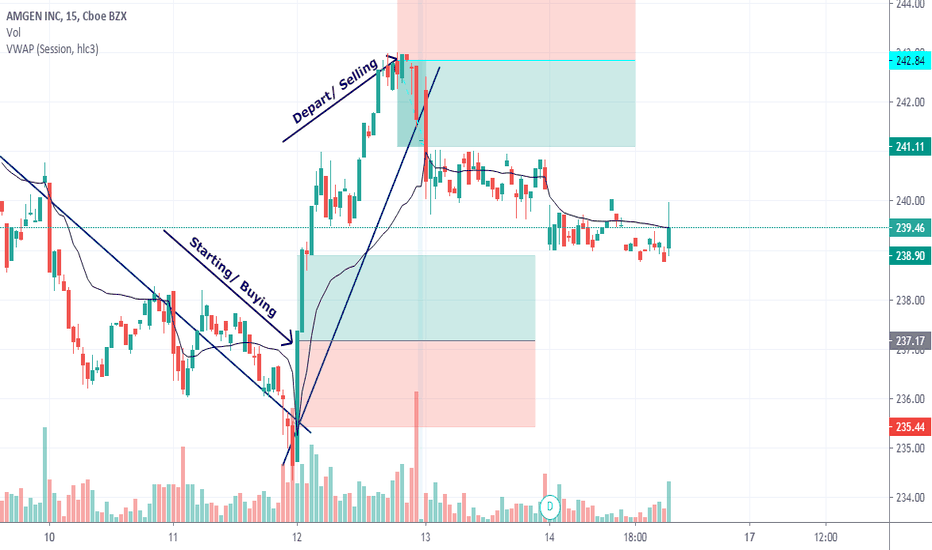

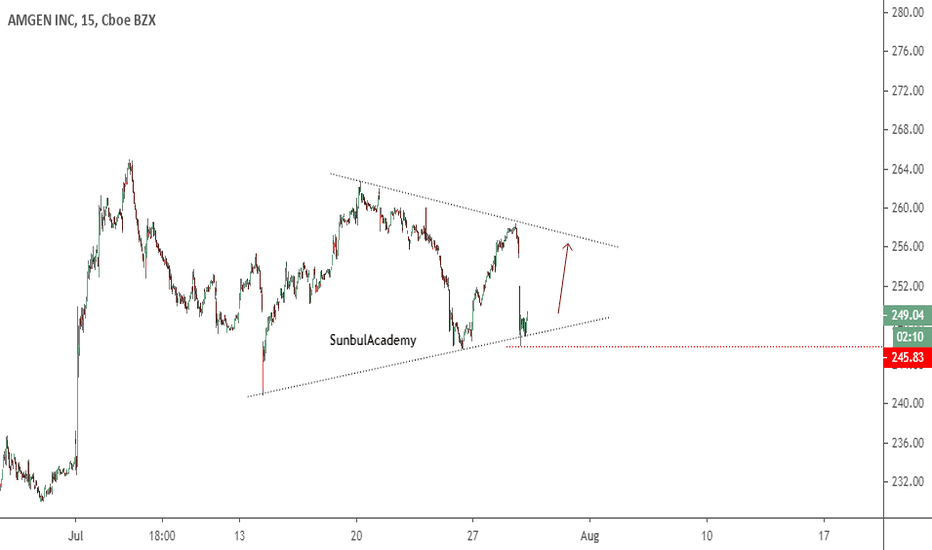

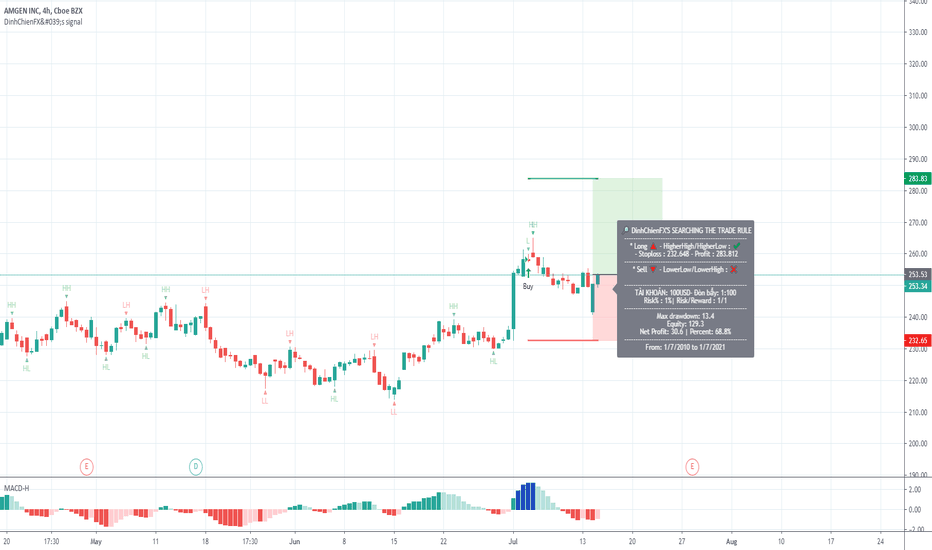

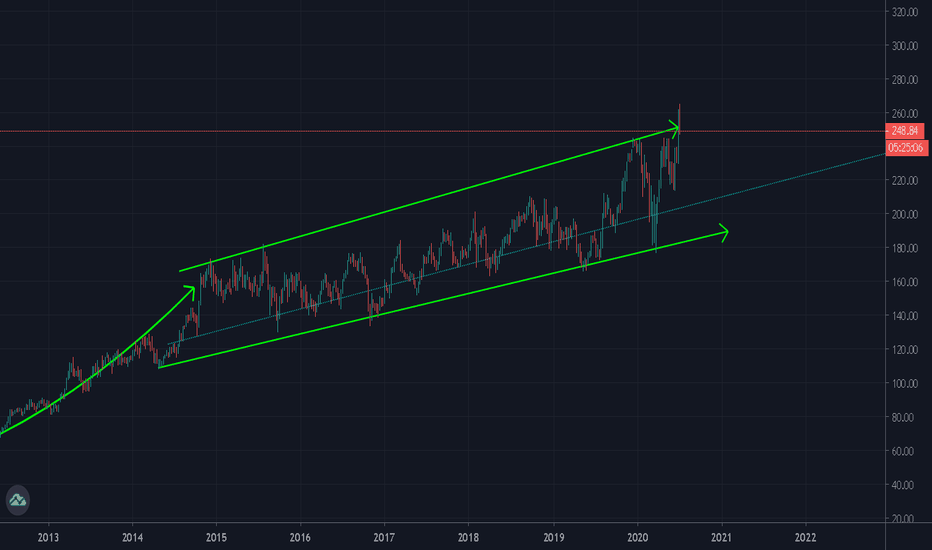

