Key facts today

Alibaba is restructuring by merging its food delivery service Ele.me and travel site Fliggy into one e-commerce group, boosting efficiency and profits. The stock is up over 33% in 2025.

Alibaba has settled for $433.5 million with investors over allegations of providing misleading information concerning Ant Group's regulatory challenges, which impacted its IPO and lending operations.

Alibaba launched 'Pay Later for Business' in the US, partnering with Balance to provide instant credit for SMEs. This solution offers flexible payments and AI-driven risk assessments.

0.10 USD

16.21 B USD

124.73 B USD

About Alibaba Group Holdings Ltd.

Sector

Industry

CEO

Yong Ming Eddie Wu

Website

Headquarters

Hangzhou

Founded

1999

ISIN

ARBCOM4601T8

Alibaba Group Holding Ltd. engages in providing technology infrastructure and marketing reach. It operates through the following business segments: China Commerce, International Commerce, Local Consumer Services, Cainiao, Cloud, Digital Media and Entertainment, and Innovation Initiatives and Others segments. The Core Commerce segment consists of platforms operating in retail and wholesale. The China Commerce segment includes China commerce retail and wholesale businesses. The International Commerce segment focuses on international commerce retail and wholesale businesses. The Local Consumer Services segment is involved in To-Home businesses, which include Ele.me, local services and delivery platform, and Taoxianda, and To-Destination segment businesses which include Amap, the provider of mobile digital map, navigation and real-time traffic information, and restaurant and local services guide platform. The Cainiao segment has Cainiao Network and offers domestic and international one-stop-shop logistics services and supply chain management solution. The Cloud segment includes Alibaba Cloud and DingTalk. The company was founded by Chung Tsai and Yun Ma on June 28, 1999 and is headquartered in Hangzhou, China.

