#Avalanche (AVAX) Setup | Can Subnets Ride the ETF Wave?📌 Coin: AVAX (Avalanche)

💰 Buy Levels:

✅ First Entry: $25.00

✅ Second Entry: $22.00

✅ Third Entry: $19.00

🛑 Panic / SL Level: Weekly close below $17.00

🧠 Fundamental Analysis (FA) – In Short

*️⃣ Sector: Layer 1 / Modular Smart Contract Platform

*️⃣ Use Case: Avalanche is a high-performance blockchain enabling scalable, low-latency dApps, tokenized assets, and Web3 games through custom subnets.

*️⃣ Tech: Uses Avalanche consensus across three chains (X/P/C), delivering near-instant finality, sub-second transaction speed, and flexible design.

*️⃣ Narrative Fit: Strong narrative alignment with RWA (Real World Assets), Web3 Gaming, and future ETF inclusion due to institutional activity.

*️⃣ Enterprise Adoption: Already used by JPMorgan pilot programs, Citi, Deloitte, MasterCard, and more — making it one of the few real-world-tested chains.

*️⃣ Unique Angle: Subnets allow permissioned chains, native gas tokens, and fully custom blockchains — ideal for both DeFi and enterprise.

📊 Tokenomics & Market Data

(As of July 2025)

🪙 Current Price: ~$23.30

🧾 Market Cap: ~$9B

🔢 Rank: Top 15

🧮 Circulating Supply: ~395M AVAX

🔒 Max Supply: 720M AVAX

🔥 Deflationary Mechanism: AVAX burn from fees, reducing long-term supply

🛠️ Validator Rewards: Distributed through staking + subnet usage

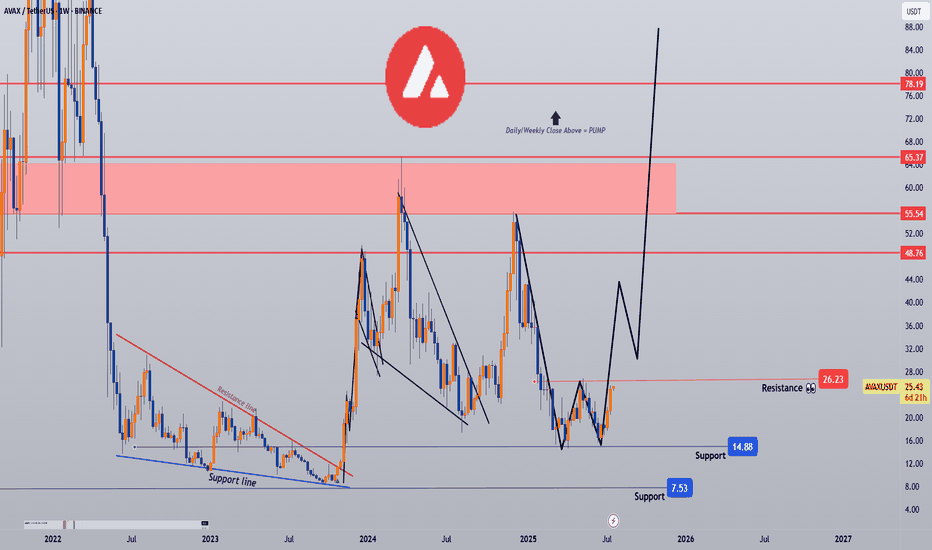

🎯 Bull Market Target (Realistic)

Target Range: $48 – $65

*️⃣ Based on prior cycle resistance, subnet growth, and DeFi/gaming recovery.

🚀 Mega Bullish Target (Speculative Top)

Target Range: $95 – $135+ $200

*️⃣ Avalanche is at the front of RWA tokenization, already powering platforms like Intain, and involved in enterprise pilots with Citi, JPMorgan, and Mastercard.

*️⃣ If RWA becomes the core crypto narrative, Avalanche’s modular subnet design could drive institutional adoption at scale.

*️⃣ While not yet in ETFs, its technical credibility + enterprise presence makes it a top candidate for future L1 ETF exposure or crypto asset baskets.

*️⃣ Combine institutional flow + Web3 gaming + subnet scaling, and you get a realistic path to triple-digit price discovery.

✅ Final Take

🧠 Avalanche is a technically mature Layer 1 with real-world traction and modular scaling via subnets — giving it strong utility and upside.

we ask Allah reconcile and repay

AVAXUSDT trade ideas

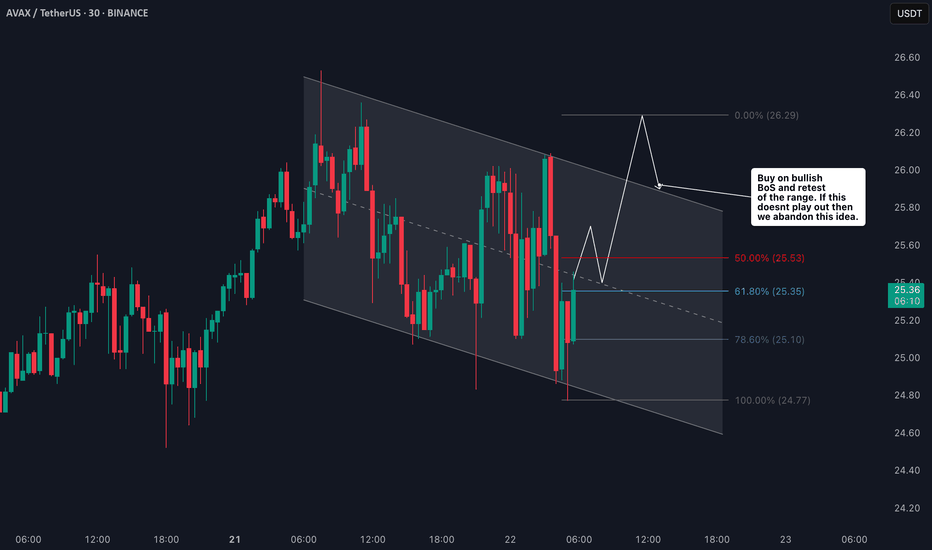

AVAX Long Swing Setup – Waiting for Support RetestAVAX has been rallying for two straight weeks, showing strong momentum. We’re watching for a healthy pullback into the $22.50–$24.00 support zone to position for continuation. If this zone holds, the risk/reward setup favors bulls with clear upside targets.