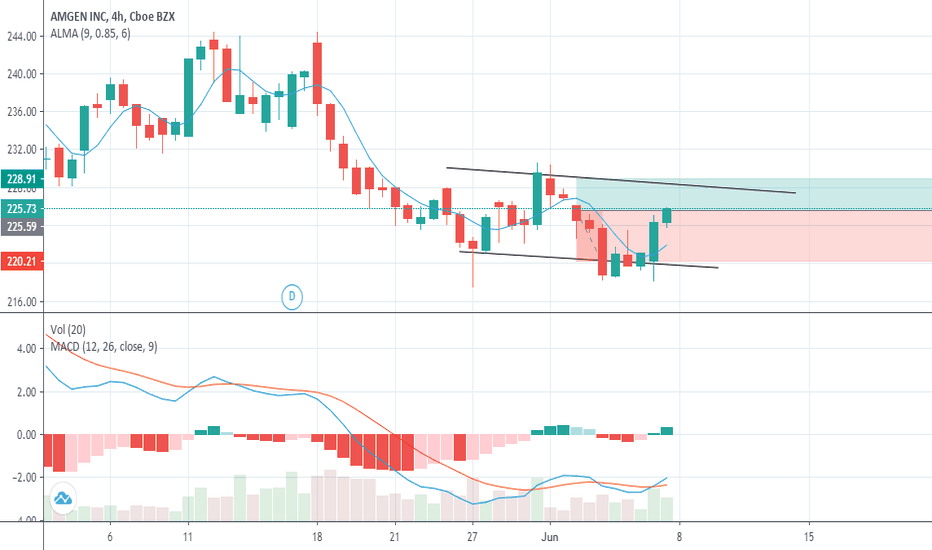

AMGEN INC: The easy winThe gain in this stock market really comes easy: two simple actions should be taken:

Firstly: we enter the market via a long position

Secondly: we close and sell our position because the market is starting to go down.

The appropriate time of each action is indicated in the chart especially the candles.

Traders who are interested in this recommendation: write in comments.

AMGND trade ideas

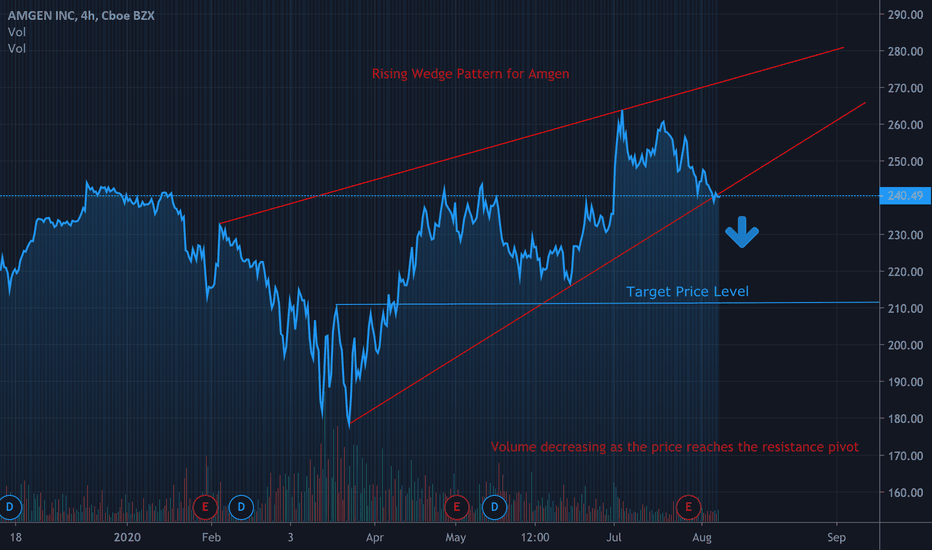

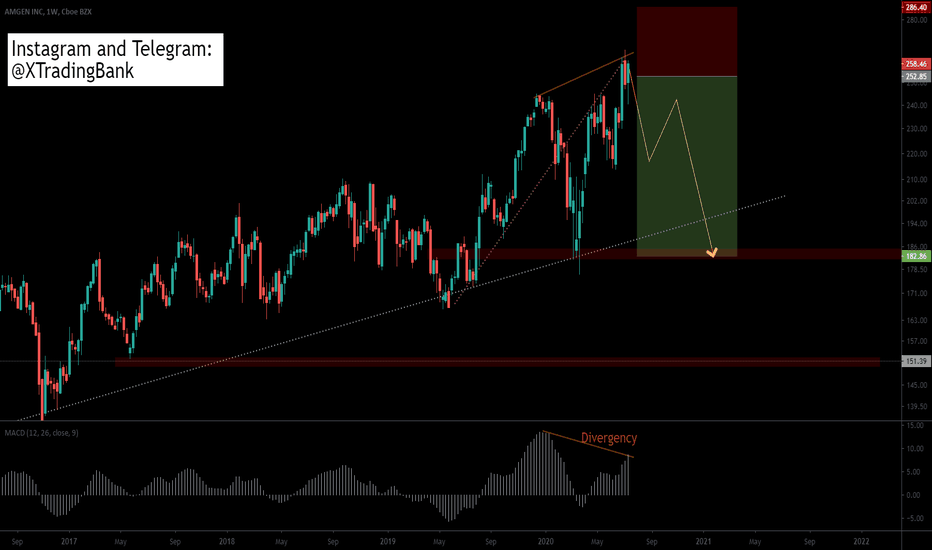