Related stocks

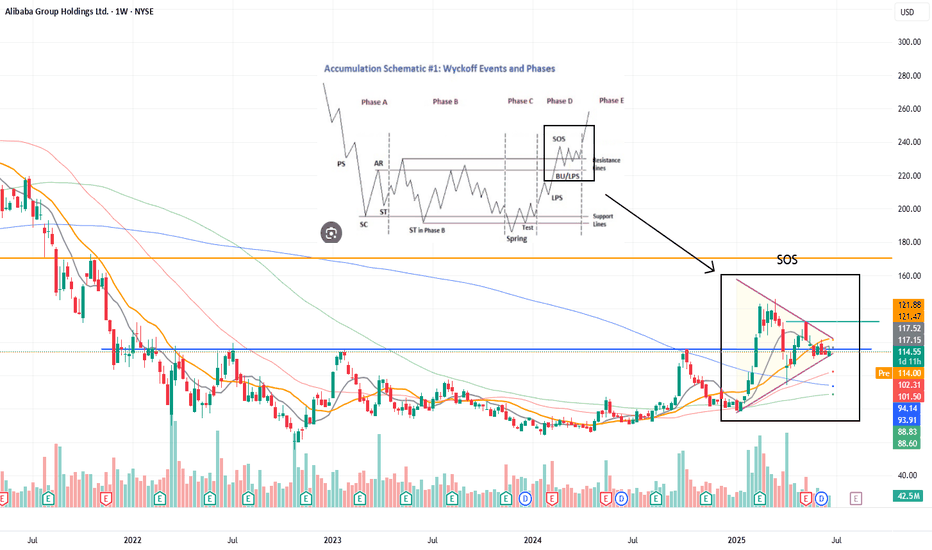

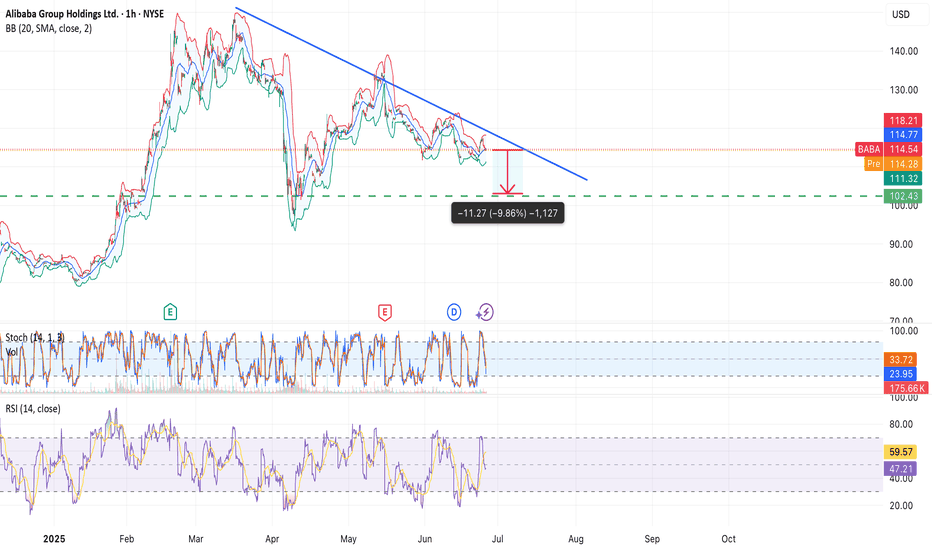

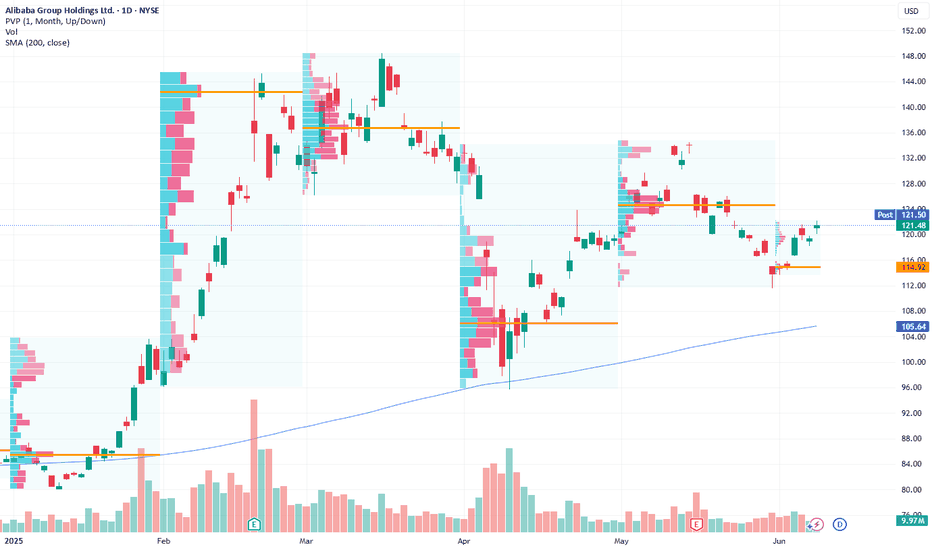

Alibaba (BABA) – Bearish Setup FormingNYSE:BABA

A descending triangle is forming on the chart, with strong resistance around $118 and horizontal support near $102. The structure suggests a potential breakdown, targeting a move of ~−9.8%.

Key observations:

