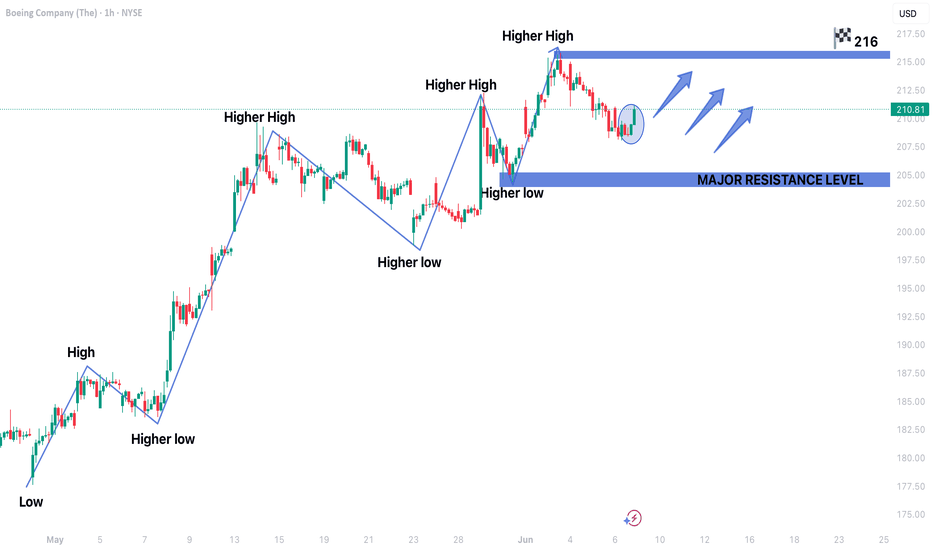

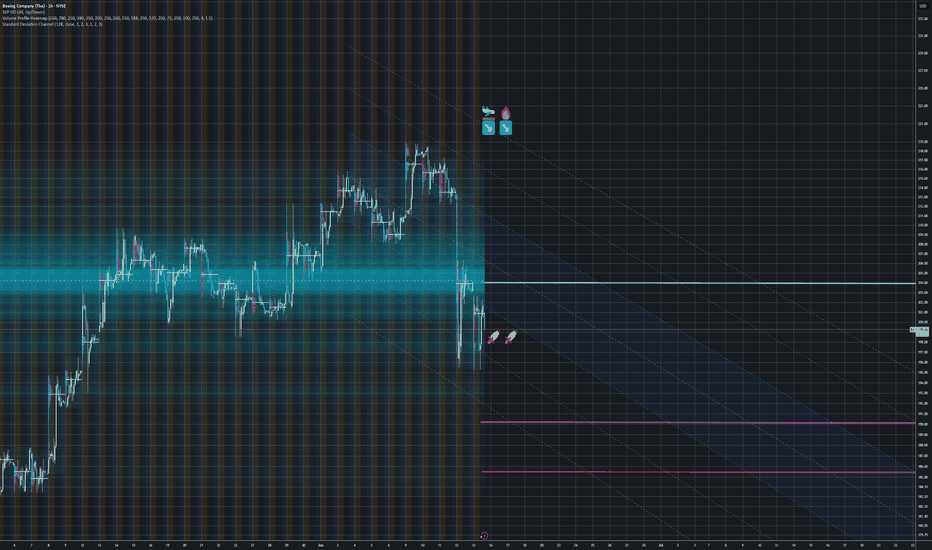

BOEING STOCK PRICE CONTINUING IN BULLISH TREND BOEING STOCK PRICE CONTINUING IN BULLISH TREND.

