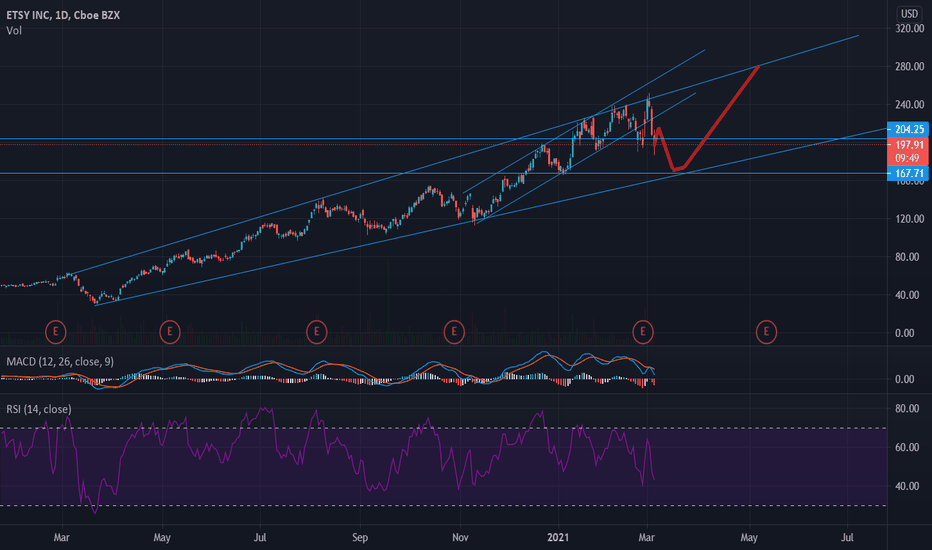

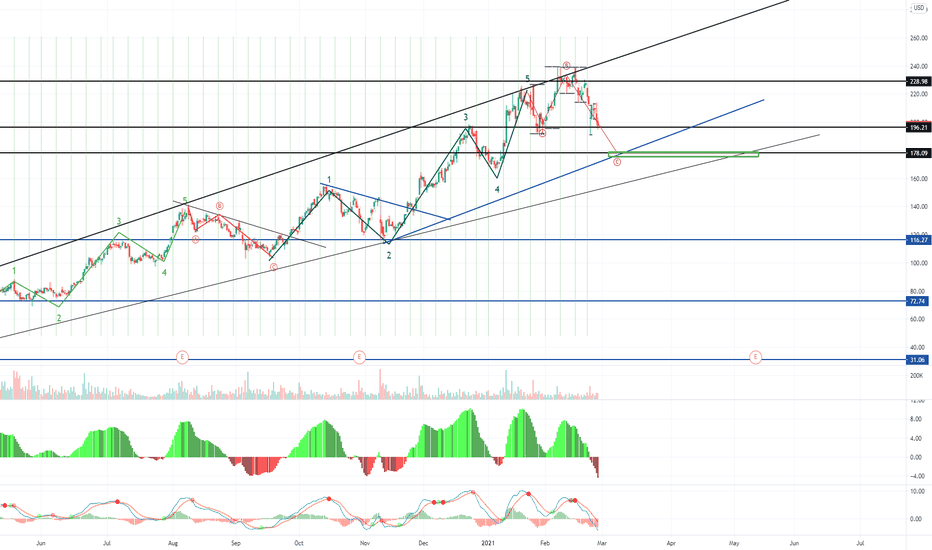

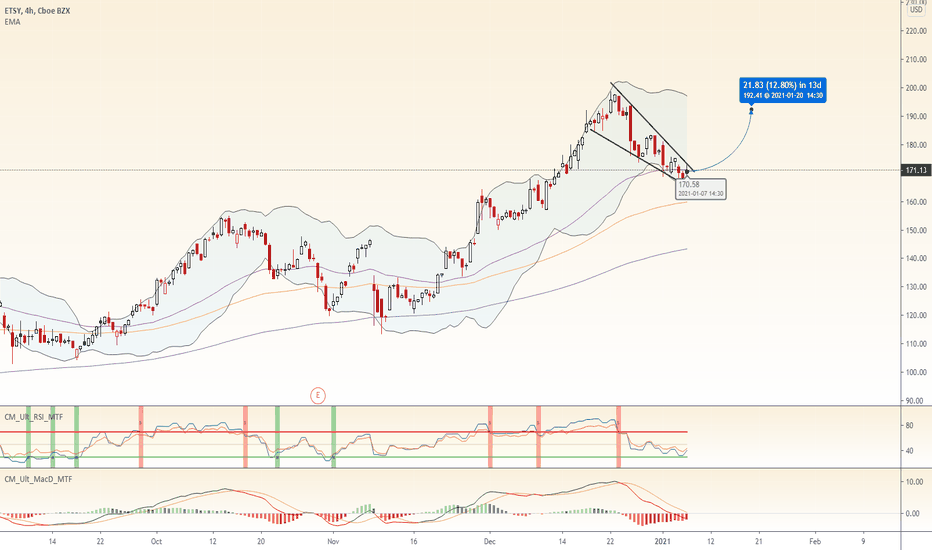

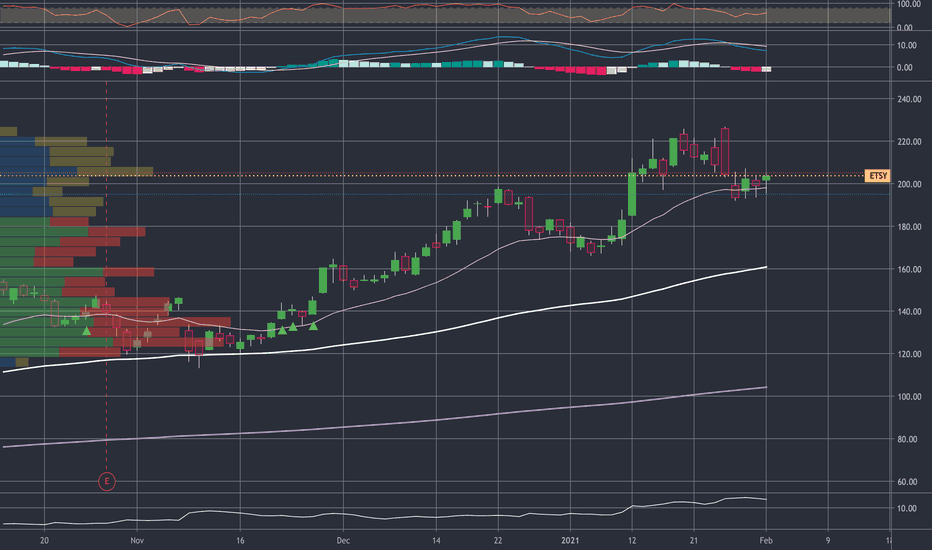

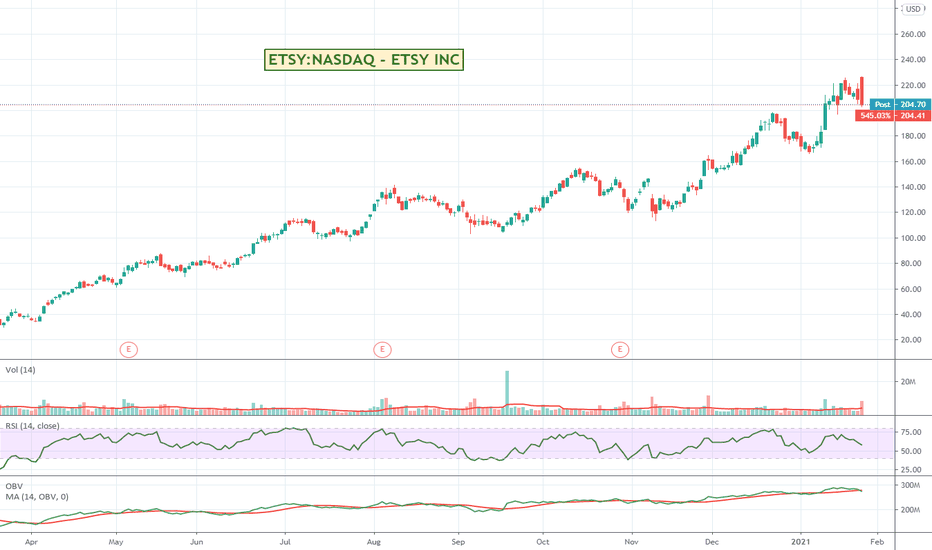

Etsy long and short termfirstly altough RSI is pretty low and you might think we are in oversold territory, analysis of previous dips has shown they don't stop until both RSI are below 40 and MACD is below 0

