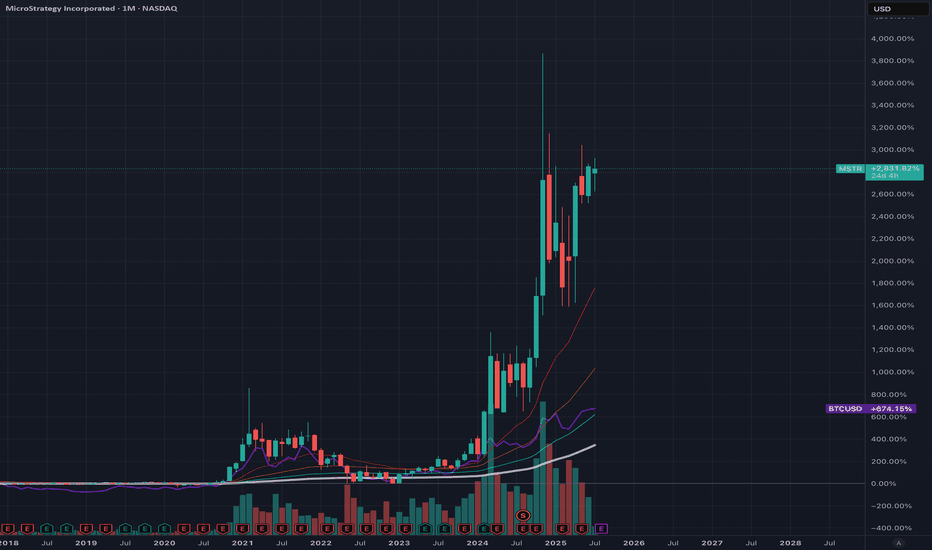

MicroStrategy Bitcoin FOMOIs it time to sell? In percentage terms, MicroStrategy has significantly outperformed its underlying asset, Bitcoin. It's concerning to watch Michael Saylor's FOMO (fear of missing out) into Bitcoin over the past year, as this could ultimately do more harm than good for Bitcoin. MicroStrategy's stoc

Key facts today

MicroStrategy faces a class action lawsuit alleging false statements about its bitcoin investment strategy. Investors who bought shares from April 30, 2024, to April 4, 2025, can join the suit.

−1.05 USD

−1.04 B USD

411.64 M USD

About MicroStrategy

Sector

Industry

CEO

Phong Q. Le

Website

Headquarters

Vienna

Founded

1989

ISIN

ARCAVA4601E2

MicroStrategy, Inc. engages in the provision of enterprise analytics and mobility software. The firm designs, develops, markets, and sells software platforms through licensing arrangements and cloud-based subscriptions and related services. Its product packages include Hyper. The company was founded by Michael J. Saylor and Sanjeev K. Bansal on November 17, 1989, and is headquartered in Vienna, VA.