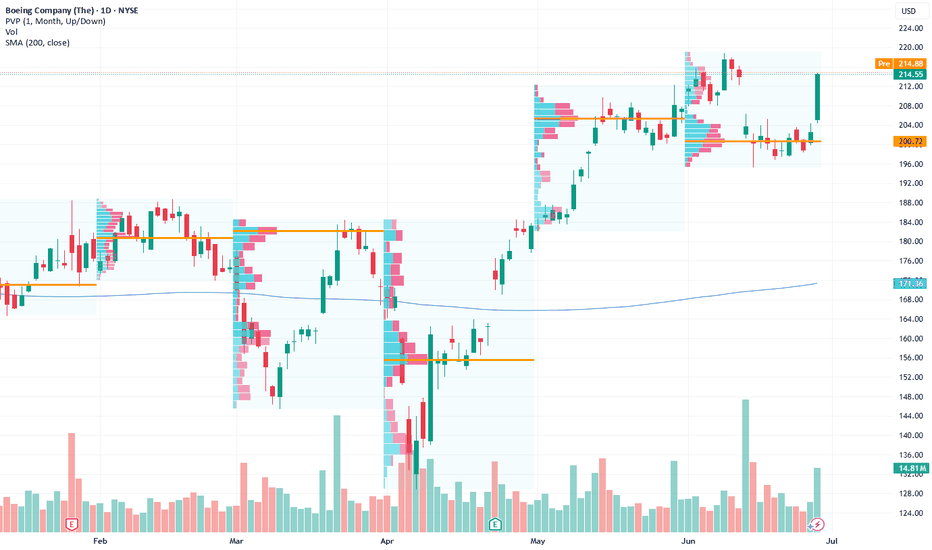

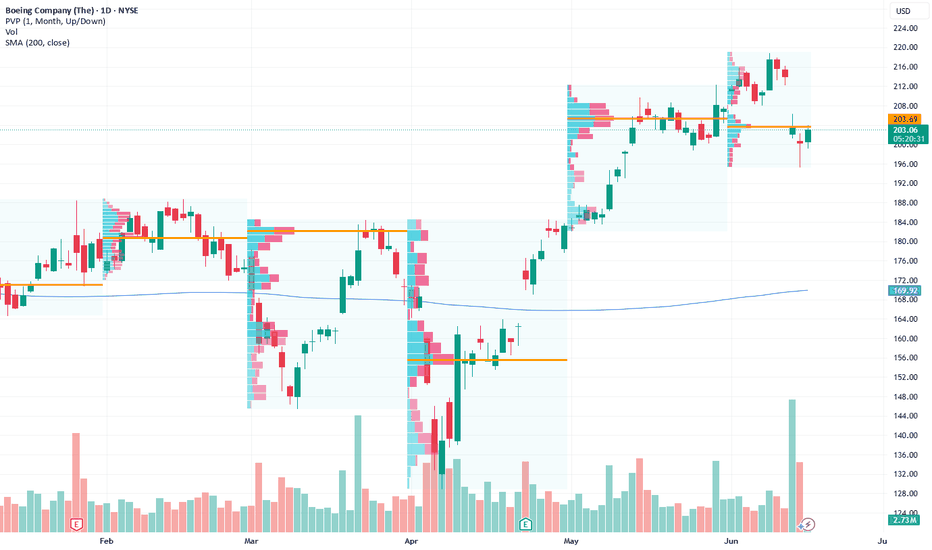

Stock is currently trading in bullish trend in 1 hour time frame.

Forming higher highs and higher lows.

Secondary trend is expected to end.

Bullish engulfing candles shows the strength of buyers in the market.

Price is expected to remain bullish for up

Key facts today

Ryanair's CEO is optimistic about U.S.-EU tariff exemptions for commercial aircraft, which could benefit Boeing as Ryanair is its largest customer in Europe.

−0.66 USD

−10.50 B USD

59.08 B USD

About Boeing Company (The)

Sector

Industry

CEO

Robert Kelly Ortberg

Website

Headquarters

Arlington

Founded

1916

ISIN

ARDEUT110061

FIGI

BBG000L7T160

Bank of America Corporation is a bank and financial holding company, which engages in the provision of banking and nonbank financial services. It operates through the following segments: Consumer Banking, Global Wealth and Investment Management, Global Banking, Global Markets, and All Other. The Consumer Banking segment offers credit, banking, and investment products and services to consumers and small businesses. The Global Wealth and Investment Management provides client experience through a network of financial advisors focused on to meet their needs through a full set of investment management, brokerage, banking, and retirement products. The Global Banking segment deals with lending-related products and services, integrated working capital management and treasury solutions to clients, and underwriting and advisory services. The Global Markets segment includes sales and trading services, as well as research, to institutional clients across fixed-income, credit, currency, commodity, and equity businesses. The All Other segment consists of asset and liability management activities, equity investments, non-core mortgage loans and servicing activities, the net impact of periodic revisions to the mortgage servicing rights (MSR) valuation model for both core and non-core MSRs, other liquidating businesses, residual expense allocations and other. The company was founded by Amadeo Peter Giannini in 1904 is headquartered in Charlotte, NC.