📌 Trade Setup:

• Entry Zone: $22.50 – $24.00

• Take Profit Targets:

o 🥇 $27 – $29

o 🥈 $33 – $35

o 🥉 $40 – $44

• Stop Loss: Daily close below $20.50

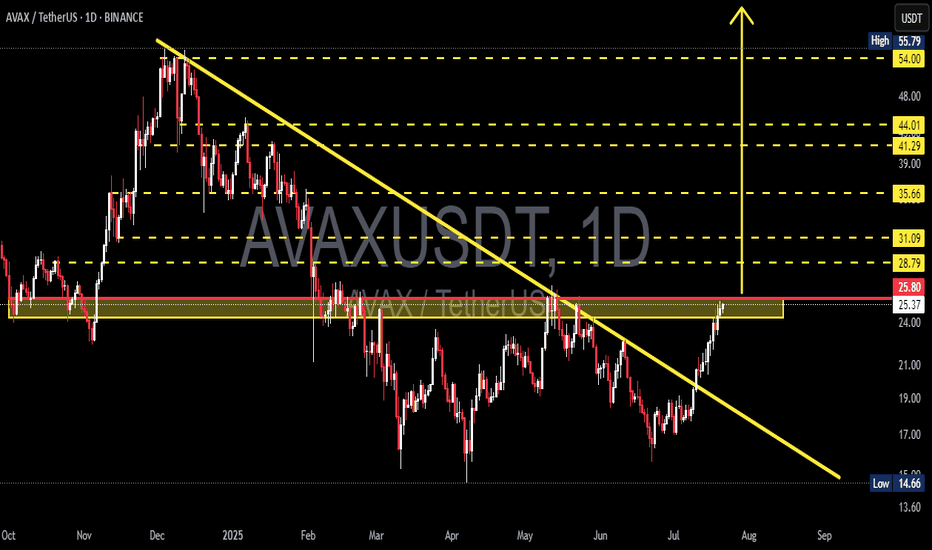

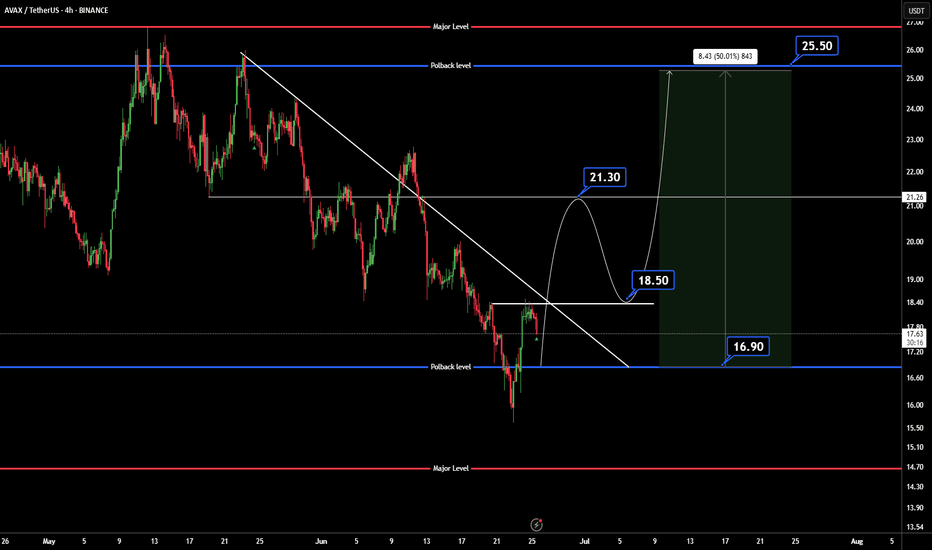

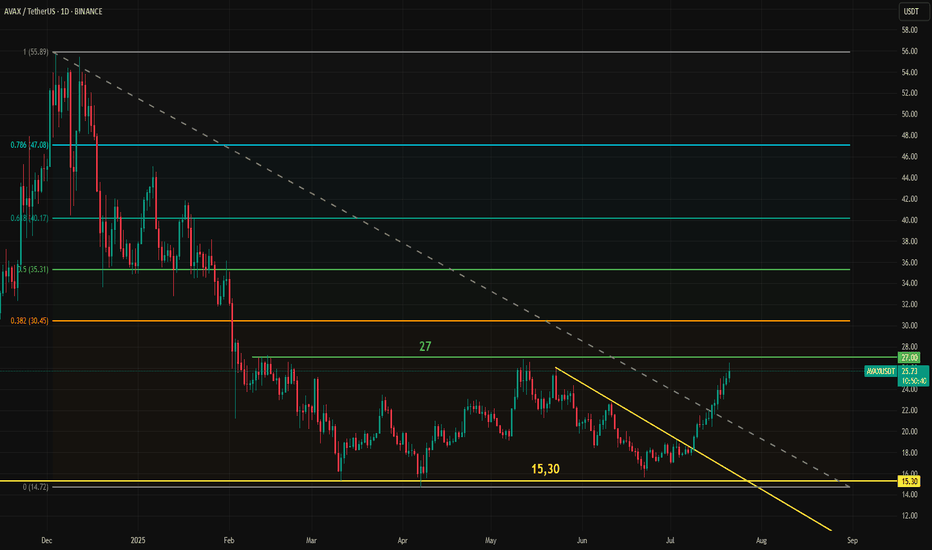

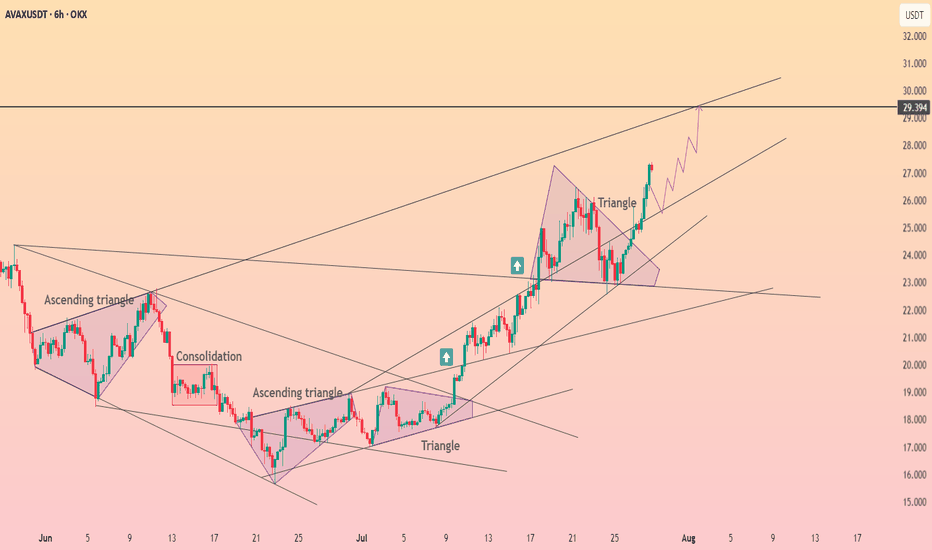

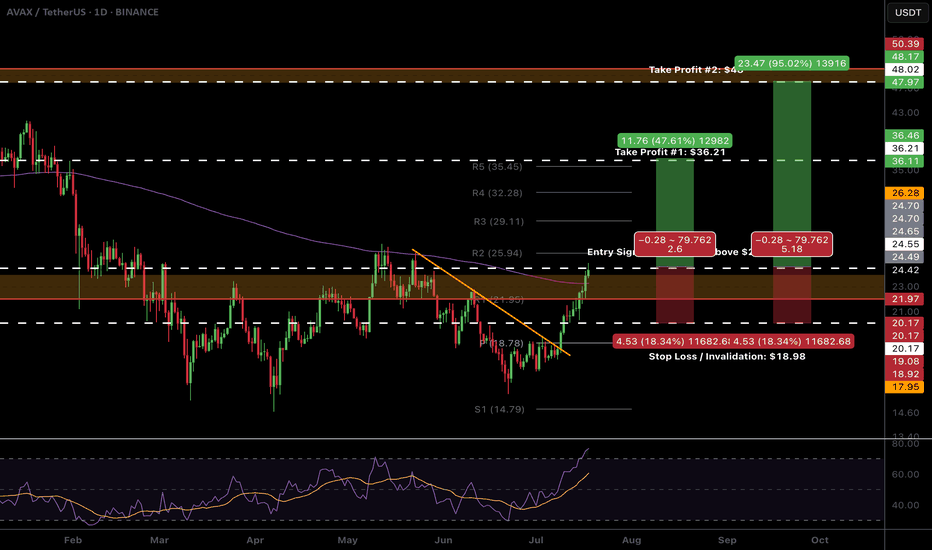

AVAX/USDT Massive Trend Reversal: Breakout from 8-Month DowntrenAVAX has just delivered one of its most technically significant moves in recent months. After spending over 8 months trapped under a descending resistance line, price action has finally broken free — suggesting a potential trend reversal and the beginning of a much larger bullish phase.

🧠 Pattern & Structure Breakdown:

📌 Descending Trendline Breakout

AVAX had been forming a descending triangle pattern, characterized by consistent lower highs and a horizontal support zone between $14.66 – $22. The recent bullish breakout from this structure, accompanied by strong volume, is a highly encouraging sign for bulls.

📌 Accumulation Zone Identified

The yellow zone on the chart ($14.66 – $22) has proven to be a strong demand zone where buyers consistently stepped in. The recent rally originates from this base, indicating possible institutional accumulation.

📌 Critical Horizontal Resistance at $25.80

Price is now testing the $25.80 resistance zone, which historically acted as a supply area. A successful daily close and confirmation above this level would officially flip the structure bullish.

📈 Bullish Scenario – Multi-Level Upside Targets:

If AVAX confirms the breakout above $25.80, these are the key bullish targets ahead:

🎯 Target 1: $28.79 – minor resistance & potential short-term TP zone

🎯 Target 2: $31.09 – previous price equilibrium

🎯 Target 3: $35.66 – key pivot from past market structure

🎯 Target 4: $41.29 and $44.01 – heavy historical supply zones

🎯 Target 5 (measured move): $54.00 to $55.79 – the projected breakout target from the descending triangle pattern

