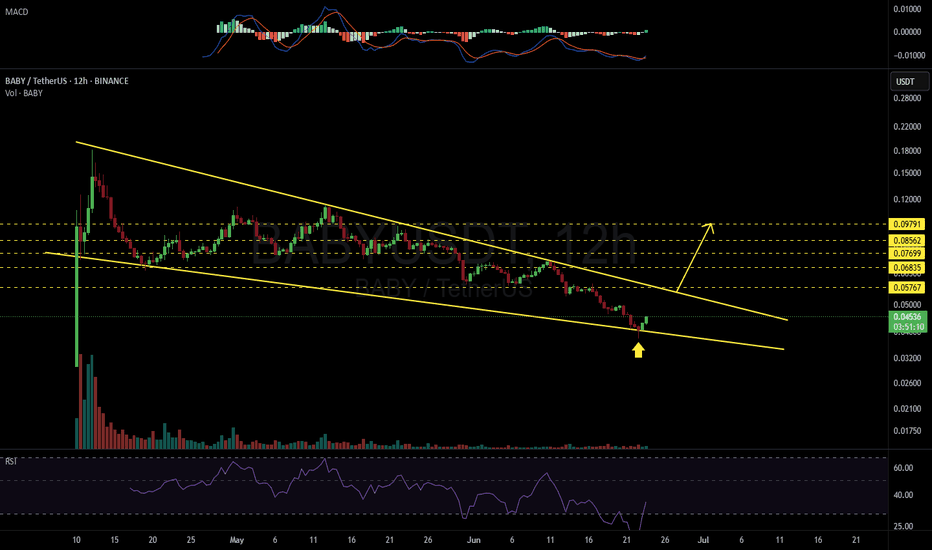

BABYUSDT 12H#BABY is trading inside a Falling Wedge pattern on the 12H timeframe, which is generally a bullish reversal setup.

Price recently tapped the bottom of the wedge and is now reacting from the support zone (📍yellow arrow), suggesting a possible early move toward a breakout.