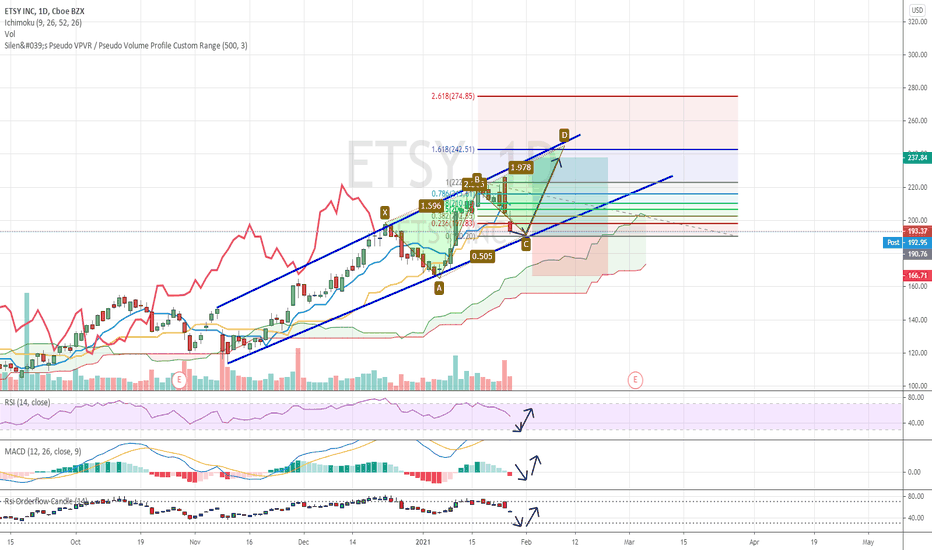

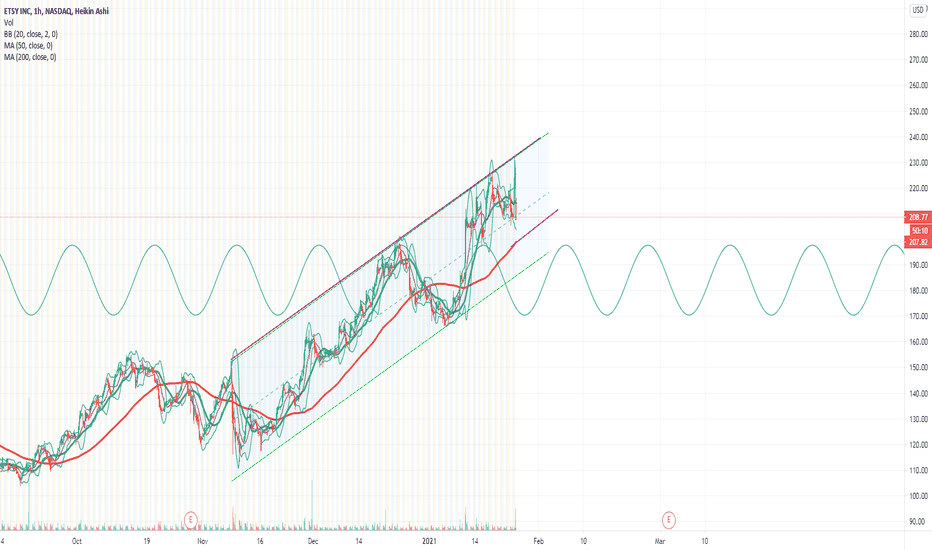

it seems like the more bullish channel has been broken retested, unsuccessfully and ETSY will continue in its bigger trend channel. we might see it dip to 167 or just above as a horizontal support and the trend channel meet. it will likely consolidate a bit at this level but i see a bright future for Etsy and think we will see another rally in anticipation of earnings. as ETSY earnings have been beating expectations very well before.

short term however i see bad news, we might jump a bit from current levels to 200 but dip down again. especially since the overall market is still shaking

