BAKEUSDT.PS trade ideas

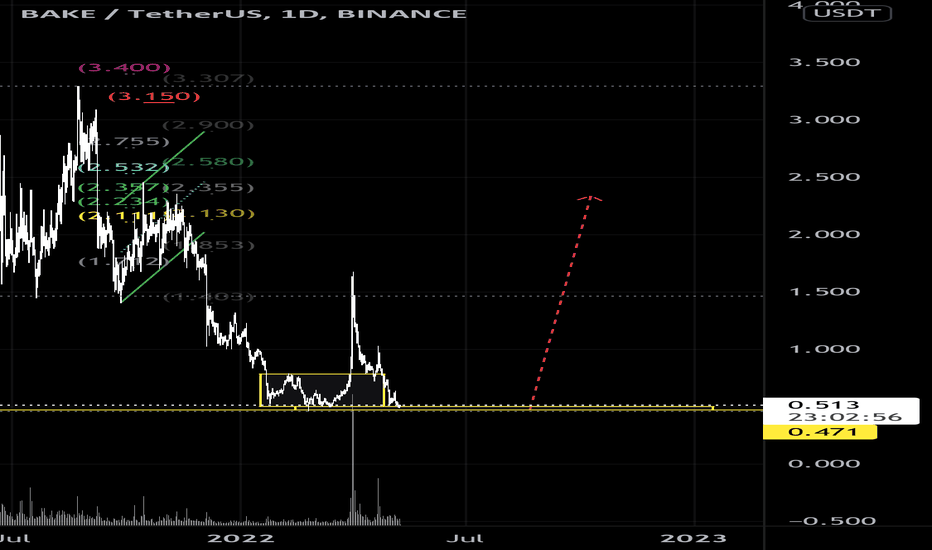

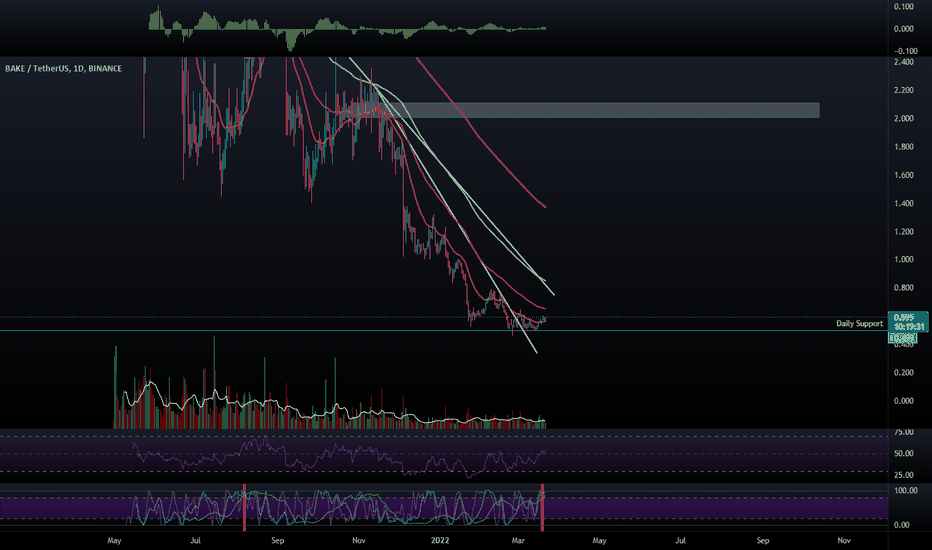

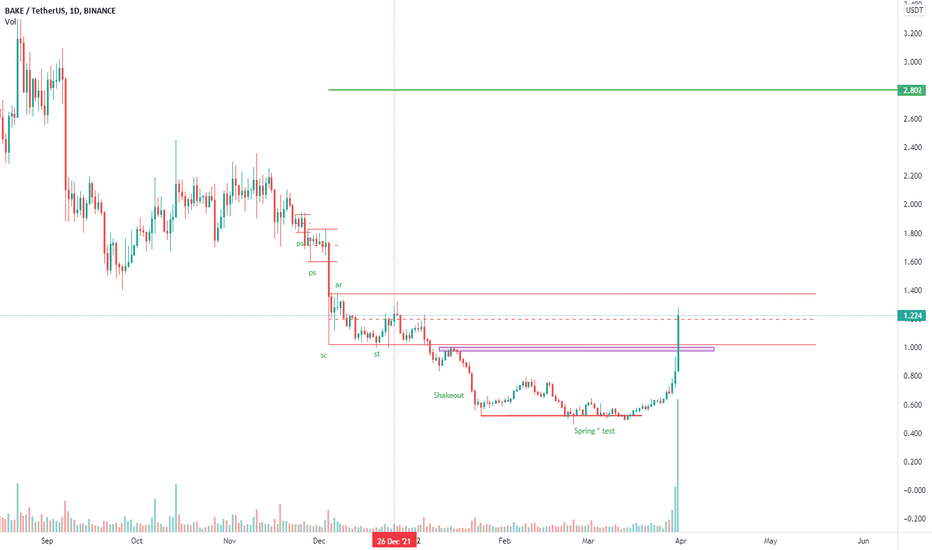

BACK last support or double bottom#BAKE/USDT

$BACK is at lowest support zone and below the middle line of descending parallel channel.