This move would represent a full technical recovery if AVAX aligns with broader market sentiment and Bitcoin remains stable or bullish.

📉 Bearish Scenario – Pullback Risks:

On the flip side, if price fails to sustain above $25.80 and gets rejected:

⚠️ A retest of $24.00 – $22.00 is likely

⚠️ If that zone breaks down, next support lies at $19.00 – $17.00

⚠️ A loss of the $17 level may trigger a return to the critical low near $14.66

This would invalidate the bullish breakout and return AVAX into a sideways or downward consolidation phase.

🔍 Additional Technical Insights:

✅ Volume is steadily increasing — showing renewed buying pressure

✅ Indicators like RSI and MACD (if applied) are likely showing bullish divergence

✅ Overall altcoin sentiment is improving, providing a tailwind for AVAX's potential breakout continuation

🧩 Final Thoughts:

AVAX is at a pivotal moment in its medium-term price structure. The breakout above the long-term downtrend line is a strong technical shift. A confirmed breakout and hold above $25.80 could trigger a multi-week or multi-month rally targeting $40 – $55+.

However, traders should be cautious of possible pullbacks and manage risk accordingly — especially as resistance zones from previous structures are being tested.

#AVAX #AVAXUSDT #CryptoBreakout #TechnicalAnalysis #Altcoins #BullishCrypto #DescendingTriangle #ReversalPattern #AVAXAnalysis

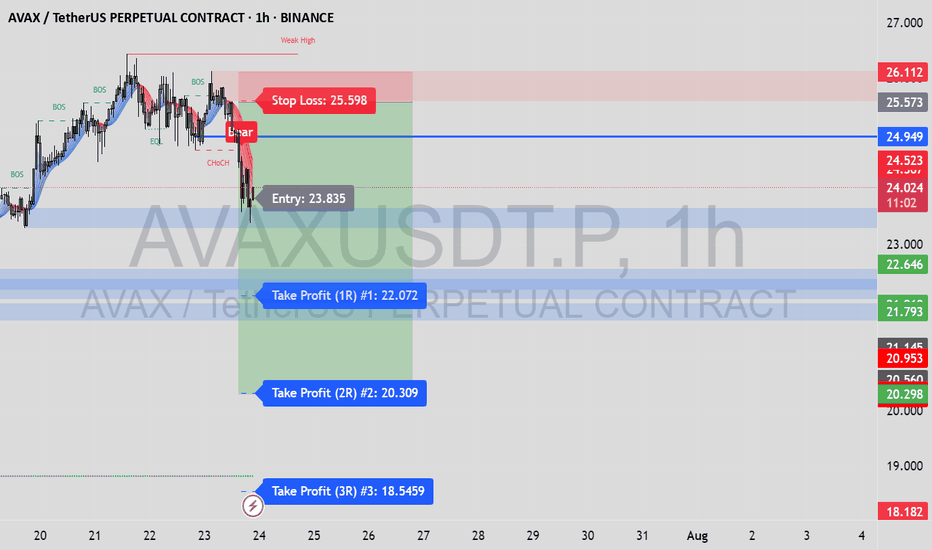

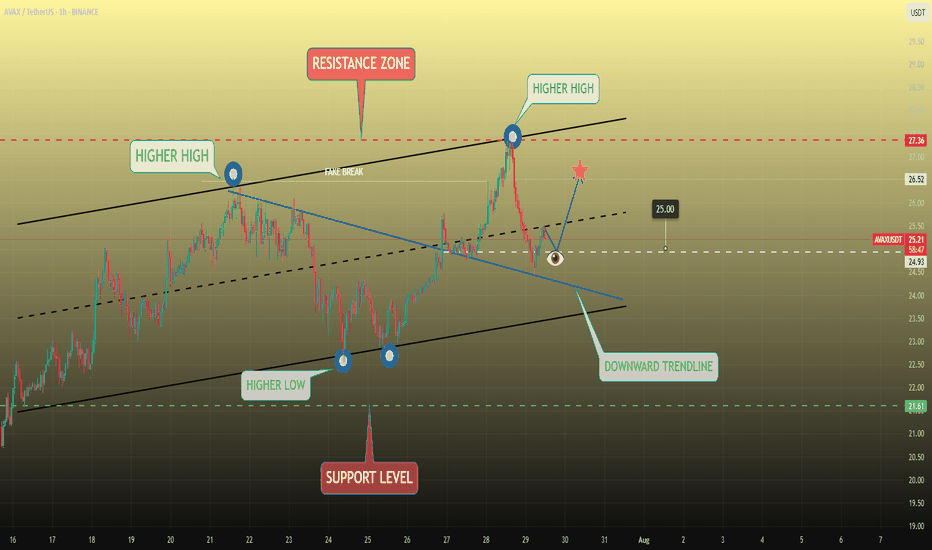

AVAXUSDT.P – High-Risk/Reward Short Setup | Smart Money Play (1H📉 AVAXUSDT.P – High-Risk/Reward Short Setup | Smart Money Play (1H)

🔍 Trade Type: Short

🕐 Timeframe: 1-Hour (1H)

📊 Entry Trigger: Change of Character (CHoCH) after Equal Highs

🎯 Target: 20.298

🛑 Stop Loss: 25.573

💰 Risk/Reward Ratio: 9.79

📌 Trade Breakdown:

This AVAX short was taken based on Smart Money Concepts, using a combination of liquidity structures and market psychology:

✅ Key Confluences:

Equal Highs (EQL) formed above internal structure – clear inducement/liquidity pool.