Related stocks

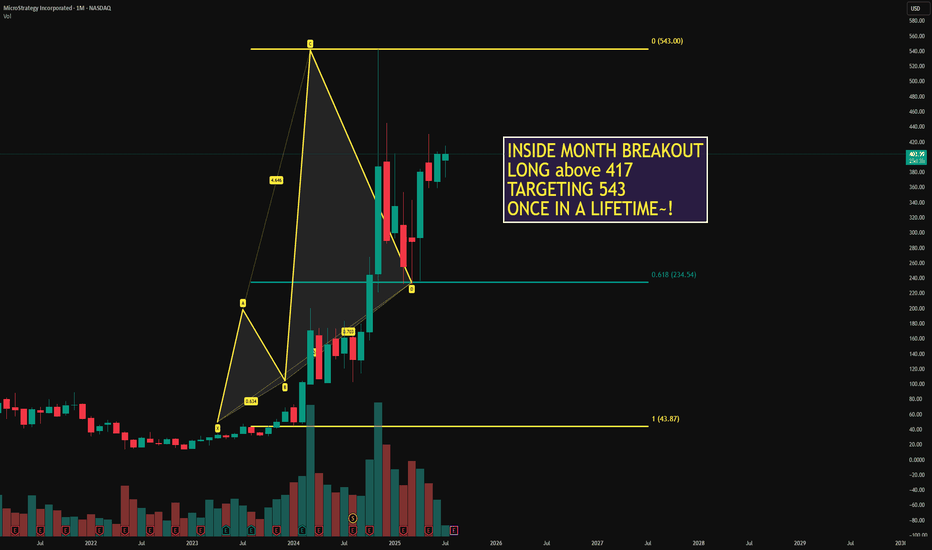

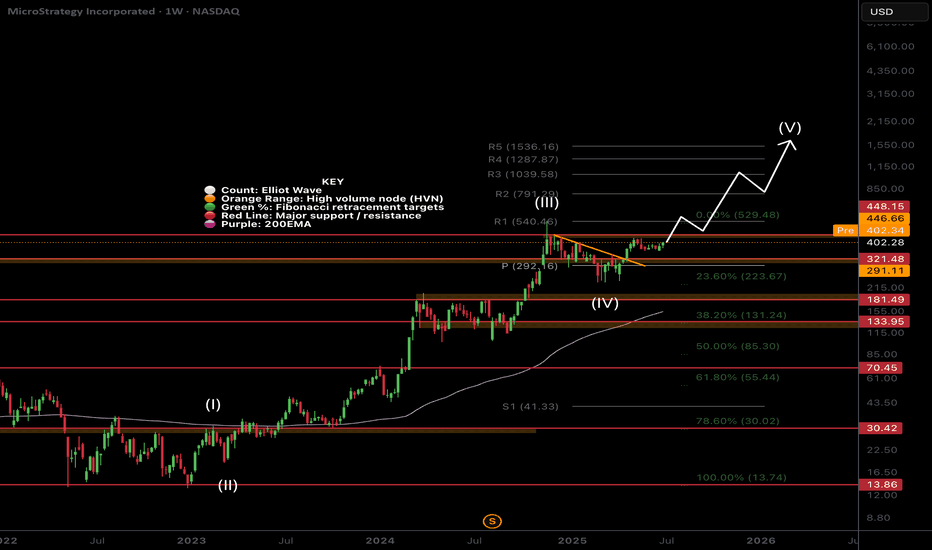

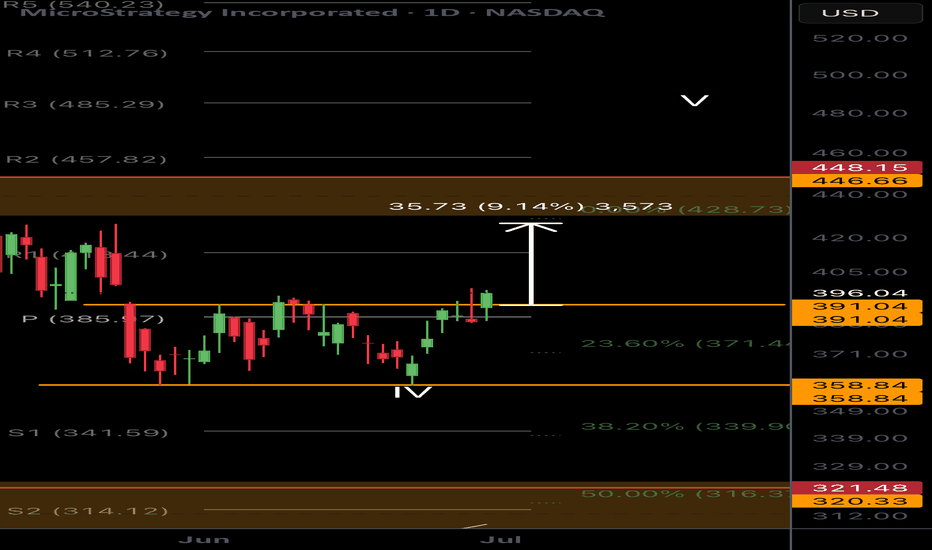

$MSTR Megatrend Continuation?NASDAQ:MSTR is market leader in the CRYPTOCAP:BTC strategic reserves strategy and has set the benchmark.