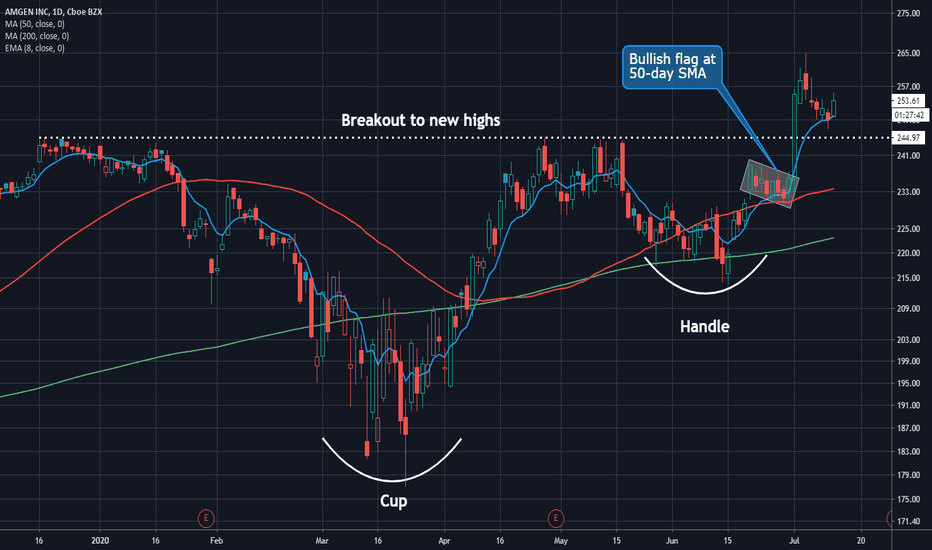

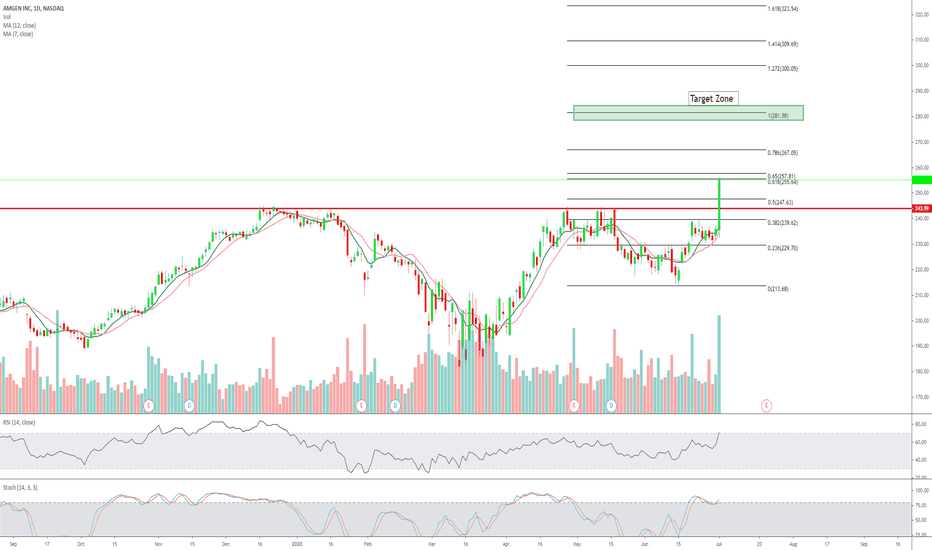

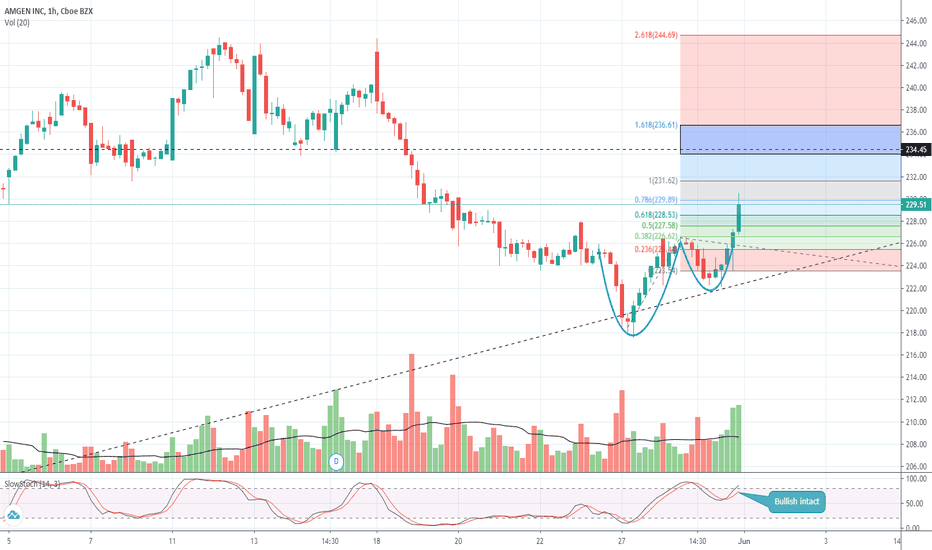

Amgen Just Broke Out. Now it’s Bouncing.Biotechnology has quietly moved up the industry rankings in the last month. We recently highlighted the long-term breakout in the iShares Nasdaq Biotechnology ETF and now its biggest holding (8% of assets) has some interesting patterns: Amgen.