let me know what u think this is only my 2nd analysis

ETSY trade ideas

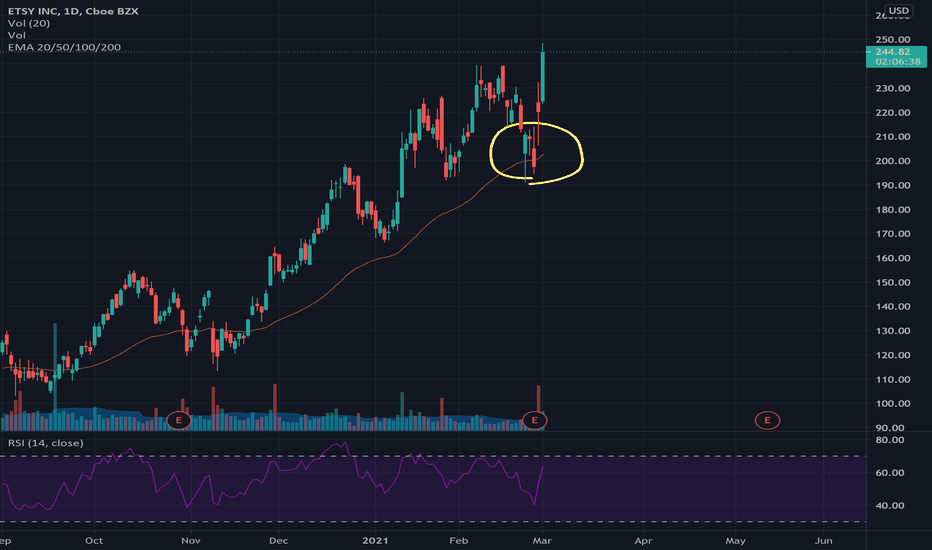

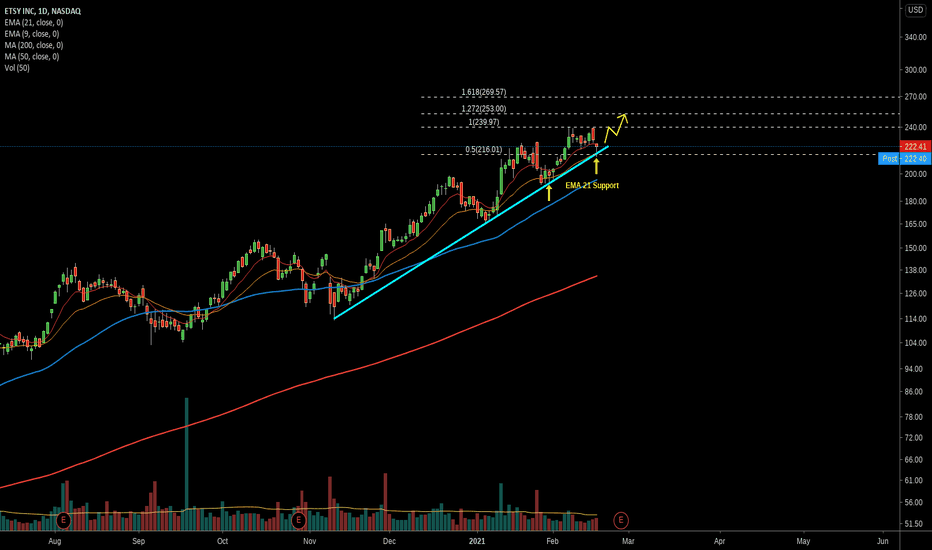

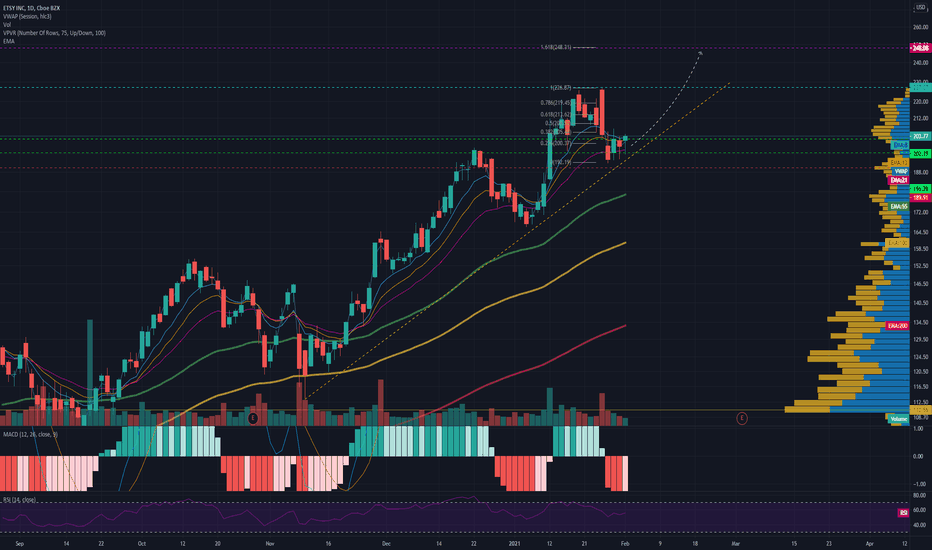