CHoCH confirmed as price broke below a major internal low → bearish intent confirmed.

Retracement into Bearish Order Block in the Premium Zone offered an optimal entry.

Strong follow-through from institutional selling after liquidity grab.

🧠 Why I Took This Trade:

This setup offered a clean narrative:

Liquidity above = taken

Internal structure = broken

OB in premium = respected

Imbalance/fair value gap below = price magnet

This alignment made it a high-confluence short with an excellent R:R ratio.

🎯 Target Zone (20.298–20.953):

This area contains unmitigated demand and prior support. I anticipate price to:

Tap into this zone to rebalance price inefficiency

Potentially react from there (watch for reversal setups)

⚠️ What I'm Watching:

Possible reaction around 21.793 support – consider partial profits

Maintain awareness of higher timeframe trend (H4/D1)

Volume shift or bullish CHoCH may signal exit before TP

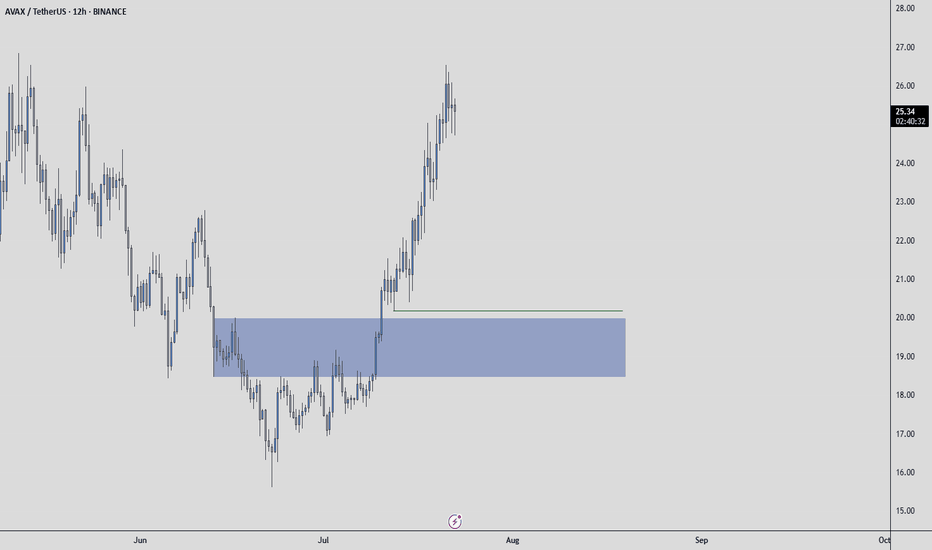

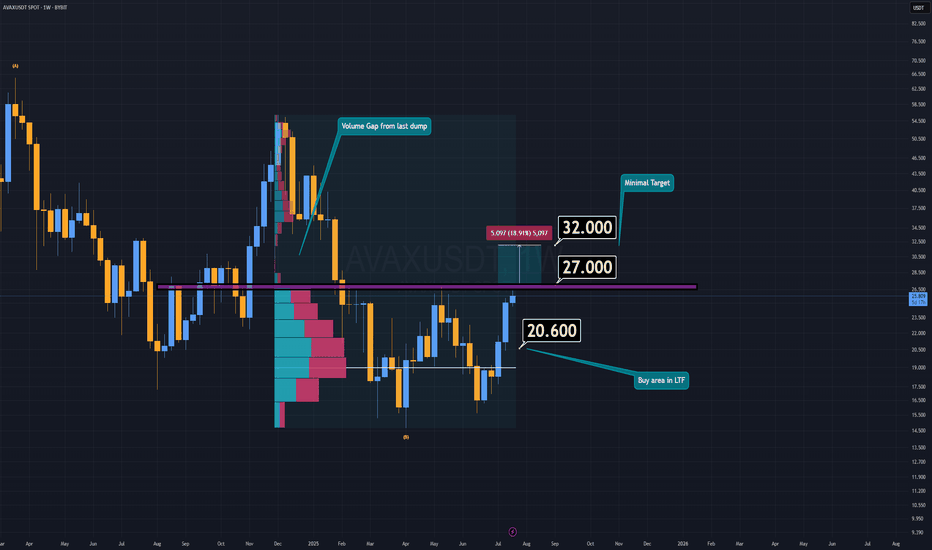

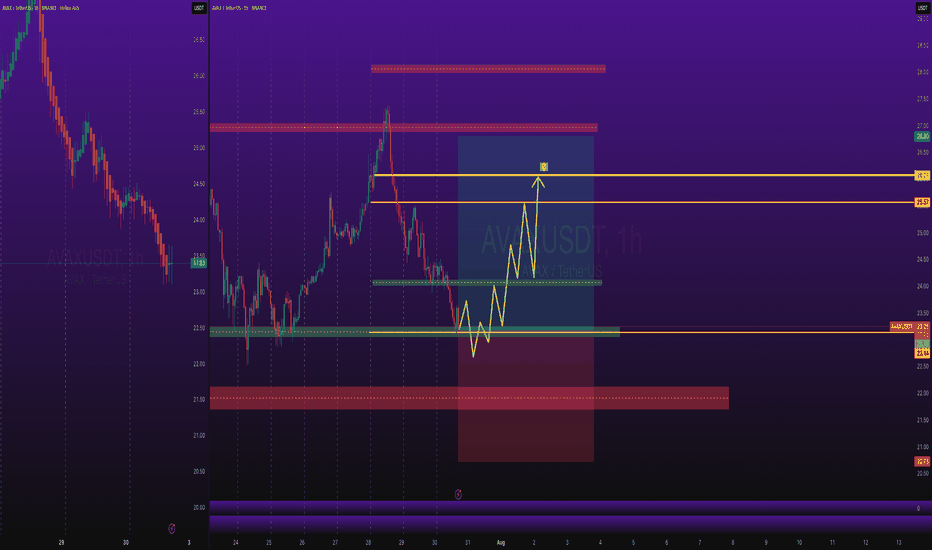

AVAXUSDT: Mid-Term AnalysisThe blue box under liquidity may do the job.

📍 Plan

If price drops into the blue box:

✅ Watch for footprint absorption (buyers stepping in)

✅ Look for CDV support or bullish divergence

✅ Confirm with a structure reclaim before entry

⚡ Reminder

No chasing. No forcing trades.

If the setup aligns, I’ll take it with clear risk.