• Price rejected from the descending trendline multiple times

• Stochastic tur

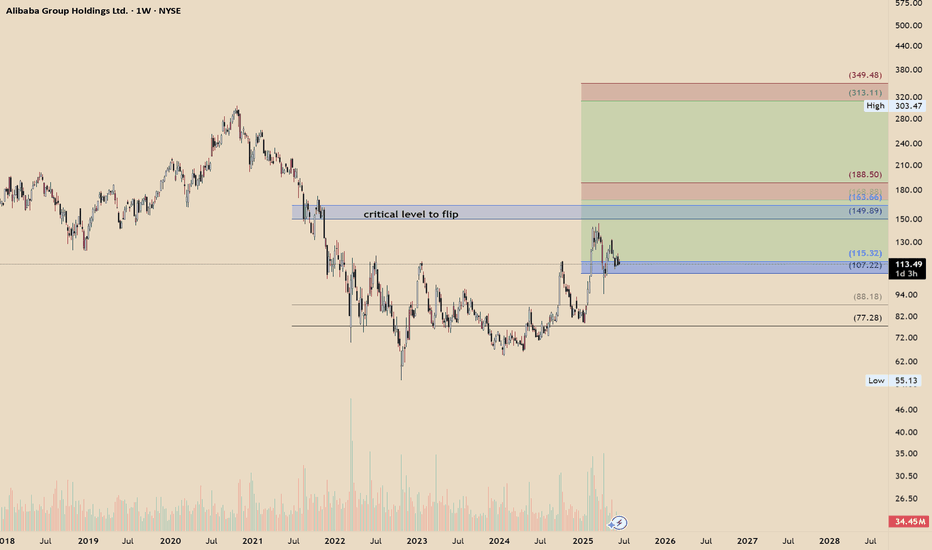

BABA undervaluedHello

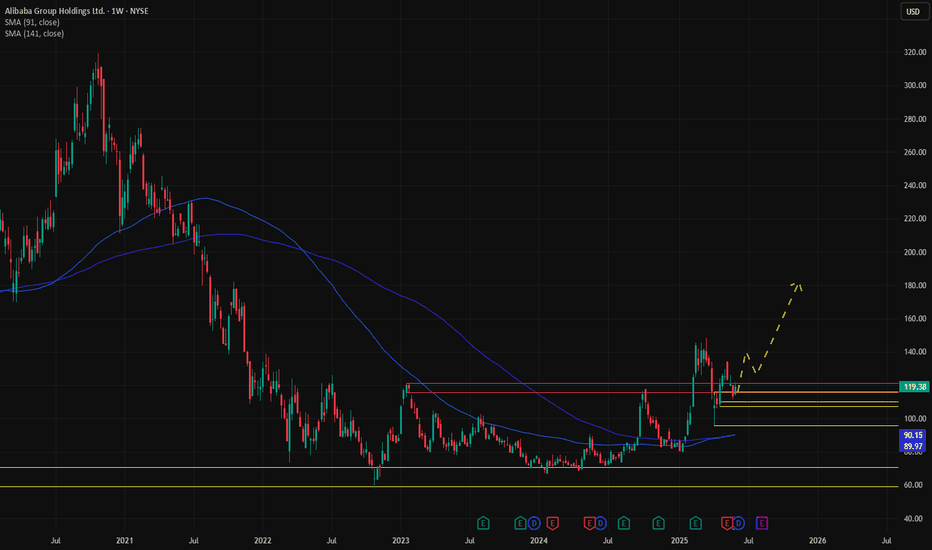

BABA has invalidated any corrective attempts due to its price action — a 3-month bullish breaker is in play, and the price has yet to test the first level of algorithmic targets around 163–168.

There’s also a critical level to flip near 149, and I’m fairly confident it will be reclaimed if ma

