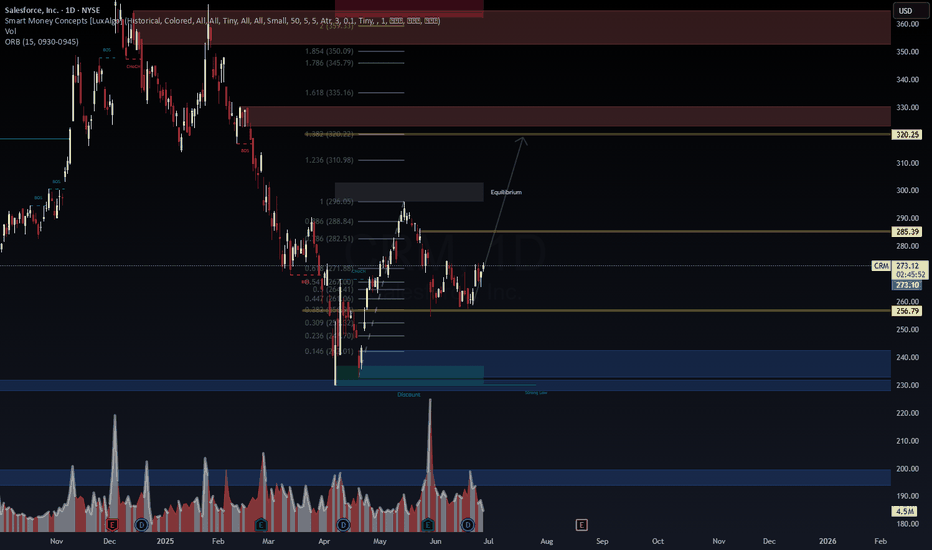

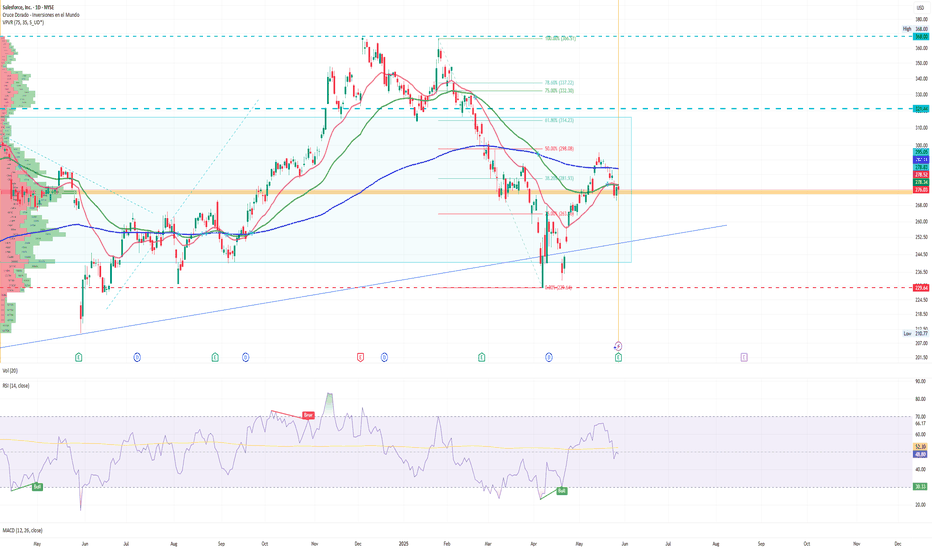

CRM: Bullish Imbalance Fill in Progress | Targeting Equilibrium 🧠 Salesforce (CRM) shows a clean price reaction from the 61.8–66% retracement zone after bullish CHoCH and internal BOS confirmations. Our Smart Money model detects a re-accumulation beneath prior imbalance zones, with a potential run toward the equilibrium range at ~296–320.