If not, I’ll wait.

The right price, or no trade.

AVAX/USDT Trade Setup: Bullish Bias with Fibonacci Targets🚀 AVAX/USDT Avalanche is currently in a strong bullish trend 🔼. On the 4H chart, price is pulling back slightly 📉, and I’m watching for momentum to pick up and break above the current range high 📊—that’s where I’ll be looking for the next entry.

🎯 My bias remains long, and in the video I break everything down in detail:

🔍 Price action

🧱 Market structure

📈 Overall trend

📍 Stop loss placement (below the previous swing low)

🎯 Targeting key Fibonacci levels

I also go over my exact Fibonacci settings and how I use them to frame the trade.

This is not financial advice ❌💼

AVAX Analysis (1W)AVAX is currently attempting to form a double bottom pattern, which could signal a strong bullish reversal if confirmed. Earlier this week, AVAX made an effort to break down the key support/resistance zone, but it lacked the necessary volume to succeed.

If AVAX manages to reclaim the resistance area around $27 or higher, and confirms the breakout with a daily candle retest, the minimum target sits at $32.

However, if AVAX fails to break through resistance, there’s potentially an even better buying opportunity in the lower timeframes—a demand zone between $20 and $20.6.

I believe altcoins will offer another chance to catch up while prices are still far below their future valuations.

-S Wishes you the best in luck.

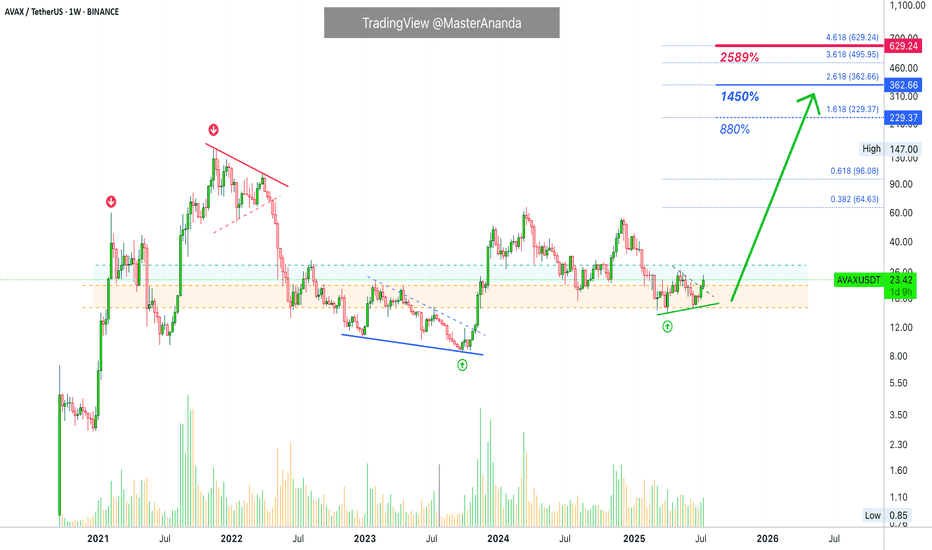

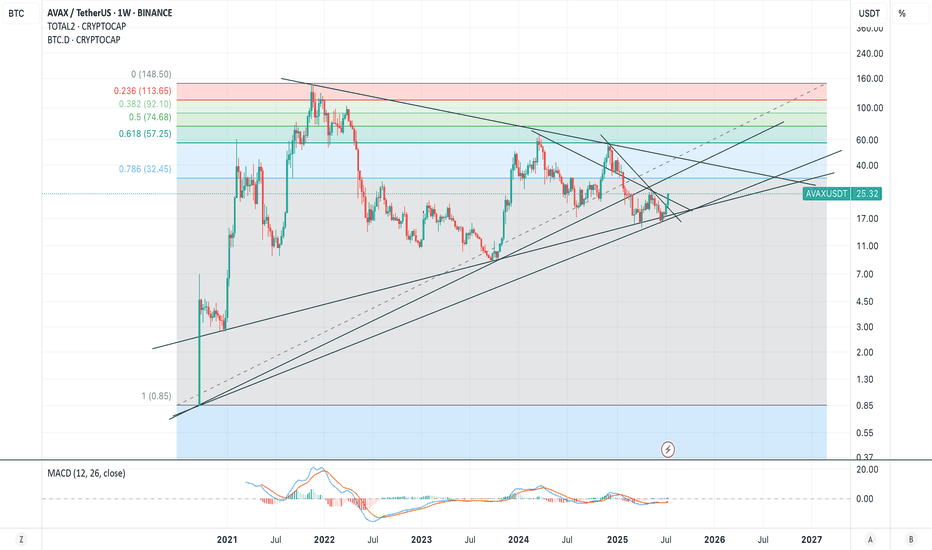

Avalanche's (AVAX) $229 & $363 Bull Market Potential ExposedStarting from the December 2020 low, Avalanche (AVAX) grew a total of 5,245% to its November 2021 all-time high. Now, if we take the true market bottom, when trading started back in September 2020 with a low of $0.85, total growth by the end of the bull market amounts to 17,152%.

It doesn't matter how you slice it, both are incredibly strong numbers.

Do you really think Avalanche will consolidate for years only to grow 500%, 600% in its bull market? I don't think so. This prolonged consolidation period was a test. Those that remained true to the market; those that continued to hold; those that continued to develop, to build and to grow within the market; all those people will be rewarded, big time.

Let's consider the true potential for AVAXUSDT in early 2026 or late 2025.

The main target is $229. I think missing a new all-time high is out of the question. We are going for the top as the market has been growing behind the scenes for so long. So much hard work has gone into making Cryptocurrency accessible to everybody and this hard work is about to pay off.

This $229 target opens up 880%. Keep in mind that this coming from current prices. If we were to consider the bear market bottom, this number would be much higher, something around 2,564%.

The next target, a "strong all-time high," is open at $363. This would give us a total profits potential of 1,450%.

As you can see, Avalanche is trading at bottom prices with plenty of room left available for growth. It is still very early if you focus on the long-term.

Thank you for reading.

Your support is appreciated.

Namaste.

Avax Tests Key Resistance at 27 for the Third TimeAvax is once again testing the 27 resistance level. The first attempt lasted over a week, and the second one held for a couple of days, but in both cases, Avax failed to break through. This time, however, it has stronger support from market-wide momentum.

Bitcoin has reached 120,000, Ethereum is posting sharp gains, and most notably, Chainlink (LINK) has already broken through its own resistance. Avax and LINK have shown a high degree of correlation, nearly 89% over the past two months. This strong relationship, while occasionally fluctuating, has been in place for several years.

A breakout for Avax may take time, but it now has more momentum and supportive conditions behind it. Still, as long as the 27 resistance holds, bulls should approach with caution before entering long positions.

