BHP - Leading power in the Copper business!Overview of our analysis for BHP!

BHP Group Limited (BHP) is one of the world’s leading diversified natural resources companies, with operations in minerals, oil, and gas. Headquartered in Australia, BHP is a dominant player in the global commodities market, particularly in iron ore, copper, and c

Key facts today

BHP Group's shares increased by approximately 1% as copper prices rose, driven by demand from Chinese buyers and optimism surrounding a potential U.S.-China trade deal.

BHP Group sold its 17% stake in the Kabanga Nickel project to Lifezone Metals for $10 million, with potential additional payments of $83 million. Lifezone now owns 100% of Kabanga Nickel.

BHP Group faces rising costs and delays at its Canadian potash project and is exploring the sale of its Australian nickel operations, while still depending on iron ore for profits.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2,175 ARS

11.48 T ARS

80.88 T ARS

4.75 B

About BHP GROUP LIMITED

Sector

Industry

CEO

Mike Henry

Website

Headquarters

Melbourne

Founded

1885

ISIN

ARDEUT112992

FIGI

BBG000L7Q2P0

BHP Group Ltd. engages in the exploration, development, production and processing of iron ore, metallurgical coal, and copper. It operates through the following segments: Copper, Iron Ore, and Coal. The Copper segment refers to the mining of copper, silver, lead, zinc, molybdenum, uranium, and gold. The Iron Ore segment involves in the mining of iron ore. The Coal segment focuses on metallurgical coal and energy coal. The company was founded on August 13, 1885 and is headquartered in Melbourne, Australia.

Related stocks

Our opinion on the current state of BHP(BHG)BHP is a global commodities company headquartered in Melbourne, Australia, with operations focused on minerals, oil, and gas. It employs approximately 62,000 people, primarily in the Americas and Australia. The company produces copper, iron, coal, oil, and gas, and holds significant stakes in some o

