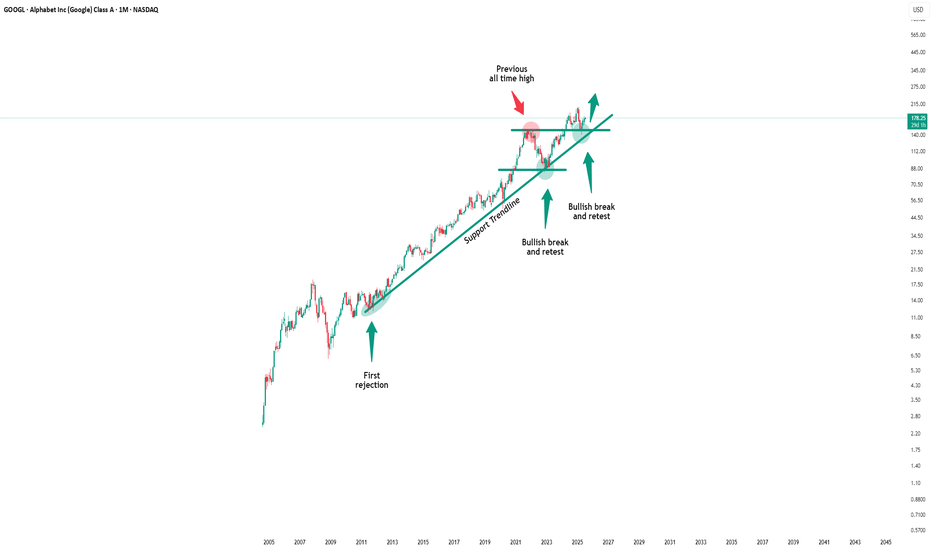

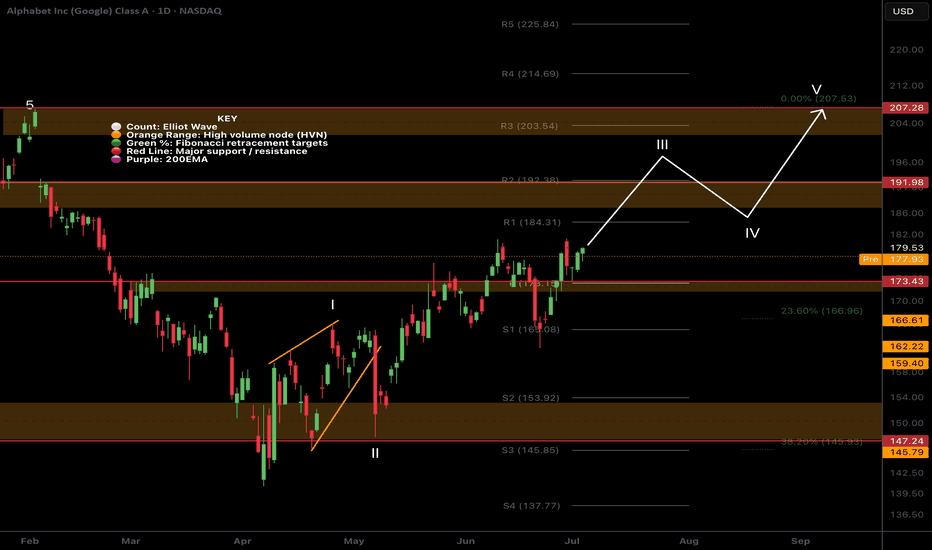

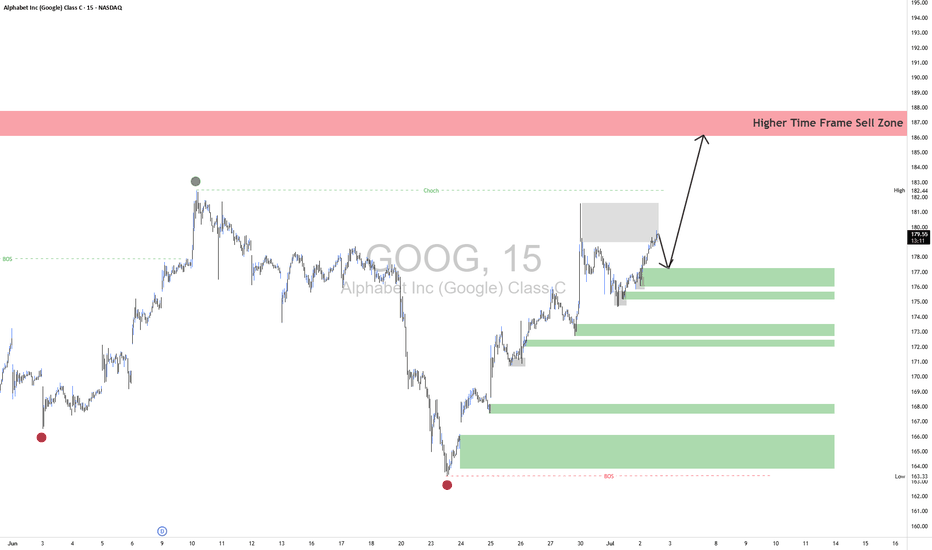

Alphabet - The textbook break and retest!📧Alphabet ( NASDAQ:GOOGL ) will head much higher:

🔎Analysis summary:

If we look at the chart of Alphabet we can basically only see green lines. And despite the recent correction of about -30%, Alphabet remains in a very bullish market. Looking at the recent all time high break and retest, the

Key facts today

Alphabet, Google's parent, faces antitrust scrutiny in the U.S. and Europe, with courts labeling Google a monopolist in search and ads. The firm is appealing a $4.33 billion fine in Europe.

Oppenheimer has maintained its 'Outperform' rating for Alphabet Inc. (Google), reflecting a positive outlook for the company's performance.

Alphabet has gained court approval for a $500 million settlement to address claims of monopolistic practices. The funds will enhance compliance systems over the next decade.

155 ARS

91.68 T ARS