📍 WaverVanir Trade Pla

0.30 USD

5.51 B USD

33.68 B USD

About Salesforce

Sector

Industry

CEO

Marc Russell Benioff

Website

Headquarters

San Francisco

Founded

1999

ISIN

ARBCOM4601J9

Salesforce, Inc. engages in the design and development of cloud-based enterprise software for customer relationship management. Its solutions include sales force automation, customer service and support, marketing automation, digital commerce, community management, collaboration, industry-specific solutions, and salesforce platform. The firm also provides guidance, support, training, and advisory services. The company was founded by Marc Russell Benioff and Parker Harris in 1999 and is headquartered in San Francisco, CA.

Related stocks

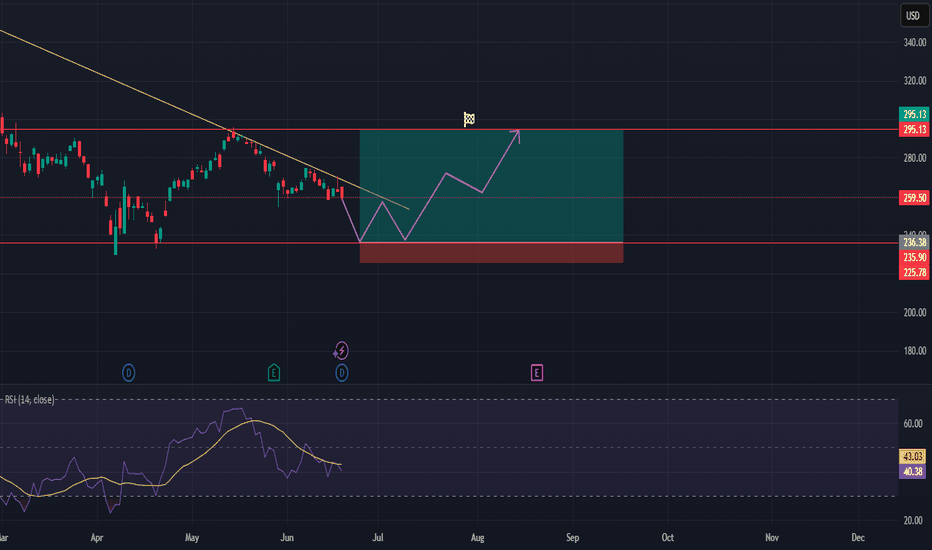

CRM long positionHi traders,

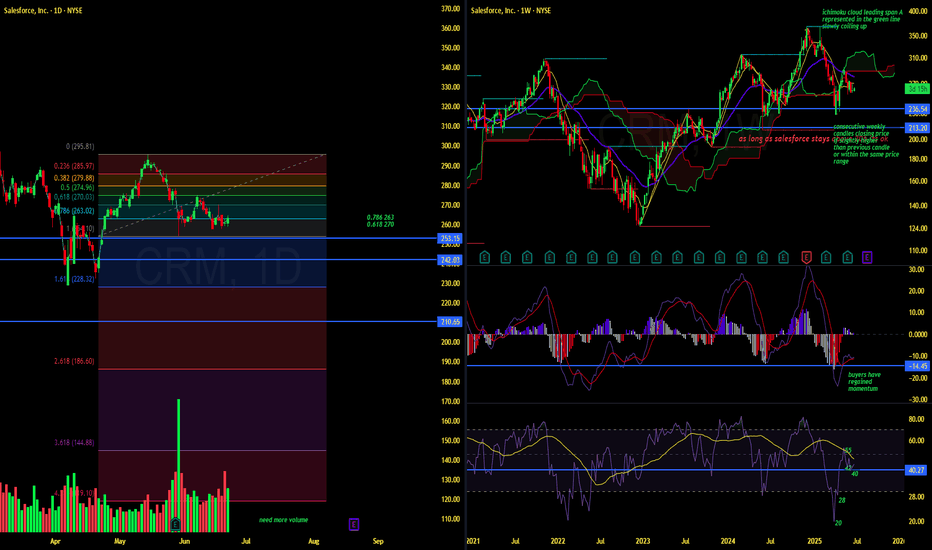

Let's have a look at 1D Salesforce, Inc chart.