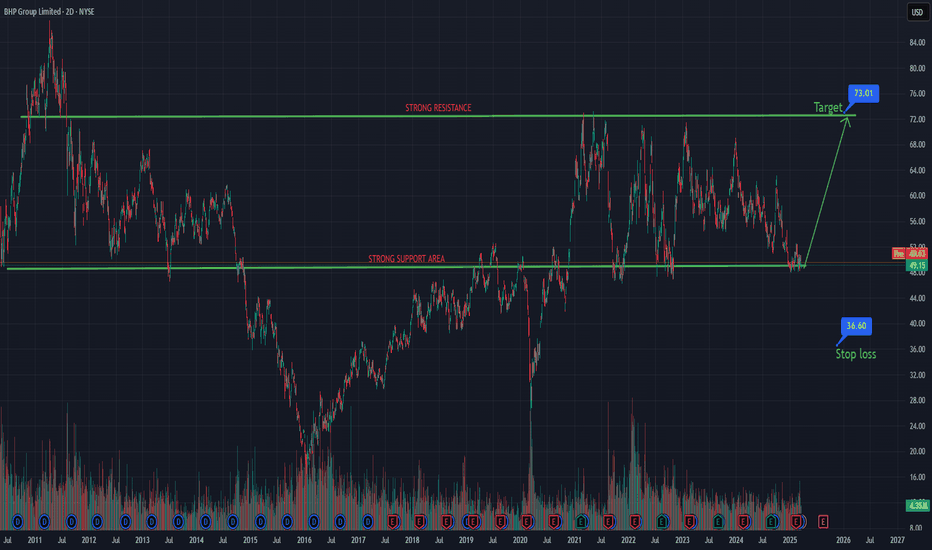

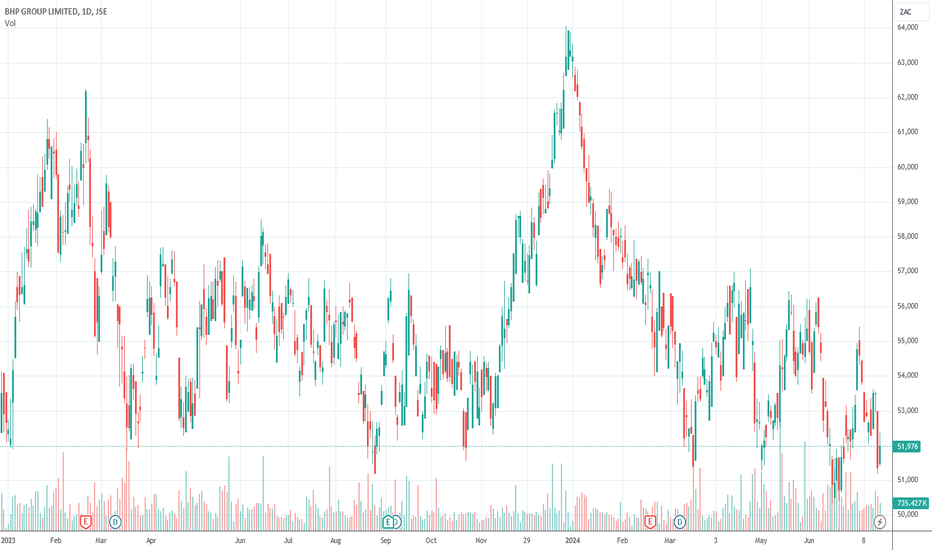

The Real BHP ChartAccidentally posted an FMG under a BHP chart, here is the BHP chart analysis breakdown.

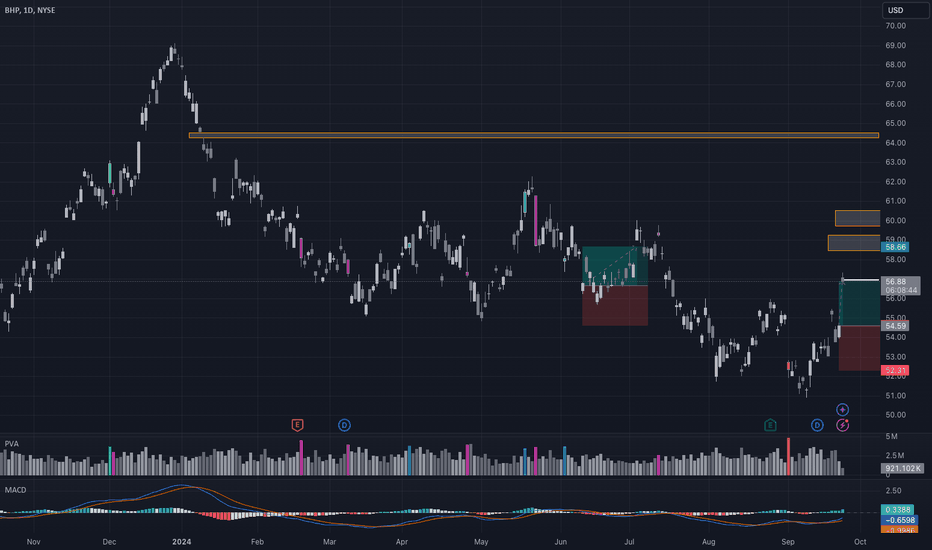

Still got a pull back predicted to occur, although the chart is looking surprisingly bullshit, i am curious to see whether it will pull back to one of these zones first.

Although there is a potential for a ABC/

Our opinion on the current state of BHP(BHG)BHP is a global commodities company headquartered in Melbourne, Australia, with operations in minerals, oil, and gas, and employing around 62,000 people, mostly in the Americas and Australia. The company is involved in producing a wide range of resources, including copper, iron ore, coal, oil, and g

BHP, Rio Tinto (commodities): Highly exposed to the prices of miBHP, Rio Tinto (commodities): Highly exposed to the prices of minerals and metals (iron, copper, coal). Their performance is closely tied to global demand, particularly in China.

Rewards

Trading at 27.1% below our estimate of its fair value

Earnings are forecast to grow 4.76% per year

Risk Analys

Our opinion on the current state of BHP(BHG)BHP is a global commodities company headquartered in Melbourne, Australia, with a workforce of 62,000 primarily based in the Americas and Australia. The company processes a diverse range of minerals, oil, and gas, including copper, iron ore, coal, oil, and gas.