Related stocks

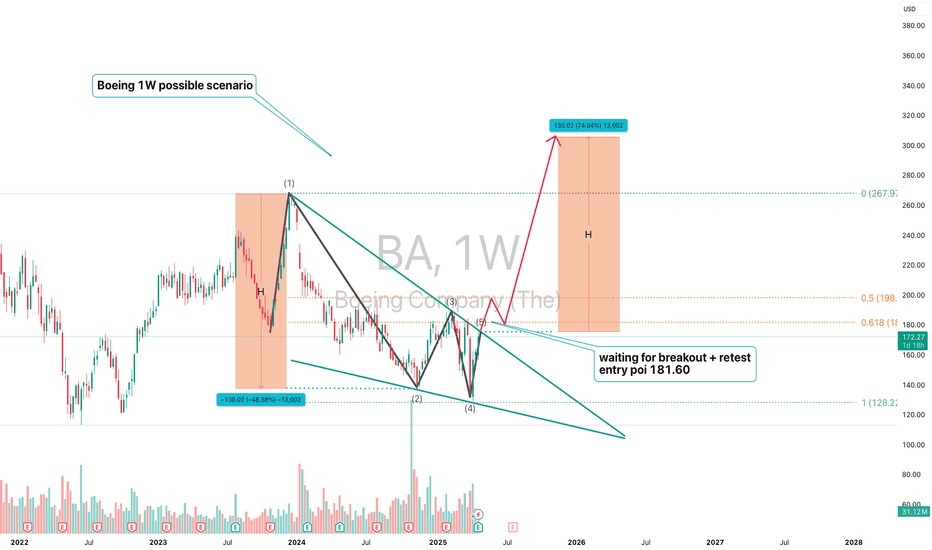

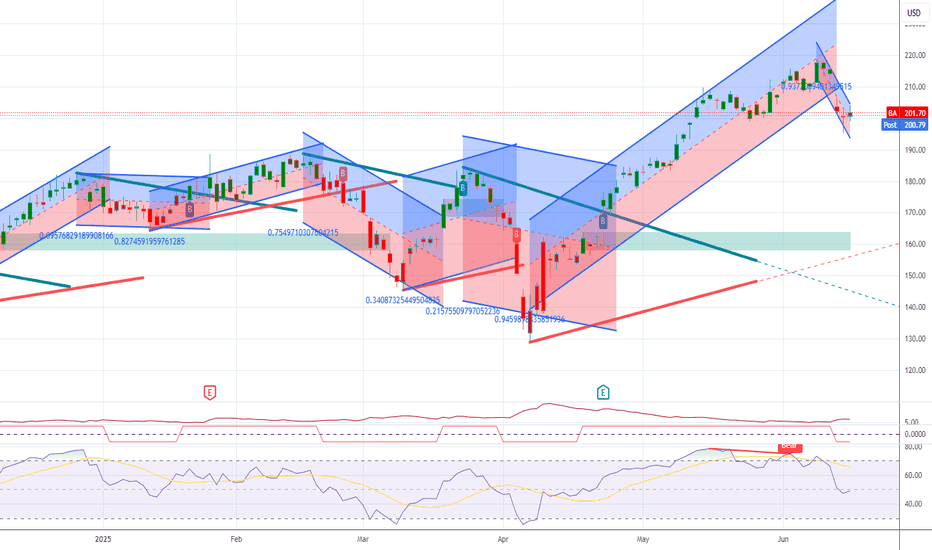

Boeing (BA, 1W) Falling Wedge + H-Projection TargetOn the weekly chart, Boeing has formed a classic falling wedge — a bullish reversal pattern that typically signals the end of a correction phase. After a sharp decline from $267.97 to $138, price action began to compress within a wedge, forming lower highs and higher lows on declining volume — a tex