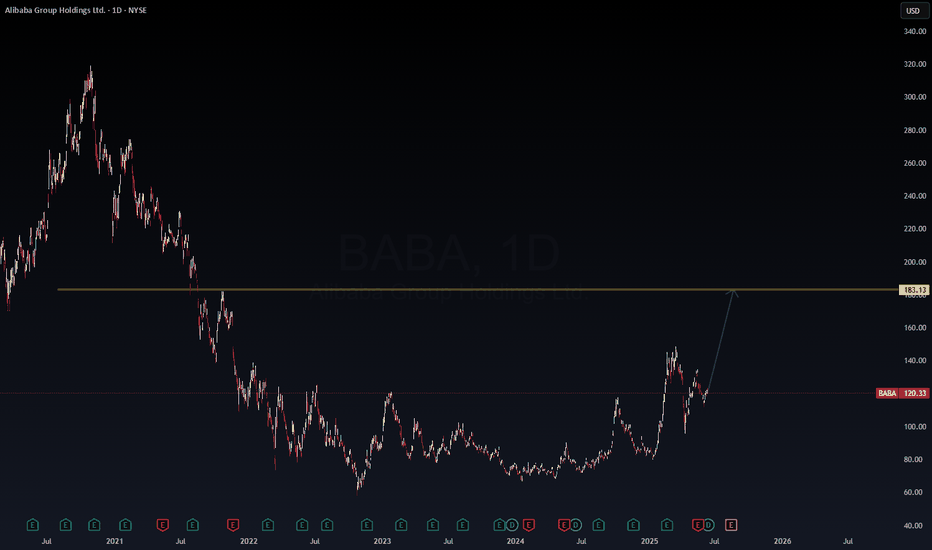

here is the #chart for $BABA Bullish with short-term caution. Alibaba ( NYSE:BABA ) is at $114.08, up 0.13% daily but down 2.92% monthly, as shown in the finance card above. X posts reflect bullish sentiment, citing a breakout above the 200-week moving average and a potential move toward $168-$183.13, driven by strong AI/cloud

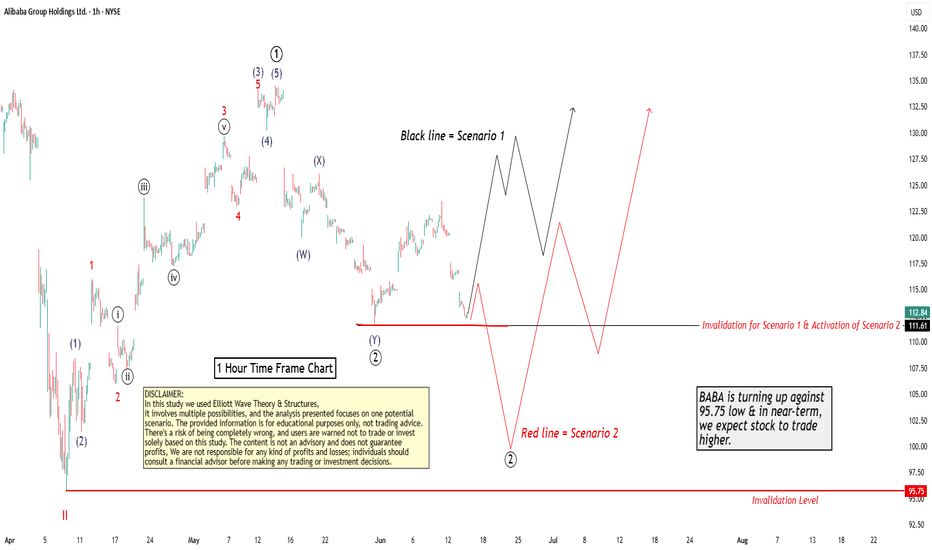

BABA Stock: A Detailed Analysis using Elliott Wave Theory RulesHello Friends,

Welcome to RK_Chaarts,

Let's analyze Ali Baba Group Holdings Limited, also known as BABA, listed on the NYSE. We'll be using the Elliott Waves theory.

Friends, as we can clearly see, after hitting a low of around $95.75 on 9th April 2025, it started an impulse wave. Within this wa

