MMMC trade ideas

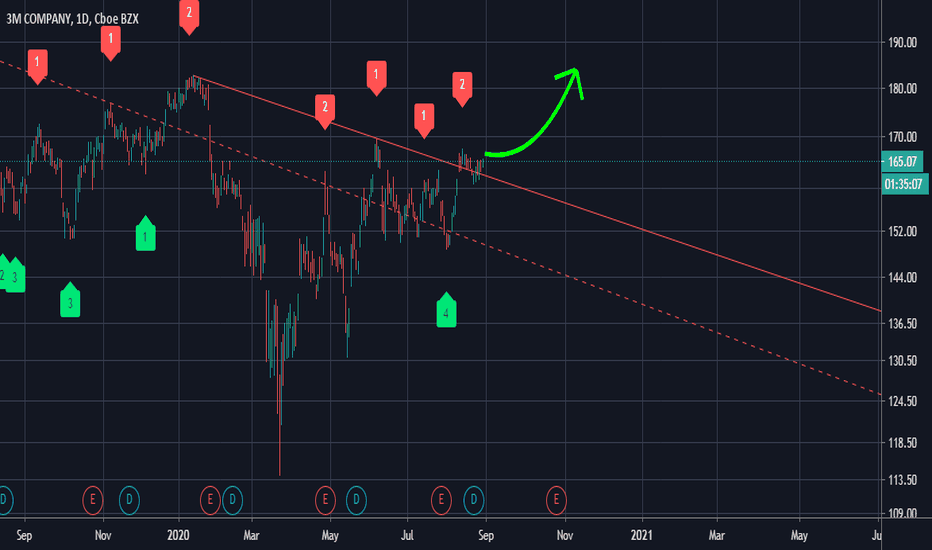

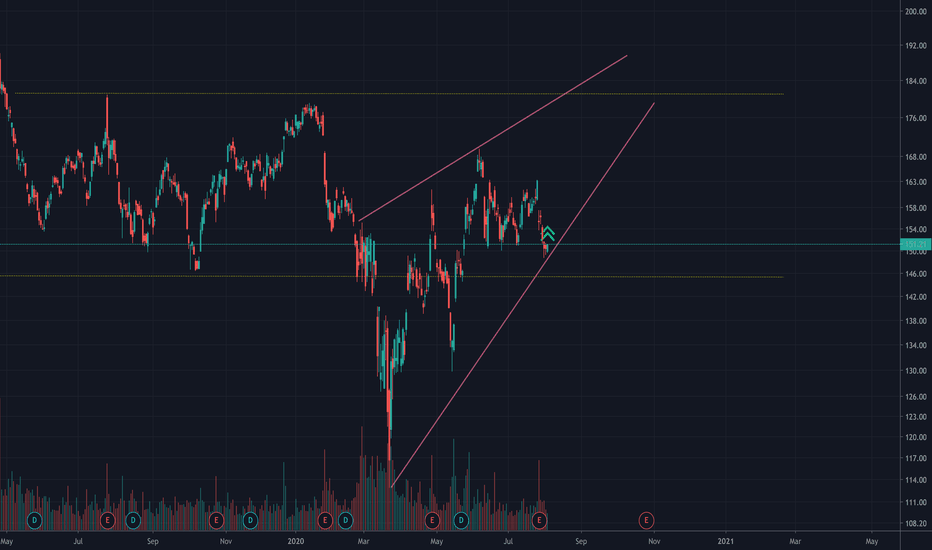

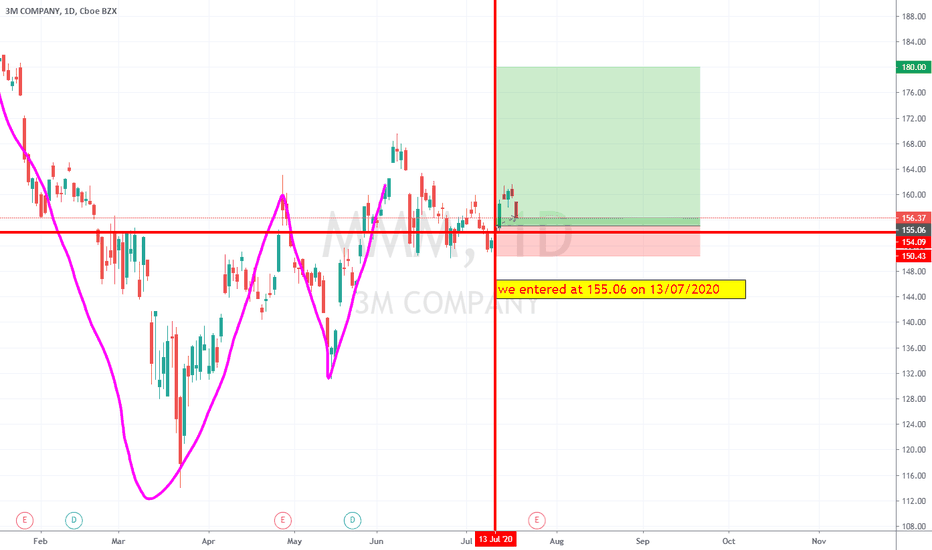

3m looks like it's getting ready for a run to the long side.Beautiful Medium term downtrend which was a correction when you see a larger picture is now broken after the consolidation. this new trend before the breakout started with completion of a Fib retracement. My only worry is I see market coming down for next few days which may impact on the strength of this stock. No matter what 3M is a good name. Would love to own at a cheaper price. This is just an opinion. Do your own homework before buying or selling any financial assets.