The stock is currently in a short-term downtrend, but it's approaching a previous support zone.

We expect 1 more dip to retest the lows from April 2025. With this dip , the RSI should revisit an oversold condition.

The target is the resist

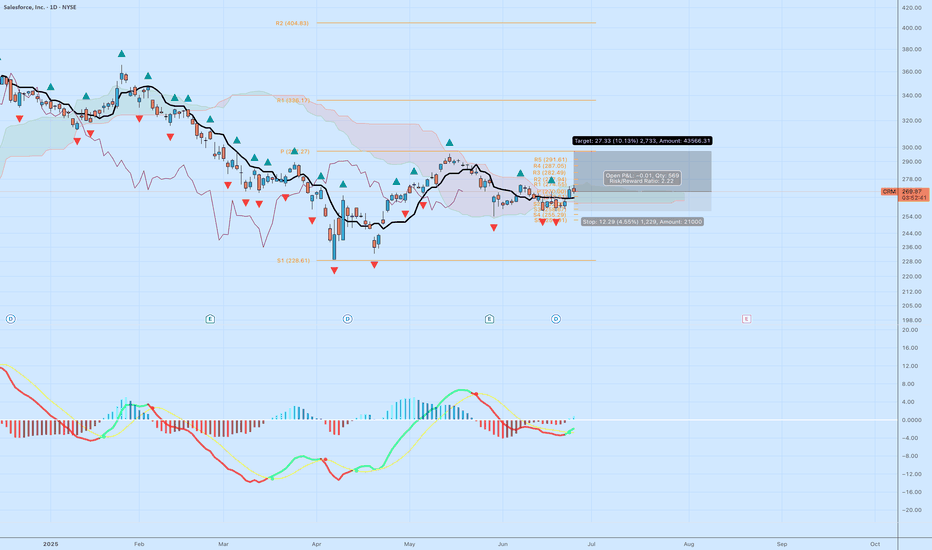

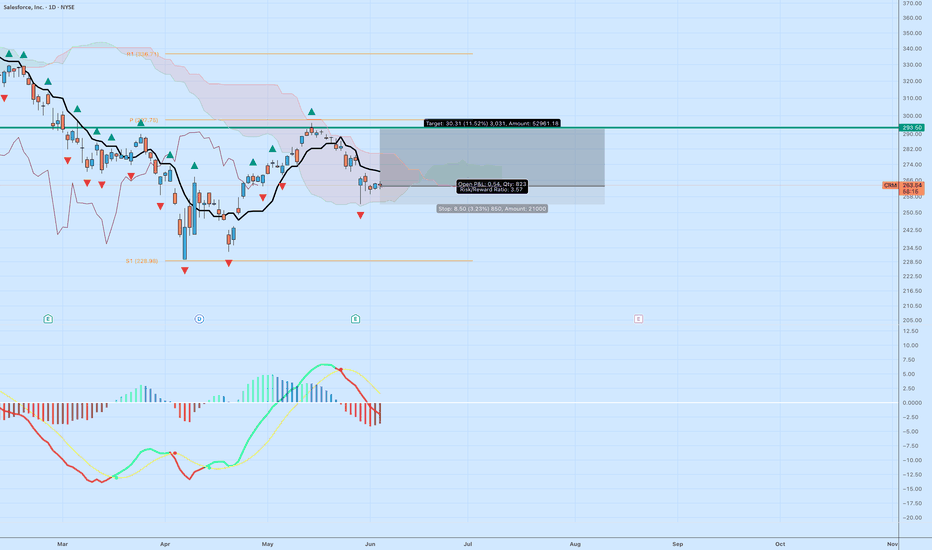

$CRM Long Setup – Coiling at Support with Breakout PotentialSalesforce ( NYSE:CRM ) is consolidating just below the Ichimoku Cloud and building a base around the $265–$270 zone. The MACD is showing early bullish crossover signals with momentum starting to shift, and the price action suggests a coiled spring setup. After multiple tests of the $265 area and a