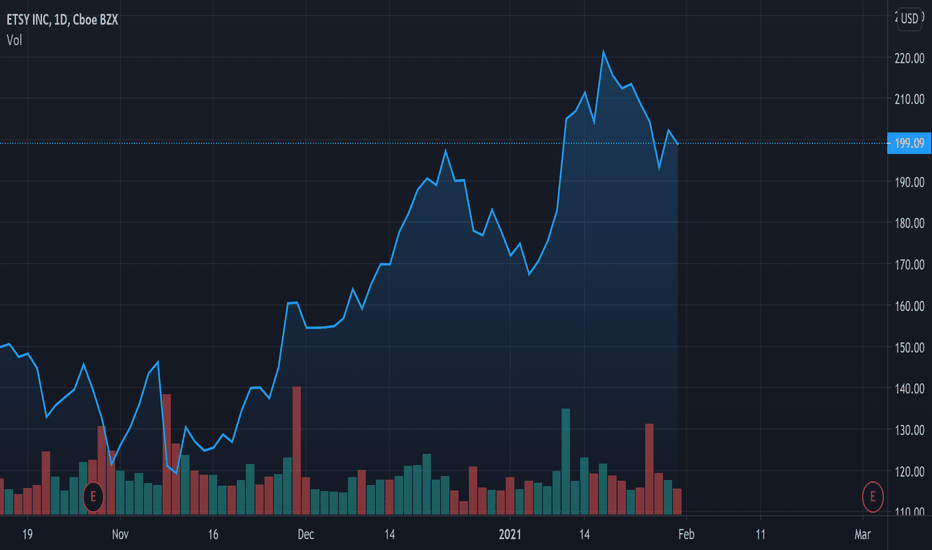

$ETSY with a bullish outlook following its earnings #StocksThe PEAD projected a bullish outlook for $ETSY after a positive over reaction following its earnings release placing the stock in drift B

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

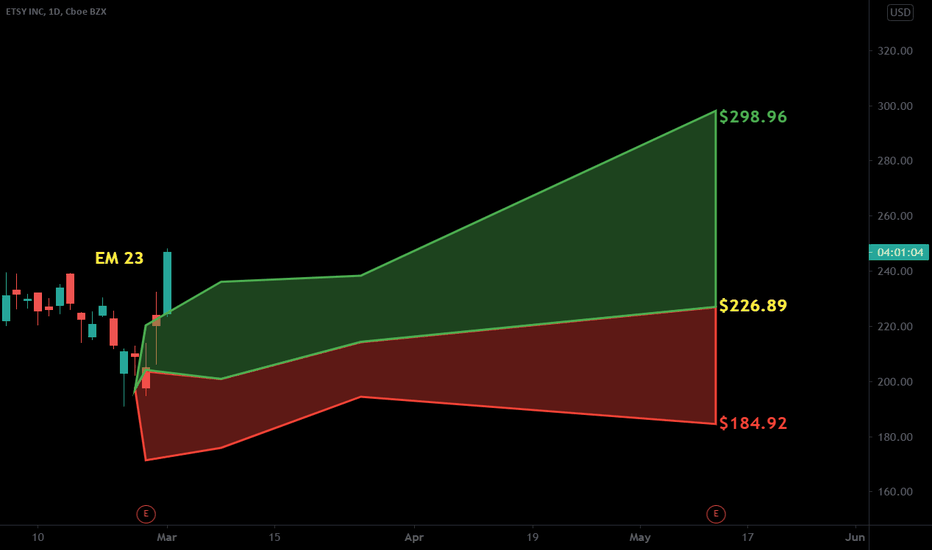

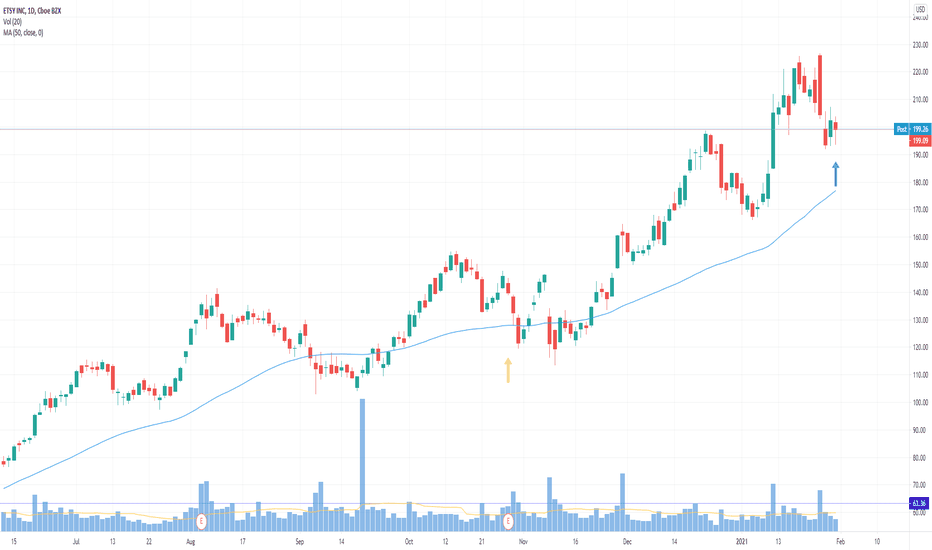

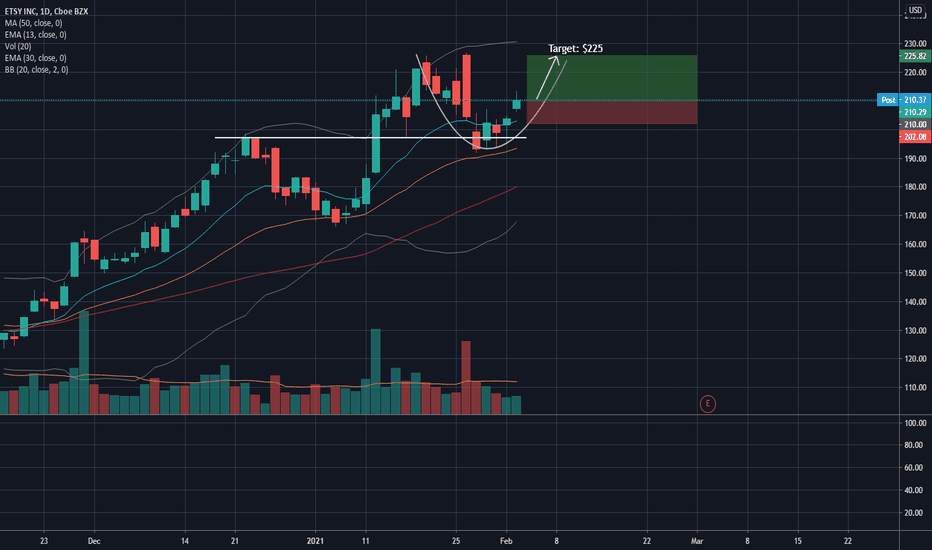

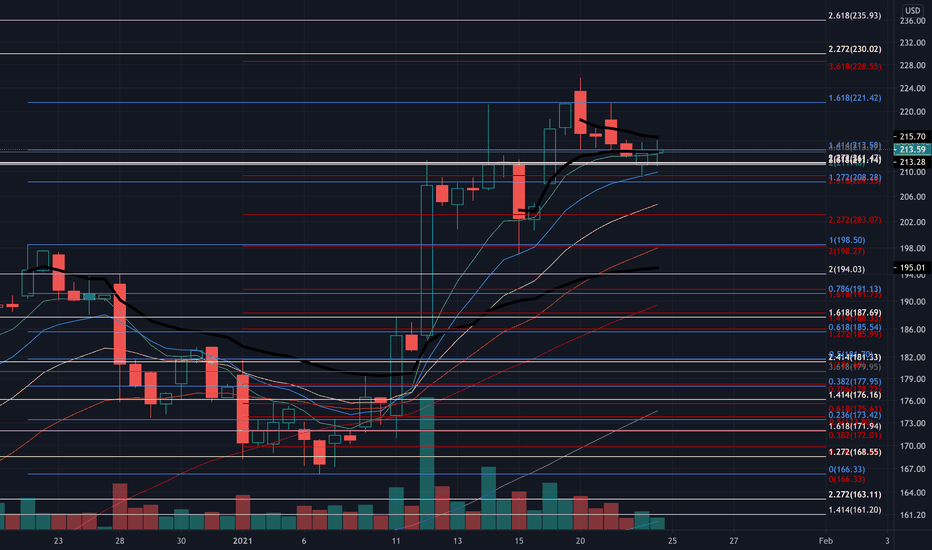

$ETSYEntry price : 199.20

Fundamentals :

- Sector: Internet Retail

- EPS % Chg (Last Qtr): 527%

- EPS % Chg (Previous Qtr): 441%

- 3 Year EPS Growth Rate: 71%

- EPS Est % Chg (Current Yr): 179%

- Sales % Chg (Last Qtr): 128%

- Sales % Chg (Previous Qtr): 137%

- 3-Year Sales Growth Rate: 44%

- Annual Pre -Tax Margin: 9.9%

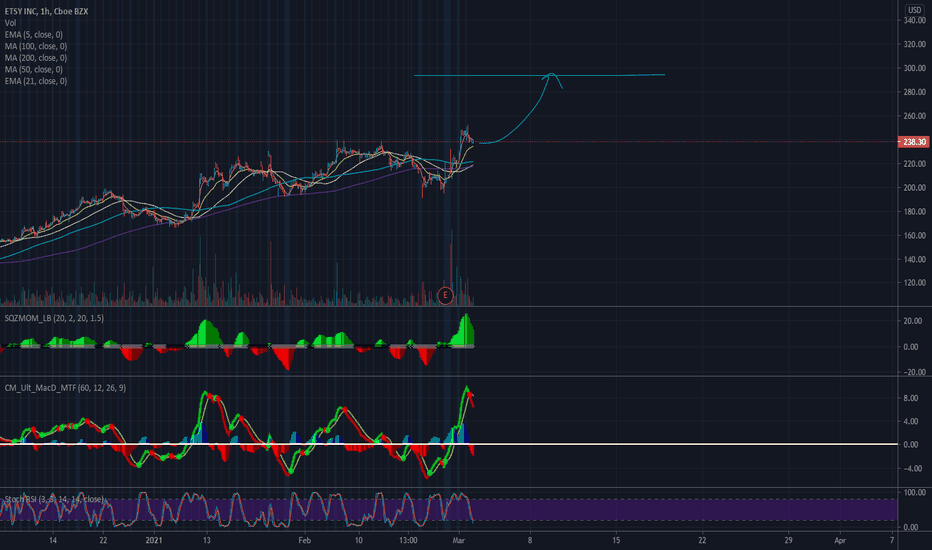

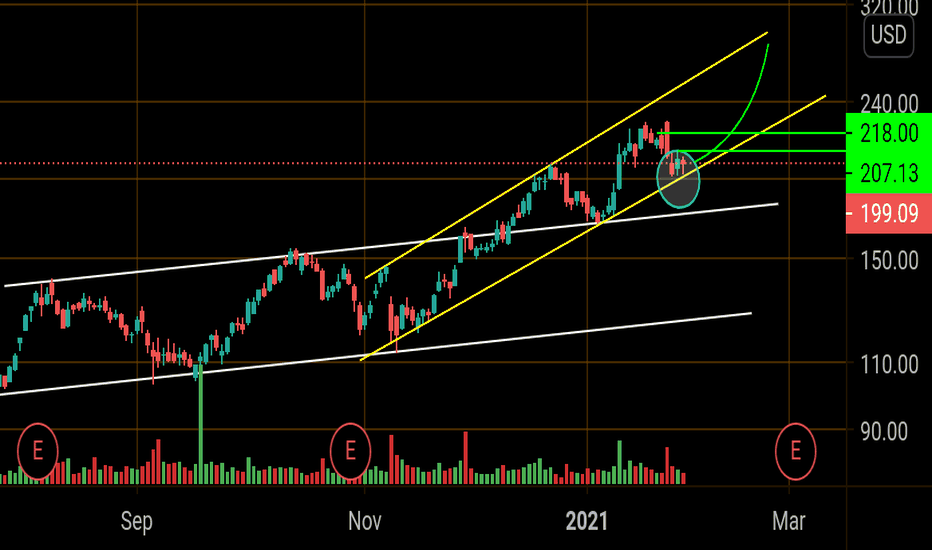

ETSY could provide an upside swing from a potential bull flagETSY seems to be forming a bullish flag on the 4H time horizon. The company saw a huge run toward the end of 2020, and has recently sold off amongst the broader market. Now that we are in another bullish tape, ETSY looks ripe for a rebound and a test of former highs. Fundamentally, the ecommerce business should continue to see buying in the current growth + inflationary environment.

