AUDUSD trade ideas

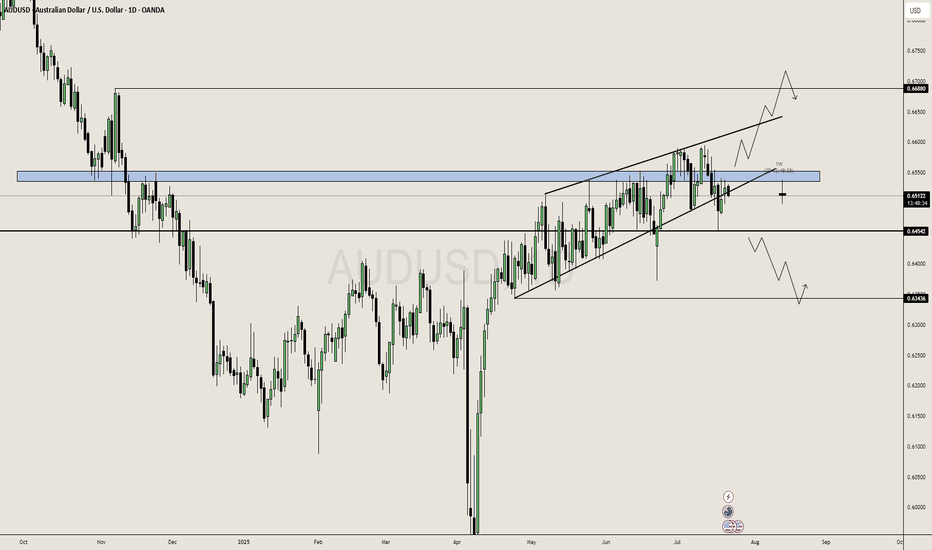

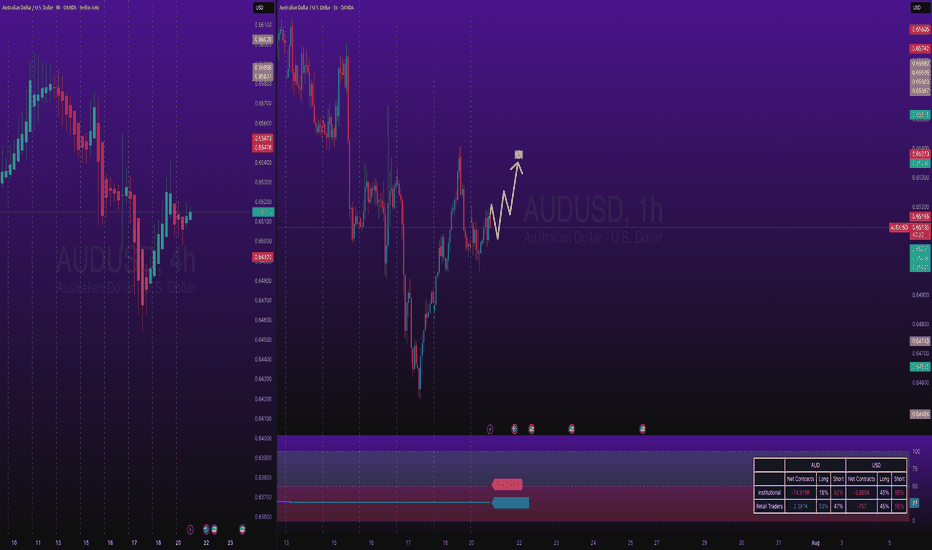

AUDUSD holding, Might Trigger a Upside MoveAUDUSD is still in Solid Sideways Range in Daily Chart. More Probabilities looking towards buy side, looking for liquidity at 0.66880.

It's in Range since 18 April, 2025 and hunting liquidity for both the buyers and sellers. Possibly it could trap seller and go in Buy Side.

In other case, The Sell Momentum can come if it breaks and holds below the 0.64500 Level. Then we can expect a sell momentum till the support level of 0.63400.

Daily is in Range so we can Predict the Price more clearly but if any of level from support or resistance breaks we can see a long-term Opportunity.