After a nearly 20x rally profit take is exceptive, price has held up extremely well through the last 6 months only dropping to the .236 Fibonacci retracement and weekly pivot. As Bitcoin cont

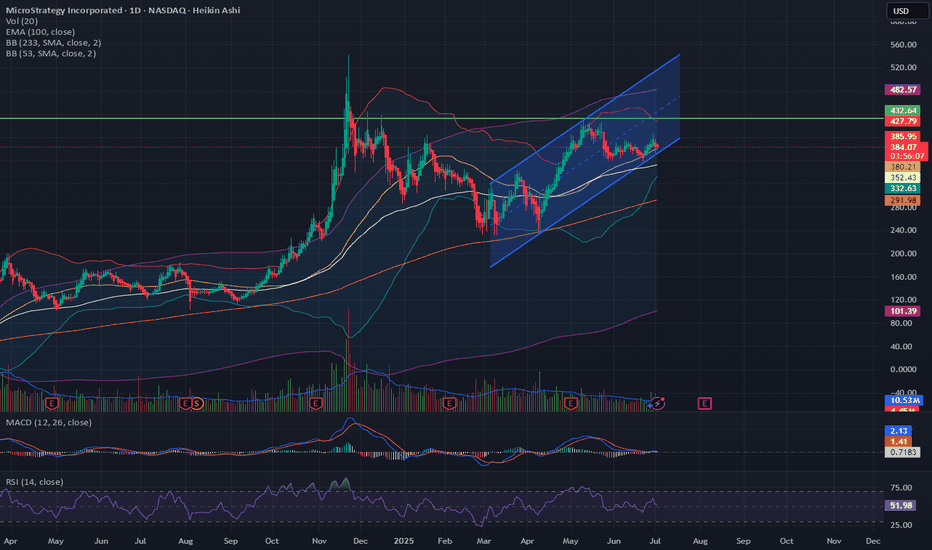

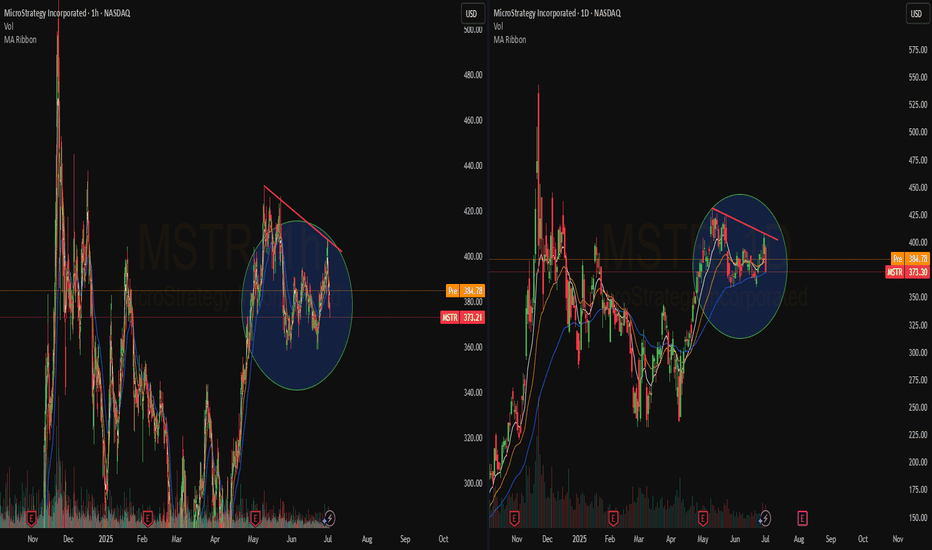

(MSTR) – Cup & Handle Brewing Inside a Rising Wedge?MSTR is currently trading around $384, consolidating just under a significant historical resistance near $432, the neckline of a potential cup and handle formation. Price action has respected a rising wedge channel since mid-April, making higher highs and higher lows with relatively muted volume – a