🐻 if price break down from this support zone, the last support can be around $0.127.

🐮 holding this support can shape double bottom pattern and price can increase to resistance zone around $2.

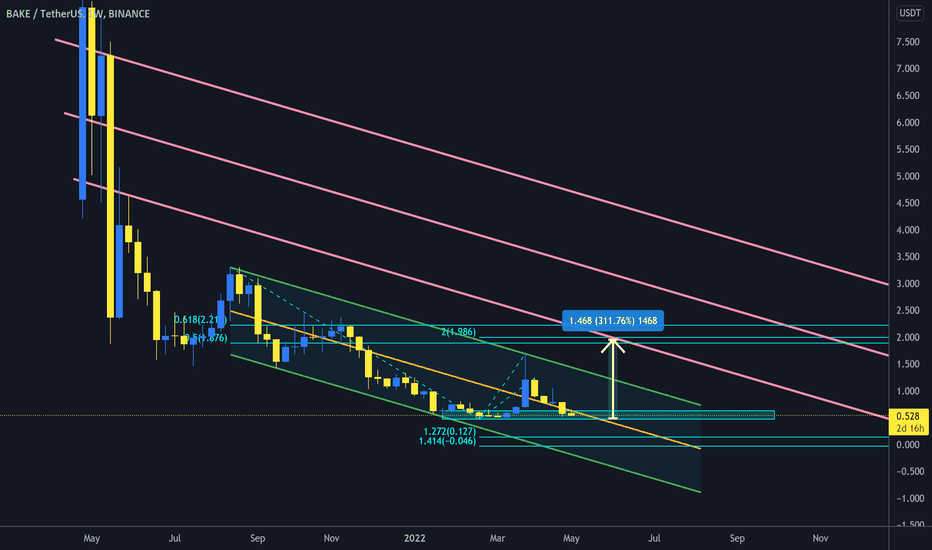

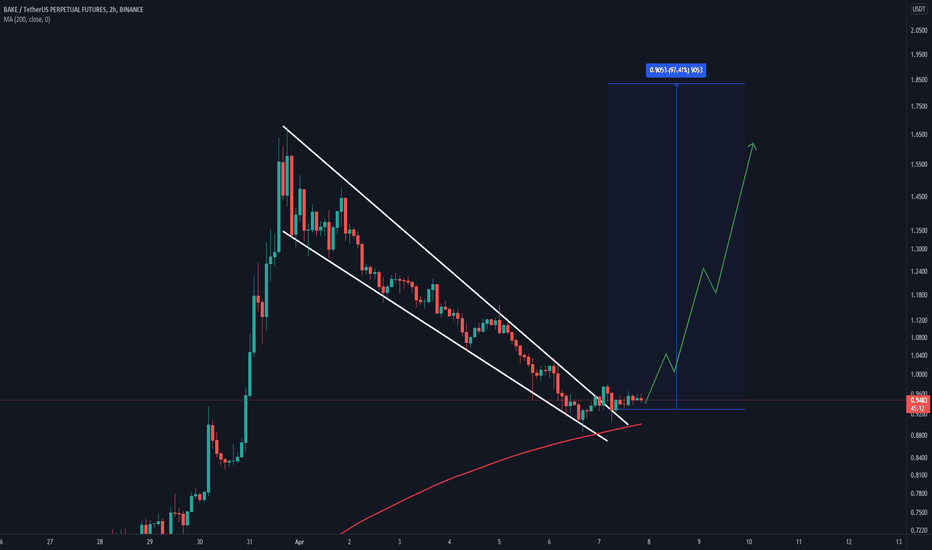

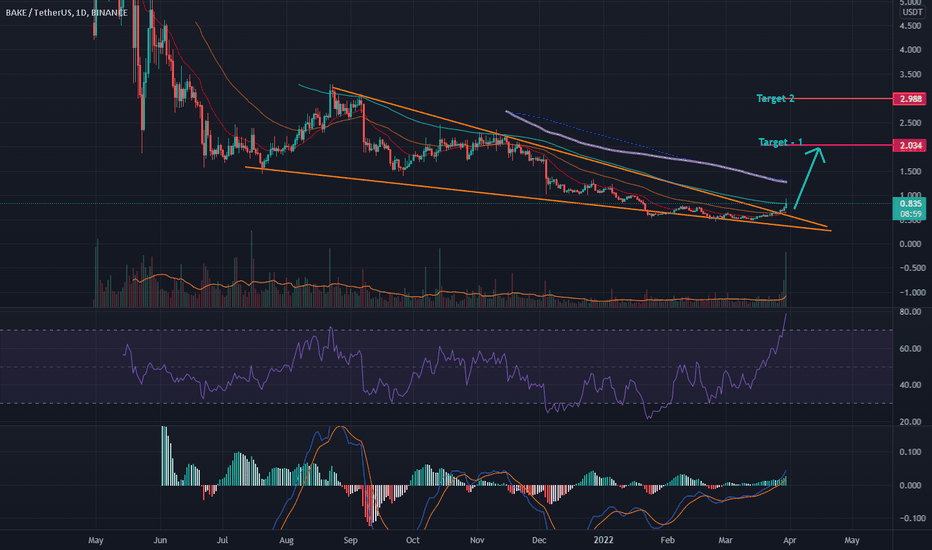

Pullback to the previous uptrend, up to the range of 1.4Pullback to the previous uptrend