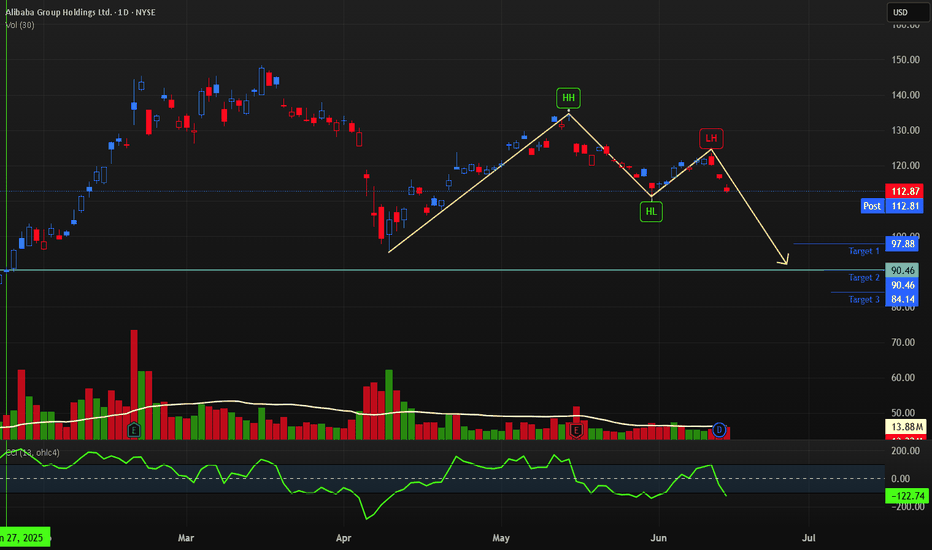

BABA (Alibaba Group Holdings) | 1D Chart OutlookPublished by WaverVanir International LLC | 06/11/2025

BABA has broken out of its multi-year base and is now in a potential macro reversal structure. The current retracement near $120 could act as a higher low before a continuation toward the unfilled liquidity zone around $183.13, a major ineffici

Alibaba: A Strategic Long Play Amid Regulatory Easing

Current Price: $119.38

Direction: LONG

Targets:

- T1 = $123.00

- T2 = $127.00

Stop Levels:

- S1 = $116.50

- S2 = $114.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ide

BABA Weekly Options Play – 2025-06-10🧾 BABA Weekly Options Play – 2025-06-10

Bias: Moderately Bearish

Timeframe: 5 trading days

Catalysts: Weakening momentum, max pain gravity, fading upside catalysts

Trade Type: Single-leg PUT option

🧠 Model Summary Table

Model Direction Strike Entry Price Target Stop Loss Confidence

Grok Bullish 125

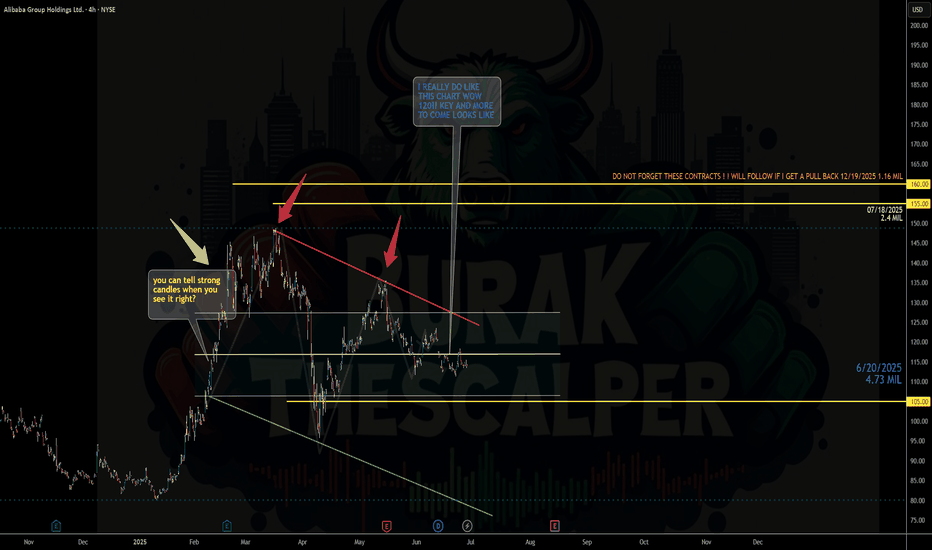

ALIBABA GROUP🎯 Trade Setup

Metric Value

Trade Type BUY

Entry Price 116

Stop Loss (SL) 106

Risk 10

Target 169

Reward 53

Risk-Reward (RR) 5.3

Last High 148

Last Low 95

📈 Key Insights

Trend Alignment: All timeframes show a bullish (UP) trend — strong multi-timeframe confluence.

Demand Zone Cluster: High confidenc

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where BABAD is featured.