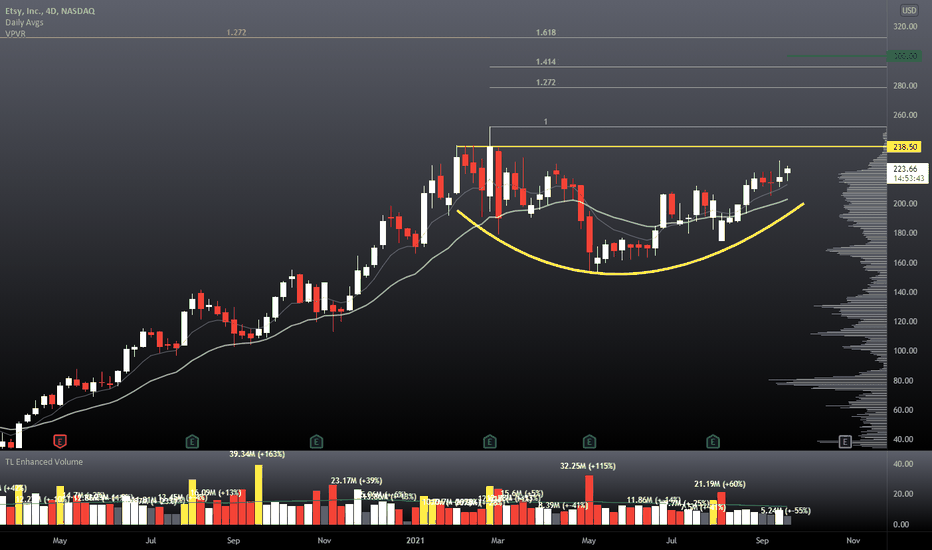

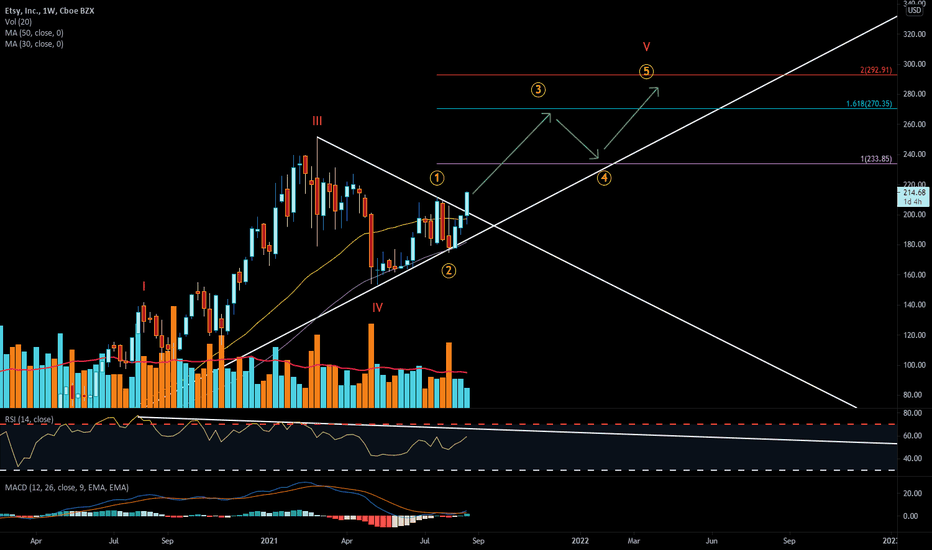

ETSY, Short, Mid and even long term BUY chance!ETSY will see higher prices ! how far it goes higher? Lets follow !