Re-growth up to the range of 1.4 to 1.6 and then falling to the base level of the previous wave.

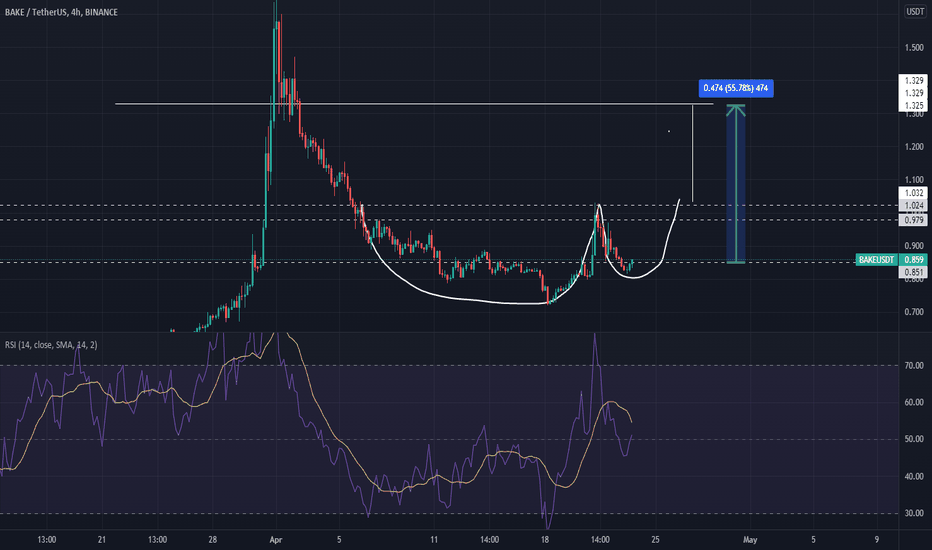

In the 4 hour chart you can see the previous uptrend.

After falling from the highest point of the previous wave, the ascending wave of the previous wave pulse should be formed.

In the second wave, it will see price growth in the range of 1.4 to 1.6.

After completing this wave, it will fall to the base level of the first wave, ie around the price of 0.65.