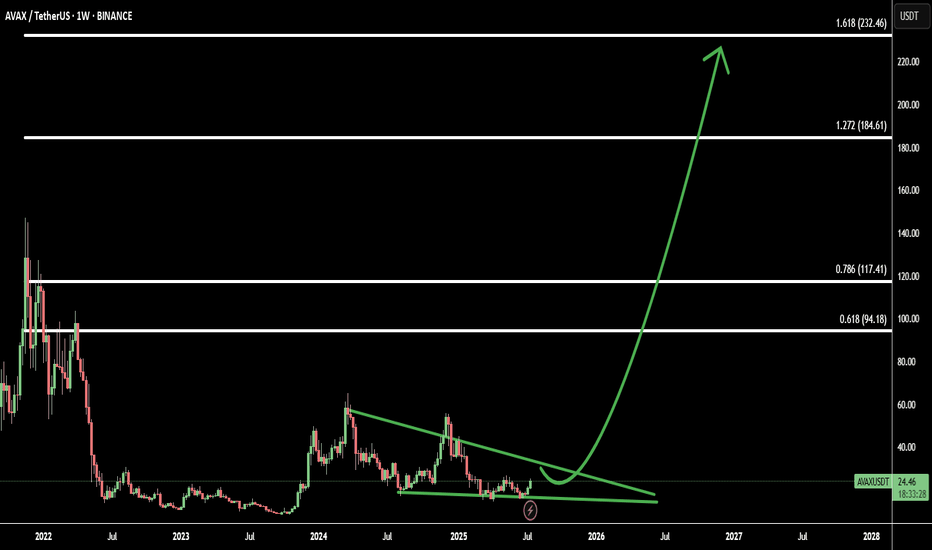

AVAX Breakout from Falling Wedge: Tracking 4 Fibonacci TargetsAvalanche (AVAXUSD) has broken out of a falling wedge pattern on the weekly timeframe, signaling a potential shift from bearish consolidation to a bullish continuation phase. The breakout is a strong technical signal often associated with trend reversals.

Using Fibonacci extensions from the breakout base, I’ve mapped out 4 critical target levels:

Target 1: 0.618 Fib – first major resistance after breakout - 94.18

Target 2: 0.786 Fib – deeper retracement and strong reaction zone - 117.41

Target 3: 1.272 Fib – full extension, potential profit-taking point - 184.61

Target 4: 1.618 Fib – aggressive upside target for extended rally - 232.46

These levels align with historical price structure and may act as magnets for bullish momentum if volume confirms the breakout.

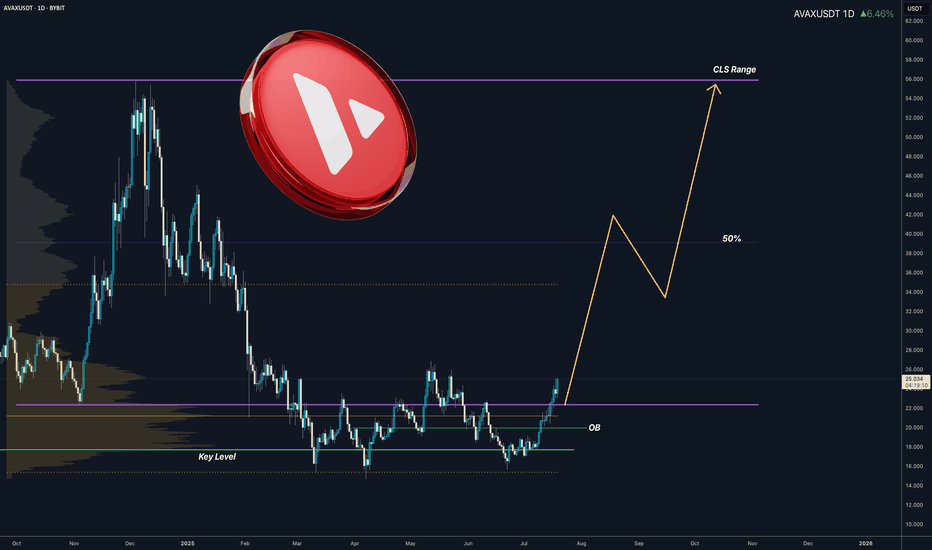

AVAX I 3M CLS Range I Model 1 I 50% partial full range potentialYo Market Warriors ⚔️

Fresh Crypto Analysis— if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Working all timeframes. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/day — banks, algos, central players.

📍Model 1:

HTF bias based on the daily and weekly candles closes,

Wait for CLS candle to be created and manipulated. Switch to correct LTF and spot CIOD. Enter and target 50% of the CLS candle.

For high probability include Dealing Ranges, Weekly Profiles and CLS Timing.

Analysis done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading is like a sport. If you consistently practice you can learn it.

“Adapt what is useful. Reject whats useless and add whats is specifically yours.”

David Perk aka Dave FX Hunter

💬 Comment any Coin I ll give you my quick view

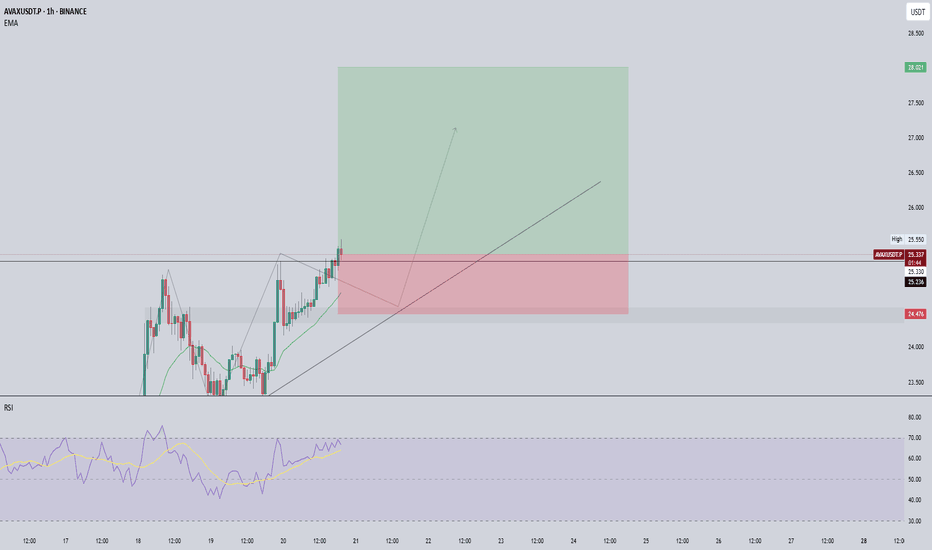

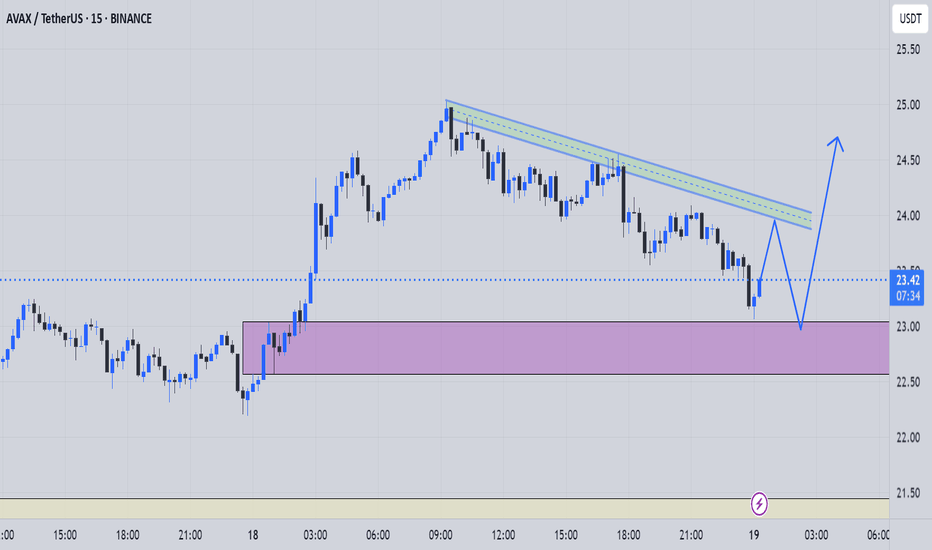

AVAX/USDT Trade Setup (1H Timeframe)🚀 AVAX/USDT Trade Setup (1H Timeframe)

Just entered this trade earlier around 25.03 USDT after seeing good momentum build-up.