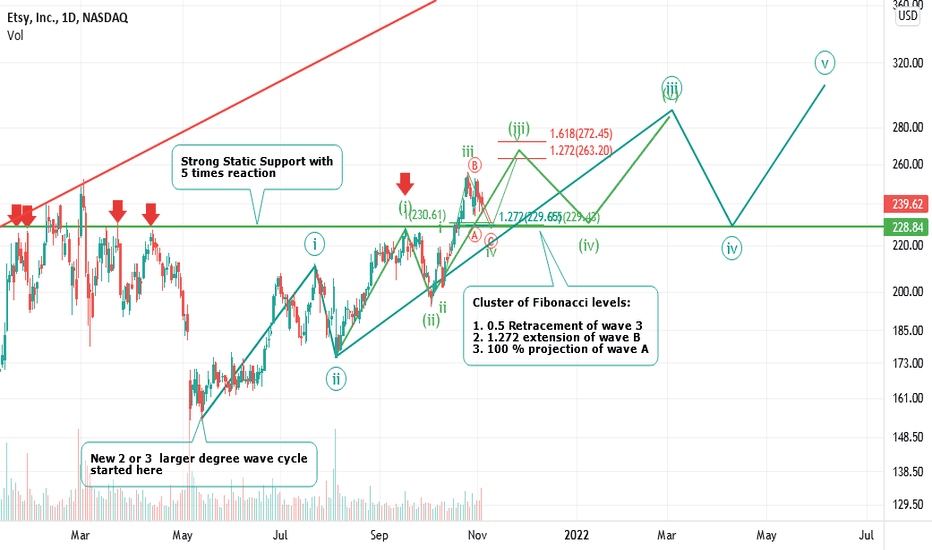

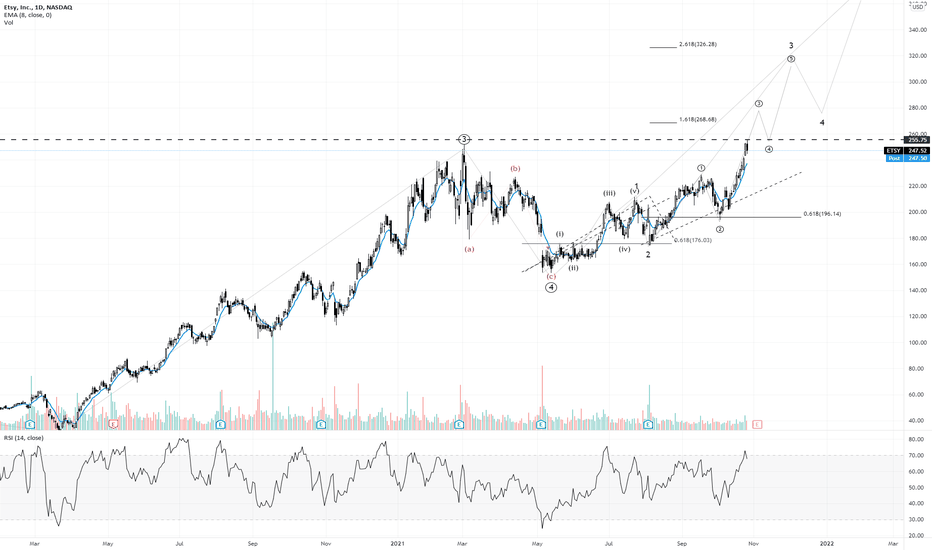

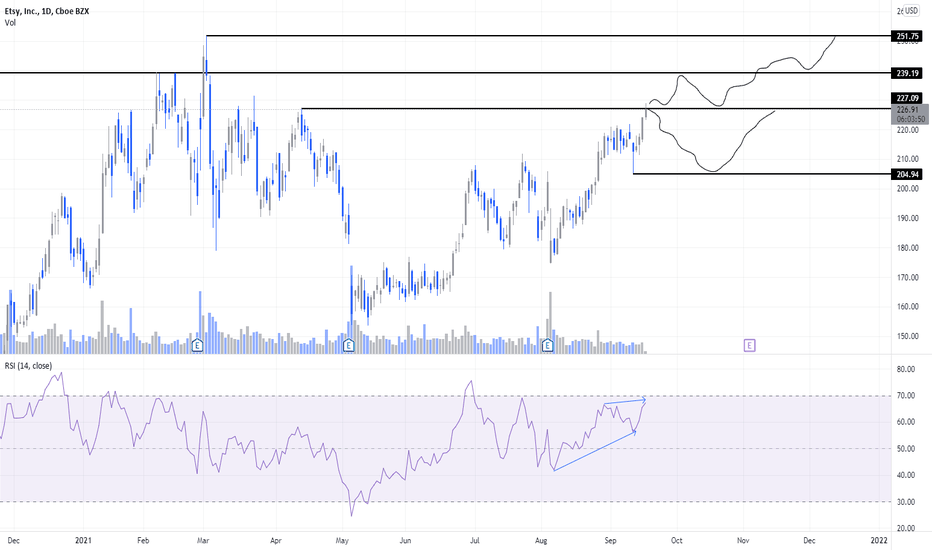

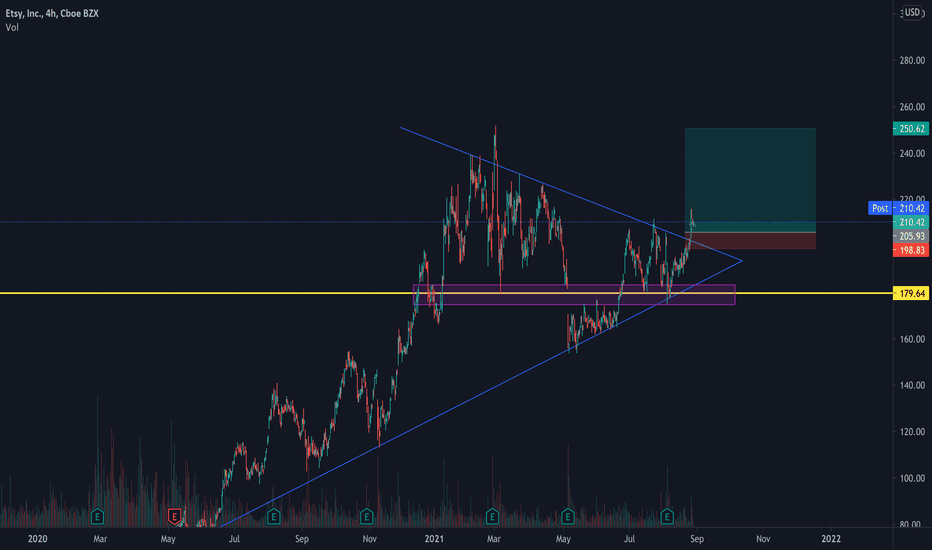

ETSY has started a new up going wave cycle at 153.8 low which may be wave 5 of a larger degree wave cycle or in best case scenario be the wave 3 of 3 of that cycle ! I promise you that if best case scenario in larger degree happens few people can imagine unbelievable targets ETSY will meet!

Lets skip that optimistic scenario for now and just suppose that ETSY is going to complete the current wave cycle disregarding its position in larger degree cycle.