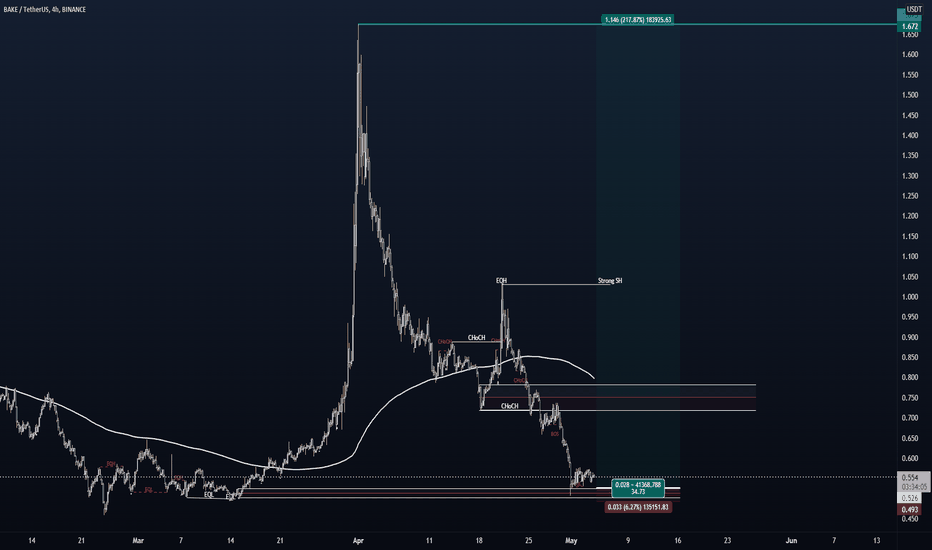

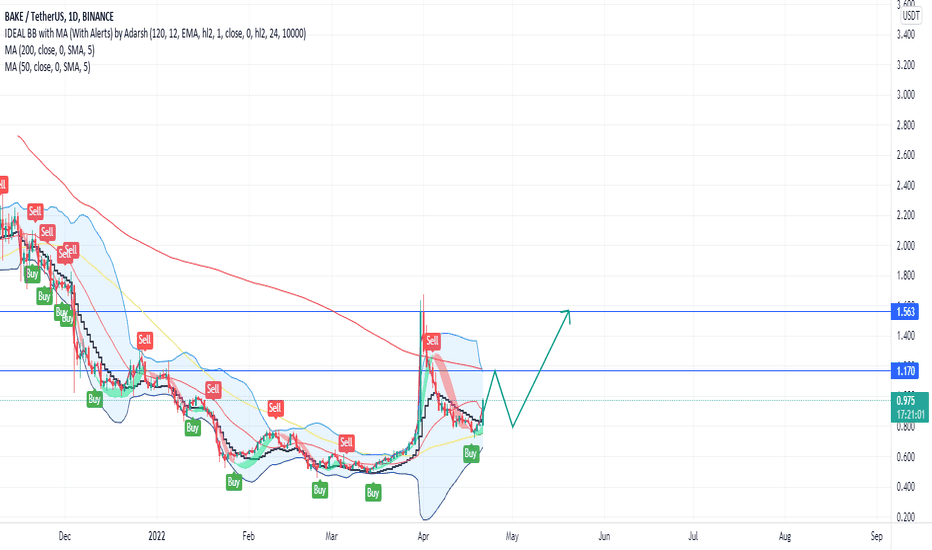

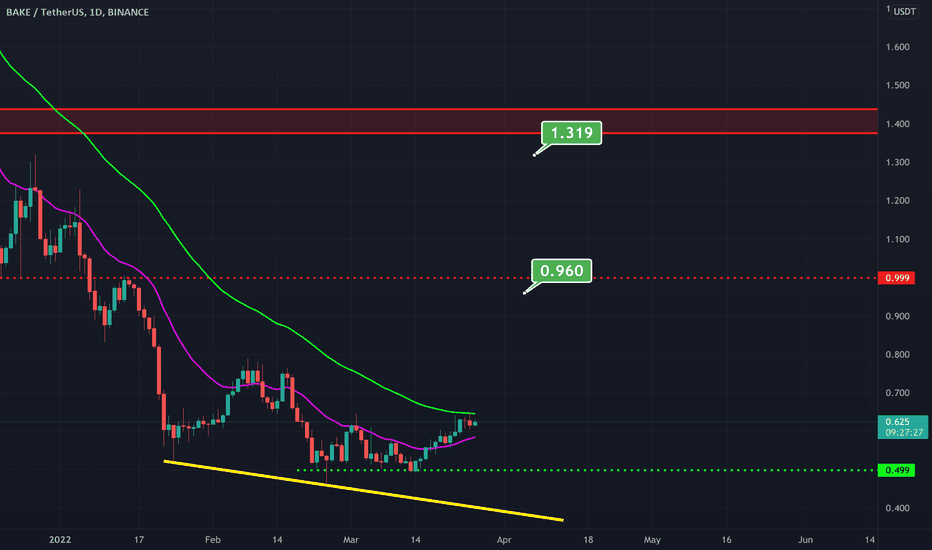

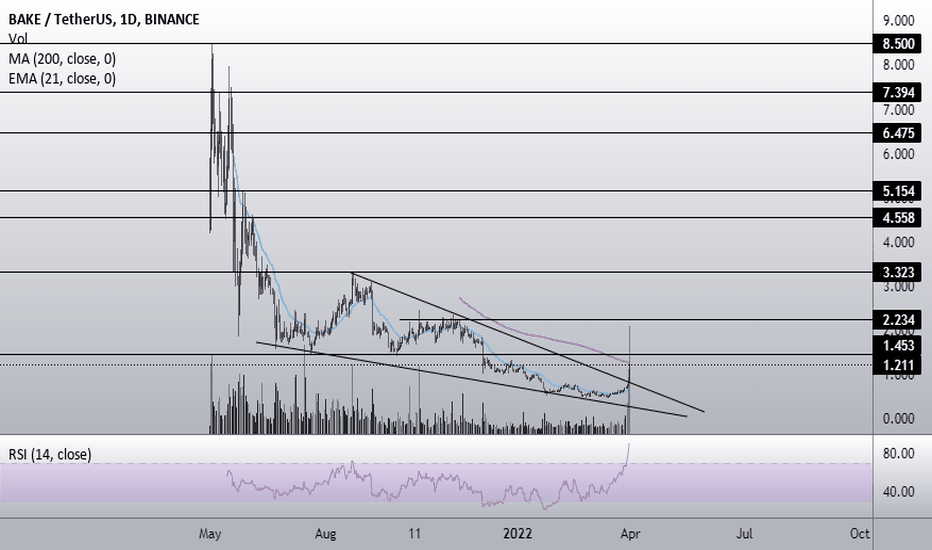

Bake now awake! We have held our support at 80 cents. Although we dipped a little lower, we managed to rise above.

If we can maintain above, we will see a beautiful rise which I do see happening. I actually see Bake rising to $3 or more by then end of the year. It may actually be sooner, let’s hope but either way, we win.

If you missed LRC’s pop a couple months ago, here’s your chance!

Remember, patience always wins. DYOR.

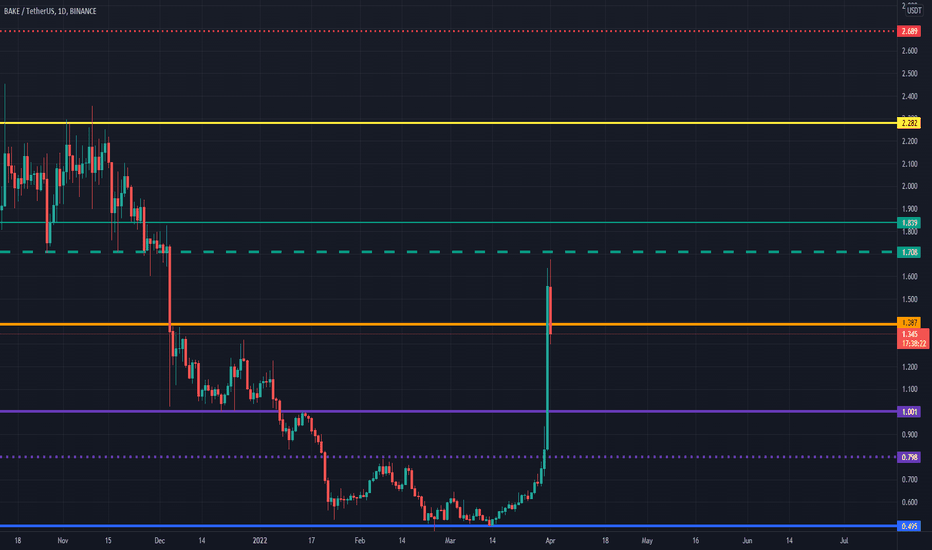