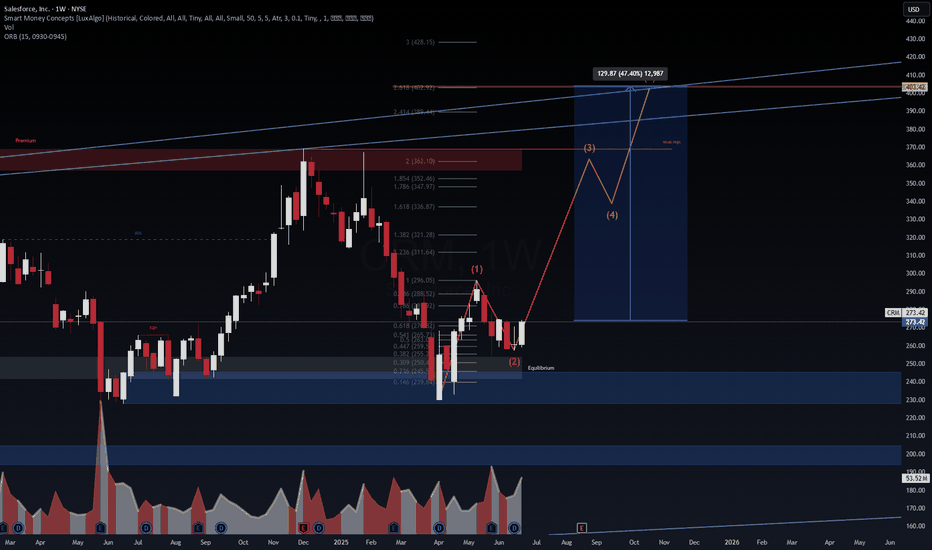

CRM: Wave Structure Analysis. WaverVanir International LLC · CRM Weekly Outlook · Published June 28 2025

Ticker: CRM | Chart: Weekly

🔹 Catalyst

• Q2 FY26 earnings on August 27 2025 after market close (TipRanks, 2025)

• Dreamforce conference mid September 2025

🔹 Macro Environment

• Fed likely to hold rates at July 30 mee

A force to be reckon with.CRM

The attached image will be of the daily and the weekly timeframe.

On July 2024 of last year the monthly candle of July 2024 had a high of 264.52. Currently in line with closing price of 263.41 today 06/24/25. Will price react the same way a year prior when volume from buyers picked up. The

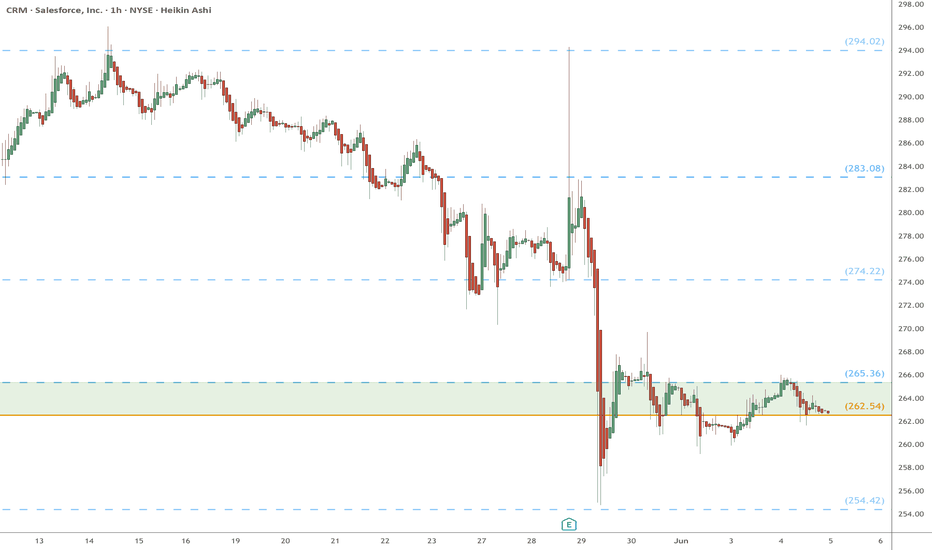

CRM watch $262-265: Major Support that will call Bull or BearCRM gave us a nice long and exit in last idea below.