As shown on the chart ETSY is reaching to strong support around 230 USD to complete labeled wave iv. This support is formed by confluence of strong static support with 5 times reaction and cluster of typical Fibonacci levels. Small up going wave may start form the support and push the price up to 263-272 target zone to complete the labeled wave v and a larger degree wave labeled as (iii). After that wave (iv) correction push down price back to around 230 USD again and new larger wave (v) move up will start to complete larger degree wave 3 up to 290. Another correction and move up will push the price finally to above 300 USD. Many long and short chances for short term traders. All above details are briefly shown on the chart.

It is worth to note that what described above for the new cycle is just the worst case scenario for that mentioned cycle ! So, What I am suggesting here is just worst case scenario inside another worst case scenario. Who can imagine best case in best case scenario ??

Best case scenario in current wave cycle is the up coming move up from 230 to 263-272 zone is going to complete just wave 1 of an smaller degree wave cycle.

All in All, ETSY is very low risk for buy entry regardless of what I am suggesting about wave cycles. I just tried to offer a general view of the stock. I may publish the best case and worst case scenarios in larger degree waves to make it even more clear for all of you my friends.

I have to emphasize although I am confident about this analysis , always there is the chance of mistake therefore as always we have to trade objectively.

Good luck every one!

ETSY trade ideas

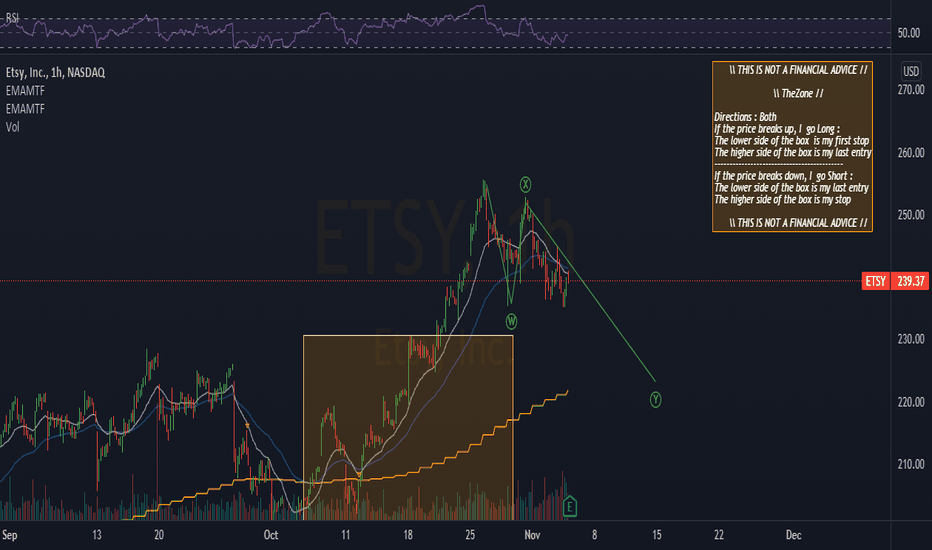

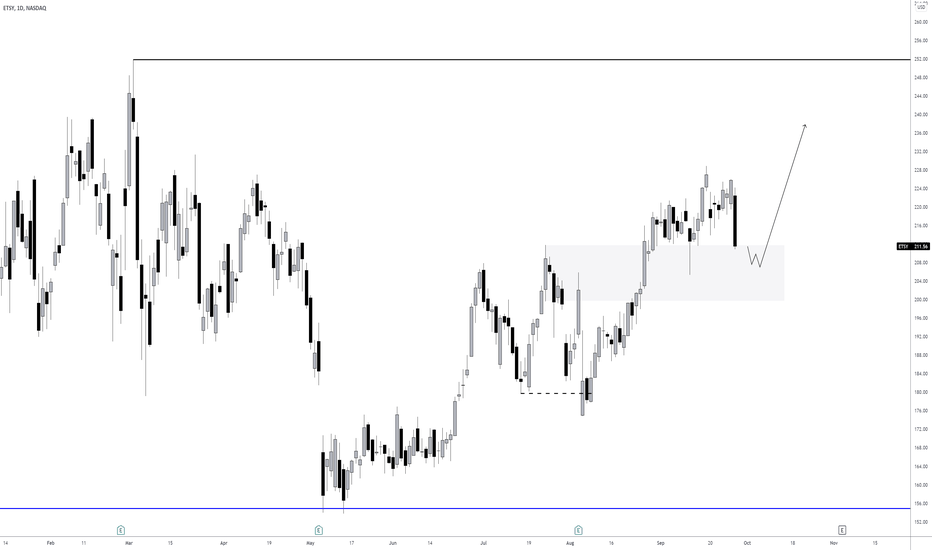

Cup and Handle Earnings 11-3Earnings after market close 11-3.

Short percent a bit over 8%.

Price was outside of top band but now falling back inside. Price may pull closer to the 50 SMA before earnings but no way to know for sue I suppose.

Support at Mid cup (MC) and HL (Handle low). Pocket pivot beneath HL.

Cup depth is 98.06. Targets are calculated using cup depth and fib levels, then added to long entry level. Throwback noted.

A healthy cup has the handle low above mid cup.

No recommendation.

Pattern valid at long entry level or above. Any pattern can fail.