$BAKE - a bounce off the blue support line and I'm LONG. This coin is curving nicely right now. I see how it could easily go fetch a 300% gain after a bounce off that daily support (blue line).

The next Order Block Resistance is over the $2.00 mark. I did not count waves for this but there is huge potential there technically speaking. These are the types of setups that make for long and profitable swing trades.

Trade safe everyone!

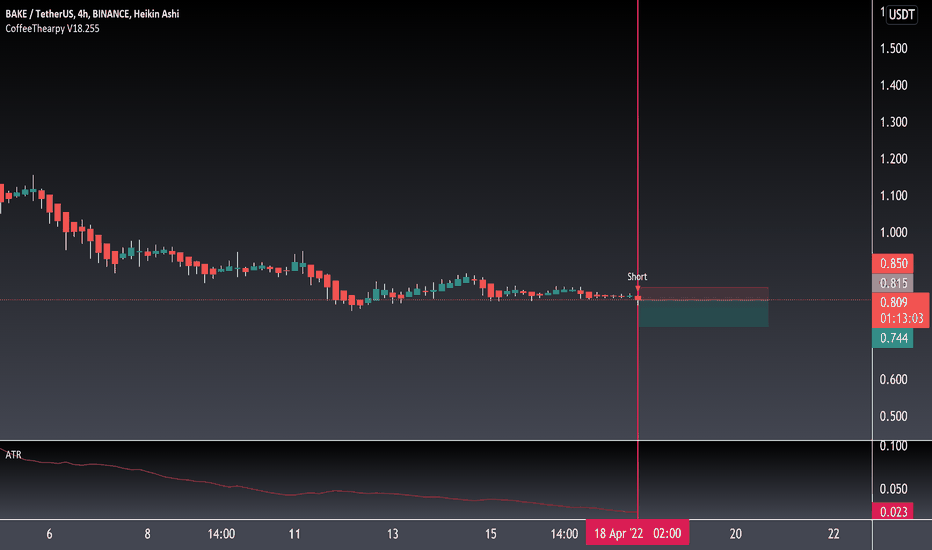

BAKE/USDT BREAKOUT! READY TO PUMPHi guys, This is CryptoMojo, One of the most active trading view authors and fastest-growing communities.