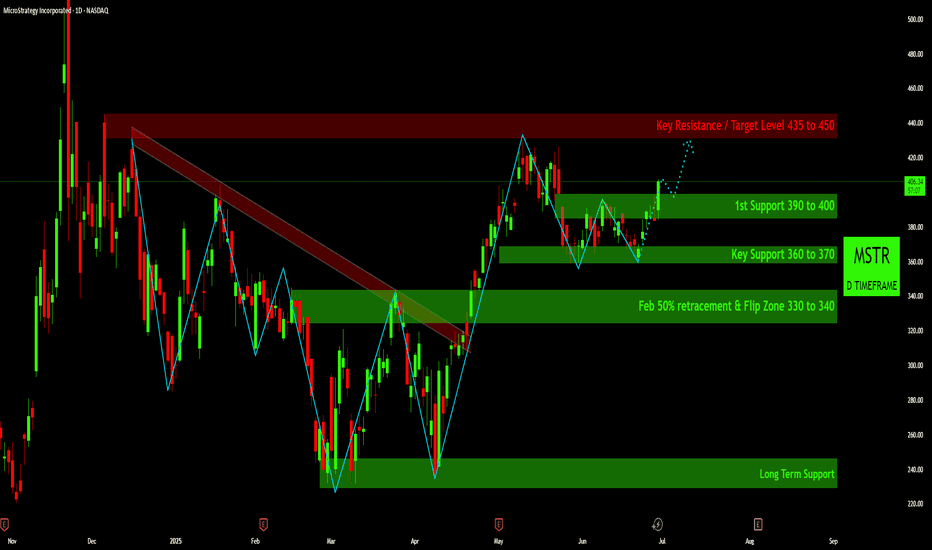

MSTR Daily Chart Analysis: Key Price LevelsThis analysis focuses on the daily chart of MicroStrategy (MSTR), highlighting significant price action, identified patterns, and predefined support and resistance levels.

Price Action Overview:

Starting from late 2024/early 2025, MSTR experienced a notable downtrend, characterized by a series

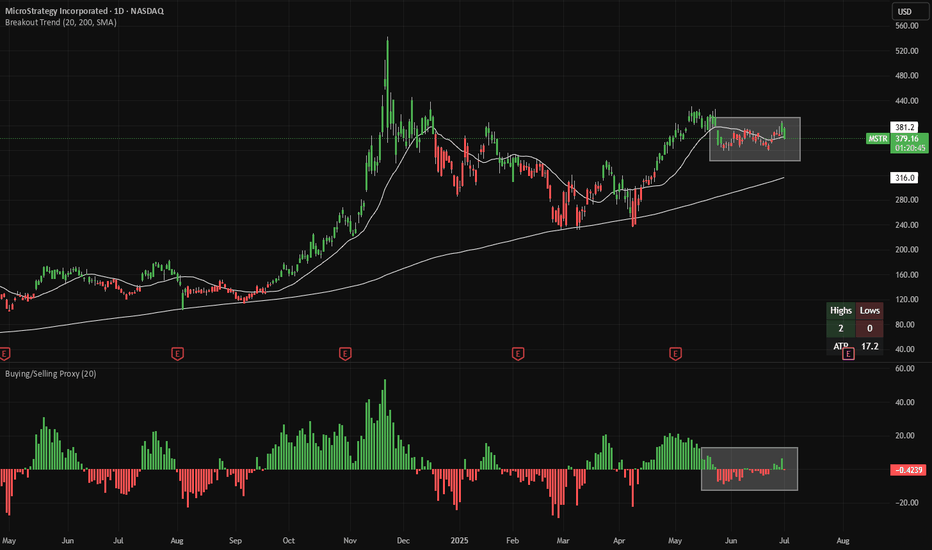

MSTR Long - high squeeze potentialMSTR recently made 20-day highs (green candles) and then sold off towards the 20D EMA trendline. Meanwhile, looking at a proxy of net buying/selling (bottom panel), there has been neither significant buying nor selling activity.

All of this is setting up the potential for a squeeze higher.

Needl

Is MSTR overvalued?Pros of Investing in MSTR

Massive Bitcoin Reserves

-Owns ~582,000 BTC (~2–3% of total supply), making it a levered proxy to Bitcoin. Any BTC rally strongly benefits MSTR.

Aggressive Treasury Strategy

-The company continuously issues equity, preferreds, and convertible bonds to buy more Bitc

See all ideas

MSTR5946535

MicroStrategy Incorporated 0.0% 01-DEC-2029Yield to maturity

5.77%

Maturity date

Dec 1, 2029

US594972AR2

MICROSTRAT. 24/29 CV ZOYield to maturity

1.40%

Maturity date

Dec 1, 2029

US594972AT8

MICROSTRAT. 25/30 CV ZOYield to maturity

−2.99%

Maturity date

Mar 1, 2030

US594972AN1

MICROSTRAT. 25/32 CVYield to maturity

−6.52%

Maturity date

Jun 15, 2032

MSTR6034213

MicroStrategy Incorporated 0.875% 15-MAR-2031Yield to maturity

−7.69%

Maturity date

Mar 15, 2031

MSTR6032672

MicroStrategy Incorporated 0.625% 15-MAR-2030Yield to maturity

−13.31%

Maturity date

Mar 15, 2030

US594972AP6

MICROSTRAT. 24/28 CV 144AYield to maturity

−17.43%

Maturity date

Sep 15, 2028

See all MSTRC bonds

Curated watchlists where MSTRC is featured.