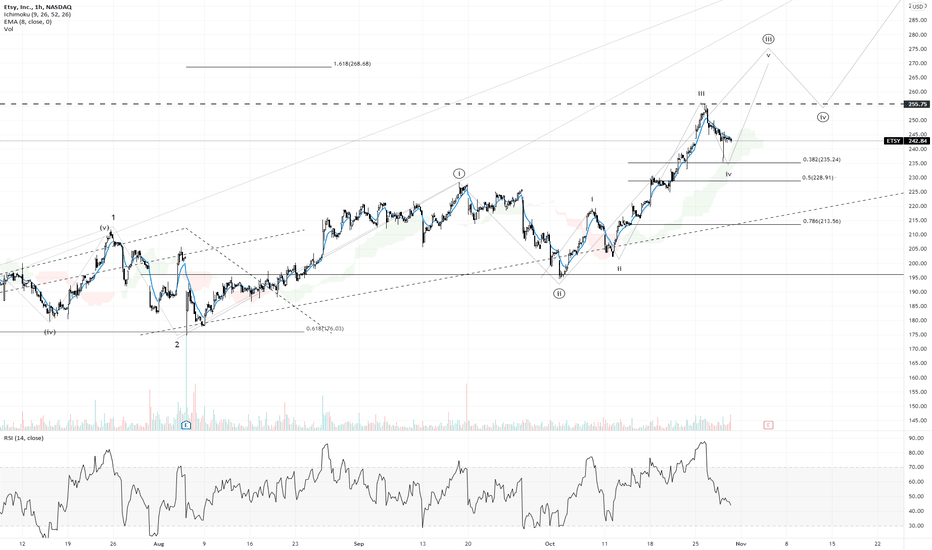

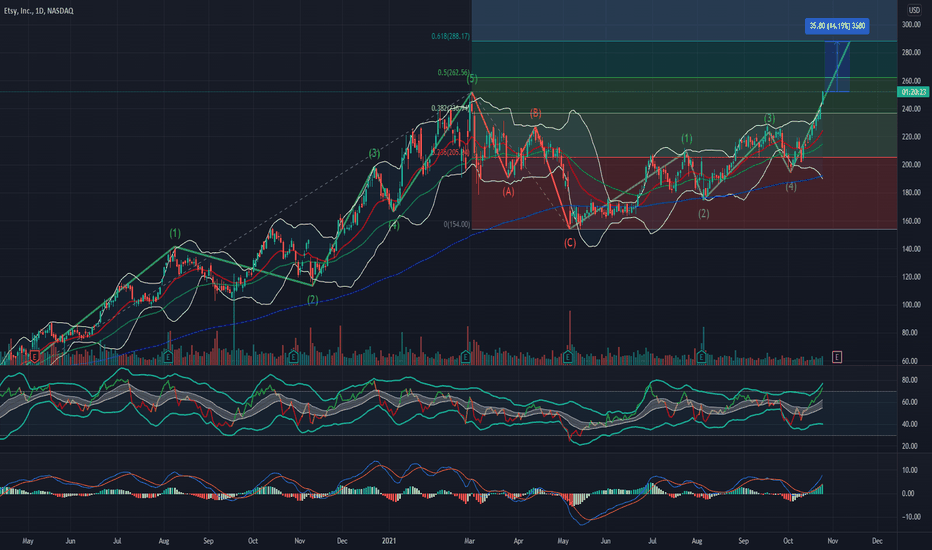

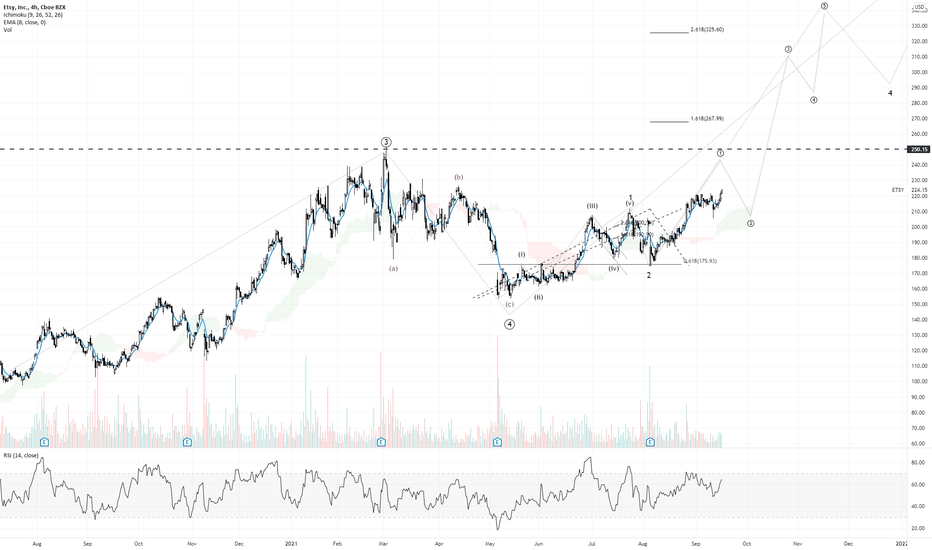

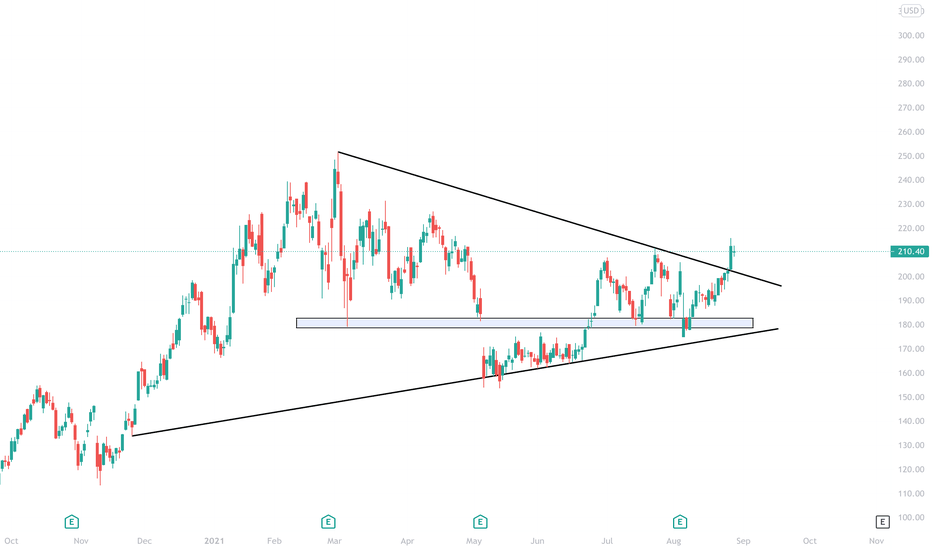

Etsy Elliot wave 5Looks like Etsy could be in the middle of a Elliot number 5 impulsive wave.

If this is true, a possible price target might be 0.618 Fibonacci which is ~288$ or ~+14%

Stop loss: 225,25$ or -10%

==> risk/reward ratio of 1.4:1 is not very tempting - so I don't recommend to enter the trade now.

If you're long already you might want to hold for more profit.

This is not financial advice.

$ETSYEtsy is an e-commerce marketplace for handcrafted and vintage goods.

It connects buyers with millions of creative sellers, helping them find the types of specialized or even personalized items that can't be mass-produced by big-box retailers. Moreover, Etsy has something for everyone, as its diverse inventory ranges from home furnishings and décor to apparel and beauty products.

Broadly speaking, this differentiates Etsy from its rivals. Its brand name has become synonymous with unique products, and that recognition has made it the 8th-most-popular e-commerce platform in the world, outranking the likes of Pinduoduo and Target.

To reinforce that advantage, management has focused on improving search and discovery, making it easier for buyers to find the products they're looking for on the platform. For instance, Etsy recently deployed new artificial intelligence models to better personalize landing pages and make recommendations more relevant for each buyer. These efforts have already boosted conversion rates and repeat purchases, and they caused an uptick in seller ad spending on the platform.

In turn, Etsy's financial performance has been impressive over the last three years.

Looking ahead, management puts its market opportunity at $437 billion by 2023. To put that in perspective, Etsy's gross merchandise sales totaled $12.4 billion over the last 12 months, representing less than 3% of the company's addressable market.

To capitalize on that opportunity, Etsy recently acquired Brazilian marketplace Elo7, expanding its presence in Latin America, the fastest-growing region of the world in terms of e-commerce sales. And shortly after, Etsy also acquired Depop, a fashion resale marketplace popular with Gen Z consumers; this moves expands Etsy's presence in the apparel sector, the fastest-growing vertical in the e-commerce industry.

More broadly, management remains focused on improving search and discovery, and cultivating trust among buyers through transparent delivery times and improved customer support. Collectively, these growth initiatives should help Etsy take market share in the years ahead. That's why this stock looks like a no-brainer.

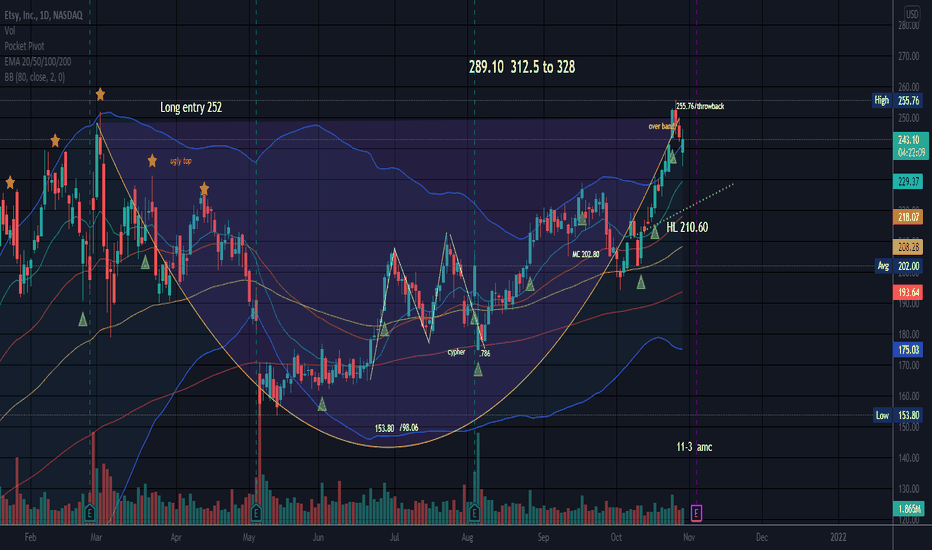

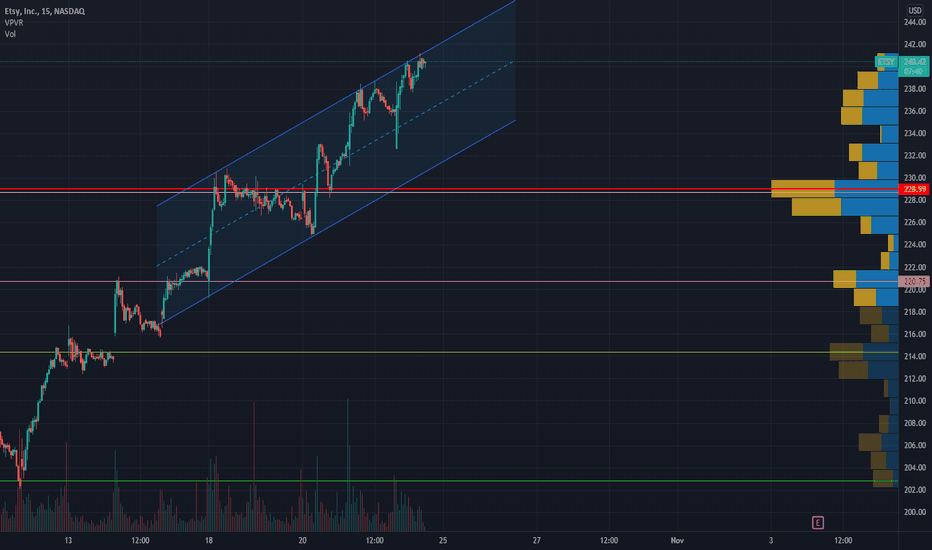

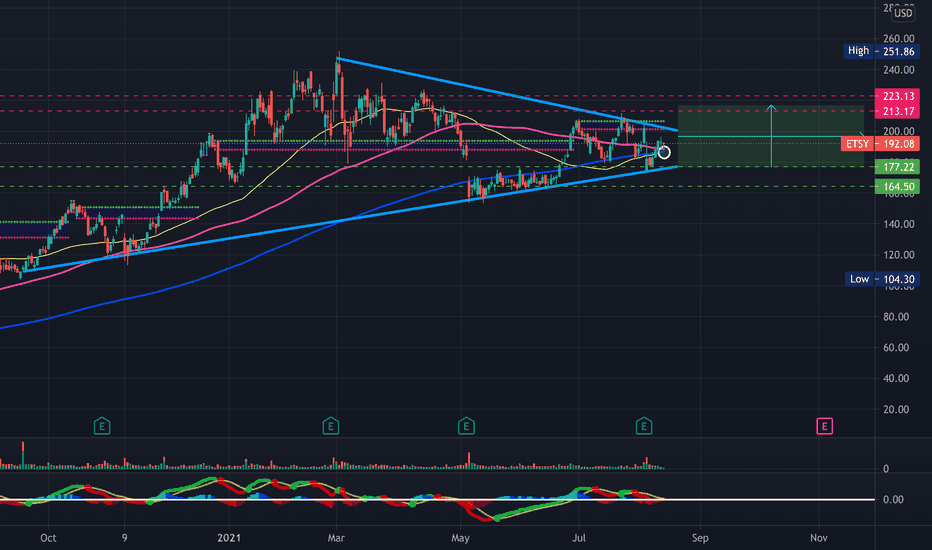

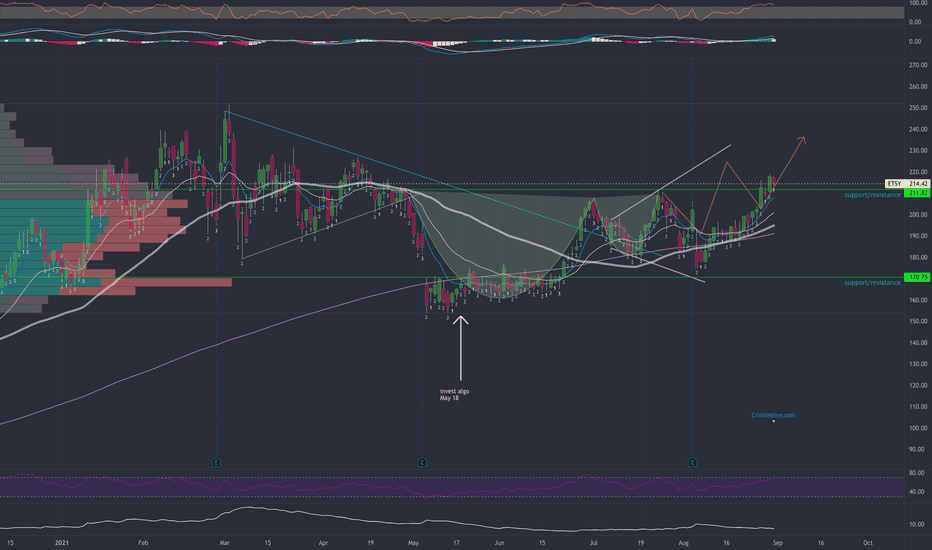

According to my chart Etsy is still looking very strong.

We had a clean break above resistance with a pullback to see if previous resistance would act as support w/ a close on a bullish hammer on the daily chart.

If this chart is correct, we should see all time high come into play.

MACD curling

RSI flat

Watchlist this.

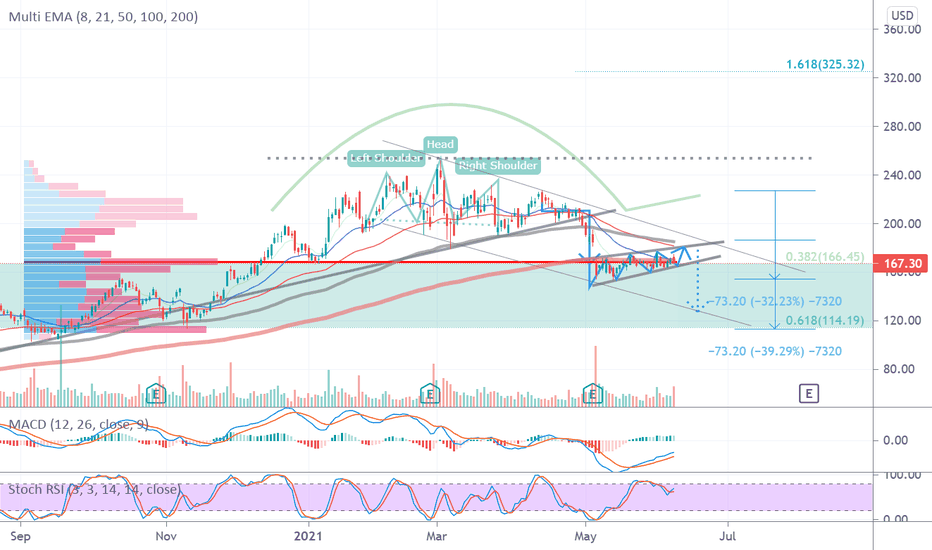

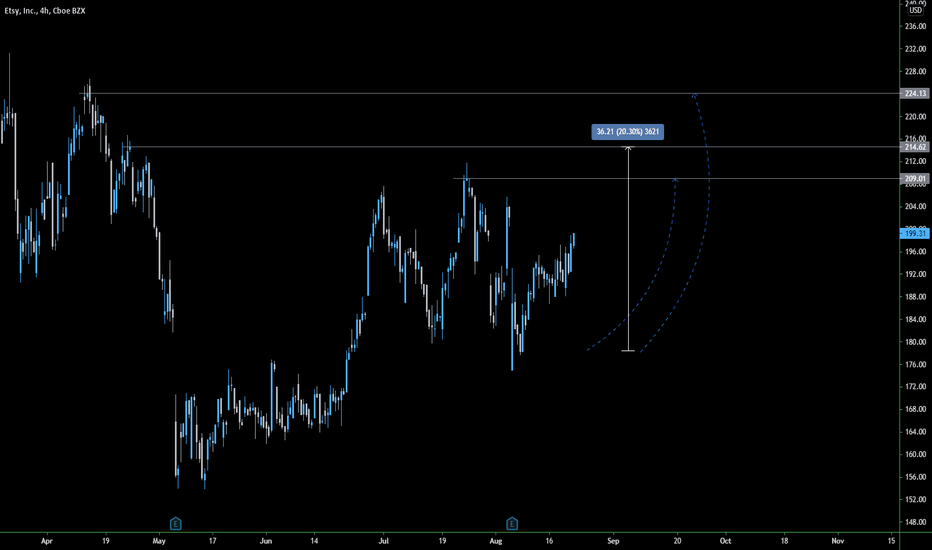

ESTY - pullback tradeEtsy, Inc. is an online marketplace for buyers and sellers, and operates in the United States, Canada, the United Kingdom, France, Germany and Australia. It mainly focuses on handmade or vintage items and craft supplies that include unique jewelry, on-trend clothing, bags, toys, art, home decor and furniture. In addition, the company offers several services to sellers including payment processing, advertising platform and shipping services.

ETSY is a strong buy within the analysts circles, with an average buy target of USD 224.

Stock has been popular within the Blogging community, Hedge fund activity has also seen a bullish signal with about 341.5K shares added last quarter.

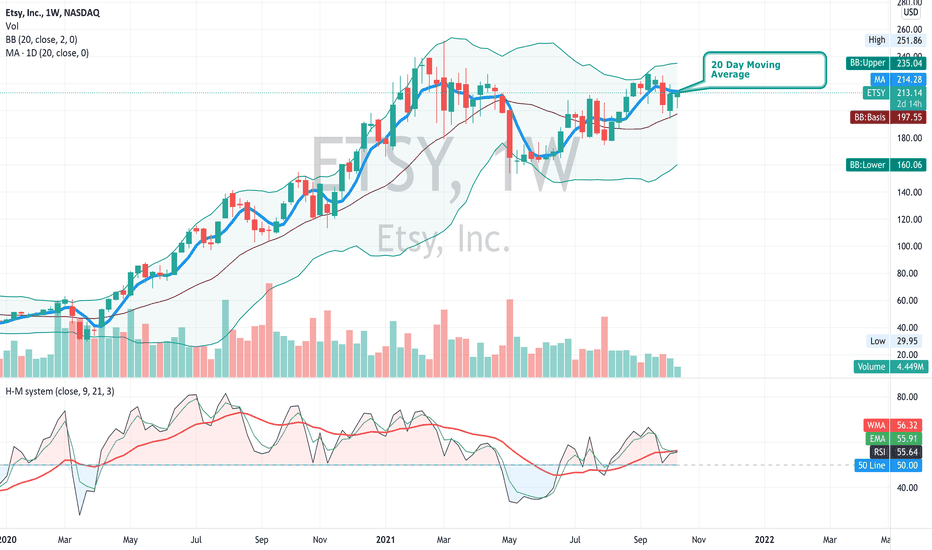

From a technical perspective, price is sitting right below the 20 Day Moving Average, but above the 20 Week moving Average. Both should add some indecision in some of the traders minds. However, RSI is bullish on multi time frames.

