

The price has made lower lows, while the RSI shows higher lows, indicating bullish divergence. This is a sign of weakening bearish momentum and the possibility of a reversal or consolidation.

Support Zone:

The price is hovering around a strong horizontal support level (yellow line). This area has previously acted as a support, increasing the likelihood of a bounce.

Volume:

Declining volume in the downtrend indicates weak bearish pressure, which further supports the case for a reversal.

Fundamental Analysis Bias

AUD Fundamentals (Strong):

COT RSI data for the AUD shows higher percentages across 13, 26, and 52-week periods, indicating strong speculative positioning for AUD. This reflects a positive sentiment toward AUD

.

NZD Fundamentals (Weak):

NZD COT RSI values are significantly lower, showing weakness in speculative sentiment compared to AUD.

Endogenous Factors (Mixed):

The endogenous factor table shows mixed scores. However, AUD scores are generally less negative or neutral, while NZD has slightly weaker scores. This gives AUD a slight fundamental edge.

Overall Bias:

The AUD/NZD pair's fundamental bias aligns bullish for AUD based on the data. If NZD fundamentals weaken further, this adds to the bullish outlook.

Conclusion and Trade Bias

Technical:

Bullish Divergence + Support Zone: Favor a bounce or reversal in the short term.

Watch for RSI to cross above 50 and confirmation of higher highs in price.

Fundamental:

AUD appears fundamentally stronger than NZD, supporting a medium-term bullish bias for the pair.

Trade Plan

Entry: Consider entering long positions near the current support level if bullish candles form on higher timeframes.

Stop Loss: Place stops slightly below the support zone.

Take Profit: Target previous resistance levels around 1.1050 and 1.1100.

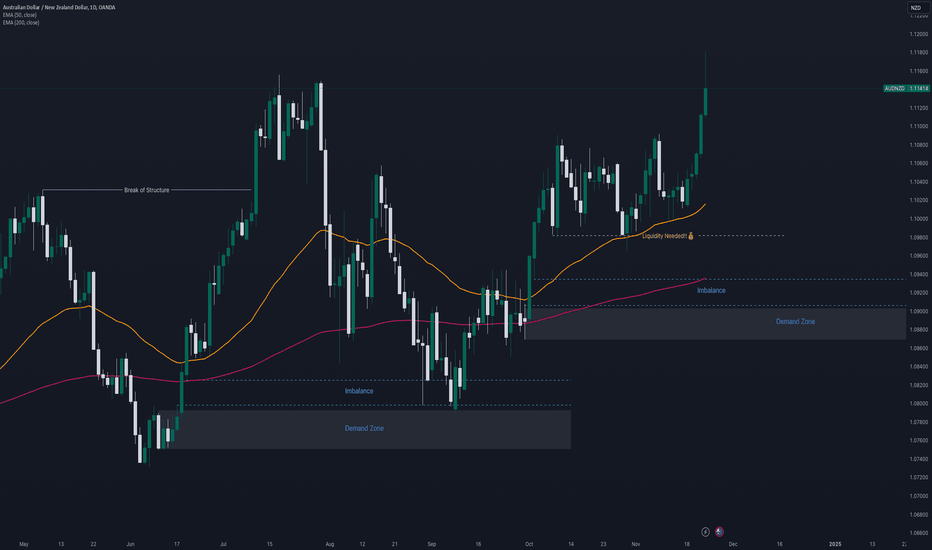

Long tern effect We're about to create another BOS, and for the upcoming days we're going to make huge pull-back for the market to have enough liquidity to go Long.

for this the Market as we see on my chart is doing well and we're going to to wait until the opportunity comes on the right place and on the right time so we can go Long.. This trend will take several weeks to come into our Golden Zone.

Even if you take Fibonacci the number will align well with the strategy there

AUD/NZD Analysis: Bullish Momentum Fueled by Institutional PositAUD/NZD shows strong potential for continued upside, supported by large speculators who are holding long positions, as indicated by the latest COT data. This aligns with the typical contrarian dynamic, where retail traders remain predominantly bearish, positioning themselves against the trend.

When retail sentiment is overwhelmingly negative, it often creates an opportunity for institutional players to push prices higher, targeting retail stop-loss orders. This dynamic suggests that AUD/NZD is well-positioned for further gains as institutional buying pressure outweighs the retail skepticism.

With speculators backing the bullish trend and retail traders positioned against it, the pair is primed for sustained upside. Traders should keep an eye on key support zones and potential entry points to capitalize on the continuing bullish momentum.