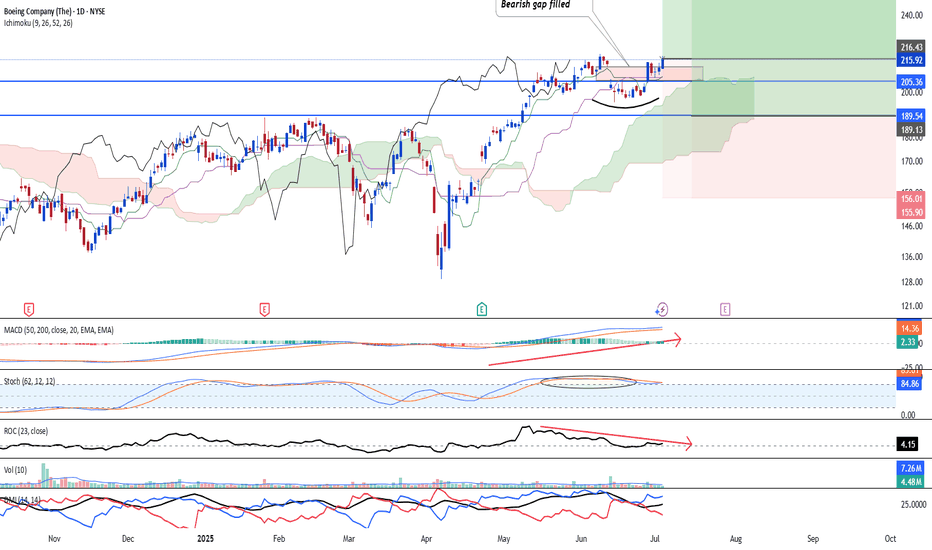

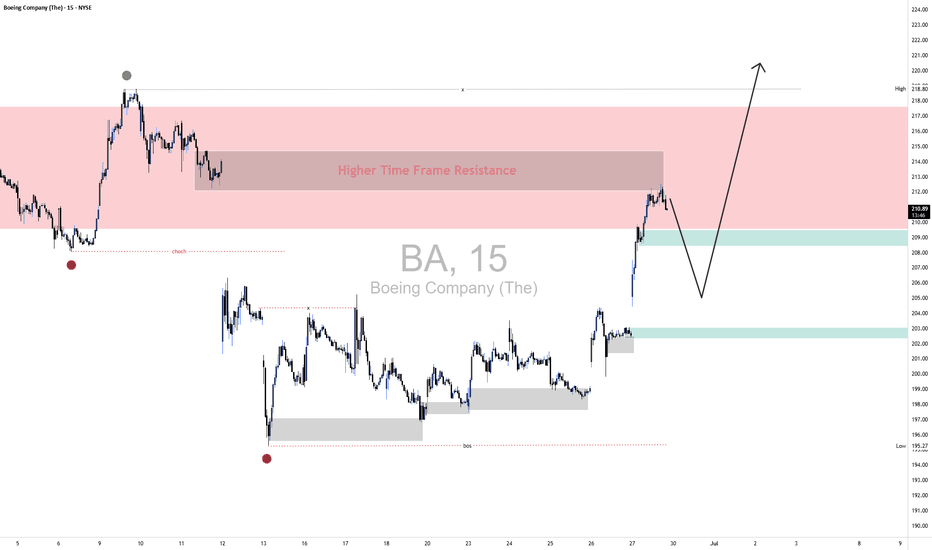

Boeing - Eyeing a recovery soon?NYSE:BA is back to the upside and has been trending upwards since early April 2025. Price action saw the stock is back into action after filling up the bearish breakaway gap. Now it is waiting to break the key resistance above 220.00 to further confirmed the upside.

Meanwhile, Ichimoku is showing

Short-term BA Short - Gap Fill OpportunityHey y’all —

Sharing this idea a bit late, but I believe there’s still more downside to capture.