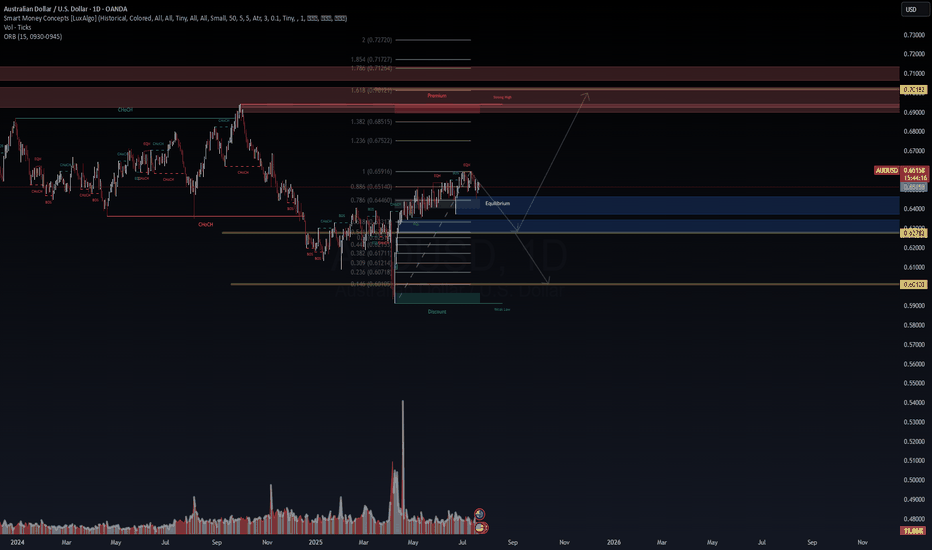

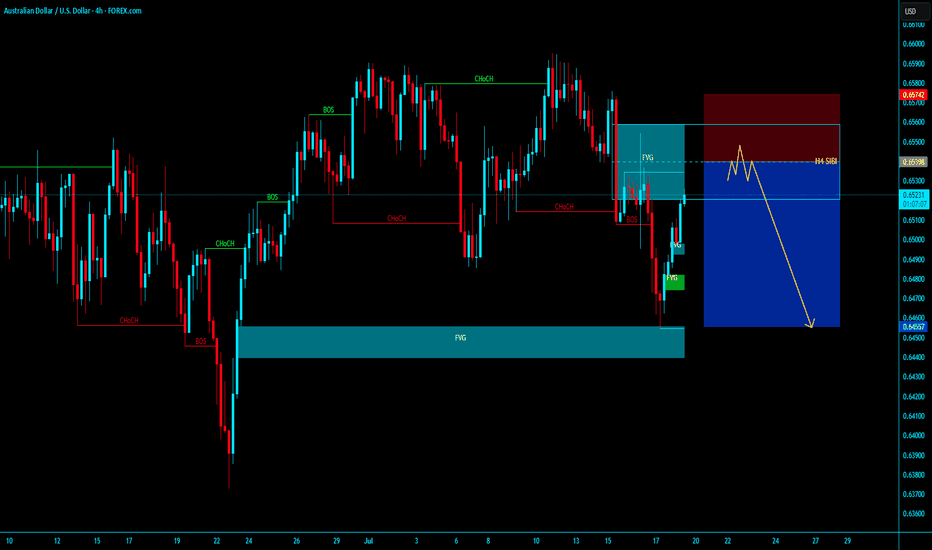

VolanX AUD/USD Tactical Short ThesisVolanX AUD/USD Tactical Short Thesis

The Aussie is showing signs of exhaustion near the 0.886 retracement and has swept major equal highs. Liquidity was engineered and harvested.

Now price is sliding into a vacuum—first target is the imbalance around 0.6440, with a deeper structural demand zone below at 0.6278.

We are positioned via /6AU5 put options, targeting this sweep as AUD re-aligns with declining China demand, copper softness, and USD firmness.

🎯 Trade Type: Long Put (0.6400P)

🎯 Target: 0.6278

🎯 Trigger: BOS below 0.6485

#VolanX #MacroTrading #SMC #AUDUSD #Options #Futures #TradingView #SmartMoney #InstitutionalLevels

AUDUSD Long PullbackOANDA:AUDUSD taking a pullback towards up, catching this pullback.

Note: I am not adding levels etc on chart because I am tired and need to go for breakfast first, simply sharing the what I see.

I manage trade on daily basis.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

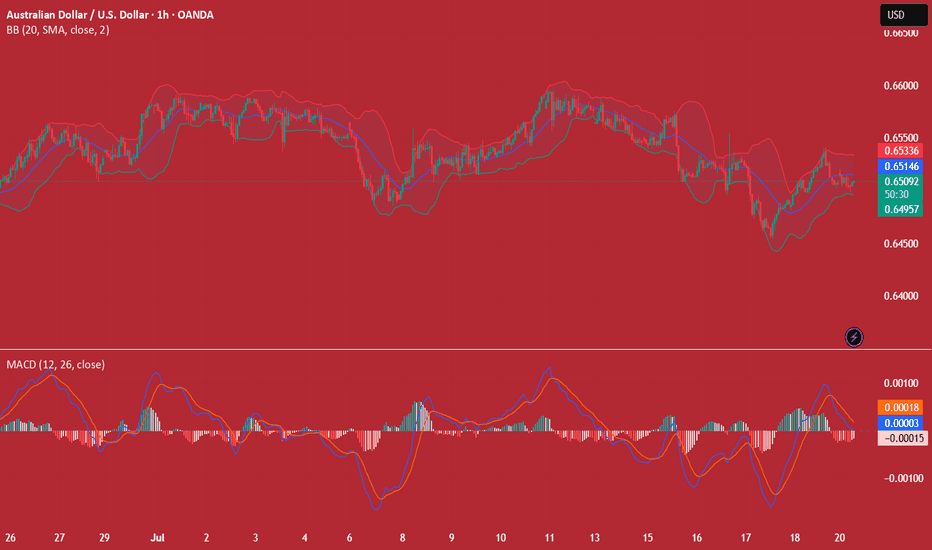

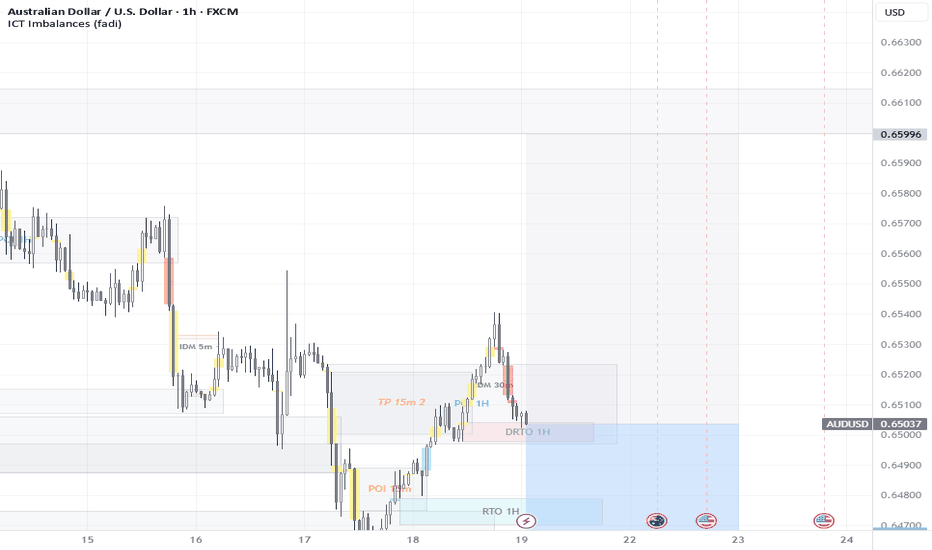

AUDUSD(20250721)Today's AnalysisMarket news:

Waller refused to comment on whether he would dissent at the July meeting, saying that the private sector was not performing as well as people thought, and said that if the president asked him to be the chairman of the Federal Reserve, he would agree.