320.31 T ARS

About Alphabet Inc (Google) Class C

Sector

Industry

CEO

Sundar Pichai

Website

Headquarters

Mountain View

Founded

2015

ISIN

ARDEUT116159

FIGI

BBG000QND871

Alphabet, Inc is a holding company, which engages in the business of acquisition and operation of different companies. It operates through the Google and Other Bets segments. The Google segment includes its main Internet products such as ads, Android, Chrome, hardware, Google Cloud, Google Maps, Google Play, Search, and YouTube. The Other Bets segment consists of businesses such as Access, Calico, CapitalG, GV, Verily, Waymo, and X. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.

Related stocks

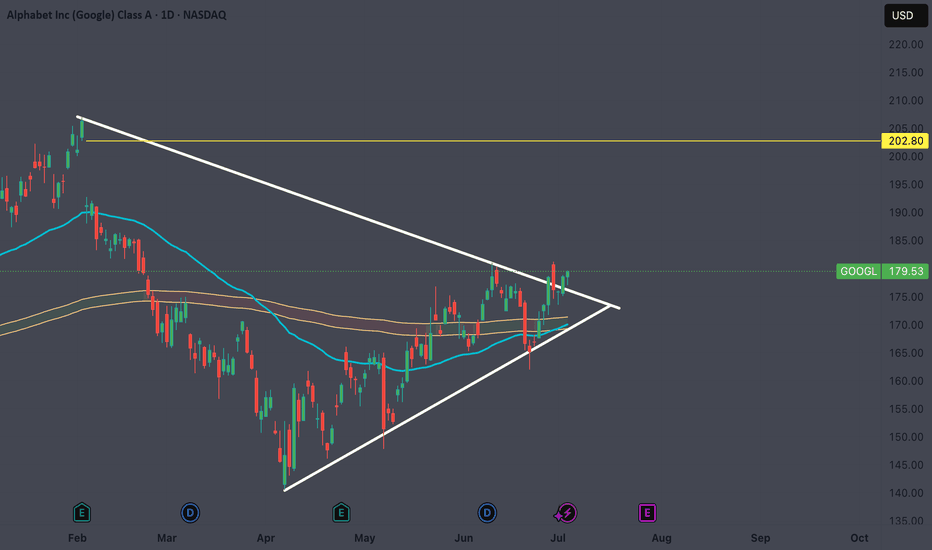

This Looks So Bullish (I See A Cup And Handle. What do you see?)Pattern Identified: Cup and Handle

From the chart of Alphabet Inc. (GOOGL), the most prominent and likely bullish pattern is a Cup and Handle formation:

Cup Formation:

The price declines sharply around February–April 2025.