AUDNZD LongCOT Report

- Non Commercials are reducing net positions in NZD, showing weakness in NZD.

- Non Commercials are increasing net positions in AUD, showing strength in AUD.

Endogenous Factors

- NZD score is falling from +4 to -2 in the last three months

- AUD score is increasing from -3 to 3 in the last three months

Exogenous Factors

- NZD Interest Rate is getting weaker

- AUD Interest Rate is getting stronger

- Overall Exogenous Factors are in favor of AUD against NZD

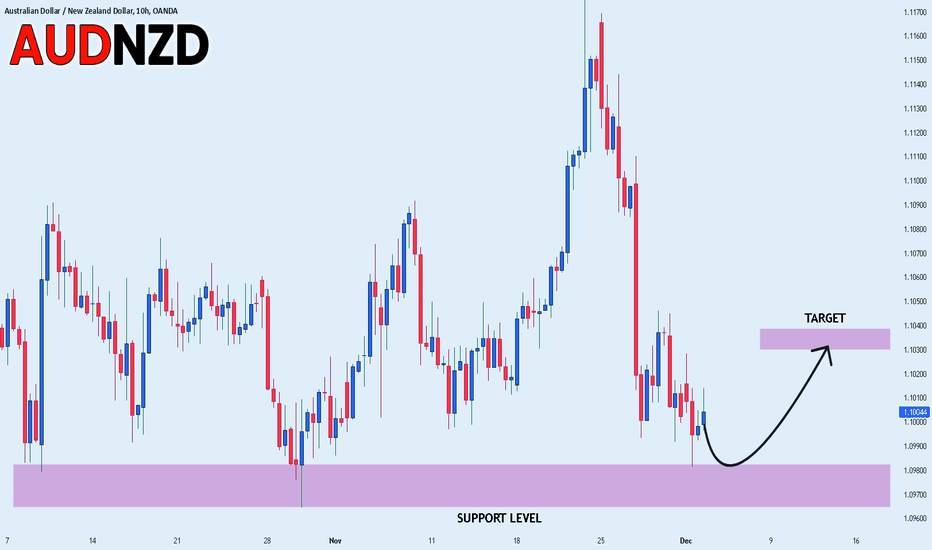

AUDNZD Will Go Higher From Support! Long!

Please, check our technical outlook for AUDNZD.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 1.101.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.105 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

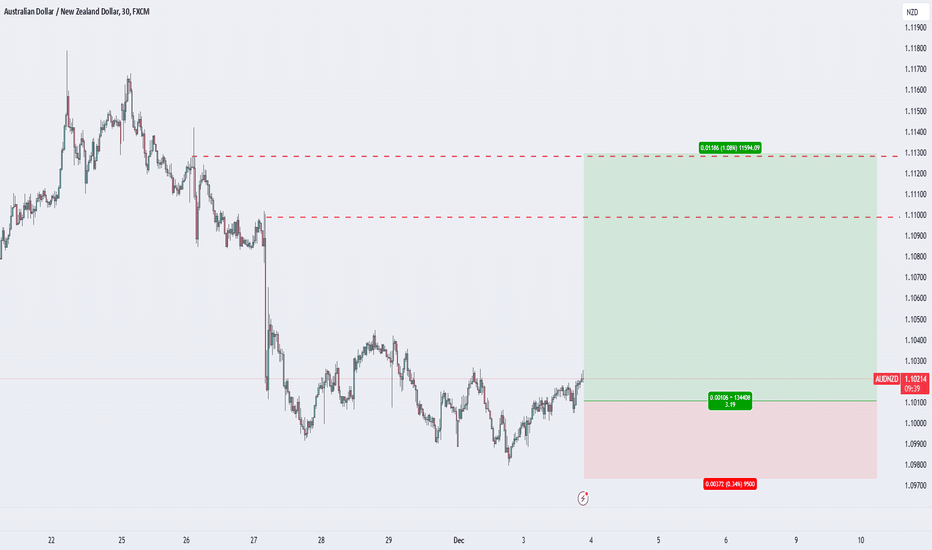

Sell AUD/NZD Bearish ChannelThe AUD/NZD pair on the M30 timeframe presents a potential selling opportunity due to a recent downward breakout from a well-defined Bearish Channel pattern. This suggests a shift in momentum towards the downside in the coming Hours.

Key Points:

Sell Entry: Consider entering a short position around the current price of 1.1005, positioned close to the breakout level. This offers an entry point near the perceived shift in momentum.

Target Levels:

1st Support – 1.0962

2nd Support – 1.0944

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI FOREX TRADING

Thank you.