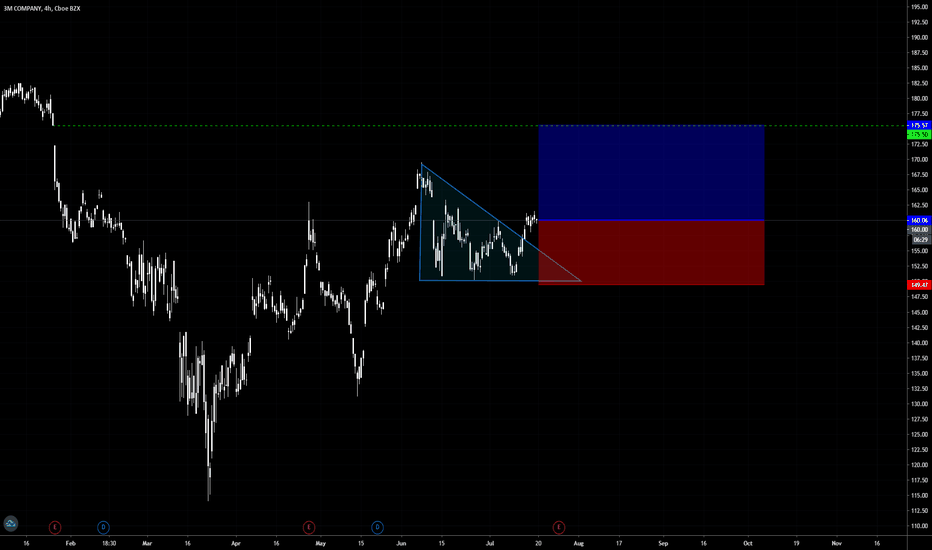

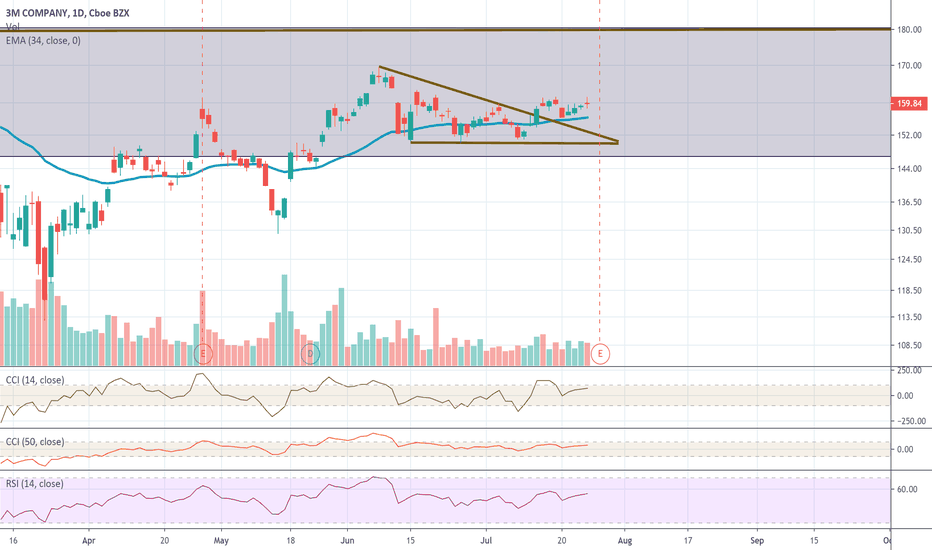

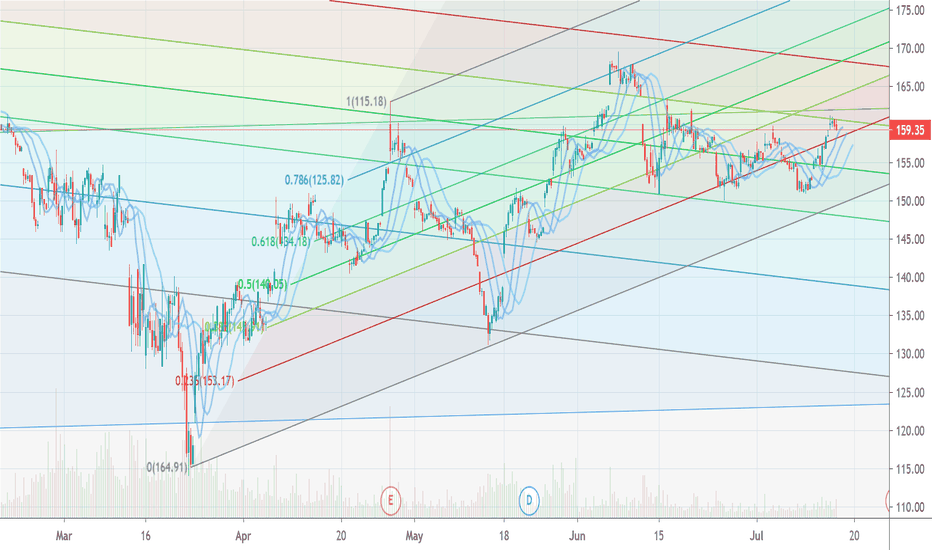