Now retreated to a major support $262.54-265.36

Bottom bound is a Golden Genesis, most important.

Above this zone is Bull, below is more Bear hell.

Look for a clean bounce or rejection for next leg.

.

Last Plot that gave perfect Entry/Exit:

E

CRM Long Setup: High R:R Opportunity Off Support ZoneSalesforce (CRM) is setting up for a compelling long opportunity based on a combination of Ichimoku cloud structure, pivot level confluence, and a strong risk/reward ratio. After a recent pullback from the $290s, CRM has entered a consolidation range just above the Ichimoku cloud. With a defined sto

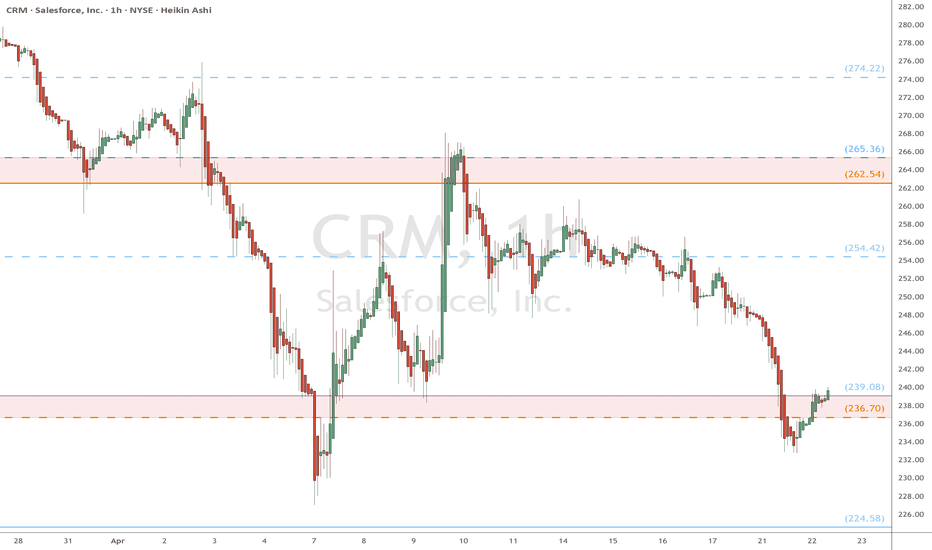

CRM watch $236.70-239.08: Resistance flip to support for bottomCRM looking weak along with the tech sector.

Watching a key support zone at $236.70-239.08

Look for Break-n-Retest or consolidation above.

.

Previous Plots below:

Topping Call after Tariff Relief pump:

Bottom Call at $212:

Profit Taking levels after bottom pump

=============================

Salesforce Goes Shopping: Acquires Informatica for $8 BillionSalesforce (NYSE: CRM) has taken a major step in its growth strategy by announcing the acquisition of Informatica (NYSE: INFA) for approximately $8 billion. Informatica closed yesterday at $24.29 per share. This deal, Salesforce’s largest since acquiring Slack in 2021, aims to strengthen its artific

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US79466LAM6

SALESFORCE 21/61Yield to maturity

6.87%

Maturity date

Jul 15, 2061

US79466LAL8

SALESFORCE 21/51Yield to maturity

6.83%

Maturity date

Jul 15, 2051

US79466LAK0

SALESFORCE 21/41Yield to maturity

6.34%

Maturity date

Jul 15, 2041

US79466LAJ3

SALESFORCE 21/31Yield to maturity

4.64%

Maturity date

Jul 15, 2031

US79466LAH7

SALESFORCE 21/28Yield to maturity

4.21%

Maturity date

Jul 15, 2028

US79466LAF1

SALESFORCE 18/28Yield to maturity

4.08%

Maturity date

Apr 11, 2028

See all CRMD bonds

Curated watchlists where CRMD is featured.