BHP owns significant interests in sev

Our opinion on the current state of BHP(BHG)BHP is a global commodities company based in Melbourne, Australia, with a workforce of 62,000 employees predominantly in the Americas and Australia. It is engaged in the extraction and processing of minerals, oil, and gas. BHP's extensive operations include ownership stakes in some of the world's le

Our opinion on the current state of BHP(BHG)BHP Group, headquartered in Melbourne, Australia, stands as one of the largest and most diversified global commodities companies. With operations primarily in the Americas and Australia, BHP employs around 62,000 people and engages in the production of essential commodities such as copper, iron ore,

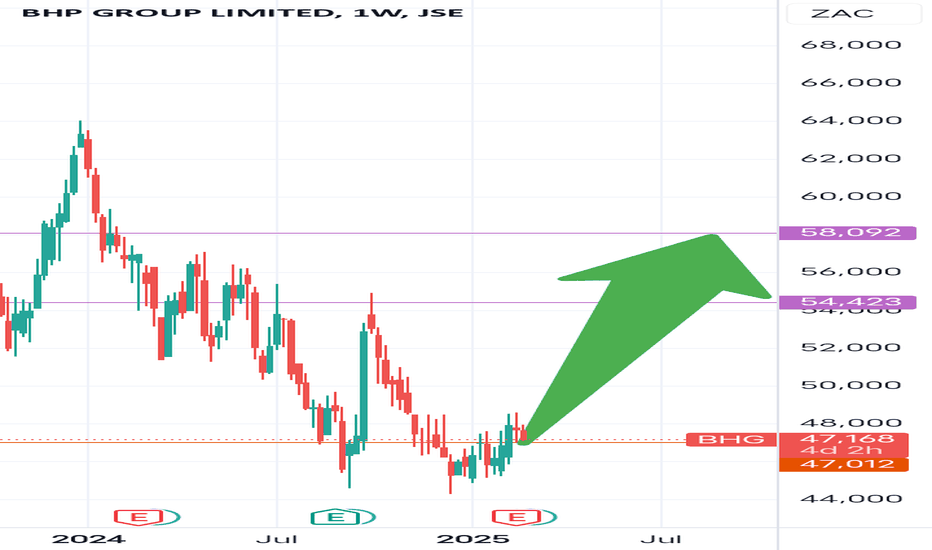

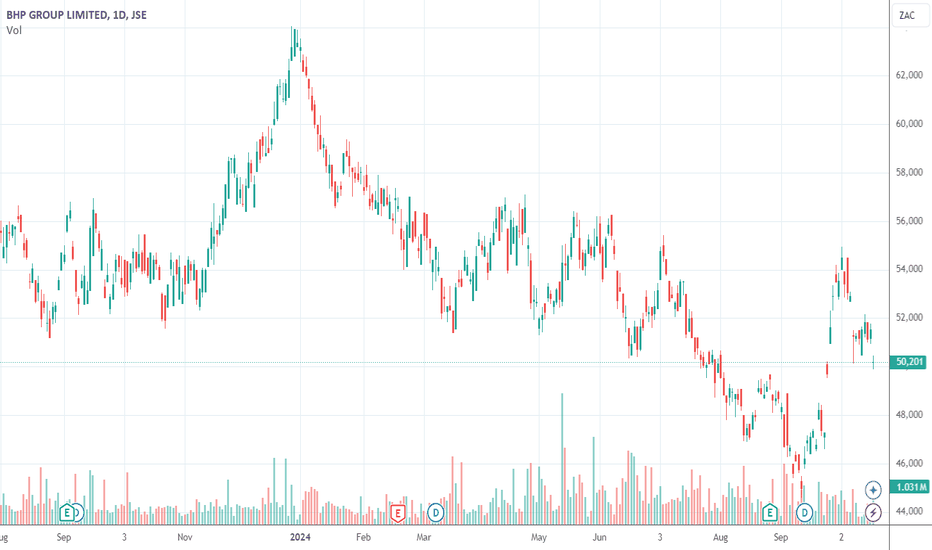

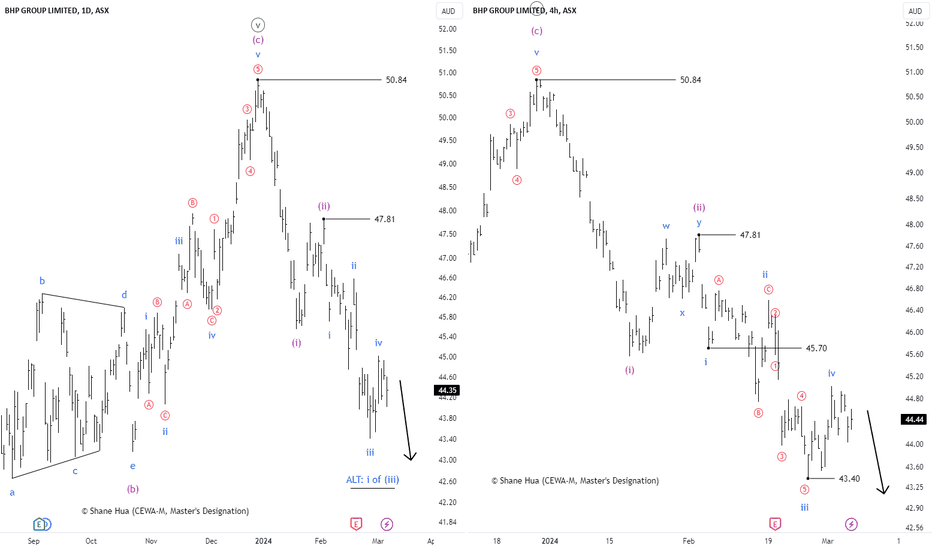

BHP: March 6, 2024(ASX) BHP Group || March 6, 2024

Master of Elliott Wave Analysis: Shane Hua (CEWA-M)

(Left chart) The broader context (Daily chart) indicates that it seems the preceding Five-waves pattern has concluded, and you can see that wave ((v))-circle-green ended at 50.84. Following that, there was a downwa

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