🟢 If an upside breakout occ

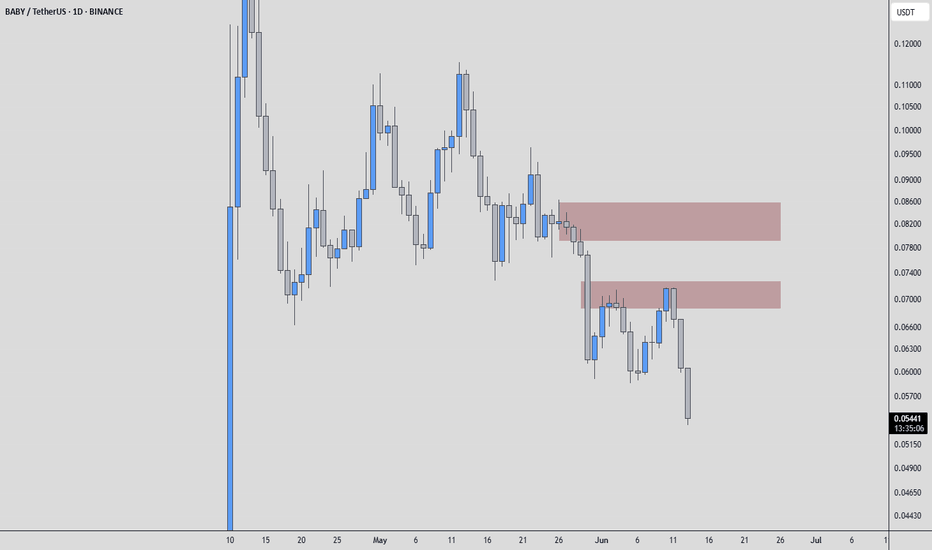

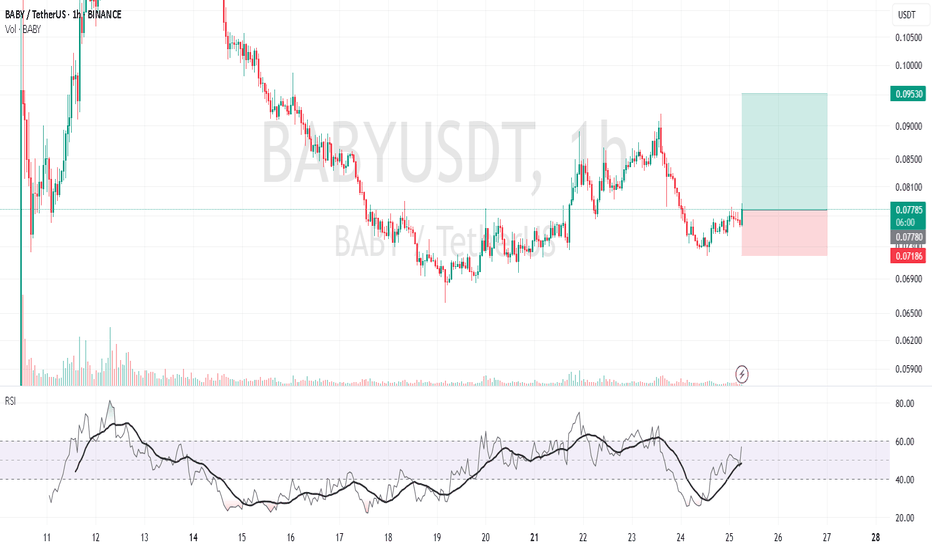

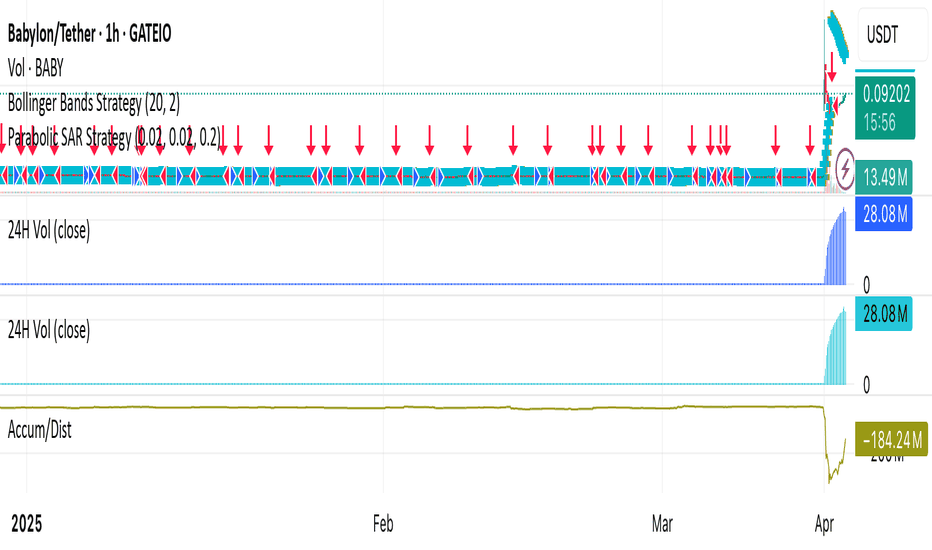

BABYUSDT: Weakness Confirmed, Short Opportunities AheadMy current read on BABYUSDT is clear: the price is showing significant weakness. This isn't a market where buyers are showing up with conviction; quite the opposite.

Because of this undeniable weakness, both red boxes I've marked on the chart are areas I'm keenly watching for short opportunities. T

