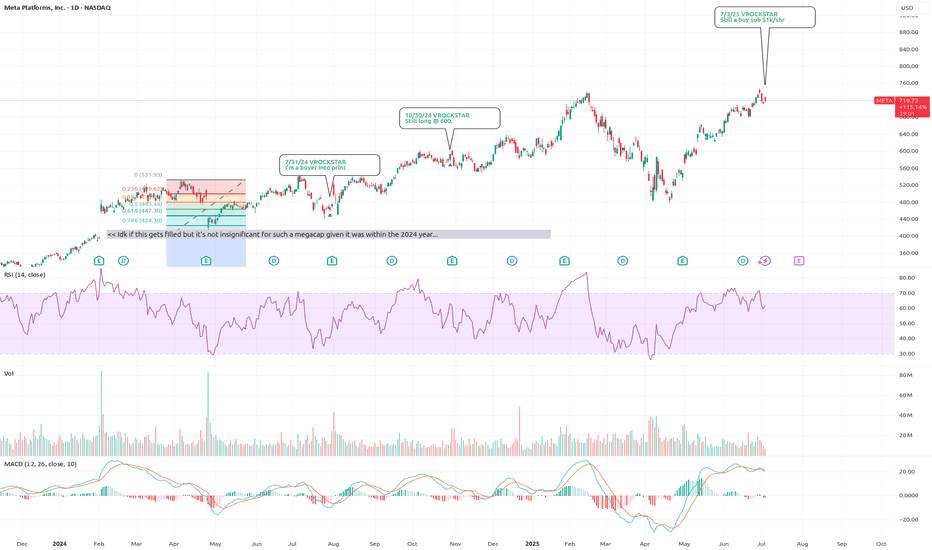

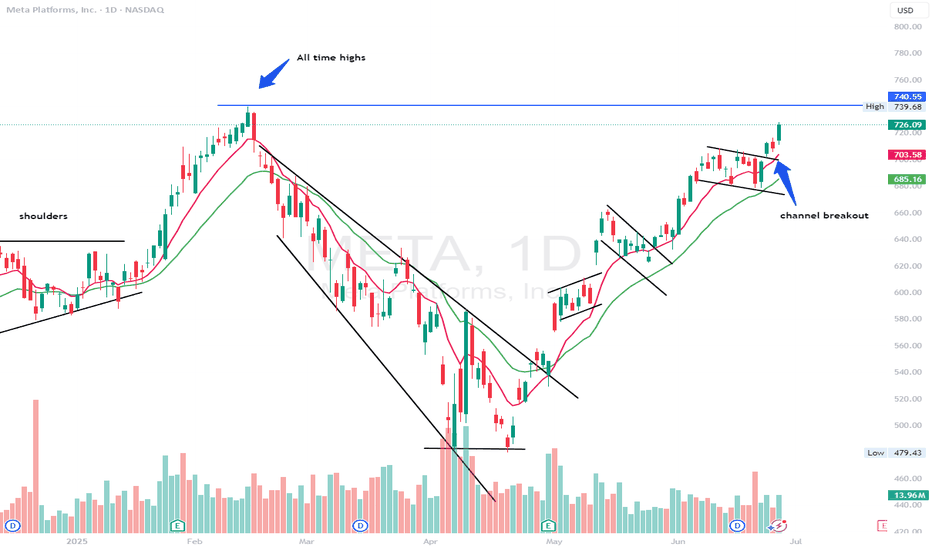

7/3/25 - $meta - Still a buy sub $1k/shr7/3/25 :: VROCKSTAR :: NASDAQ:META

Still a buy sub $1k/shr

- reality is, why would you bet against zuck

- his platforms are hitting on all strides. he is willing to internally build the best AI when he's falling behind by hiring the best talent and it is a LOT cheaper to hire for collectively $50

Key facts today

Meta Platforms (META) stock rose 195% in five years, now at $720.98. In six months, it gained 17.1%, outperforming the S&P 500 by 10.2%. EBITDA margin is 59.9%.

Meta Platforms is making significant investments in artificial intelligence, actively attracting talent and pursuing aggressive strategies to enhance its competitive position in the AI sector.

Meta Platforms has acquired a nearly 3% stake in EssilorLuxottica for about $3.5 billion to boost AI glasses development, aiming to increase its stake to 5% and expand production.

1.00 USD

55.39 B USD

146.11 B USD

About Meta Platforms

Sector

Industry

CEO

Mark Elliot Zuckerberg

Website

Headquarters

Menlo Park

Founded

2004

ISIN

ARBCOM460168

Meta Platforms, Inc. engages in the development of social media applications. It builds technology that helps people connect and share, find communities, and grow businesses. It operates through the Family of Apps (FoA) and Reality Labs (RL) segments. The FoA segment consists of Facebook, Instagram, Messenger, WhatsApp, and other services. The RL segment includes augmented, mixed and virtual reality related consumer hardware, software, and content. The company was founded by Mark Elliot Zuckerberg, Dustin Moskovitz, Chris R. Hughes, Andrew McCollum, and Eduardo P. Saverin on February 4, 2004, and is headquartered in Menlo Park, CA.

Related stocks

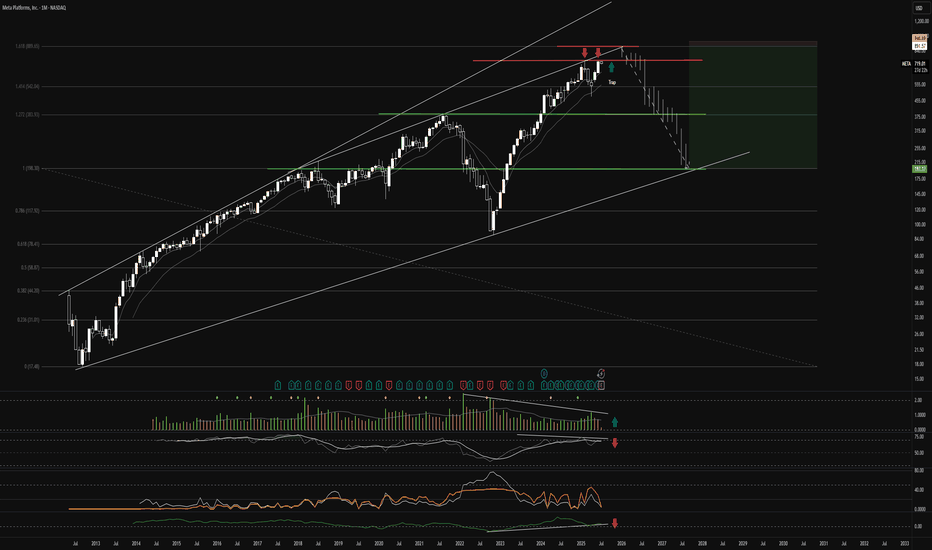

$META Braces for Market HeadwindsWhile the NASDAQ is flirting with putting a double-top in, technology companies like NASDAQ:MSFT NASDAQ:GOOGL and NASDAQ:META are increasing CapEx spend for future Ai infrastructure. Margin compression is likely to result with a smaller hit from energy costs - estimated at about 1% of revenue

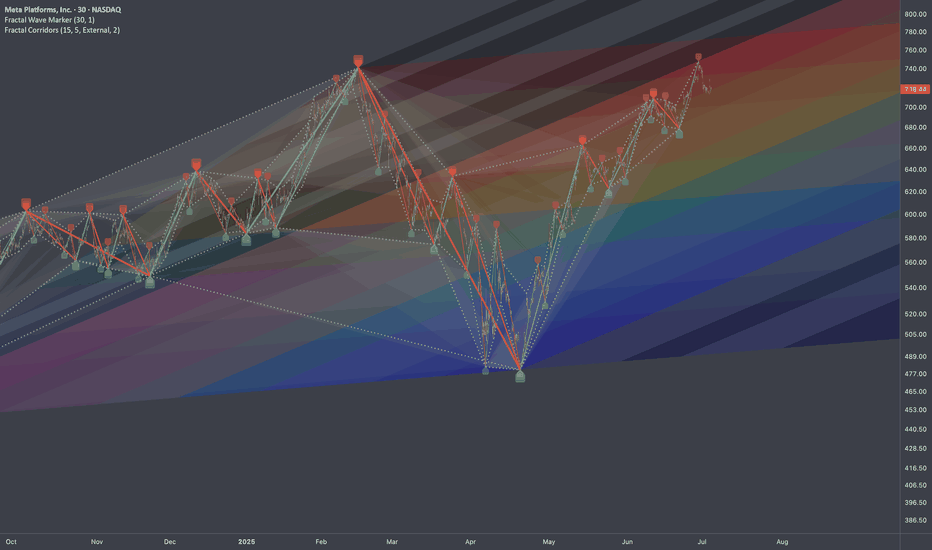

META: Testing Alternative Interconnection TypeResearch Notes

Given expression like this:

Fractal Corridors can be used for horizontal perspective of the same pattern manifestation. Alternative frames of reference exposes how historic swings of various magnitude in some way wire the following price dynamics. tradingview.sweetlogin.com helps to s

META Shares Signal Major Reversal Risk Amid Potential 2B Top PatThe shares of META, the NASDAQ-listed owner of Facebook, recently reached overbought levels as the stock price rose above its upper Bollinger Band and its Relative Strength Index climbed above 70. This suggests that META is likely to enter a period of sideways consolidation or perhaps experience a s

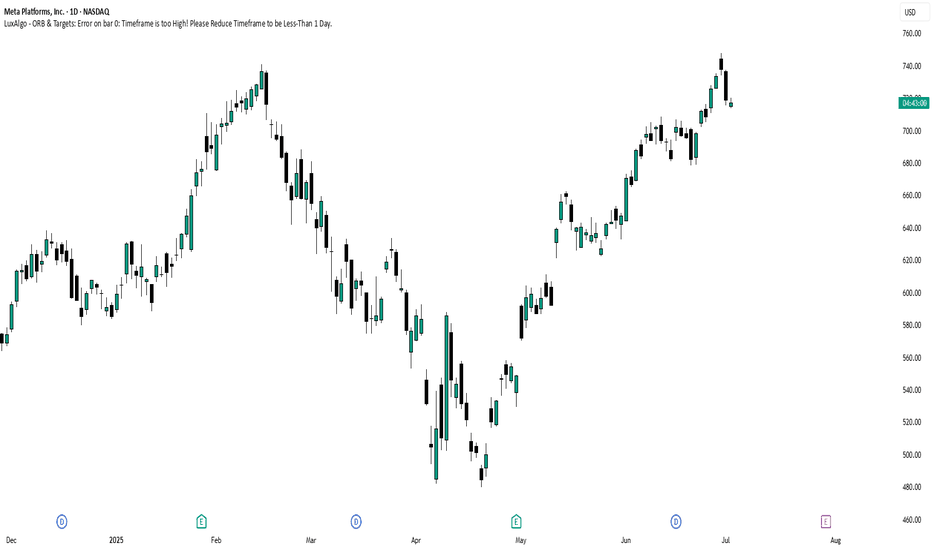

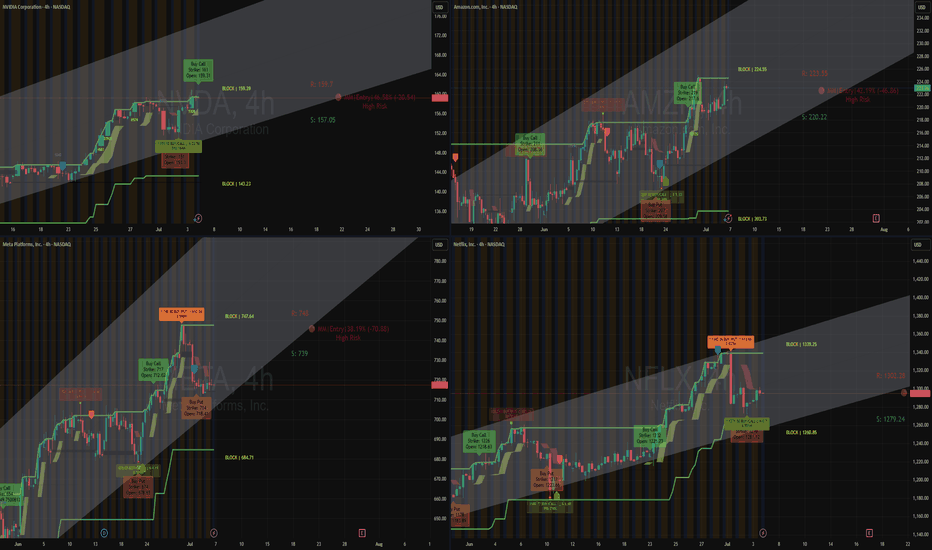

NVDA, AMZN, META AND NFLX 4HS CHARTNASDAQ:NVDA SUP: 157 | RES: 159.7 – Triangle forming.

NASDAQ:AMZN SUP: 220 | RES: 224 – Compression zone.

NASDAQ:META SUP: 700 | RES: 739 – Needs reclaim to recover.

NASDAQ:NFLX SUP: 1279 | RES: 1302 – Bullish dip hold.

#trading #stocks #technicalanalysis #optionsflow #NVDA #AMZN #META #NFLX

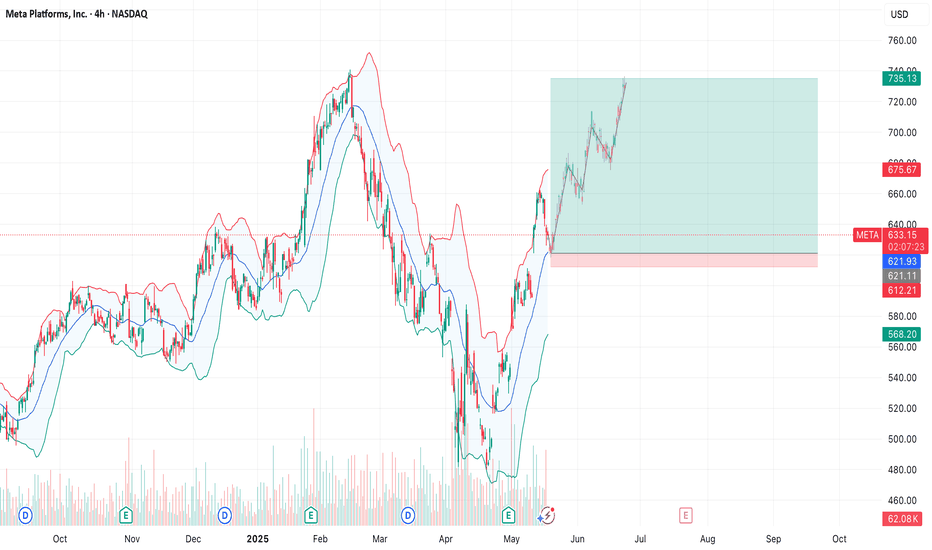

META Monday Play: Coiling Under $735 – Breakout or Breakdown?🧠 GEX-Based Options Sentiment:

META is currently hovering right under a dense gamma cluster. The $735–$740 range includes the highest positive GEX level, the CALL wall, and a major resistance zone. Bulls will need strong momentum to break through this level.

The key gamma magnet below is around $722

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US30303M8D7

META PLATF. 22/32 144AYield to maturity

15.46%

Maturity date

Aug 15, 2032

FB5458295

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

6.31%

Maturity date

Aug 15, 2062

FB5522241

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

6.15%

Maturity date

Aug 15, 2062

FB5458293

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

6.11%

Maturity date

Aug 15, 2052

FB5522214

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

6.09%

Maturity date

Aug 15, 2052

FB5868810

Meta Platforms, Inc. 5.55% 15-AUG-2064Yield to maturity

5.85%

Maturity date

Aug 15, 2064

FB5868809

Meta Platforms, Inc. 5.4% 15-AUG-2054Yield to maturity

5.81%

Maturity date

Aug 15, 2054

FB5581331

Meta Platforms, Inc. 5.75% 15-MAY-2063Yield to maturity

5.81%

Maturity date

May 15, 2063

FB5581330

Meta Platforms, Inc. 5.6% 15-MAY-2053Yield to maturity

5.76%

Maturity date

May 15, 2053

FB5458289

Meta Platforms, Inc. 3.5% 15-AUG-2027Yield to maturity

5.28%

Maturity date

Aug 15, 2027

FB5458291

Meta Platforms, Inc. 3.85% 15-AUG-2032Yield to maturity

5.23%

Maturity date

Aug 15, 2032

See all METAD bonds

Curated watchlists where METAD is featured.

Big software stocks: Red pill gains

9 No. of Symbols

Political stocks: The corridors of power

15 No. of Symbols

See all sparks