Technical analysis:

Today's buying and selling boundaries:

0.6506

Support and resistance levels:

0.6572

0.6547

0.6531

0.6481

0.6466

0.6441

Trading strategy:

If the price breaks through 0.6531, consider buying, and the first target price is 0.6547

If the price breaks through 0.6506, consider selling, and the first target price is 0.6481

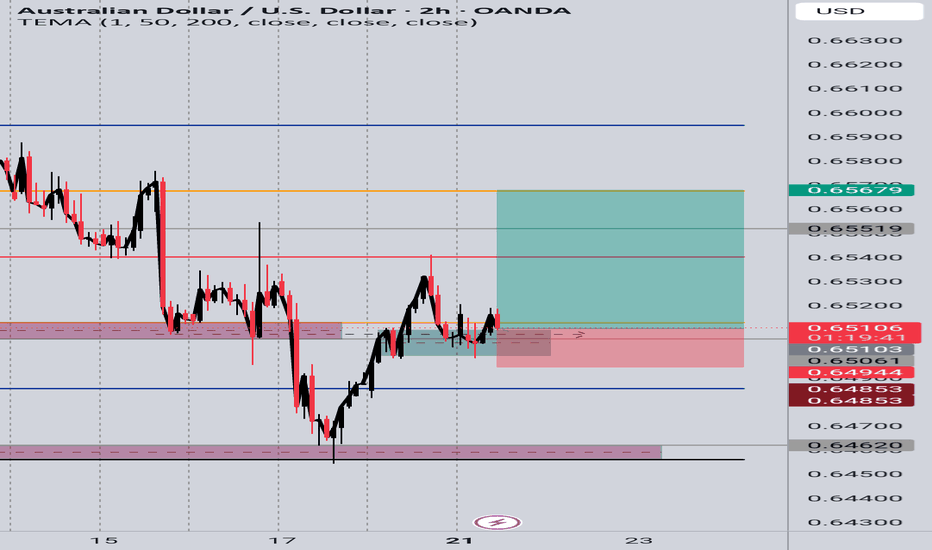

AUD/USD 2H – Price Action Buy SetupAfter a strong bullish push, price pulled back into a previous demand zone near 0.65000, where buyers had clearly stepped in before.

The previous resistance around 0.6510 was broken and now appears to be acting as support — a classic sign of a break and retest.

The current bullish rejection candle near the zone confirms buying interest.

✅ Entry: Around 0.6500

❌ Stop Loss: Below the recent low / demand zone (~0.6485)

🎯 Take Profit: 0.6550 and 0.6567 (previous swing high

Price is now forming higher lows and pushing upward — watching for continuation toward the next resistance.

#AUDUSD #PriceAction #BreakAndRetest #ForexSetup #SupportResistance #TrendContinuation #ForexAnalysis

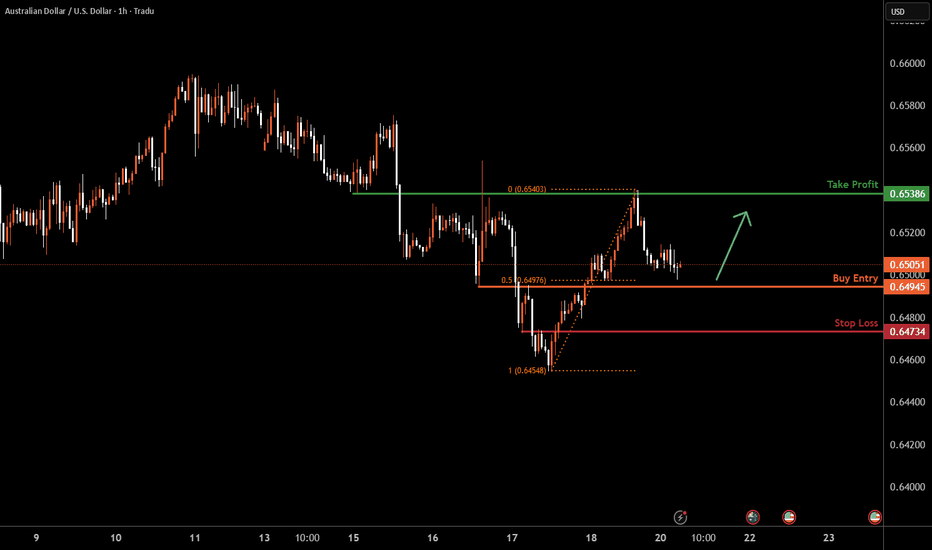

AUDUSD H1 I Bullish Bounce off the 50% FibBased on the H1 chart analysis, the price is approaching our buy entry level at 0.6494, a pullback support that aligns with the 50% Fib retracement.

Our take profit is set at 0.6538, an overlap resistance.