MMM - Channeling ReversalNYSE:MMM

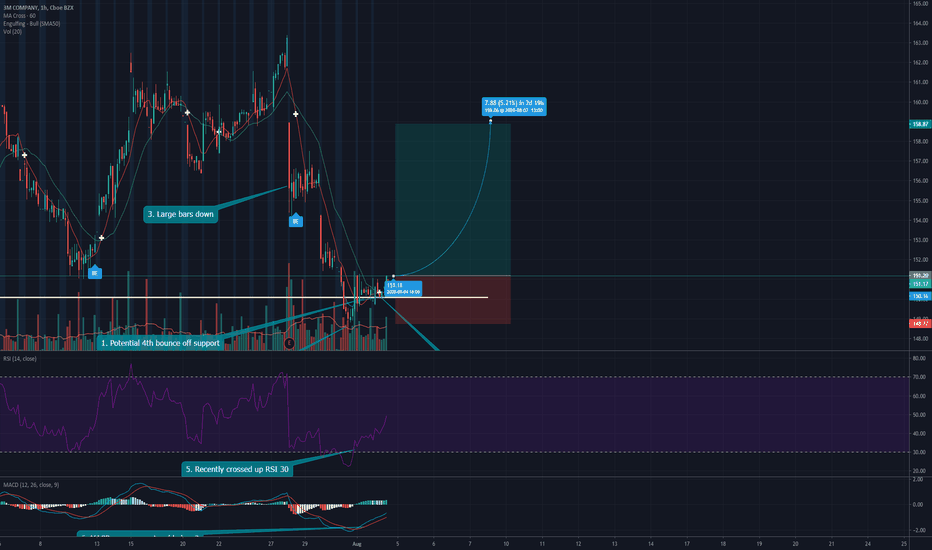

SWING TRADE

MMM showing signs of a reversal in it's current channeling pattern.