Last Friday’s massive pump on BA closed the gap on the daily timeframe. Based on the current structure, the chart suggests a likely move to close the lower gap as well. I entered around the checkered fl

Boeing Company (The) (BA) Powers Global AviationBoeing Company (The) (BA) is a global aerospace leader, manufacturing commercial airplanes, defense systems, and space technology. With iconic aircraft like the 737 and major contracts with governments worldwide, Boeing plays a key role in global aviation and security. The company’s growth is driven

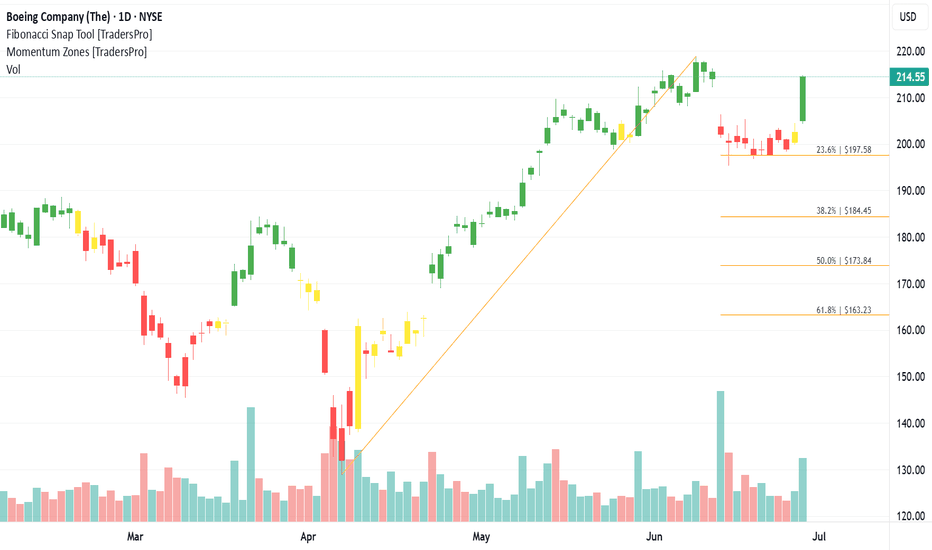

Boeing Stock: Is A Short-Term Rally Still In Flight?- Current Price: $214.55

- Key Insights: Boeing exhibits bullish technical momentum but risks of short-

term pullback are increasing due to overbought conditions. Support levels

around $207-$210 and resistance at $222-$225 are key. Geopolitical tailwinds

and long-term aviation demand bolster

BA, Boeing1. Higher Timeframe Context

Price is currently trading within a well-defined higher timeframe supply zone between 214–218, which previously acted as a major distribution area. This zone aligns with a prior bearish impulse leg and represents unmitigated institutional sell-side interest.

2. Current P

Boeing: Long Trade Potential Amid Defense MomentumCurrent Price: $200.32

Direction: LONG

Targets:

- T1 = $206.00

- T2 = $209.00

Stop Levels:

- S1 = $198.00

- S2 = $195.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to i

[$BA] Boeing's black friday?NYSE:BA

Quick-Take

Unfortunately, an accident occured with a Boeing Dreamliner 787 in India.

This triggered a 'small crash' in the stock as well, due to Boeing's (ongoing) raising concerns for quality and safety.

However, we should see it as chance for a potential swing-trade of 7 days.

⭕ Risks

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US97023BS3

BOEING CO. 16/46Yield to maturity

7.56%

Maturity date

Jun 15, 2046

US97023BV6

BOEING CO. 17/47Yield to maturity

7.43%

Maturity date

Mar 1, 2047

BCOC

BOEING CO. 15/45Yield to maturity

7.36%

Maturity date

Mar 1, 2045

BA4602171

Boeing Company 3.625% 01-MAR-2048Yield to maturity

7.22%

Maturity date

Mar 1, 2048

BA4762315

Boeing Company 3.85% 01-NOV-2048Yield to maturity

7.08%

Maturity date

Nov 1, 2048

BA4798350

Boeing Company 3.825% 01-MAR-2059Yield to maturity

7.04%

Maturity date

Mar 1, 2059

BA4866210

Boeing Company 3.95% 01-AUG-2059Yield to maturity

7.00%

Maturity date

Aug 1, 2059

BA4829131

Boeing Company 3.9% 01-MAY-2049Yield to maturity

7.00%

Maturity date

May 1, 2049

BA4866209

Boeing Company 3.75% 01-FEB-2050Yield to maturity

6.93%

Maturity date

Feb 1, 2050

BA5803372

Boeing Company 7.008% 01-MAY-2064Yield to maturity

6.86%

Maturity date

May 1, 2064

BA4798349

Boeing Company 3.5% 01-MAR-2039Yield to maturity

6.57%

Maturity date

Mar 1, 2039

See all BAC bonds

Curated watchlists where BAC is featured.