The stop loss is placed at 0.673, a pullback support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

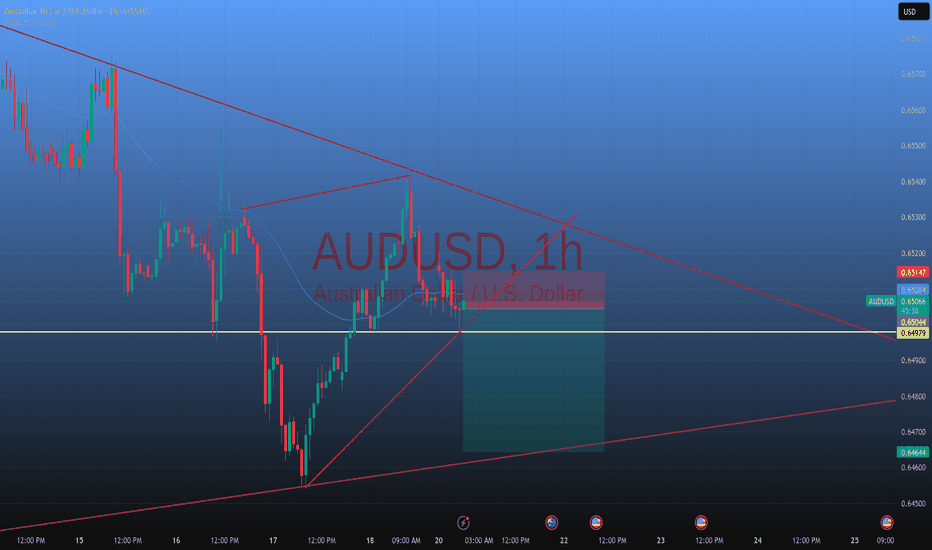

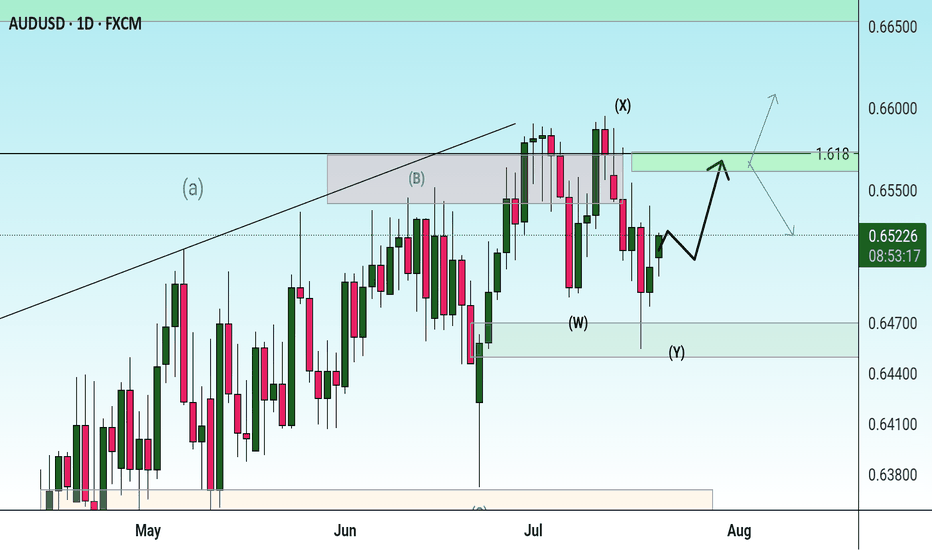

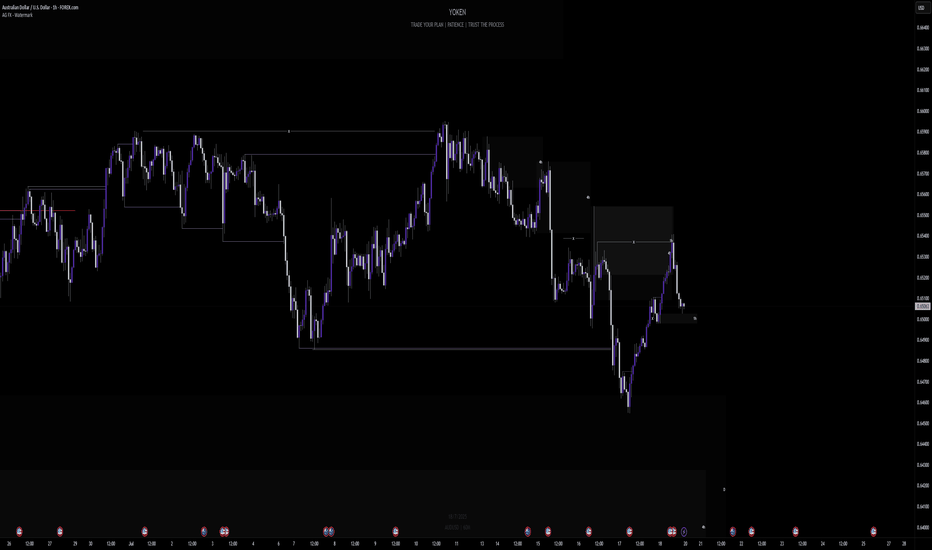

Week of 7/20/25: AUDUSD AnalysisLast week's price action was bearish and this week I will follow bearish order flow unless internal 1h structure continues to be bullish. I'm going to look for shorts after 1h internal structure is broken as confirmation, then take trades down to the daily demand zone and then look for bullish signals.