(An elaboration of my previous idea)

Reasons:

1. Potential 4th bounce off support

2. Crossing of 9 & 50 MA

3. Large bars previously pushing down

4. Huge Volume down trending ending bar

5. Recently crossed up RSI 30

6. MACD cross over signal below 0

Entry: 151.18

Target: 159.06

Stop Loss: 148.75

Risk Reward: 3.16

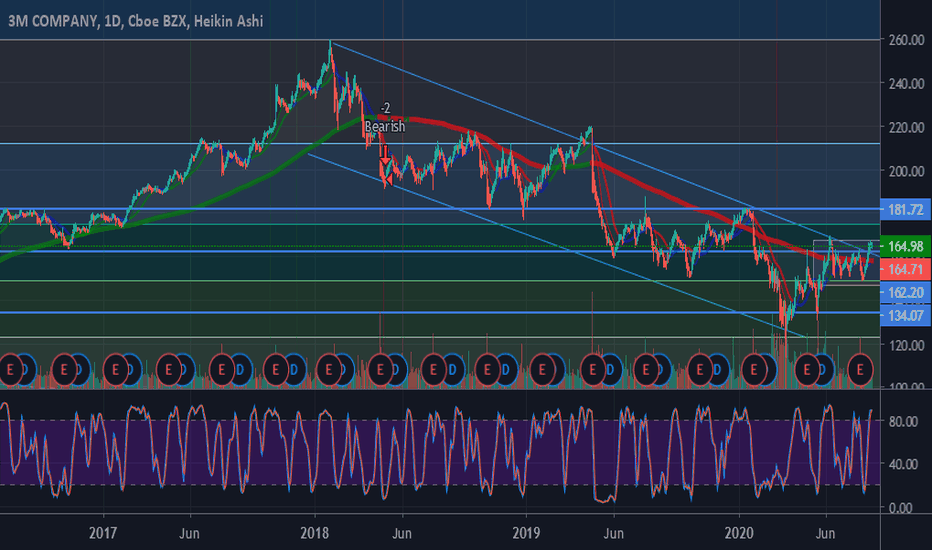

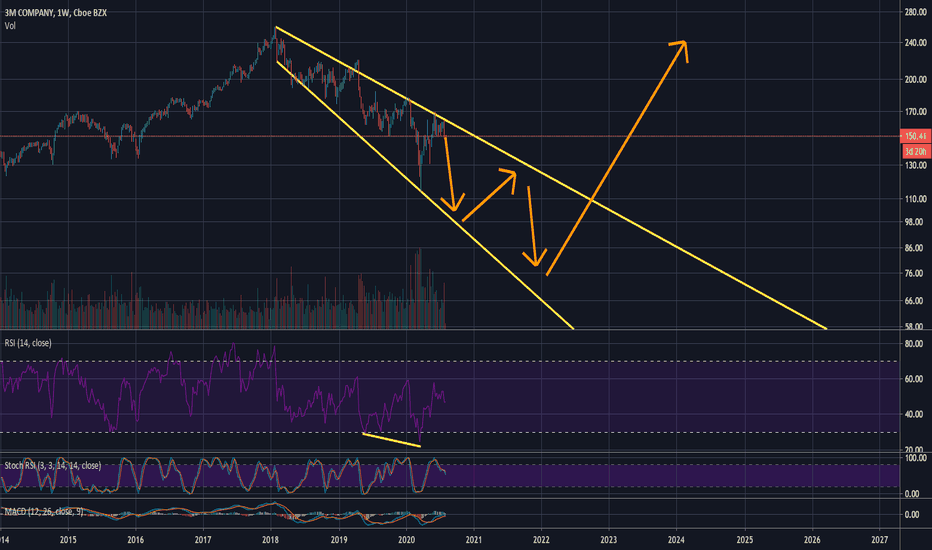

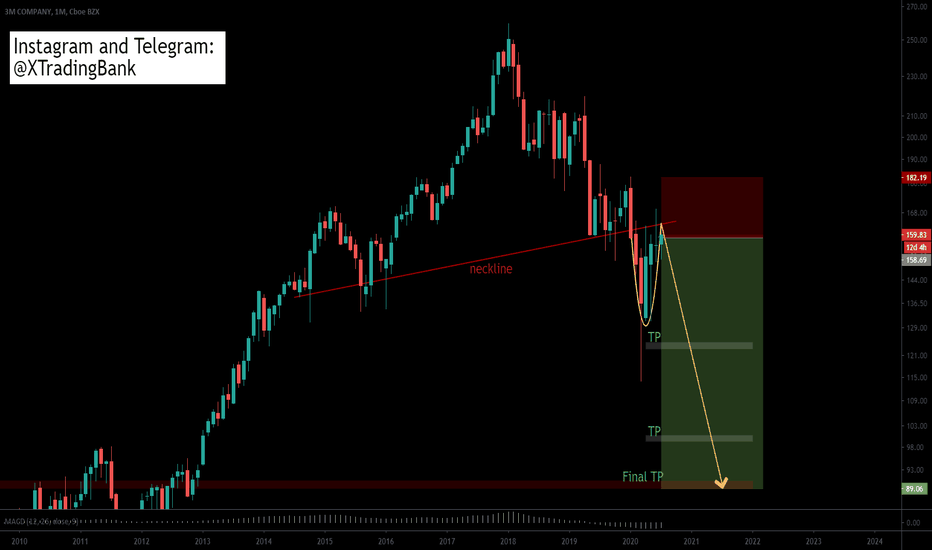

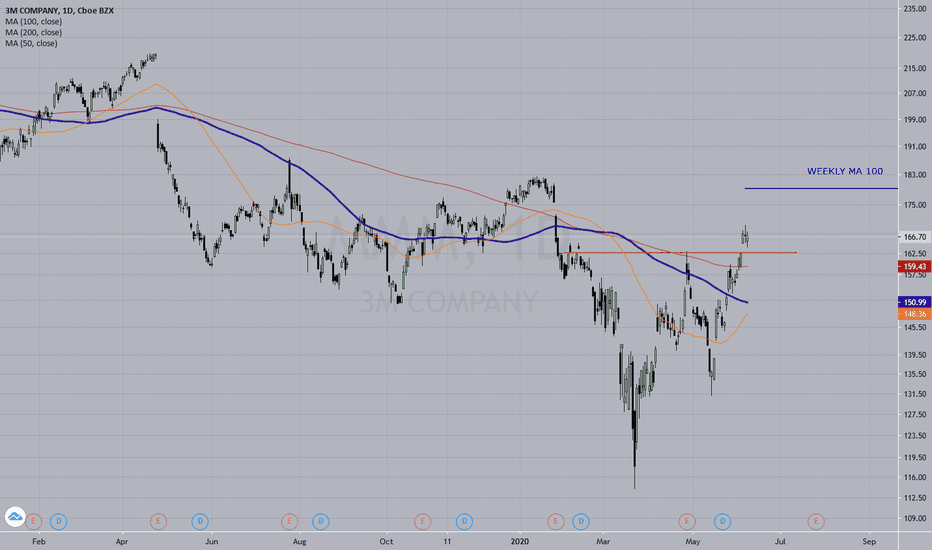

The Other Kind of Broadening FormationIn many of my posts, I highlight the rising broadening patterns that have emerged on many of today's popular tech stocks. These of course, once complete, are somewhat devastating to those patterns' underlyings. The price action tends to fall from those broadening patterns with some force.

However, significantly more rare in today's highly financialized bubble stock market is the converse pattern, the falling broadening pattern. And with 3M, that is what we see. A fundamental shift in the price action began in 2018, ending 3M's multi-decade bull market. This agrees with a general shift in tone that I see on many world indices that began in 2018.

And it was at this point that it began to form it's falling broadening pattern. As with many other stocks, this will of course deteriorate significantly, however, this ends with a terrific moonshot to the upside. That of course will not be happening any time too soon, as presently, the bearish convergence on the RSI indicates to us that we have more downside to come first.

But, perhaps it is in our eventual future that manufacturing in the United States will make some recovery, and perhaps this stock will reflect that when it is time.