Support zone I’m watching: 24.30–24.45, aligned with 1H EMA

Resistance area: 28.00, but I'm locking partials near 26.50 in case it slows down

RSI was still comfy at 66.99, not yet overbought

Volume steady, candles pushing clean = signs of strong trend continuation

Stop loss is at 24.676 for safety if momentum shifts.

📌 Plan:

Trail my stop behind swing lows

Watch RSI — if it hits 80+, I’ll start scaling out

Targeting 2.1 RR ratio, just keeping it consistent

This is not a hype play — price broke structure and retested properly. If volume stays solid, I’m letting it run.

This isn’t financial advice — just sharing what I’m seeing.

**Risk Management First – Not Financial Advice**

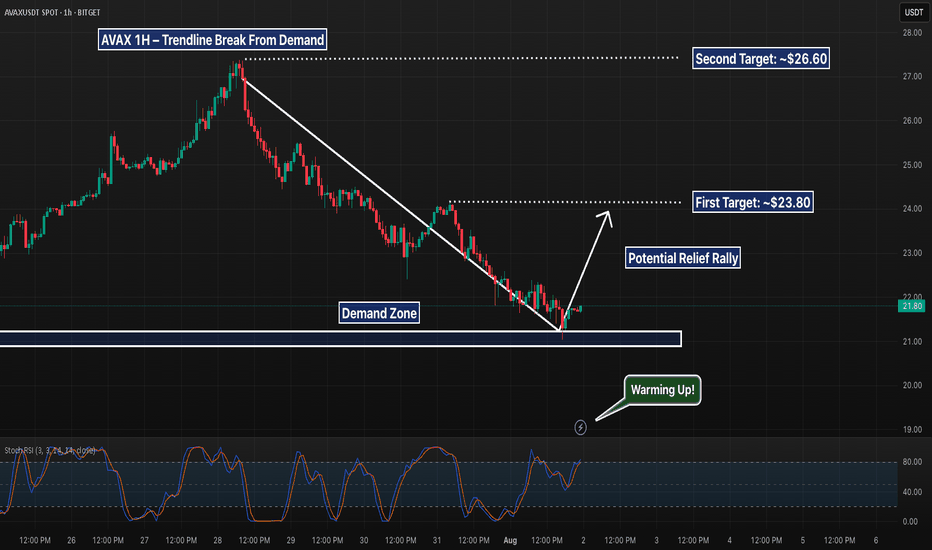

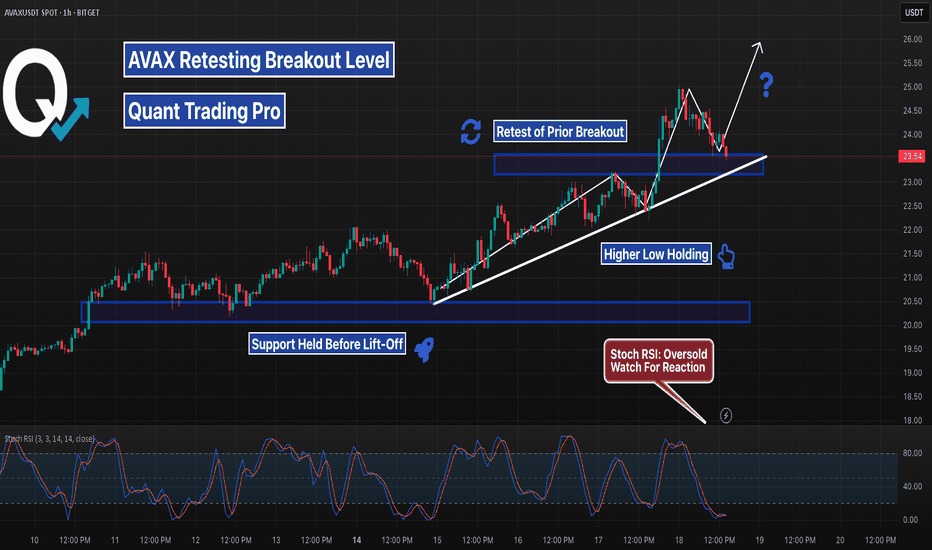

AVAX - Trendline Break From Demand, But Can Bulls Push to $24?AVAX is showing signs of life after rebounding cleanly off a local demand zone near $21 and breaking its recent downtrend line. This structure opens the door to a possible short-term rally — with first resistance sitting near $23.80 and a secondary target at $26.60. However, Stoch RSI is already pushing into overbought, so momentum must sustain or risk another fade.

A retrace to retest the broken trendline and hold would add confluence for longs. If that fails, bulls may get trapped.

📌 Demand bounce

📌 Trendline break

📌 Eyes on follow-through to reclaim higher levels

This is early-stage structure shift — not confirmation yet, but worth watching.

CryptoTrade: AVAXUSD Long Trade with SL and TPCOINBASE:AVAXUSDT Long Swing Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader.

I manage trade on daily basis.

this is good trade, lets see, don't be greedy, risk what you can afford.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

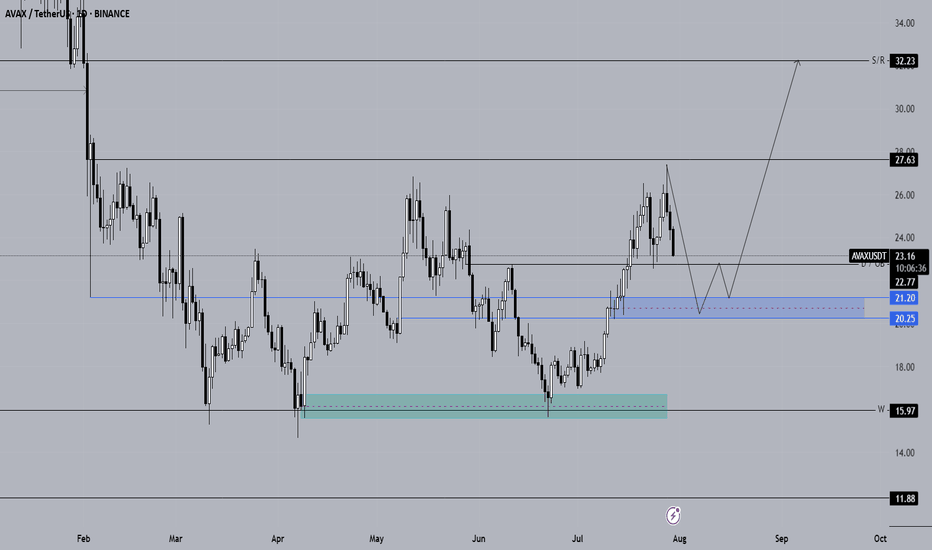

Long-Term Technical Analysis of AVAX CoinWhen evaluating AVAX for long-term investments, the blue support zone highlighted on the chart stands out as the key area to monitor for potential spot entries. If AVAX closes daily candles below the $22.77 level, it is expected to continue its downward trend.