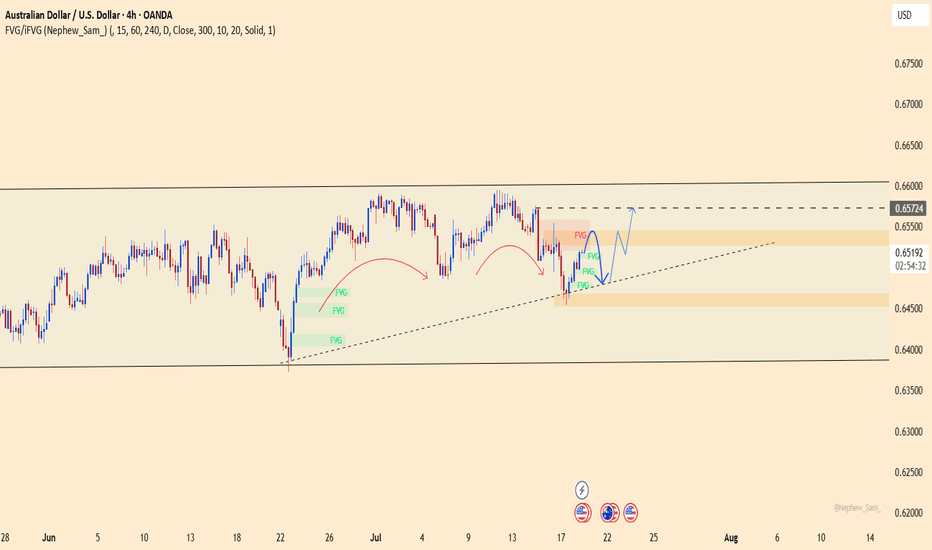

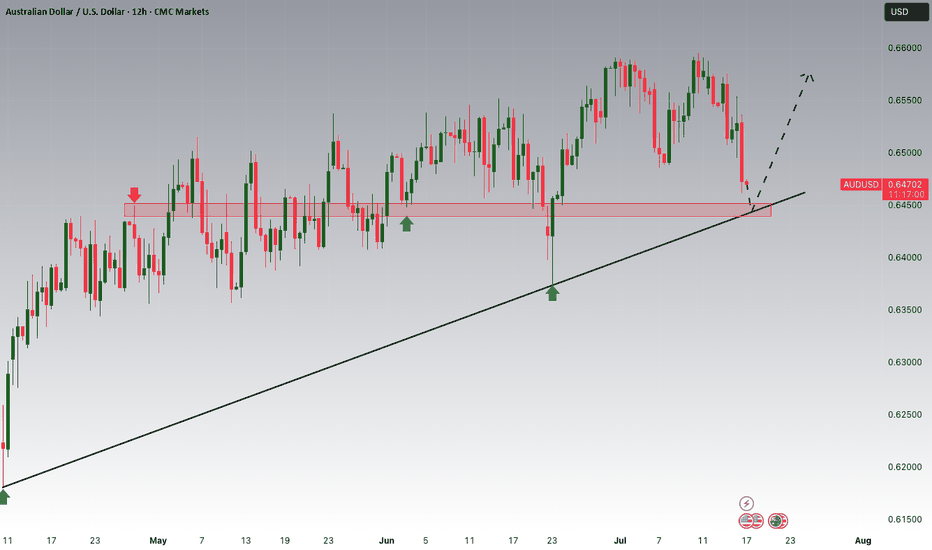

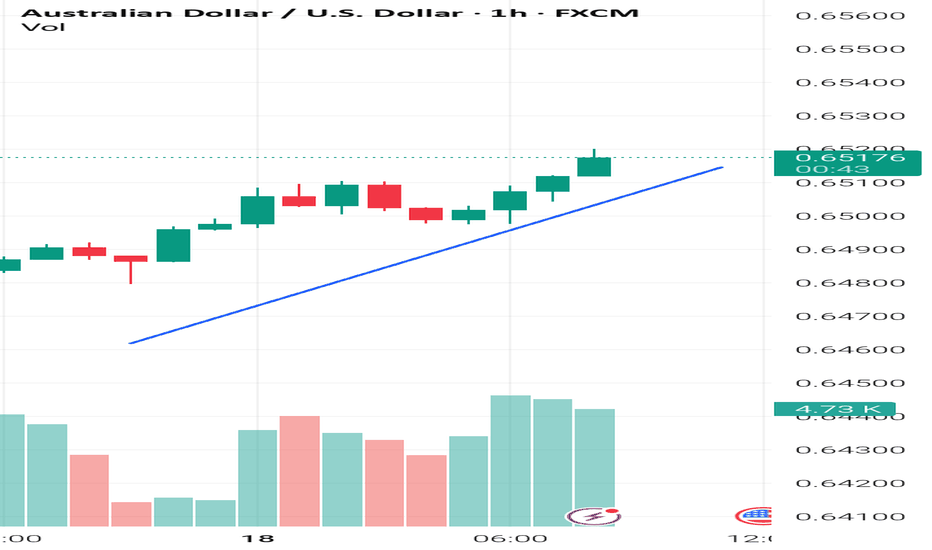

AUDUSD – bullish momentum returns, ready for a breakout?AUDUSD is showing clear strength after rebounding from a key support zone. The bullish structure remains intact with a series of higher lows, and the ascending trendline continues to hold. The recent pullback appears to be a healthy retracement before the market gathers momentum for the next leg up.

On the news front, the pair is supported by strong Australian employment data and expectations that the Federal Reserve will keep interest rates steady. This has slightly weakened the US dollar, giving AUD room to recover.

If buying pressure holds, AUDUSD could break through the overhead resistance and enter a new bullish phase. Now is the time for traders to watch price action closely and wait for a clear confirmation signal!

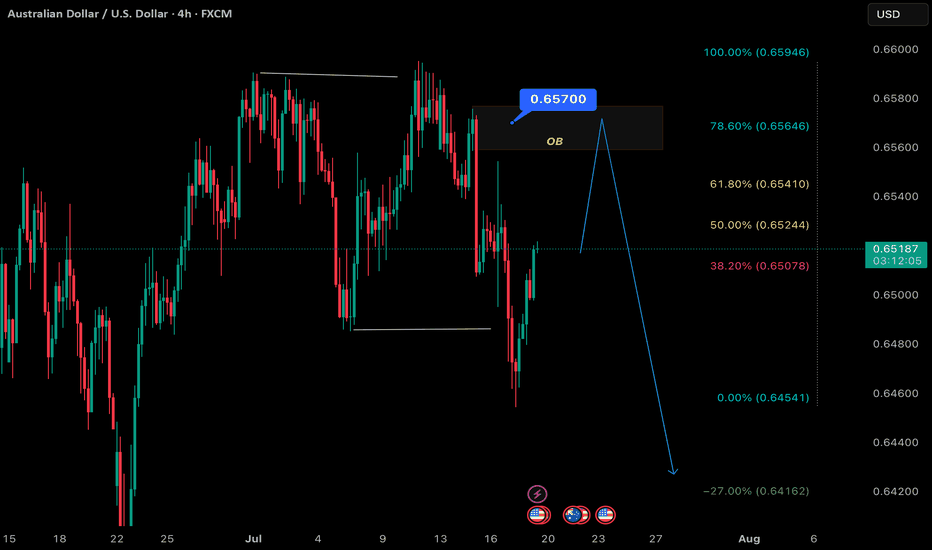

idea on a chartUD/USD stays mildly on the downside at this point. Fall from 0.6594 is tentatively seen as a correction to rise from 0.5913. Deeper fall would be seen to 38.2% retracement of 0.5913 to 0.6594 at 0.6334. Strong support could be seen there to bring rebound. For now, near term outlook is neutral as long as 0.6594 resistance holds, and more consolidations would be seen.