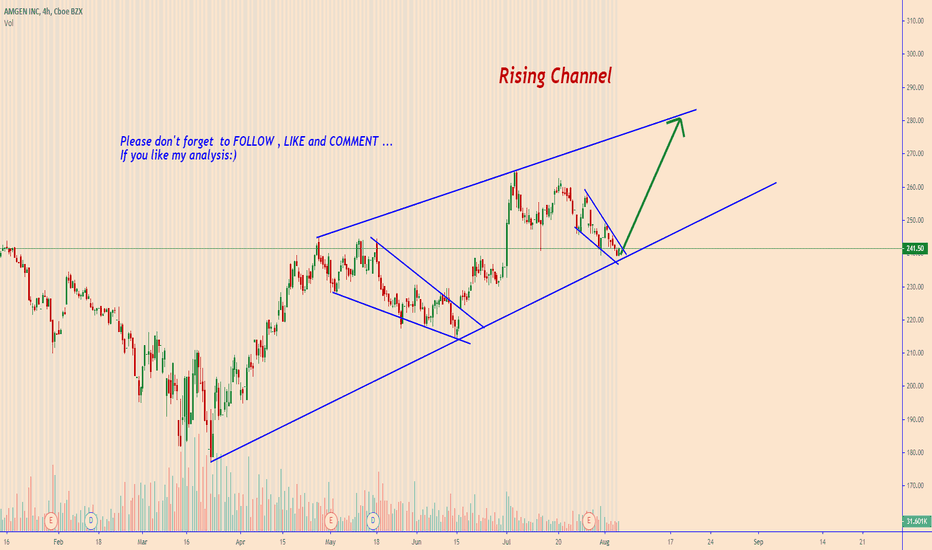

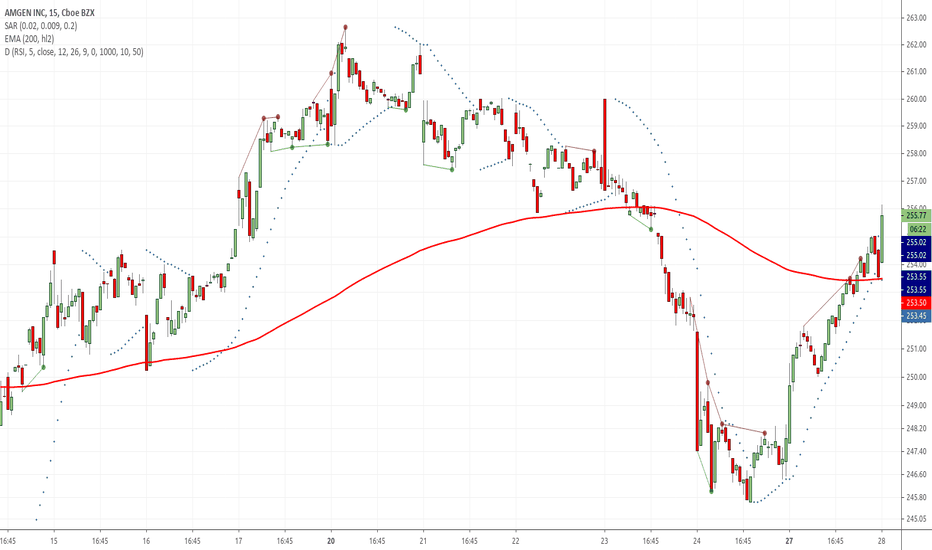

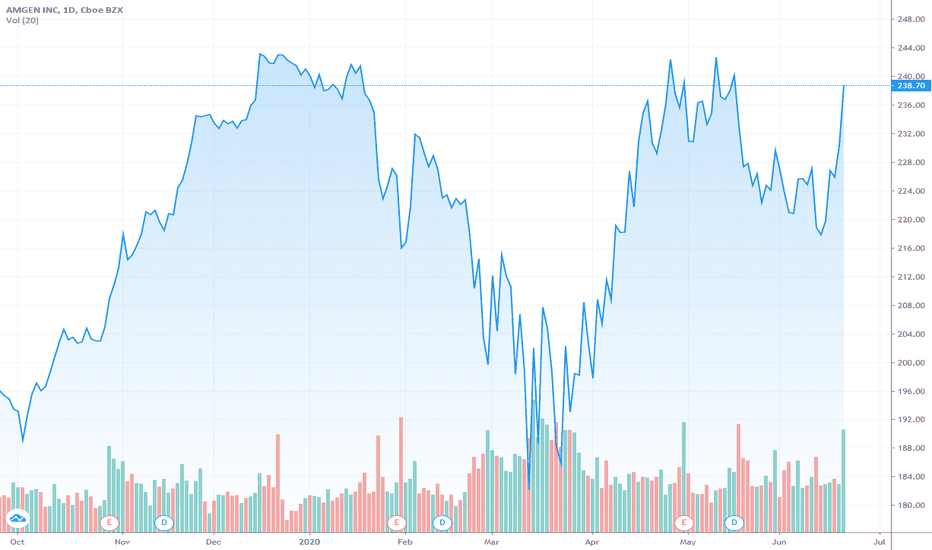

AMGN broke out to new highs in late 2019 and crashed along with the rest of the market in March. It then proceeded to make a higher low in June as it found support at its 200-day simple moving average (SMA). This produced a cup-and-handle chart pattern.

The stock had a tight bullish flag above its 50-day SMA in late June, and then ripped to new highs after winning a patent case against Novartis.

AMGN pulled back last week. It formed a hammer candlestick on Friday and is now bouncing at its 8-day exponential moving average (EMA). That line can serve as a potential risk-management area.

There are two reasons why it may not dip a lot more. First, AMGN hasn’t run much yet versus its December highs. So, there may not be many profit-takers yet. Second, the relative strength in IBB following its recent breakout could provide tailwinds.

AMGN reports earnings after the closing bell on July 28.