Out of the 147 stocks in the Retailing space, 42% are above the 5Day MA and 24% are above the 20 Day MA. The sector needs to show more action to bring the bulls interest back in here...I

If ETSY closes above the 20 Day MA, we could look for a swing trade.

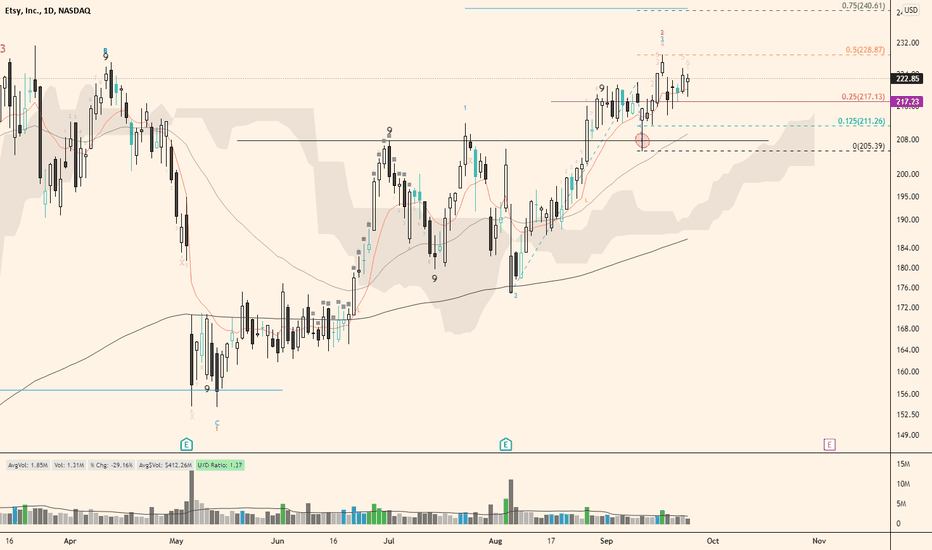

$ETSY playI did a simple ROIC sort search and found this business being one of the top. I am a technical guy but I take a glance at some fundamental numbers sometimes and $ETSY pop out to me as a pretty good value play. Did a rough DCF and I believe with a conservative revenue projection and a margin of safety $ETSY imo is worth around $40B.

Yes, I still look at technicals for my entry. As of now I see a strong impulsive move. I'm gonna use that move and buy the 25% or 12.5% extension. According to TD D-Wave we are still on wave 3 up.

The stock did give a nice bounce off of resistance turned support but I missed it. Will monitor this play regularly alongside my other 2 fundamental plays: $PLTR and $CRWD. Both $PLTR and $CRWD however are extremely overvalued on paper and DCF terms but they show great technical strength. $ETSY will be a play accompanied by fundamentals. Really look forward to seeing how the stock unfolds.

$ETSYEtsy’s shares rose last Thursday as the online arts-and-crafts retailer joined fellow Internet retailers in a continuing roller-coaster ride.

Etsy recently traded at $213.12, up 5.4%, and has climbed about 9% in the past six months with plenty of ups and downs.

Earlier this month, they reported better-than-expected second-quarter earnings, but provided a third-quarter revenue forecast that fell short of analysts estimates.

Etsy posted profit and revenue that handily beat Wall Street estimates, but said it now expects revenue of between $500 million and $525 million for the current quarter, below current consensus forecasts of $527.5 million.

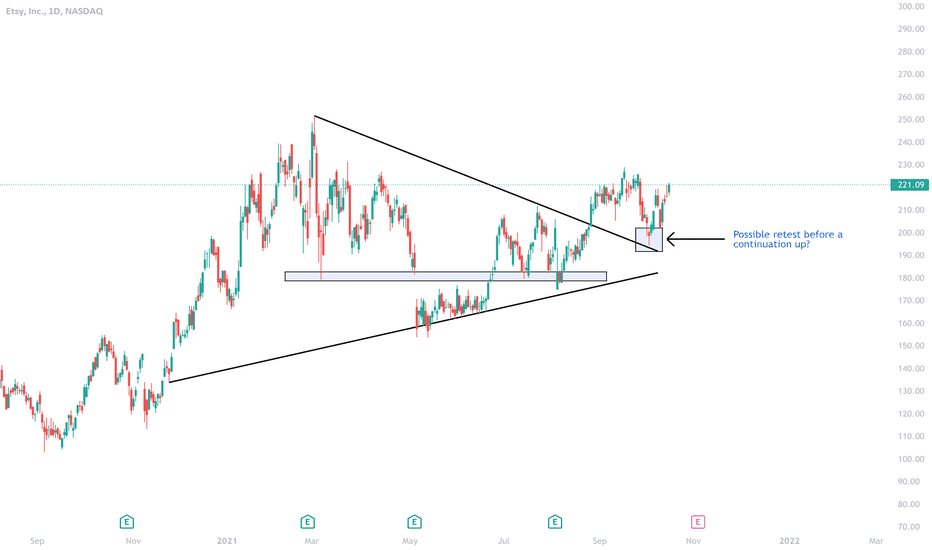

When we look at the technicals analysis ETSY is starting to look very bullish, in my opinion.

We broke out clean of the symmetrical triangle to the upside.

We have the MACD above 4.90

We saw the 50MA cross the 200MA

& we also have the RSI above 50.

I can easily see this running up to all time highs again. I’m bullish.

Keep this on your watchlist.

- Factor Four