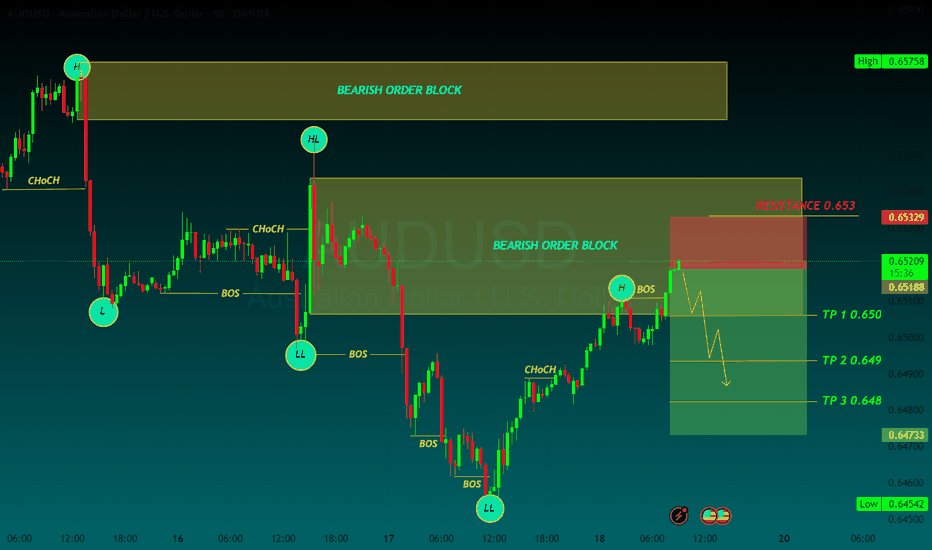

AUDUSD SELLAUD/USD dives to three-week lows near 0.6560 after weak Australian employment data

The Australian Dollar is one of the weakest performers of the G8 currencies on Thursday, hammered by a disappointing Australian Employment report and the overall risk-averse market, which is boosting demand for safe-haven assets, such as the US Dollar

The battle between the Australian Dollar (AUD) and the US Dollar (USD) will be one worth watching in 2025, with central banks stealing the limelight. The Reserve Bank of Australia (RBA) has kept interest rates at record highs whilst most of its overseas counterparts started the loosening process. The US Federal Reserve (Fed), on the other hand, has trimmed the benchmark interest rate by 100 bps through 2024 and aims to slow the pace of cuts in 2025. The central banks’ imbalance aims for record lows in AUD/USD

TP 1 0.650

TP 2 0.649

TP 3 0.648

RESISTANCE 0.653

AUD USD long to close out the week? With the S&P pushing new highs, the VIX below 17 and recent dovish comments from WALLER. I feel the stage could be set for a positive end to the week. The WALLER comments having moved the needle towards USD weakness into the weekend.

I've left the JPY alone due to potentially strange movent ahead of weekend elections.

The trade is a 20 pip stop loss with a 25 pip profit target.

I've chosen the AUD to long because at the time of placing the trade, it's the currency that has momentum against the other currencies.

It sounds simple but the risk to the trade is USD strength.

If it's ongoing, I will close the trade before end of day to avoid weekend risk.

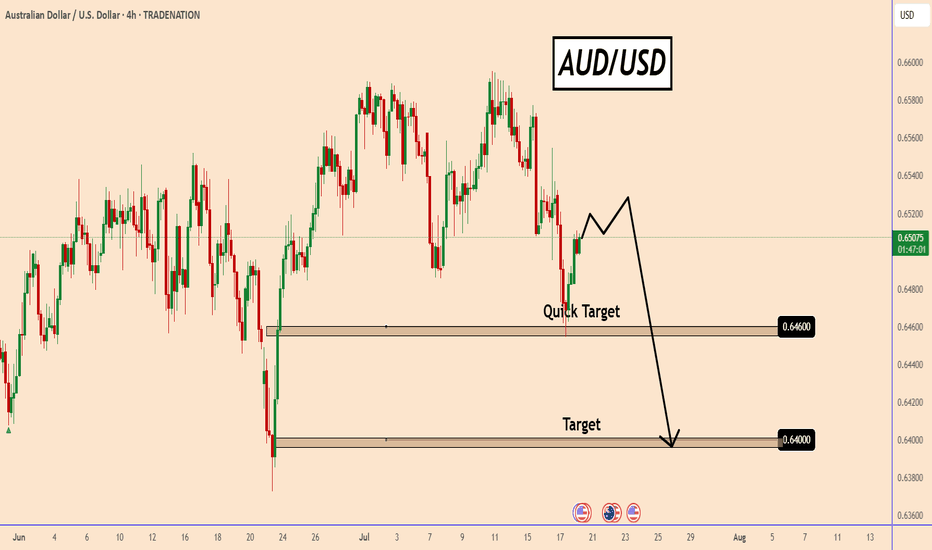

AUDUSD could fall again despite bullish momentumAUDUSD could fall again despite bullish momentum

AUDUSD found strong support near 0.6460.