It then forms a rounded bottom.

Recovers back to the previous resistance

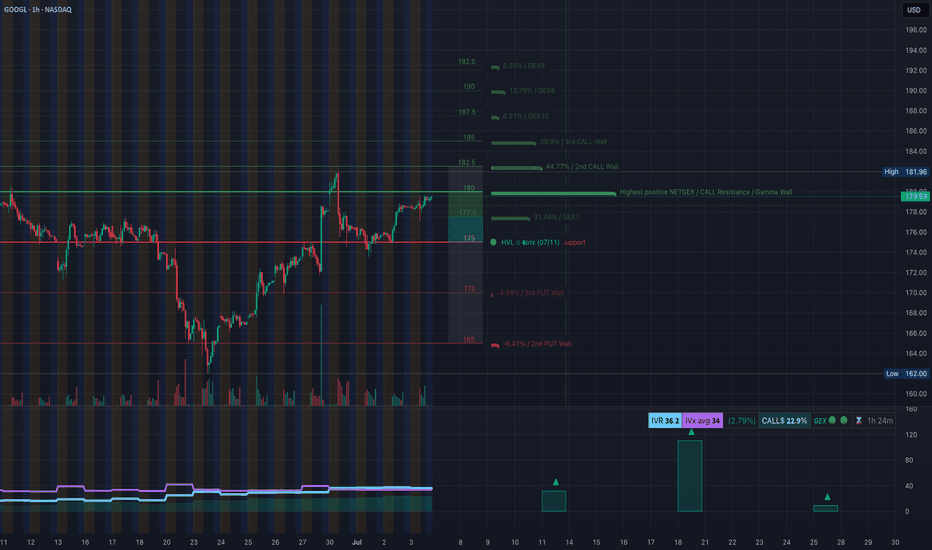

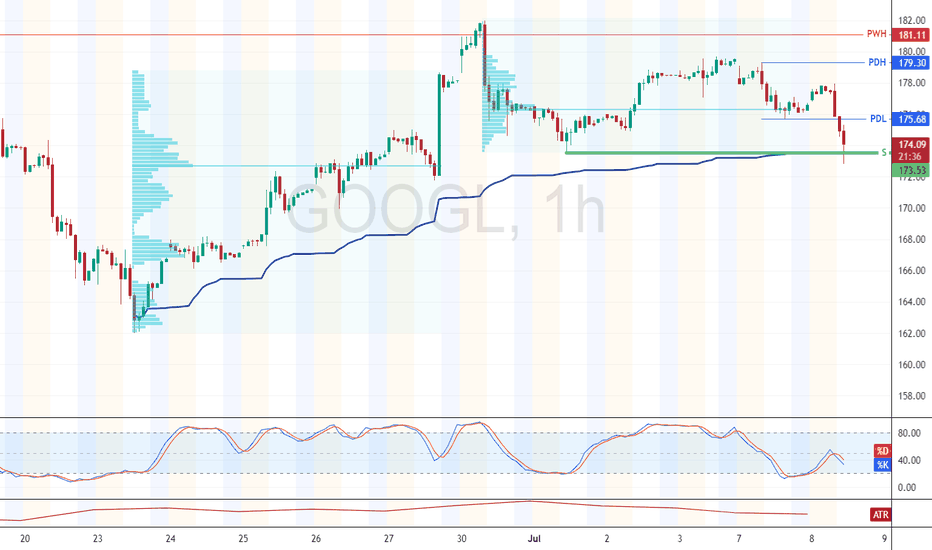

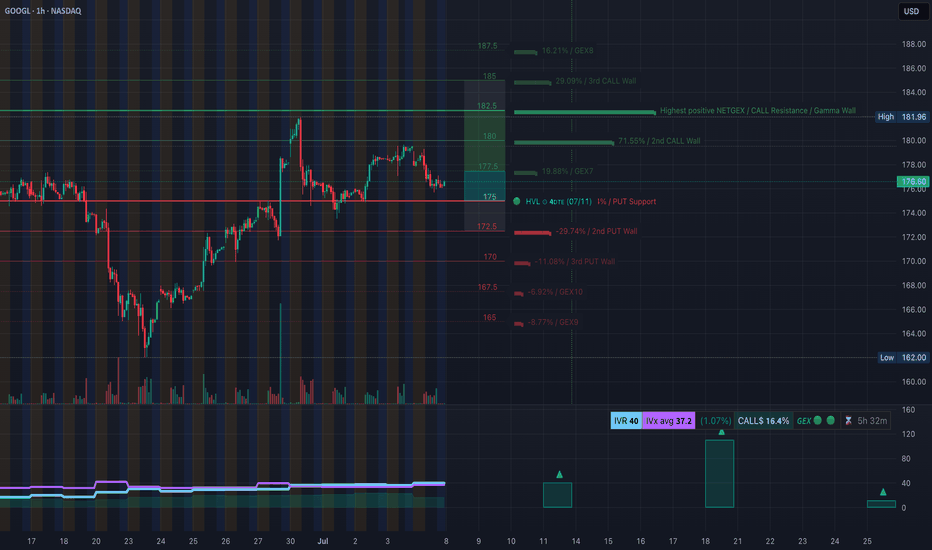

GOOGL Breaking Out of Downtrend? July 7🔍 GEX-Based Options Insight (Chart 1)

* Current Price: $179.53

* Highest Positive Gamma Level: $180 — this is the key gamma wall. Price is magnetized toward it and may experience hesitation or consolidation here.

* Call Walls Above:

* $182.5 → 2nd Call Wall

* $185 → 3rd Call Wall (possible e

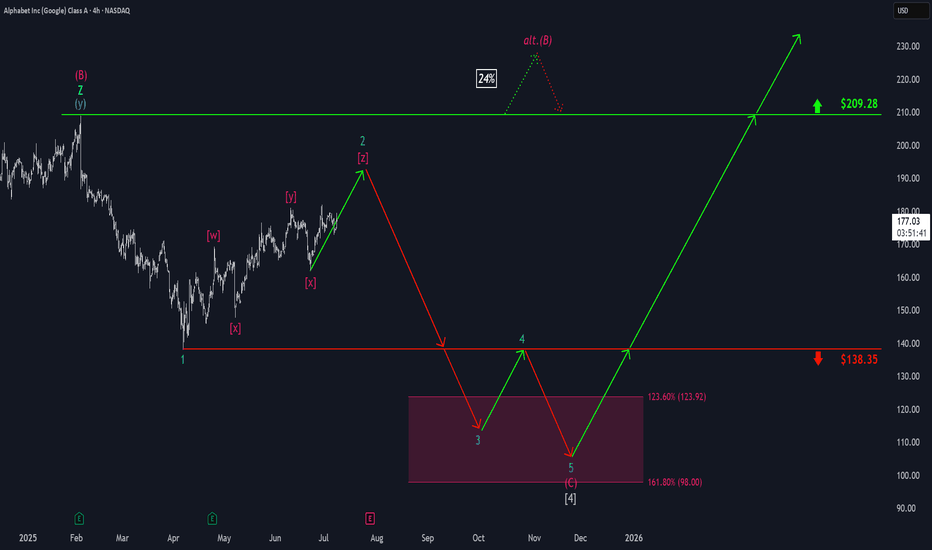

Google: Upcoming TopWe locate Google in turquoise wave 2 (of a downward impulse). In more detail, we see the stock developing a complex - - - pattern and expect turquoise wave 2 to conclude imminently with wave . All the while, the price should maintain a safe distance from resistance at $209.28. Looking ahead to tu

GOOGLE Count changed, Bullish outlook.I have adjusted NASDAQ:GOOG NASDAQ:GOOGL Elliot wave count with a wave 1 completing a leading diagonal backed up by a deep wave 2 correction into High Volume Node support (HVN). We potentially have another 1-2 with fast drop and recovery to the S1 daily pivot which would make long term outlook e

GOOGL – Sitting on the Edge! What’s Next After This Break? 📊 GEX Analysis – Options Sentiment Insight:

* Call Resistance Wall: Strongest resistance at 180–182.5 area (High GEX%, Gamma Wall, 2nd & 3rd CALL Wall). A breakout above this may trigger a gamma squeeze.