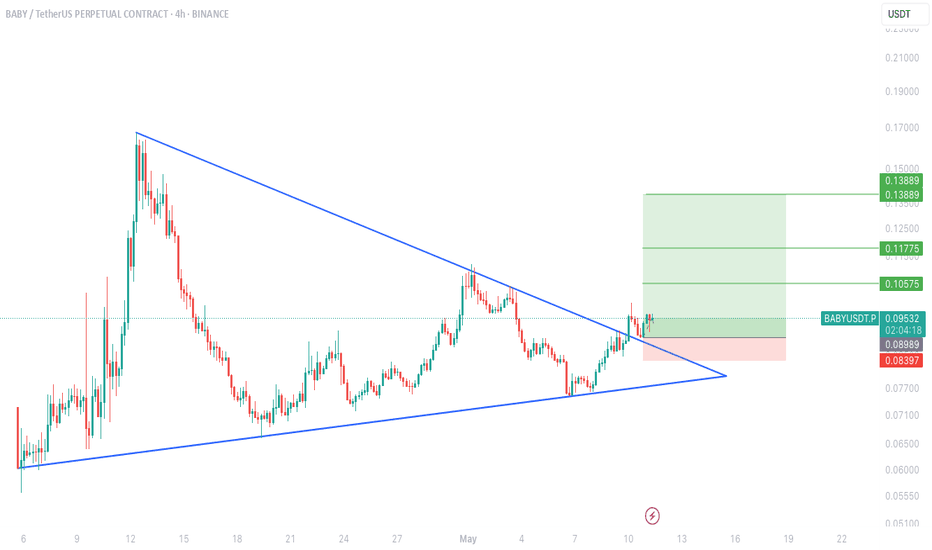

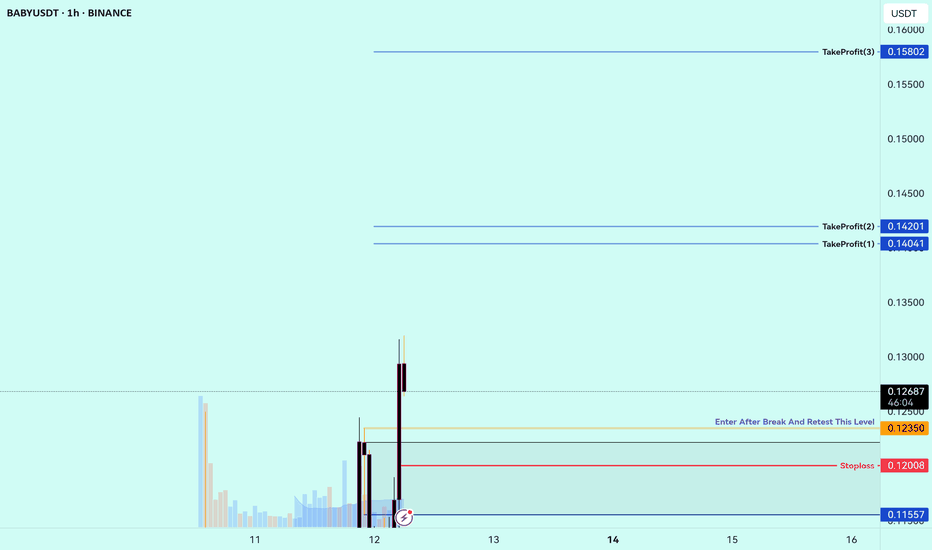

$BABY Breakout Alert!TSX:BABY chart update:

Symmetrical triangle breakout in action on the 4H chart! 📈

Price has broken above the resistance trendline with solid structure, confirming a classic bullish continuation setup!

🎯 Targets:

• TP1: $0.10575

• TP2: $0.11775

• TP3: $0.13889

📍 Risk-reward is prime with tight in

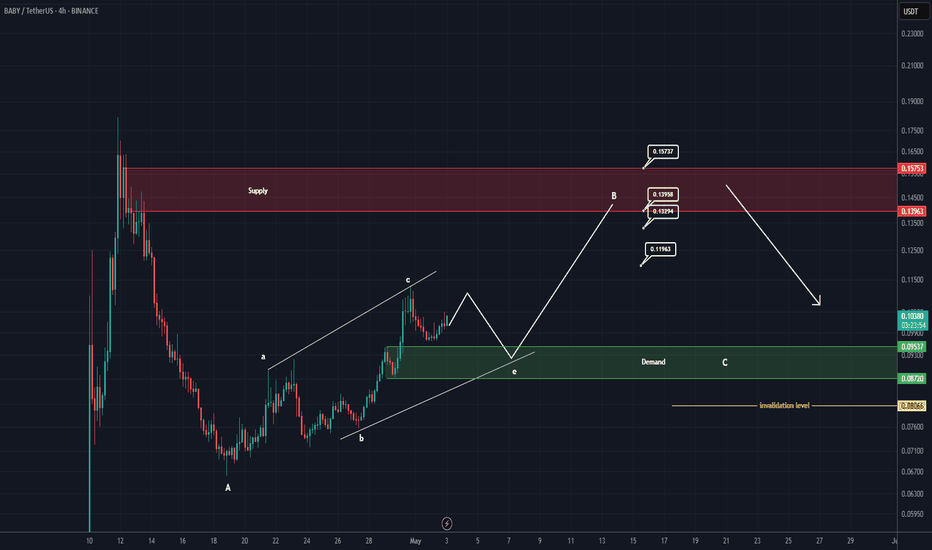

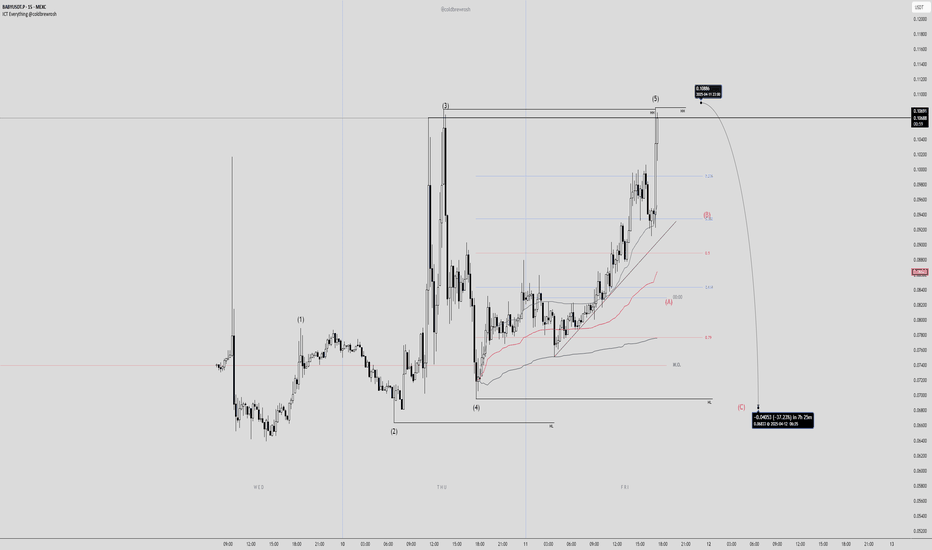

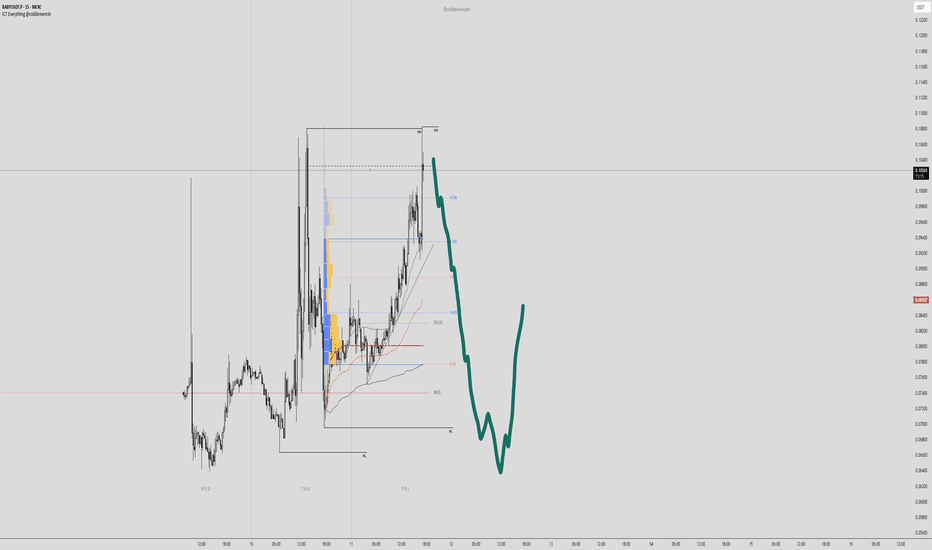

BABY Looks Bullish (4H)Note: Given the corrective nature of the market, only consider entering this symbol within the green zone. Move to break-even at the first target.

According to the Baby structure, this symbol appears to be aiming to remain bullish.

From the point where we placed the (A) on the chart, expansion wav

#BABY: Exploring Early-Stage Meme Utility

**Description**:

This trading idea centers on **BABY**, a meme-inspired cryptocurrency that blends community-driven momentum with emerging utility in the decentralized finance (DeFi) and NFT spaces. **BABY** has gained traction for its appeal to retail investors, with a strong online presence an

BABY Token: Long-Term Hold vs. Short-Term TradesTraders face a choice: hold BABY for its protocol potential or trade its volatility. Here’s how to decide:

Long-Term Case:

Babylon’s innovative architecture and growing Bitcoin staking utility suggest long-term appreciation.

Promotions can drive initial liquidity, supporting higher prices over time.

BABY Futures: Managing Drawdowns During Promotional Rallies

Promotions can lead to sharp rallies followed by deep drawdowns. Here’s how to protect your capital:

Risk Management Tips:

Trailing Stops: Use trailing stops to lock in profits as BABY rallies.

Dollar-Cost Averaging: Enter positions in stages to reduce average cost.

Sentiment Indicators: Monitor so

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy