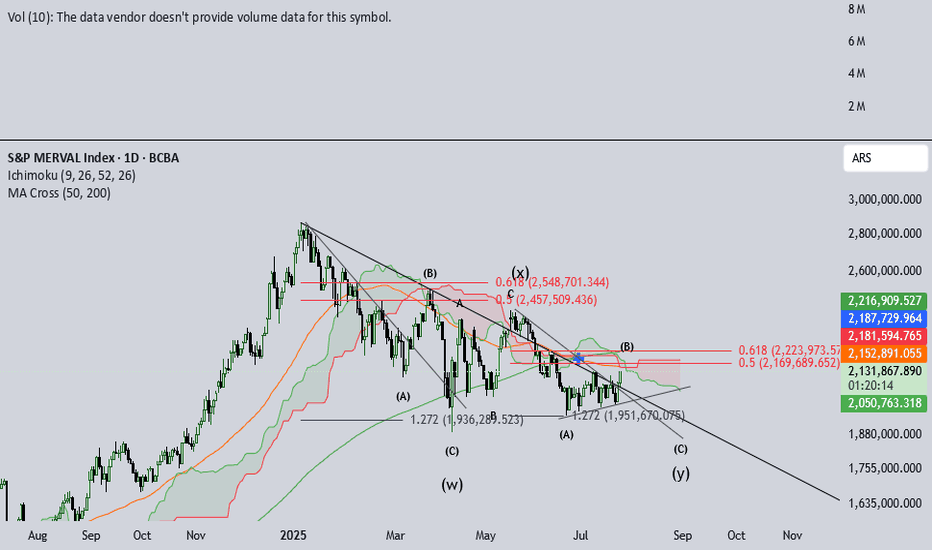

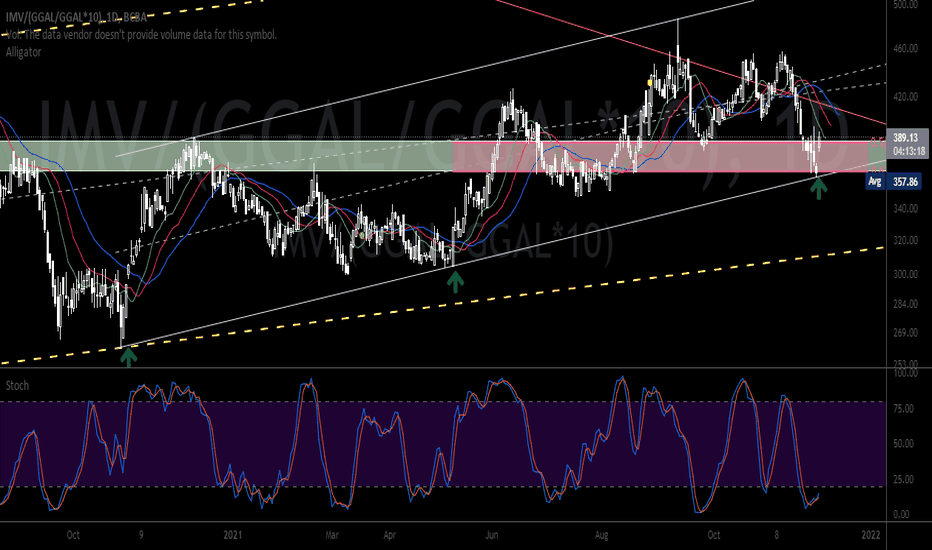

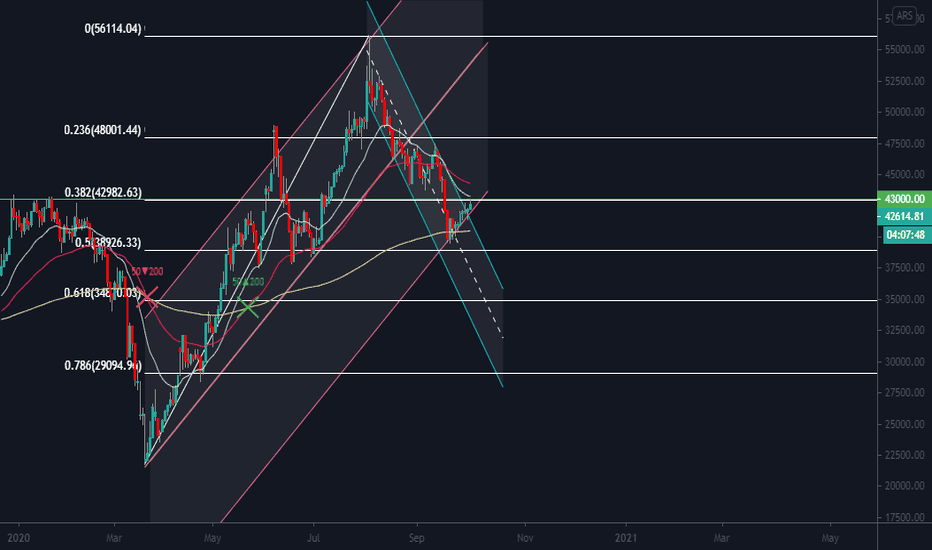

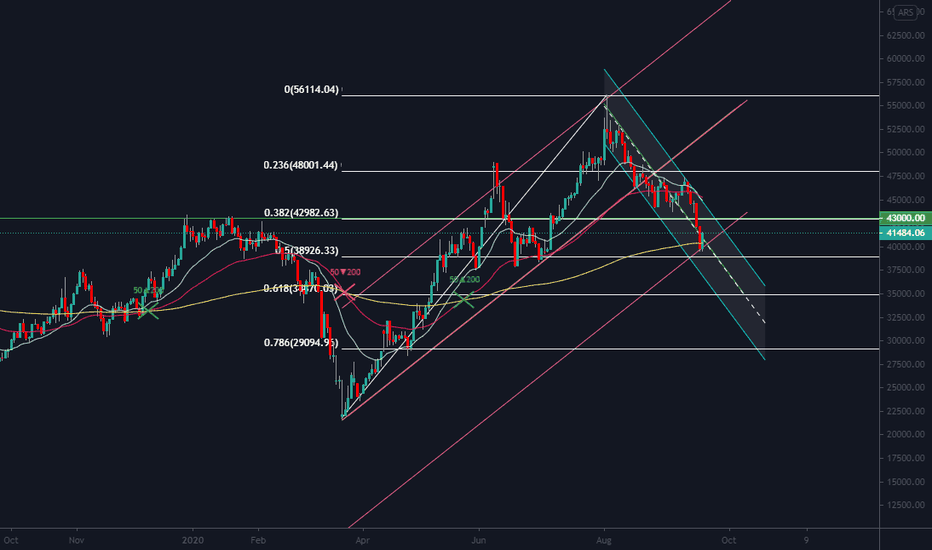

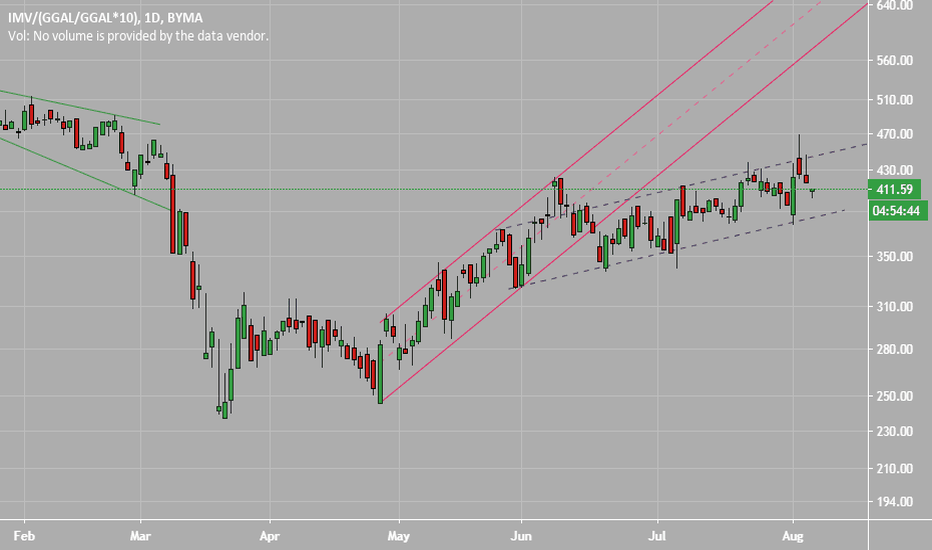

IMV Multiple analysisIMV, Argentina's Merval Index valued in pesos, has been in a downtrend since jan-25. Due to electoral process, noise has been increasing this last week, amidst some shade on what seemed as an easy win for Milei's gov.

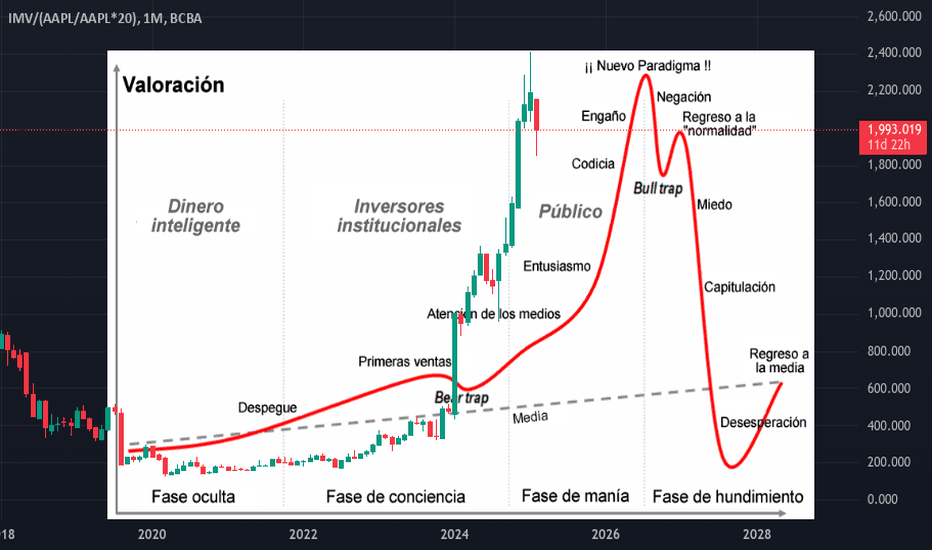

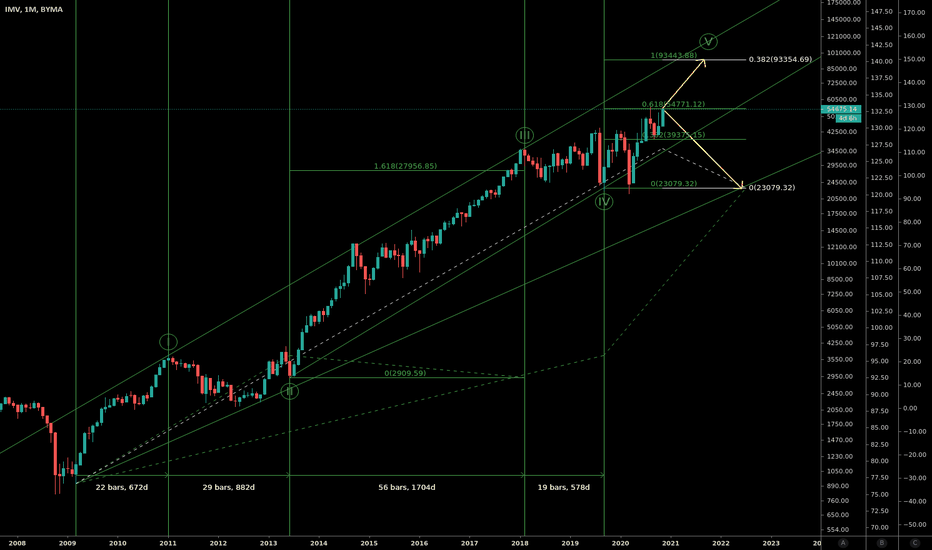

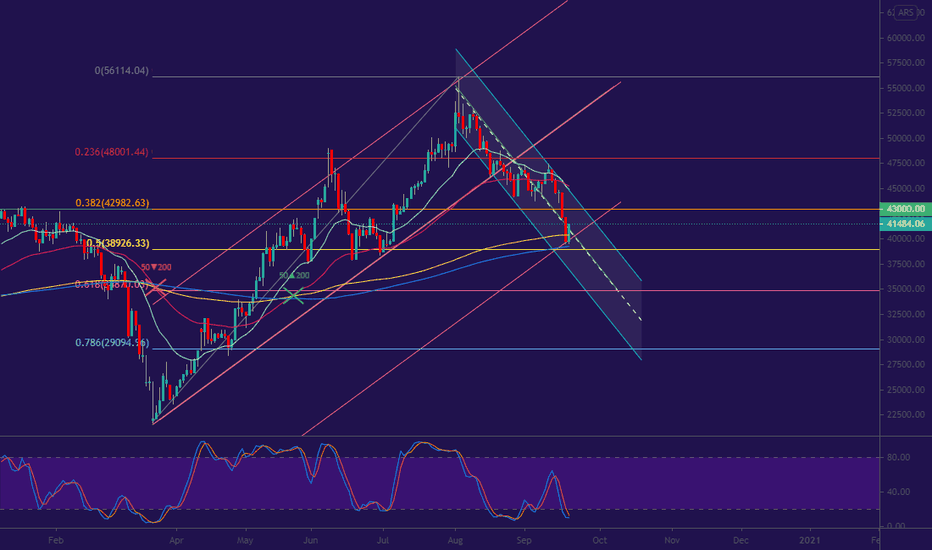

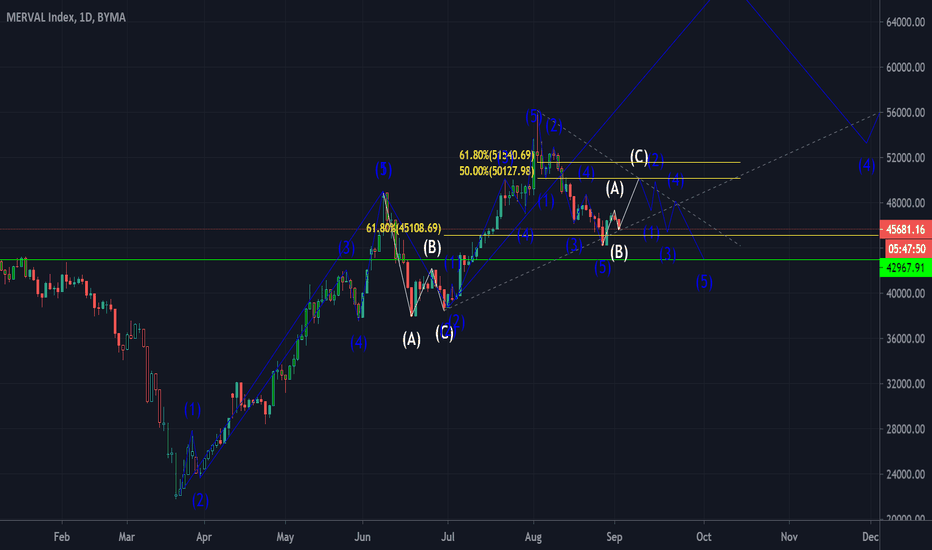

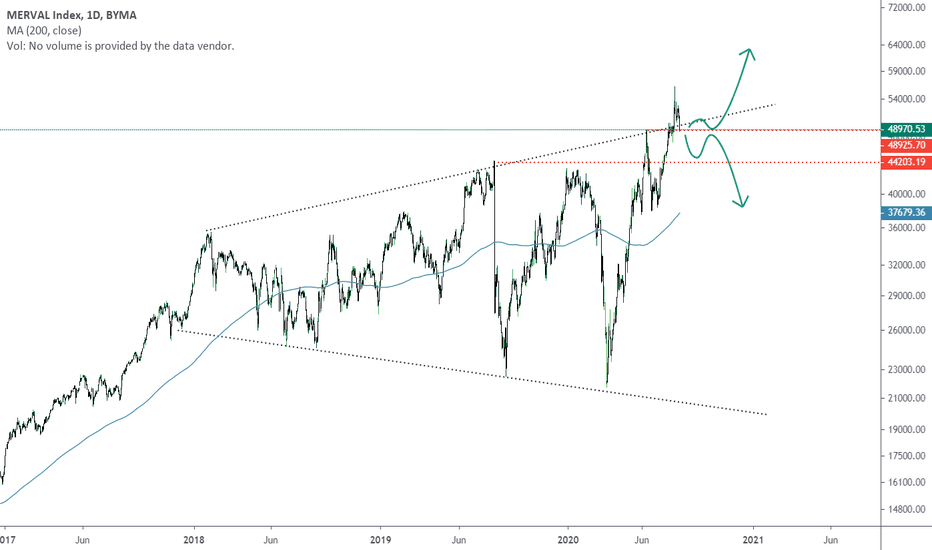

The amount of chatter the Merval has brought up is inmense. This psychology is similar to that expected in IVth elliott's waves. Also, jul 2022 - dic 2024 saw huge gains, signaling IIIrd elliot´s wave behavior.

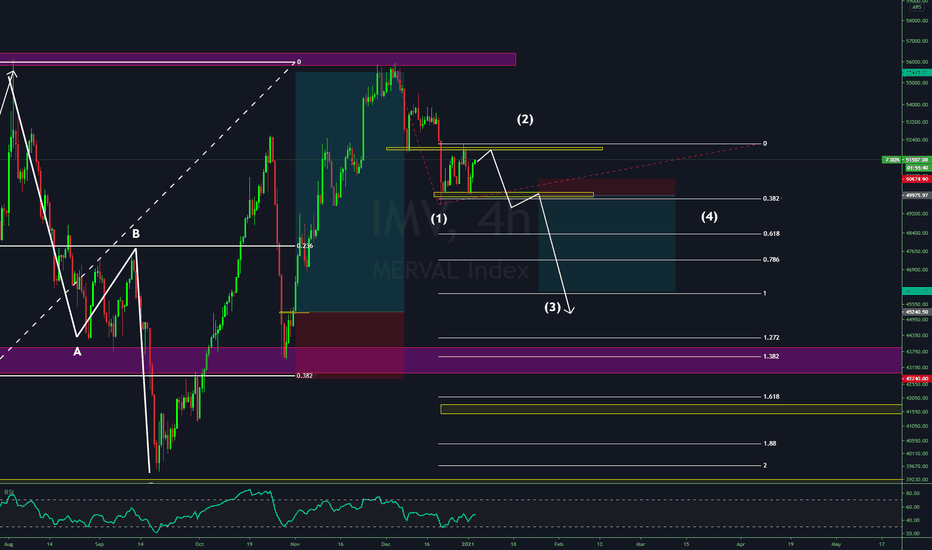

This long and extended IVth can be seen after such huge rallies. Anxiety begins to build up and retail investors begin to be shaken out. This IVth wave seems to be a triple-three type. Volatile and fast, this structure destroys an investor's patience.

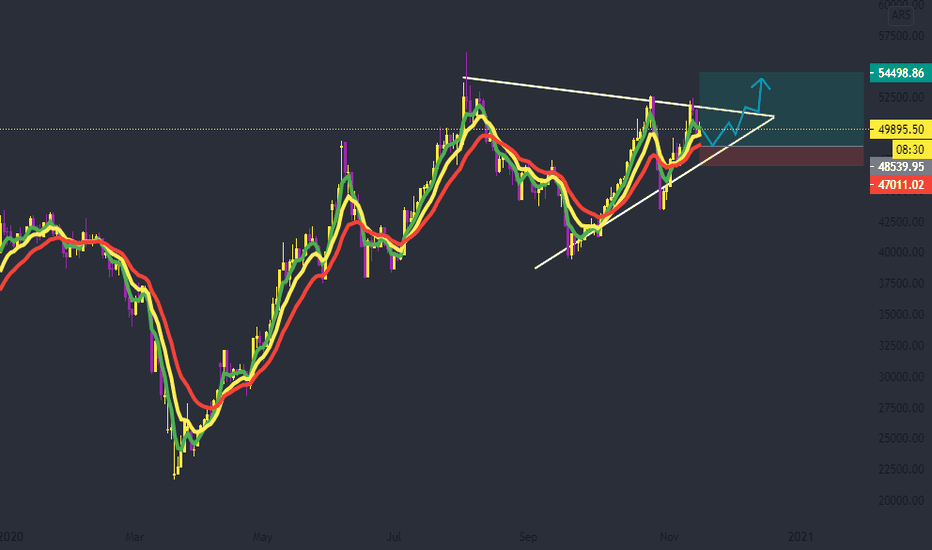

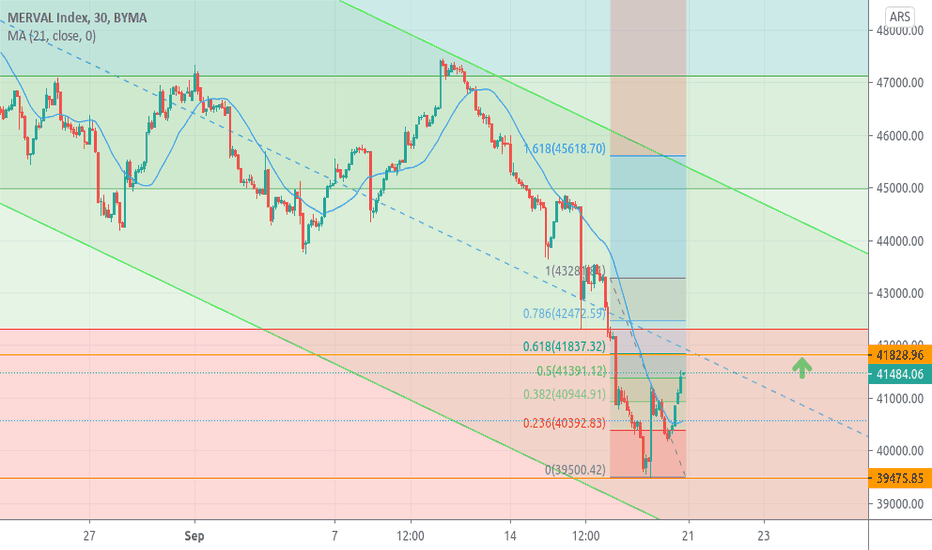

Recent developements in the money market seem to have calmed down and peace seems to be partially restored. September elections are around the corner and this little Pax may be threatened.

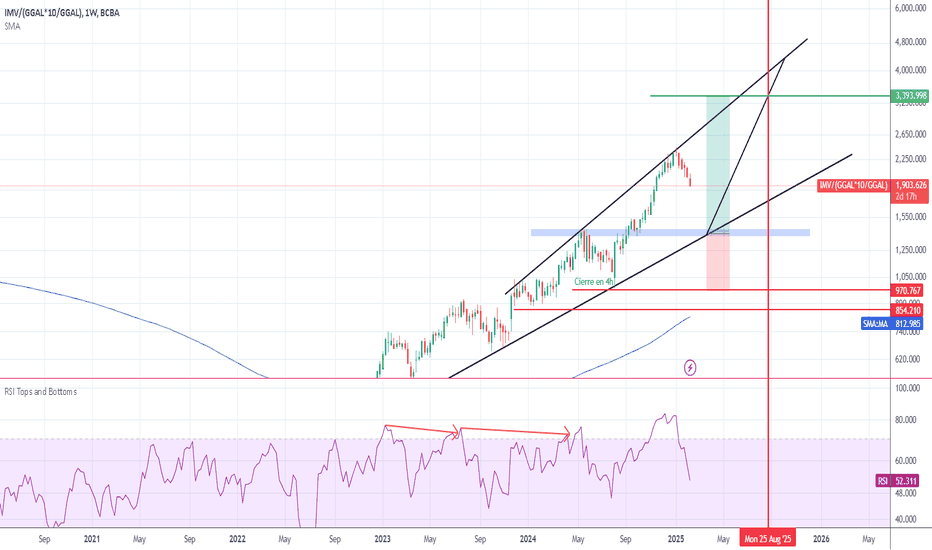

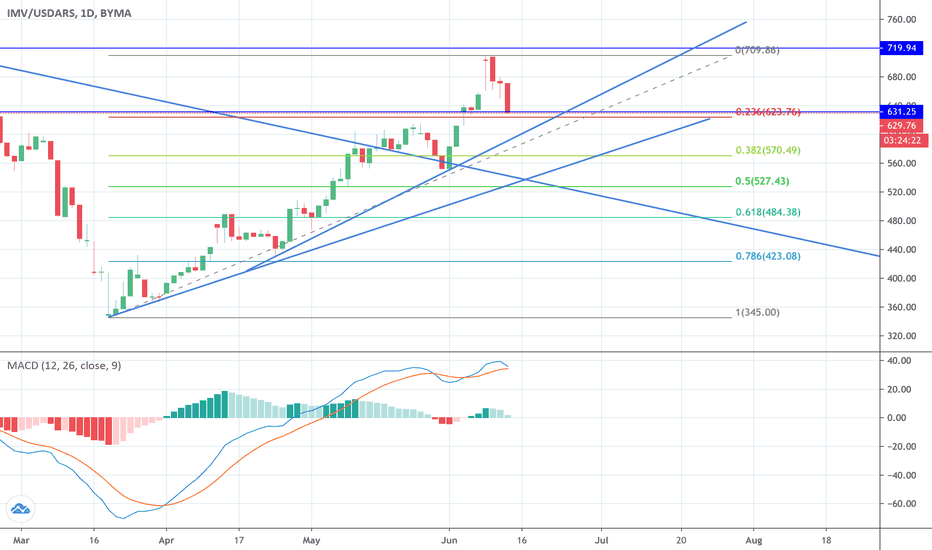

I'm inclined to believe NOTHING WILL HAPPEN in these elections the govt faces, nor will the gov succeed enourmously, nor will it fail badly. So, I believe the index will likely test previous (W) wave bottoms, to then breakout for a final Vth wave. This analysis is compatible with a triangle-shaped breakout.

IMV trade ideas

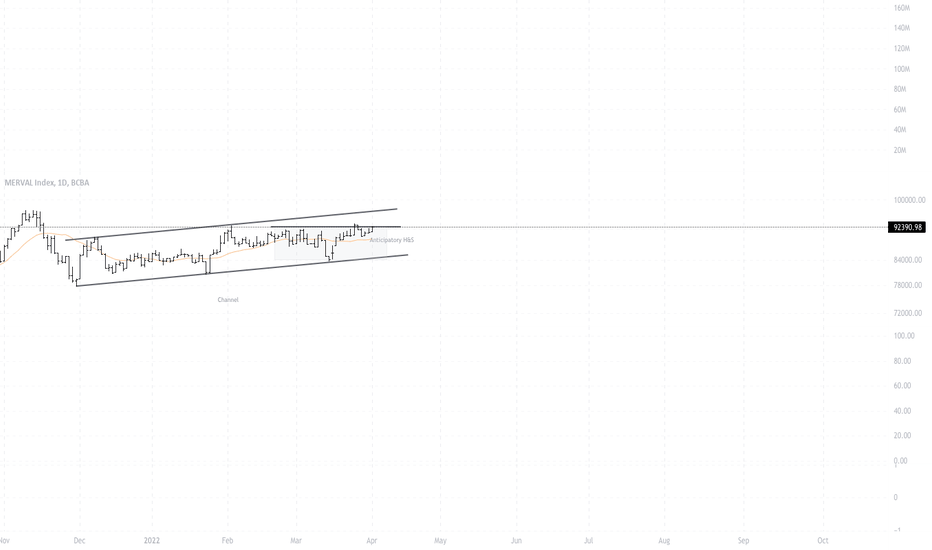

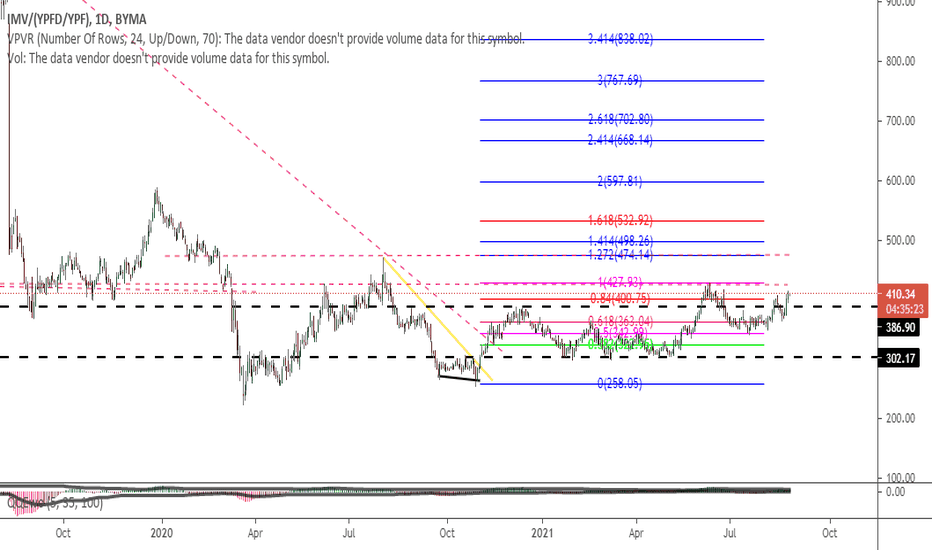

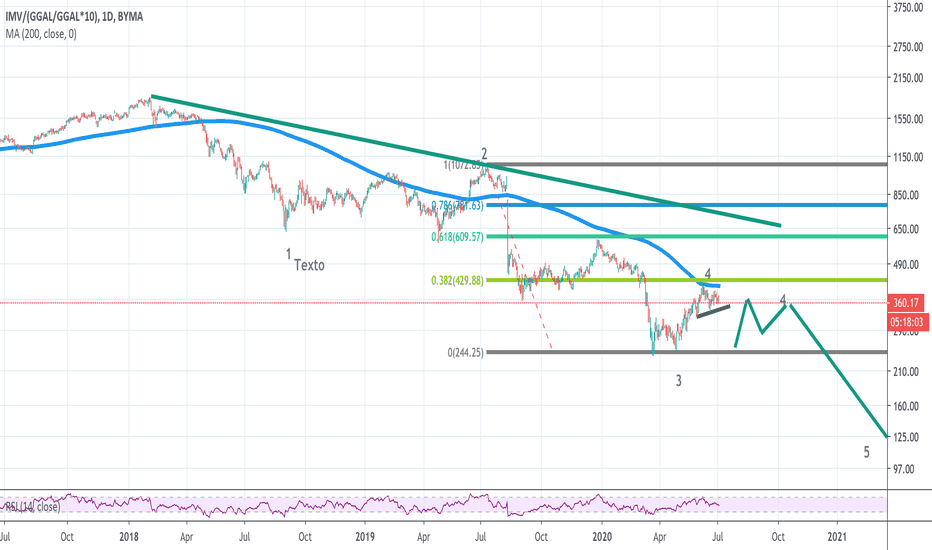

REPETICION BOLSA ARGENTINA MERVAL DOLARESEl conteo del índice merval revierte dificultad porque el mercado alcista de la bolsa argentina empezó en 1985, cuando el índice merval fue creado enn 1986, empalmando índices o teniendo en cuenta el previo indice general que se calcula distinto al merval, el bear market del 2018 puede contarse como 5 ondas de C de un plano o como doble zig-zag en ambas interpretaciones idealmente y tanto tiempo se manntenga 435/445 faltan nuevos mínimos al 2021, en 2021 año fibonacci podemos ver piso del peso ajustado por tasa y piso de bolsa en dólares, es decir el dólar tendrá su maximo poder de compra de activos argentinos como 1982, y el dólar perderé valor relativo a activos como 1982/2001.