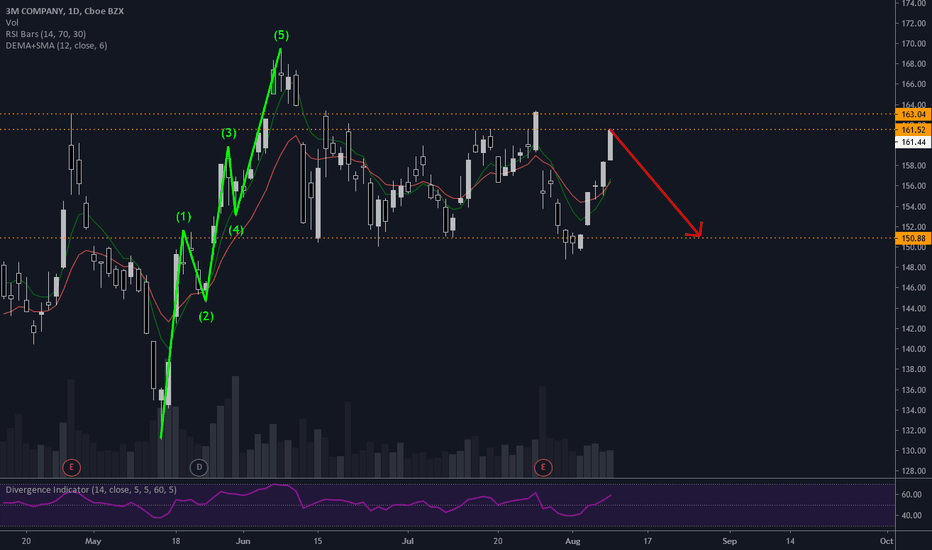

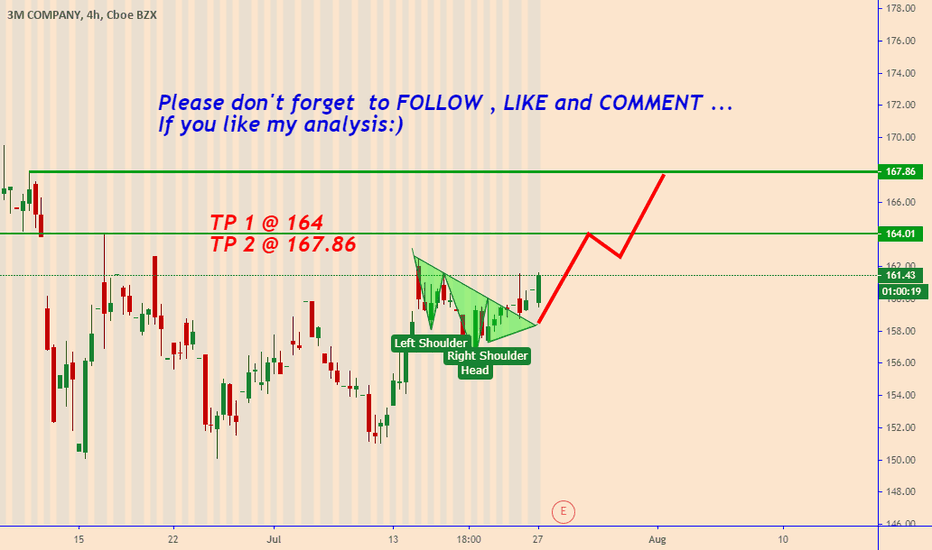

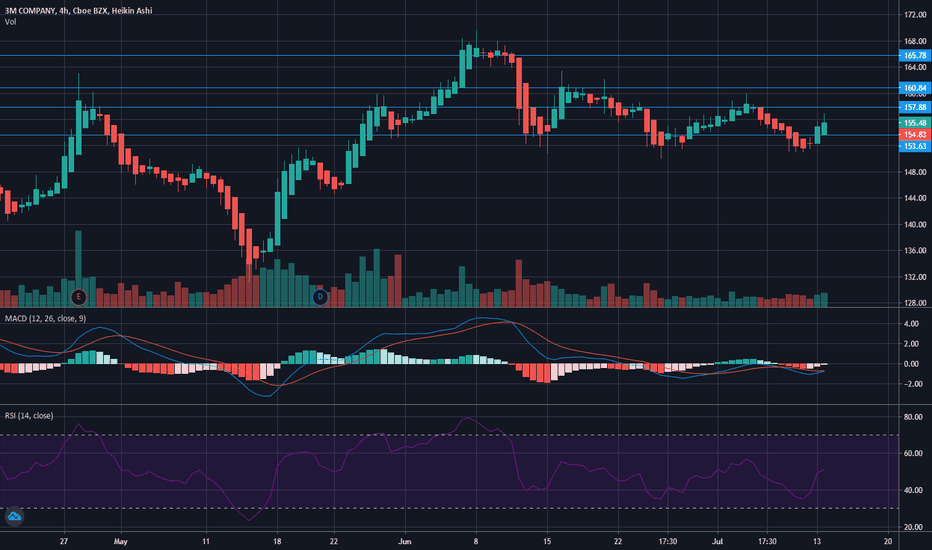

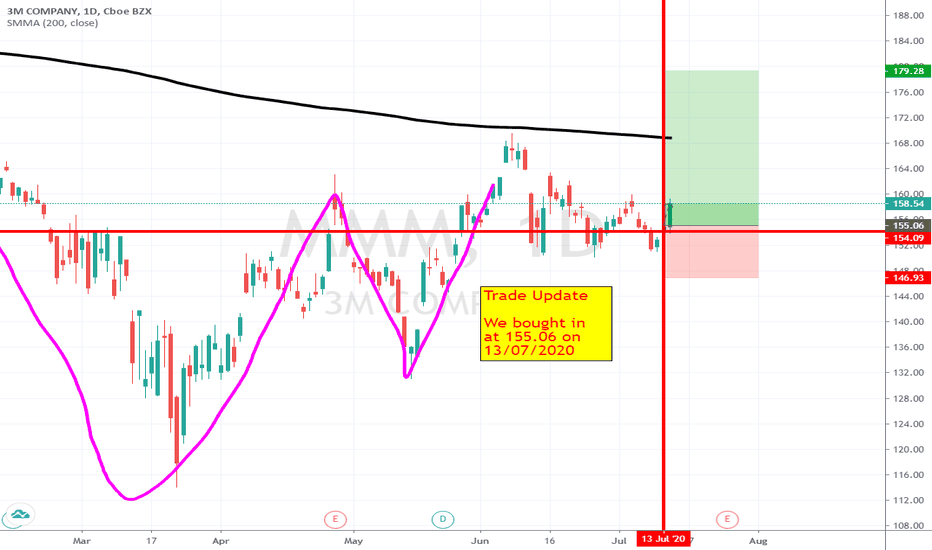

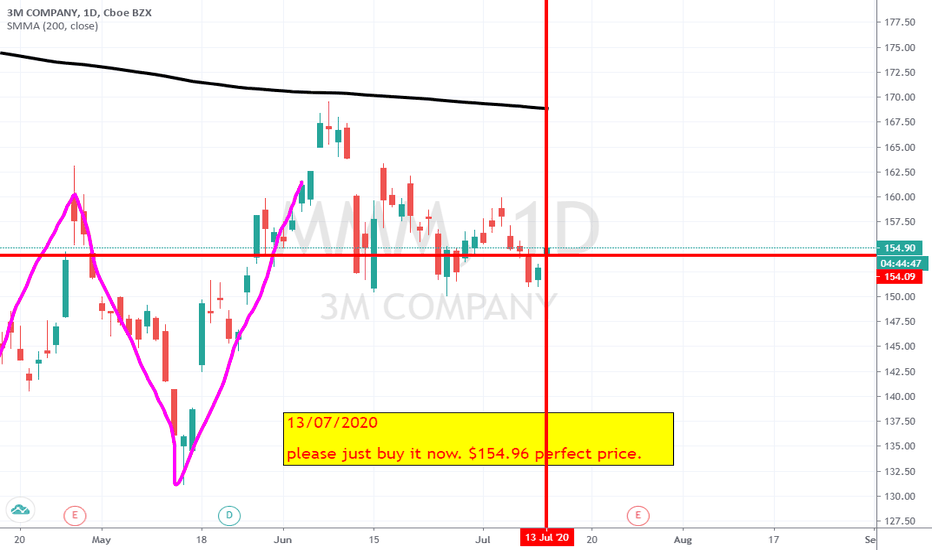

Potential AB=CD Pattern $MMM$MMM Has gapped down off of earnings and is trending down. It pulled back intraday to the .382 Fib Retracement level and stalled today at the .618 Fib Extension. Looking to get one more push to the downside at least to complete AB=CD pattern. It could push further though.