The primary spot buy zone for AVAX is identified between the $21.20 – $20.25 support range. If the price retraces into the blue zone on the chart, we plan to initiate spot positions. Should AVAX show a reversal from this area, our next upside targets are $27.63 and $32, respectively.

If AVAX fails to generate a strong reaction from the blue zone and continues to decline, we will then monitor the $18 support level. As long as AVAX holds above $18, our bullish outlook from this analysis remains valid.

Not Financial Advice (NFA).

Avalanche broke through the $26 level ┆ HolderStatBINANCE:AVAXUSDT is consolidating just beneath the $33 resistance after reclaiming a prior range high. Price action is forming a classic bull flag while higher lows continue to support the structure. A breakout above $33 could confirm bullish continuation toward $35 and $36. Momentum remains strong as long as the $31.5 support holds, making AVAX one of the key watchlists this week.

AVAXUSDT Corrective Move In The MarketAVAXUSDT

retraced sharply from the 27.34 resistance zone after making a higher high but found support above the descending trendline. The recent corrective move has paused at a key structure level near 24.96, hinting at potential bullish continuation. A breakout above this local resistance could trigger a rally toward the 26.50–27.34 target zone. Momentum builds as long as price remains above the trendline and higher low structure.

📈 Key Levels

Buy zone: 24.80 – 25.30

Buy trigger: Break and hold above 25.30

Target: 26.50

Invalidation: Close below 24.00

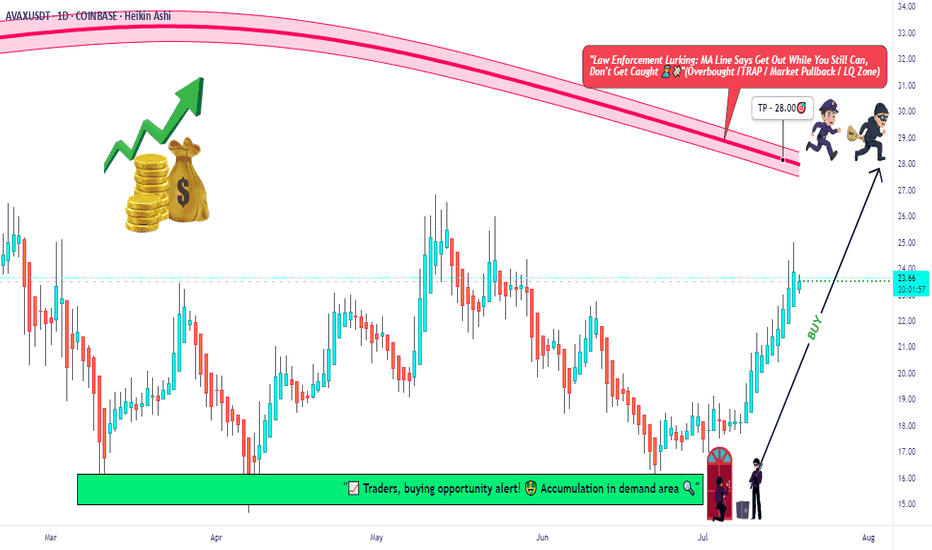

AVAX Long Only | Moving Average Trap Heist in Action🧨“Avalanche Crypto Vault Break-In 💣 | Thief Trader’s Long Playbook”⚔️💸🚀

(AVAX/USDT Crypto Heist Plan – Swing/Day Trade Blueprint)

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Welcome, Money Makers, Market Pirates, and Chart Snipers! 🤑💰💼✈️

This ain’t just another setup — this is a strategic crypto ambush on AVAX/USDT, cooked up with the 🔥 Thief Trading Playbook 🔥. We're planning a clean, no-fingerprint heist into the Red Moving Average Zone. That’s the liquidity vault, and yes — the police (market makers) are watching 👮♂️🚨... but so are we. Stay sharp. 💼🔦

💥 Mission Objectives:

🎯 Entry Point (The Infiltration Point)

"The vault's wide open! Swipe the Bullish loot at any decent price" 📈

Smart thieves wait for pullbacks on the 15m or 30m chart to plant their limit orders near swing lows/highs. Use layered orders (DCA style) to scale in like a pro. 💣🔁

🛑 Stop Loss (Your Getaway Exit)

Secure your trade. SL at the nearest wick low/high on the 1D timeframe (around 21:00 candle).

Your SL = your personal risk code. Choose it based on lot size & how deep you're inside the vault. 🎭🚫

🏴☠️ Take Profit Target (The Treasure Room)

🎯 Target: 28.00 USDT

...or escape early if the heat (volatility) gets too intense. Protect the bag. 💼💰

⚡ Special Note for Scalpers:

🧲Only operate on the Long Side.

If you’ve got deep pockets, smash in directly. Otherwise, ride with swing bandits. Use trailing SL to secure stolen profits. 🧨📉📈

🔍 Market Heat Map & Rationale:

The AVAX/USDT setup is flashing bullish strength, backed by:

🧠 On-Chain Metrics 📊

💡 Market Sentiment

📰 Macro Catalysts

🌐 Intermarket Synchronicity

📡 Go grab the full breakdown on:

⚠️ Red Alert: News Zones Ahead! 📰🚫

Avoid fresh trades during high-volatility news releases.

Lock in gains with trailing SL. Risk management is not optional — it’s the escape vehicle. 🚗💨

📝 Legal Talk (Don’t Skip):

This isn’t investment advice. Just a well-planned blueprint from a market thief.

You're responsible for your own loot and losses. 🎭📉📈

❤️ Boost the Brotherhood 💥

Smash the 🔥BOOST BUTTON🔥 if you found value.

Every boost powers our Thief Trading Gang’s next big score. 🚀💸

Stay tuned for the next heist plan. I’ll be back with more charts, more loot, and less mercy. 🐱👤📊💥

avaxpump"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

$AVAX Ready to breakout!CRYPTOCAP:AVAX looks ready to pop.

High Volume Node resistance and daily 200EMA is clear and now support. We don't want to see price rejected and moving back below this area.

The R5 daily pivot is my first partial take profit $35-36 followed by the major resistance High Volume Node at $48

Daily RSI is overbought with unconfirmed bearish divergence so watch out for this but should be good to run in the mean time. BTC permitting...

Safe trading