Do consider following me for the latest updates and Long /Short calls on almost every exchange.

I post short mid and long-term trade setups too.

Let’s get to the chart!

I have tried my best to bring the best possible outcome in this chart, Do not consider it as financial advice.

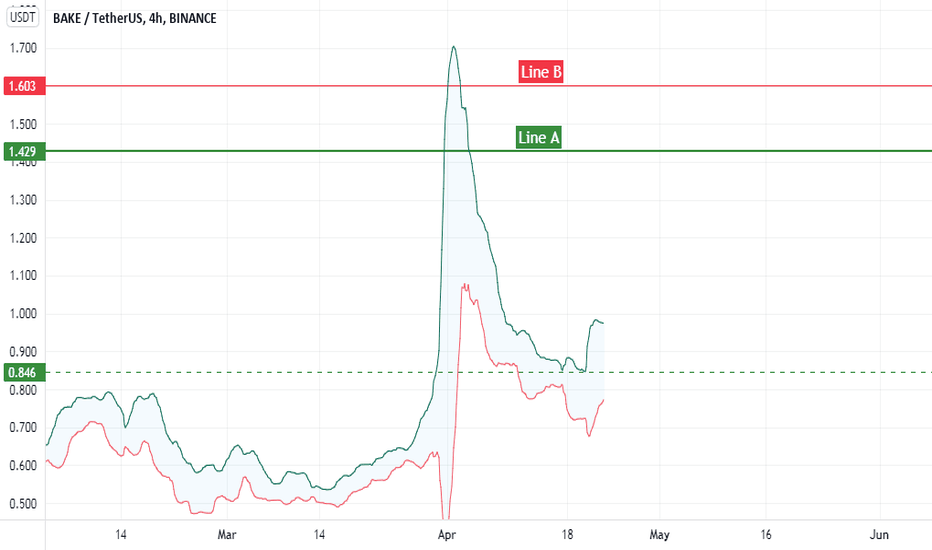

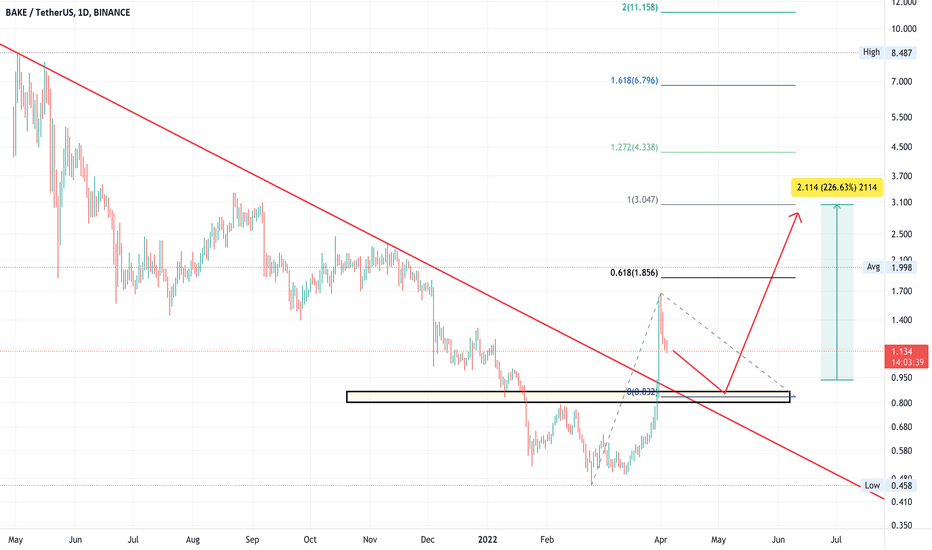

Buy some BAKE at CMP and add more up to $0.9

Target:- 25-30%

SL:- $0.8750

Lev:-10x

Keep your SL tight.

This chart is likely to help you in making better trade decisions, if it did do consider upvoting this chart.

Would also love to know your charts and views in the comment section.

Bake - It's Been awhile This is a chart that I am not completely sure about as price action for alt coins is entirely contingent upon BTC, which is further contingent upon market makers, exchanges, real demand ect..