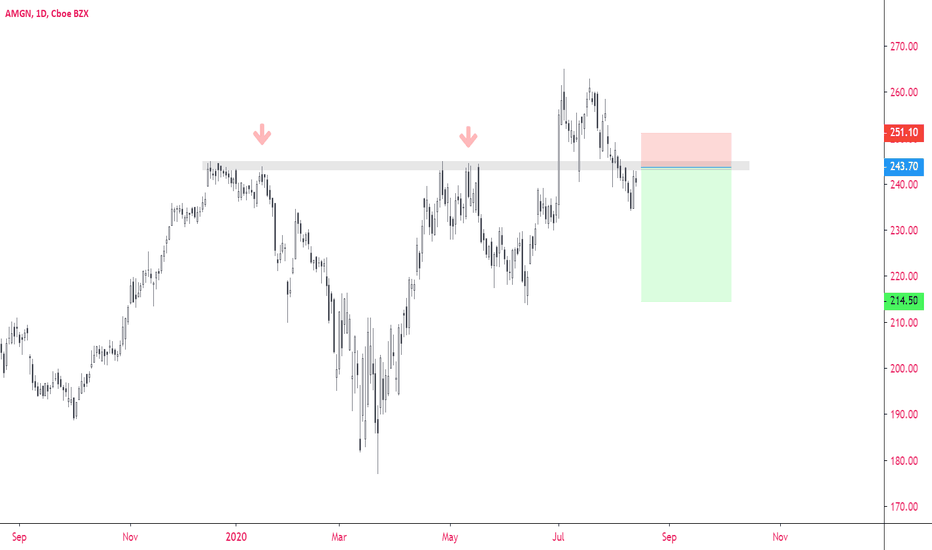

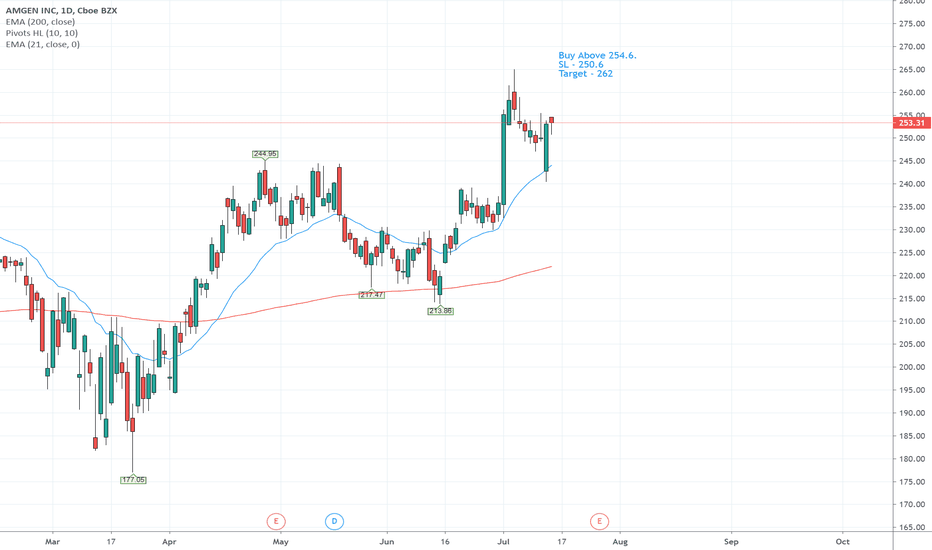

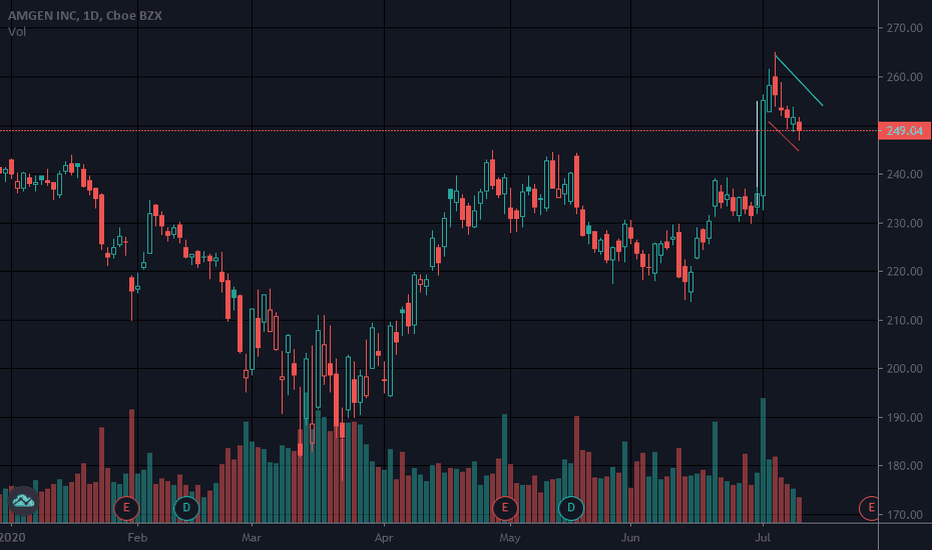

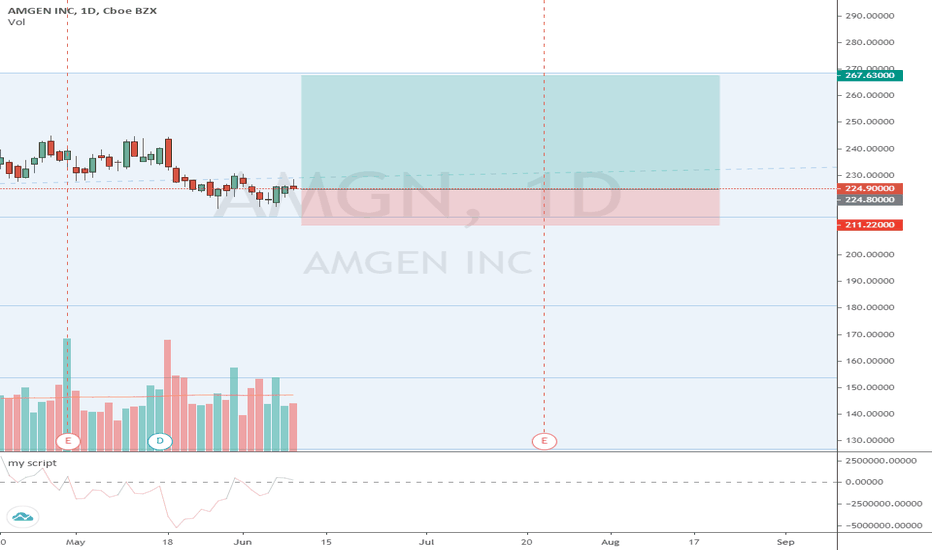

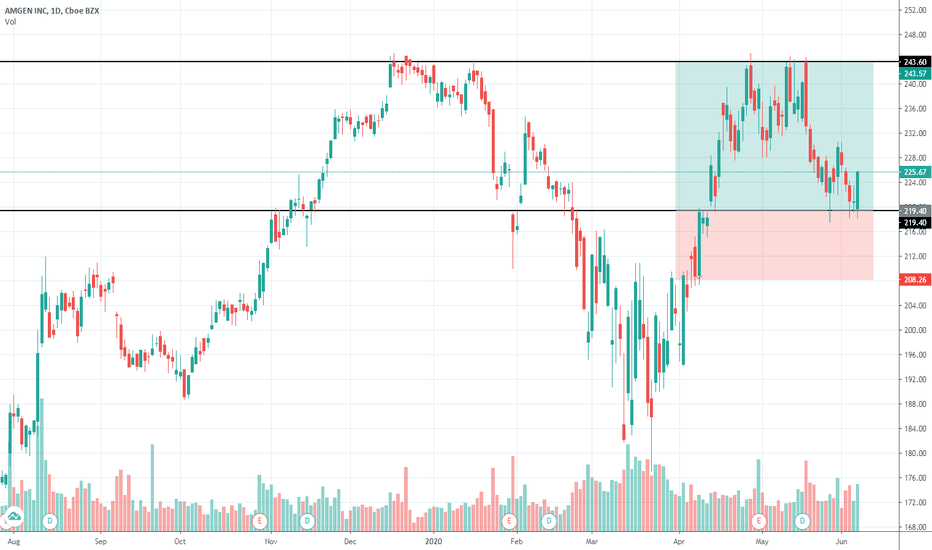

AMGN Setting to Try 52 Week High AgainAfter a price rejection yet again at the 52 week high at the $243.60 range in May, we see a sell off and now the price is being supported at $219.40. It could also be shorts covering that is forming the consolidation. Stock is also oversold, according to the Stoch RSI. This could be a good entry point to go long and test the 52 week resistance again.