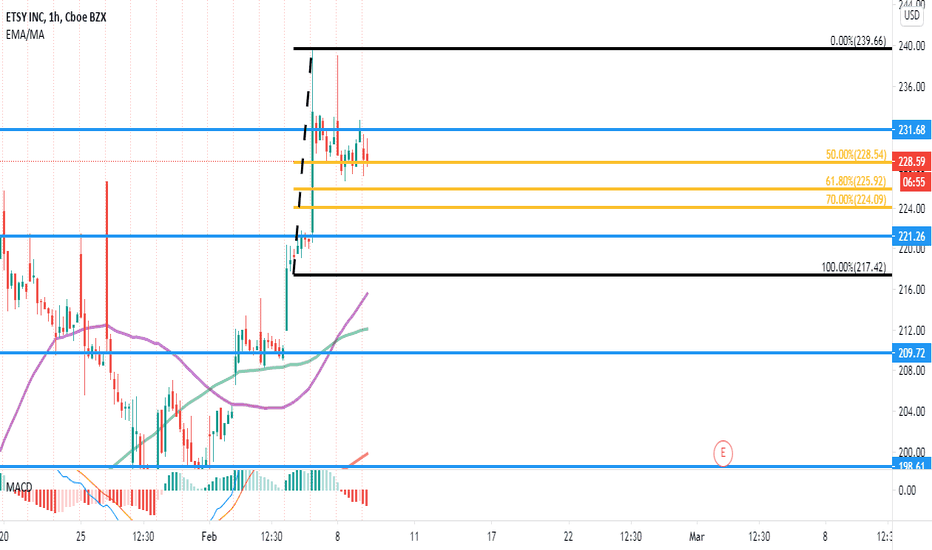

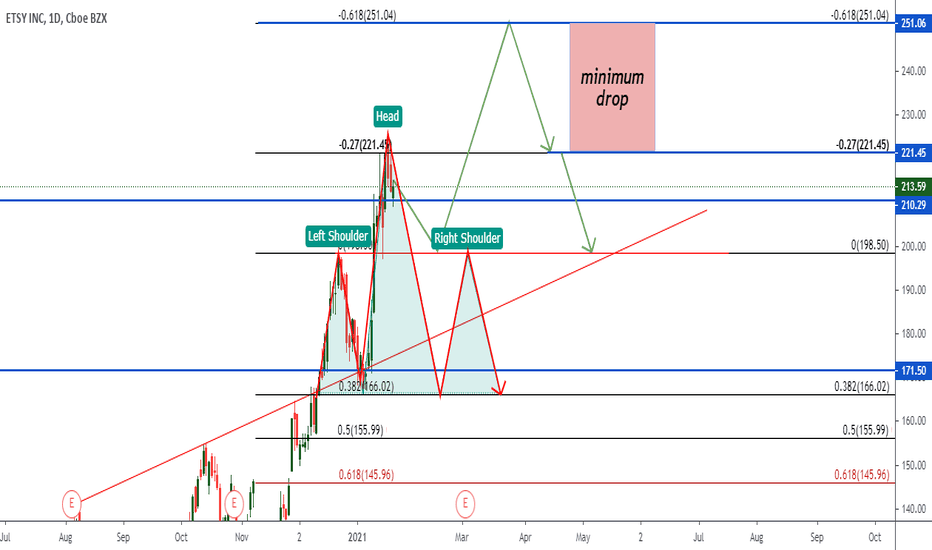

etsy hi there.

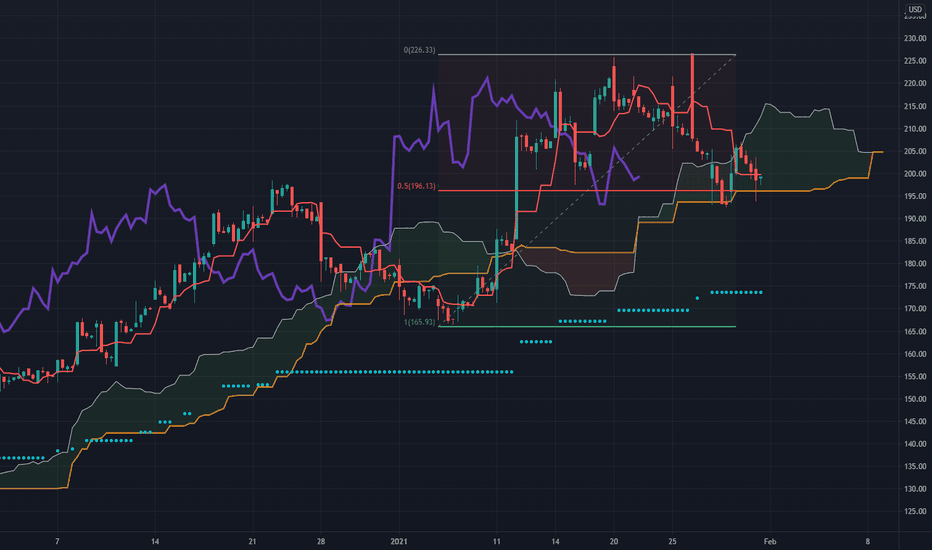

1st phase : I see this stocks are running some bear motive is active, that's why i see there is 2 phase is on my mind and eyes. causes market is reactive not predictive. at this moment if market close bellow 210 then first drop area is 198.50 but if cross this level 198.50 then market go down 166.02.

2nd phase : if market close above 198.50 and give us a bullish motive then we can easily achieve 250 range.

lest see what happen in market. you can see my previous analysis . see u later and stay with me for future analysis and reference.

link bellow