* discharge should not be traded around, however, if BTC bounces somewhere in the area of where price is now, I would expect Bake to do something like this.. (it certainly has more room for upside than this chart shows,

however, BTC taking a turn downward ***would certainly invalidate this chart

Good luck and best regards

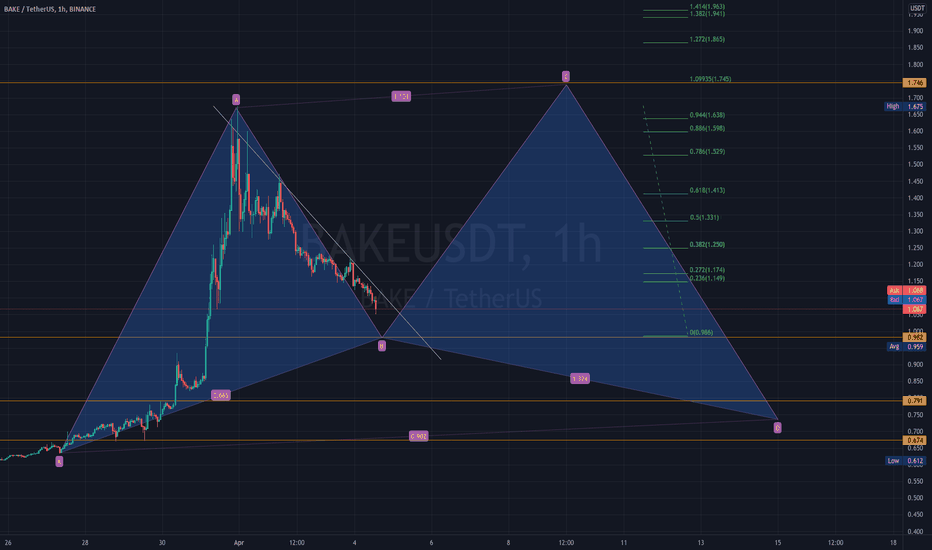

BakeryToken (BAKE) formed bullish Gartley for upto 48% moveHi dear friends, hope you are well and welcome to the new trade setup of BakeryToken (BAKE)

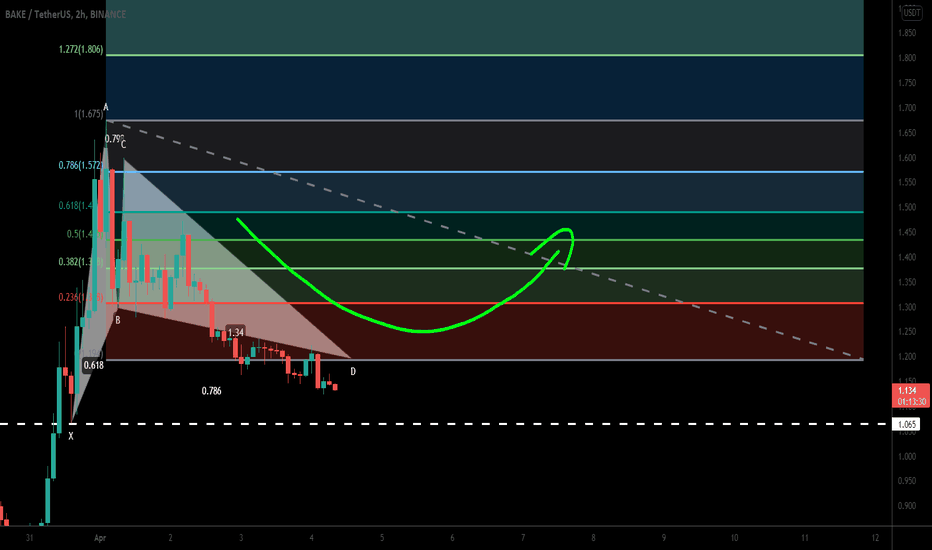

On a 2-hr time frame, BAKE has formed bullish Gartley pattern.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