* Support Zone: HVL @ 174.39 — aligned with PUT support and GEX10 (-6.92%) at 167.5, forming a k

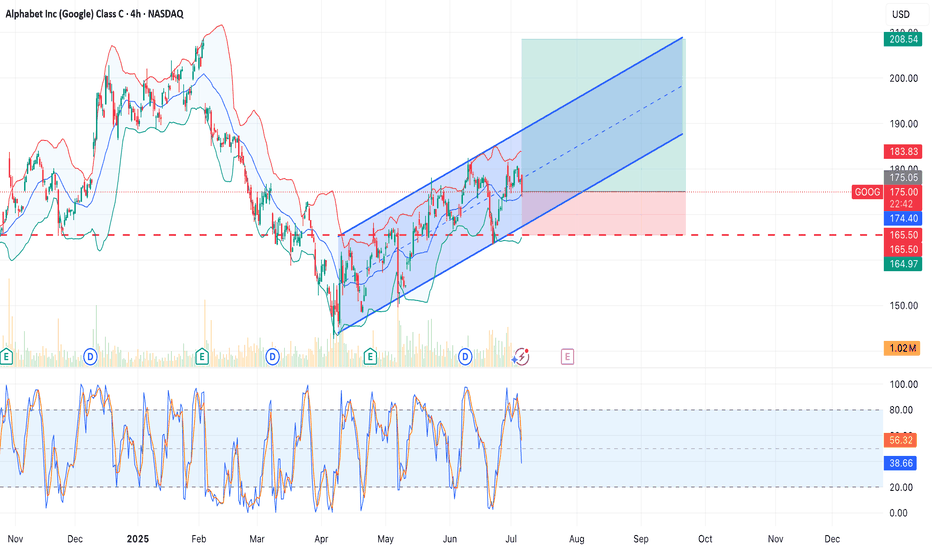

Momentum Watch: GOOG Entry ZoneNASDAQ:GOOG – Trend Continuation Setup

The price has been trending within a clean ascending channel since April 2025.

After a pullback toward the midline and Bollinger basis, price is showing potential support.

Setup:

• Entry: $175 (conceptual)

• Stop: $165.5 (below channel)

• Target: $208 (u

GOOG LongMarket Structure Breakdown

Initial Break of Structure (BOS) – Bearish Phase

A significant bearish BOS occurred after a liquidity sweep above the prior high. This marked the temporary dominance of sellers, driving price downward.

Change of Character (ChoCh) – Sentiment Shift

Following the bearish le

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

GOOG5025299

Alphabet Inc. 0.45% 15-AUG-2025Yield to maturity

8.16%

Maturity date

Aug 15, 2025

US2079KAF4

ALPHABET 20/50Yield to maturity

7.02%

Maturity date

Aug 15, 2050

US2079KAG2

ALPHABET 20/60Yield to maturity

6.92%

Maturity date

Aug 15, 2060

US2079KAE7

ALPHABET 20/40Yield to maturity

6.29%

Maturity date

Aug 15, 2040

GOOG6065579

Alphabet Inc. 5.3% 15-MAY-2065Yield to maturity

5.59%

Maturity date

May 15, 2065

GOOG6065578

Alphabet Inc. 5.25% 15-MAY-2055Yield to maturity

5.52%

Maturity date

May 15, 2055

GOOG6065581

Alphabet Inc. 4.5% 15-MAY-2035Yield to maturity

4.83%

Maturity date

May 15, 2035

US2079KAD9

ALPHABET 20/30Yield to maturity

4.50%

Maturity date

Aug 15, 2030

US2079KAC1

ALPHABET 16/26Yield to maturity

4.30%

Maturity date

Aug 15, 2026

XS306443038

ALPHABET 25/54Yield to maturity

4.17%

Maturity date

May 6, 2054

GOOG6065580

Alphabet Inc. 4.0% 15-MAY-2030Yield to maturity

4.15%

Maturity date

May 15, 2030

See all GOOGL bonds

Curated watchlists where GOOGL is featured.