Overnight the price rose despite the lack of any news on the economic calendar.

This could be related to the low volume of the current month and perhaps small currency injections or profit taking create such moves.

The price is not yet clear, but there is a high possibility of further decline in the coming days. It may show signs of reversal soon and could fall to 0.6460 and 0.6400.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

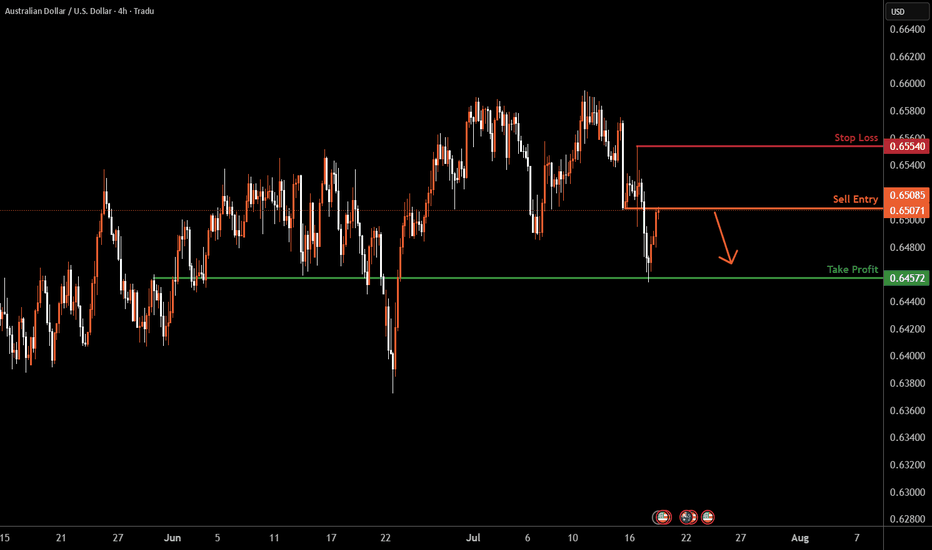

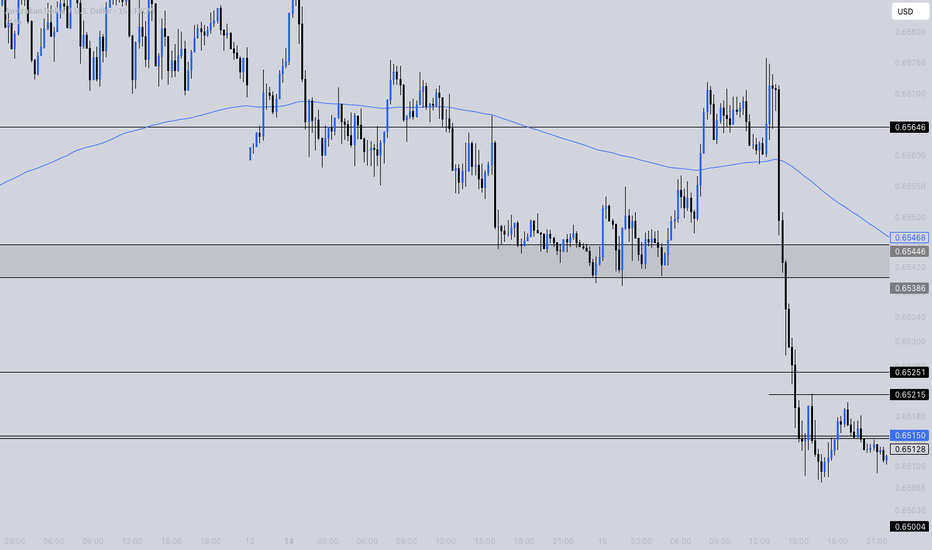

AUDUSD H4 I Falling from the pullback resistanceBased on the H4 chart, the price is testing our sell entry level at 0.6508, a pullback resistance.

Our take profit is set at 0.6457, an overlap support.

The stop loss is set at 0.6554, a swing high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

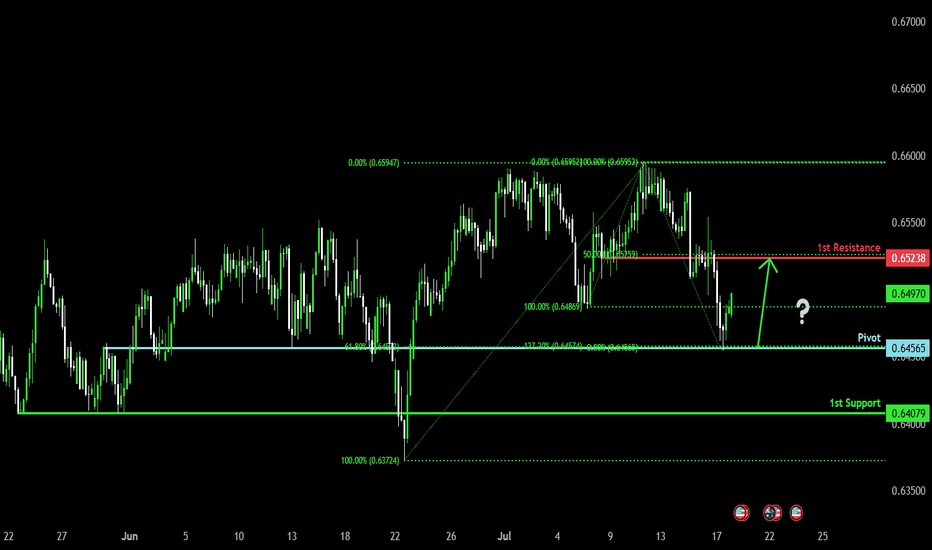

Bullish bounce?The Aussie (AUD/USD) has bounced off the pivot and could rise to the 1st resistance.