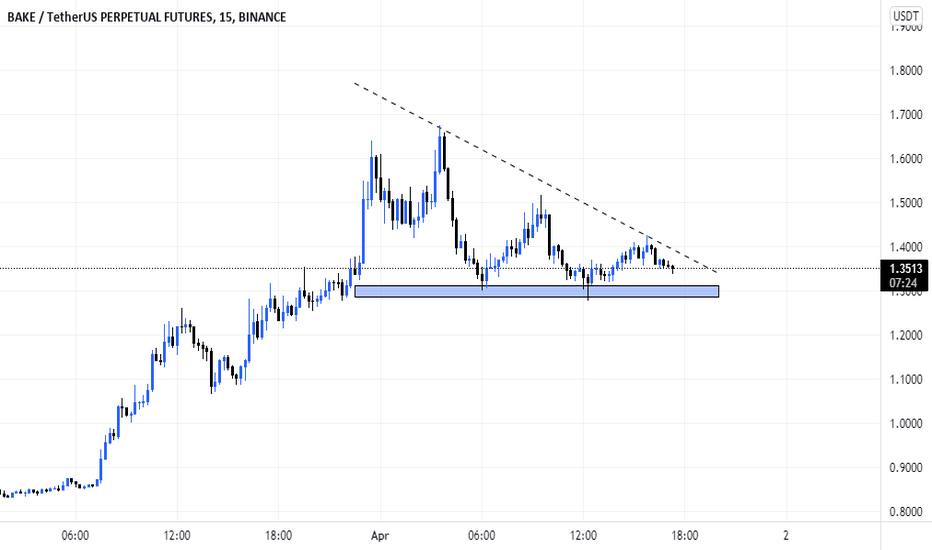

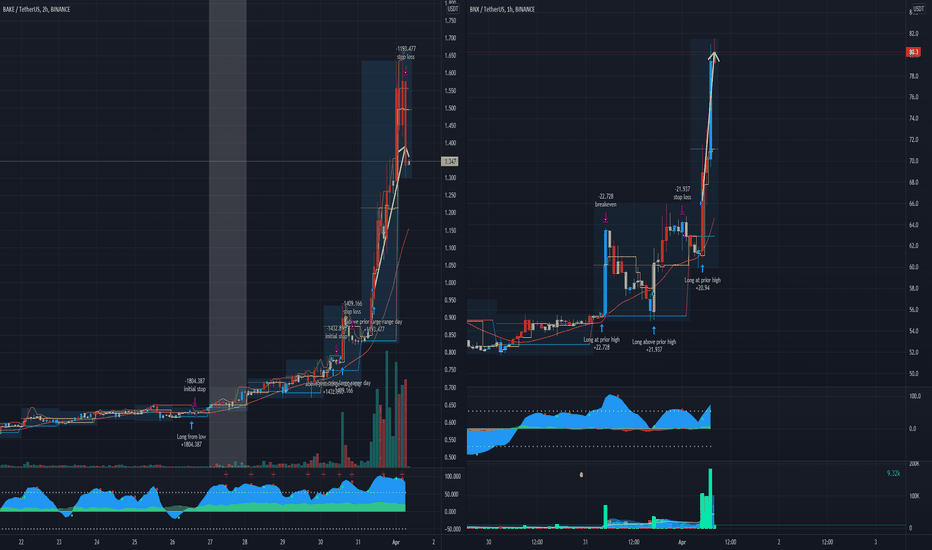

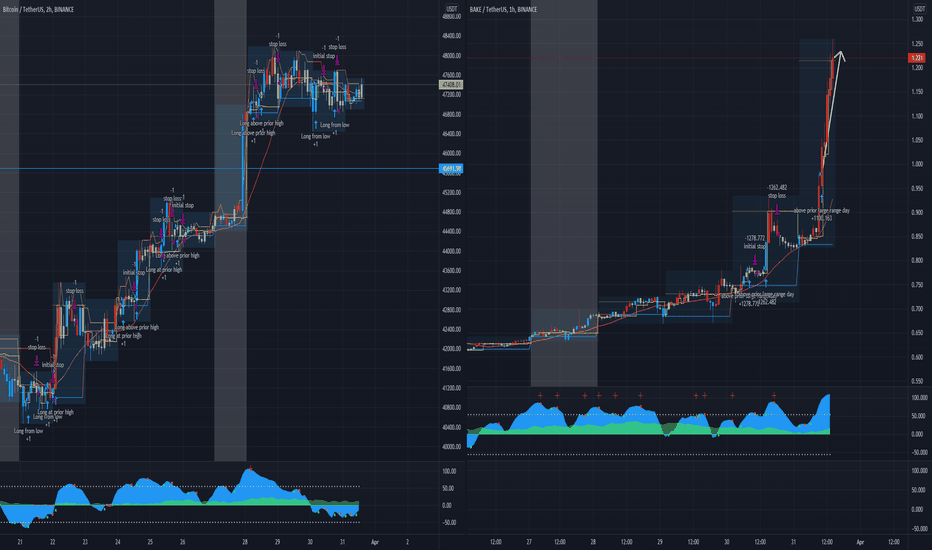

BAKEUSDT (BakeryToken) Mid to Daily tf Range Updated till 1-4-22BAKEUSDT (BakeryToken) Midtier to Daily timeframe range. A alt with decent price action and clean chart till now. the pump at 31 march 2022 is very much make sense as there is a massive gap from its top and the low volume #spring test from its bottom zone. it didnt took much for a push back. it did been reasonable to its zone provided some solid intraday setups and some scalps setups for daytraders. with not much of retail interest compare to other alt's it can get more volatile which it didnt for a while, which is a surprise.

Update on Crypto Breakout Strategythere is an even better setup than waiting for a daily range that is higher than the range of entire week:

simply scan for markets that had a high RELATIVE VOLUME today then place a buy stop trigger for the morning trades.

BNX today and BAKEUSDT yesterday show that you can get 10%+ trades with this method