16IM

BHP BILLITON FINANCE LTD 4.3% GTD SNR EMTN 25/09/42Yield to maturity

6.30%

Maturity date

Sep 25, 2042

US92928WAH88

WMCFinanceUSA 6,25% 15/05/2033Yield to maturity

6.28%

Maturity date

May 15, 2033

US55451AR9

BHP BILLITON F. 12/42Yield to maturity

6.03%

Maturity date

Feb 24, 2042

US55451AV0

BHP BILLITON F. 13/43Yield to maturity

5.81%

Maturity date

Sep 30, 2043

BBL5647381

BHP Billiton Finance (USA) Ltd. 5.5% 08-SEP-2053Yield to maturity

5.77%

Maturity date

Sep 8, 2053

BBL6009238

BHP Billiton Finance (USA) Ltd. 5.3% 21-FEB-2035Yield to maturity

5.10%

Maturity date

Feb 21, 2035

BBL3705472

WMC Finance (USA) Ltd. 7.35% 01-DEC-2026Yield to maturity

4.97%

Maturity date

Dec 1, 2026

US55451BA5

BHP BILL.FI. 23/33Yield to maturity

4.96%

Maturity date

Feb 28, 2033

BBL5647380

BHP Billiton Finance (USA) Ltd. 5.25% 08-SEP-2033Yield to maturity

4.92%

Maturity date

Sep 8, 2033

BBL6009237

BHP Billiton Finance (USA) Ltd. 5.125% 21-FEB-2032Yield to maturity

4.73%

Maturity date

Feb 21, 2032

US55451AY4

BHP BILL.FI. 23/26Yield to maturity

4.61%

Maturity date

Feb 27, 2026

See all BHP bonds

Curated watchlists where BHP is featured.