Pivot: 0.6456

1st Support: 0.6407

1st Resistance: 0.6523

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

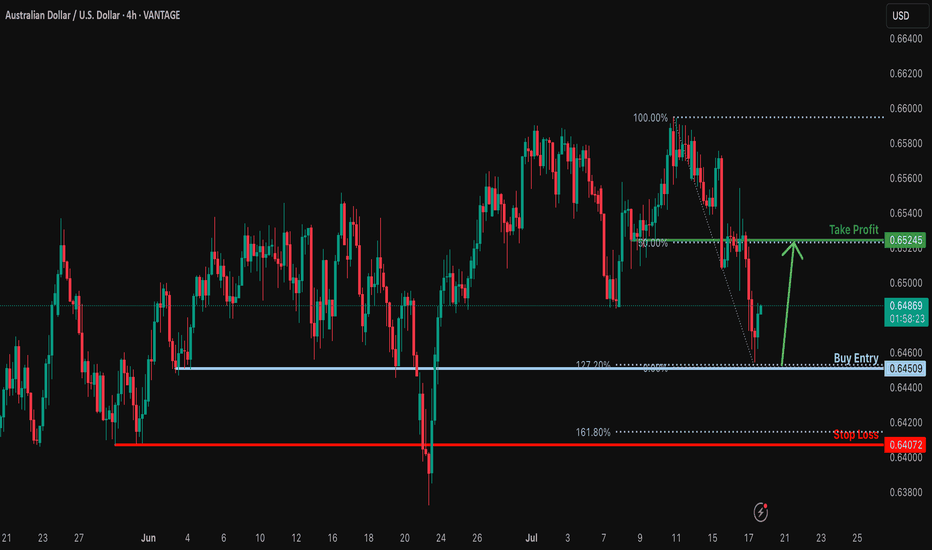

Bullish bounce off for the Aussie?The price has bounced off the support level which is a pullback support that aligns with the 127.2% Fibonacci extension and could potentially rise from this level to our take profit.

Entry: 0.6450

Why we like it:

There is a pullback support that aligns with the 127.2% Fibonacci extension.

Stop loss: 0.6407

Why we lik eit:

There is a pullback support that is slightly below the 161.8% Fibonacci extension.

Take profit: 0.6524

Why we like it:

There is an overlap resistance that lines up with the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

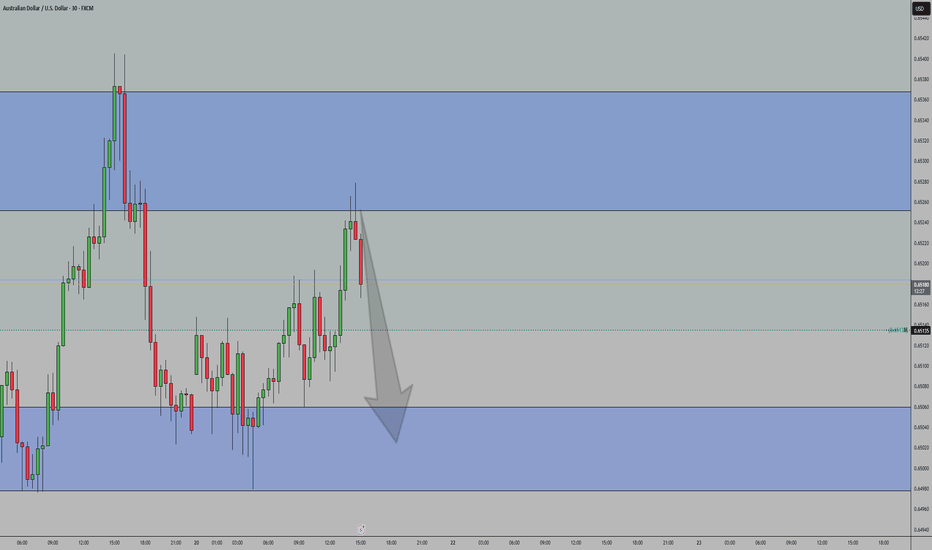

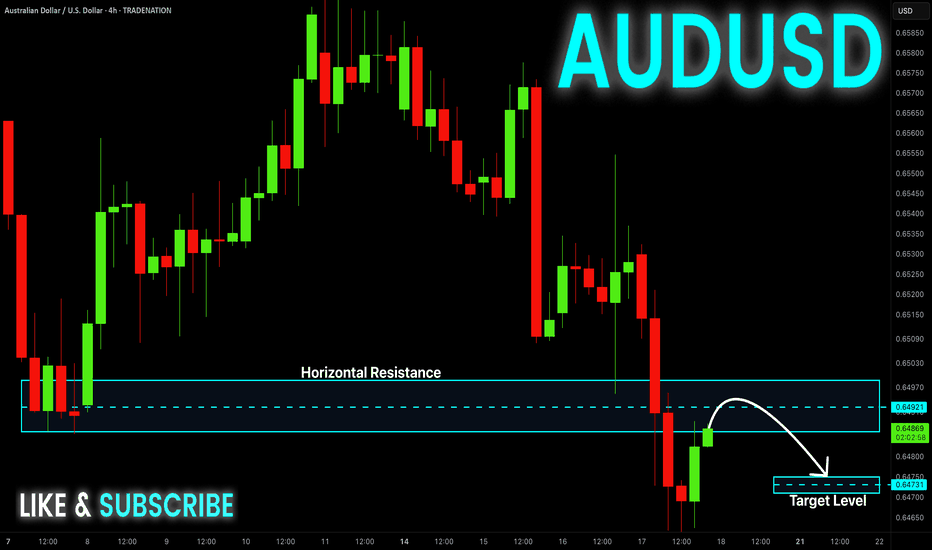

AUD-USD Local Short! Sell!

Hello,Traders!

AUD-JPY is making a bullish

Rebound and the pair is

Making a retest of the key

Horizontal resistance of 0.6497

From where we will be

Expecting a local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.